Hospital Acquired Infection Control Market | Acumen Research and Consulting

Hospital Acquired Infection Control Market (By Type: Equipment, Services, Consumables; By End Use: Hospitals and Intensive Care Units (ICUs), Ambulatory Surgical and Diagnostic Centers, Others) - Global Industry Analysis, Market Size, Opportunities and Forecast 2021 - 2028

Published :

Report ID:

Pages :

Format : ![]()

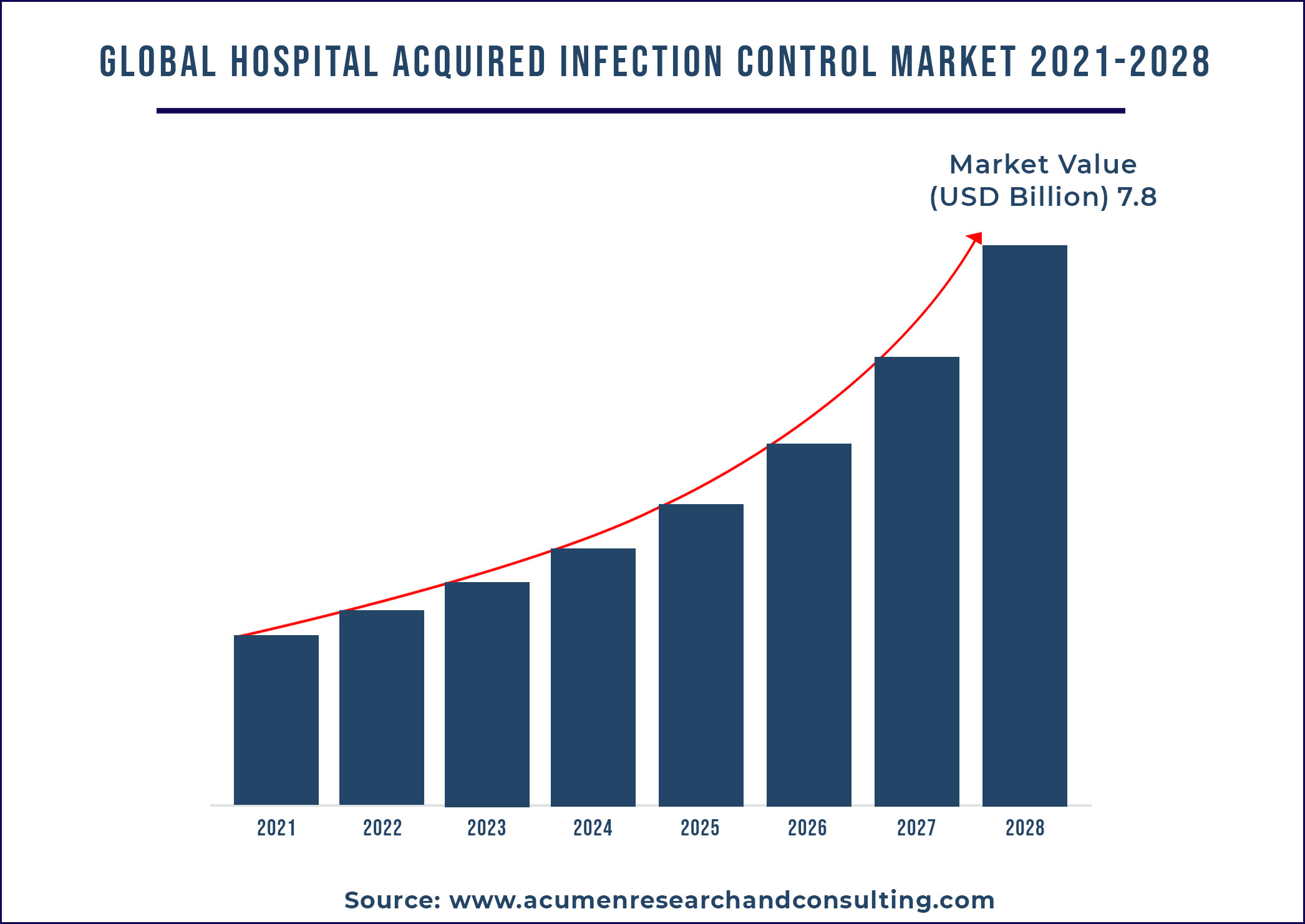

The global hospital acquired infection control market is anticipated to grow at a CAGR of around 5.1% during the forecast period 2021 to 2028 and to reach around US$ 7.8 Bn by 2028.

