Hydraulic Fracturing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Hydraulic Fracturing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

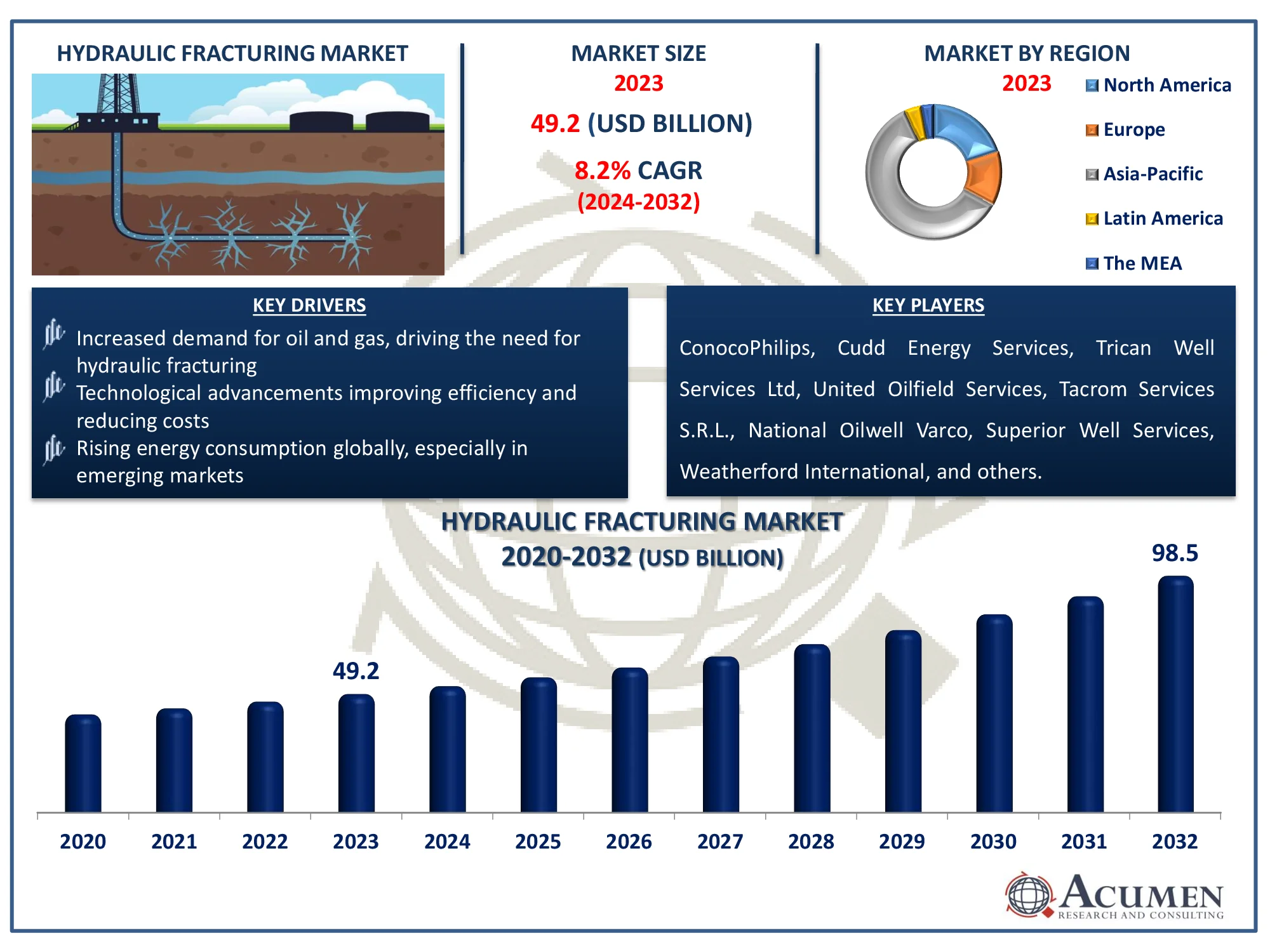

The Global Hydraulic Fracturing Market Size accounted for USD 49.2 Billion in 2023 and is estimated to achieve a market size of USD 98.5 Billion by 2032 growing at a CAGR of 8.2% from 2024 to 2032.

