Hydraulic Valves Market | Acumen Research and Consulting

Hydraulic Valves Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

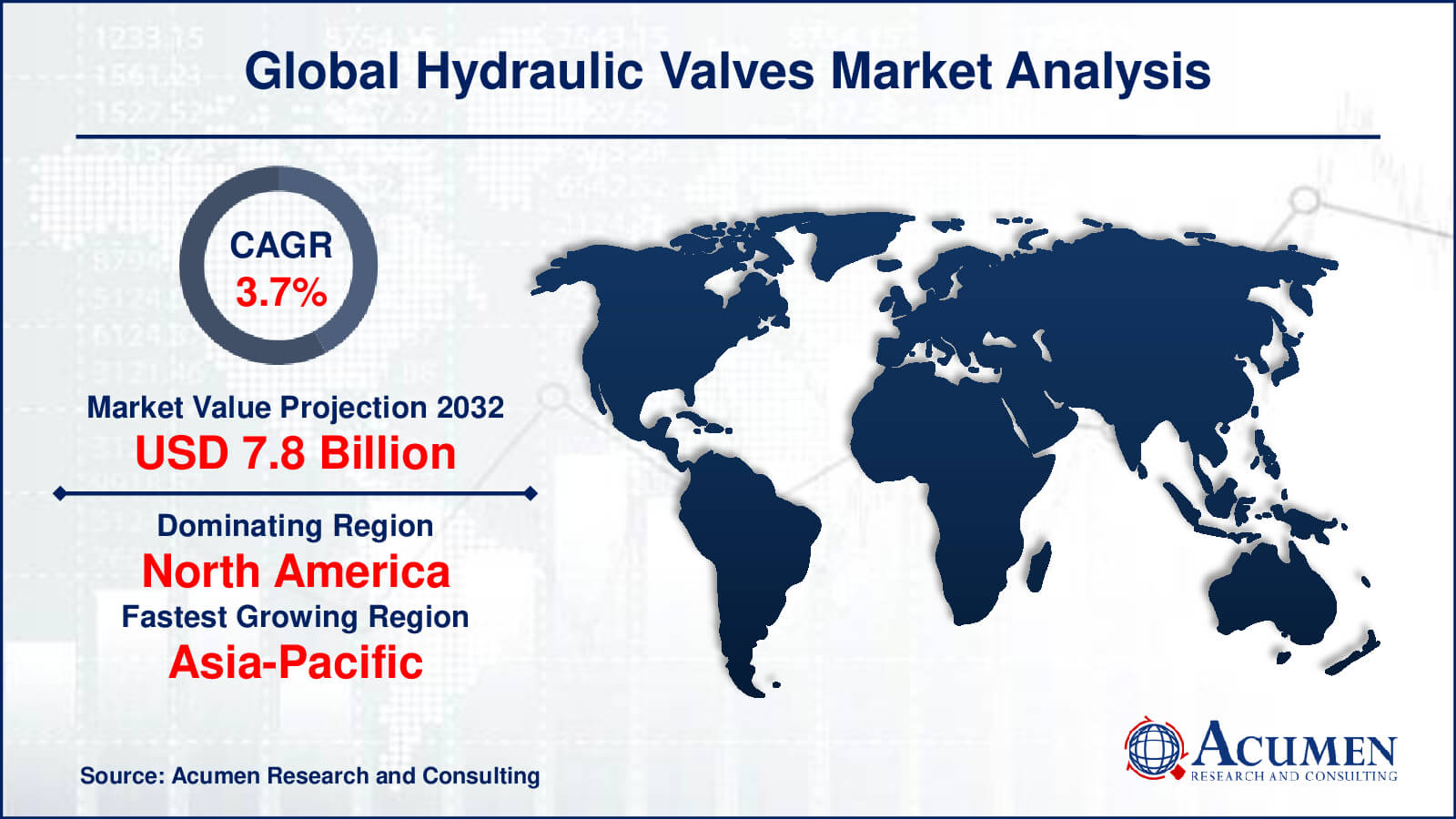

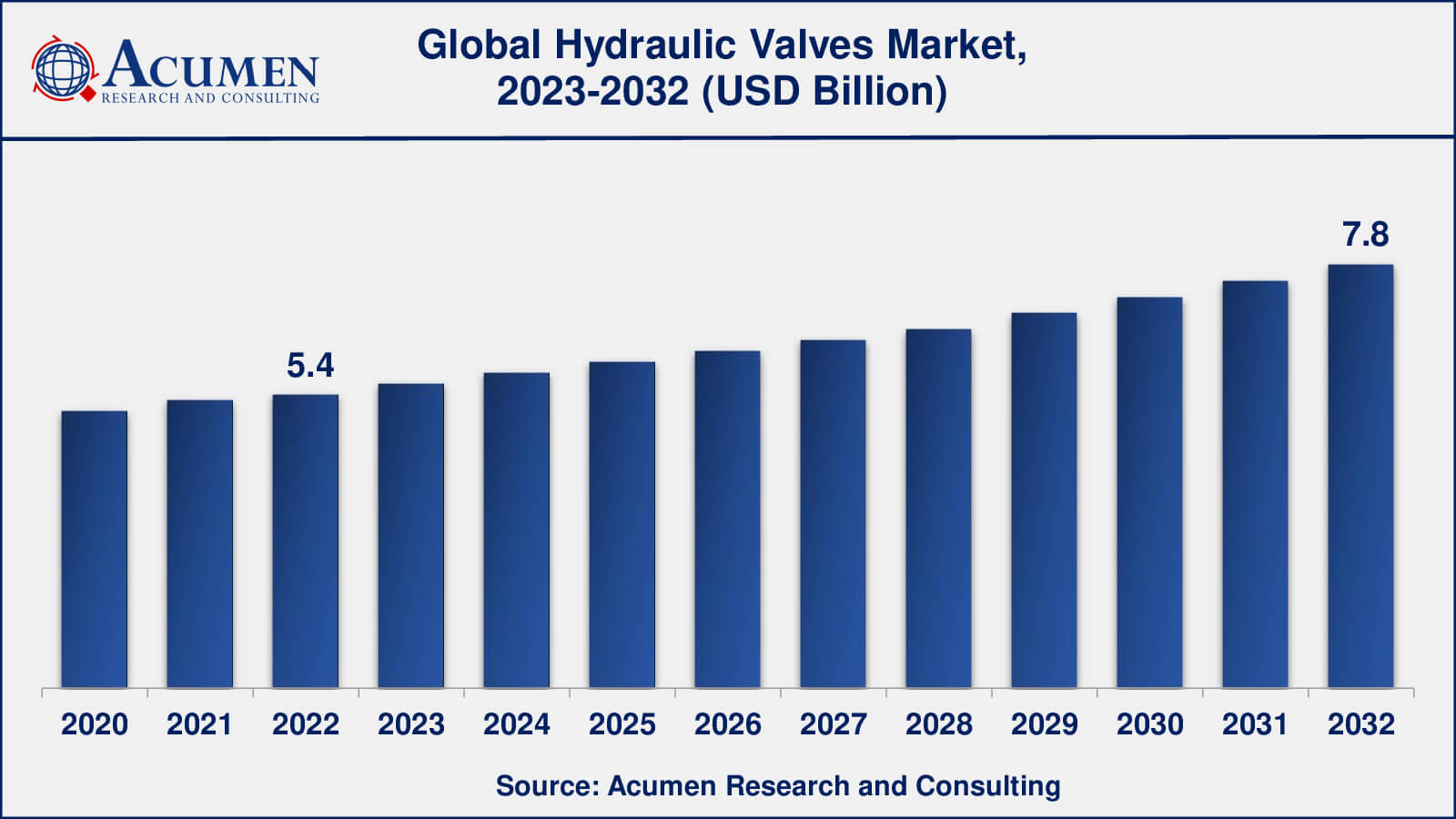

The Global Hydraulic Valves Market Size accounted for USD 5.4 Billion in 2022 and is estimated to achieve a market size of USD 7.8 Billion by 2032 growing at a CAGR of 3.7% from 2023 to 2032.

