Hot Melt Adhesives Market | Acumen Research and Consulting

Hot Melt Adhesives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

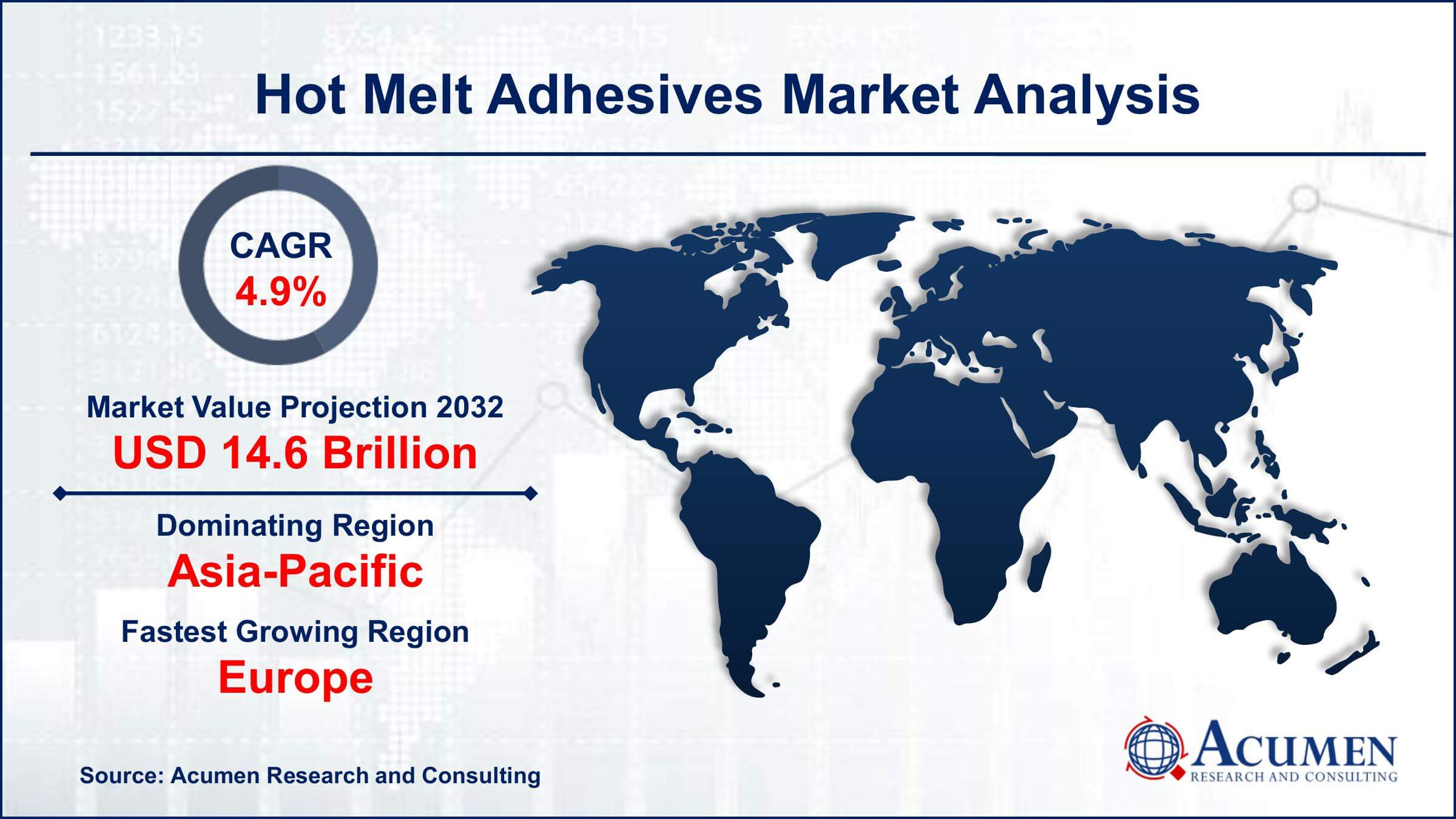

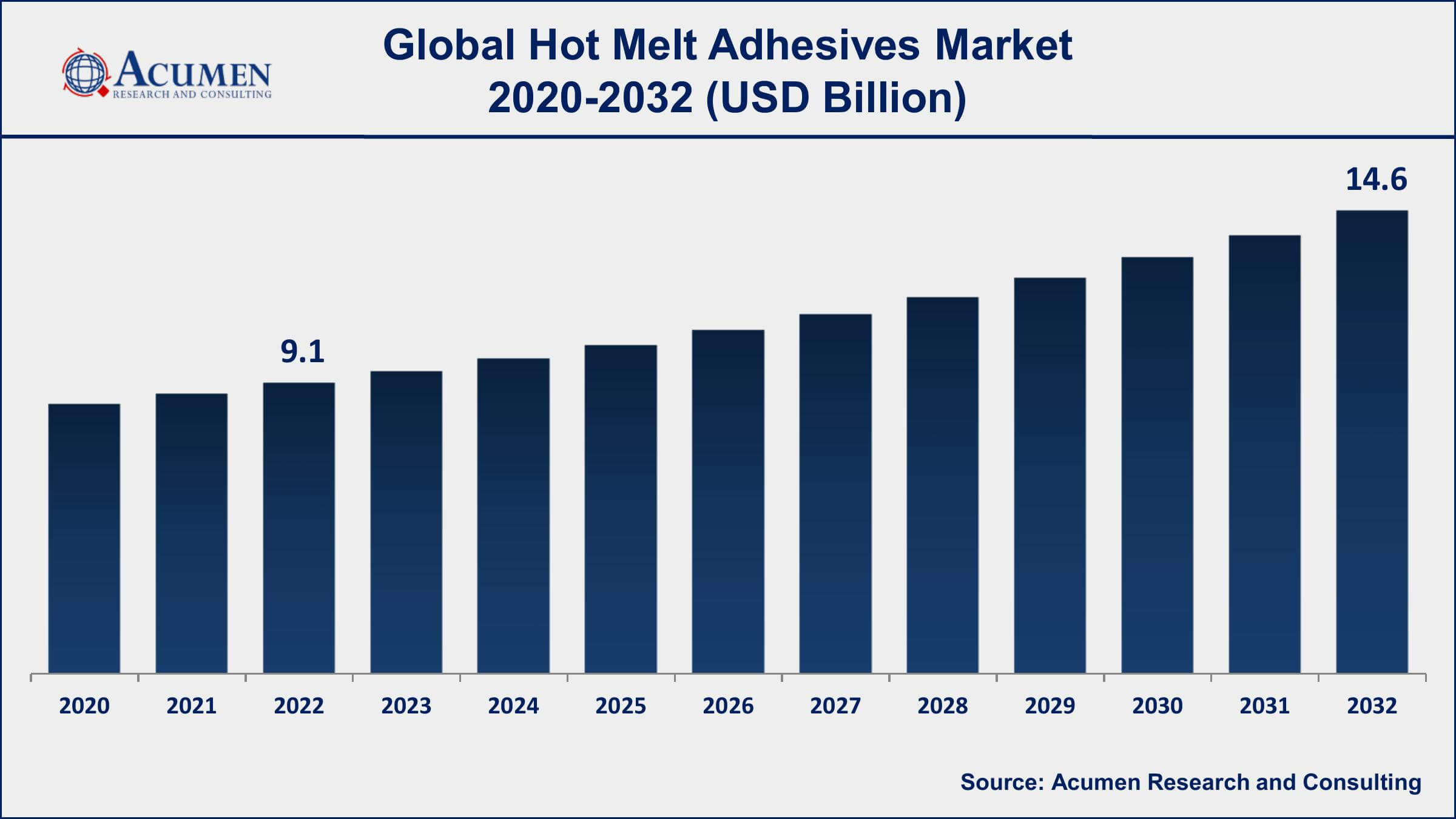

The Global Hot Melt Adhesives Market Size accounted for USD 9.1 Billion in 2022 and is projected to achieve a market size of USD 14.6 Billion by 2032 growing at a CAGR of 4.9% from 2023 to 2032.

