Healthcare Information System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Healthcare Information System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

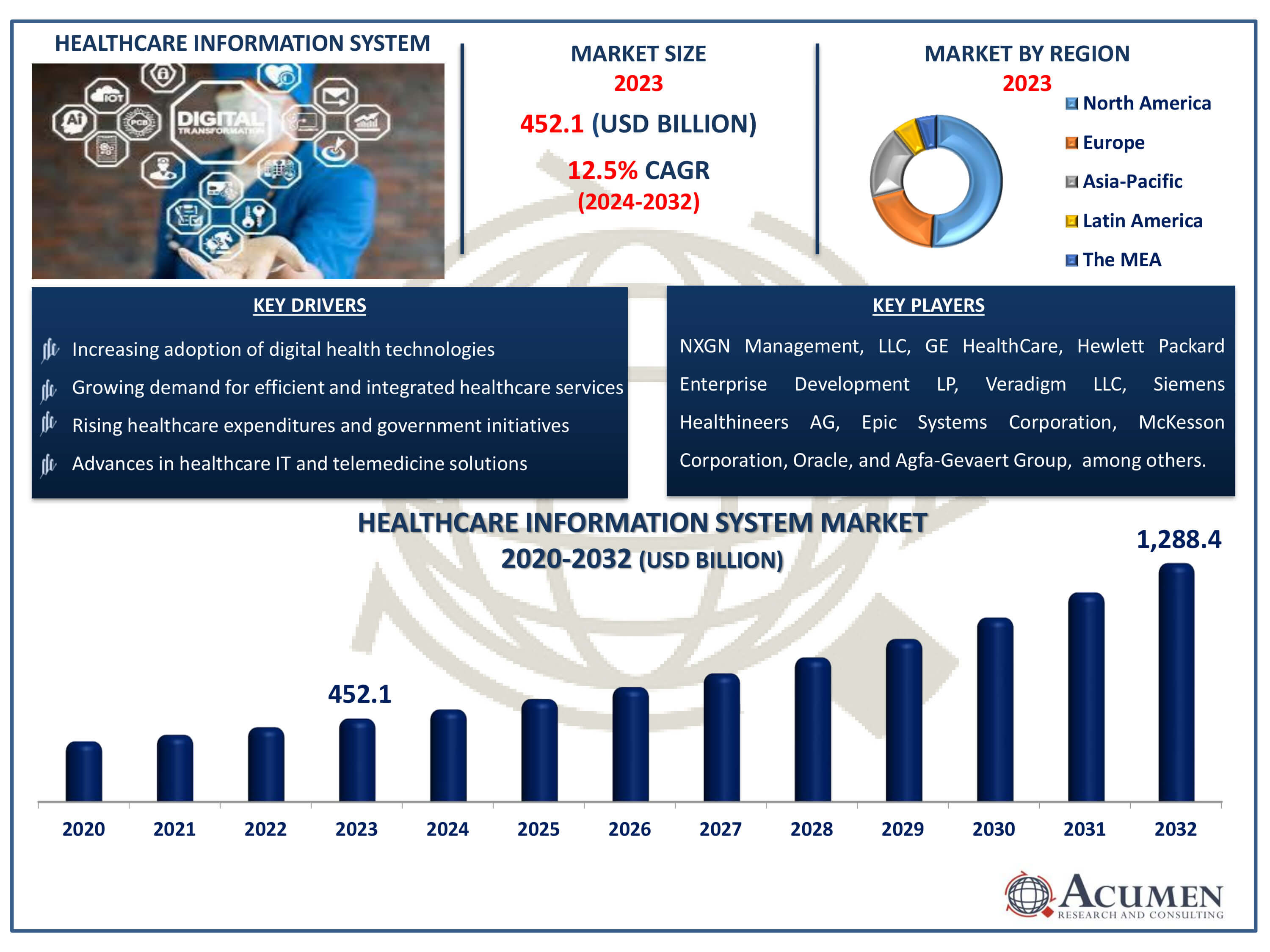

The Healthcare Information System Market Size accounted for USD 452.1 Billion in 2023 and is estimated to achieve a market size of USD 1,288.4 Billion by 2032 growing at a CAGR of 12.5% from 2024 to 2032.

