Hydrocolloids Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Hydrocolloids Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

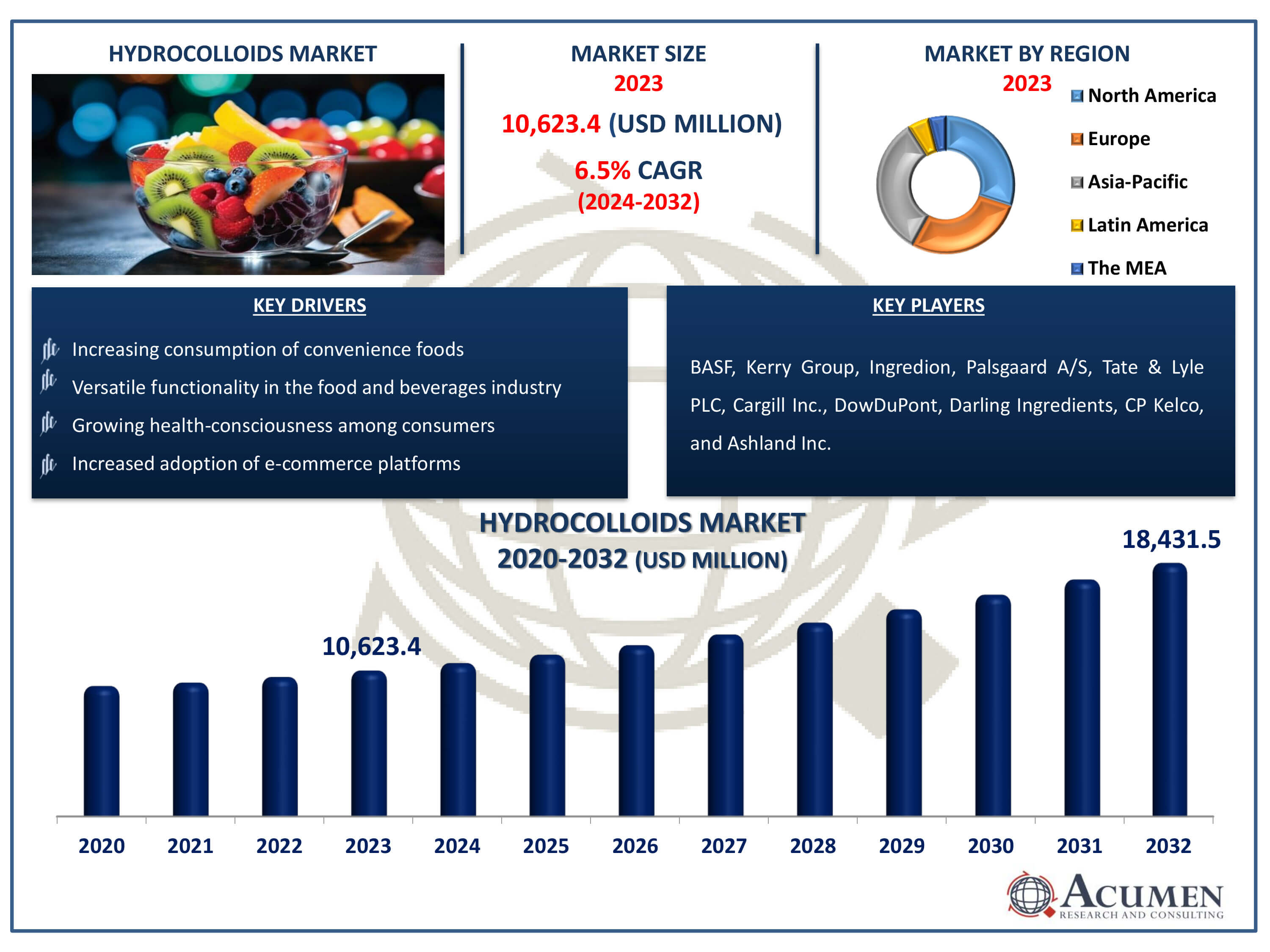

The Hydrocolloids Market Size accounted for USD 10,623.4 Million in 2023 and is estimated to achieve a market size of USD 18,431.5 Million by 2032 growing at a CAGR of 6.5% from 2024 to 2032.

