Hearing Implants and Biomaterials Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Hearing Implants and Biomaterials Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

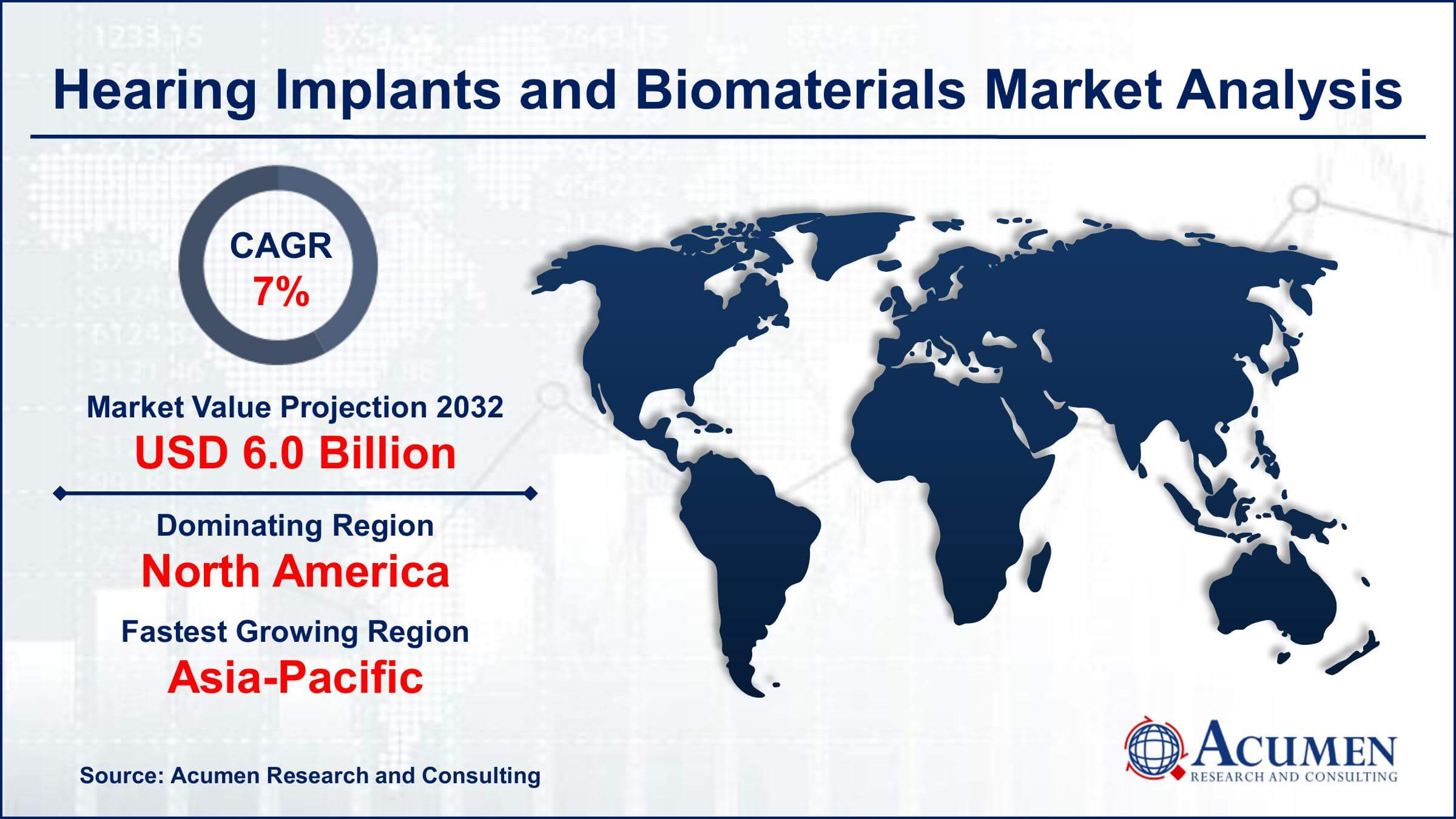

