Hereditary Angioedema Treatment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Hereditary Angioedema Treatment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

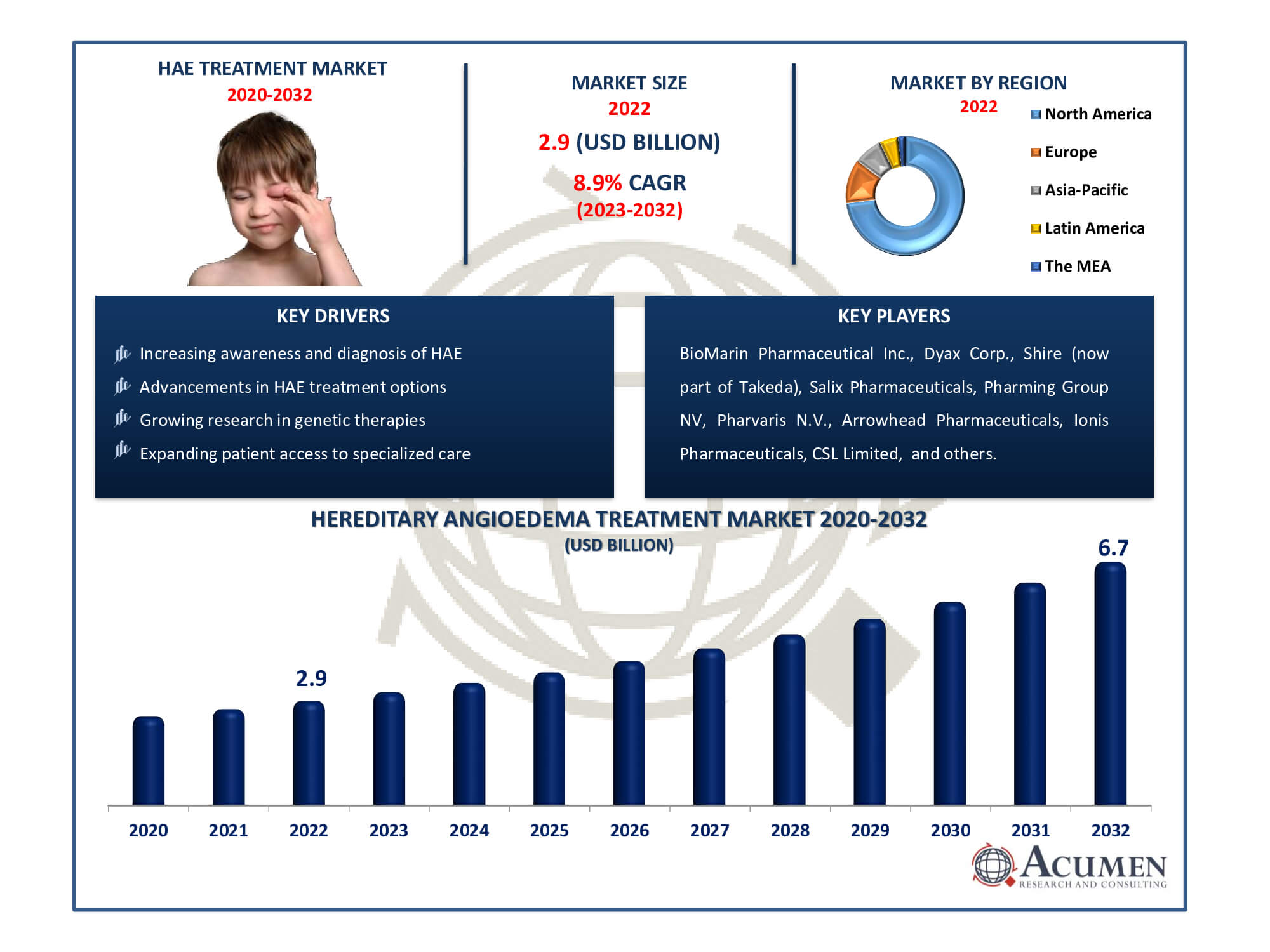

The Global Hereditary Angioedema Treatment Market Size accounted for USD 2.9 Billion in 2022 and is estimated to achieve a market size of USD 6.7 Billion by 2032 growing at a CAGR of 8.9% from 2023 to 2032.

