Hybrid Drive Train Market | Acumen Research and Consulting

Hybrid Drive Train Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

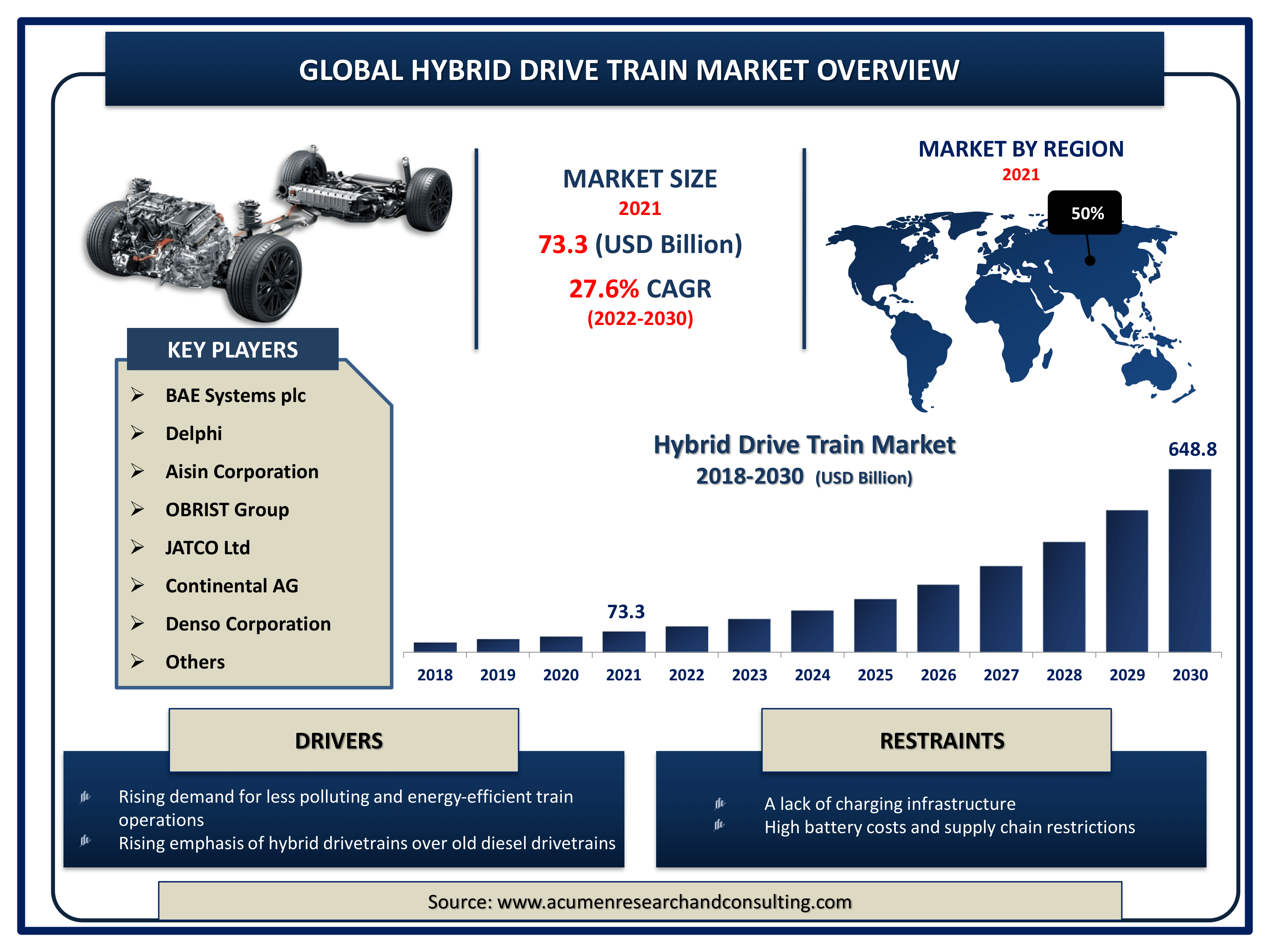

The Global Hybrid Drive Train Market Size accounted for USD 73.3 Billion in 2021 and is estimated to achieve a market size of USD 648.8 Billion by 2030 growing at a CAGR of 27.6% from 2022 to 2030. Growing government incentives for low and zero-emission automobiles are expected to drive hybrid drive train market growth. Furthermore, research, development, and demonstration (RD&D) projects to reduce overall hybrid vehicle battery costs and resource-related issues will have a massive influence on the hybrid drive train market value.