Hydraulic Fracturing Market Highlights

- The global hydraulic fracturing market is projected to reach USD 98.5 billion by 2032, with a CAGR of 8.2% from 2024 to 2032

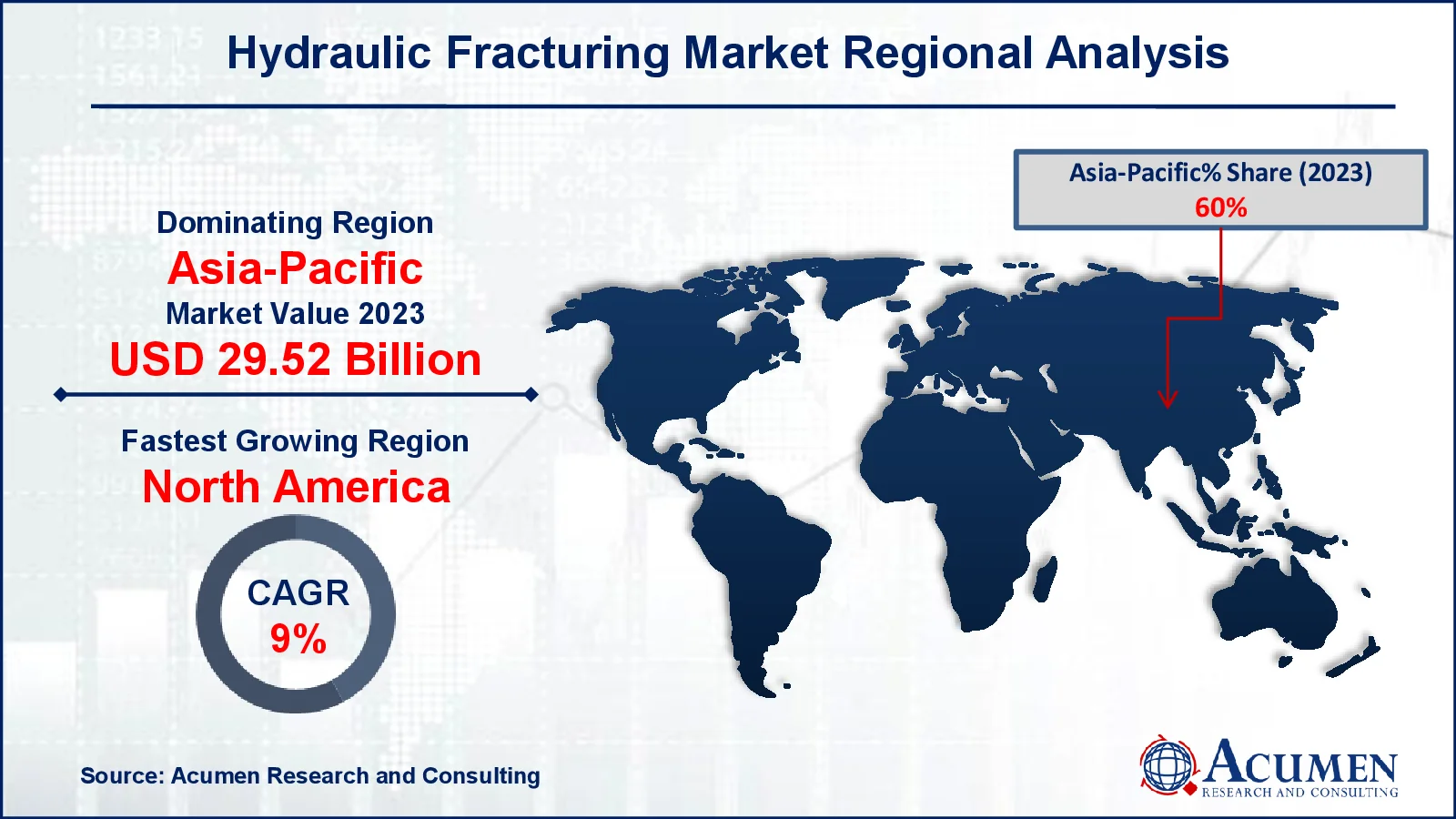

- In 2023, the Asia-Pacific hydraulic fracturing market held a value of approximately USD 29.52 billion

- The North America region is expected to grow at a CAGR of over 9% from 2024 to 2032

- The horizontal well type sub-segment captured 90% of the market share in 2023

- Shift towards eco-friendly fracturing fluids is the hydraulic fracturing market trend that fuels the industry demand

Hydraulic fracturing is a well-known technology that uses the flow of hydrocarbons to the surface to generate fissures in rock formations. Fractures are formed by pumping large amounts of fluid under high stress, which includes Horizontals such as ceramic pallets, sand, water, and chemical additives that expand fractures in rock formation. Noise and air pollution, earthquakes, water usage and contamination are some of the concerns associated with the technology, and fracking is illegal in many countries.