Hereditary Angioedema Treatment Market Highlights

- Global hereditary angioedema treatment market revenue is poised to garner USD 6.7 billion by 2032 with a CAGR of 8.9% from 2023 to 2032

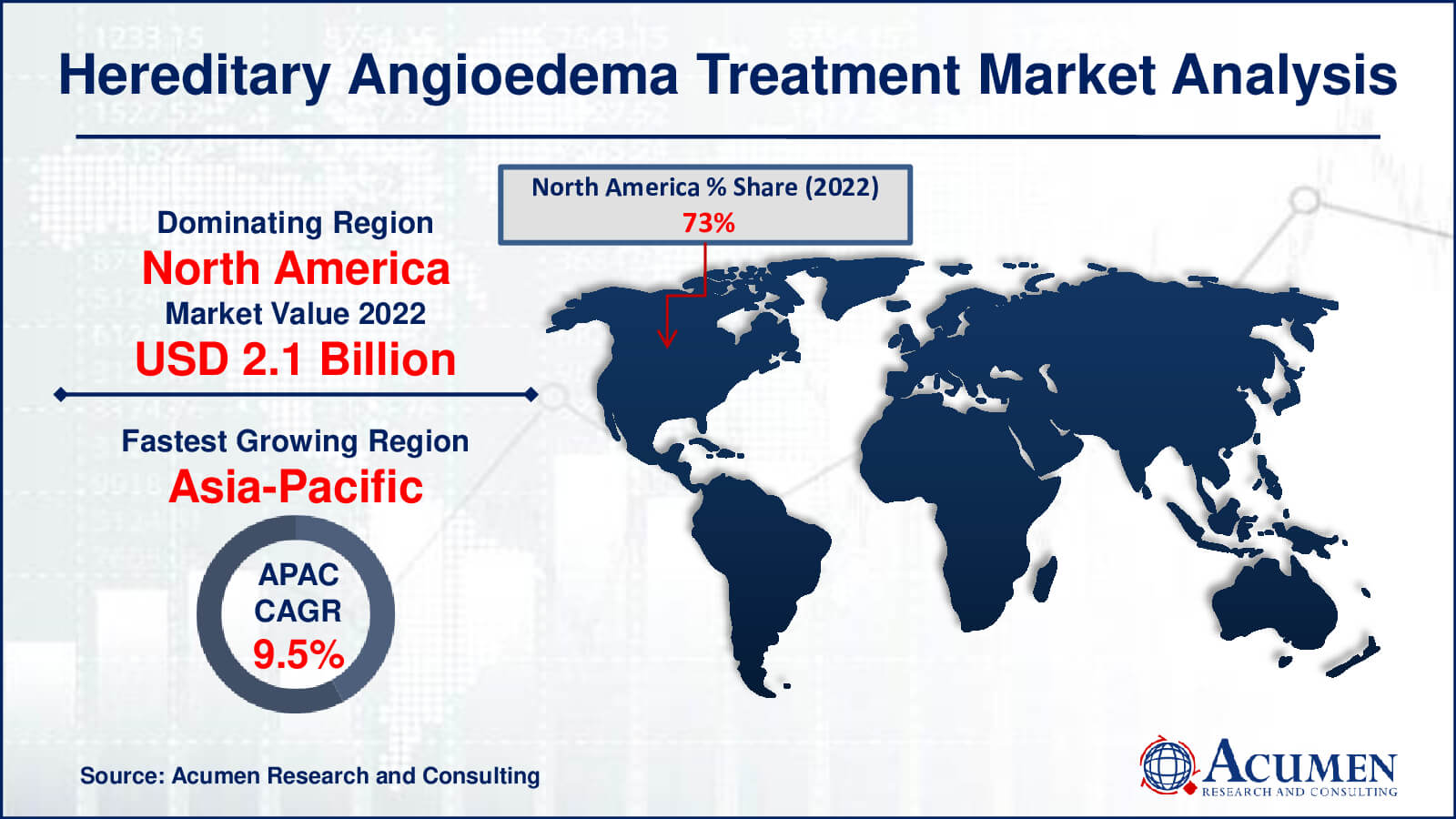

- North America hereditary angioedema treatment market value occupied around USD 2.12 billion in 2022

- Asia-Pacific hereditary angioedema treatment market growth will record a CAGR of more than 9.5% from 2023 to 2032

- Among drug class, the C1-esterase inhibitor sub-segment generated over US$ 1.5 billion revenue in 2022

- Based on route of administration, the subcutaneous sub-segment generated around 48% share in 2022

- Improved patient support and advocacy programs is a popular hereditary angioedema (HAE) treatment market trend that fuels the industry demand

Hereditary angioedema (HAE) is a rare genetic disorder known to be inherited in an autosomal dominant pattern. The condition is usually associated with recurrent attacks of severe swelling (angioedema) that can affect any part of the body, often targeting mucosal surfaces such as the lining of the gastrointestinal tract, mouth, tongue, throat, larynx, and genitourinary system, among others. According to estimates from the Food and Drug Administration (FDA), Hereditary Angioedema affects approximately 1 in 50,000 people, with around 6,500 individuals suffering from this condition in the US alone. Moreover, HAE resulted in over 5,000 emergency department visits, with 41% of cases leading to hospitalization over a one-year period in the US. Furthermore, statistics from the National Organization for Rare Disorders (NORD) indicate that HAE affects both males and females equally, with symptoms typically manifesting in early childhood. Globally, an estimated one in 50,000 to 150,000 individuals is affected by this disorder.

Global Hereditary Angioedema Treatment Market Dynamics

Market Drivers

- Increasing awareness and diagnosis of HAE

- Advancements in HAE treatment options

- Growing research in genetic therapies

- Expanding patient access to specialized care

Market Restraints

- High treatment costs for HAE therapies

- Limited availability of effective treatments

- Challenges in early diagnosis

- Relatively small patient population