Hydrocolloids Market Highlights

- Global hydrocolloids market revenue is poised to garner USD 18,431.5 million by 2032 with a CAGR of 6.5% from 2024 to 2032

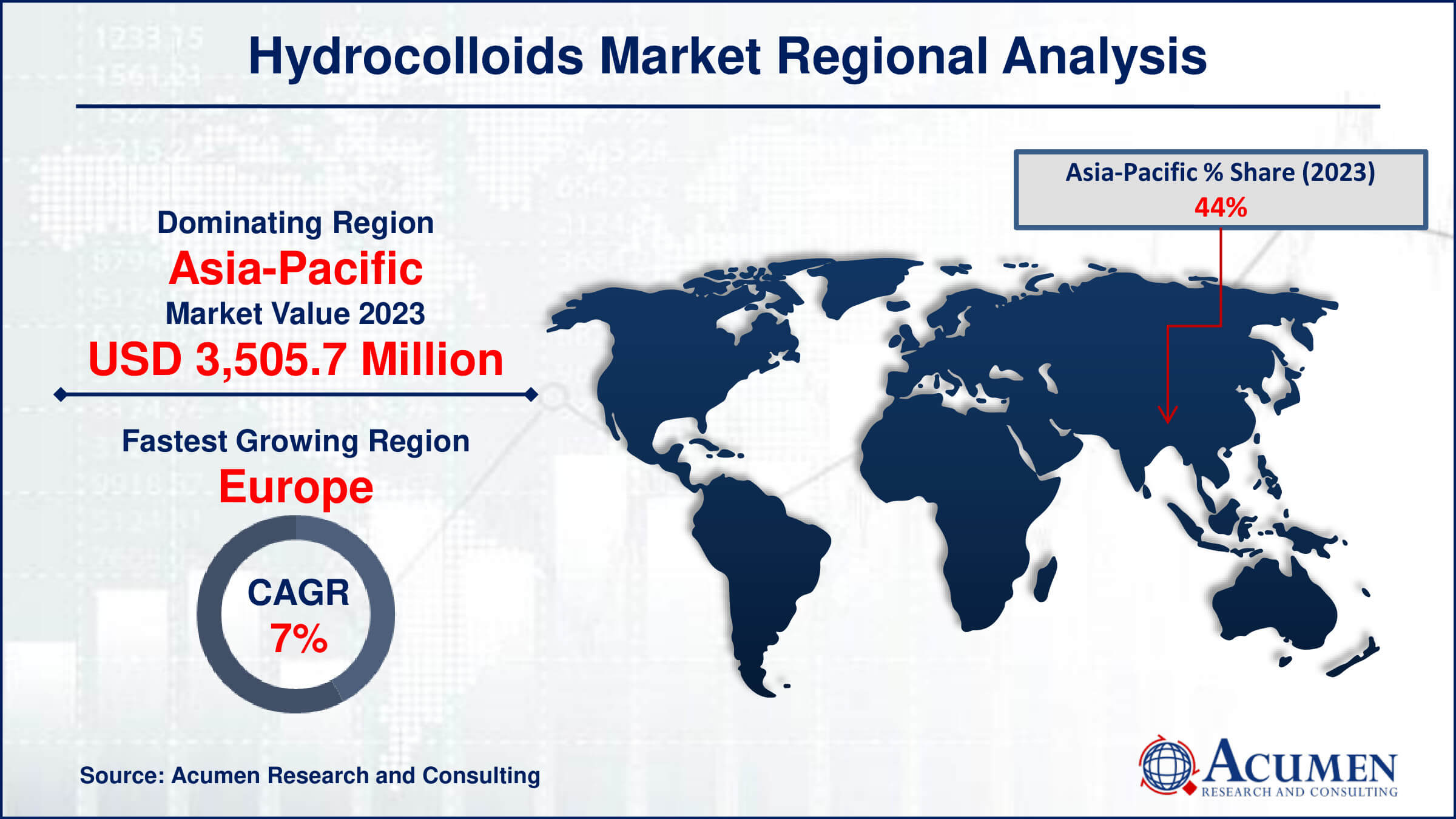

- Asia-Pacific hydrocolloids market value occupied around USD 3,505.7 million in 2023

- Europe hydrocolloids market growth will record a CAGR of more than 7% from 2024 to 2032

- Among function, the stabilizers sub-segment generated significant revenue in 2023

- Based on product, the gelatin sub-segment generated around 33% hydrocolloids market share in 2023

- Integration with other health monitoring systems is a popular hydrocolloids market trend that fuels the industry demand