Hybrid Drive Train Market Report Key Highlights

- Global hybrid drive train market revenue is expected to increase by USD 648.8 Billion by 2030, with a 27.6% CAGR from 2022 to 2030.

- Asia-Pacific hybrid drive train market share accounted for over 50% shares in 2021

- Europe hybrid drive train market growth is forecast to register above 26% CAGR through 2030

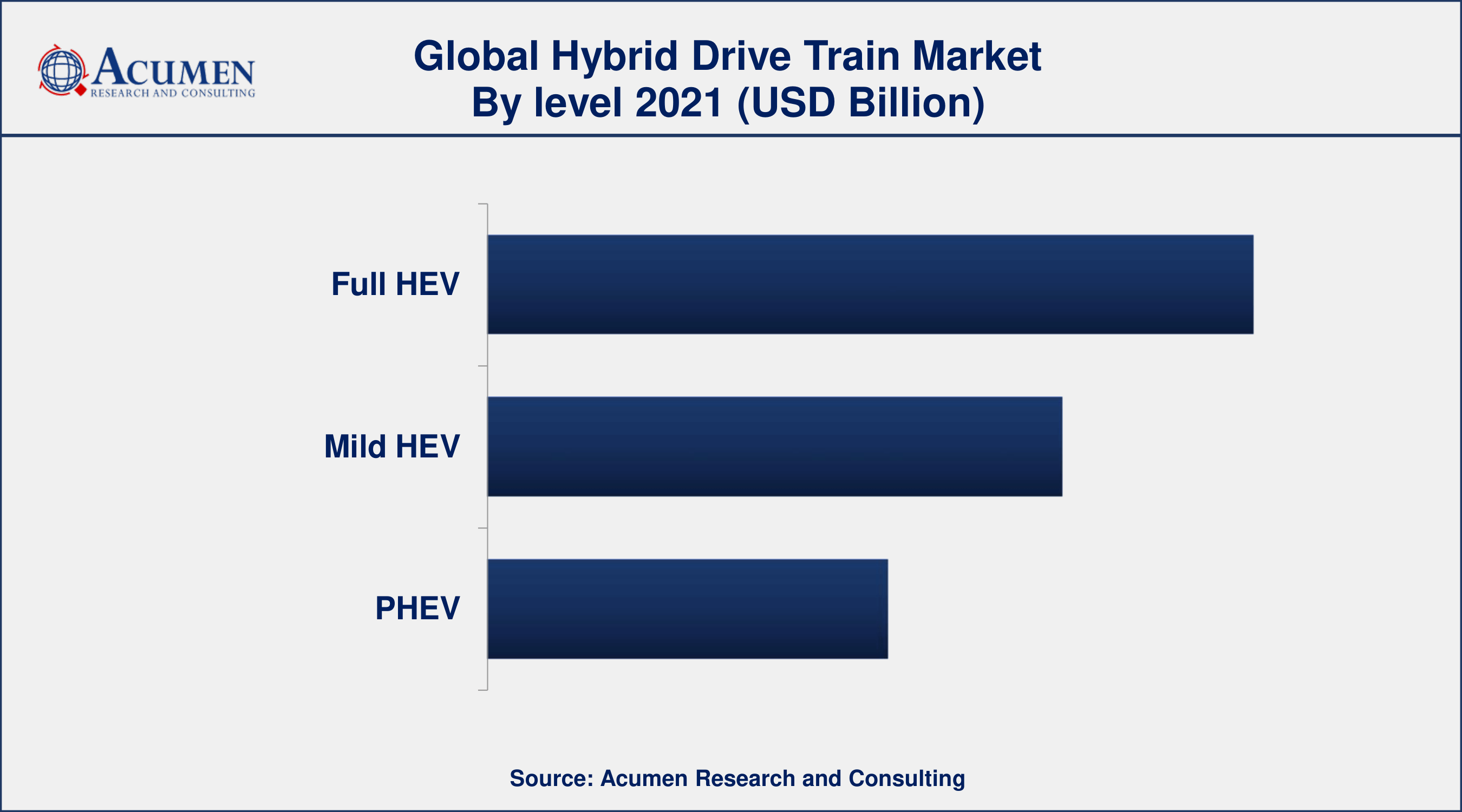

- By level, the full HEV segment has accounted market share of over 43% in 2021

- By type, series-parallel segment engaged more than 50% of the total market share in 2021

