Healthcare Logistics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Healthcare Logistics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

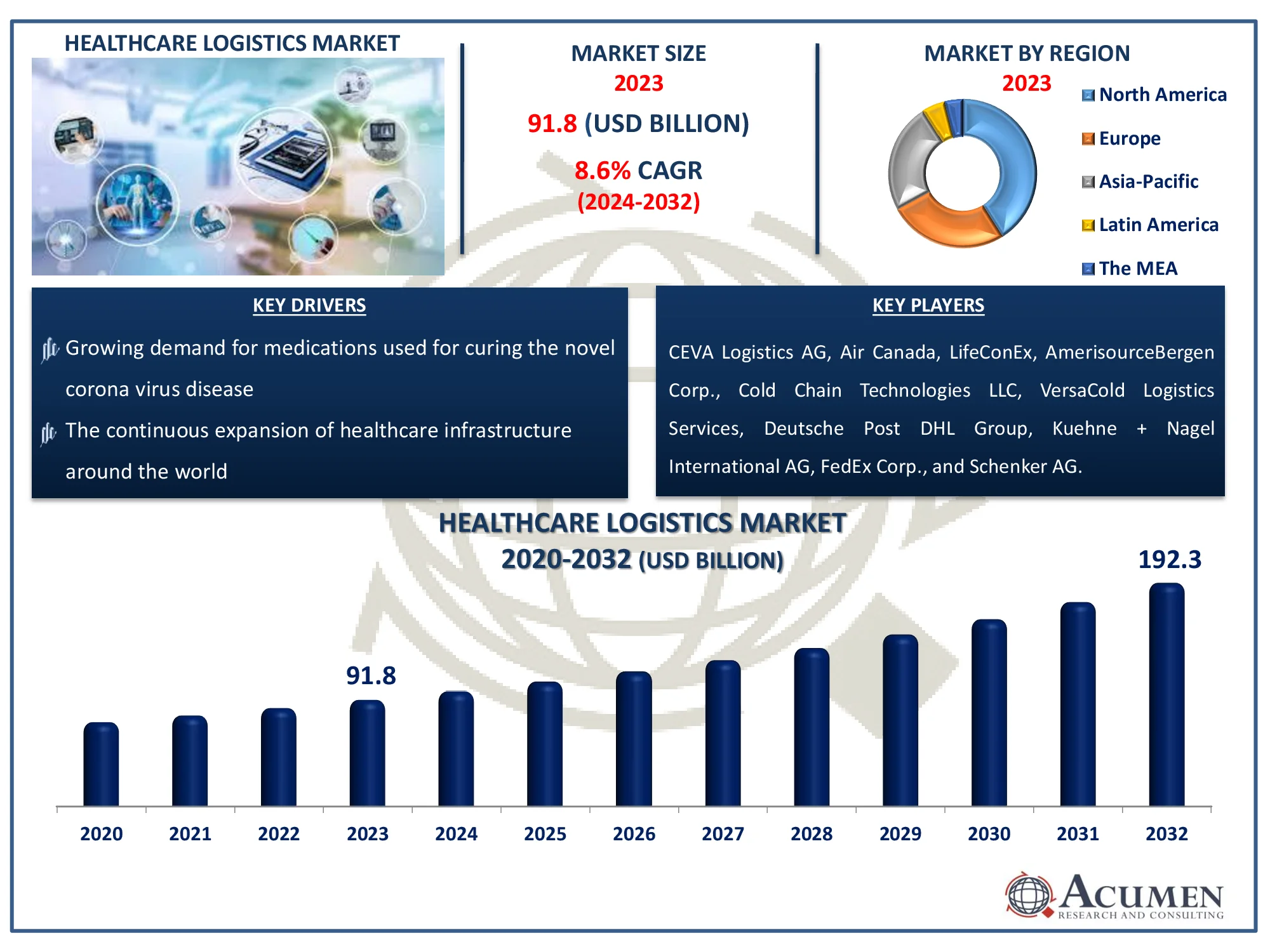

Request Sample Report

The Global Healthcare Logistics Market Size accounted for USD 91.8 Billion in 2023 and is estimated to achieve a market size of USD 192.3 Billion by 2032 growing at a CAGR of 8.6% from 2024 to 2032.