Global Hydraulic Fracturing Market Dynamics

Market Drivers

- Increased demand for oil and gas, driving the need for hydraulic fracturing

- Technological advancements improving efficiency and reducing costs

- Rising energy consumption globally, especially in emerging markets

Market Restraints

- Environmental concerns and regulatory challenges related to fracking

- High operational and maintenance costs for hydraulic fracturing equipment

- Water usage issues in areas with limited water resources

Market Opportunities

- Development of eco-friendly fracking technologies to address environmental concerns

- Growth in unconventional oil and gas reserves, increasing the demand for hydraulic fracturing

- Expansion of hydraulic fracturing activities in offshore and deepwater region

Hydraulic Fracturing Market Report Coverage

| Market | Hydraulic Fracturing Market |

| Hydraulic Fracturing Market Size 2022 |

USD 49.2 Billion |

| Hydraulic Fracturing Market Forecast 2032 | USD 98.5 Billion |

| Hydraulic Fracturing Market CAGR During 2023 - 2032 | 8.2% |

| Hydraulic Fracturing Market Analysis Period | 2020 - 2032 |

| Hydraulic Fracturing Market Base Year |

2022 |

| Hydraulic Fracturing Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Well Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ConocoPhilips, Cudd Energy Services, Trican Well Services Ltd, United Oilfield Services, Tacrom Services S.R.L., National Oilwell Varco, Superior Well Services, Weatherford International, Patterson UTI, and Calfrac Well Services. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Hydraulic Fracturing Market Insights

Growing E&P in unconventional oil and gas deposits, particularly in shale basins, is likely to continue to be a primary driver of market expansion. The rising need for primary energy in electricity generation, transportation, and household activity in major economies around the world has resulted in increased oil and gas consumption. The depletion of standard resources has caused a reduction in manufacturing among the world's biggest oil and gas producers. The declining production of petroleum is likely to increase the demand gap. Horizontal boiling, combined with hydraulic fracturing procedures, has increased unconventional hydrocarbon extraction reserves. The governments of the United States and China have proposed a variety of initiatives to assist economic growth, including financial help, FDI provisions, and hydrocarbon tax benefits.

However, the growth of hydraulic fracturing markets may be hampered by high capital costs and a negative environmental impact. Shifting trends in the development of unconventional assets such as shale, tight gas, tight oil, and carbon bed methane (CBM) are projected to drive market expansion in hydraulic fracture in the next years. Sophisticated extraction processes have also helped E&P companies increase profits in deep- and ultra-deep-sea, low-profit locations, and Arctic sites.

The Energy Information Agency (EIA) predicts that E&P activities in unconventional resources, such as shale gas and tight oil, will gain traction in coming years. Exploration of alternative hydrocarbon reserves is likely to delay the depletion of conventional reserves by a few years. These factors are projected to have a positive impact on the hydraulic fracturing market throughout the forecast period.

The hydraulic fracturing market value chain is divided into multiple complicated categories, including exploration and production (E&P), petroleum field services, water and waste disposal, micro seismic monitoring, fracturing fluids, fracturing systems, and regulatory agencies.

Due to the possible environmental concerns, stringent restrictions and safety standards imposed by various national governments and regulatory organizations, such as the EPA and REACH, are projected to stymie business growth. Moratoriums and prohibitions on hydraulic fracturing imposed by many regional agencies in France, Romania, Tunisia, and Bulgaria will also pose significant challenges for industry participants.

Hydrofracking operations are likewise significantly tied to crude oil prices. Low crude oil prices have significantly impacted oil production in narrow and shallow reservoirs during the previous two years, particularly in North America. The acquisition of a permanent water source, as well as concerns about waste management, represents a danger to industry participants. To reduce environmental risk, major industries have developed innovative systems that require little or no water.

