Hematology Diagnostics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2025 - 2033

Published :

Report ID:

Pages :

Format :

Hematology Diagnostics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2025 - 2033

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

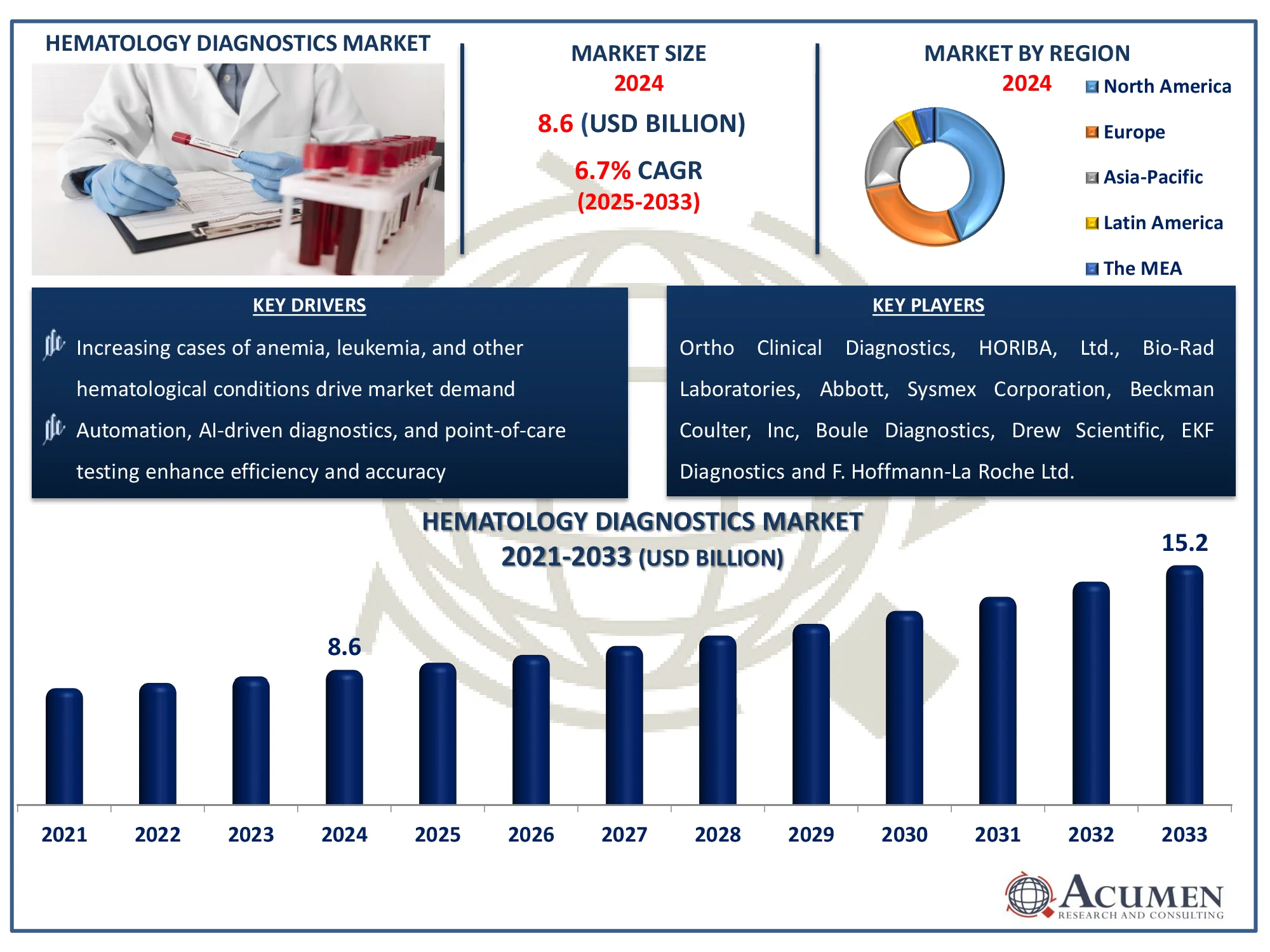

The Global Hematology Diagnostics Market Size accounted for USD 8.6 Billion in 2024 and is estimated to achieve a market size of USD 15.2 Billion by 2033 growing at a CAGR of 6.7% from 2025 to 2033.