Report coverage

| Market | Hospital Acquired Infection Control Market |

| Analysis Period | 2017 - 2028 |

| Base Year | 2020 |

| Forecast Data | 2021 - 2028 |

| Segments Covered | By Type, By End Use, and By Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Olympus Corporation, BD, Getinge AB, Xenex Disinfection Services Inc., 3M, STERIS, ASP, Ecolab, Belimed AG, and KCWW |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope | 10 hrs of free customization and expert consultation |

Market Dynamics

There is increase in number of patients receiving various treatments in hospitals. With compromised immune system these patients are more vulnerable to catch infections. In American hospitals alone, the Centers for Disease Control (CDC) estimates that HAIs account for an estimated 1.7 million infections and 99,000 associated deaths each year. Consumer’s awareness related to HAI is increasing, chancing government approach and implementation of strict rules is expected to impact the market growth. Rise in number of inpatients in hospitals related to various diseases and increasing awareness among consumers related to HAI are major factors expected to drive the growth of global hospital acquired infection control market. Hospital acquired infection is witnessing a peak in past few years. Increase in mortality is growing concern among consumers. According to the World Health Organization, over 2.5 million HAI episodes occur every year in Europe, with more than 90,000 deaths attributed to the 6 most common types: healthcare-associated pneumonia, health care-associated urinary tract infection (HA-UTI), surgical site infection (SSI), health care-associated Clostridium difficile, health care-associated neonatal sepsis, and healthcare-associated bloodstream infection. Each year, about 1 in 25 U.S. hospital patient is diagnosed with at least one infection related to hospital care alone.

High investment by major players for R& activities for development of new solutions and approach towards new product launches to attract new customers are factor responsible for hospital acquired infection control market growth.

In 2021, Kinnos a biotechnology company launched its new healthcare-focused flagship product, Highlight for Bleach Wipes in American Professionals in Infection Control (APIC) 2021 Conference. The product launch is expected to help company enhance the customer base and increase revenue.

Garsite, a global manufacturer of aviation refueling and specialty pumping equipment, launched its own line of disinfecting equipmen in 2020. Initially the company has two products available in the line. Their approach towards launching “Sanitizing Booth” that provides a hygienic and sterile pass through environment by releasing a mist of sanitizing spray over objects. This is expected to help company enhance business.

Factors such as stringent government regulations and high cost associated to products and implementation are factors expected to hamper the growth of global hospital acquired infection control market. In addition, lack of developed infrastructure in developing countries for adoption of new devices is expected to challenge the growth of target market. However, increasing product R&D activities by major players, rise in awareness among consumers and players focus towards tracking the untapped market are factors expected to create new opportunities for players operating in the global hospital acquired infection control market over the forecast period. In addition, increasing partnership between regional and international players is expected to support the revenue transaction of the target market.

