High Potent Active Pharmaceutical Ingredient Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

High Potent Active Pharmaceutical Ingredient Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

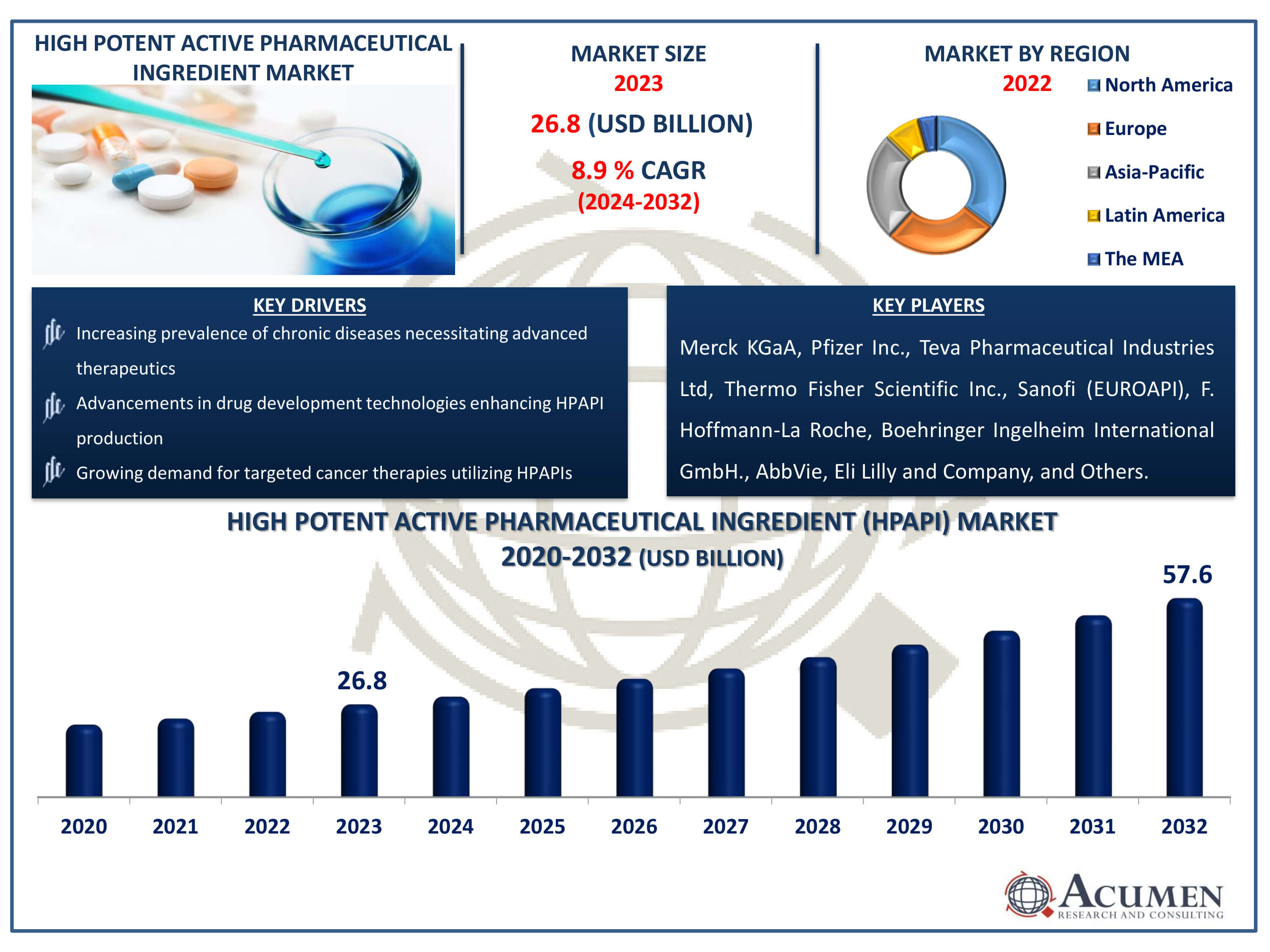

The High Potent Active Pharmaceutical Ingredient Market Size accounted for USD 26.8 Billion in 2023 and is estimated to achieve a market size of USD 57.6 Billion by 2032 growing at a CAGR of 8.9% from 2024 to 2032.