Hematology Diagnostics Market Highlights

- Global hematology diagnostics market revenue is poised to garner USD 15.2 billion by 2033 with a CAGR of 6.7% from 2025 to 2033

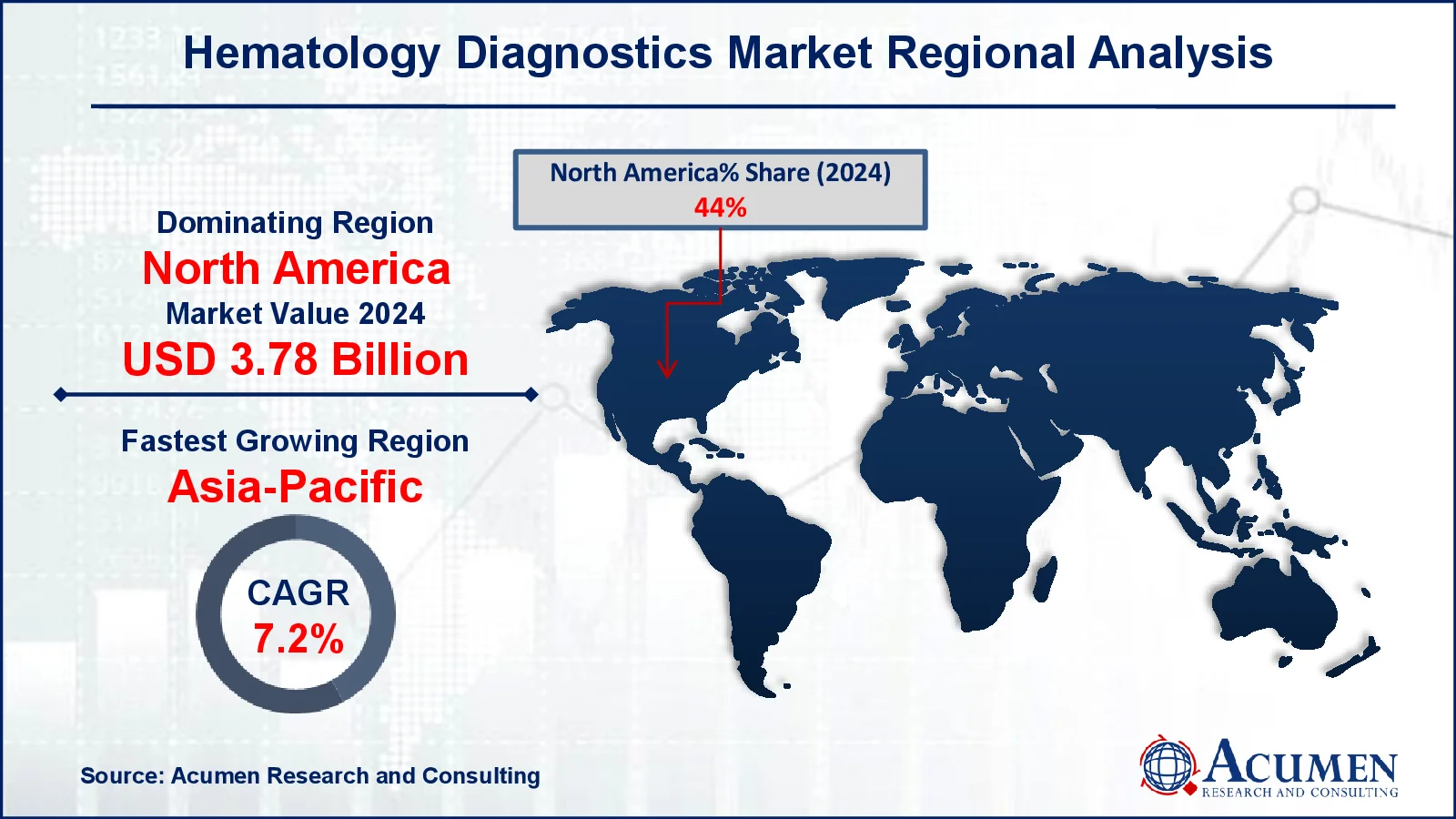

- North America hematology diagnostics market value occupied around USD 3.78 billion in 2024

- Asia-Pacific hematology diagnostics market growth will record a CAGR of more than 7.2% from 2025 to 2033

- Among product, the consumables sub-segment generated 67% of share in 2024

- As per test type, complete blood count (CBC) test holds 46% share in 2024

- Hospitals as a end-users dominates and covers 41% of share in 2024

- Innovations in blood tests, such as liquid biopsies, are improving early cancer detection is a popular market trend that fuels the industry demand

Hematology is a branch of medicine concerned with the study of blood, blood diseases, and blood-producing organs. Hematology deals with difficulties involving white platelets, red platelets, bone marrow, lymph, and platelets. It also has an effect on plasma, a fluid component of the blood. Hematology encompasses various IVD breakthroughs, including blood analysis, flow cytometry, molecular and atomic diagnostics, hemostasis, histology, and cytology. Some blood-related infections include weakening, leukemia, myelofibrosis, life-threatening lymphomas, blood transfusions, and bone marrow. Hematology also studies weakness, sickness, hemophilia, and blood coagulation.

