High Pressure Grinding Roller Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

High Pressure Grinding Roller Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

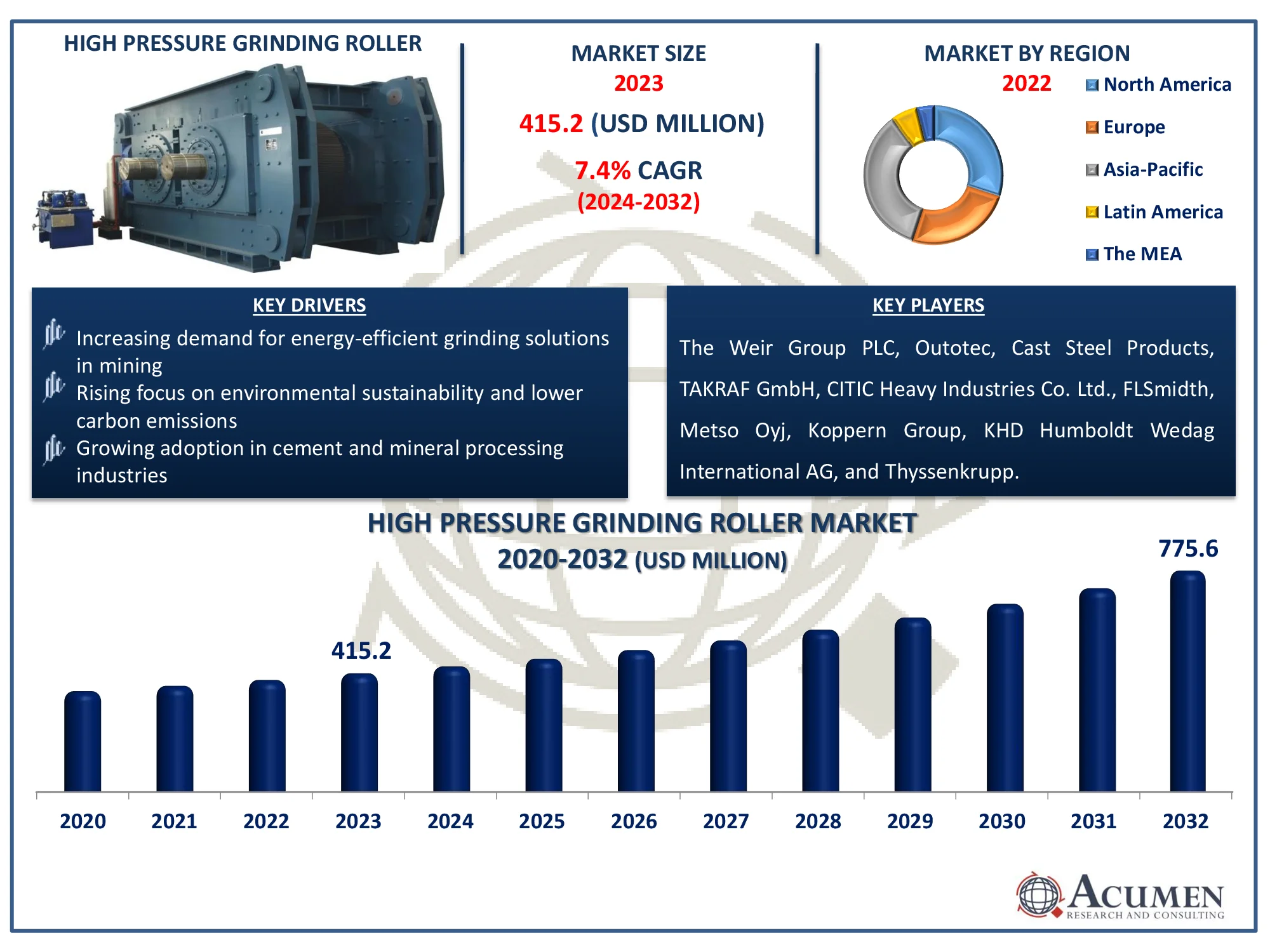

Request Sample Report

The Global High Pressure Grinding Roller Market Size accounted for USD 415.2 Million in 2023 and is estimated to achieve a market size of USD 775.6 Million by 2032 growing at a CAGR of 7.4% from 2024 to 2032.