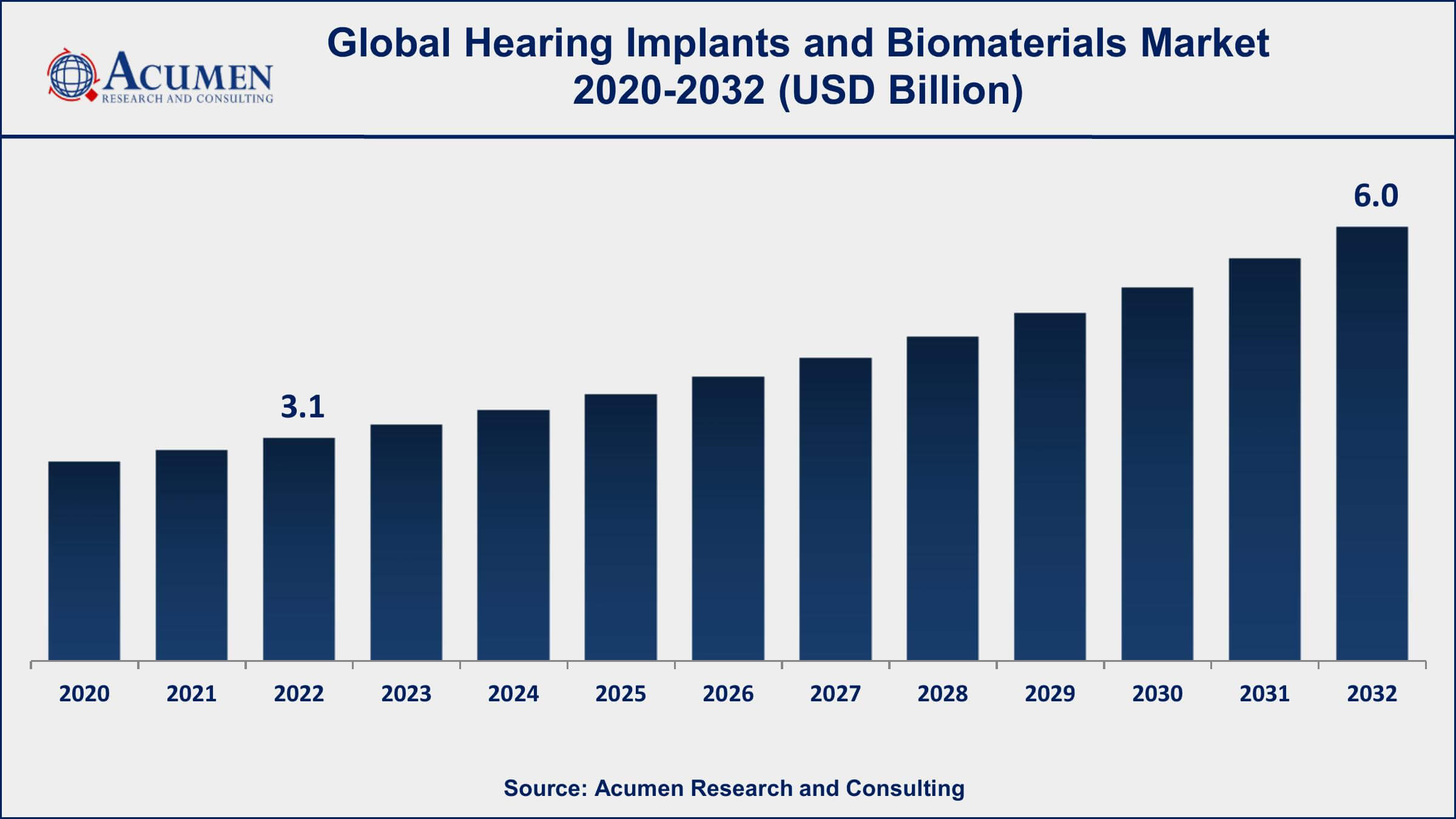

The Global Hearing Implants and Biomaterials Market Size accounted for USD 3.1 Billion in 2022 and is projected to achieve a market size of USD 6.0 Billion by 2032 growing at a CAGR of 7% from 2023 to 2032.

