High Pressure Seals Market | Acumen Research and Consulting

High Pressure Seals Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

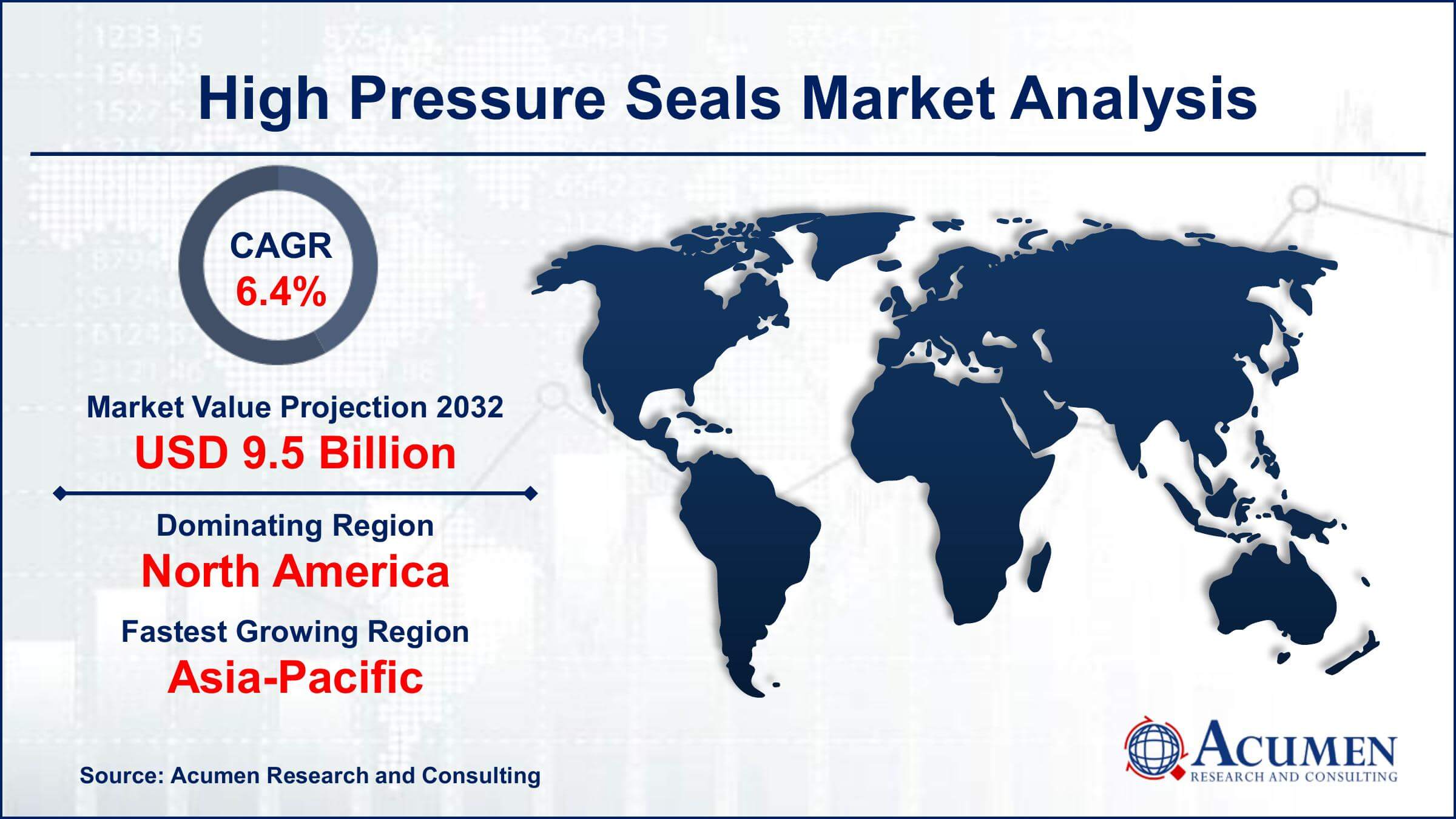

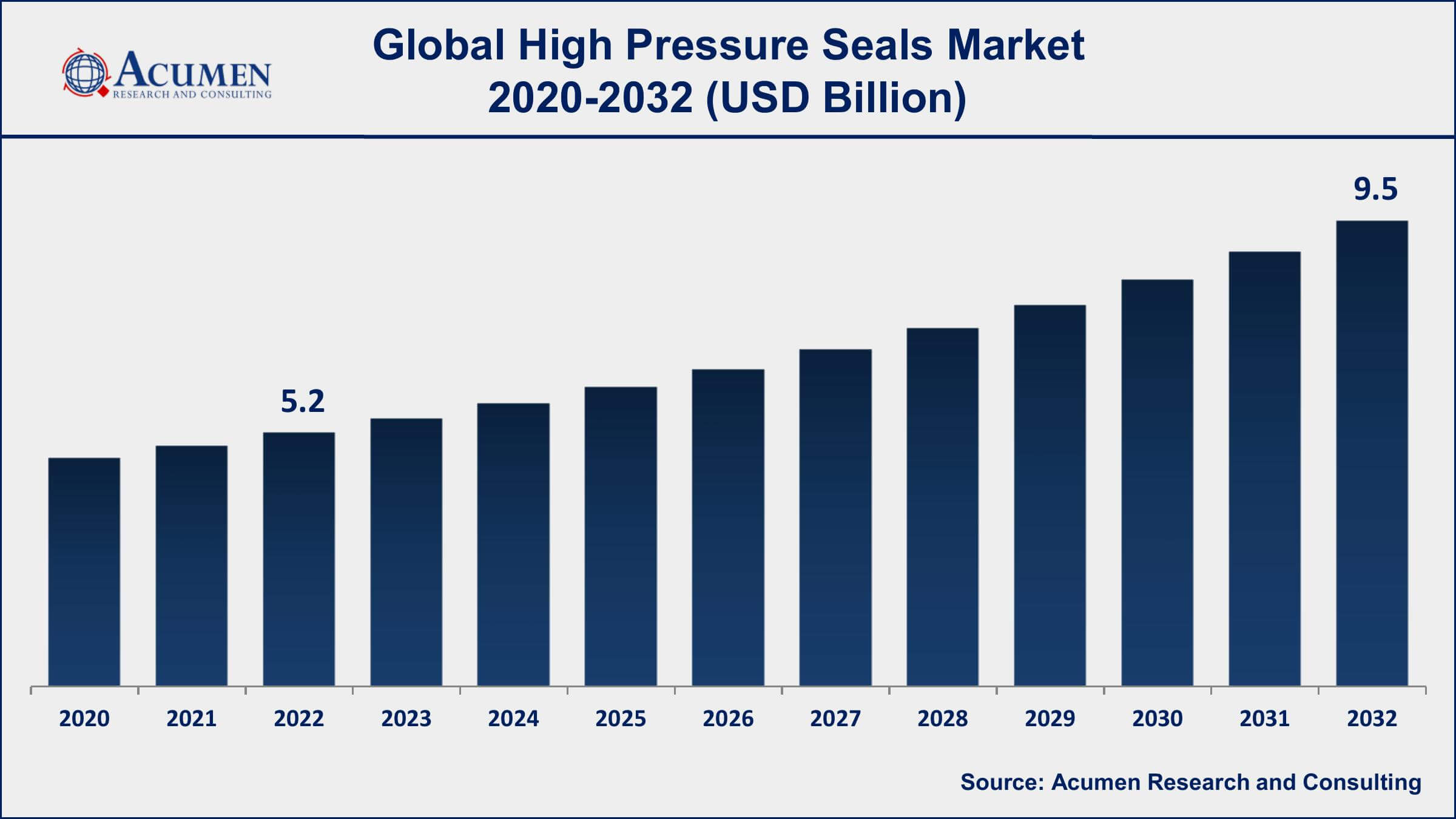

The Global High Pressure Seals Market Size accounted for USD 5.2 Billion in 2022 and is projected to achieve a market size of USD 9.5 Billion by 2032 growing at a CAGR of 6.4% from 2023 to 2032.

