Healthcare Patent Filing Outsourcing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Healthcare Patent Filing Outsourcing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

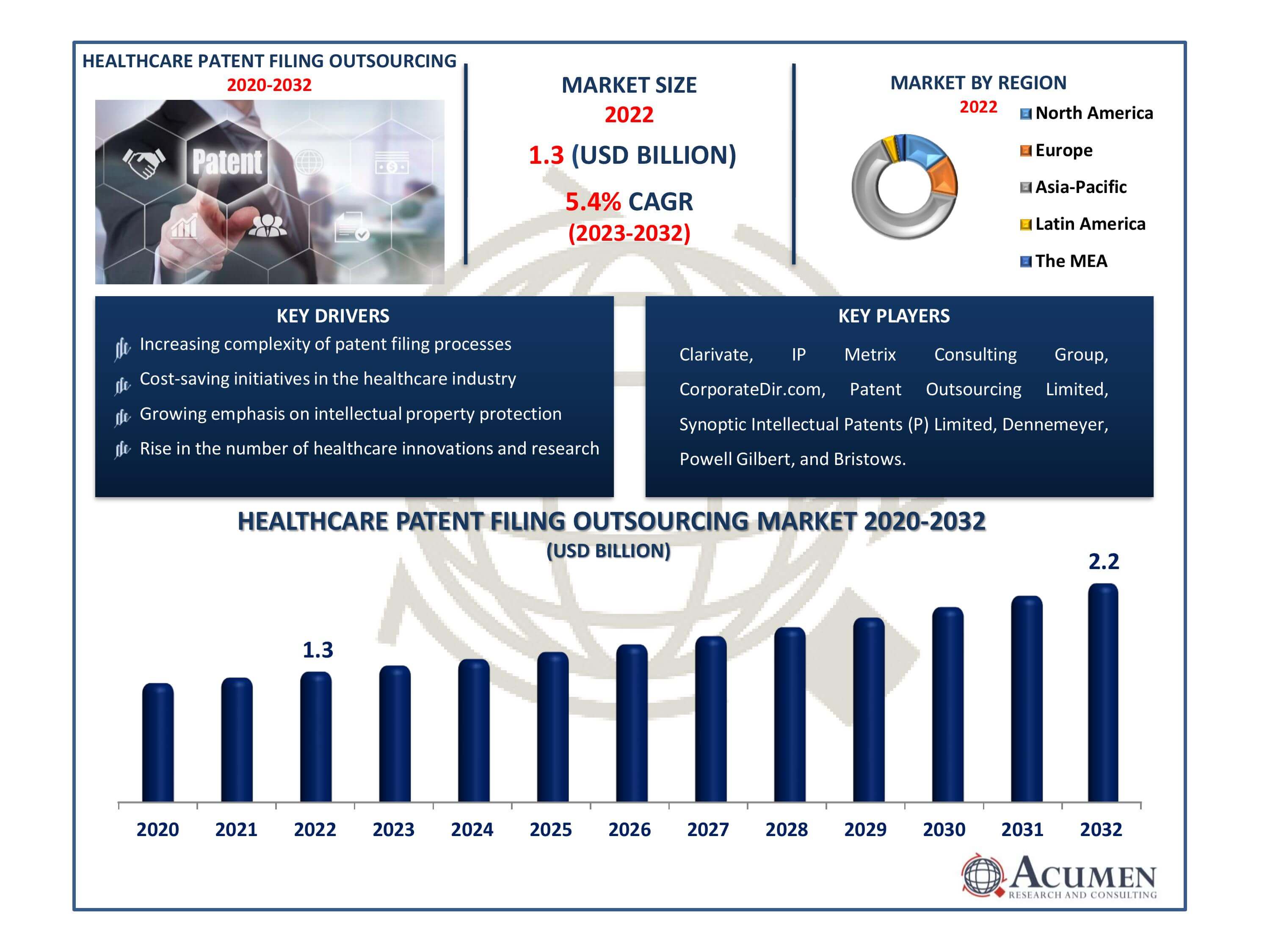

The Healthcare Patent Filing Outsourcing Market Size accounted for USD 1.3 Billion in 2022 and is estimated to achieve a market size of USD 2.2 Billion by 2032 growing at a CAGR of 5.4% from 2023 to 2032.