Hearing Implants and Biomaterials Market Key Highlights

- Global hearing implants and biomaterials market revenue is expected to increase by USD 6.0 Billion by 2032, with a 7% CAGR from 2023 to 2032

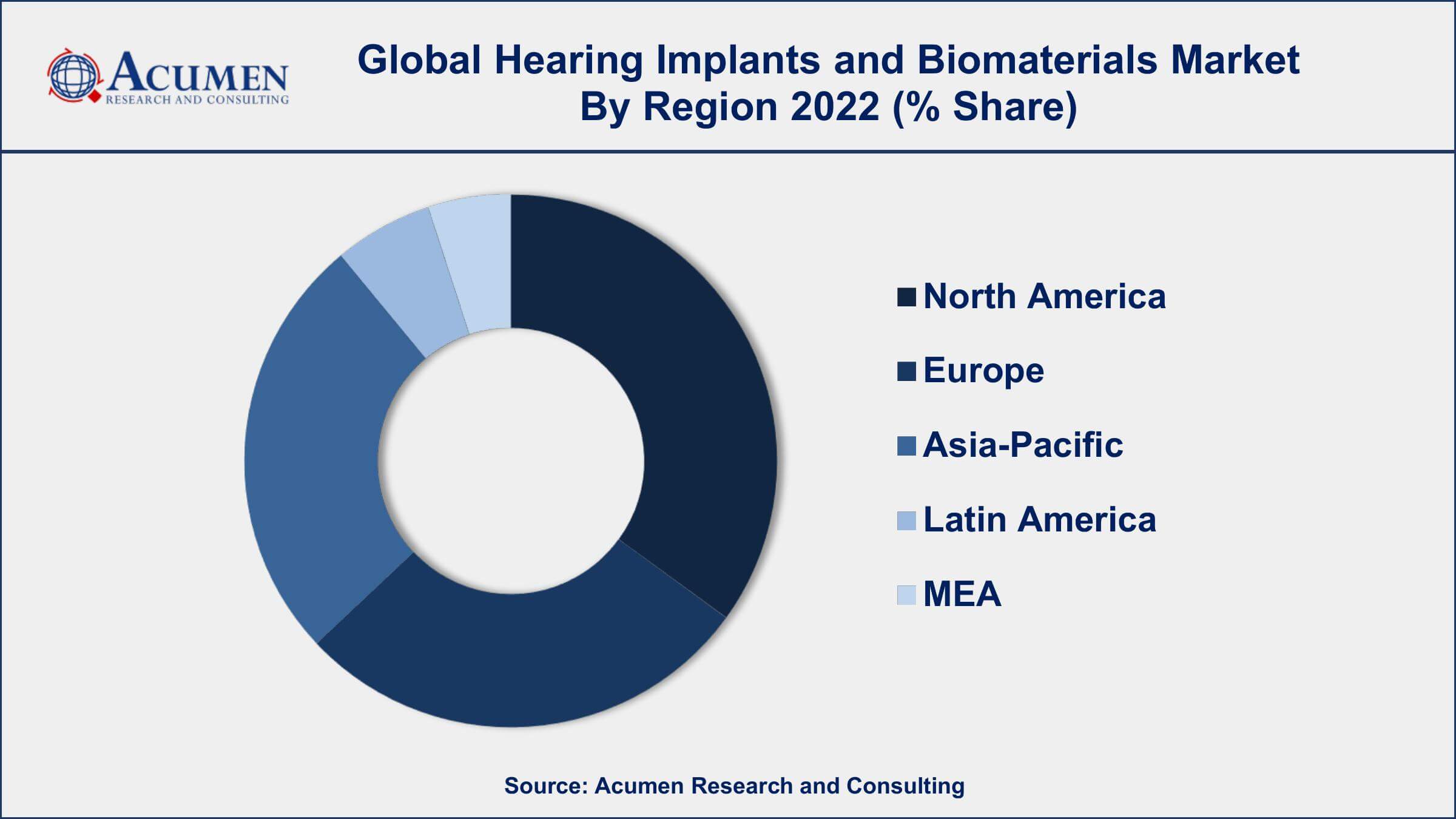

- North America region led with more than 38% of hearing implants and biomaterials market share in 2022

- Asia-Pacific hearing implants and biomaterials market growth will record a CAGR of over 8% from 2023 to 2032

- According to the World Health Organization (WHO), around 466 million people worldwide have disabling hearing loss, and this number is expected to increase to over 900 million by 2050

- According to a study published in the Journal of Biomedical Materials Research, titanium is the most commonly used biomaterial in cochlear implants

- Cochlear implants have been used for more than 30 years, and over 600,000 people worldwide have received them

- Increasing prevalence of infectious diseases worldwide, drives the hearing implants and biomaterials market value

Hearing implants and biomaterials are medical devices and materials used to treat different types of hearing loss. These technologies are designed to enhance the ability to hear sounds by implanting devices into the inner ear or middle ear. These devices stimulate the auditory nerves, bypassing the damaged parts of the ear, and providing improved sound perception to the user. The hearing implants market includes cochlear implants, bone-anchored hearing aids (BAHA), middle ear implants, and auditory brainstem implants (ABI). Biomaterials are also used in the manufacturing of hearing implants, such as titanium implants and electrode arrays.