High Potent Active Pharmaceutical Ingredient Market Highlights

- Global high potent active pharmaceutical ingredient market revenue is poised to garner USD 57.6 billion by 2032 with a CAGR of 8.9% from 2024 to 2032

- North America high potent active pharmaceutical ingredient market value occupied around USD 9.4 billion in 2023

- Asia-Pacific high potent active pharmaceutical ingredient market growth will record a CAGR of more than 10% from 2024 to 2032

- Among product, the synthetic sub-segment generated 69% of the market share in 2023

- Based on manufacturer type, the in-house sub-segment generated 68% market share in 2023

- Based on drug type, the innovative drug type sub-segment generated 70% market share in 2023

- Increasing demand for oncology drugs is the high potent active pharmaceutical ingredient market trend that fuels the industry demand

High potency active pharmaceutical ingredients (HPAPIs) are pharmacologically active substances that demonstrate biological activity at very low concentrations, typically with a daily therapeutic dose of less than 10 mg. According to the Drug, Chemical & Associated Technologies (DCAT) report, HPAPIs remain a significant focus for the pharmaceutical manufacturing sector. Many manufacturers, both large and small, are heavily investing in the HPAPI market, viewing it as a lucrative opportunity. This has led to numerous new product innovations as companies compete aggressively in this space.

High potency active pharmaceutical ingredients (HPAPIs) are essential in the development of medications that require very small doses to achieve their therapeutic effect. These compounds are particularly vital in oncology, where they are used in chemotherapy to target cancer cells with minimal impact on healthy tissues. HPAPIs also play a crucial role in hormone treatments, such as in endocrine therapies for breast and prostate cancers. Additionally, they are used in the production of antibody-drug conjugates (ADCs), which combine targeted therapy with cytotoxic agents for precision treatment. Furthermore, HPAPIs are employed in antiviral drugs, providing effective treatments for diseases like HIV and hepatitis with enhanced efficacy.

Global High Potent Active Pharmaceutical Ingredient Market Dynamics

Market Drivers

- Increasing prevalence of chronic diseases necessitating advanced therapeutics

- Advancements in drug development technologies enhancing HPAPI production

- Growing demand for targeted cancer therapies utilizing HPAPIs

Market Restraints

- High costs associated with the manufacturing and handling of HPAPIs

- Stringent regulatory requirements and compliance challenges

- Limited availability of skilled professionals specialized in HPAPI production

Market Opportunities

- Expansion in emerging markets with rising healthcare infrastructure

- Collaborations and partnerships for innovative drug development

- Advancements in containment technologies reducing production risks

High Potent Active Pharmaceutical Ingredient Market Report Coverage

| Market | High Potent Active Pharmaceutical Ingredient Market |

| High Potent Active Pharmaceutical Ingredient Market Size 2022 | USD 26.8 Billion |

| High Potent Active Pharmaceutical Ingredient Market Forecast 2032 | USD 57.6 Billion |

| High Potent Active Pharmaceutical Ingredient Market CAGR During 2023 - 2032 | 8.9% |

| High Potent Active Pharmaceutical Ingredient Market Analysis Period | 2020 - 2032 |

| High Potent Active Pharmaceutical Ingredient Market Base Year |

2022 |

| High Potent Active Pharmaceutical Ingredient Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Manufacturer Type, By Drug Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Merck KGaA, Pfizer Inc., Teva Pharmaceutical Industries Ltd, Thermo Fisher Scientific Inc., Sanofi (EUROAPI), F. Hoffmann-La Roche, Boehringer Ingelheim International GmbH., AbbVie, Eli Lilly and Company, Aurigene Pharmaceutical Services Limited, and Bristol-Myers Squibb Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

High Potent Active Pharmaceutical Ingredient Market Insights

Increasing prevalence of chronic diseases necessitating advanced therapeutics which significantly drives high potent (API) market. The rising prevalence of chronic diseases such as cancer, diabetes, and cardiovascular conditions is fueling the demand for advanced therapeutics. For instance, according to the "Cancer Facts and Figures 2023," published by the American Cancer Society in January 2023, an estimated 1.9 million new cancer cases are expected to be diagnosed in 2023. Among these, prostate cancer is projected to account for 288,300 cases, lung cancer for 238,340 cases, and female breast cancer for 300,590 cases. This surge necessitates the development and production of high potent active pharmaceutical ingredients (HPAPIs), which offer targeted and effective treatment options. Consequently, the HPAPI market is experiencing significant growth to meet the specialized needs of these complex therapies. This trend underscores the critical role of innovative pharmaceuticals in addressing ongoing health challenges.

