Hydraulic Cylinder Market | Acumen Research and Consulting

Hydraulic Cylinder Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

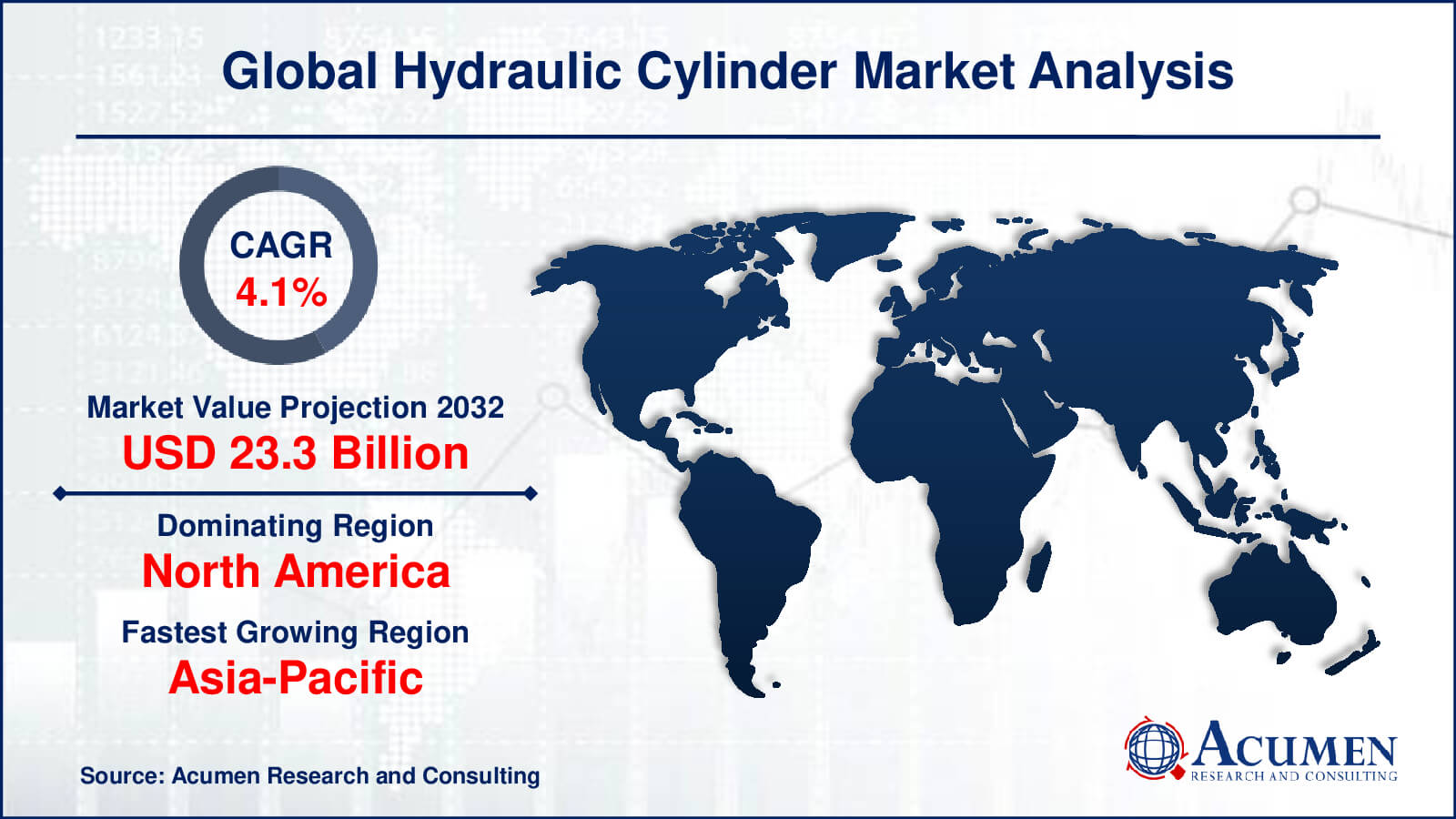

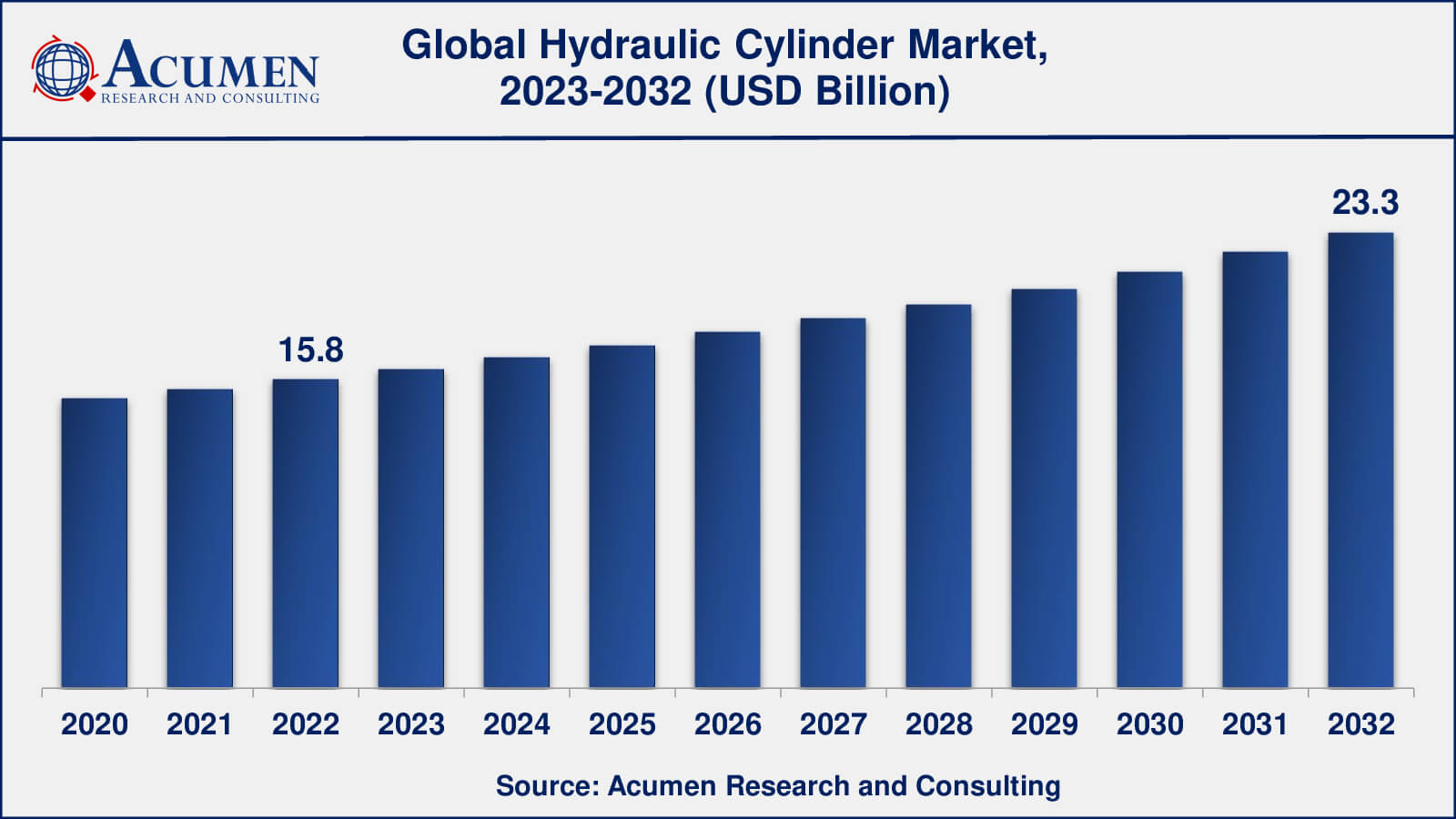

The Global Hydraulic Cylinder Market Size collected USD 15.8 Billion in 2022 and is set to achieve a market size of USD 23.3 Billion in 2032 growing at a CAGR of 4.1% from 2023 to 2032.

Hydraulic Cylinder Market Report Statistics

- Global hydraulic cylinder market revenue is estimated to reach USD 23.3 billion by 2032 with a CAGR of 4.1% from 2023 to 2032

- North America hydraulic cylinder market value occupied more than USD 4.9 billion in 2022

- Asia-Pacific hydraulic cylinder market growth will record a CAGR of over 4% from 2023 to 2032

- Among function, the double-acting sub-segment generated around 70% share in 2022