Report Key Highlights

- Global hot melt adhesives market revenue is expected to increase by USD 14.6 Billion by 2032, with a 4.9% CAGR from 2023 to 2032

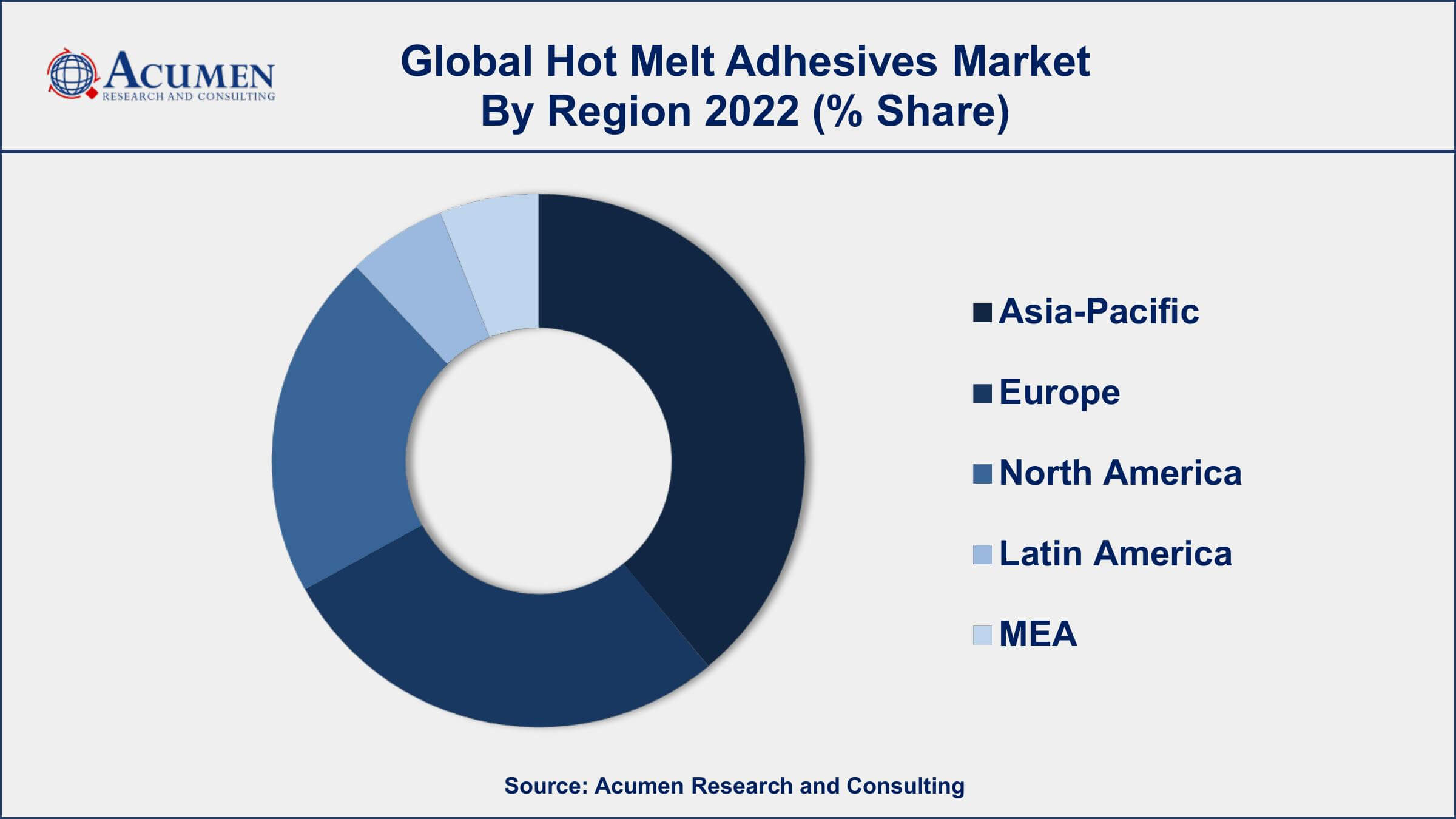

- Asia-Pacific region led with more than 43% of hot melt adhesives market share in 2022

- Europe hot melt adhesives market growth will record a CAGR of over 5% from 2023 to 2032

- The packaging industry is the largest end-user of hot melt adhesives, accounting for around 32% of the global demand.

- Hot melt adhesives account for over 50% of the global adhesive market

- Increasing construction activities and use in flooring, roofing, and insulation applications, drives the hot melt adhesives market size

Hot melt adhesives (HMA) are thermoplastic materials that are melted and applied as a liquid onto a surface. They solidify upon cooling to form a strong bond between two materials. HMAs are widely used in various sectors such as packaging, construction, automotive, woodworking, and textiles due to their high bonding strength, fast setting time, and versatility. These adhesives are also cost-effective, eco-friendly, and can be easily applied using different techniques such as spraying, rolling, or extrusion.

