Hemoglobinopathy Market | Acumen Research and Consulting

Hemoglobinopathy Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

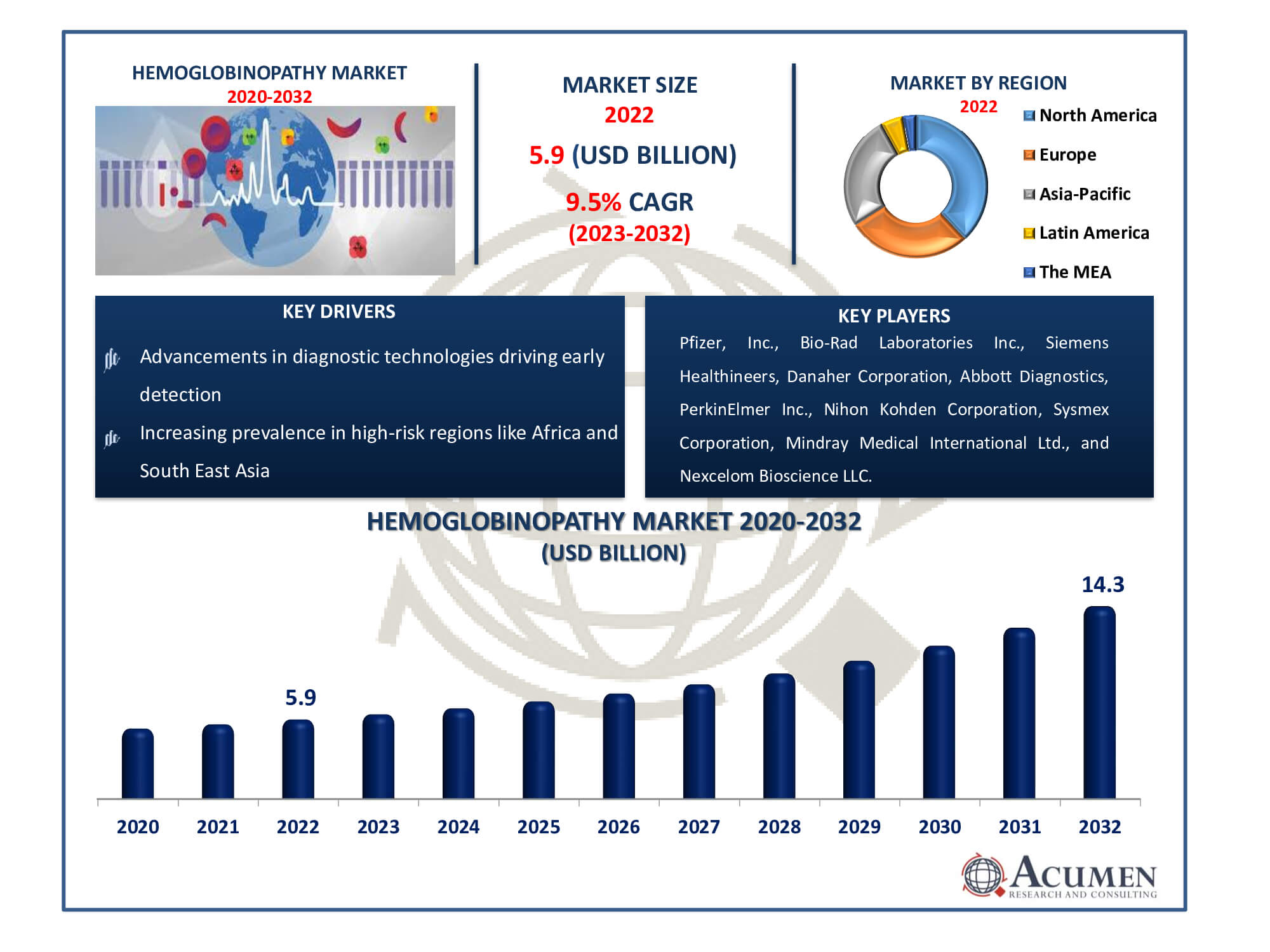

The Hemoglobinopathy Market Size accounted for USD 5.9 Billion in 2022 and is estimated to achieve a market size of USD 14.3 Billion by 2032 growing at a CAGR of 9.5% from 2023 to 2032.