Report Key Highlights

- Global high pressure seals market revenue is expected to increase by USD 9.5 Billion by 2032, with a 6.4% CAGR from 2023 to 2032

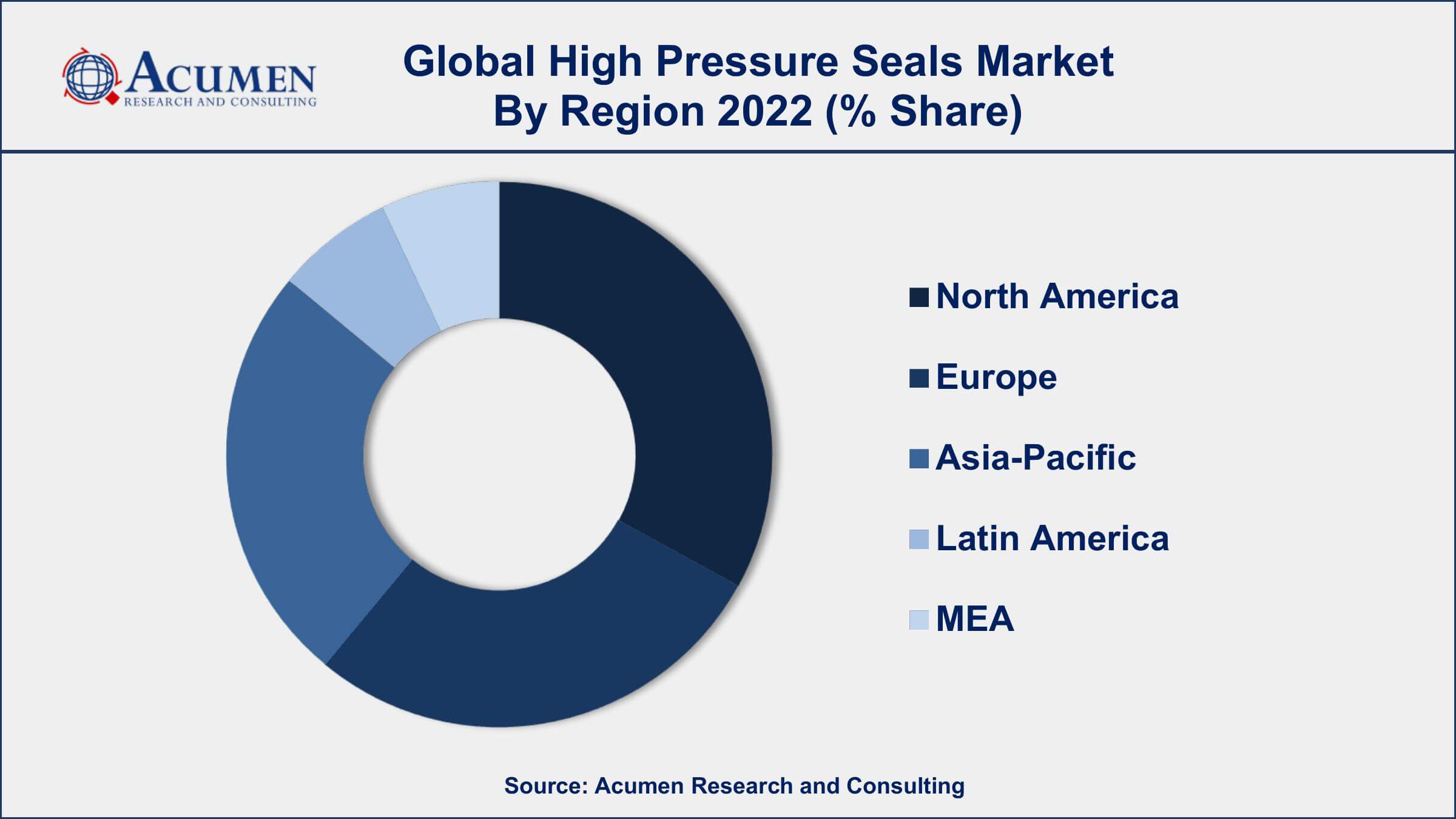

- North America region led with more than 38% of high pressure seals market share in 2022

- The oil and gas industry is the largest end-user of high pressure seals, accounting for over 35% of the market share

- The most common types of high pressure seals are O-rings, rotary seals, and hydraulic seals

- The aerospace industry is expected to witness the fastest growth in the market, with a CAGR of 7% from 2023 to 2030

- Growing demand in the renewable energy sector, drives the high pressure seals market size

High-pressure seals are mechanical components that are designed to prevent the leakage of fluids and gases from high-pressure environments, typically those above 1,000 psi. These seals are used in a wide range of industries including oil and gas, chemical processing, aerospace, and automotive, among others. They are made from a variety of materials such as elastomers, thermoplastics, and metals, and can be customized to suit specific applications.