The global hot melt adhesives market has been growing steadily over the past few years, and it is expected to continue its growth trajectory in the coming years. The market growth can be attributed to the increasing demand for HMAs in the packaging industry, especially in the food and beverage sector, due to their excellent bonding strength and resistance to moisture and temperature fluctuations. The construction industry is also expected to contribute significantly to the market expansion, owing to the rising construction activities across the globe and the increasing use of HMAs in flooring, roofing, and insulation applications. Moreover, the development of bio-based HMAs and the increasing use of HMAs in the automotive and electronics industries are also expected to fuel the market's growth in the coming years.

Global Hot Melt Adhesives Market Trends

Market Drivers

- Growing demand from the packaging industry, especially in the food and beverage sector

- Increasing construction activities and use of HMAs in flooring, roofing, and insulation applications

- Rising demand for bio-based HMAs

- Growing use of HMAs in the automotive and electronics industries

Market Restraints

- Volatility in raw material prices

- Concerns over the environmental impact of HMAs

Market Opportunities

- Increasing use of HMAs in the textile industry

- Growing demand for customized adhesives to meet specific customer requirements

Hot Melt Adhesives Market Report Coverage

| Market | Hot Melt Adhesives Market |

| Hot Melt Adhesives Market Size 2022 | USD 9.1 Billion |

| Hot Melt Adhesives Market Forecast 2032 | USD 14.6 Billion |

| Hot Melt Adhesives Market CAGR During 2023 - 2032 | 4.9% |

| Hot Melt Adhesives Market Analysis Period | 2020 - 2032 |

| Hot Melt Adhesives Market Base Year | 2022 |

| Hot Melt Adhesives Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Raw Material, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Henkel AG & Co. KGaA, 3M Company, H.B. Fuller Company, Arkema Group, Jowat SE, Sika AG, Beardow Adams Ltd, Ashland Global Holdings Inc., Avery Dennison Corporation, DOW Corning Corporation, Bostik SA, and Huntsman Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Hot melt adhesives are also known as hot glue and are usually thermoplastic adhesives that are commonly marketed in solid with the cylindrical form of different diameters. Hot melt adhesives are produced in such a way that when it melts, they can melt in an electric hot glue gun. These adhesives have special and diverse advantages of being fast processing as compared to other traditional adhesives. Despite solvent-based and water-based adhesives, hot melt adhesives do not require the process of drying after their application. Hot melt adhesives begin the process of bonding immediately after their application on the concerned object since it cools down very quickly and attains its solidification point immediately. This feature of fast solidification of hot melt adhesives is best suited for its application in industries that require bonding versatility, high-speed manufacturing line, fast green strength, minimal shrinkage, and large gap filling. Some of the other major applications of hot melt adhesives include automotive, textiles, consumer products, and footwear. Textile applications of hot melt adhesives include interlinings, apparel assembly, and panel bonding among others. Automotive applications of hot melt adhesives include fabric edge turns, headliner assembly, seat laminations, and door panel fabric attachment among others. On the other hand, the consumer applications of hot melt adhesives include craft & apparel products as well as general assembly products.

Rising demand for hot melt adhesives especially from companies involved in high-speed manufacturing lines is one of the key factors driving the hot melt adhesive market value. In addition, changing trends across the packaging industry, which is considered to be the largest end-user of hot melt adhesives, are anticipated to bolster the demand for hot melt adhesives across the globe. Also, regulation by the Environment Protection Agency, especially in the U.S. and other European countries for the use of eco-friendly products is further anticipated to bring a surge in the overall demand for hot melt adhesive products in the foreseeable years. Moreover, hot melt adhesives find applications in disposable products and applications such as feminine hygiene, baby diapers, and adult incontinence products. Baby diapers in the disposables segment are considered to be the major consumers of hot melt adhesives over the forecast period while adult incontinence products account for a relatively smaller fraction of the demand. The rapid increase in investments especially in the construction industry primarily in the developing Asia-Pacific and Middle East & Africa regions is another key factor boosting demand for hot melt adhesives over the forecast period.