Healthcare Information System Market Highlights

- Global healthcare information system market revenue is poised to garner USD 1,288.4 billion by 2032 with a CAGR of 12.5% from 2024 to 2032

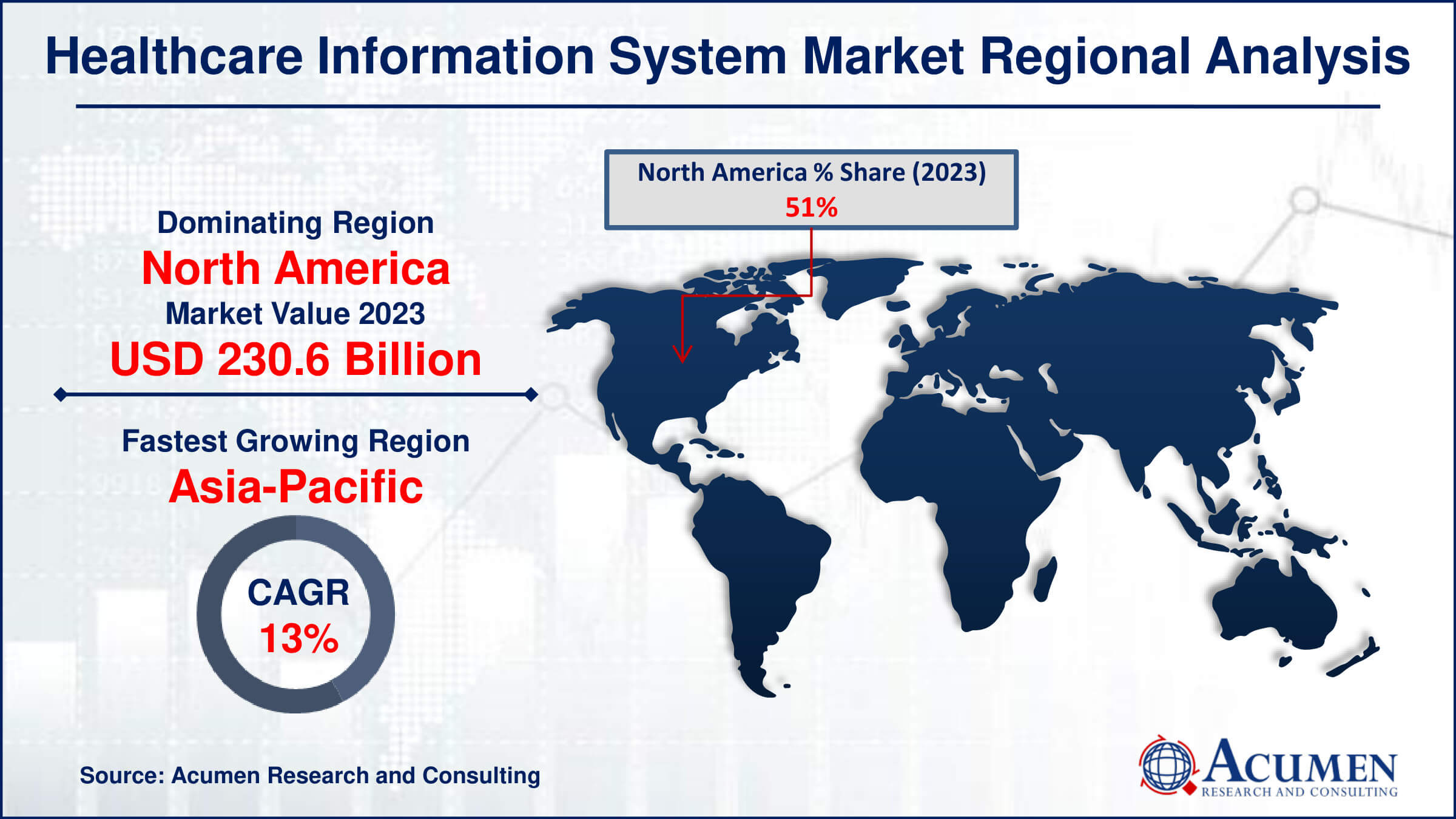

- North America healthcare information system market value occupied around USD 230.6 billion in 2023

- Asia-Pacific healthcare information system market growth will record a CAGR of more than 13% from 2024 to 2032

- Among deployment, the web-based sub-segment generated more than USD 194.4 billion revenue in 2023

- Based on component, the services sub-segment generated around 47% market share in 2023

- Emerging markets with underdeveloped healthcare IT infrastructure is a popular healthcare information system market trend that fuels the industry demand

Healthcare information systems are used to collect, store, manage, and transfer data on people's health or the activities of health-care organizations. There are various types of healthcare information systems, including operational and tactical systems, subject and task-based systems, clinical and administrative systems, and financial systems. Furthermore, these systems are primarily intended to aid healthcare providers in handling routine tasks and patient data. These systems are classified into software solutions, including as electronic health records (EHR), practice management software, laboratory information systems, and radiology information systems. Integrating these technologies improves the efficiency and quality of healthcare delivery, resulting in better patient outcomes and more efficient operations.