The hydrocolloid market is experiencing significant growth driven by the rising demand for gelatine-based products, which offer creaminess, reduced fat content, enhanced mouthfeel, and intensified flavor profiles. This surge is propelled by several factors, including the expanding processed food sector, a growing health-conscious consumer base, and the increasing need for convenience foods within the food industry. Hydrocolloids are complex compounds that, when immersed in water, form viscous dispersions and gels. They offer a diverse range of advantageous properties in food applications, including gelling, stabilizing, emulsifying, and thickening. Among these, thickening and gelling are the most prevalent uses. Moreover, hydrocolloids find extensive use in pharmaceuticals due to their valuable attributes such as foaming, wetting, stabilizing, suspending, emulsifying, and bio-adhesive properties. Additionally, hydrocolloid dressings are utilized in medical settings for treating various wounds, including pressure ulcers, chronic venous ulcers, partial-thickness wounds, and diabetic foot ulcers. These dressings create a moist environment conducive to wound healing while offering protection against bacteria.

Global Hydrocolloids Market Dynamics

Market Drivers

- Increasing consumption of convenience foods

- Versatile functionality in the food and beverages industry

- Growing health-consciousness among consumers

- Increased adoption of e-commerce platforms

Market Restraints

- Stringent guidelines and international quality standards

- The limited supply of raw materials

- Fluctuating prices of raw materials due to factors like weather conditions and geopolitical instability

Market Opportunities

- Increasing public awareness of the advantages of low-fat and low-calorie foods

- Increasing use as pharmaceutical excipient

- Rising demand for plant-based and vegan alternatives

Hydrocolloids Market Report Coverage

| Market | Hydrocolloids Market |

| Hydrocolloids Market Size 2022 | USD 10,623.4 Million |

| Hydrocolloids Market Forecast 2032 | USD 18,431.5 Million |

| Hydrocolloids Market CAGR During 2023 - 2032 | 6.5% |

| Hydrocolloids Market Analysis Period | 2020 - 2032 |

| Hydrocolloids Market Base Year |

2022 |

| Hydrocolloids Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Function, By Source, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF, Kerry Group, Ingredion, Palsgaard A/S, Tate & Lyle PLC, Cargill Inc., DowDuPont, Darling Ingredients, CP Kelco, and Ashland Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Hydrocolloids Market Insights

The global hydrocolloid market is poised for significant expansion driven by several key factors. Increased utilization of hydrocolloid-based construction materials, coupled with growing demand from the personal care and pharmaceutical sectors, is anticipated to drive market growth. Additionally, the rising need for thickening and gelling applications in the food and beverage industry is expected to further boost market expansion. The demand for hydrocolloids is also escalating due to the increasing preference for nutritious food products, particularly among health-conscious consumers. This trend is paralleled by a surge in demand for processed meals owing to their convenience, further propelling market growth. Hydrocolloids play a pivotal role in the food processing industry, serving as essential thickeners, gelling agents, and stabilizers, thus underlining their significance in driving market dynamics. Overall, the global hydrocolloid market is set to experience substantial growth, driven by diverse applications across various industries and the evolving preferences of consumers towards healthier and more convenient food options.

Hydrocolloids Market Segmentation

The worldwide market for hydrocolloids is split based on product, function, source, application, and geography.

Hydrocolloid Products

- Gelatin

- Gum Arabic

- Xanthan Gum

- Alginates

- Carrageenan

- Guar Gum

- Agar

- Locust Bean Gum

- Pectin

- Carboxy Methyl Cellulose

In 2023, the gelatin segment is anticipated to dominate the market share based on product types. Gelatin, derived from animal sources like porcine, chicken, bovine, and marine, is formed through partial hydrolysis of collagen. Renowned for its exceptional stabilizing, gelling, and foaming properties, gelatin finds extensive application in the food and beverage industry. Its demand is projected to surge over the hydrocolloids industry forecast period, driven by the rising preference for convenient and nutritious food and beverage products. Moreover, its utilization in medicinal applications is also expected to contribute to the segment's growth trajectory.

Hydrocolloid Functions

- Thickener

- Stabilizers

- Gelling agents

- Others

According to the hydrocolloids industry analysis, various functions are delineated, including thickeners, stabilizers, coating agents, fat replacers, gelling agents, and others. Projections indicate that the stabilizers segment will experience the most rapid growth. Stabilizers serve as additives designed to enhance the viscosity of beverages, thereby refining their flavor and texture. Additionally, these compounds play a crucial role in maintaining emulsification processes by preventing the settling of components. Among the most commonly utilized hydrocolloids in the stabilizers category are xanthan gum, gum acacia, and gum arabic.

