Healthcare Staffing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2025 - 2033

Published :

Report ID:

Pages :

Format :

Healthcare Staffing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2025 - 2033

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

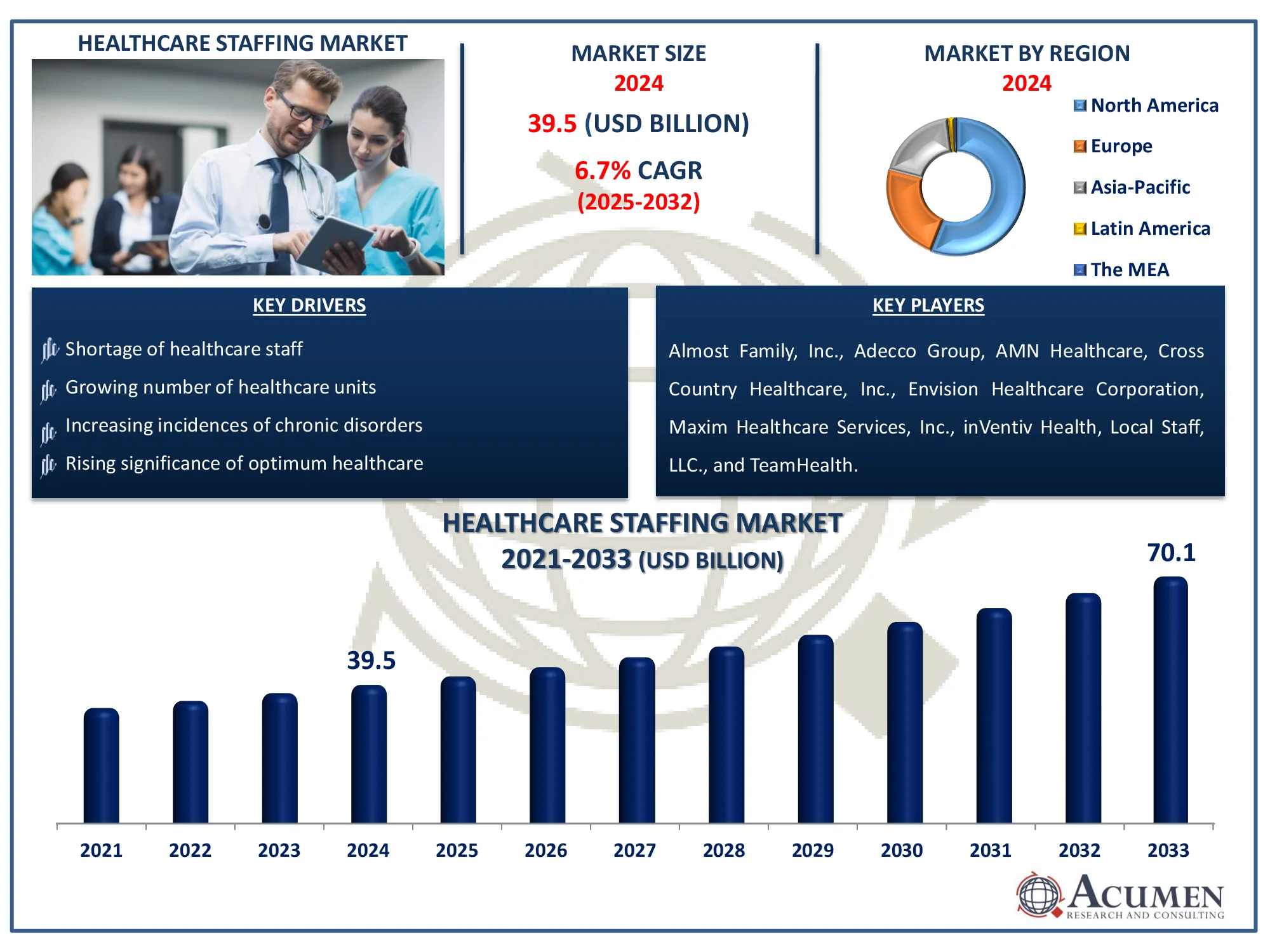

The Global Healthcare Staffing Market Size accounted for USD 39.5 Billion in 2024 and is estimated to achieve a market size of USD 70.1 Billion by 2033 growing at a CAGR of 6.7% from 2025 to 2033.