Hydraulic Fracturing Market Segmentation

The worldwide market for hydraulic fracturing is split based on technology, well type, application, and geography.

Hydraulic Fracturing Technologies

- Sliding Sleeve

- Plug and Perf

According to the hydraulic fracturing industry analysis, plug and perf has been the most popular hydraulic fracturing technique, accounting notable share in market. The method of hydrofracturing casted holes is widely employed and is expected to remain reasonably strong during the prediction period.

Sliding sleeve technology continues to advance, and it is increasingly being used in open-hole and naturally cracked constructions. The two approaches are utilized alone or in combination depending on some of the main criteria, such as price, fracture performance, structural form, and pore ability.

Hydraulic Fracturing Well Types

- Horizontal

- Vertical

The horizontal well type dominates the hydraulic fracturing business, because of its ease of access to reservoirs. Drilling horizontally exposes a bigger surface area of the wellbore to the reservoir, which improves oil or gas flow. It also allows for the extraction of resources from tight formations that vertical wells cannot efficiently penetrate. As a result, horizontal wells are less expensive and produce more efficiently, making them the favored choice in current hydraulic fracturing operations.

Hydraulic Fracturing Applications

- Tight oil

- Shale gas

- Tight gas

According to the hydraulic fracturing market forecast, tight oil is likely to dominate industry due to large reserves in shale and other unconventional formations. Hydraulic fracturing, or fracking, is the principal method for unlocking tight oil because it splits the rock and releases trapped hydrocarbons. The growing need for energy, combined with advances in fracking technology, has made tight oil extraction more economically viable. As a result, tight oil production is expected to dominate the market, particularly in regions like North America, where shale plays are plentiful.

Hydraulic Fracturing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Hydraulic Fracturing Market Regional Analysis

For several reasons, Asia-Pacific dominates the hydraulic fracturing market due to the region's increasing demand for energy, coupled with significant shale gas and tight oil reserves in countries like China and India. Advancements in fracking technology and the push for energy security have spurred investments in hydraulic fracturing projects across the region. As energy needs rise, Asia-Pacific is expected to continue leading in hydraulic fracturing market share.

North America is expected to see robust growth in the hydraulic fracturing market, driven by the vast shale oil and gas reserves in the United States and Canada. For instance, in North America, North Dakota voted to redirect USD 221 million in federal coronavirus funding to various state agencies, including a USD 16 million award to oil corporations to promote the fracking process. The region has been a pioneer in fracking technology, significantly increasing production in shale plays like the Permian Basin. As the demand for domestic energy and exports grows, North America’s market is set to expand further in the coming years.

Hydraulic Fracturing Market Players

Some of the top hydraulic fracturing companies offered in our report include ConocoPhilips, Cudd Energy Services, Trican Well Services Ltd, United Oilfield Services, Tacrom Services S.R.L., National Oilwell Varco, Superior Well Services, Weatherford International, Patterson UTI, and Calfrac Well Services.

Frequently Asked Questions

How big is the hydraulic fracturing market?

The hydraulic fracturing market size was valued at USD 49.2 billion in 2023.

What is the CAGR of the global hydraulic fracturing market from 2024 to 2032?

The CAGR of hydraulic fracturing is 8.2% during the analysis period of 2024 to 2032.

Which are the key players in the hydraulic fracturing market?

The key players operating in the global market are including ConocoPhilips, Cudd Energy Services, Trican Well Services Ltd, United Oilfield Services, Tacrom Services S.R.L., National Oilwell Varco, Superior Well Services, Weatherford International, Patterson UTI, and Calfrac Well Services.

Which region dominated the global hydraulic fracturing market share?

Asia-Pacific held the dominating position in hydraulic fracturing industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of hydraulic fracturing during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global hydraulic fracturing industry?

The current trends and dynamics in the hydraulic fracturing industry include increased demand for oil and gas, driving the need for hydraulic fracturing, technological advancements improving efficiency and reducing costs, and rising energy consumption globally, especially in emerging markets.

Which well type held the maximum share in 2023?

The horizontal well type held the maximum share of the hydraulic fracturing industry.