Herceptin Biosimilar Market Size - Global Industry, Share, Analysis, Trends and Forecast 2025 - 2033

Published :

Report ID:

Pages :

Format :

Herceptin Biosimilar Market Size - Global Industry, Share, Analysis, Trends and Forecast 2025 - 2033

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

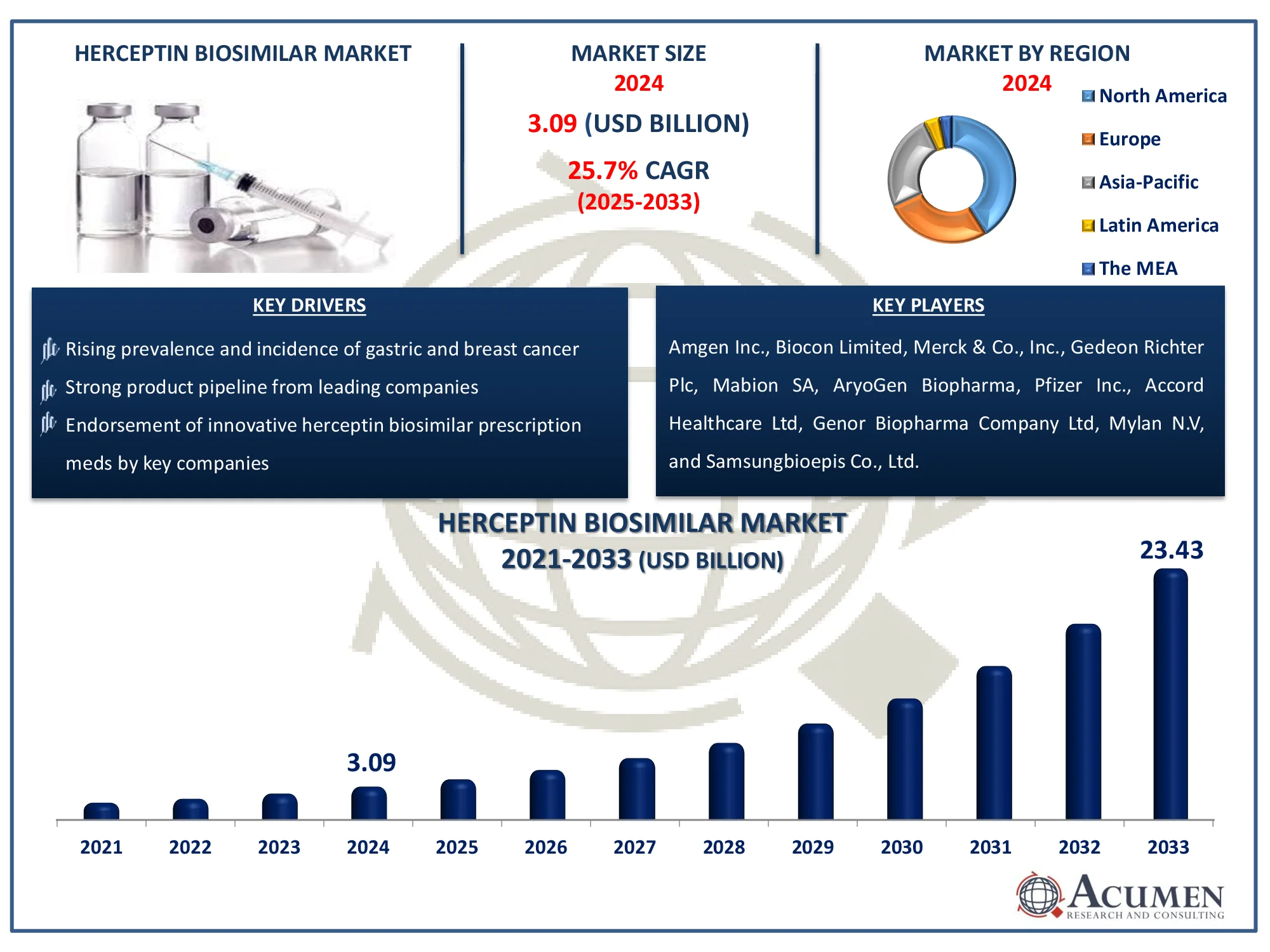

The Global Herceptin Biosimilar Market Size accounted for USD 3.09 Billion in 2024 and is estimated to achieve a market size of USD 23.43 Billion by 2033 growing at a CAGR of 25.7% from 2025 to 2033.