Healthcare Staffing Market Highlights

- Global healthcare staffing market revenue is poised to garner USD 70.1 billion by 2033 with a CAGR of 6.7% from 2025 to 2033

- As per recent statistics, the number of general practitioners in the US is 472,560, in Germany 392,402, and in the UK 300,000

- North America healthcare staffing market value occupied around USD 22.1 billion in 2024

- As of 2022, the US had approximately 297 active physicians per 100,000 residents, equating to about 29.7 physicians per 10,000 population

- Asia-Pacific healthcare staffing market growth will record a CAGR of more than 7.1% from 2025 to 2033

- As of June 2022, India had 1,308,009 allopathic doctors registered with the National Medical Commission (NMC) and state medical councils

- Among service type, the travel nurse sub-segment generated around USD 13.8 billion revenue in 2024

- Based on end-use, the hospitals sub-segment generated 41% healthcare staffing market share in 2024

- Innovation in lightweight and durable ladder materials for improved performance is a popular healthcare staffing market trend that fuels the industry demand

Healthcare staffing agencies are recruitment firms that provide a broad spectrum of healthcare staff ranging from nurses and physicians to allied clinicians and pharmacists. Healthcare facilities often need assistance for recruitment on a short and long-term basis due to funding gaps and a shortage of skilled workforce. Locum tenens travel nurses, per diem nurses, and allied healthcare professionals are the major staff that hospitals and other healthcare facilities need. High demand for these professionals due to the aging population and shortage of skilled professionals are the driving factors of the market. According to a recent report published by CNN, the U.S. will need to recruit about 2.3 million new doctors, nurses, and nursing assistant professionals by 2025 to take care of its aging population. This shortage is even more in rural or remote areas. Hence, healthcare facilities recruit staff on a contract basis so that depending on their requirement they can get help from locum tenens or travel nurses.

Global Healthcare Staffing Market Dynamics

Market Drivers

- Shortage of healthcare staff

- Growing number of healthcare units

- Increasing incidences of chronic disorders

- Rising significance of optimum healthcare

Market Restraints

- Growing cost of skilled healthcare providers

- Lower job security

Market Opportunities

- Rising number of healthcare and nursing institutions

- Growing expenditure in the healthcare infrastructure

Healthcare Staffing Market Report Coverage

|

Market |

Healthcare Staffing Market |

|

Healthcare Staffing Market Size 2024 |

USD 39.5 Billion |

|

Healthcare Staffing Market Forecast 2033 |

USD 70.1 Billion |

|

Healthcare Staffing Market CAGR During 2025 - 2033 |

6.7% |

|

Healthcare Staffing Market Analysis Period |

2020 - 2033 |

|

Healthcare Staffing Market Base Year |

2024 |

|

Healthcare Staffing Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Service Type, By End-use, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Almost Family, Inc., Adecco Group, AMN Healthcare, Cross Country Healthcare, Inc., Envision Healthcare Corporation, General Healthcare Resources, Inc., Maxim Healthcare Services, Inc., inVentiv Health, Local Staff, LLC., and TeamHealth. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Healthcare Staffing Market Insights

Opportunities to travel, flexible schedules, short-term assignments, and experience at different locations are attracting healthcare staff to work as travel nurses or temporarily. Thus, the growing preference of healthcare staff to work temporarily is anticipated to further propel market growth. The strong demand for all healthcare professionals across the globe due to the aging population and an increasing number of patients suffering from chronic diseases and a lack of skilled professionals are expected to boost the market growth. For instance, according to the World Health Organization (WHO), in 2013, there was a shortage of 7.2 million healthcare workers across the world. It is anticipated to reach 12.9 million by 2035.

The entry of new players, mergers, and acquisitions of existing layers for expansion, and investment by investment firms in the healthcare staffing agencies considering the growth in the market are the key factors to stimulate market growth. For instance, investment by KKR Group, Humana, and others invested in healthcare staffing agencies in recent years. However, stringent employment policies for the welfare of staff and advances in biomedical technology are key limiting factors of the global healthcare staffing market.

Healthcare Staffing Market Segmentation

The worldwide market for healthcare staffing is split based on service type, end-use, and geography.