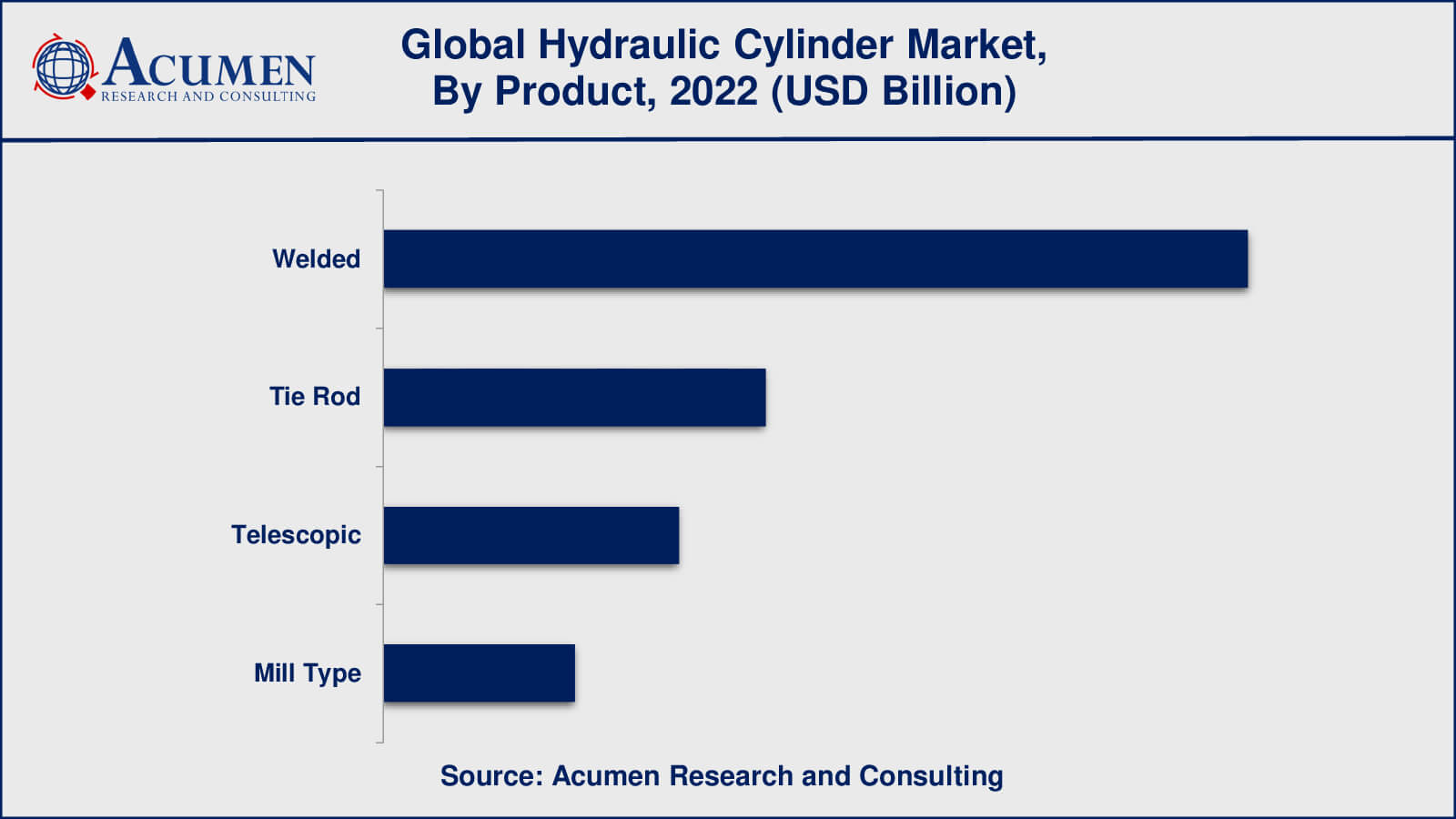

- Based on product, the welded sub-segment generated around US$ 8 billion revenue in 2022

- Adoption of eco-friendly hydraulic fluids is a popular hydraulic cylinder market trend that fuels the industry demand

A hydraulic cylinder can be used to give a unidirectional force through a unidirectional stroke. It is also known as a linear hydraulic motor which is a type of mechanical actuator. It has many fields of use, mainly in manufacturing machinery, construction machinery (engineering trams), and civil engineering. The linear hydraulic motor is another term for a hydraulic cylinder. Pressurized hydraulic fluid gives power to hydraulic cylinders that are mainly oil. The hydraulic cylinder has a cylindrical barrel in which a piston rod has a piston connected to it and moves back and forth continuously. The barrel is closed from one end by the cylindrical head (also known as the gland) and on the other end by the cylinder bottom (also known as the cap). The piston has seals and rings which are sliding. The inside of the cylinder is divided by the piston into two chambers - the piston rod side chamber and the bottom chamber.