- Growing demand for clean mobility and transportation solutions, drive the hybrid drive train market size

A drive train is a set of components that transfers power from a vehicle's engine or motor to the wheels. The design of the hybrid electric vehicle's drive train determines how the electric motor interacts with the conventional engine. The drive train influences the mechanical efficiency, fuel consumption, and purchase price of the vehicle. Hybrid drive trains include both conventional and plug-in hybrids, with models involving series, parallel, and series/parallel drive trains. Due to the lack of internal combustion engines in battery-electric and hydrogen fuel cell vehicles, they use different drive train assemblies (though some components are shared).

Global Hybrid Drive Train Market Dynamics

Market Drivers

- Rising demand for less polluting and more energy-efficient train operations

- Growing advantages of hybrid drivetrains over conventional diesel drivetrains

- Growing demand for clean mobility and transportation solutions

- Existence of various automotive OEMs and financial support for technological advancements

Market Restraints

- A lack of charging infrastructure

- High battery costs and supply chain restrictions

Market Opportunities

- Increasing financial incentives & expenditures on infrastructure support

- Strict emission regulations and carbon-reduction programs

Hybrid Drive Train Market Report Coverage

| Market | Hybrid Drive Train Market |

| Hybrid Drive Train Market Size 2021 | USD 73.3 Billion |

| Hybrid Drive Train Market Forecast 2030 | USD 648.8 Billion |

| Hybrid Drive Train Market CAGR During 2022 - 2030 | 27.6% |

| Hybrid Drive Train Market Analysis Period | 2018 - 2030 |

| Hybrid Drive Train Market Base Year | 2021 |

| Hybrid Drive Train Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Level, By Type, By Components, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BAE Systems plc, Delphi, Aisin Corporation, OBRIST Group, ZF Friedrichshafen AG (ZF Group), JATCO Ltd, Continental AG, Denso Corporation, Hofer Powertrain, Magna International Inc., BorgWarner Inc., and PUNCH POWERTRAIN NV. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Reducing Emissions And Increase In Fuel Economy Bolster The Growth Of Global Hybrid Drive Train Market

According to a report released by the National Renewable Energy Laboratory, hybrid drive trains achieve 24% better fuel economy than internal-combustion-engine vehicles (ICEVs). Furthermore, the parallel hybrid drive train consumes 4% less fuel than the series hybrid. The series hybrid drive train has a strong influence on fuel economy and a thermostat control strategy that ignores thermal transient effects, and it is among the best of those evaluated solely on fuel economy. Such factors have a positive impact on the global hybrid drive train market's growth.

High Government Support Or Involvement Propel The Growth Of Global Hybrid Drive Train Market Trend

According to a report released by the United Nations Environment Program (UNEP), the UNEP, the International Transport Forum (ITF), and the FIA Foundation for the Automobile and Society, as well as the International Energy Agency (IEA), are collaborating to develop and implement the Global Fuel Economy Initiative (GFEI), which aims to double road vehicle fuel efficiency. Apart from that, the potential energy savings for passenger vehicles are significant. Fuel consumption is currently reduced by 25-35% as a result of hybrid drive train technology. Such factors fuel the growth of the global hybrid drive train market and will continue to do so throughout the forecast period.

Presence Of Multiple Original Equipment Manufacturers (OEMS) Coupled With Investments Fuel The Growth Of Global Hybrid Drive Train Market

The Japanese market will develop lucrative opportunities for the hybrid drive train market owing to the presence of prominent OEMs residing in this country. Because heavy electric vehicles (HEVs) have made significant investments in a dominant middle-ground technology that meets emission standards and consumer needs, growth in battery electric vehicles (BEVs) will contribute approximately 13% by 2030. Furthermore, HEVs are likely to maintain their status because a combination of low annual mileage and a high proportion of urban driving makes hybrid drive trains an adequate technology for the country's growth. Such factors are to blame for the eventual growth of the global hybrid drive train market.