Hemoglobinopathy Market Highlights

- Global hemoglobinopathy market revenue is poised to garner USD 14.3 billion by 2032 with a CAGR of 9.5% from 2023 to 2032

- North America hemoglobinopathy market value occupied around USD 2.2 billion in 2022

- Asia-Pacific hemoglobinopathy market growth will record a CAGR of more than 11% from 2023 to 2032

- Among type, the thalassemia sub-segment generated over US$ 2.8 billion revenue in 2022

- Based on therapy, the monoclonal antibody medication sub-segment generated around 60% share in 2022

- Rising focus on personalized medicine for better management is a popular hemoglobinopathy market trend that fuels the industry demand

Hemoglobinopathy is a genetic disorder that causes structural abnormalities in hemoglobin molecules. It is a type of hereditary single-gene disease and represents the most common form of sickle cell disease. It is highly prevalent in Africa, South East Asia, and the Mediterranean basin. Critical cases of hemoglobinopathy can lead to anemia, organ dysfunction, or even death if left untreated. Diagnostic tests for the presence of hemoglobinopathies include Gel electrophoresis and complete blood count. Unfortunately, there is no permanent cure for this disease, which has led to an increased demand in the pharmaceutical sector for new product innovations. The high prevalence of the disease, coupled with national control programs in developing economies, drives the need for drug therapy.

Global Hemoglobinopathy Market Dynamics

Market Drivers

- Increasing prevalence in high-risk regions like Africa and South East Asia

- Growing demand for innovative pharmaceutical solutions

- National control programs in developing economies

- Advancements in diagnostic technologies driving early detection

Market Restraints

- Lack of permanent cure options

- Limited accessibility to advanced treatments in certain regions

- Ethical and regulatory challenges in drug development

Market Opportunities

- Research and development for novel therapies

- Collaborative efforts for affordable treatments in underserved areas

- Technological advancements aiding precise diagnostics

Hemoglobinopathy Market Report Coverage

| Market | Hemoglobinopathy Market |

| Hemoglobinopathy Market Size 2022 | USD 5.9 Billion |

| Hemoglobinopathy Market Forecast 2032 | USD 14.3 Billion |

| Hemoglobinopathy Market CAGR During 2023 - 2032 | 9.5% |

| Hemoglobinopathy Market Analysis Period | 2020 - 2032 |

| Hemoglobinopathy Market Base Year |

2022 |

| Hemoglobinopathy Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Therapy, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Pfizer, Inc., Bio-Rad Laboratories Inc., Siemens Healthineers, Danaher Corporation, Abbott Diagnostics, PerkinElmer Inc., Nihon Kohden Corporation, Sysmex Corporation, Mindray Medical International Ltd., Nexcelom Bioscience LLC., Sangamo Therapeutics, Inc., and bluebird bio, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Hemoglobinopathy Market Insights

Increasing cases of hemoglobinopathy stand as major driving forces for growth, particularly in regions like Southeast Asia and Africa. Approximately 300,000 to 500,000 children are born every year with hemoglobin disorders, according to the World Health Organization (WHO). More than half of these children born with Hb disorders suffer from sickle cell disease (SCD) and thalassemia. Failure to recognize these diseases escalates the death-to-survival ratio for SCD and thalassemia patients. The National Institutes of Health is expected to bolster market growth over the hemoglobinopathy industry forecast period by heightening government and enterprise awareness initiatives for hemoglobin variants, such as the sickle cell initiative launched.

Usual neonatal screening programs serve as effective measures to detect potentially harmful and fatal problems, such as thalassemia and SCD, at an early stage in children, especially in advanced countries. For instance, in 2013, the CDC and the Association of the Laboratories for Public Health partnered on a hemoglobinopathy newborn health screening program under the Division of Blood Disorders. This initiative aimed to assist laboratories in evaluating complications associated with hemoglobinopathies. Additionally, it aimed to provide education on hemoglobinopathy screening programs to caregivers, healthcare workers, and patients.

Another reason for the market's growth is the surge in R&D activities focused on developing new therapeutics. The NHLBI supports SCD research programs aiming to discover novel methods for detecting, treating, and enhancing patient outcomes. Advancements, including gene replacement or editing of the defective SCD gene, along with the transplantation of corrected genes into patients, are underway, leveraging progress in gene-editing technology. Anticipated grants for SCD prevention and treatments are also expected to enhance disease management, following the enactment of the Sickle Cell Disease Research, Surveillance, Prevention, and Treatment Act.

Hemoglobinopathy Market Segmentation

The worldwide market for hemoglobinopathy is split based on type, therapy, distribution channel, and geography.