Healthcare Logistics Market Highlights

- Global healthcare logistics market revenue is poised to garner USD 192.3 Billion by 2032 with a CAGR of 8.6% from 2024 to 2032

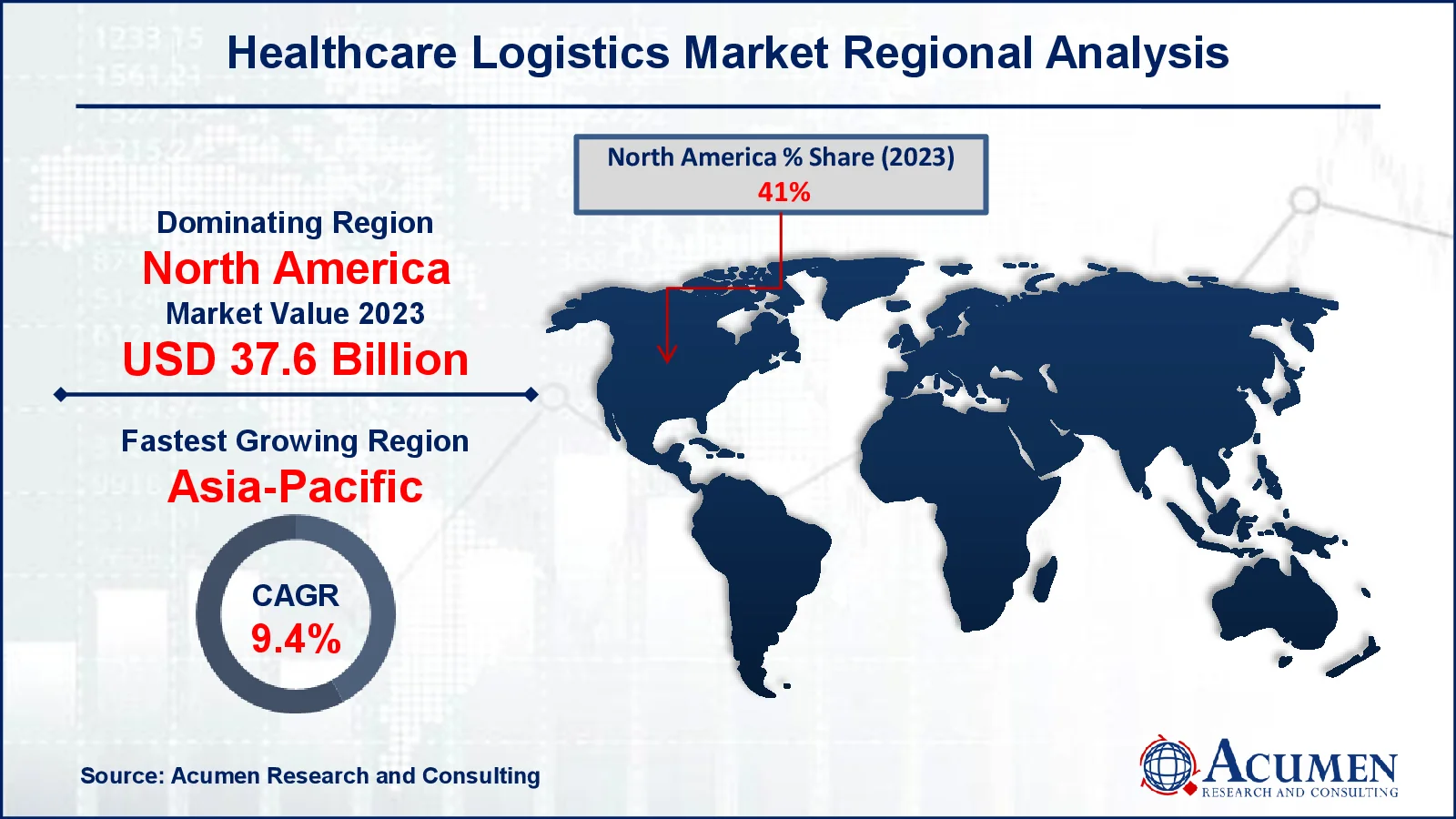

- North America healthcare logistics market value occupied around USD 37.6 billion in 2023

- Asia-Pacific healthcare logistics market growth will record a CAGR of more than 9.4% from 2024 to 2032

- Among service type, the transportation sub-segment generated more than USD 64.3 billion revenue in 2023

- Based on supply chain, the cold chain logistics sub-segment generated around 54% healthcare logistics market share in 2023

- Rising adoption of temperature-controlled logistics for biologics and specialty drugs is a popular healthcare logistics market trend that fuels the industry demand