Market Opportunities

- Emerging markets for HAE treatments

- Development of novel therapies and technologies

- Collaborative efforts in research and development

Hereditary Angioedema Treatment Market Report Coverage

| Market | Hereditary Angioedema Treatment Market |

| Hereditary Angioedema Treatment Market Size 2022 | USD 2.9 Billion |

| Hereditary Angioedema Treatment Market Forecast 2032 | USD 6.7 Billion |

| Hereditary Angioedema Treatment Market CAGR During 2023 - 2032 | 8.9% |

| Hereditary Angioedema Treatment Market Analysis Period | 2020 - 2032 |

| Hereditary Angioedema Treatment Market Base Year |

2022 |

| Hereditary Angioedema Treatment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Drug Class, By Treatment Type, By Route of Administration, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BioMarin Pharmaceutical Inc., Dyax Corp., Shire (now part of Takeda), Salix Pharmaceuticals, Pharming Group NV, Pharvaris N.V., Arrowhead Pharmaceuticals, Ionis Pharmaceuticals, CSL Limited, Attune Pharmaceuticals, Adverum Biotechnologies, Inc., and KalVista Pharmaceuticals, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Hereditary Angioedema Treatment Market Insights

Approval of Novel Drugs for the Treatment Coupled With Pipeline Drugs Boosts the HAE Market Globally

The US Food and Drug Administration (USFDA) approved Orladeyo (berotralstat) as an oral treatment for the prevention against swelling attacks in people suffering from HAE aged 12 years and older. These approval marks Orladeyo, the first and only oral treatment available for the patients where preventive treatment was only available previously through injection or infusions. Additionally, in August 2018, the USFDA approved Takhzyro (lanadelumab), the first monoclonal antibody approved in the US for treating patients 12 years and older with types 1 and 2 HAE. Apart from that, drug name, "Lanadelumab" is currently under pipeline analysis/clinical trials of phase 3. The clinical study is sponsored by the Takeda Pharmaceutical Company Limited for evaluating the safety, pharmacokinetics, and pharmacodynamics of "Lanadelumab" in children with the age of 2 years to <12 years for people suffering from Hereditary Angioedema (HAE).