The high pressure seals market has been experiencing significant growth in recent years, driven by the increasing demand for high pressure seals in the oil and gas industry. This industry requires reliable and durable seals for use in high-pressure and high-temperature applications, such as drilling, well completion, and pipeline transport. The growing demand for energy from emerging economies has also led to an increase in exploration and production activities, further driving the high pressure seals market growth. Additionally, advancements in seal materials and designs have led to improved performance and durability, allowing for seals to operate in more extreme conditions. The use of simulation and modeling software has also allowed for more accurate predictions of seal performance, leading to further innovation and growth in the market.

Global High Pressure Seals Market Trends

Market Drivers

- Increasing exploration and production activities in the oil and gas industry

- Advancements in seal materials and designs

- Growing demand for high-performance seals in the aerospace industry

- Growing demand for energy from emerging economies

- Increasing demand for high-pressure seals in the automotive industry

Market Restraints

- High cost of high-pressure seals compared to traditional seals

- Limited availability of skilled technicians for installation and maintenance

Market Opportunities

- Growing demand for high-pressure seals in the renewable energy sector

- Increasing demand for high-performance seals in medical equipment and devices

High Pressure Seals Market Report Coverage

| Market | High Pressure Seals Market |

| High Pressure Seals Market Size 2022 | USD 5.2 Billion |

| High Pressure Seals Market Forecast 2032 | USD 9.5 Billion |

| High Pressure Seals Market CAGR During 2023 - 2032 | 6.4% |

| High Pressure Seals Market Analysis Period | 2020 - 2032 |

| High Pressure Seals Market Base Year | 2022 |

| High Pressure Seals Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Material, By End-User Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Parker Hannifin Corporation, Freudenberg Sealing Technologies GmbH & Co. KG, Trelleborg AB, SKF Group, Hallite Seals International Ltd., James Walker Group Ltd., Garlock Sealing Technologies LLC, Flowserve Corporation, Dichtomatik Americas LP, Chesterton Company, EagleBurgmann Germany GmbH & Co. KG, and John Crane Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

High pressure seals are leakage control equipment that is deployed on rotating equipment such as the mixer and pumps to limit the leakage of gases and liquid from escaping into the environment. High pressure seals are mostly made up of metal or alloys, Apart from these materials, other materials such as plastics, and elastomers are also used in manufacturing high pressure seals. High pressure seals are designed to provide long service life and low friction for extreme pressure applications over wide temperature ranges. These types of seals are commonly used in helical shafts in heavy industries, working rolls for hot and cold rolling mills, marine shafts, machinery for paper, pumps, and gearboxes.

The market growth of high pressure seals is attributed to the growing demand from the chemical & petrochemicals industry in the Asia-Pacific and the expansion of the power generation industry, especially in emerging economies. The major restraining factor in the high pressure seals market value is the shifting focus towards renewable or alternate energy. Power generation is the major end-use industry for high pressure seals and if the demand for alternative energy picks up, it will affect the demand for high pressure seals in the coming period. In addition, gland packing and sealless pumps can also hinder market growth. Further, the major opportunities lie in the establishment of nuclear power generation plants. International Atomic Energy Agency projected that nuclear electricity generation may grow from 15% to 45% by 2020 and 25% to 95% by 2030. However, the degrading quality of polymer and elastomeric seals coupled with lowering the operating pressure of pumps to reduce energy consumption can be a major challenge in high pressure seals market.

High Pressure Seals Market Segmentation

The global high pressure seals market segmentation is based on material, end-user industry, and geography.

