Hedge Fund Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Hedge Fund Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

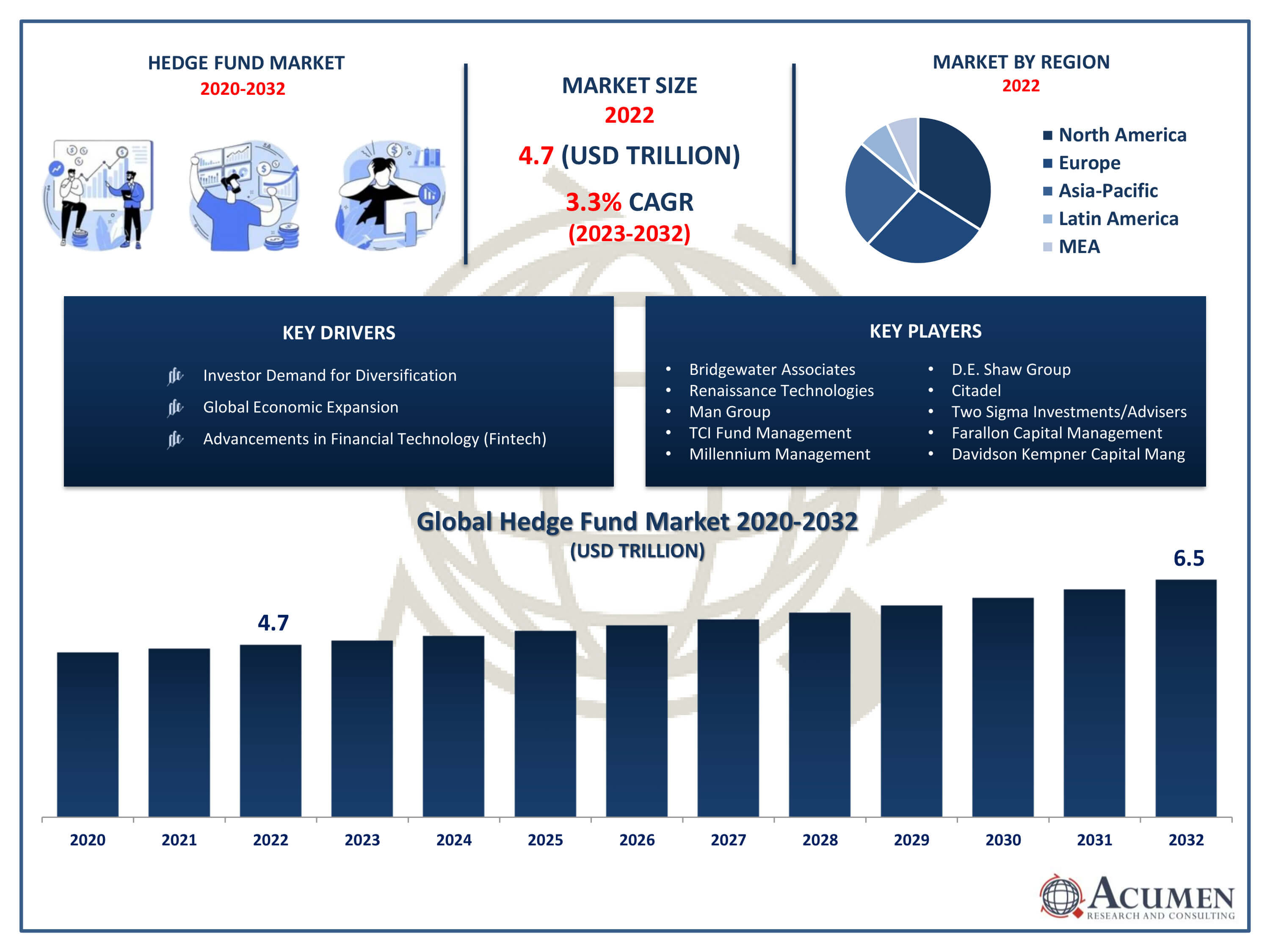

The Hedge Fund Market Size accounted for USD 4.7 Trillion in 2022 and is projected to achieve a market size of USD 6.5 Trillion by 2032 growing at a CAGR of 3.3% from 2023 to 2032.