Herceptin Biosimilar Market Highlights

- Global herceptin biosimilar market revenue is poised to garner USD 23.43 billion by 2033 with a CAGR of 25.7% from 2025 to 2033

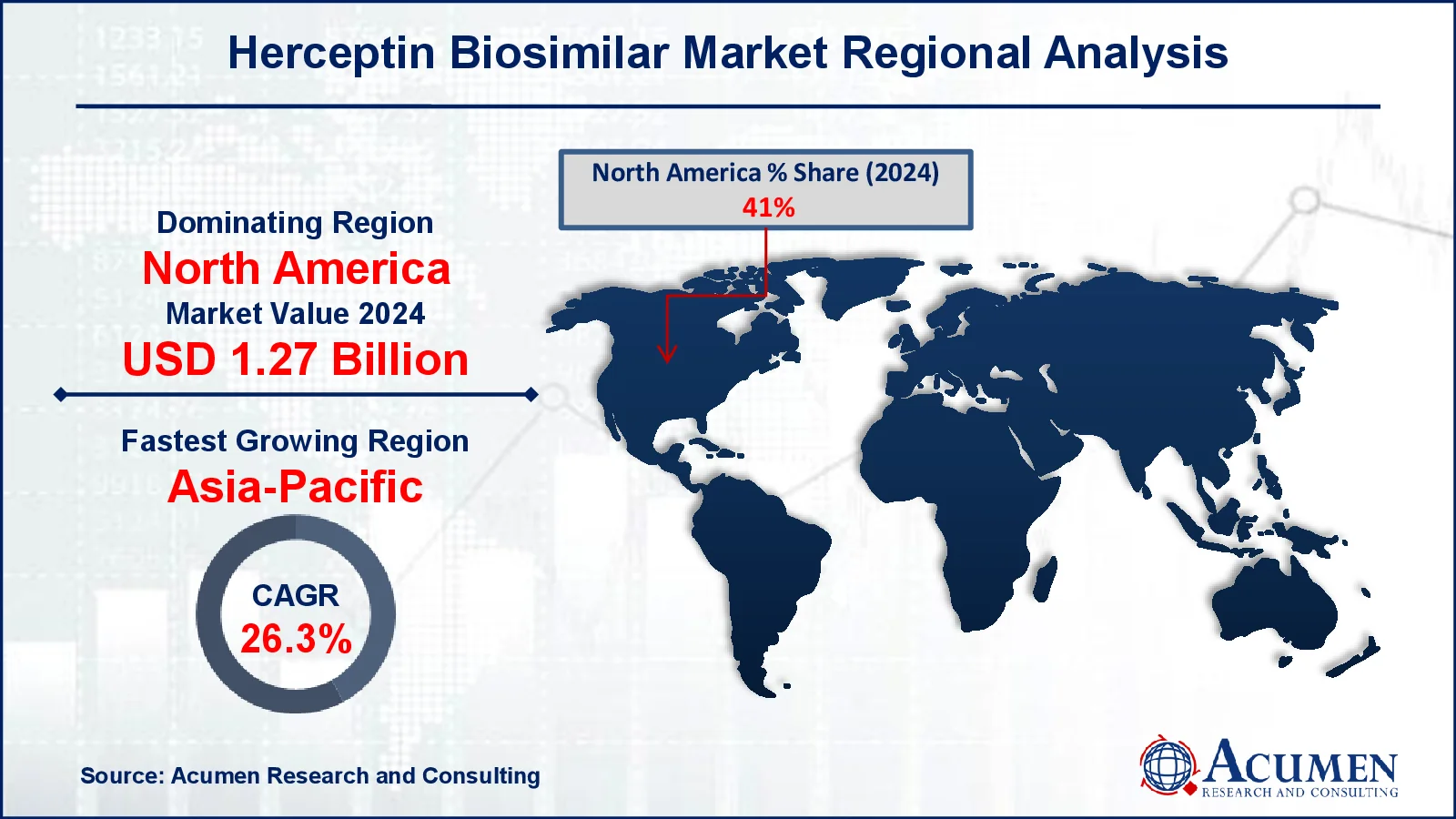

- North America herceptin biosimilar market value occupied around USD 1.27 billion in 2024

- Asia-Pacific herceptin biosimilar market growth will record a CAGR of more than 26.3% from 2025 to 2033

- Among application, the breast cancer sub-segment generated significant revenue in 2024

- As per National Breast Cancer Foundation, Inc., around 310,720 women and 2,800 men in the US were diagnosed with invasive breast cancer in 2024

- Based on end-user, the hospital & clinics sub-segment generated around 40% market share in 2024