High costs associated with the manufacturing and handling of HPAPIs impedes growth of high potent active pharmaceutical ingredient (HPAPI) market. The high-potency active pharmaceutical ingredient (HPAPI) market encounters a significant challenge concerning containment. HPAPIs are characterized by their biological activity at very low doses. As the biological activity and specificity of these highly potent drug substances increase, so does the risk associated with handling them during manufacturing. To address these challenges, substantial investment in specialized containment resources is necessary. Containment is crucial for limiting the spread of highly active substances, ensuring the safety of employees and the environment, and providing effective protection.

The expansion of healthcare infrastructure in emerging markets presents a significant growth opportunity for the high potency active pharmaceutical ingredients (HPAPI) market. For instance, according to India Brand Equity Foundation, the Indian healthcare market was valued at US$ 110 billion in 2016 and is currently expected to reach US$ 638 billion by 2025. As these regions invest in advanced medical facilities and services, the demand for innovative and potent pharmaceuticals increases. This drives the need for HPAPIs, which are crucial in the development of targeted therapies for complex diseases. Consequently, pharmaceutical companies are likely to focus on these markets to capitalize on the growing healthcare needs and enhance their global presence. Moreover, collaborations and partnerships for innovative treatments f cancer further becomes opportunity in forecasted year. For instance, in January 2022, Helsinn and Immedica formed an exclusive partnership to commercialize cancer supportive care products in major European markets.

High Potent Active Pharmaceutical Ingredient Market Segmentation

The worldwide market for high potent active pharmaceutical ingredient (HPAPI) is split based on product, manufacturer type, drug type, applications, and geography.

HPAPI Market By Product

- Synthetic

- Biotech

According to the HPAPI industry analysis, the high potency active pharmaceutical ingredient (HPAPI) market is dominated by synthetic products due to their precision in targeting specific diseases, consistent quality, and scalability in production. Synthetic HPAPIs offer significant advantages in terms of structural complexity and functionality, which are essential for the efficacy of advanced therapeutics. Additionally, technological advancements in chemical synthesis and manufacturing processes have bolstered their dominance. This has led to an increase in demand for synthetic HPAPIs, especially in oncology and chronic disease treatments.

HPAPI Market By Manufacturer Type

- In-house

- Outsourced

According to the high potent active pharmaceutical industry analysis, the in-house manufacturer type segment dominates due to the need for stringent control over quality, safety, and regulatory compliance. These manufacturers possess specialized facilities and expertise necessary for handling and producing high-potency compounds. By maintaining operations internally, companies can ensure tighter security and protection against contamination. Additionally, in-house manufacturing allows for better intellectual property management and faster response to market demands. Furthermore, key players also focuses on in-house manufacturing over outsourcing. For instance, Cipla, Inc. launched a "API re-imagination" campaign in August 2021 to develop its own manufacturing capabilities, leveraging current government incentives such as production subsidies.

HPAPI Market By Drug Type

- Innovative

- Generic

According to HPAPI industry forecast, innovative drugs dominates due to their advanced therapeutic benefits and ability to target complex diseases more effectively. These drugs often represent the cutting edge of medical research, incorporating novel mechanisms of action and high specificity. The demand for innovative HPAPIs is driven by the pharmaceutical industry's focus on developing treatments for conditions such as cancer and autoimmune disorders. Consequently, the market is characterized by significant research and development in innovative drug types to continually grown the market. For instance, Zydus Cadila launched the first biosimilar antibody-drug combination trastuzumab emtansine, known as Ujvira, in May 2021. Overall, this innovation further maintain segment’s dominance in market.