Global Healthcare Information System Market Dynamics

Market Drivers

- Increasing adoption of digital health technologies

- Growing demand for efficient and integrated healthcare services

- Rising healthcare expenditures and government initiatives

- Advances in healthcare IT and telemedicine solutions

Market Restraints

- High implementation and maintenance costs

- Data privacy and security concerns

- Interoperability issues between different healthcare systems

Market Opportunities

- Expansion of telehealth and remote patient monitoring

- Growing use of AI and machine learning in healthcare

- Increased focus on patient-centric care models

Healthcare Information System Market Report Coverage

| Market | Healthcare Information System Market |

| Healthcare Information System Market Size 2022 | USD 452.1 Billion |

| Healthcare Information System Market Forecast 2032 | USD 1,288.4 Billion |

| Healthcare Information System Market CAGR During 2023 - 2032 | 12.5% |

| Healthcare Information System Market Analysis Period | 2020 - 2032 |

| Healthcare Information System Market Base Year |

2022 |

| Healthcare Information System Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Deployment, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | NXGN Management, LLC, GE HealthCare, Hewlett Packard Enterprise Development LP, Veradigm LLC, Siemens Healthineers AG, Epic Systems Corporation, McKesson Corporation, Oracle, Agfa-Gevaert Group, Medidata (Dassault Systèmes), and Koninklijke Philips N.V. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Healthcare Information System Market Insights

Several main reasons drive the global market for healthcare information systems. One of the key drivers is the growing elderly population, which demands enhanced healthcare services to address chronic diseases and age-related health issues. As the older population develops, so does the demand for efficient healthcare information systems that enable optimum care and management. Another key contributor is the rising expense of healthcare. Healthcare information systems can help to control and perhaps lower overall healthcare costs by streamlining processes, eliminating redundant procedures, and improving resource management. Furthermore, the rising prevalence of some fatal diseases, such as cancer and coronary heart disease, has increased the demand for advanced information systems that may enhance patient outcomes, manage vast amounts of patient data, and accelerate research and development of treatment techniques.

Various government and healthcare service providers are rapidly implementing healthcare information systems to meet expanding healthcare demands in a cost-effective manner. These technologies provide better management of medical resources and patient data, perhaps leading to enhanced healthcare delivery. Furthermore, the adoption of IT-enabled services in developing economies opens up numerous prospects for market expansion. Countries like India and China, which have enormous populations and expanding healthcare infrastructures, are progressively integrating healthcare information systems. This tendency is projected to fuel long-term market expansion in these regions.

However, there are certain constraints that may limit the growth of the healthcare information system market. A major constraint is a scarcity of qualified and skilled experts. The successful deployment and administration of healthcare information systems necessitates a staff that is knowledgeable in both healthcare and IT. A dearth of such experienced professionals may impede the successful use of these technologies. Moreover, the high costs of maintaining and servicing healthcare information systems present a considerable barrier. These expenditures can be exorbitant, particularly for smaller healthcare providers. Another key issue is interoperability, which refers to the ability of various information systems and software applications to communicate, share data, and use that information. Interoperability difficulties can result in inefficiencies and data silos, reducing the value of healthcare information systems.

Healthcare Information System Market Segmentation

The worldwide market for healthcare information system is split based on component, deployment, application, end-use, and geography.

Healthcare Information System HIS Market By Component

- Hardware

- Software & Systems

- Services

According to healthcare information system industry analysis, the services segment has the biggest market share. This dominance is due to the growing need for consulting, implementation, training, and maintenance services, which are required for the successful deployment and operation of healthcare information systems. Healthcare providers require constant support to ensure that these systems operate properly and meet regulatory criteria. The complexity of integrating numerous technological solutions, as well as the necessity for regular upgrades and technical assistance, all contribute to increased demand for services. Furthermore, the transition to value-based care models and the use of new technology demand specialist services in order to maximize the benefits of healthcare information systems.

Healthcare Information System HIS Market By Deployment

- On-Premises

- Web-Based

- Cloud-Based

Healthcare information systems can be deployed in three ways on-premises, web-based, and in the cloud. Notably, the web-based segment has the highest market share. This choice stems from the flexibility and accessibility that web-based solutions provide, allowing healthcare personnel to access critical information from anywhere with internet access. Web-based solutions provide real-time data updates and cooperation among healthcare teams, resulting in improved efficiency and patient care. Furthermore, they frequently have lower upfront costs than on-premises systems and are easier to expand, making them appealing to healthcare providers of all sizes. The increased emphasis on remote healthcare services and telemedicine drives up the demand for web-based healthcare information systems.