Hemoglobinopathy Types

- Thalassemia

- Sickle Cell Disease

- Others

Thalassemia's high prevalence and clinical significance make it a prominent player in the hemoglobinopathy market. This genetic blood condition causes aberrant haemoglobin synthesis, which can result in anaemia and other related problems. Its market dominance is greatly influenced by its significance in several places, especially in South Asia, the Mediterranean countries, and parts of Africa. Ongoing research projects focused on creating cutting-edge medication interventions and gene therapies are driving the thalassemia market. The need for diagnostic tools and treatment options is also fueled by increased awareness efforts and proactive screening programmes for carriers and affected persons.

The financial burden of thalassemia highlights the need for ongoing improvements in supporting care and treatment options, as well as the impact it has on patients and their families quality of life. As a result, thalassemia continues to receive a lot of attention in the hemoglobinopathy market, underscoring the necessity of continuing therapeutic advancements and efficient management techniques.

Hemoglobinopathy Therapy

- Monoclonal Antibody Medication

- ACE inhibitors

- Hydroxyurea

- Others

According to hemoglobinopathy industry analysis, the market is dominated by monoclonal antibody medication because of its precise and targeted therapy strategy. By modifying the immune system's reaction and helping to manage hemoglobinopathies such sickle cell disease (SCD), these drugs are designed to attach selectively to certain targets. Their widespread adoption has been fueled by advances in biotechnology and drug research, as well as their effectiveness in targeting specific biochemical pathways linked to certain illnesses. The promise for better patient outcomes and quality of life is what makes monoclonal antibody medication so successful: it can lessen symptoms, lessen problems, and open the door for more individualised and efficient treatment plans.

Hemoglobinopathy Distribution Channels

- Hospital Pharmacy

- Online Providers

- Drug Stores and Retail Pharmacy

Drug stores and retail pharmacies stand out as the major market sector for hemoglobinopathy because of their widespread accessibility and convenience. For patients in need of supportive care items and regular drugs for the treatment of haemoglobin diseases such as thalassemia and sickle cell disease (SCD), these stores are essential hubs.

Their widespread presence in the community and accessibility enable patients to obtain necessary prescription drugs, dietary supplements, and supportive therapies at the earliest opportunity. Furthermore, these establishments frequently provide a wide array of products that address different patient requirements, serving as a one-stop shop for people looking for assistance and remedies for hemoglobinopathies. Improved patient outcomes and illness management are eventually facilitated by this accessibility, which encourages greater adherence to treatment plans.

Hemoglobinopathy Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Hemoglobinopathy Market Regional Analysis