The logistics of medical, surgical, and pharmaceutical goods and equipment is known as medical or healthcare logistics. It also includes medical and laboratory devices, medical equipment supplies, and other materials, products, and items of equipment to help specialists, doctors, veterinary doctors, clinicians, and other health professionals. Medicinal logistics is a subset of logistics operations that focuses on transporting, storing, properly handling, and delivering generic medicines from the manufacturing site to the specified location. Medical logistics includes the entire supply chain operations, from start to finish. Raw materials are transported from their source to a production facility, and then to a machine shop. Any mode of transportation, including trucks, railways, ships, airplanes, temperature-controlled vehicles, and cars, can provide healthcare transportation. Additionally, the global expansion of medical facilities and infrastructure drives the growth of the market.

Global Healthcare Logistics Market Dynamics

Market Drivers

- Growing demand for medications used for curing the novel corona virus disease

- The continuous expansion of healthcare infrastructure around the world

- Increasing reliance on seaborne pharmaceutical transportation

- Increasing worldwide pharmaceutical sales

Market Restraints

- High cost of reverse supply chain operations

- Shortage of experienced professionals

- Lack of supportive government policies

Market Opportunities

- The growing demand for over-the-counter (OTC) pharmaceutical products

- The introduction of drone technology in the healthcare logistics market

- Expansion of AI-driven supply chain optimization in healthcare logistics

Healthcare Logistics Market Report Coverage

|

Market |

Healthcare Logistics Market |

|

Healthcare Logistics Market Size 2023 |

USD 91.8 Billion |

|

Healthcare Logistics Market Forecast 2032 |

USD 192.3 Billion |

|

Healthcare Logistics Market CAGR During 2024 - 2032 |

8.6% |

|

Healthcare Logistics Market Analysis Period |

2020 - 2032 |

|

Healthcare Logistics Market Base Year |

2023 |

|

Healthcare Logistics Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Service Type, By Supply Chain, End User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

CEVA Logistics AG, United Parcel Service Inc., Air Canada, LifeConEx, AmerisourceBergen Corp., Cold Chain Technologies LLC, VersaCold Logistics Services, Continental Cargo OU, Deutsche Post DHL Group, Kuehne + Nagel International AG, FedEx Corp., and Schenker AG. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Healthcare Logistics Market Insights

The rapid developments of biological drugs, as well as the expansion of the pharmaceutical industry, are expected to drive growth and demand in the healthcare logistics market. The COVID-19 disease outbreak's short-term market impact is critical for the rapid growth of medical logistics. Governments around the world are emphasizing healthcare facilities and an ample supply of medications for patients in the midst of the pandemic. As a result, trade in traditional medicines from various countries is expanding.

The growing demands for over-the-counter medications such as minerals, vitamins, and supplements, gastrointestinal drugs, common cold, and flu drugs, and dermatology products are also contributing to the market's growth. Furthermore, the growing use of air cargo logistics for long-distance and international air distribution of precious drugs and vaccines is expected to fuel market growth. Aside from that, the global healthcare logistics market is being hampered by increased complexities as a result of time-bound deliveries and supply chain customization.

Healthcare Logistics Market Segmentation

Healthcare Logistics Market Segmentation

The worldwide market for healthcare logistics is split based on product, service type, supply chain, end user, and geography.

Healthcare Logistics Product

- Pharmaceutical Products

- Medical Devices

- Others

According to healthcare logistics industry analysis, based on the products, the medical devices segment is projected to expand significantly during the forecast period. Rapid technological advancements, combined with an increase in the existing elderly population, can be attributed to this tremendous growth. Industry innovation is driven by consumer demands for better, faster, and more accessible healthcare. However, Growth provides an excellent opportunity for medical device manufacturers to introduce and develop new products, increase market share, and work to improve the lives of patients through better healthcare.

In addition, the rising prevalence of chronic diseases, as well as the increasing focus of healthcare systems on early diagnosis and treatment, is increasing the number of patients undergoing advanced surgical procedures, driving demand for medical devices. Furthermore, increased investments in R&D by medical technology providers, as well as favorable conditions provided by federally regulated entities for their approval, are expected to boost this industry during the forecast period.