Hydraulic Valves Market Highlights

- Global hydraulic valves market revenue is poised to garner USD 7.8 billion by 2032 with a CAGR of 3.7% from 2023 to 2032

- North America hydraulic valves market value occupied almost USD 2 million in 2022

- Asia-Pacific hydraulic valves market growth will record a CAGR of around 4% from 2023 to 2032

- Among product type, the directional hydraulic valves sub-segment generated around US$ 1.9 billion revenue in 2022

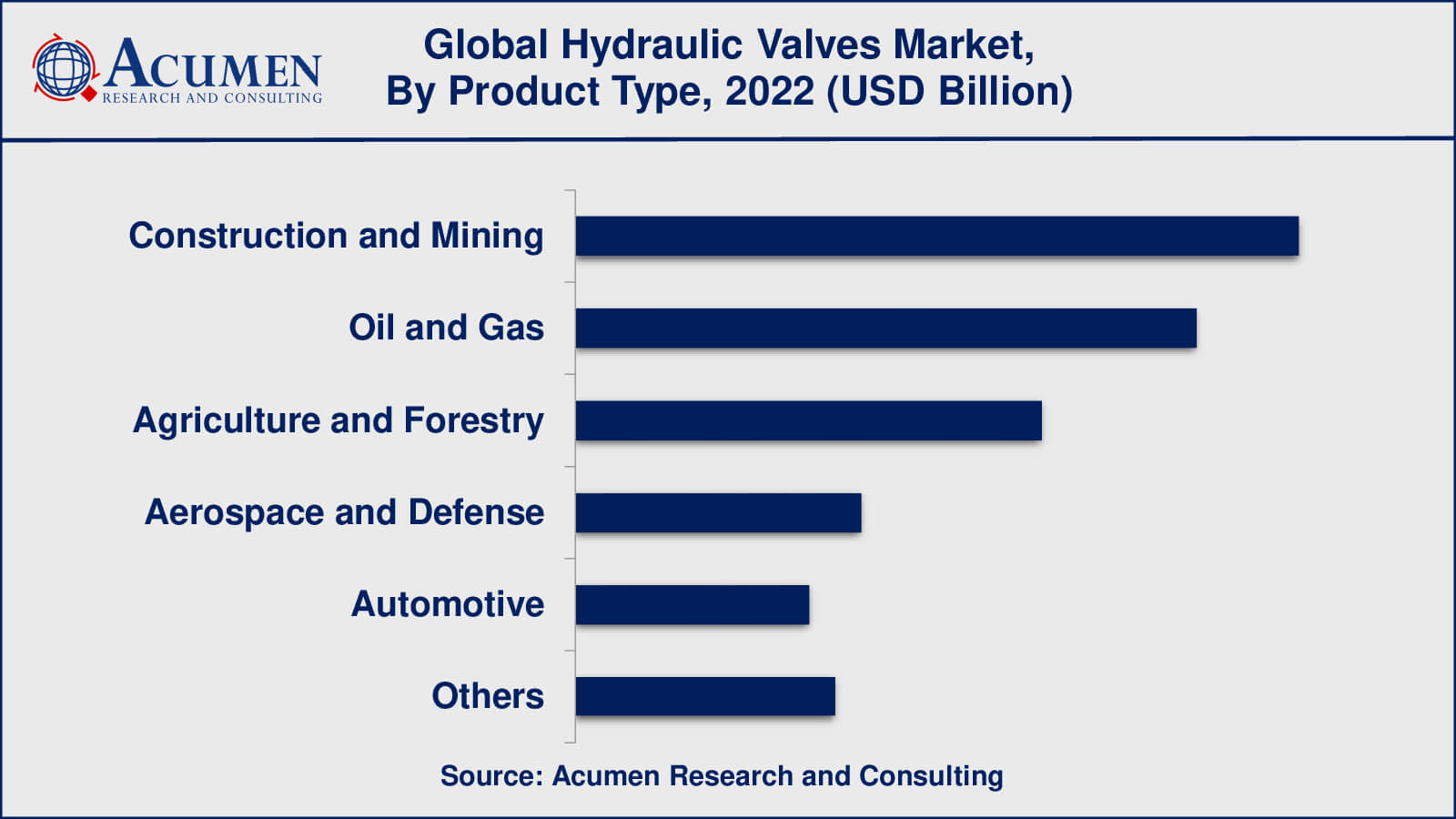

- Based on end-use industry, the construction and mining sub-segment generated over 28% share in 2022