Fast Product Approvals Stimulate the Hereditary Angioedema Market Growth Globally

With the help of the US Hereditary Angioedema Association, it has been witnessed that there are fast product approvals to treat HAE. The US Hereditary Angioedema Association encourages pharmaceutical companies to continue to develop new and improve current HAE therapies. The HAEA takes a pivotal role in patient recruitment for clinical trials. In December 2020, BioCryst Pharmaceuticals, Inc. announced that the US Food and Drug Administration (USFDA) has approved oral, once-daily ORLADEYO™ (berotralstat). The new product helps in preventing attacks of HAE in adults and pediatric patients 12 years and older.

Rising Prevalence of Global Hereditary Angioedema (HAE) Market Upsurge the Demand for Innovative Therapies

Hereditary angioedema (HAE) is a rare but potentially life threatening disease that affects approx.1 in 67,000 individuals with no identified differences in prevalence due to associated sex or ethnicity. There is a genetic component of autosomal dominant inheritance in approx. 75% of patients, while 25% of patients present with a spontaneous mutation. Therefore, it is found that there is no evidence of family history of disease. Symptoms of HAE often begin during childhood or adolescence that worsen around puberty and persists through a patient’s lifetime. The onset of symptoms of 11.2 years, with approx. 50% of patients experiences their first attack before the age of 10 years. The US HAEA Angioedema Center at UC San Diego provides comprehensive care for patients suffering from angioedema. The several range of innovative therapies involve state-of-the-art diagnostic test and techniques. Currently, the new study has been announced that evaluates the safety and efficacy of repeated subcutaneous (SC) administration of "Lanadelumab". It plays a vital role in preventing angioedema attacks in adolescents and adults with non-histaminergic angioedema with normal C1-INH.

Hereditary Angioedema Treatment Market Segmentation

The worldwide market for hereditary angioedema (HAE) treatment is segmented by drug class, treatment type, and route of administration. Under drug class, it is categorized into C1-esterase inhibitor, bradykinin B2 receptor antagonist, kallikrein inhibitor, and other classes. Regarding treatment type, the market is divided into prophylaxis and on-demand. In terms of the route of administration, the market includes intravenous, subcutaneous, and oral options.

Hereditary Angioedema Treatment Drug Classes

- C1-Esterase Inhibitor

- Bradykinin B2 Receptor Antagonist

- Kallikrein Inhibitor

- Others

According to the analysis of the hereditary angioedema (HAE) treatment industry, the C1-esterase inhibitor dominates the overall HAE treatment market, and it has maintained its dominance for some time. The majority of people suffering from HAE either lack a sufficient amount of the protein called C1 esterase inhibitor (C1-INH) or have a malfunctioning protein. This deficiency or dysfunction leads to episodes of swelling.

CINRYZE (C1 esterase inhibitor [human]) is the first preventive therapy indicated to assist in preventing HAE attacks in children aged 6 to 12 years old. Additionally, C1-esterase inhibitor is recommended as the first-line treatment for both long-term prophylaxis and short-term prophylaxis. Moreover, it is prescribed for the management of HAE, with C1-esterase inhibitor being an option for the acute treatment of HAE.

Hereditary Angioedema Treatment Types

- Prophylaxis

- On-demand

Regarding treatment type, on-demand treatment accounted for the largest HAE treatment market share in the past and is expected to continue dominating until the forecast period. The consistent use of on-demand products for managing acute hereditary angioedema (HAE) attacks strongly influences the HAE treatment market. HAE, being a complement disorder, benefits from on-demand treatment with newly approved and emerging therapies, as recommended by the American Academy of Allergy, Asthma & Immunology.