Healthcare Staffing Based on Service Type

- Travel Nurse

- Locum Tenens

- Per Diem Nurse

- Allied Healthcare

According to our healthcare staffing industry analysis, the travel nurse segment accounted for the largest segment of the market in 2024. However, the locum tenens segment is expected to observe the fastest growth during the forecast period. The allied healthcare segment consists of physical therapists, occupational therapists, pharmacists, and respiratory therapists. The rising demand of these professionals due to the increasing geriatric population and chronic disease patients and shortage of skilled service providers are the key factors for the dominance of the segment in the market. Furthermore, several allied professionals choose to work in the contract due to flexibility for the work and opportunity to work with various organizations. According to the JOLTS survey in the U.S., a wide gap has found between job openings and job hires in the healthcare field. For instance, in January 2016, about 1,046,000 openings were there in the healthcare sector and 519,000 job hires that means about half millions of unfilled jobs. The gap has been growing since 2014.

Healthcare Staffing Based on End-Use

- Hospitals

- Ambulatory Facilities

- Clinics

- Others

The healthcare staffing market is projected to be dominated by the hospitals segment, which is anticipated to hold the largest share. This is primarily due to the high demand for skilled healthcare professionals, including nurses, physicians, and specialists, to meet the growing patient influx and complex care needs. Hospitals operate 24/7 and require a large, diverse workforce to manage emergencies, surgeries, and chronic care. Additionally, the rise in aging populations, increasing prevalence of chronic diseases, and the need for specialized care further drive staffing demands. Hospitals also face high turnover rates, creating a continuous need for temporary and permanent staffing solutions. While ambulatory facilities, clinics, and other segments contribute, hospitals remain the largest end-user due to their scale, scope, and critical role in healthcare delivery.

Healthcare Staffing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Healthcare Staffing Market Regional Analysis

The North America region accounted for the maximum share of the global healthcare staffing market in 2024 due to a lack of skilled professionals as compared to demand, cost-cutting of hospitals and healthcare supplier, and preference of healthcare professionals to work independently. Presence of major service providers in the region is another key factor for the dominance in the market. Strategic initiatives such as mergers and collaborations by these players further propel the market growth. For instance, AMN Healthcare acquired Advanced Medical Personnel Services, Inc., an allied and nurse staffing agency that serves clinics, hospitals, skilled nursing facilities, schools, and home health settings. With this acquisition, AMN healthcare expands its allied professionals and nursing staff along with the number of clients.

Asia-Pacific is anticipated to grow at the fastest rate during the healthcare staffing market forecast period. This can be attributed to increasing awareness about the advantages associated with contract staffing. Contract staffing does not involve liabilities that normally associated with permanent staff, one can choose from a larger pool, and the recruitment process is faster. India, China, Singapore, Australia, and Japan are the key markets in the Asia-Pacific region.

Healthcare Staffing Market Players

Some of the top healthcare staffing companies offered in our report includes Almost Family, Inc., Adecco Group, AMN Healthcare, Cross Country Healthcare, Inc., Envision Healthcare Corporation, General Healthcare Resources, Inc., Maxim Healthcare Services, Inc., inVentiv Health, Local Staff, LLC., and TeamHealth.

Frequently Asked Questions

How big is the healthcare staffing market?

The healthcare staffing market size was valued at USD 39.5 Billion in 2024.

What is the CAGR of the global healthcare staffing market from 2025 to 2033?

The CAGR of healthcare staffing is 6.7% during the analysis period of 2025 to 2033.

Which are the key players in the healthcare staffing market?

The key players operating in the global market are Almost Family, Inc., Adecco Group, AMN Healthcare, Cross Country Healthcare, Inc., Envision Healthcare Corporation, General Healthcare Resources, Inc., Maxim Healthcare Services, Inc., inVentiv Health, Local Staff, LLC., and TeamHealth.

Which region dominated the global healthcare staffing market share?

North America held the dominating position in healthcare staffing industry during the analysis period of 2025 to 2033.

Which region registered fastest CAGR from 2025 to 2033?

Asia-Pacific region exhibited fastest growing CAGR for market of healthcare staffing during the analysis period of 2025 to 2033.

What are the current trends and dynamics in the global healthcare staffing industry?

The current trends and dynamics in the healthcare staffing industry include increasing incidences of chronic disorders, and rising significance of optimum healthcare.

Which end-use held the maximum share in 2024?

The hospitals end-use held the maximum share of the healthcare staffing industry.