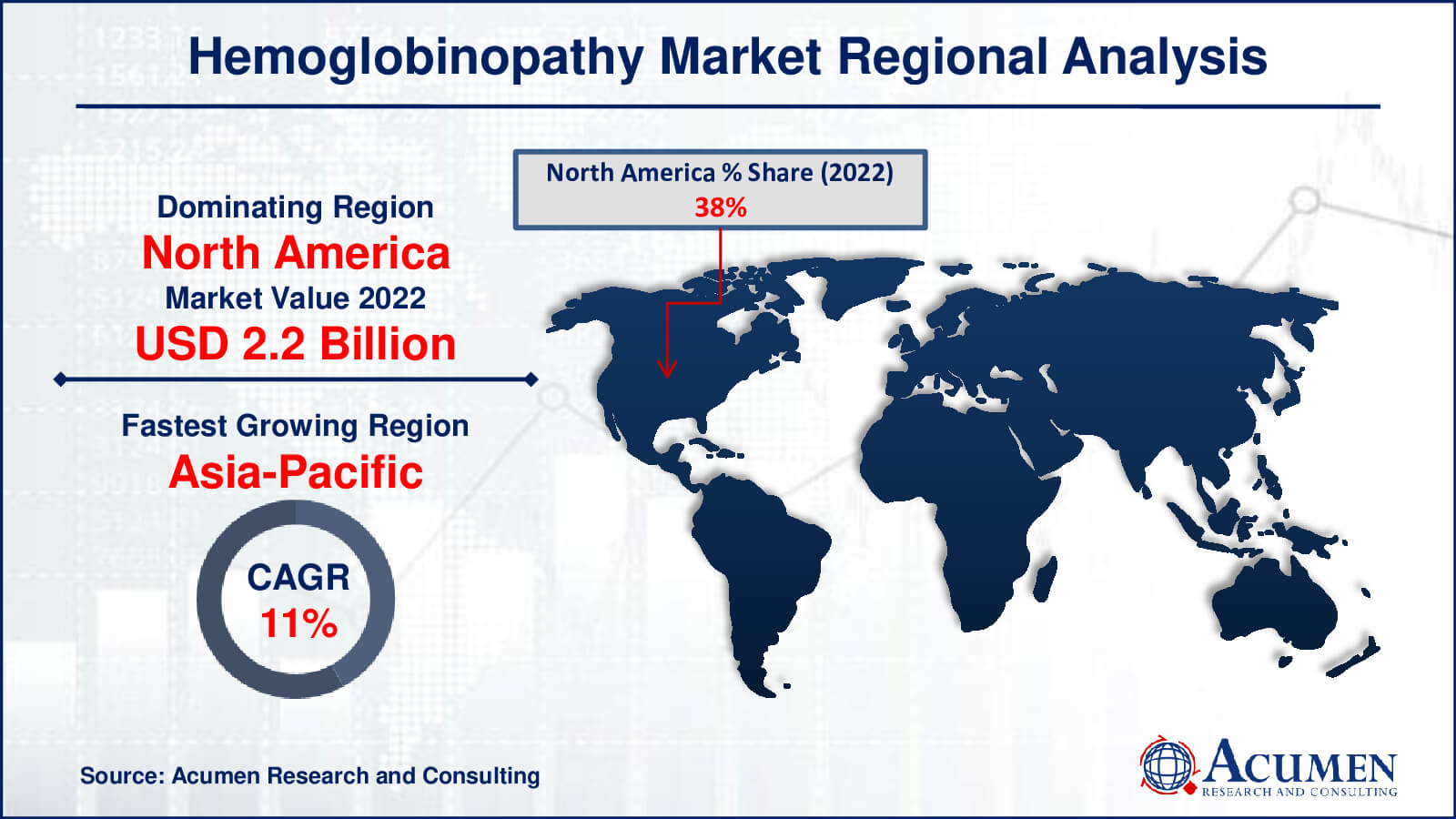

In terms of hemoglobinopathy market analysis, due to increased investment in R&D by major players, improved reimbursement scenarios, and high-quality sanitary infrastructure, North America led the overall revenue market in 2022.

Asia Pacific is expected to experience the fastest growth during the hemoglobinopathy market forecast period. Producers are anticipated to find lucrative growth opportunities in the future with the introduction of indigenous, low-cost diagnostic kits for thalassemia and Sickle-cell disease, alongside increasing patient awareness.

Although hemoglobinopathy incidence is high in underdeveloped economies, including nations in South-East Asia and the Sub-Saharan area, a stronger healthcare system is anticipated to enhance global management of hemoglobinopathies, particularly in advanced markets such as North America and Asia-Pacific. Advanced diagnostics and therapeutics are likely to drive business development in the coming years.

Hemoglobinopathy Market Players

Some of the top hemoglobinopathy companies offered in our report includes Pfizer, Inc., Bio-Rad Laboratories Inc., Siemens Healthineers, Danaher Corporation, Abbott Diagnostics, PerkinElmer Inc., Nihon Kohden Corporation, Sysmex Corporation, Mindray Medical International Ltd., Nexcelom Bioscience LLC., Sangamo Therapeutics, Inc., and bluebird bio, Inc.

Frequently Asked Questions

How big is the hemoglobinopathy market?

The hemoglobinopathy market size was USD 5.9 Billion in 2022.

What is the CAGR of the global hemoglobinopathy market from 2023 to 2032?

The CAGR of hemoglobinopathy is 9.5% during the analysis period of 2023 to 2032.

Which are the key players in the hemoglobinopathy market?

The key players operating in the global market are including Pfizer, Inc., Bio-Rad Laboratories Inc., Siemens Healthineers, Danaher Corporation, Abbott Diagnostics, PerkinElmer Inc., Nihon Kohden Corporation, Sysmex Corporation, Mindray Medical International Ltd., Nexcelom Bioscience LLC., Sangamo Therapeutics, Inc., and bluebird bio, Inc.

Which region dominated the global hemoglobinopathy market share?

North America held the dominating position in hemoglobinopathy industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of hemoglobinopathy during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global hemoglobinopathy industry?

The current trends and dynamics in the hemoglobinopathy industry include increasing prevalence in high-risk regions like Africa and South East Asia, growing demand for innovative pharmaceutical solutions, national control programs in developing economies, and advancements in diagnostic technologies driving early detection.

Which type held the maximum share in 2022?

The thalassemia type held the maximum share of the hemoglobinopathy industry.