Hybrid Drive Train Market Segmentation

The global hybrid drive train market segmentation is based on level, type, components, and geography.

Hybrid Drive Train Market By Level

- Full HEV

- Mild HEV

- PHEV

According to a hybrid drive train market forecast, the plug-in hybrid electric vehicle (PHEV) segment will hold lucrative opportunities for the overall market in the coming years, accounting for a significant share of the market. This is because PHEV sales will skyrocket in Europe, with Germany, France, the United Kingdom, and the Nordic countries accounting for 39%, 35%, 33%, and 47% respectively, by 2030. Furthermore, the adoption of PHEVs provides consumers with more options in terms of vehicle powertrain and size. Such factors are responsible for segmental growth, which in turn contributes to the overall growth of the hybrid drive train market.

Hybrid Drive Train Market By Type

- Parallel

- Series

- Series-Parallel

According to a hybrid drive train industry analysis, the series-parallel drive train segment will account for the lion's share of the global market. According to the Union of Concerned Scientists, series drive trains are the most basic hybrid configuration, performing best in stop-and-go traffic where gasoline and diesel engines are inefficient. Furthermore, according to the National Renewable Energy Laboratory, adopting a series drive train is 18% more fuel efficient than an ICEV. Such factors have a positive impact on segmental growth, which ultimately contributes to the overall growth of the global hybrid drive train market.