- Integration of smart technologies is a popular hydraulic valves market trend that fuels the industry demand

Hydraulic valves are a vital feature of hydraulic power systems. They regulate the flow and pressure of water or oil in the systems by controlling the volume of fluid that flows through the system. Hydraulic valves are critical components in hydraulic systems that control the flow, direction, and pressure of the hydraulic fluid to enable the efficient operation of various machinery and equipment. They play a vital role in regulating the performance and safety of hydraulic systems in a wide range of applications across different industries. The increasing demand for hydraulic valves from the wastewater and water industry is one of the main forces driving the market growth.

Global Hydraulic Valves Market Dynamics

Market Drivers

- Increasing demand from end-use industries

- Emphasis on energy-efficient solutions

- Adoption of digitalization and IoT

- Shift towards electro-hydraulic and proportional hydraulic valves

Market Restraints

- High cost of advanced hydraulic valves

- Intense competition and price pressures

- Regulatory and environmental constraints

Market Opportunities

- Growing adoption of automation and digitalization

- Growing demand from renewable energy sector

- Increasing adoption of additive manufacturing

- Focus on aftermarket services

Hydraulic Valves Market Report Coverage

| Market | Hydraulic Valves Market |

| Hydraulic Valves Market Size 2022 | USD 5.4 Billion |

| Hydraulic Valves Market Forecast 2032 | USD 7.8 Billion |

| Hydraulic Valves Market CAGR During 2023 - 2032 | 3.7% |

| Hydraulic Valves Market Analysis Period | 2020 - 2032 |

| Hydraulic Valves Market Base Year | 2022 |

| Hydraulic Valves Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Eaton Corporation, Bosch Rexroth AG, Parker Hannifin Corporation, Daikin Industries, Ltd., Kawasaki Heavy Industries, Ltd., HAWE Hydraulik SE, Curtiss-Wright Corporation, Emerson Electric Co., Sun Hydraulics LLC, Hydac International GmbH, Bucher Hydraulics GmbH, Atos Spa, Danfoss Power Solutions, Moog Inc., and Hengli Hydraulic Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Hydraulic Valves Market Insights

The global hydraulic valve market is highly fragmented with the presence of well-diversified national and international vendors. Opportunities are manifold such as - the intensely competitive environment in this market is expected to get bigger with the rise in product extensions, brand-new technology, and amalgamations. Positively, the global hydraulic valve market will witness steady growth over the forecast period. Globally, there is an increase in demand for uncontaminated and pure water for domestic consumption purposes. Advanced economies have a well-developed infrastructure for water production. However, there are a few challenges such as the BRIC nation’s lack of effective supply facilities, resulting in impurities polluting the water during conveyance and government regulations on industrial wastewater disposal in APAC, which has led to the contamination of natural reservoirs. Nonetheless, such factors have led to increased investment in the water and wastewater treatment industry, which, in turn, is expected to boost the demand for hydraulic valves over the next five years.

Hydraulic Valves Market, By Segmentation

The worldwide market for hydraulic valves is split based on product type, end-use industry, and geography.

Hydraulic Valve Product Types

- Directional

- Flow

- Pressure

- Electro-Hydraulic

- Others

According to hydraulic valves industry research, directional control valves are the most commonly used and dominant type of hydraulic valves on the market. These valves are used in hydraulic systems to control the direction of fluid flow, allowing for precise control of actuator movement and positioning. In addition, flow control valves, which control the rate of fluid flow in a hydraulic system, and pressure control valves, which regulate the pressure of the hydraulic fluid, are widely used in a variety of hydraulic applications.