Global Hydraulic Cylinder Market Dynamics

Market Drivers

- Increased demand in the construction industry

- Surging demand for heavy equipment

- Growth in the manufacturing industry

- Increasing demand for customized hydraulic cylinders

Market Restraints

- High maintenance and operating costs

- Limited efficiency in extreme conditions

- High initial investment

Market Opportunities

- Expansion of the aerospace industry

- Emergence of electric and hybrid hydraulic systems

Hydraulic Cylinder Market Report Coverage

| Market | Hydraulic Cylinder Market |

| Hydraulic Cylinder Market Size 2022 | USD 15.8 Billion |

| Hydraulic Cylinder Market Forecast 2032 | USD 23.3 Billion |

| Hydraulic Cylinder Market CAGR During 2023 - 2032 | 4.1% |

| Hydraulic Cylinder Market Analysis Period | 2020 - 2032 |

| Hydraulic Cylinder Market Base Year | 2022 |

| Hydraulic Cylinder Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Function, By Product, By Application, By Bore Size, and By Industry Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Aggressive Hydraulics, Actuant Corp., Bailey International LLC, Best Metal Products, Burnside Eurocyl Ltd., Burnside Group, Bosch Rexroth A.G., Burnside Autocyl (tullow) Ltd., Burnside Hydracyl Ltd., Bucher Hydraulics Gmbh, Dongyang Mechatronics Corp., Chapel Group, Changzhou Sunde Hydraulic Equipment Co. Ltd., Douce Hydro, and Eaton Corp. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Hydraulic Cylinder Market Growth Factors

The demand for hydraulic cylinders is mainly led to its growing number of applications in various areas including agriculture, manufacturing, mining, construction, defense, and aerospace. Moreover, the rise in demand from OEMs is due to increasing advancements in the level of industrial processes and leading global trade adds up towards the growth of the hydraulic cylinder market. The market is growing rapidly and it is mainly led by the growing economies. There has been a significant increase in the economic condition of major Asian countries such as China and India after-global economic recession. This has cleared the path for the rise of low-scale companies involved in the work of manufacturing and construction. Various manufacturing companies in the Americas and EMEA region are outsourcing their manufacturing demands to various other economies such as India and China, in order to take advantage of less expensive labor costs. Also, most companies have started their manufacturing operations in these economies to benefit maximum from the low-cost manufacturing capabilities and the availability of skilled labor. This step helps companies to enhance their market presence. Therefore, the market is facing enhancement in the investments among both domestic and international vendors. European and North American markets have attained a saturation level. No matter, the stable markets have given a vast chance to the emerging markets, by the action of outsourcing their manufacturing needs to the other emerging small markets. These days, material handling machines such as level luffing cranes, stackers, and e-overhead traveling cranes are largely used by industries such as beverages and foods, energy and power, oil refineries, and retail excluding the engineering and construction domain.

Hydraulic Cylinder Market Segmentation

The worldwide market for hydraulic cylinder is categorized based on function, product, application, bore size, industry vertical, and geography.

Hydraulic Cylinder Function Outlook

- Double-Acting

- Single-Acting

According to the hydraulic cylinder market forecast, double-acting hydraulic cylinders account for the majority of the market. Because they can operate in both directions and apply force in both extending and retracting strokes, double-acting hydraulic cylinders provide greater flexibility and efficiency. They are commonly used in applications such as construction equipment, industrial machinery, and aerospace equipment that require precise control of force, speed, and positioning.

Single-acting hydraulic cylinders, on the other hand, only operate in one direction and rely on an external force to retract the piston, such as gravity or a spring. They are commonly used in applications where the load is supported by other means, such as lifting, and where simplicity and cost-effectiveness are prioritized.

Hydraulic Cylinder Product Outlook

- Welded

- Tie Rod

- Telescopic

- Mill Type

The two types that dominate the hydraulic cylinder market are welded hydraulic cylinders and tie rod hydraulic cylinders. Welded hydraulic cylinders are popular because of their high strength, durability, and leak resistance. They're commonly found in heavy-duty applications like construction equipment, mining machinery, and Material Handling equipment.

Tie rod hydraulic cylinders are also commonly used in a variety of applications due to their ease of maintenance and low cost. They have tie rods that connect the end caps and cylinder barrel, making them simple to disassemble and repair. Tie rod hydraulic cylinders are frequently found in agricultural machinery, industrial machinery, and mobile equipment.