HPAPI Market Application

- Oncology

- Hormonal Disorders

- Glaucoma

- Others

According to the high potent (API) market forecast, the oncology segment is expected to dominate the market due to the increasing prevalence of cancer and the rising demand for targeted therapies. For instance, Merck stated in June 2022 that its Verona-based HPAPI facility in the United States would be doubled in size to address rising demand for cancer therapy components. Moreover, advances in biotechnology and the development of more effective and specific cancer treatments are driving this growth. Additionally, the high potency of oncology drugs, which allows for lower dosages and reduced side effects, makes them particularly valuable in cancer therapy. This trend is further supported by significant investments in cancer research and drug development by pharmaceutical companies.

High Potent Active Pharmaceutical Ingredient Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

-Market,-2023---2032.jpg)

High Potent Active Pharmaceutical Ingredient Market Regional Analysis

For several reasons, the North America dominates high potent active pharmaceutical ingredient market. This is due to the expansion of a facility specifically intended to manufacture HPAPIs and complicated antibody drug conjugates (ADCs). For instance, Millipore Sigma announced a US$65 million expansion facility for its HPAPI manufacturing capability facility in the United States. This is one of the primary factors driving the growth of the high potency active pharmaceutical component market. Additionally, growing cases of chronic diseases, an increase in healthcare spending, and the presence of large manufacturers producing HPAPI in this region further contributes to high potent (API) market growth.

The Asia-Pacific region is the fastest growing in the HPAPI market, driven by increasing investments in healthcare infrastructure and pharmaceutical R&D. The region's burgeoning population and rising prevalence of chronic diseases are boosting demand for advanced therapeutics. Furthermore, favorable government policies and cost-effective manufacturing capabilities attract significant attention from global pharmaceutical companies. For instance, January 2023- Sai Life Sciences, one of India's fastest growing Contract Research, Development, and Manufacturing Organizations (CRO-CDMOs), announced the opening of a new High-Potency API (HPAPI) manufacturing facility at its cGMP API Manufacturing site in Bidar. This new facility broadens the company's experience in HPAPI development and manufacture, hence expediting its clients' NCE development processes. Overall, this growth is further supported by the expansion of local pharmaceutical companies and a surge in outsourcing activities.

High Potent Active Pharmaceutical Ingredient Market Players

Some of the top high potent active pharmaceutical ingredient (HPAPI) companies offered in our report include Merck KGaA, Pfizer Inc., Teva Pharmaceutical Industries Ltd, Thermo Fisher Scientific Inc., Sanofi (EUROAPI), F. Hoffmann-La Roche, Boehringer Ingelheim International GmbH., AbbVie, Eli Lilly and Company, Aurigene Pharmaceutical Services Limited, and Bristol-Myers Squibb Company.

Frequently Asked Questions

How big is the high potent active pharmaceutical ingredient market?

The high potent active pharmaceutical ingredient market size was valued at USD 26.8 Billion in 2023.

What is the CAGR of the global high potent active pharmaceutical ingredient market from 2024 to 2032?

The CAGR of high potent active pharmaceutical ingredient (HPAPI) is 8.9% during the analysis period of 2024 to 2032.

Which are the key players in the high potent active pharmaceutical ingredient market?

The key players operating in the global market are including Merck KGaA, Pfizer Inc., Teva Pharmaceutical Industries Ltd, Thermo Fisher Scientific Inc., Sanofi (EUROAPI), F. Hoffmann-La Roche, Boehringer Ingelheim International GmbH., AbbVie, Eli Lilly and Company, Aurigene Pharmaceutical Services Limited, and Bristol-Myers Squibb Company.

Which region dominated the global high potent active pharmaceutical ingredient market share?

North America held the dominating position in high potent active pharmaceutical ingredient (HPAPI) industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of high potent active pharmaceutical ingredient (HPAPI) during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global high potent active pharmaceutical ingredient (HPAPI) industry?

The current trends and dynamics in the high potent active pharmaceutical ingredient (HPAPI) industry include increasing prevalence of chronic diseases necessitating advanced therapeutics, advancements in drug development technologies enhancing HPAPI production, and growing demand for targeted cancer therapies utilizing HPAPIs.

Which Product held the maximum share in 2023?

The synthetic product held the maximum share of the high potent active pharmaceutical ingredient (HPAPI) industry.?