Electro-hydraulic valves, which use electrical signals to control hydraulic valve opening and closing, are gaining popularity due to their precise control and automation capabilities, particularly in advanced hydraulic systems and applications. Others could include various specialised types of hydraulic valves such as proportional valves, cartridge valves, check valves, and relief valves, among others, which may have specific applications in specific industries or niche markets.

Hydraulic Valve End-Use Industries

- Construction and Mining

- Oil and Gas

- Agriculture and Forestry

- Aerospace and Defense

- Automotive

- Others

According to the hydraulic valves market forecast, the construction and mining industries have been major users of hydraulic valves, particularly in heavy equipment and machinery used in material handling, earthmoving, excavating, and other construction and mining applications. Hydraulic valves are used in construction and mining equipment to control the movements of hydraulic cylinders, motors, and other hydraulic components, providing precise control and efficient operation.

Hydraulic valves are used in a variety of applications in the oil and gas industry, including subsea equipment, offshore drilling rigs, pipeline systems, and hydraulic fracturing operations. Hydraulic valves are used in critical operations such as controlling fluid flow, regulating pressure, and ensuring safety and reliability in the extraction and transportation of oil and gas.

Hydraulic Valves Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Hydraulic Valves Market Regional Analysis

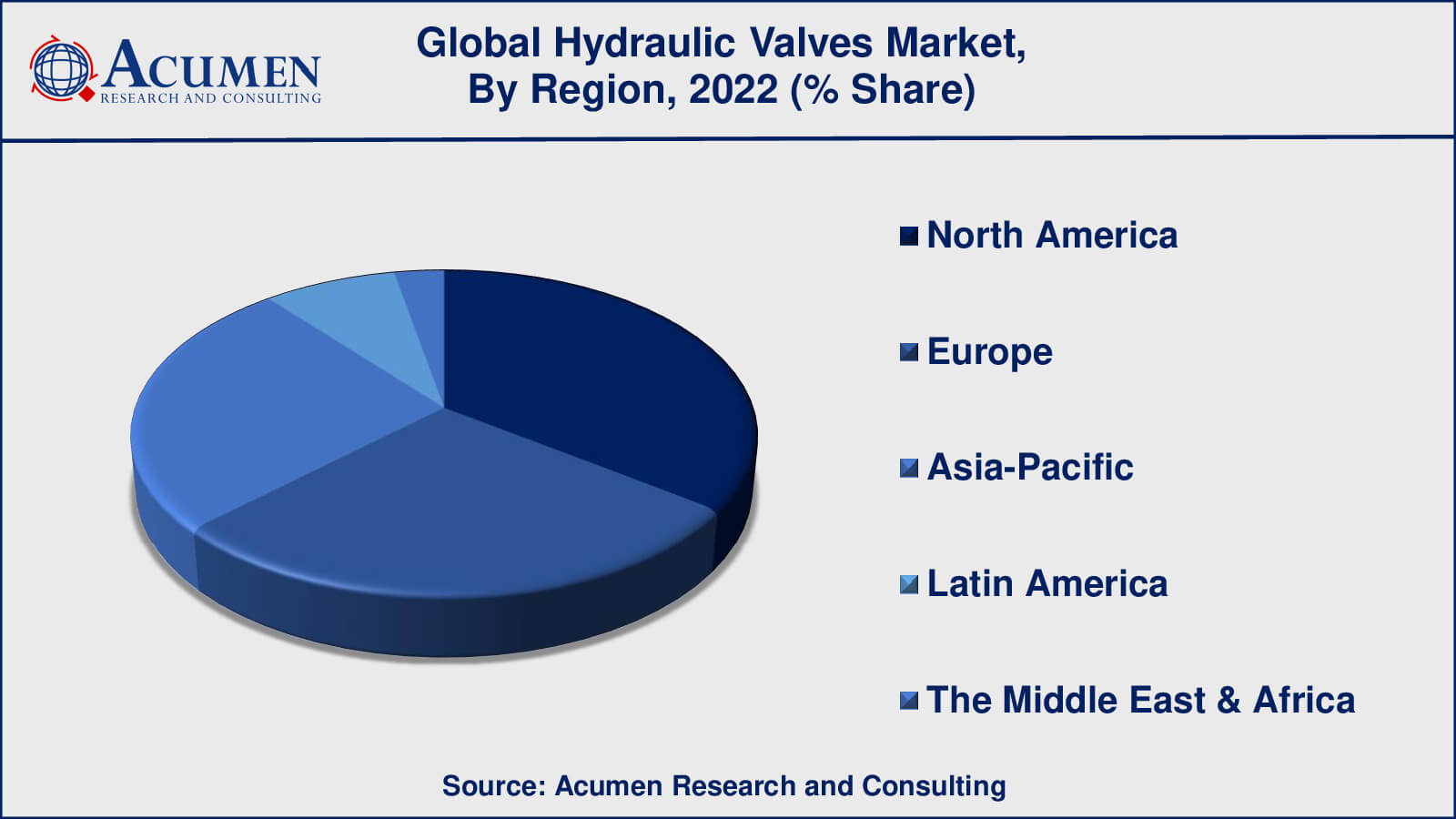

North America and Europe account for the majority of the global hydraulic valves market, with the United States and Germany leading the way. However, due to changing market dynamics and trends, the exact ranking of regions in terms of market size may vary over time.

The presence of key industries such as construction, agriculture, oil and gas, and aerospace in North America drives the hydraulic valves market. These industries extensively use hydraulic valves in their equipment and machinery. Technological advancements, increased automation, and an emphasis on energy-efficient solutions all have an impact on the demand for hydraulic valves in North America.