High Pressure Grinding Roller Market (By Power Rating: 2 x 100 kW - 2 x 650 kW, 2 x 650 kW - 2 x 1900 kW, 2 x 1900 kW - 2 x 3700, and 2 x 3700 kW and above; By Material Processed: Ferrous Metals and Ferroalloys Processing, and Non-Ferrous Metals Processing; By Application: Diamond Liberation, Base Metal Liberation, Precious Metal Beneficiation, Pellet Feed Preparation; By End-user: Cement, Ore and Mineral Processing, and Others; and By Region: North America, Europe, Asia-Pacific, Latin America, and MEA)

High Pressure Grinding Roller Market Highlights

- Global high pressure grinding roller market revenue is poised to garner USD 775.6 million by 2032 with a CAGR of 7.4% from 2024 to 2032

- Asia-Pacific high pressure grinding roller market value occupied around USD 145.3 million in 2023

- North America high pressure grinding roller market growth will record a CAGR of more than 8.3% from 2024 to 2032

- Based on material processed, the non-ferrous metals processing sub-segment generated 80% market share in 2023

- Among end-user, the ore and mineral processing sub-segment generated 60% of the market share in 2023

- Growing focus on sustainability encourages the use of high-pressure grinding rollers for reduced environmental impact is the high pressure grinding roller market trend that fuels the industry demand

HPGR (High pressure grinding roller) equipment is a cutting-edge energy-saving comminution technology. High pressure causes boundary weakening in the feed material and the production of microcracks, resulting in a significant volume of fine material. High-pressure grinding rollers are now standard in the cement, briquetting, iron ore, and diamond industries. High pressure grinding rollers are made up of two rolls set on a sturdy frame. One roll is allowed to float on rails and is supported by pneumo-hydraulic springs, while the other is fastened to the frame. The feed is propelled into the gap between the rolls and the crushers via the antiparticle breakage mechanism.

Global High Pressure Grinding Roller Market Dynamics

Market Drivers

- Increasing demand for energy-efficient grinding solutions in mining

- Rising focus on environmental sustainability and lower carbon emissions

- Growing adoption in cement and mineral processing industries

Market Restraints

- High initial capital investment for equipment and infrastructure

- Limited awareness and adoption in small- to mid-sized operations

- Complex maintenance requirements and downtime

Market Opportunities

- Expanding mining activities in emerging economies

- Technological advancements in HPGR design for better performance

- Rising need for solutions to reduce operational costs in ore processing

High Pressure Grinding Roller Market Report Coverage

| Market | High Pressure Grinding Roller Market |

| High Pressure Grinding Roller Market Size 2022 |

USD 415.2 Million |

| High Pressure Grinding Roller Market Forecast 2032 | USD 775.6 Million |

| High Pressure Grinding Roller Market CAGR During 2023 - 2032 | 7.4% |

| High Pressure Grinding Roller Market Analysis Period | 2020 - 2032 |

| High Pressure Grinding Roller Market Base Year |

2022 |

| High Pressure Grinding Roller Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Power Rating, By Material Processed, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | The Weir Group PLC, Outotec, Cast Steel Products, TAKRAF GmbH, CITIC Heavy Industries Co. Ltd., FLSmidth, Metso Oyj, Koppern Group, KHD Humboldt Wedag International AG, and Thyssenkrupp. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

High Pressure Grinding Roller Market Insights

The world is rapidly becoming more environmentally friendly and energy mindful. Because mineral and mining processing consumes significant amounts of energy, the mining sector is seeking for ways to reduce its energy footprint. In mineral processing and mining processes, energy is typically the most expensive product. Grinding, or comminuting, is typically the most energy-intensive process between metal and mining. One of the primary reasons for utilizing high pressure grinding rollers as a grinding replacement is their energy economy compared to conventional crushers and mills. The relatively regular and consistent loading of the material in the high pressure grinding roller compression zone helps to increase its effectiveness.

Many small and medium-sized businesses in the high pressure grinding roller (HGPR) market are unaware of the technology's advantages. Because of their inadequate understanding, they are cautious to implement HPGR systems, which can be more expensive upfront than traditional approaches. As a result, the market's growth is stifled since smaller enterprises are slower to make the transition. Without widespread understanding and adoption, the potential for HPGR expansion is limited.

Technological developments in HPGR design, such as increased wear resistance, energy economy, and automation integration, have greatly improved performance in high pressure grinding roller (HGPR) market. These advances enable increased throughput, lower operating costs, and more consistent product output. As a result, sectors such as mining and cement are rapidly adopting HPGR technology. This opens up new business prospects as industries seek more environmentally friendly and efficient grinding options.