High Pressure Seals Market By Material

- Metal

- Thermoplastic polyurethane (TPU)

- Ethylene propylene dyne terpolymer (EPDM)

- Fluorocarbon-based synthetic rubber

- Hydrogenated nitrile butadiene rubber (HBR)

- Others

In terms of materials, the hydrogenated nitrile butadiene rubber (HBR) segment has seen significant growth in the high pressure seals market in recent years. Hydrogenated nitrile butadiene rubber (HNBR) is a type of synthetic rubber that offers excellent resistance to high pressures, temperatures, and chemicals. HNBR seals are used in various high-pressure applications, including oil and gas drilling, chemical processing, and hydraulic systems, among others. One of the key drivers of growth for the HNBR segment is the increasing demand for seals with high durability and resistance to extreme conditions. HNBR seals offer superior mechanical properties, such as high tensile strength, excellent resistance to abrasion, and low compression set, making them suitable for use in high-pressure and high-temperature environments. In addition, the increasing use of HNBR seals in the automotive industry is expected to contribute to the growth of the HNBR segment.

High Pressure Seals Market By End-User Industry

- Oil & Gas

- Power Generation

- Automotive

- Chemicals

- Mining

- Healthcare

- Aerospace

- Others

According to the high pressure seals market forecast, the power generation segment is expected to witness significant growth in the coming years. The power generation segment includes a wide range of power sources such as thermal, hydro, nuclear, and renewable energy, among others. High pressure seals are used in various power generation equipment, such as steam turbines, gas turbines, compressors, and pumps, among others. One of the key drivers of growth for high pressure seals in the power generation segment is the increasing demand for power generation, driven by the growing global population and industrialization. The need for reliable and efficient power generation equipment is critical, and high pressure seals play a vital role in ensuring their safe and efficient operation. Furthermore, the increasing adoption of renewable energy sources, such as wind and solar, is expected to drive the demand for high pressure seals in the power generation segment.

High Pressure Seals Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

High Pressure Seals Market Regional Analysis

Geographically, North America is dominating the high pressure seals market in 2022. One of the primary reasons is the high demand for high pressure seals in the oil and gas industry. North America is the largest producer and consumer of oil and gas in the world, and the growing exploration activities in the region have increased the demand for high pressure seals. Additionally, the region is also witnessing significant growth in the pharmaceutical, chemical, and food processing industries, which also require high pressure seals for their operations. Another reason why North America is dominating the seals market is due to the presence of several leading manufacturers in the region. These manufacturers have invested heavily in research and development to produce innovative high pressure seal solutions that can cater to the specific needs of different industries. Furthermore, the strict regulations and standards imposed by regulatory bodies such as the American Petroleum Institute (API) and the Occupational Safety and Health Administration (OSHA) in North America have led to the development of high-quality and reliable high pressure seals.

High Pressure Seals Market Player

Some of the top high pressure seals market companies offered in the professional report include Parker Hannifin Corporation, Freudenberg Sealing Technologies GmbH & Co. KG, Trelleborg AB, SKF Group, Hallite Seals International Ltd., James Walker Group Ltd., Garlock Sealing Technologies LLC, Flowserve Corporation, Dichtomatik Americas LP, Chesterton Company, EagleBurgmann Germany GmbH & Co. KG, and John Crane Inc.

Frequently Asked Questions

What was the market size of the global high pressure seals in 2022?

The market size of high pressure seals was USD 5.2 Billion in 2022.

What is the CAGR of the global high pressure seals market from 2023 to 2032?

The CAGR of high pressure seals is 6.4% during the analysis period of 2023 to 2032.

Which are the key players in the high pressure seals market?

The key players operating in the global market are including Parker Hannifin Corporation, Freudenberg Sealing Technologies GmbH & Co. KG, Trelleborg AB, SKF Group, Hallite Seals International Ltd., James Walker Group Ltd., Garlock Sealing Technologies LLC, Flowserve Corporation, Dichtomatik Americas LP, Chesterton Company, EagleBurgmann Germany GmbH & Co. KG, and John Crane Inc.

Which region dominated the global High Pressure Seals market share?

North America held the dominating position in high pressure seals industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of high pressure seals during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global high pressure seals industry?

The current trends and dynamics in the high pressure seals industry include increasing exploration and production activities in the oil and gas industry, and advancements in seal materials and designs.

Which end-user industry held the maximum share in 2022?

The oil & gas end-user industry held the maximum share of the high pressure seals industry.