Healthcare Patent Filing Outsourcing Market Highlights

- Global healthcare patent filing outsourcing market revenue is poised to garner USD 2.2 billion by 2032 with a CAGR of 5.4% from 2023 to 2032

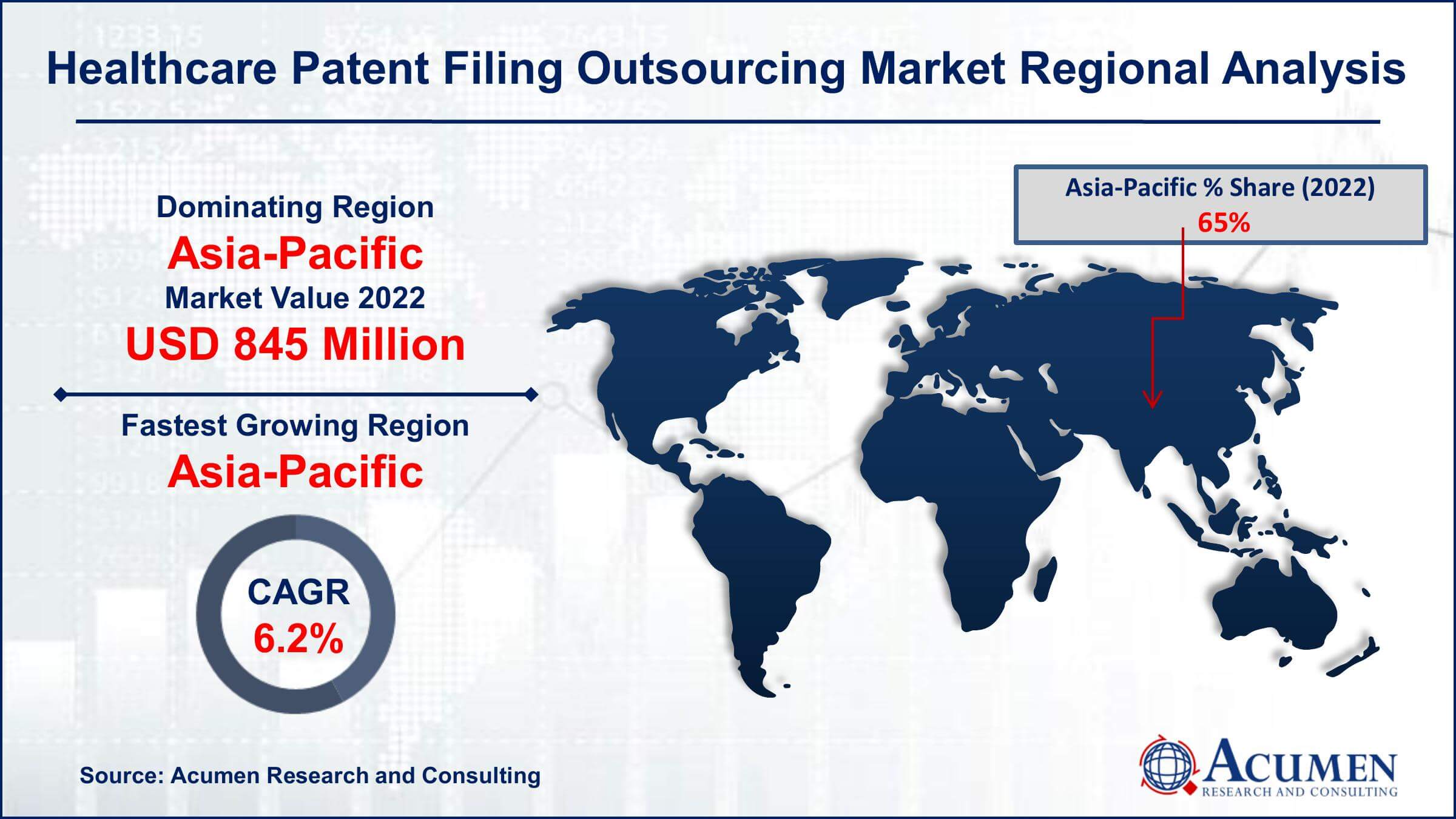

- Asia-Pacific healthcare patent filing outsourcing market value occupied around USD 845 million in 2022

- Asia-Pacific healthcare patent filing outsourcing market growth will record a CAGR of more than 6.2% from 2023 to 2032

- Among domain, the MedTech sub-segment generated over US$ 676 million revenue in 2022

- Based on origin, the resident sub-segment generated around 64% share in 2022

- Evolving regulatory support for intellectual property protection is a popular healthcare patent filing outsourcing market trend that fuels the industry demand

When a startup company develops a new healthcare product or device, it must file a patent to protect its copyrights and reduce the risk of product copying. These patents serve as safeguards against competitors selling similar or related products. Before applying for a healthcare patent, the product in question typically requires approval from the Food and Drug Administration (FDA). The patent filing process is generally time-consuming and complex. Healthcare patent filing outsourcing companies offer comprehensive support to healthcare firms throughout the process, contributing to the increased growth of the healthcare patent filing outsourcing market. These companies provide services for pre-filing, filing, prosecution, and post-grant stages.