Hydrocolloid Sources

- Botanical

- Microbial

- Seaweed

- Animal

- Synthetic

The botanical segment is poised to emerge as the fastest-growing sector within the global hydrocolloids market. This surge can be attributed significantly to the evolving preferences of consumers towards plant-based products, marking a substantial shift in the industry landscape. The escalating adoption of hydrocolloids in the natural pharmaceutical and cosmetic sectors further propels the growth trajectory of this segment. Moreover, the burgeoning trend towards gluten- and lactose-free products is fueling increased demand for hydrocolloids, driving market share expansion in novel product formulations. This paradigm shift underscores the pivotal role of botanical-sourced hydrocolloids in meeting the evolving needs of discerning consumers, thereby amplifying their significance within the market ecosystem.

Hydrocolloid Applications

- Food & Beverage

- Cosmetics & personal care products

- Pharmaceuticals

The food and beverage segment is forecasted to dominate the hydrocolloid market share in 2023, exhibiting a commanding presence driven by several key factors. A significant contributor to this segment's prominence is the widespread establishment of food and beverage manufacturing facilities, coupled with a notable uptick in consumer spending on innovative and conveniently processed products. Hydrocolloids play a crucial role in this sector owing to their remarkable ability to modify liquid flow properties, enhance gelling capacity, facilitate oil droplet emulsification, and inhibit ice recrystallization. These multifaceted functionalities position hydrocolloids as indispensable ingredients within the food service industry, where they contribute to enhancing product quality, texture, and overall consumer experience.

Hydrocolloids Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Hydrocolloids Market Regional Analysis

In terms of hydrocolloids market analysis, the Asia-Pacific region has emerged as the most significant market globally. The increasing use of carboxymethyl cellulose in processed foods, coupled with the burgeoning apparel and construction industries, is anticipated to drive the regional demand for these products. China is expected to be a major consumer due to its rising demand for food and beverage products. The availability of abundant raw materials is predicted to further fuel market growth in this region. Moreover, the growing urbanization and rising disposable incomes are leading to increased consumption of convenience and packaged foods, which in turn boosts the demand for hydrocolloids. Additionally, hydrocolloid manufacturing hubs in India, China, Thailand, and Indonesia contribute substantially to the region's growth.

In Europe, industry is likewise expanding rapidly expected to grow throughout the hydrocolloids market forecast period. The region's demand is being driven by a greater emphasis on natural and clean-label ingredients in the food and beverage industry. The growing popularity of vegan and plant-based diets has increased the demand for hydrocolloids as thickeners, stabilizers, and emulsifiers. Advancements in food technology and a strong regulatory framework supporting food safety and quality have spurred the European market to become one of the fastest-growing regions in the hydrocolloids market. Furthermore, the increasing use of hydrocolloids in the pharmaceutical and cosmetics industries is driving market expansion in Europe. The considerable emphasis on R&D in these industries is likely to drive innovation and increase the use of hydrocolloids.

Hydrocolloids Market Players

Some of the top hydrocolloids companies offered in our report includes BASF, Kerry Group, Ingredion, Palsgaard A/S, Tate & Lyle PLC, Cargill Inc., DowDuPont, Darling Ingredients, CP Kelco, and Ashland Inc.

Frequently Asked Questions

How big is the hydrocolloids market?

The hydrocolloids market size was valued at USD 10,623.4 million in 2023.

What is the CAGR of the global hydrocolloids market from 2024 to 2032?

The CAGR of hydrocolloids is 6.5% during the analysis period of 2024 to 2032.

Which are the key players in the hydrocolloids market?

The key players operating in the global market are including BASF, Kerry Group, Ingredion, Palsgaard A/S, Tate & Lyle PLC, Cargill Inc., DowDuPont, Darling Ingredients, CP Kelco, and Ashland Inc.

Which region dominated the global hydrocolloids market share?

Asia-Pacific held the dominating position in hydrocolloids industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of hydrocolloids during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global hydrocolloids industry?

The current trends and dynamics in the hydrocolloids industry include increasing consumption of convenience foods, versatile functionality in the food and beverages industry, growing health-consciousness among consumers, and increased adoption of e-commerce platforms.

Which function held the maximum share in 2023?

The stabilizers function expected to held the maximum share of the hydrocolloids industry.