High Performance Computing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

High Performance Computing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

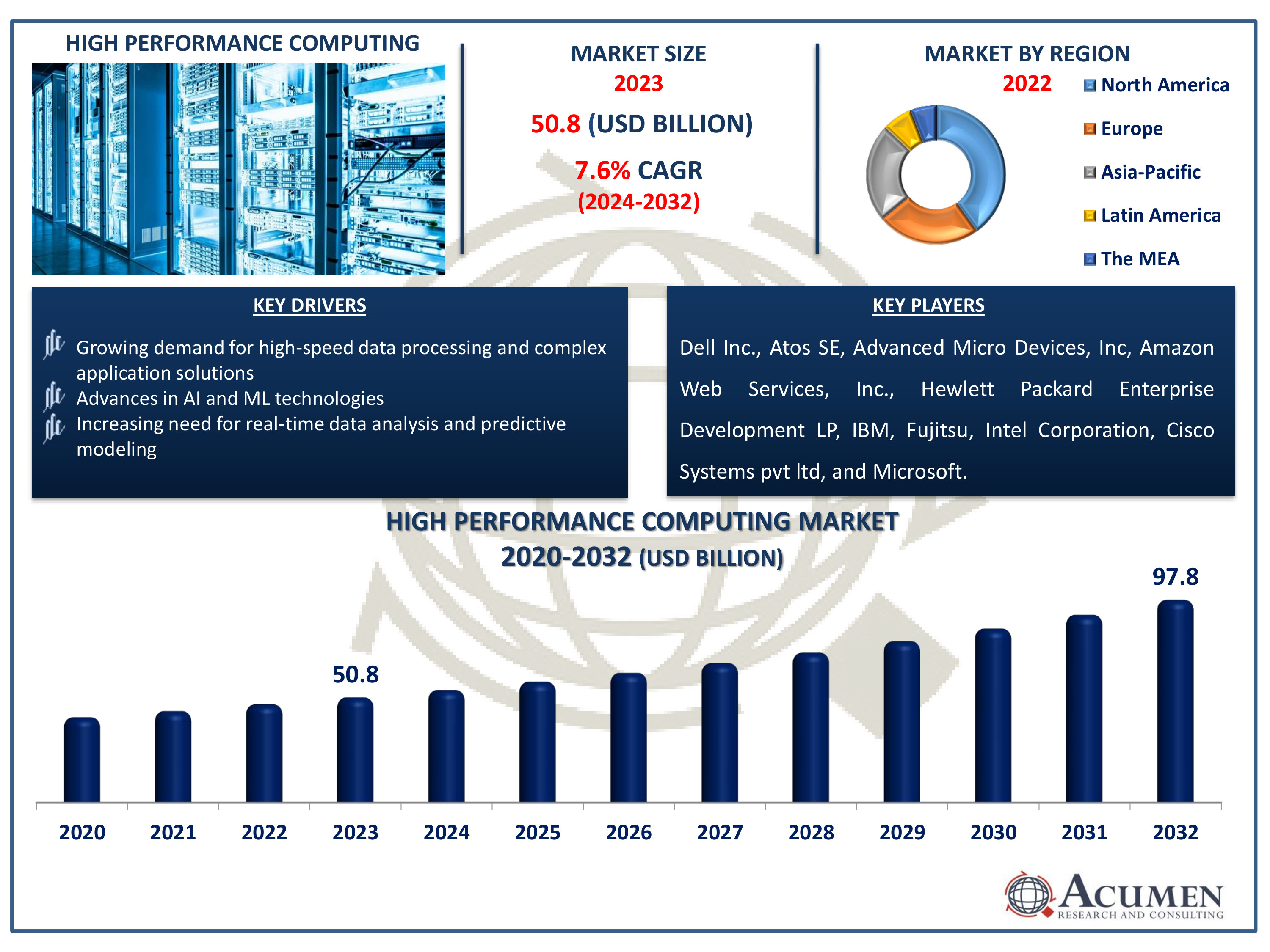

The High Performance Computing Market Size accounted for USD 50.8 Billion in 2023 and is estimated to achieve a market size of USD 97.8 Billion by 2032 growing at a CAGR of 7.6% from 2024 to 2032.