The global hearing implants and biomaterials market has been growing steadily due to an increase in the prevalence of hearing loss, advancements in technology, and a growing geriatric population. Additionally, rising awareness about the benefits of hearing implants over traditional hearing aids is expected to further drive the growth of the market. Cochlear implants are the most widely used hearing implant devices and are expected to continue dominating the market in the coming years. The high success rates of these devices and the increasing adoption of minimally invasive surgical techniques are expected to drive the growth of this segment. The bone-anchored hearing aids (BAHA) segment is also expected to experience significant growth, as these devices offer a viable solution for patients with conductive hearing loss.

Global Hearing Implants and Biomaterials Market Trends

Market Drivers

- Increase in the prevalence of hearing loss

- Technological advancements in hearing implants and biomaterials

- Rising demand for minimally invasive surgical procedures

- Government initiatives to provide affordable hearing implants and services

Market Restraints

- High cost of hearing implants

- Lack of awareness about hearing loss and available treatments

Market Opportunities

- Growing demand for hearing implants in emerging markets

- Integration of hearing implants with other medical devices

- Rising awareness about hearing loss and available treatments, particularly among younger generations

Hearing Implants and Biomaterials Market Report Coverage

| Market | Hearing Implants and Biomaterials Market |

| Hearing Implants and Biomaterials Market Size 2022 | USD 3.1 Billion |

| Hearing Implants and Biomaterials Market Forecast 2032 | USD 6.0 Billion |

| Hearing Implants and Biomaterials Market CAGR During 2023 - 2032 | 7% |

| Hearing Implants and Biomaterials Market Analysis Period | 2020 - 2032 |

| Hearing Implants and Biomaterials Market Base Year | 2022 |

| Hearing Implants and Biomaterials Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Material Type, By End-user, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Cochlear Limited, MED-EL, Sonova Holding AG, Advanced Bionics LLC (Sonova Holding AG), William Demant Holding A/S, Oticon Medical, Sivantos Pte. Ltd. (WS Audiology), GN Store Nord A/S, Starkey Hearing Technologies, Nurotron Biotechnology Co., Ltd., Envoy Medical Corporation, and Sound Pharmaceuticals, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Hearing implants are medical devices that are surgically placed in order to treat the damaged parts of the inner ear and hence provide sound signals to the brain. The market for hearing implants and biomaterials is expected to foresee significant growth due to the advancement of various hearing implant materials such as polymers and ceramics. In addition, growing awareness of the population towards the benefits of hearing surgeries would also drive the growth of the market during the forecast period.

The market for hearing implants and biomaterials is expected to witness significant growth in the coming years. According to the Department of Neurological Surgery at the University of California, San Francisco, over 80,000 people globally have cochlear implants, out of which, approximately 25,000 people are from the United States. The organization also estimated that the demand for hearing implants is increasing annually by approximately 20%.

In addition, growing opportunities across the Asia-Pacific market; as well as the emergence of the need for technologically advanced hearing implants are a few major opportunities for the global market. The high-unmet medical needs pertaining to hearing losses, coupled with constantly improving healthcare expenditure in the region are some key factors attributing to the market growth in developing countries of the Asia-Pacific region.

Hearing Implants and Biomaterials Market Segmentation

The global hearing implants and biomaterials market segmentation is based on product type, material type, end-user, and geography.

Hearing Implants and Biomaterials Market By Product Type

- Cochlear Implants

- Bone-Anchored Hearing Aids (BAHA)

- Middle Ear Implants

- Auditory Brainstem Implants (ABI)

- Others

According to the hearing implants and biomaterials industry analysis, the cochlear implants segment accounted for the largest market share in 2022. Cochlear implants are medical devices that are surgically implanted into the inner ear to bypass the damaged parts and provide sound perception to people with severe to profound hearing loss. These implants are designed to directly stimulate the auditory nerve, improving the user's ability to hear and communicate. The growth of the cochlear implants segment can be attributed to various factors, such as a rise in the prevalence of hearing loss, an increase in awareness about the benefits of cochlear implants, and technological advancements in the devices. Furthermore, the segment's growth is driven by increasing demand for cochlear implants among both children and adults. Children with severe to profound hearing loss can receive cochlear implants as early as 12 months of age, leading to significant improvements in their speech and language development.