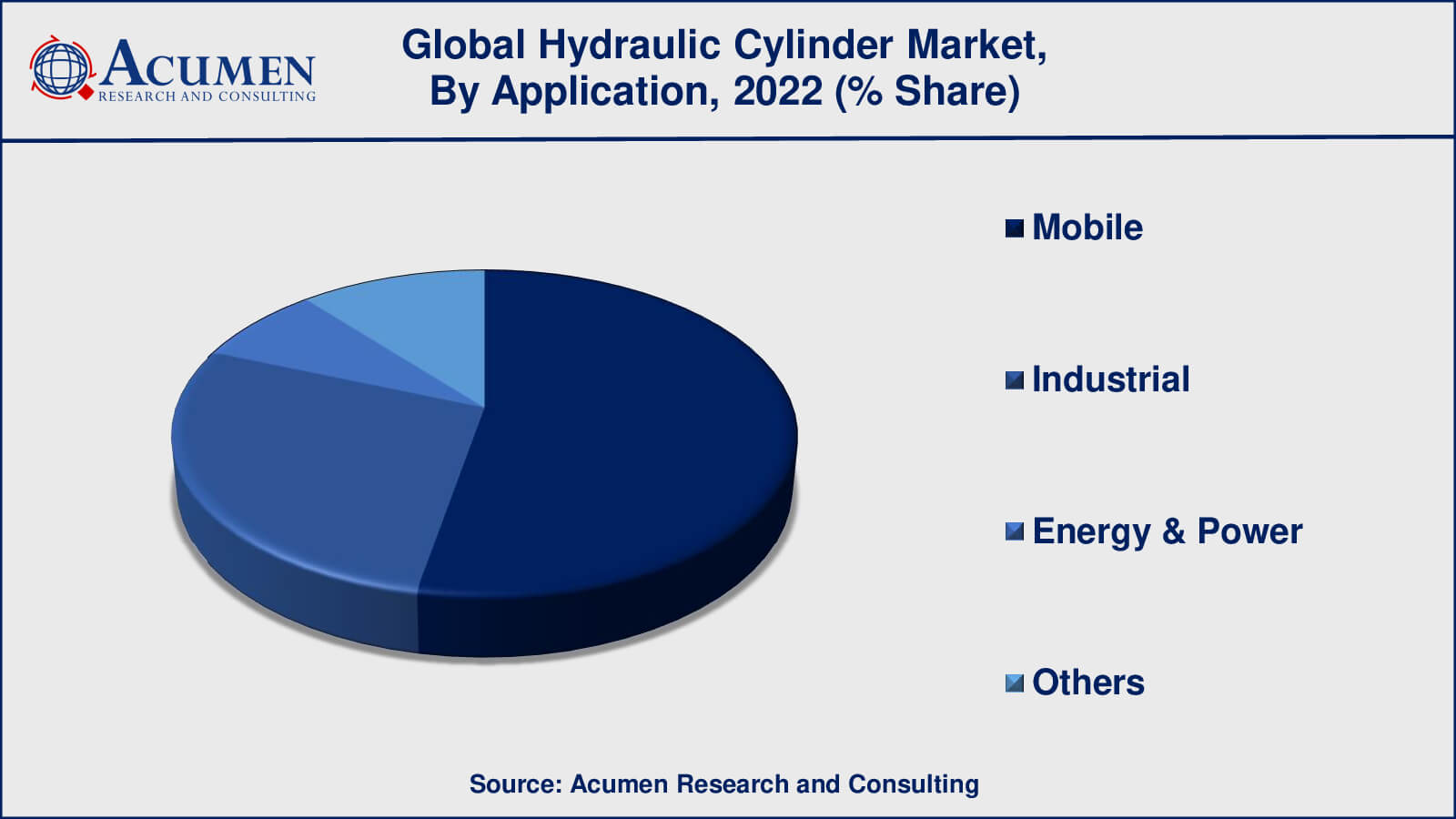

Hydraulic Cylinder Application Outlook

- Mobile

- Industrial

- Energy & Power

- Others

In terms of value, mobile applications dominate the hydraulic cylinder market, fueled primarily by demand for heavy equipment in the construction, mining, and agriculture sectors. Furthermore, due to their wide range of applications in various industrial sectors such as automotive, manufacturing, construction, and aerospace, industrial applications accounted for a significant share of the market. Hydraulic cylinders are also used extensively in the energy and power industries, particularly in hydraulic power generation systems, turbines, and hydroelectric power plants. Hydraulic cylinders are also used in marine, aerospace, defense, and Material Handling equipment.