High Pressure Grinding Roller Market Segmentation

The worldwide market for high pressure grinding roller is split based on power rating, material processed, application, end-user, and geography.

High Pressure Grinding Roller Power Ratings

- 2 x 100 kW - 2 x 650 kW

- 2 x 650 kW - 2 x 1900 kW

- 2 x 1900 kW - 2 x 3700

- 2 x 3700 kW and above

According to the high pressure grinding roller industry analysis, in terms of power rating, the 2 x 1900 kW - 2 x 3700 kW segment represented a market estimate in the global market. Demand for this power extension is driven by the need for more power in base and precious metal mining operations. Additionally, it provides the best balance of efficiency and power for major mining and industrial applications. This line addresses the growing need for crushing capacity in a variety of heavy-duty applications.

High Pressure Grinding Roller Material Processed

- Ferrous Metals and Ferroalloys Processing

- Non-Ferrous Metals Processing

According to the high pressure grinding roller industry analysis, in terms of material prepared, the non-ferrous metals handling segment represents a modestly developed market when compared to the ferrous metals and ferroalloys preparation sector, due to increased demand for HPGR from gold, copper, and precious stone mining activities. These rollers are used to crush and process valuable metals such as copper and gold. HPGR technology is popular in this field because of its energy efficiency and capacity to handle challenging ores, lowering costs and increasing metal recovery rates.

High Pressure Grinding Roller Applications

- Diamond Liberation

- Base Metal Liberation

- Precious Metal Beneficiation

- Pellet Feed Preparation

According to the high pressure grinding roller market forecast, precious metal beneficiation is a prominent application in the industry because of the technology's ability to treat hard ores such as gold and platinum efficiently. HPGR improves metal recovery by using energy-efficient comminuting to reduce ore to smaller pieces, allowing for improved mineral extraction. The requirement for greater throughput and cost-effective operations in precious metal mining has fueled HPGR adoption. Furthermore, its ability to conserve water and energy makes it appealing for environmentally responsible mining techniques.

High Pressure Grinding Roller End-user

- Cement

- Ore and Mineral Processing

- Others

According to the high pressure grinding roller market forecast, the mining and mineral processing sector is the principal end-user due to the efficiency and efficacy of HPGR technology in grinding hard materials. HPGRs offer a more energy-efficient and cost-effective alternative to traditional grinding processes, which is critical for large-scale ore and mineral processing. Their ability to generate finer and more consistent product sizes improves the entire beneficiation process, making them vital in the mining and minerals industry.

High Pressure Grinding Roller Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