Hedge Fund Market Highlights

- Global hedge fund market revenue is expected to increase by USD 6.5 trillion by 2032, with a 3.3% CAGR from 2023 to 2032

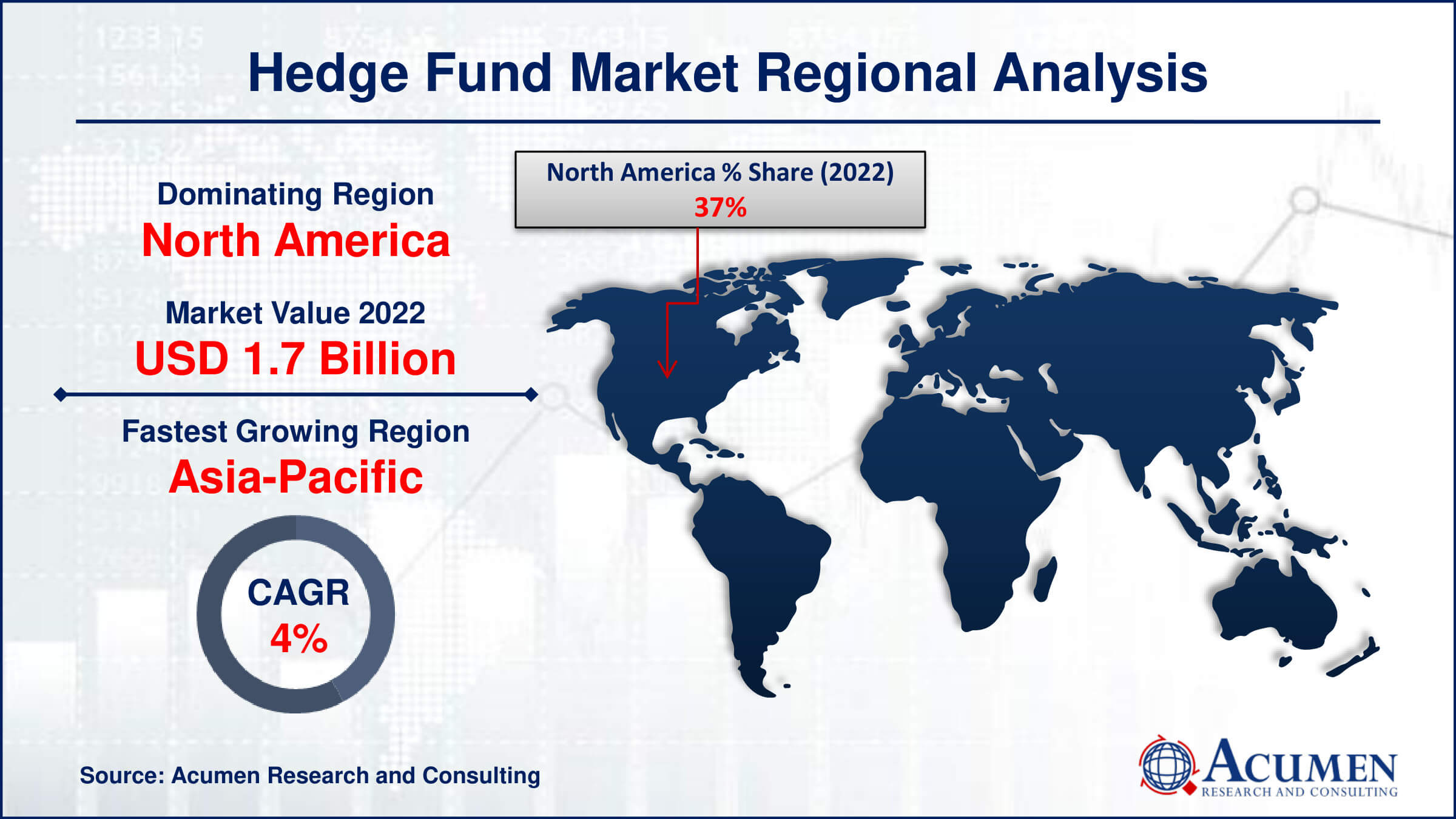

- North America region led with more than 37% of hedge fund market share in 2022

- Asia-Pacific hedge fund market growth will record a CAGR of more than 4% from 2023 to 2032