According to estimates from Prime Therapeutics, there are four different products approved for on-demand treatment of acute HAE episodes. These include subcutaneous (SC) ecallantide (Kalbitor®), a plasma kallikrein inhibitor; SC icatibant (Firazyr®), a bradykinin receptor antagonist; and two intravenous (IV) C1-INH drugs, Berinert® and Ruconest.

Hereditary Angioedema Treatment Route of Administrations

- Intravenous

- Subcutaneous

- Others

According to the hereditary angioedema treatment market forecast, the intravenous therapies segment has been the dominant segment in the past and is expected to continue holding a significant revenue share throughout the forecast period, which spans from 2023 to 2032. Existing therapies for the management of HAE are predominantly administered intravenously. This is one of the key factors contributing significantly to the overall hereditary angioedema market globally.

Hereditary Angioedema Treatment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

North America Dominates The Hereditary Angioedema (HAE) Treatment Industry

North America leads the global hereditary angioedema (HAE) treatment market due to several factors. This leadership is attributed to the rising prevalence of hereditary angioedema, a growing focus on treatment options for the condition, and a well-established healthcare system. According to the American Osteopathic Association, HAE is estimated to affect approximately 1 in 50,000 individuals in the United States, with no significant ethnic group differences. In the US alone, HAE attacks result in 15,000 to 30,000 emergency room visits annually. Management of HAE attacks in this region benefits from innovative therapies and fast product approvals.

For instance, human plasma-derived C1 INH concentrate (Berinert) received FDA approval in 2009 for managing angioedema attacks of the face and abdomen in adults and adolescent patients. Furthermore, Berinert received FDA approval to expand its label, allowing for self-administration and treatment of acute laryngeal attacks of HAE.

In contrast, the Asia-Pacific region is expected to experience significant growth in the forecast period. This growth is driven by increased patient awareness and the launch of novel therapies for managing hereditary angioedema, presenting lucrative opportunities for regional expansion.

Hereditary Angioedema Treatment Market Players

Some of the top hereditary angioedema treatment companies offered in our report includes BioMarin Pharmaceutical Inc., Dyax Corp., Shire (now part of Takeda), Salix Pharmaceuticals, Pharming Group NV, Pharvaris N.V., Arrowhead Pharmaceuticals, Ionis Pharmaceuticals, CSL Limited, Attune Pharmaceuticals, Adverum Biotechnologies, Inc., and KalVista Pharmaceuticals, Inc.

Frequently Asked Questions

What was the size of the hereditary angioedema treatment market?

The size of hereditary angioedema treatment market was USD 2.9 billion in 2022.

What is the CAGR of the hereditary angioedema treatment market from 2023 to 2032?

The CAGR of hereditary angioedema treatment is 8.9% during the analysis period of 2023 to 2032.

Which are the key players in the hereditary angioedema treatment market?

The key players operating in the global market are BioMarin Pharmaceutical Inc., Dyax Corp., Shire (now part of Takeda), Salix Pharmaceuticals, Pharming Group NV, Pharvaris N.V., Arrowhead Pharmaceuticals, Ionis Pharmaceuticals, CSL Limited, Attune Pharmaceuticals, Adverum Biotechnologies, Inc., and KalVista Pharmaceuticals, Inc.

Which region dominated the global hereditary angioedema treatment market share?

North America held the dominating position in hereditary angioedema treatment industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of hereditary angioedema treatment during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global hereditary angioedema treatment industry?

The current trends and dynamics in the hereditary angioedema treatment industry include increasing awareness and diagnosis of HAE, and advancements in HAE treatment options, and growing research in genetic therapies.

Which drug class held the maximum share in 2022?

The C1-esterase inhibitor drug class held the maximum share of the hereditary angioedema treatment industry.