Hematology is a branch of medicine concerned with the study of blood, blood diseases, and blood-producing organs. Hematology deals with difficulties involving white platelets, red platelets, bone marrow, lymph, and platelets. It also has an effect on plasma, a fluid component of the blood. Hematology encompasses various IVD breakthroughs, including blood analysis, flow cytometry, molecular and atomic diagnostics, hemostasis, histology, and cytology. Some blood-related infections include weakening, leukemia, myelofibrosis, life-threatening lymphomas, blood transfusions, and bone marrow. Hematology also studies weakness, sickness, hemophilia, and blood coagulation.

Global Hematology Diagnostics Market Dynamics

Market Drivers

- Increasing cases of anemia, leukemia, and other hematological conditions drive market demand

- Automation, AI-driven diagnostics, and point-of-care testing enhance efficiency and accuracy

- Aging populations with higher susceptibility to blood-related diseases boost market

Market Restraints

- Advanced diagnostic equipment and maintenance costs limit affordability

- Compliance with evolving healthcare regulations slows product approvals

- Lack of trained personnel affects the adoption of advanced diagnostic tools

Market Opportunities

- Rising healthcare infrastructure in developing countries presents growth potential

- Enhancing diagnostic accuracy and efficiency through automation

- Demand for rapid and portable diagnostics in remote areas is rising

Hematology Diagnostics Market Report Coverage

|

Market |

Hematology Diagnostics Market |

|

Hematology Diagnostics Market Size 2024 |

USD 8.6 Billion |

|

Hematology Diagnostics Market Forecast 2033 |

USD 15.2 Billion |

|

Hematology Diagnostics Market CAGR During 2025 - 2033 |

6.7% |

|

Hematology Diagnostics Market Analysis Period |

2021 - 2033 |

|

Hematology Diagnostics Market Base Year |

2024 |

|

Hematology Diagnostics Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Product, By Test Type, By End-Use, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled Aviation |

Ortho Clinical Diagnostics, HORIBA, Ltd., Bio-Rad Laboratories, Abbott Laboratories, Sysmex Corporation, Beckman Coulter, Inc, Boule Diagnostics, Drew Scientific, EKF Diagnostics and F. Hoffmann-La Roche Ltd. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Hematology Diagnostics Market Insights

The rising incidence of cancer is a major driver of worldwide hematological diagnostics market growth. Based on statistics from the National Center for Health Statistics and national cancer registries, the American Cancer Society predicts that there will be 1,958,310 new cancer cases and 609,820 cancer-related deaths in the United States by 2023. Blood cancer is one of the most frequent types of cancer and affects people of all ages. The increased frequency of blood malignancies and other hematological illnesses is driving up the demand for hematology diagnostics. For example, the Leukemia and Lymphoma Society states that nearly every nine minutes, someone in the United States dies from a blood cancer—equivalent to around 157 individuals every day or more than six per hour.

The market's expansion is primarily driven by the rising prevalence of blood disorders, developments in automated hematology analyzers, and more public awareness. Furthermore, rising demand for lab automation and increased consolidation among market competitors and diagnostic labs are important drivers of the hematological diagnostics market. Point-of-care (POC) hematological tests are simple to perform, requiring little training and allowing for remote testing. These tests also reduce turnaround times and improve diagnostic efficiency. In January 2023, Seamaty demonstrated the success of its SD1 Auto Dry Chemistry Analyzer, a proof-of-concept equipment known for its accuracy and efficiency in medical diagnostics, considerably enhancing patient care through shortened turnaround times.

Increasing use of these tests is likely to fuel market expansion during the forecast period. Furthermore, the increasing number of diagnostic facilities and the availability of improved tools help to drive market growth. However, the high cost of automated devices and low awareness in emerging economies may restrict market expansion.

Hematology Diagnostics Market Segmentation

Hematology Diagnostics Market Segmentation

The worldwide market for hematology diagnostics is split based on product, test type, end-use, and geography.