- By strategy, the long/short equity are the largest segment of the market, accounting for over 31% of the global market share

- By type, the offshore is one of the largest and fastest-growing segments of the hedge fund industry

- Increasing interest from institutional investors and high-net-worth individuals, drives the hedge fund market value

A hedge fund is an investment fund that pools capital from accredited individuals or institutional investors and employs various strategies to earn returns for its investors. Unlike traditional investment funds, hedge funds have greater flexibility in their investment approach, allowing them to use a wide range of financial instruments and techniques, such as short selling, leverage, and derivatives trading. The goal of a hedge fund is to generate positive returns regardless of the direction of the broader financial markets, and they often target absolute returns rather than relative performance compared to a benchmark.

A hedge fund is an investment fund that pools capital from accredited individuals or institutional investors and employs various strategies to earn returns for its investors. Unlike traditional investment funds, hedge funds have greater flexibility in their investment approach, allowing them to use a wide range of financial instruments and techniques, such as short selling, leverage, and derivatives trading. The goal of a hedge fund is to generate positive returns regardless of the direction of the broader financial markets, and they often target absolute returns rather than relative performance compared to a benchmark.

The hedge fund market growth can be influenced by various factors, including economic conditions, technological advancements, regulatory changes, and investor sentiment. In recent years, global financial markets have experienced significant growth, driven by factors such as technological innovation, globalization, and increasing participation from retail investors. Advances in financial technology have facilitated easier access to markets, while global economic expansion and low-interest rates have contributed to the overall growth of investment opportunities. However, market growth is also subject to periodic fluctuations and challenges, such as economic downturns, geopolitical events, and regulatory developments. Investors and market participants need to adapt to these changes to navigate the dynamic landscape of financial markets successfully.

Global Hedge Fund Market Trends

Market Drivers

- Investor demand for diversification

- Global economic expansion

- Advancements in financial technology (Fintech)

- Low interest rates, favorable borrowing conditions

- Increased institutional allocation to alternative investments

Market Restraints

- Regulatory compliance challenges

- Market volatility and uncertainty

Market Opportunities

- Rising interest in sustainable and ESG investing

- Innovations in quantitative and algorithmic strategies

Hedge Fund Market Report Coverage

| Market | Hedge Fund Market |

| Hedge Fund Market Size 2022 | USD 4.7 Trillion |

| Hedge Fund Market Forecast 2032 | USD 6.5 Trillion |

| Hedge Fund Market CAGR During 2023 - 2032 | 3.3% |

| Hedge Fund Market Analysis Period | 2020 - 2032 |

| Hedge Fund Market Base Year |

2022 |

| Hedge Fund Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Strategy, By Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Bridgewater Associates, Renaissance Technologies, Man Group, TCI Fund Management, Millennium Management, D.E. Shaw Group, Citadel, Two Sigma Investments/Advisers, Farallon Capital Management, and Davidson Kempner Capital Management. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Unlike traditional investment funds, hedge funds have a broader mandate, allowing them to invest in a diverse array of financial instruments, including stocks, bonds, commodities, and derivatives. Hedge funds often utilize sophisticated techniques such as short selling, leverage, and derivatives to manage risk and capitalize on market opportunities. The name "hedge fund" originates from the industry's historical practice of hedging against market downturns, aiming to provide positive returns regardless of overall market conditions. The applications of hedge funds are multifaceted. One primary function is to provide investors with diversification by using alternative investment strategies that may not correlate closely with traditional asset classes like stocks and bonds. Hedge funds can be employed for risk management, as their flexibility allows for the implementation of strategies designed to mitigate potential losses in a portfolio. Additionally, hedge funds cater to sophisticated investors seeking alpha, or excess returns above the market average, by exploiting market inefficiencies and employing active management strategies.