High Performance Computing Market Highlights

- Global high performance computing market revenue is poised to garner USD 97.8 billion by 2032 with a CAGR of 7.6% from 2024 to 2032

- North America high performance computing market value occupied around USD 20.3 billion in 2023

- Asia-Pacific high performance computing market growth will record a CAGR of more than 8.4% from 2024 to 2032

- Among component, the servers sub-segment generated 34% of share in 2023

- Based on deployment , the on-premises sub-segment generated 60% of high performance computing market share in 2023

- As per server prize band, USD 250,000-500,000 and above gives significant share of high performance computing (HPC) market in 2023

- Among end user, government & defense sub-segment generated 25% of market share in high performance computing market

- Increasing adoption of AI and machine learning is a popular high performance computing market trend that fuels the industry demand

High performance computing (HPC) refers to the use of supercomputers and parallel processing techniques to solve complex computational problems at high speeds. It involves the aggregation of computing power to deliver much higher performance than traditional desktop computers or workstations. HPC is essential for tasks that require processing large amounts of data and performing intricate calculations, such as climate modeling, genetic sequencing, and simulations in physics and chemistry. It is also widely used in industries like aerospace, automotive design, and financial modeling, where precise and fast computations are critical. Additionally, HPC plays a vital role in artificial intelligence, enabling advanced machine learning and data analysis capabilities. As technology advances, HPC continues to evolve, driving innovation and efficiency in various scientific and industrial fields.

Global High Performance Computing Market Dynamics

Market Drivers

- Growing demand for high-speed data processing and complex application solutions

- Advances in artificial intelligence and machine learning technologies

- Increasing need for real-time data analysis and predictive modeling

Market Restraints

- High cost of HPC infrastructure and maintenance

- Limited availability of skilled professionals to manage HPC systems

- Concerns over data security and privacy in HPC environments

Market Opportunities

- Expansion of cloud-based HPC services offering scalable solutions

- Integration of HPC with IoT and big data analytics for enhanced insights

- Growing application of HPC in personalized medicine and genomics research

High Performance Computing Market Report Coverage

| Market | High Performance Computing Market |

| High Performance Computing Market Size 2022 | USD 50.8 Billion |

| High Performance Computing Market Forecast 2032 | USD 97.8 Billion |

| High Performance Computing Market CAGR During 2023 - 2032 | 7.6% |

| High Performance Computing Market Analysis Period | 2020 - 2032 |

| High Performance Computing Market Base Year |

2022 |

| High Performance Computing Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Deployment, By Server Prize Band, By Organization Size, By Industry Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Dell Inc., Atos SE, Advanced Micro Devices, Inc, Amazon Web Services, Inc., Hewlett Packard Enterprise Development LP, IBM, Fujitsu, Intel Corporation, Cisco Systems pvt ltd, and Microsoft. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

High Performance Computing Market Insights

The surge in demand for high-speed data processing and complex application solutions is significantly driving the HPC industry. With the increasing complexity of tasks in fields like artificial intelligence, machine learning, and data analytics, organizations require robust computing power to process vast amounts of data swiftly and accurately. High-performance computing systems enable faster simulations, improved modeling capabilities, and real-time data processing, making them indispensable for research institutions, financial services, and tech companies. Additionally, the rise of cloud computing and advancements in hardware technology further bolster the high-performance computing market, ensuring efficient and scalable solutions for diverse computational needs.

In high-performance computing environments, data security and privacy concerns are significant restraints on market growth. The vast amounts of sensitive information processed and stored in high-performance computing systems make them prime targets for cyber-attacks. Ensuring robust security measures increases operational costs and complexity, deterring some potential users. Additionally, compliance with stringent regulatory standards poses challenges for high-performance computing providers and users. These factors collectively hinder the widespread adoption and expansion of HPC technologies.

The expansion of cloud-based high performance computing services offering scalable solutions presents significant opportunities for the HPC market. For instance, in August 2023, Hewlett Packard Enterprise revealed that phoenix NAP, an IT services provider, is enhancing its Bare Metal Cloud platform. This upgrade integrates cloud-native HPE ProLiant RL300 Gen11 servers featuring Ampere Computing processors. The enhanced services are tailored to support AI inferencing, cloud gaming, and other cloud-native workloads, emphasizing improved performance and energy efficiency. These services enable businesses and researchers to access powerful computing resources without the need for substantial upfront investment in infrastructure. Scalability ensures that users can easily adjust their computing power to match demand, making it cost-effective and efficient. This accessibility promotes innovation across various industries, from scientific research to financial modeling. Consequently, cloud-based HPC services are driving growth and democratizing access to advanced computational capabilities.

High Performance Computing Market Segmentation

The worldwide market for high performance computing is split based on component, deployment, server prize band, organization size, industry vertical, and geography.