Healthcare Information System HIS Market By Application

- Pharmacy Automation Systems

- Medication Dispensing System

- Packaging & Labeling System

- Storage & Retrieval System

- Automated Medication Compounding System

- Tabletop Tablet Counters

- Hospital Information System

- Electronic Health Record

- Electronic Medical Record

- Real-time Healthcare

- Patient Engagement Solution

- Population Health Management

- Laboratory Informatics

- Revenue Cycle Management

- Medical Imaging Information System

- Radiology Information Systems

- Monitoring Analysis Software

- Picture Archiving and Communication Systems

Several applications in the healthcare information system industry address specific demands across healthcare facilities. Among these, revenue cycle management (RCM) has the highest market share. RCM solutions simplify financial processes across the patient's care journey, from appointment scheduling and insurance verification to billing and payment collection. These systems enable appropriate compensation for healthcare services given, optimize revenue collection, and limit revenue leakage by using efficient claims administration and rejection avoidance. The growing complexity of healthcare billing and reimbursement, combined with regulatory changes, creates a requirement for effective RCM systems. Healthcare providers need RCM systems that work smoothly with other information systems, improving operational efficiency and financial performance while adhering to healthcare laws.

Healthcare Information System HIS Market By End-Use

- Hospitals & Ambulatory Services

- Diagnostic Centers

- Academic And Research Institutes

Hospitals & ambulatory services is the market's largest segment and it is expected to grow over the healthcare information system industry forecast period. This dominance is fueled by the widespread use of information technologies to manage patient records, expedite operations, and improve clinical decision-making in both inpatient and outpatient settings. Hospitals rely on these systems to improve patient care, maintain regulatory compliance, and maximize resource use. Ambulatory services, such as outpatient clinics and urgent care centers, benefit from information systems that enable efficient scheduling, invoicing, and patient administration. The integration of electronic health records (EHRs) and telemedicine solutions improves the functionality of healthcare information systems in these environments. As healthcare companies work to improve operational efficiency and patient outcomes, the use of advanced information systems grows throughout hospitals and ambulatory services.

Healthcare Information System Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Healthcare Information System Market Regional Analysis

In terms of healthcare information system market analysis, North America is expected to dominate the market growth during the forecast period (2024-2032) due to strong demand for quality diagnostics and government initiatives. Moreover, the increasing geriatric population and prevalence of chronic diseases like cardiovascular diseases and cancer are likely to propel market growth in this region.

Europe is also expected to be a second largest region during the healthcare information system market forecast period, driven by increasing demand for better healthcare facilities and the integration of healthcare systems through digitization. Asia Pacific is anticipated to hold a significant share during the forecast period, attributed to an expanding aging population and increasing incidence of chronic diseases. Advancements in healthcare infrastructure and rising investments by healthcare IT companies further contribute to market growth in this region.

LAMEA is expected to show steady growth, hindered by factors such as limited knowledge and government support, poor IT infrastructure, and economic conditions.

Healthcare Information System Market Players

Some of the top healthcare information system companies offered in our report includes NXGN Management, LLC, GE HealthCare, Hewlett Packard Enterprise Development LP, Veradigm LLC, Siemens Healthineers AG, Epic Systems Corporation, McKesson Corporation, Oracle, Agfa-Gevaert Group, Medidata (Dassault Systèmes), and Koninklijke Philips N.V.

Frequently Asked Questions

How big is the healthcare information system market?

The healthcare information system market size was valued at USD 452.1 billion in 2023.

What is the CAGR of the global healthcare information system market from 2024 to 2032?

The CAGR of healthcare information system is 12.5% during the analysis period of 2024 to 2032.

Which are the key players in the healthcare information system market?

The key players operating in the global market are including NXGN Management, LLC, GE HealthCare, Hewlett Packard Enterprise Development LP, Veradigm LLC, Siemens Healthineers AG, Epic Systems Corporation, McKesson Corporation, Oracle, Agfa-Gevaert Group, Medidata (Dassault Syst�mes), and Koninklijke Philips N.V.

Which region dominated the global healthcare information system market share?

North America held the dominating position in healthcare information system industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of healthcare information system during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global healthcare information system industry?

The current trends and dynamics in the healthcare information system industry include increasing adoption of digital health technologies, growing demand for efficient and integrated healthcare services, rising healthcare expenditures and government initiatives, and advances in healthcare IT and telemedicine solutions.

Which end-use held the maximum share in 2023?

The hospitals & ambulatory services held the maximum share of the healthcare information system industry.