Global Healthcare Patent Filing Outsourcing Market Dynamics

Market Drivers

- Increasing complexity of patent filing processes

- Cost-saving initiatives in the healthcare industry

- Growing emphasis on intellectual property protection

- Rise in the number of healthcare innovations and research

Market Restraints

- Data security and confidentiality concerns

- Variability in global patent regulations

- Limited availability of skilled professionals

Market Opportunities

- Emerging markets for healthcare patent filing services

- Advancements in automation and AI for patent processing

- Expansion of telehealth and digital healthcare innovations

Healthcare Patent Filing Outsourcing Market Report Coverage

| Market | Healthcare Patent Filing Outsourcing Market |

| Healthcare Patent Filing Outsourcing Market Size 2022 | USD 1.3 Billion |

| Healthcare Patent Filing Outsourcing Market Forecast 2032 | USD 2.2 Billion |

| Healthcare Patent Filing Outsourcing Market CAGR During 2023 - 2032 | 5.4% |

| Healthcare Patent Filing Outsourcing Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Domain, By Service, By Origin, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Clarivate, IP Metrix Consulting Group, CorporateDir.com, Patent Outsourcing Limited, Synoptic Intellectual Patents (P) Limited, Dennemeyer, Powell Gilbert, Bristows, HOYNG ROKH MONEGIER, and CARPMAELS & RANSFORD LLP. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Healthcare Patent Filing Outsourcing Market Insights

The rising demand for a cost-efficient and time-saving patent filing process is driving the growth of the global healthcare patent filing outsourcing market

Outsourcing has become a popular strategy for healthcare organizations seeking to control the increasing costs of service delivery. Outsourcing non-core services allows healthcare administrators and staff to focus more effectively on the organization's core business. Moreover, one of the most commonly cited benefits is that patent outsourcing enhances service quality. Other users have mentioned benefits such as economies of scale, utilization of the external provider's infrastructure, the opportunity for healthcare organizations to concentrate on their core operations, and increased flexibility.

Startups are flourishing in the healthcare industry, contributing to the growth of the global healthcare patent filing outsourcing market.

The primary reason cited for outsourcing healthcare patent filing is cost savings. In the fiercely competitive and rapidly evolving technology industry, organizations prioritize cost reduction to gain or maintain a competitive edge. During outsourcing agreements, the customer shares proprietary information and intellectual property with the outsourcing provider to facilitate service delivery. While the outsourcing provider gains access to the customer's data, which may be copyrighted or involve patented techniques and processes, their service delivery platform includes software and technological processes that are eligible for copyright protection or patentability.

In many outsourcing transactions, the outsourcing provider's employees and the enterprise personnel work under the same trademark. This can be risky if the outsourcing provider fails to meet expectations. When IT functions are outsourced, skilled staff and expertise are transferred to the service provider, leaving the customer heavily reliant on the service provider.

To mitigate potential risks and downsides, parties entering into outsourcing arrangements must exercise caution when negotiating contract terms. Provisions should be included to control and minimize these risks.

Healthcare Patent Filing Outsourcing Market Segmentation

The worldwide market for healthcare patent filing outsourcing is split based on domain, service, origin, and geography.

Healthcare Patent Filing Outsourcing Domains

- Medtech

- Consumables and Disposables

- Diagnosis and Imaging Devices

- Drug Delivery Devices

- Surgical Devices

- Wearable Medical Devices

- Assistive Care devices

- Pharmaceutical

As per the healthcare patent filing outsourcing industry analysis, the Medtech domain dominated the industry in 2022. The medical technology industry's dynamic and inventive nature is responsible for its supremacy. Innovative medical technology, diagnostic instruments, and healthcare gadgets are constantly being developed and introduced by MedTech companies; therefore, they all need strong patent protection. Because medical patents are so complicated, Medtech companies can successfully negotiate complex regulatory frameworks and protect their intellectual property by outsourcing their patent filing services. The Medtech industry has established its dominance in the healthcare patent filing outsourcing environment due to the growing emphasis on patient care and the necessity for quick technical developments. This dominance is further substantiated by market analysis, underscoring the significance of Medtech's leadership in the healthcare patent filing outsourcing sector.