Segment Analysis by Region

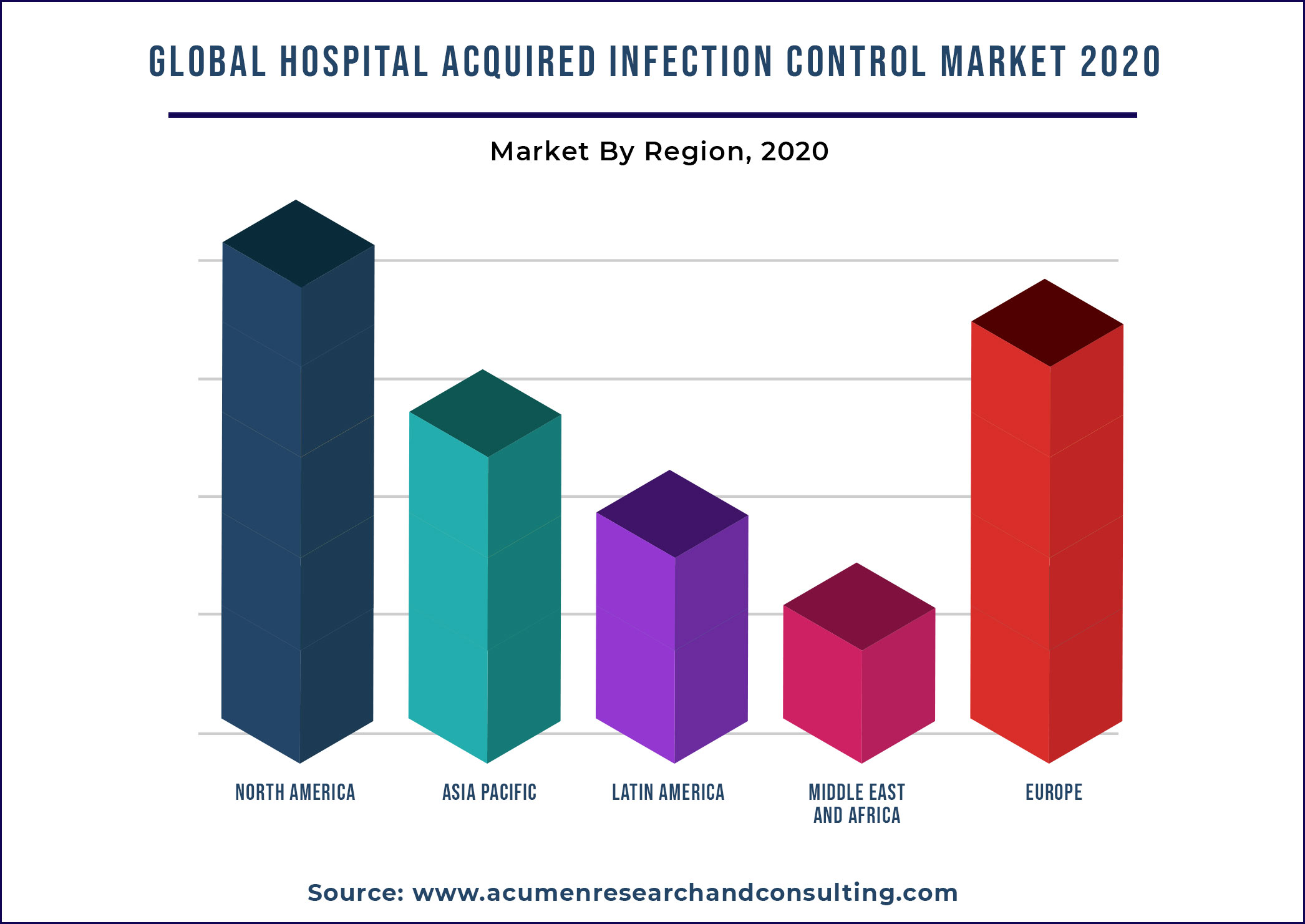

The market in Asia Pacific is expected to witness faster growth in the target market due to consumer’s awareness related to infectious diseases is growing.

Chancing government healthcare regulations, high spending on development of hospital infrastructure, and approach towards educating consumers pertaining to HAI through advertising are factors expected to impact the growth of regional market. Major players approach towards enhancing business in developing countries and inclination towards strategic partnership and agreements is expected to augment the market growth in this Asia Pacific region.

Competitive Landscape

The global hospital acquired infection control market is highly competitive due to presence of large number of players and innovative product offerings. In addition, business expansion activities through partnerships and agreements are factors expected to further increase the competition.