- Growing emphasis on personalized medicine in oncology treatment is a popular herceptin biosimilar market trend that fuels the industry demand

The increasing number of individuals residing with gastric cancer and metastatic breast cancer is expected to stimulate demand opportunities for companies in the global herceptin biosimilar market. Furthermore, increased research and development, as well as increased cancer therapy awareness, increase the herceptin biosimilar market size. Additionally, rising healthcare costs and the existence of novel R&D investments provide an opportunity for herceptin biosimilar market share. However, negative consequences caused by herceptin biologic drugs, stringent regulations governing herceptin biosimilar authorization, as well as the availability of alternative treatments available may limit the global herceptin biosimilar market size. Herceptin is the cancer medication used in the treatment of the breast cancer. It is monoclonal antibodies and is used along with the chemotherapy drugs. It is also termed as a targeted therapy drug. Trastuzumab is the one of the brand name herceptin which is administered by slow injection to a vein. In 2014, herceptin has lost the patent in Japan and Europe which has opened the gates for the development of the biosimilar to enter the market. Whereas, the patent for the drug in the U.S. expired in 2019. The companies are continuously trying to introduce the new generic drugs to expand the global herceptin biosimilars market value.

Global Herceptin Biosimilar Market Dynamics

Market Drivers

- Rising prevalence and incidence of gastric and breast cancer

- Strong product pipeline from leading companies

- Increasing advancement in the healthcare sector

- Endorsement of innovative herceptin biosimilar prescription meds by key companies

Market Restraints

- Existence of alternatives

- High costs for development

- Significant side effects associated with herceptin

Market Opportunities

- Strategic acquisitions and mergers by major influencers

- Increase in healthcare spending

- Expanding access to biosimilars in emerging markets

Herceptin Biosimilar Market Report Coverage

|

Market |

Herceptin Biosimilar Market |

|

Herceptin Biosimilar Market Size 2024 |

USD 3.09 Billion |

|

Herceptin Biosimilar Market Forecast 2033 |

USD 23.43 Billion |

|

Herceptin Biosimilar Market CAGR During 2025 - 2033 |

25.7% |

|

Herceptin Biosimilar Market Analysis Period |

2021 - 2033 |

|

Herceptin Biosimilar Market Base Year |

2024 |

|

Herceptin Biosimilar Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Application, By End-User, By Distribution Channel, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Amgen Inc., Biocon Limited, Merck & Co., Inc., Gedeon Richter Plc, Mabion SA, Roche Holding AG, AryoGen Biopharma, Pfizer Inc., Accord Healthcare Ltd, Genor Biopharma Company Ltd, Mylan N.V, and Samsungbioepis Co., Ltd. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Herceptin Biosimilar Market Insights

During last few years, there is a significant rise in the cancer patient pool. Increasing prevalence of the cancer and increasing demand for the targeted therapy have led to drive the herceptin biosimilars market growth. Breast cancer is the most widely occurred cancer in the woman. According to the U.S. breast cancer Statistics, over 12.4% of the total American woman develops breast cancer in their lifetime. Changing lifestyle, increasing pollution and adoption of smoking by the people has fuelled the growth of the market value. As there are huge opportunity for the development of the cancer drug a number of companies are continuously investing a huge amount of capital in research and development. Increasing spending on research & development and increasing demand for the better drugs for the treatment has supported and created a huge opportunity in coming future.

On the other hand, availability of the alternative treatment and huge side effects of the drugs may slow the growth of the herceptin biosimilars market size during the forecasted period.

Herceptin Biosimilar Market Segmentation

Herceptin Biosimilar Market Segmentation

The worldwide market for herceptin biosimilar is split based on application, end-user, distribution channel, and geography.

Herceptin Biosimilar Application

- Breast Cancer

- Gastric Cancer

- Other

According to herceptin biosimilar industry analysis, the breast cancer segment is predicted to lead the global market growth over the forecast. This growth is due to a rise in the prevalence and incidence of breast cancer in women. According to the World Health Organization, approximately 627,000 women died from breast cancer in 2018, increasing the demand for monoclonal antibodies & driving the expansion of this segment. As a result, herceptin biosimilar market shares are influenced by these factors.