Healthcare Patent Filing Outsourcing Services

- Pre-Filing

- Filing & Prosecution

- Post Grant

The healthcare patent filing outsourcing market is led and dominated by the filing & prosecution segment. This segment's vital role in the patenting process is what fuels its supremacy. In order to prepare, file, and oversee patent applications while negotiating the complexities of the legal and regulatory environment, filing and prosecution services are needed. It is the most important part of patent protection and requires accuracy and specialised expertise. Healthcare companies rely on outsourcing partners because of their experience in making sure patent applications are successfully prosecuted and meet compliance requirements. The industry's foundation for healthcare patent filing outsourcing is this segment's dominance, which highlights the importance of effective patent filing and protection. This is substantiated by market analysis and underscores its continued significance in the future, as indicated by the market forecast.

Healthcare Patent Filing Outsourcing Origins

- Resident

- Non-Resident

According to the healthcare patent filing outsourcing market forecast, the resident segment is the largest for a number of important reasons. The proximity and experience with local regulatory and legal frameworks of resident service providers make them a preferred partner for healthcare organisations seeking to outsource patent filing. Because of their in-depth knowledge of the local healthcare system, these resident service providers guarantee improved compliance and communication. Furthermore, resident service providers can give prompt responses and real-time support both of which are essential in the frequently time-sensitive process of submitting a patent. They are the go-to company for healthcare patent filing due to their local presence and experience, which furthers their dominance in this market. This dominance is supported by the market forecast, which indicates their continued significance in the future.

Healthcare Patent Filing Outsourcing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Healthcare Patent Filing Outsourcing Market Regional Analysis

In terms of region, Asia-Pacific is expected to dominate the global healthcare patent filing outsourcing market. The Board of Investment (BOI) is a Thai government agency responsible for promoting investment. It offers tax and non-tax incentives to pharmaceutical and biotechnology investors. Tax incentives for pharmaceutical manufacturing companies include exemptions from import duties on machinery, corporate income tax exemptions for five, six, or seven years based on the location zone with a cap on the investment amount, and exemptions or reductions in import duties on raw materials and essential parts, also based on the location zone.

Notably, no CROs in Thailand have officially obtained OECD-GLP or ICH-GCP accreditation. However, they are actively working towards compliance to meet these standards through practical application. Some companies, like Bio-Innova and International Bio Services, have applied for GLP accreditation and are currently undergoing audits by the Bureau of Laboratory Quality Standards. It's important to note that Thai CROs are not legally required to adhere to OECD-GLP/GCP standards.

In contrast, medical device and pharmaceutical companies in North America and Europe often outsource their patent filing processes to Asia Pacific countries due to the availability of low-cost labor. This trend is expected to drive regional market growth over the forecast period.

Healthcare Patent Filing Outsourcing Market Players

Some of the top healthcare patent filing outsourcing companies offered in our report includes Clarivate, IP Metrix Consulting Group, CorporateDir.com, Patent Outsourcing Limited, Synoptic Intellectual Patents (P) Limited, Dennemeyer, Powell Gilbert, Bristows, HOYNG ROKH MONEGIER, and CARPMAELS & RANSFORD LLP.

Frequently Asked Questions

How big is the healthcare patent filing outsourcing market?

The market size of healthcare patent filing outsourcing was USD 1.3 billion in 2022.

What is the CAGR of the global healthcare patent filing outsourcing market from 2023 to 2032?

The CAGR of healthcare patent filing outsourcing is 5.4% during the analysis period of 2023 to 2032.

Which are the key players in the healthcare patent filing outsourcing market?

The key players operating in the global market are including Clarivate, IP Metrix Consulting Group, CorporateDir.com, Patent Outsourcing Limited, Synoptic Intellectual Patents (P) Limited, Dennemeyer, Powell Gilbert, Bristows, HOYNG ROKH MONEGIER, and CARPMAELS & RANSFORD LLP.

Which region dominated the global healthcare patent filing outsourcing market share?

North America held the dominating position in healthcare patent filing outsourcing industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of healthcare patent filing outsourcing during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global healthcare patent filing outsourcing industry?

The current trends and dynamics in the healthcare patent filing outsourcing industry include increasing complexity of patent filing processes, cost-saving initiatives in the healthcare industry, growing emphasis on intellectual property protection, and rise in the number of healthcare innovations and research.

Which Domain held the maximum share in 2022?

The Medtech domain held the maximum share of the healthcare patent filing outsourcing industry.?