The hedge fund market has witnessed notable growth driven by several factors in recent years. One key driver is the increasing demand for alternative investments and diversification among institutional and high-net-worth investors. Hedge funds, with their ability to employ diverse strategies, such as long/short positions, leverage, and derivatives, offer a unique approach to managing portfolios and generating returns that are not solely dependent on traditional market movements. This demand for non-traditional investment strategies has led to the proliferation of hedge funds, attracting capital and contributing to the overall expansion of the hedge fund industry. Additionally, advancements in financial technology have played a crucial role in the growth of the hedge fund industry. The use of sophisticated algorithms, data analytics, and artificial intelligence has enhanced the ability of hedge fund managers to analyze market trends, identify investment opportunities, and manage risk more effectively.

Integration of Financial Blockchain Technology Supports the Hedge Fund Market Growth

The FinTech blockchain market was valued at USD 2.2 billion in 2022 and is projected to reach USD 93.3 billion by 2032, growing at a CAGR of 45.6% from 2023 to 2032. The integration of FinTech blockchain technology into the hedge fund industry is transforming the financial landscape, particularly in the Asia-Pacific region. Blockchain's ability to provide increased security, transparency, and efficiency is attracting hedge fund managers who want to use these benefits to improve operational performance and risk management. Blockchain's immutable and decentralized nature ensures accurate and timely transaction records, which reduces fraud and operational errors. Furthermore, blockchain enables the creation of smart contracts, which automate and streamline various hedge fund processes. As the Asia-Pacific region's hedge fund market and technological innovation continue to expand, the adoption of blockchain technology is increasing the appeal and performance of hedge funds, positioning the region as a hub for cutting-edge financial solutions and global investing opportunities.

Hedge Fund Market Segmentation

The global hedge fund market segmentation is based on strategy, type, and geography.

Hedge Fund Market By Strategy

- Long/Short Equity

- Event Driven

- Global Macro

- Multi Strategy

- Managed Futures/CTA

- Long/Short Credit

- Others

In terms of strategies, the long/short equity segment accounted for the largest market share in 2022. Long/short equity strategies involve taking both long positions in undervalued securities expected to appreciate and short positions in overvalued securities anticipated to decline. This approach allows hedge fund managers to navigate various market conditions, potentially profiting from both upward and downward price movements. The appeal of long/short equity strategies lies in their ability to provide a level of downside protection during market downturns, making them attractive to investors seeking more resilient investment vehicles. The growth of the long/short equity segment is also attributed to increasing investor interest in active management and the pursuit of alpha, especially in times of market uncertainty. Hedge fund managers employing long/short equity strategies leverage their stock-picking skills, fundamental analysis, and market insights to generate alpha, outperforming traditional benchmarks.

Hedge Fund Market By Type

- Offshore

- Fund of Funds

- Domestic

According to the hedge fund market forecast, the offshore segment is expected to witness significant growth in the coming years. Offshore hedge funds are typically established in jurisdictions that offer favorable regulatory environments, tax benefits, and legal frameworks, making them attractive for fund managers seeking operational flexibility and tax efficiency. The most common offshore jurisdictions include the Cayman Islands, Bermuda, and the British Virgin Islands. The growth of the offshore segment can be attributed, in part, to the ability of these jurisdictions to provide a stable and supportive environment for hedge fund activities, allowing fund managers to focus on investment strategies without being burdened by excessive regulatory constraints. Investors are drawn to offshore hedge funds for several reasons. The regulatory frameworks in these jurisdictions often provide a level of confidentiality and privacy, attracting high-net-worth individuals and institutional investors seeking to protect their financial information.