High Performance Computing HPC Market by Components

- Servers

- Storage

- Networking Devices

- Software

- Services

- Cloud

- Others

According to high performance computing industry analysis, the servers segment dominates the market due to the increasing demand for powerful and efficient data processing capabilities in various industries. With advancements in technology, servers now offer enhanced computational power, scalability, and reliability, making them essential for complex simulations, data analysis, and machine learning tasks. Additionally, the rise of cloud computing and big data analytics has further fueled the demand for robust server infrastructures. As organizations seek to handle large volumes of data and perform intensive computations, servers remain the backbone of HPC systems.

High Performance Computing HPC Market Server Prize Bands

- USD 250,000-500,000 and above

- USD 250,000-100,000 and below

USD 250,000-500,000 and above server prize band and above has long been an industry leader in the high performance computing (HPC) market, due to their unparalleled computational power and advanced capabilities. These high-end servers are essential for handling complex simulations, data analysis, and large-scale processing tasks, making them indispensable for scientific research, financial modeling, and artificial intelligence. Their dominance is further bolstered by continuous innovations and support from leading technology companies. As a result, they remain the preferred choice for organizations requiring top-tier performance and reliability.

High Performance Computing HPC Market Deployments

- On-Premises

- Cloud-Based

In the HPC industry, on-premises deployment mode dominates the high-performance computing market due to its superior control over data security and performance. Organizations prefer this mode for handling sensitive data and applications requiring high computational power. It allows for customized hardware configurations tailored to specific needs, ensuring optimal performance. Additionally, it offers lower latency and greater reliability compared to cloud-based solutions.

High Performance Computing HPC Market Organization Sizes

- Small and Medium Enterprises (SMEs)

- Large Enterprises

historically, large enterprises anticipated to dominate due to several reasons. Firstly, they have substantial financial resources to invest in expensive HPC systems and infrastructure. Secondly, large enterprises often have complex computational needs that require the scale and capability offered by HPC solutions. Thirdly, they can afford dedicated teams for system maintenance and support, ensuring continuous operation. Lastly, the scale of operations in large enterprises often necessitates advanced simulations, data analytics, and modeling that HPC systems excel in, giving them a competitive edge in various industries like aerospace, finance, and scientific research.

High Performance Computing HPC Market Industry Vertical

- Gaming

- Banking, Financial Networking Devices, and Insurance (BFSI)

- Healthcare & Bioscience

- Retail

- Government and Defense

- Media & Entertainment

- Manufacturing

- Education & Research

- Transportation

- Others

In the high performance computing market, the government and defense industry dominates market due to its critical need for advanced computational capabilities to enhance national security, intelligence analysis, and military operations. These sectors rely on HPC for simulations, cryptographic analysis, and complex data processing to maintain strategic advantages. Additionally, government funding and investments drive innovation and development in HPC technologies. The industry's focus on cybersecurity and real-time data analytics further fuels its dominance in this market. Consequently, the government and defense sector remains at the forefront of adopting and utilizing cutting-edge HPC solutions.