Healthcare Logistics Service Type

- Transportation

- Air Freight

- Sea Freight

- Overland Transportation

- Warehouse and Storage

- Monitoring Components

Based on the service type, the transportation segment takes maximum share within the market also the warehouse and storage segment gained considerable market share in 2023 due to increased demand for logistics solutions from the pharmaceutical and healthcare industries. Pharmaceutical warehousing provides a full range of pharmaceutical warehousing services, including cold storage and distribution of bulk pharmaceutical chemicals, medicines, and medical equipment. The rapidly increasing demand for branded and generic pharmacy products has created a huge demand for storage facilities to preserve and procure the efficacy of these products after production, as well as their subsequent distribution to distributors and retailers via multiple channels. As a result, the warehouse and storage segment increases market demand.

Healthcare Logistics Supply Chain

- Cold Chain Logistics

- Non-Cold Chain Logistic

In terms of the supply chain, the cold chain logistics segment will gain a significant market share during the forecast period owing to increase demand for temperature-controlled product lines, such as the ongoing distribution of COVID-19 vaccines, which require precision temperature control transportation services to keep the products' efficiency. Furthermore, stringent government regulations requiring highly temperature-sensitive generic drugs to be kept at precise temperatures are supposed to propel segment growth throughout the forecast period. Temperature-controlled logistics and warehousing are required as a result of factors such as the development of sophisticated biological-based medicines, systemic treatment deliveries, vaccines, and complex nutrients that necessitate cold chain refinements.

Healthcare Logistics End User

- Pharmaceutical Companies

- Hospitals & Clinics

- Biotechnology Companies

- Retail & Online Pharmacies

The pharmaceutical companies are likely to dominate the market as a result of the rising demand for efficient supply chain solutions to handle medication, vaccine, and biologic delivery. Stringent restrictions governing temperature-sensitive shipments, particularly for biologics and specialty pharmaceuticals, have increased reliance on advanced cold chain logistics. The growing pharmaceutical industry, fueled by increased chronic diseases and drug innovation, exacerbates this segment's logistical needs. Furthermore, the global expansion of the pharmaceutical business, which includes contract manufacturing and research, has increased need for specialised logistics services. Pharmaceutical companies influence the healthcare logistics by prioritizing speed, security, and regulatory compliance.

Healthcare Logistics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Healthcare Logistics Market Regional Analysis

Healthcare Logistics Market Regional Analysis

North America is expected to largest during the healthcare logistics market forecast period. The increased demand for vaccines, cellular therapies, and blood components in the pharmaceutical industry is propelling the North American healthcare logistics market forward. Furthermore, the increased supply of generic drugs and vaccines fueled by the global COVID-19 epidemic and increased investments by leading pharmaceutical companies is driving demand for healthcare logistics in North America. With three major countries, North America is among the widest and most varied logistics markets in the world, with the transport of goods by road, sea, air, and rail across extensive border crossings. The logistics sector in North America is dominated by the United States, Canada, and Mexico. Furthermore, the rising supplies of advanced medical devices and demand for a variety of pharmacy products and services, such as OTC drugs, in the domestic market have helped the market in gaining a sizable market share.

Healthcare Logistics Market Players

Some of the top healthcare logistics companies offered in our report includes CEVA Logistics AG, United Parcel Service Inc., Air Canada, LifeConEx, AmerisourceBergen Corp., Cold Chain Technologies LLC, VersaCold Logistics Services, Continental Cargo OU, Deutsche Post DHL Group, Kuehne + Nagel International AG, FedEx Corp., and Schenker AG.

Frequently Asked Questions

How much was the estimated value of the Global Healthcare Logistics Market in 2021 and projection by 2030?

The estimated value of Global Healthcare Logistics Market in 2021 was accounted to be US$ 77.9 Bn and market projected to reach US$ 158.5 Bn by 2030

What will be the projected CAGR for Global Healthcare Logistics Market during forecast period of 2022 to 2030?

The projected CAGR of Global Healthcare Logistics Market during the analysis period of 2021 to 2030 is 8.3%

Which are the prominent competitors operating in the market?

The prominent players of the global healthcare logistics market involve CEVA Logistics AG, United Parcel Service Inc., Air Canada, LifeConEx, AmerisourceBergen Corp., Cold Chain Technologies LLC, VersaCold Logistics Services, Continental Cargo OU, Deutsche Post DHL Group, Kuehne + Nagel International AG, FedEx Corp., and Schenker AG.

Which region held the dominating position in the global healthcare logistics market?

Europe held the dominating share for healthcare logistics during the analysis period of 2022 to 2030

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for healthcare logistics during the analysis period of 2022 to 2030