Hydraulic Cylinder Bore Size Outlook

- <50 MM

- 50-150 MM

- >150 MM

In general, the bore size range of 50-150 mm is the most widely used and thus dominates the hydraulic cylinder market. The bore size range of 50-150 mm is appropriate for a variety of applications, including industrial machinery, construction equipment, and Material Handling equipment. This bore size range strikes a balance between force output and operation speed, making it a versatile choice for a wide range of applications. Smaller applications, such as medical equipment, robotics, and automation systems, typically use bore sizes of 50 mm. The bore size range of >150 mm is commonly used in heavy-duty applications such as mining equipment, marine equipment, and aerospace applications that require high force output.

Hydraulic Cylinder Industry Vertical Outlook

- Automotive

- Material Handling

- Aerospace and Defense

- Oil and Gas

- Mining

- Agriculture

- Marine and Shipyard Industry

- Transportation

- Waste Management

- Manufacturing

- Earthmoving Equipment

- Pulp and Paper Industry

According to hydraulic industry analysis, the hydraulic cylinder market is dominated by the industrial machinery Industry Vertical due to the wide range of applied in diverse sectors such as automotive, manufacturing, and Material Handling. The automotive sector represents an important market for hydraulic cylinders, owing to the demand for heavy-duty equipment in the manufacturing process as well as automotive systems like braking, steering, and suspension.

Another significant market for hydraulic cylinders is Material Handling, which is driven primarily by the demand for hydraulic equipment such as forklifts, cranes, and hoists in warehouses, distribution centers, and manufacturing facilities. Other Industry Verticals that contribute to the demand for hydraulic cylinders include aerospace and defense, agriculture, oil and gas, mining, transportation, marine and shipyard, earthmoving equipment, waste management, and the pulp and paper industry.

Hydraulic Cylinder Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Hydraulic Cylinder Market Regional Analysis

North America and Europe are established markets for hydraulic cylinders due to the established industrial and manufacturing sectors. These areas have a high demand for hydraulic cylinders in a variety of applications, including construction, material handling, and aerospace. The presence of key market players, as well as advancements in technology, is expected to propel the hydraulic cylinder market in North America and Europe.

The Asia-Pacific region is expected to witness noteworthy growth in the hydraulic cylinder market because of the rapid industrialization and infrastructure development in countries such as India, China, and Japan. The Asia-Pacific region's demand for hydraulic cylinders is primarily driven by the construction, mining, and agriculture industries. The growing use of automation and robotics in manufacturing processes is expected to drive the growth of the hydraulic cylinder market in this region.

Hydraulic Cylinder Market Players

Some of the global hydraulic cylinder companies profiled in the report include Aggressive Hydraulics, Actuant Corp., Bailey International LLC, Best Metal Products, Burnside Eurocyl Ltd., Burnside Group, Bosch Rexroth A.G., Burnside Autocyl (tullow) Ltd., Burnside Hydracyl Ltd., Bucher Hydraulics Gmbh, Dongyang Mechatronics Corp., Chapel Group, Changzhou Sunde Hydraulic Equipment Co. Ltd., Douce Hydro, and Eaton Corp.

Frequently Asked Questions

What was the market size of the global hydraulic cylinder in 2022?

The market size of hydraulic cylinder was USD 15.8 billion in 2022.

What is the CAGR of the global hydraulic cylinder market from 2023 to 2032?

The CAGR of hydraulic cylinder is 4.1% during the analysis period of 2023 to 2032.

Which are the key players in the hydraulic cylinder market?

The key players operating in the global market are including Aggressive Hydraulics, Actuant Corp., Bailey International LLC, Best Metal Products, Burnside Eurocyl Ltd., Burnside Group, Bosch Rexroth A.G., Burnside Autocyl (tullow) Ltd., Burnside Hydracyl Ltd., Bucher Hydraulics Gmbh, Dongyang Mechatronics Corp., Chapel Group, Changzhou Sunde Hydraulic Equipment Co. Ltd., Douce Hydro, and Eaton Corp.

Which region dominated the global hydraulic cylinder market share?

North America held the dominating position in hydraulic cylinder industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of hydraulic cylinder during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global hydraulic cylinder industry?

The current trends and dynamics in the hydraulic cylinder industry include increased demand in the construction industry, surging demand for heavy equipment, and growth in the manufacturing industry.

Which application held the maximum share in 2022?

The mobile application held the maximum share of the hydraulic cylinder industry.