High Performance Computing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

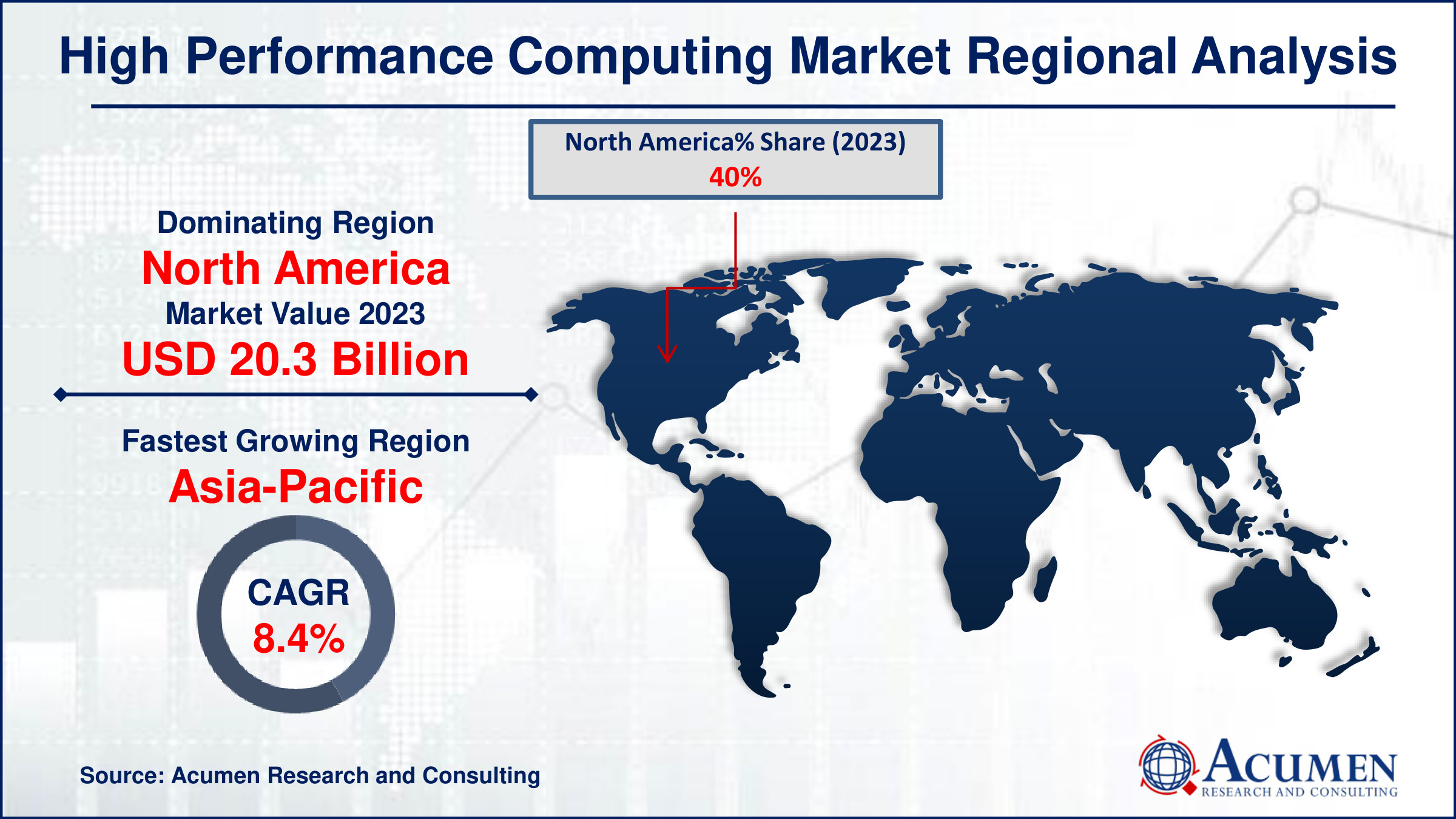

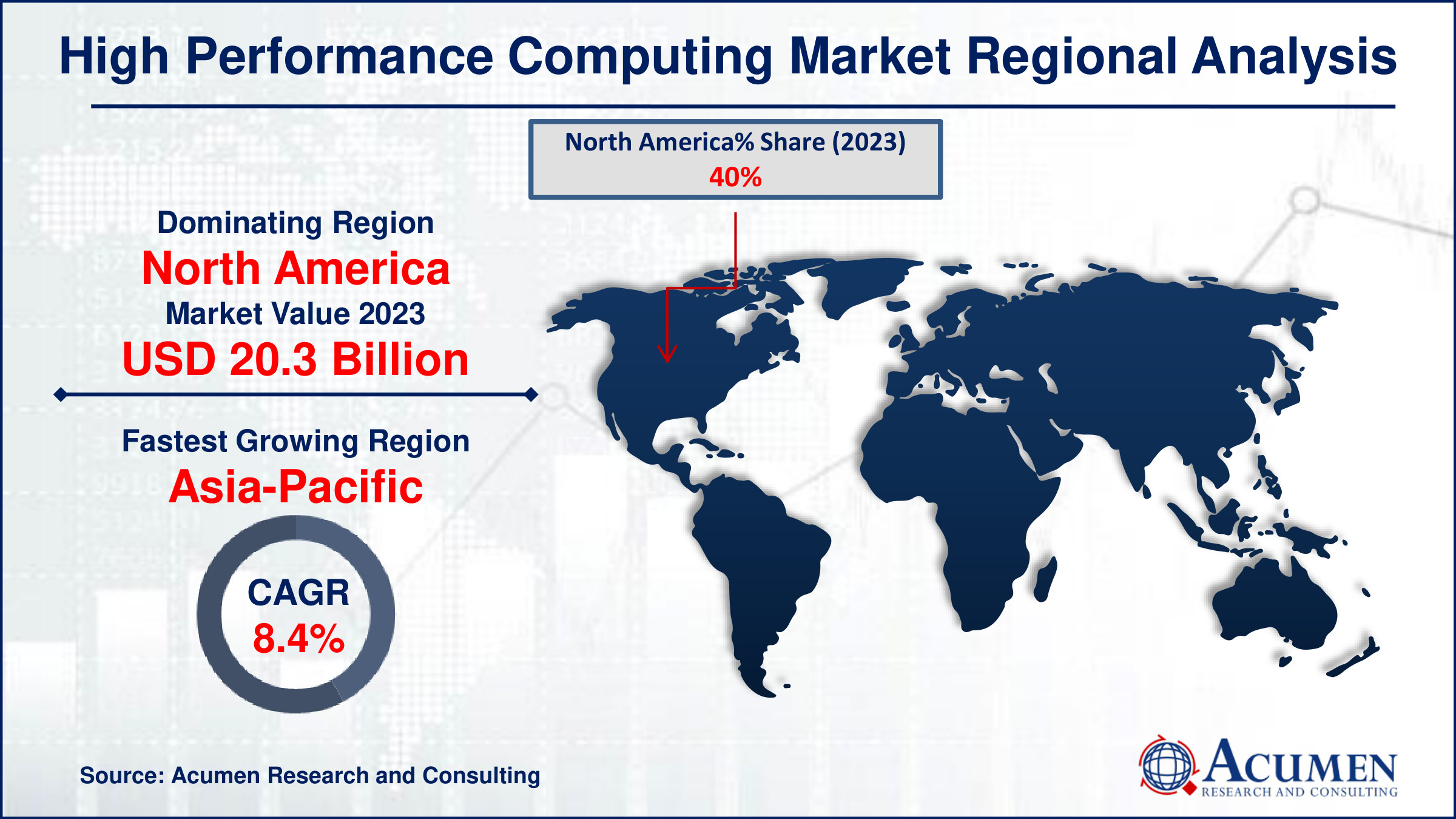

High Performance Computing Market Regional Analysis

The market in North America dominates high performance computing market. The presence of robust key players further contributes to market growth in this region. For instance, in January 2022, NVIDIA Corporation, a US-based company known for its graphics processing units (GPUs), system on a chip (SoC), and application programming interfaces (APIs), acquired Bright Computing, a US-based company specializing in automation and management software for high-performance computing (HPC) and machine learning (ML). The financial details of the acquisition were not disclosed. Furthermore, North America is home to major organizations like Boeing and General Motors, along with numerous small and medium enterprises, all of which are actively embracing HPC to overcome technical limitations. This factor is anticipated to further drive adoption in the North American region.

Asia-Pacific is fastest-growing region high performance computing market, driven by increasing investments in technology infrastructure and government initiatives. For instance, the United Arab Emirates (UAE) government has initiated digital transformation initiatives like Smart Abu Dhabi and Smart Dubai, aimed at encouraging cloud computing adoption and boosting the demand for HPC systems. The region's expanding industrial base, particularly in sectors like automotive, aerospace, and healthcare, is fueling the demand for advanced computing capabilities. Additionally, the rise of artificial intelligence, big data analytics, and cloud computing is further propelling HPC adoption.