In recent years, Asia-Pacific emerging economies such as China and India have experienced rapid industrialization, infrastructure development, and increased demand for construction, mining, and agriculture equipment, which may have contributed to a faster growth rate in the hydraulic valves market in those regions. Because of established industrial sectors, advanced manufacturing capabilities, and demand from various end-use industries, North America and Europe are also significant markets for hydraulic valves.

Hydraulic Valves Market Players

Some of the top hydraulic valves companies offered in the professional report Eaton Corporation, Bosch Rexroth AG, Parker Hannifin Corporation, Daikin Industries, Ltd., Kawasaki Heavy Industries, Ltd., HAWE Hydraulik SE, Curtiss-Wright Corporation, Emerson Electric Co., Sun Hydraulics LLC, Hydac International GmbH, Bucher Hydraulics GmbH, Atos Spa, Danfoss Power Solutions, Moog Inc., and Hengli Hydraulic Co., Ltd.

Frequently Asked Questions

What was the market size of the global hydraulic valves in 2022?

The market size of hydraulic valves was USD 5.4 billion in 2022.

What is the CAGR of the global hydraulic valves from 2023 to 2032?

The CAGR of hydraulic valves is 3.7% during the analysis period of 2023 to 2032.

Which are the key players in the hydraulic valves market?

The key players operating in the global hydraulic valves market is includes Eaton Corporation, Bosch Rexroth AG, Parker Hannifin Corporation, Daikin Industries, Ltd., Kawasaki Heavy Industries, Ltd., HAWE Hydraulik SE, Curtiss-Wright Corporation, Emerson Electric Co., Sun Hydraulics LLC, Hydac International GmbH, Bucher Hydraulics GmbH, Atos Spa, Danfoss Power Solutions, Moog Inc., and Hengli Hydraulic Co., Ltd.

Which region dominated the global hydraulic valves market share?

North America held the dominating position in hydraulic valves industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of hydraulic valves during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global hydraulic valves industry?

The current trends and dynamics in the hydraulic valves industry include increasing demand from end-use industries, emphasis on energy-efficient solutions, adoption of digitalization and IoT, and shift towards electro-hydraulic and proportional hydraulic valves.

Which product type held the maximum share in 2022?

The directional hydraulic valves product type held the maximum share of the hydraulic valves industry.