Hearing Implants and Biomaterials Market By Material Type

- Metal

- Polymer

- Ceramic

- Other

In terms of the material type, the metal segment is expected to witness significant growth in the coming years. Metals such as titanium, platinum, and gold are used to create the implant itself, while electrode arrays used in cochlear implants are often made of platinum-iridium or other metal alloys. The growth of the metal segment is attributed to the unique properties of metals that make them suitable for use in hearing implants. For example, titanium is biocompatible, lightweight, and strong, making it an ideal material for implants. It also has the ability to fuse with the surrounding bone, allowing for a stable and long-lasting implant. Platinum is also commonly used in implants due to its corrosion resistance and biocompatibility. Additionally, advancements in metal manufacturing technology have led to the development of more complex and customizable implant designs.

Hearing Implants and Biomaterials Market By End-user

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Research and Academic Institutes

- Others

According to the hearing implants and biomaterials market forecast, the hospitals and clinics segment is expected to witness significant growth in the coming years. Hospitals and clinics provide a wide range of services, including pre-operative evaluation, surgical implantation, post-operative care, and rehabilitation services, making them an essential part of the overall hearing implant market. The growth of the hospitals and clinics segment is driven by several factors, including the increasing prevalence of hearing loss, rising demand for hearing implants, and technological advancements in implantation techniques. In addition, hospitals and clinics are investing in advanced equipment and facilities to provide quality services to patients. Moreover, the increasing number of government initiatives and programs to promote hearing health and provide access to affordable hearing implants and services is expected to fuel the growth of this segment.

Hearing Implants and Biomaterials Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Hearing Implants and Biomaterials Market Regional Analysis

North America is dominating the hearing implants and biomaterials market due to several factors. One of the key drivers is the high prevalence of hearing loss in the region, which has led to significant demand for hearing implants and related services. According to the National Institute on Deafness and Other Communication Disorders (NIDCD), approximately 15% of American adults aged 18 and over report some trouble hearing, which translates to over 37 million people. Furthermore, the availability of advanced healthcare infrastructure, favorable reimbursement policies, and increasing government initiatives to promote hearing health are contributing to the growth of the hearing implants and biomaterials market in North America. For instance, in the United States, the Medicare program covers cochlear implants for eligible beneficiaries, making the devices more accessible and affordable to those who need them.

Hearing Implants and Biomaterials Market Player

Some of the top hearing implants and biomaterials market companies offered in the professional report include Cochlear Limited, MED-EL, Sonova Holding AG, Advanced Bionics LLC (Sonova Holding AG), William Demant Holding A/S, Oticon Medical, Sivantos Pte. Ltd. (WS Audiology), GN Store Nord A/S, Starkey Hearing Technologies, Nurotron Biotechnology Co., Ltd., Envoy Medical Corporation, and Sound Pharmaceuticals, Inc.

Frequently Asked Questions

What was the market size of the global hearing implants and biomaterials in 2022?

The market size of hearing implants and biomaterials was USD 3.1 Billion in 2022.

What is the CAGR of the global hearing implants and biomaterials market from 2023 to 2032?

The CAGR of hearing implants and biomaterials is 7% during the analysis period of 2023 to 2032.

Which are the key players in the hearing implants and biomaterials market?

The key players operating in the global market are including Cochlear Limited, MED-EL, Sonova Holding AG, Advanced Bionics LLC (Sonova Holding AG), William Demant Holding A/S, Oticon Medical, Sivantos Pte. Ltd. (WS Audiology), GN Store Nord A/S, Starkey Hearing Technologies, Nurotron Biotechnology Co., Ltd., Envoy Medical Corporation, and Sound Pharmaceuticals, Inc.

Which region dominated the global hearing implants and biomaterials market share?

North America held the dominating position in hearing implants and biomaterials industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of hearing implants and biomaterials during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global hearing implants and biomaterials industry?

The current trends and dynamics in the hearing implants and biomaterials industry include increase in the prevalence of hearing loss, and rising demand for minimally invasive surgical procedures.

Which product type held the maximum share in 2022?

The cochlear implants product type held the maximum share of the hearing implants and biomaterials industry.