High Performance Computing Market Players

Some of the top high performance computing companies offered in our report include Dell Inc., Atos SE, Advanced Micro Devices, Inc, Amazon Web Services, Inc., Hewlett Packard Enterprise Development LP, IBM, Fujitsu, Intel Corporation, Cisco Systems Pvt Ltd, and Microsoft.

Frequently Asked Questions

How big is the high performance computing market?

The high performance computing management market size was valued at USD 50.8 billion in 2023.

What is the CAGR of the global high performance computing market from 2024 to 2032?

The CAGR of high performance computing is 7.6% during the analysis period of 2024 to 2032.

Which are the key players in the high performance computing market?

The key players operating in the global market are including Dell Inc., Atos SE, Advanced Micro Devices, Inc, Amazon Web Services, Inc., Hewlett Packard Enterprise Development LP, IBM, Fujitsu, Intel Corporation, Cisco Systems Pvt Ltd, and Microsoft.

Which region dominated the global high performance computing market share?

North America held the dominating position in high performance computing industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of high performance computing during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global high performance computing industry?

The current trends and dynamics in the high performance computing industry include growing demand for high-speed data processing and complex application solutions, advances in artificial intelligence and machine learning technologies, and increasing need for real-time data analysis and predictive modeling.

Which Deployment held the maximum share in 2023?

The on-premise held the maximum share of the high performance computing industry.