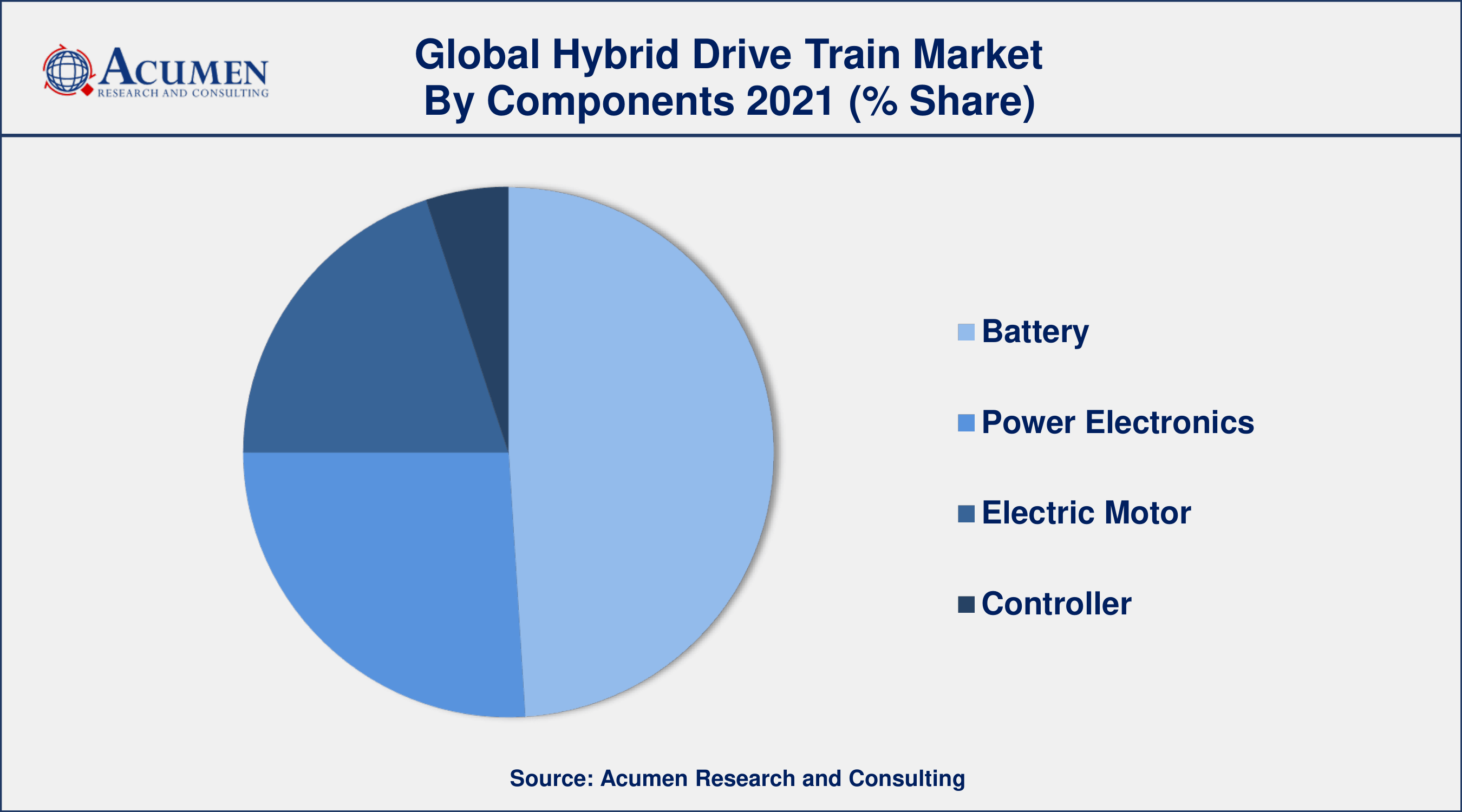

Hybrid Drive Train Market By Components

- Construction Power Electronics

- Battery

- Electric Motor

- Controller

In terms of components, the battery segment will account for the majority of the market share in 2021. Recent developments in the industry include recently designed nickel-metal hydride battery cells, which have a longer life cycle than rechargeable batteries and thus are safer. With advancements in chemistry and increased production extent, battery costs can be reduced. Furthermore, continuing electric motor advancements for vehicle controls as well as batteries will propel the industry forward.

Hybrid Drive Train Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Asia-Pacific To Take A Forefront Lead In Hybrid Drive Train Market; Europe To Record All-Time High CAGR During The Forecast Period

In the coming years, Asia-Pacific will have a dominant share of the hybrid drive train market, accounting for 50% of the global market. This is due to the Chinese government's financial and non-financial incentives, which have propelled China to the forefront of the electric vehicle (EV) market. Furthermore, among Asia-Pacific countries, China has the fastest growth in BEVs as a major market, accounting for 12% by 2025 and 26% by 2030. Apart from that, the presence of large OEMs is a key factor that contributes to the growth of the APAC hybrid drive train market. Japan, among Asia-Pacific provinces, is a contributor to the hybrid drive train market. The presence of strong players/OEMS makes it a lucrative country for the growth of the overall market of the hybrid drive train.

Europe, on the other hand, will have the fastest-growing CAGR in the hybrid drive train market in the coming years. According to the IEA report, Europe is followed by 1.2 million electric cars, with a staggering increase of 3,85,000 electric cars over the previous year. Furthermore, Norway remains the market leader in electric vehicles, accounting for 46% of new electric vehicle sales in 2018. This is one of the major factors contributing to the global growth of the hybrid drive train market.

Hybrid Drive Train Market Players

Some of the top hybrid drive train market companies offered in the professional report include BAE Systems plc, Delphi, Aisin Corporation, OBRIST Group, ZF Friedrichshafen AG (ZF Group), JATCO Ltd, Continental AG, Denso Corporation, Hofer Powertrain, Magna International Inc., BorgWarner Inc., and PUNCH POWERTRAIN NV.

Frequently Asked Questions

What is the size of global hybrid drive train market in 2021?

The estimated value of global hybrid drive train market in 2021 was accounted to be USD 73.3 Billion.

What is the CAGR of global hybrid drive train market during forecast period of 2022 to 2030?

The projected CAGR hybrid drive train market during the analysis period of 2022 to 2030 is 27.6%.

Which are the key players operating in the market?

The prominent players of the global hybrid drive train market are BAE Systems plc, Delphi, Aisin Corporation, OBRIST Group, ZF Friedrichshafen AG (ZF Group), JATCO Ltd, Continental AG, Denso Corporation, Hofer Powertrain, Magna International Inc., BorgWarner Inc., and PUNCH POWERTRAIN NV.

Which region held the dominating position in the global hybrid drive train market?

Asia-Pacific held the dominating hybrid drive train during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Europe region exhibited fastest growing CAGR for hybrid drive train during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global Hybrid Drive Train market?

Rising demand for less polluting and more energy-efficient train operations, and growing advantages of hybrid drivetrains over conventional diesel drivetrains, drives the growth of global hybrid drive train market.

By type segment, which sub-segment held the maximum share?

Based on type, series-parallel segment is expected to hold the maximum share of the hybrid drive train market.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date