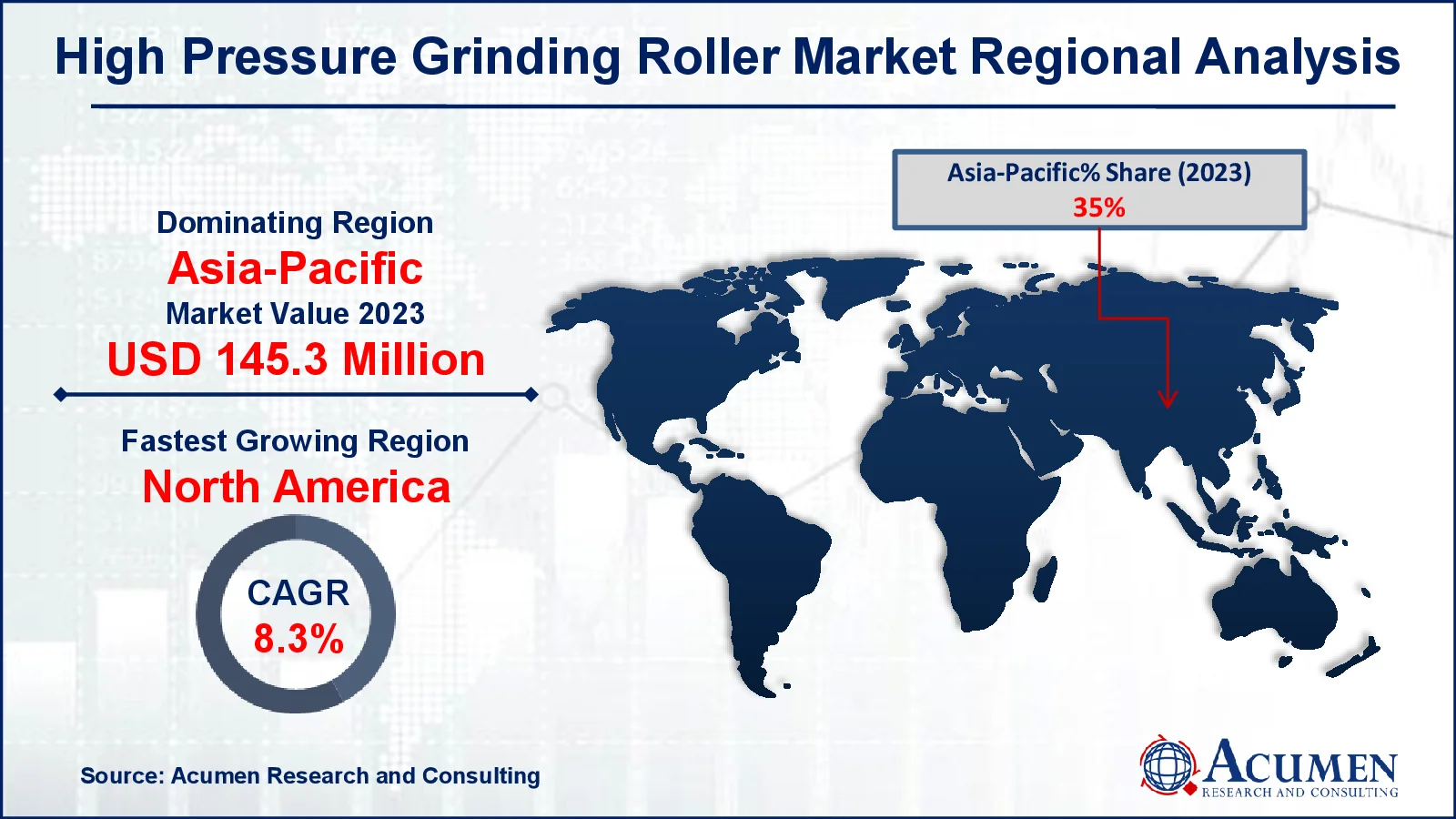

High Pressure Grinding Roller Market Regional Analysis

For several reasons, the Asia-Pacific HGPR market had the largest market share, accounting for USD 145.3 million in 2023. The global high weight crushing roller market is influenced primarily by factors related to the growing demand for high efficiency and low emission comminution solutions. Furthermore, sliding mineral valuations have driven global demand for improved comminution arrangements, which has fueled the growth of the high weight crushing roller market. The typical appraisal of metals is declining over the world as a result of the ongoing depletion of high-value mineral formations. As a result, despite increased comminution efforts, the value gained from collecting the optimal material following the mining process is decreasing. This has increased the operating costs of comminution.

North America is fastest-growing region in HGPR market, due to rising demand for energy-efficient grinding solutions in mining industry. Growing industrialization in countries like U.S., and Canada further contributes to the growth of market.

High Pressure Grinding Roller Market Players

Some of the top high pressure grinding roller companies offered in our report include The Weir Group PLC, Outotec, Cast Steel Products, TAKRAF GmbH, CITIC Heavy Industries Co. Ltd., FLSmidth, Metso Oyj, Koppern Group, KHD Humboldt Wedag International AG, and Thyssenkrupp.

Frequently Asked Questions

How big is the high pressure grinding roller market?

The high pressure grinding roller market size was valued at USD 415.2 million in 2023.

What is the CAGR of the global high pressure grinding roller market from 2024 to 2032?

The CAGR of high pressure grinding roller is 7.4% during the analysis period of 2024 to 2032.

Which are the key players in the high pressure grinding roller market?

The key players operating in the global market are including The Weir Group PLC, Outotec, Cast Steel Products, TAKRAF GmbH, CITIC Heavy Industries Co. Ltd., FLSmidth, Metso Oyj, Koppern Group, KHD Humboldt Wedag International AG, and Thyssenkrupp.

Which region dominated the global high pressure grinding roller market share?

Asia-Pacific held the dominating position in high pressure grinding roller industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of high pressure grinding roller during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global high pressure grinding roller industry?

The current trends and dynamics in the high pressure grinding roller industry include quick delivery of medical services to remote or underserved areas, technological advancements improve reliability and versatility of high pressure grinding roller, and government support for using modern gadgets to deliver greater care.

Which by material processed held the maximum share in 2023?

The non-ferrous metals processing held the maximum share of the high pressure grinding roller industry.