Hematology Diagnostics Market By Product

- Instrument

- Analyzers

- Flow Cytometers

- Others

- Consumables

- Reagents

- Stains

- Others

According to hematology diagnostics industry analysis, consumables held the biggest market share in 2024. Consumables are further classified as reagents, stains, and others. The rising prevalence of blood diseases and other infections is causing a surge in demand for consumables. However, improved consumer awareness and early identification of blood problems are also driving the consumables business throughout the anticipated timeframe of 2025 to 2033.

Hematology Diagnostics Market By Test Type

- Complete Blood Count (CBC) Test

- Platelet Function Test

- Hemoglobin Test

- Hematocrit Test

- Other Test Types

According to hematology diagnostics industry analysis, the blood count sub-segment generated the most revenue in 2024 and is predicted to continue this trend for the forecast period 2025 to 2033. Blood count tests, such as complete blood count (CBC), are used for routine check-ups and to assess overall health. Several illnesses, including anemia, allergies, vitamin and iron shortages, and infections, can be easily detected using these tests.

Hematology Diagnostics Market By End-Use

- Hospitals

- Diagnostic Labs

- Others

According to hematology diagnostics market forecast, hospitals will have a substantial market share by 2024. The diagnostic labs segment, on the other hand, is projected to expand substantially during the forecast period. The expanding number of diagnostic facilities, as well as the availability of improved instruments, are likely to fuel demand in the hospital sector. Furthermore, automation in the field of hematological diagnostics has enabled hospitals and laboratories to focus on research and development operations.

Hematology Diagnostics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Hematology Diagnostics Market Regional Analysis

Hematology Diagnostics Market Regional Analysis

In terms of regional segments, in 2024, North America led the hematology diagnostics market, owing to a growing geriatric population, a favorable reimbursement landscape, strong technology infrastructure, and the launch of breakthrough point-of-care testing technologies. Furthermore, the Canadian Cancer Society projected that by 2023, Canada would have around 18.6 cases of leukemia per 100,000 males, with cancer remaining a primary cause of mortality and the number of new cancer diagnoses increasing year after year.

Japan is expected to provide the most market potential in the Asia-Pacific region, due to its well-developed healthcare system and big aging population. Meanwhile, emerging economies like India and China are likely to make major contributions to market growth as the incidence of blood cancer rises. As per the NIH, in India, lymphoid leukemia was the most common pediatric cancer (0-14 years old), accounting for 29.2% of cases in boys and 24.2% in girls. Furthermore, cancer incidence in the country is predicted to climb by 12.8% by 2025 when compared to 2020, driving demand for hematological diagnostics.

Hematology Diagnostics Market Players

Some of the top hematology diagnostics companies offered in our report includes Ortho Clinical Diagnostics, HORIBA, Ltd., Bio-Rad Laboratories, Abbott Laboratories, Sysmex Corporation, Beckman Coulter, Inc, Boule Diagnostics, Drew Scientific, EKF Diagnostics and F. Hoffmann-La Roche Ltd.

Frequently Asked Questions

What was the market size of the global Hematology Diagnostics in 2024?

The market size of hematology diagnostics was USD 8.6 Billion in 2024.

What is the CAGR of the global Hematology Diagnostics market from 2025 to 2033?

The CAGR of hematology diagnostics is 6.7% during the analysis period of 2025 to 2033.

Which are the key players in the Hematology Diagnostics market?

The key players operating in the global market are including Ortho Clinical Diagnostics, HORIBA, Ltd., Bio-Rad Laboratories, Abbott Laboratories, Sysmex Corporation, Beckman Coulter, Inc, Boule Diagnostics, Drew Scientific, EKF Diagnostics and F. Hoffmann-La Roche Ltd.

Which region dominated the global Hematology Diagnostics market share?

North America held the dominating position in hematology diagnostics industry during the analysis period of 2025 to 2033.

Which region registered fastest CAGR from 2025 to 2033?

Asia-Pacific region exhibited fastest growing CAGR for market of hematology diagnostics during the analysis period of 2025 to 2033.

What are the current trends and dynamics in the global Hematology Diagnostics industry?

The current trends and dynamics in the hematology diagnostics industry increasing cases of anemia, leukemia, and other hematological conditions, automation, AI-driven diagnostics, and point-of-care testing enhance efficiency and accuracy, and aging populations with higher susceptibility to blood-related diseases boost market.

Which product held the maximum share in 2024?

The consumables held the maximum share of the hematology diagnostics industry.