Herceptin Biosimilar End-User

- Hospital & Clinics

- Oncology Centers

- Others

The hospitals & clinics category often provides the most income for herceptin biosimilars. This is because hospitals and clinics are the principal treatment facilities for cancer patients, including those with HER2-positive breast cancer. They manage vast patient populations, deliver medications, and frequently have dedicated oncology divisions. Additionally, hospitals profit from bulk purchasing and long-term contracts, which drive up sales. Oncology facilities also make substantial contributions, but they typically serve a smaller, more specialized patient population. The "Others" group, which may include retail pharmacies or home healthcare services, earns far less revenue because to its limited role in administering sophisticated medicines such as Herceptin biosimilars. As a result, hospitals and clinics continue to generate the majority of revenue.

Herceptin Biosimilar Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

The majority of herceptin biosimilars are distributed through hospital pharmacies. Hospitals are the principal sites for cancer therapy, where biosimilars such as herceptin are delivered under physician supervision. Biosimilars are preferred by oncologists and healthcare workers in hospitals because they are less expensive and have equivalent efficacy to the reference medicine. Furthermore, hospitals usually have established procurement systems and ties with pharmaceutical suppliers to assure consistent supply and availability. This segment also benefits from insurance coverage and reimbursement policies, which make biosimilars more affordable for patients. Because cancer treatment requires specialized care, hospital pharmacies remain the principal distribution channel for herceptin biosimilars, ensuring patient safety and efficacy. Retail and internet pharmacies, while expanding, play a supporting role due to the need for expert oversight when administering such prescriptions.

Herceptin Biosimilar Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Herceptin Biosimilar Market Regional Analysis

Herceptin Biosimilar Market Regional Analysis

North America is the greatest market for herceptin biosimilars, with the United States in the forefront. The region benefits from high healthcare spending, a robust regulatory environment, and the presence of big pharmaceutical companies that are actively researching and commercializing biosimilars. The US Food and Drug Administration (FDA) has enacted legislation to speed biosimilar approvals, creating a favorable environment for business growth. Furthermore, the region's high prevalence of breast cancer has increased demand for low-cost treatments such as herceptin biosimilars. The combination of contemporary healthcare infrastructure, patient awareness, and government support has cemented North America's status as the industry leader.

Europe is the second largest in the global market value owing to the patent expiry of the drug in Europe. In 2014, herceptin biosimilar has lost the patent which has increased the market for the generics of the herceptin. Additionally, introduction of the new generics products in European market and continuous research & development in the drug discovery has boosted the growth of the market in Europe.

The Asia-Pacific area is the fastest-growing in the herceptin biosimilar market forecast period, led by China and India. Several factors contribute to this expansion, including rising breast cancer rates, expanded healthcare infrastructure, and increased government activities to promote biosimilar usage. The region benefits from cheaper production costs, especially in India, a global hub for biosimilar manufacturing. Furthermore, increased awareness of cancer therapy and efforts to make medicines more affordable are driving market expansion. The Asia-Pacific region's enormous patient population, combined with economic development and healthcare investments, puts it as a significant growth driver for the market.

Herceptin Biosimilar Market Players

Some of the top herceptin biosimilar companies offered in our report includes Amgen Inc., Biocon Limited, Merck & Co., Inc., Gedeon Richter Plc, Mabion SA, Roche Holding AFG, AryoGen Biopharma, Pfizer Inc., Accord Healthcare Ltd, Genor Biopharma Company Ltd, Mylan N.V, and Samsungbioepis Co., Ltd.

Frequently Asked Questions

How big is the herceptin biosimilar market?

The herceptin biosimilar market size was valued at USD 3.09 Billion in 2024.

What is the CAGR of the global herceptin biosimilar market from 2025 to 2033?

The CAGR of herceptin biosimilar is 25.7% during the analysis period of 2025 to 2033.

Which are the key players in the herceptin biosimilar market?

The key players operating in the global market are Amgen Inc., Biocon Limited, Merck & Co., Inc., Gedeon Richter Plc, Mabion SA, Roche Holding AG, AryoGen Biopharma, Pfizer Inc., Accord Healthcare Ltd, Genor Biopharma Company Ltd, Mylan N.V, and Samsungbioepis Co., Ltd.

Which region dominated the global herceptin biosimilar market share?

North America held the dominating position in herceptin biosimilar industry during the analysis period of 2025 to 2033.

Which region registered fastest CAGR from 2025 to 2033?

Asia-Pacific region exhibited fastest growing CAGR for market of herceptin biosimilar during the analysis period of 2025 to 2033.

What are the current trends and dynamics in the global herceptin biosimilar industry?

The current trends and dynamics in the herceptin biosimilar industry include increase in healthcare spending, and expanding access to biosimilars in emerging markets.

Which distribution channel held the maximum share in 2024?

The hospital pharmacies distribution channel held the maximum share of the herceptin biosimilar industry.