Hot Melt Adhesives Market Segmentation

The global hot melt adhesives market segmentation is based on raw material, application, and geography.

Hot Melt Adhesives Market By Raw Material

- Ethylene Vinyl Acetate (EVA)

- Styrenic Block Copolymers (SBC)

- Polyolefins

- Polyester

- Polyurethane (PU)

- Others

In terms of raw materials, the ethylene vinyl acetate (EVA) segment is one of the fastest-growing segments in the hot melt adhesives market. EVA hot melt adhesives are widely used in various applications due to their excellent bonding strength, flexibility, and low-temperature resistance. They are also cost-effective and easy to apply, making them a popular choice in several industries. The packaging industry is one of the major applications for EVA hot melt adhesives. They are used in packaging products such as corrugated boxes, cartons, and bags due to their excellent bonding strength and resistance to moisture and temperature fluctuations. The increasing demand for packaged food and beverages, especially in emerging economies, is expected to drive the EVA hot melt adhesives market growth.

Hot Melt Adhesives Market By Application

- Packaging

- Building & Construction

- Woodworking

- Assembly

- Transportation

- Bookbinding

- Nonwovens

- Footwear & Leather

- Other

According to the hot melt adhesives market forecast, the building & construction segment is expected to witness significant growth in the coming years. Hot melt adhesives are widely used in various building and construction applications such as flooring, roofing, insulation, and panel laminating, among others, due to their excellent bonding strength, flexibility, and resistance to moisture and temperature fluctuations. One of the major factors driving the growth of the building and construction segment in the market is the increasing construction activities across the globe, especially in emerging economies such as India, China, and Brazil. The rapid urbanization and industrialization in these countries are driving the demand for new infrastructure, including commercial and residential buildings, which is expected to boost the demand for hot melt adhesives in the construction industry.

Hot Melt Adhesives Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Hot Melt Adhesives Market Regional Analysis

The Asia-Pacific region is currently leading the hot melt adhesives market and is expected to continue to do so in the coming years. There are several factors contributing to this trend. Firstly, the region has a large and growing population, with a rapidly expanding middle class. This is driving demand for packaged food and beverages, consumer electronics, and automotive products, all of which require hot melt adhesives. Another key factor contributing to the market growth in the Asia-Pacific region is the increasing industrialization and urbanization in countries such as China and India. This is driving the demand for infrastructure development and construction activities, which, in turn, is fueling the demand for hot melt adhesives in the building and construction industry.

Moreover, the Asia-Pacific region is also witnessing significant growth in the packaging industry, which is another major application area for hot melt adhesives. The growing e-commerce industry in the region, coupled with the increasing demand for packaged food and beverages, is driving the demand for hot melt adhesives in the packaging sector.

Hot Melt Adhesives Market Player

Some of the top hot melt adhesives market companies offered in the professional report include Henkel AG & Co. KGaA, 3M Company, H.B. Fuller Company, Arkema Group, Jowat SE, Sika AG, Beardow Adams Ltd, Ashland Global Holdings Inc., Avery Dennison Corporation, DOW Corning Corporation, Bostik SA, and Huntsman Corporation.

Frequently Asked Questions

What was the market size of the global hot melt adhesives in 2022?

The market size of hot melt adhesives was USD 9.1 Billion in 2022.

What is the CAGR of the global hot melt adhesives market from 2023 to 2032?

The CAGR of hot melt adhesives is 4.9% during the analysis period of 2023 to 2032.

Which are the key players in the hot melt adhesives market?

The key players operating in the global market are including Henkel AG & Co. KGaA, 3M Company, H.B. Fuller Company, Arkema Group, Jowat SE, Sika AG, Beardow Adams Ltd, Ashland Global Holdings Inc., Avery Dennison Corporation, DOW Corning Corporation, Bostik SA, and Huntsman Corporation.

Which region dominated the global hot melt adhesives market share?

Asia-Pacific held the dominating position in hot melt adhesives industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of hot melt adhesives during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global hot melt adhesives industry?

The current trends and dynamics in the hot melt adhesives industry include growing demand from the packaging industry, and rising need for bio-based HMAs.

Which raw material held the maximum share in 2022?

The ethylene vinyl acetate (EVA) raw material held the maximum share of the hot melt adhesives industry.