Hospital Acquired Infection Control Market Segment Analysis, 2020

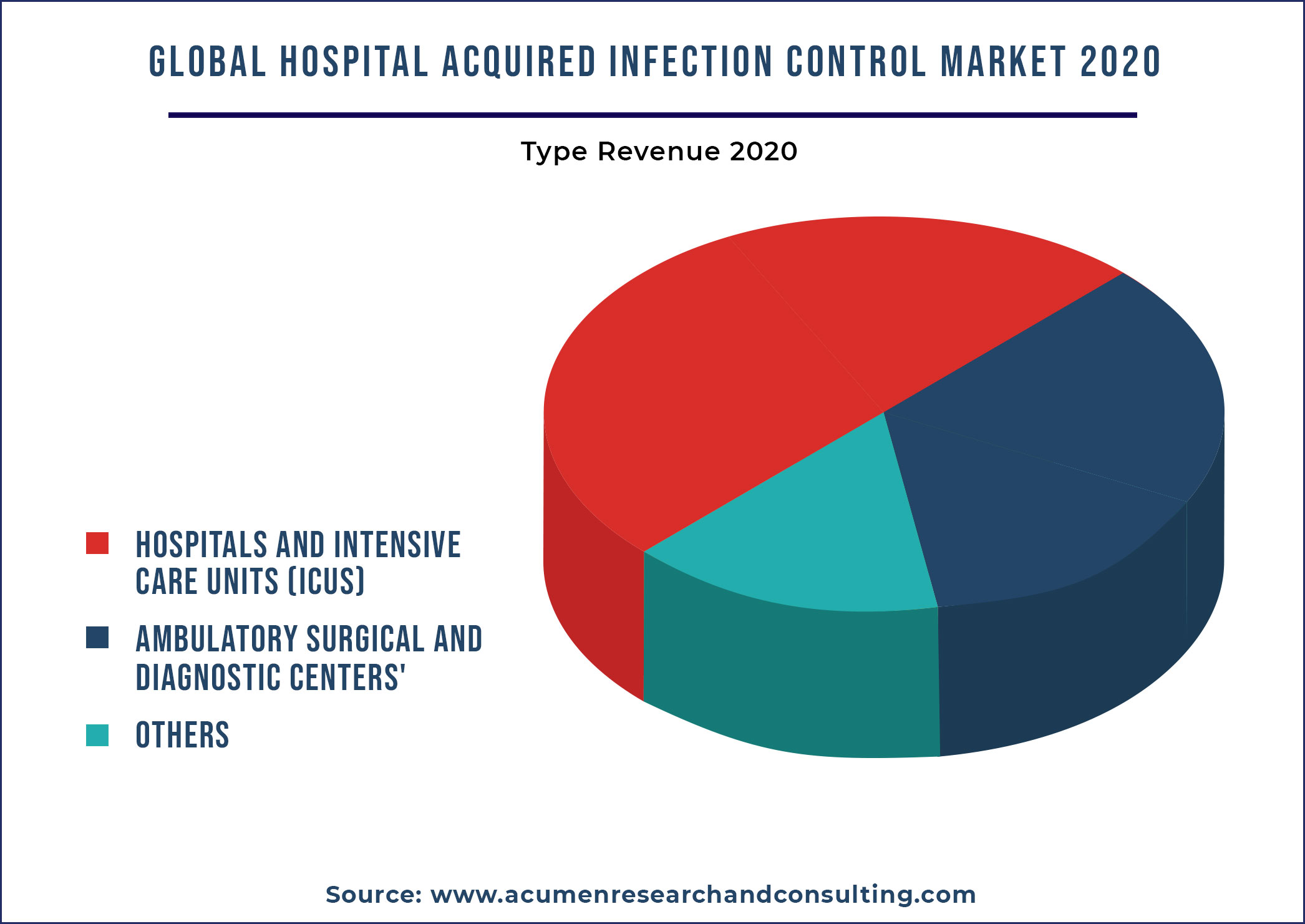

The global hospital acquired infection control market is segmented into type and end use. The type segment is divided into equipment, service, and consumable. Among type the consumable segment is expected to account for major revenue share in the global hospital acquired infection control market due to rising awareness among consumers to stay hygienic.

The end use segment is bifurcated into Hospitals and intensive care units (ICUs), ambulatory surgical and diagnostic centers, and others. Among end use the hospitals and intensive care units (ICUs) segment is expected to account for significant revenue share in the target market. The players profiled in the global hospital acquired infection control market are Olympus Corporation, BD, Getinge AB, Xenex Disinfection Services Inc., 3M, STERIS, ASP, Ecolab, Belimed AG, and KCWW.

Market Segmentation

Market By Type

Equipment

- Sterilization Equipment

- Heat Sterilization Equipment

- Moist Heat Sterilization

- Dry Heat Sterilization

- Heat Sterilization Equipment

- Low Temperature Sterilization

- Radiation Sterilization

- Others

- Disinfection Equipment

- Washer Disinfector

- Flusher Disinfector

- Endoscopic Reprocessor Systems

Services

Consumables

- Disinfectants

- Sterilization Consumables

- Others (Waste Disposal, PPE)

Market By End Use

Hospitals and Intensive Care Units (ICUs)

Ambulatory Surgical and Diagnostic Centers

Others

Market By Geography

North America

• U.S.

• Canada

Europe

• U.K.

• Germany

• France

• Spain

• Rest of Europe

Asia-Pacific

• China

• Japan

• India

• Australia

• South Korea

• Rest of Asia-Pacific

Latin America

• Brazil

• Mexico

• Rest of Latin America

Middle East & Africa

• GCC

• South Africa

• Rest of Middle East & Africa

Frequently Asked Questions

What will be the market size of global hospital acquired infection control market in 2028?

The global hospital acquired infection control market in 2028 is expected to be above US$ 7.8 Bn.

What is the CAGR of the global hospital acquired infection control market?

The CAGR of the global hospital acquired infection control market from 2021-2028 is above 5.1%.

Which is the major factor expected to drive the global market?

Rise in number of inpatients in hospitals related to various diseases and increasing awareness among consumers related to HAI are major factors expected to drive the growth of global hospital acquired infection control market.

Which segment is growing in type segment?

In type the consumables segment is growing at faster pace.

which region is expected to grow faster?

In the global market the Asia Pacific region is expected to grow faster.

What are the players considered in the report scope?

Some of the players considered in the report scope are Olympus Corporation, BD, Getinge AB, Xenex Disinfection Services Inc., and 3M.

Which region is expected to account for major revenue share in the global market?

The North America is expected to account for major revenue share in the global market.