Hedge Fund Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Hedge Fund Market Regional Analysis

North America has emerged as the dominating region in the hedge fund market for several reasons, reflecting the region's robust financial infrastructure, sophisticated investor base, and a concentration of skilled fund managers. The United States, in particular, is home to a significant majority of the world's hedge funds, with major financial hubs like New York and Connecticut serving as epicenters of hedge fund activity. The United States has been the largest donor to the Global Fund since its inception in 2002, playing a crucial role in shaping its strategic direction and policies as a Board member. According to Global Fund data, the U.S. has contributed a total of $24.87 billion to date. For the Sixth Replenishment, covering the period from 2020 to 2022, the U.S. contributed $4.68 billion. In a significant commitment for the Seventh Replenishment, covering 2023 to 2025, the U.S. announced a pledge of $6 billion. This announcement was made during an event hosted by the U.S. Government in New York City on September 21, 2022.

The depth and breadth of the U.S. financial markets, coupled with a well-established legal and regulatory framework, have created an environment conducive to the growth and success of hedge funds. Investor confidence and institutional support further contribute to North America's dominance in the hedge fund industry. Institutional investors, including pension funds, endowments, and foundations, play a substantial role in driving the demand for hedge fund strategies. These sophisticated investors often allocate a portion of their portfolios to hedge funds to benefit from diversification and alternative investment strategies. Additionally, the presence of a highly skilled talent pool in finance, coupled with a culture of innovation and risk-taking, has allowed North American hedge fund managers to excel in developing and implementing complex investment strategies. The combination of these factors solidifies North America's position as a dominant force in the global hedge fund industry.

The Asia-Pacific hedge fund market is expanding rapidly, fueled by increased investor interest and favorable economic conditions. The region's growing high-net-worth individual (HNWI) population and institutional investments are driving up demand for hedge fund strategies that provide diversification and risk management. Countries such as China, Japan, India and Australia are driving this growth, aided by regulatory reforms and the development of financial markets. Furthermore, the use of advanced technologies and data analytics improves hedge fund performance and operational efficiency. This dynamic landscape is attracting global hedge fund managers to establish and expand their presence in the Asia-Pacific region, thereby accelerating market growth.

In addition, India's growing participation in global financial initiatives, such as contributions to the Global Fund, demonstrates the region's growing influence in international finance. Since joining the Global Fund as a donor in 2006, India has contributed a total of US$76.5 million, including a recent pledge of US$25 million for the Global Fund's Seventh Replenishment, which will cover 2023-2025. This increase from US$22 million for the Sixth Replenishment (2020-2022) demonstrates India's commitment to global health causes and its broader strategy of integrating with global financial systems. The synergy between India's domestic financial growth and international financial contributions exemplifies the Asia-Pacific region's dynamic economic landscape, which is attracting and sustaining global investment, including in the burgeoning hedge fund industry.

Hedge Fund Market Player

Some of the top hedge fund market companies offered in the professional report include Bridgewater Associates, Renaissance Technologies, Man Group, TCI Fund Management, Millennium Management, D.E. Shaw Group, Citadel, Two Sigma Investments/Advisers, Farallon Capital Management, and Davidson Kempner Capital Management.

Frequently Asked Questions

How big is the hedge fund market?

The hedge fund market size was USD 4.7 Trillion in 2022.

What is the CAGR of the global hedge fund market from 2023 to 2032?

The CAGR of hedge fund is 3.3% during the analysis period of 2023 to 2032.

Which are the key players in the hedge fund market?

The key players operating in the global market are including Bridgewater Associates, Renaissance Technologies, Man Group, TCI Fund Management, Millennium Management, D.E. Shaw Group, Citadel, Two Sigma Investments/Advisers, Farallon Capital Management, and Davidson Kempner Capital Management.

Which region dominated the global hedge fund market share?

North America held the dominating position in hedge fund industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of hedge fund during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global hedge fund industry?

The current trends and dynamics in the Hedge Fund Market growth include investor demand for diversification, global economic expansion, and advancements in financial technology (Fintech).

Which strategy held the maximum share in 2022?

The long/short equity strategy held the maximum share of the hedge fund industry.