Healthcare Distribution Market Size - Global Industry, Share, Analysis, Trends and Forecast 2025 - 2033

Published :

Report ID:

Pages :

Format :

Healthcare Distribution Market Size - Global Industry, Share, Analysis, Trends and Forecast 2025 - 2033

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

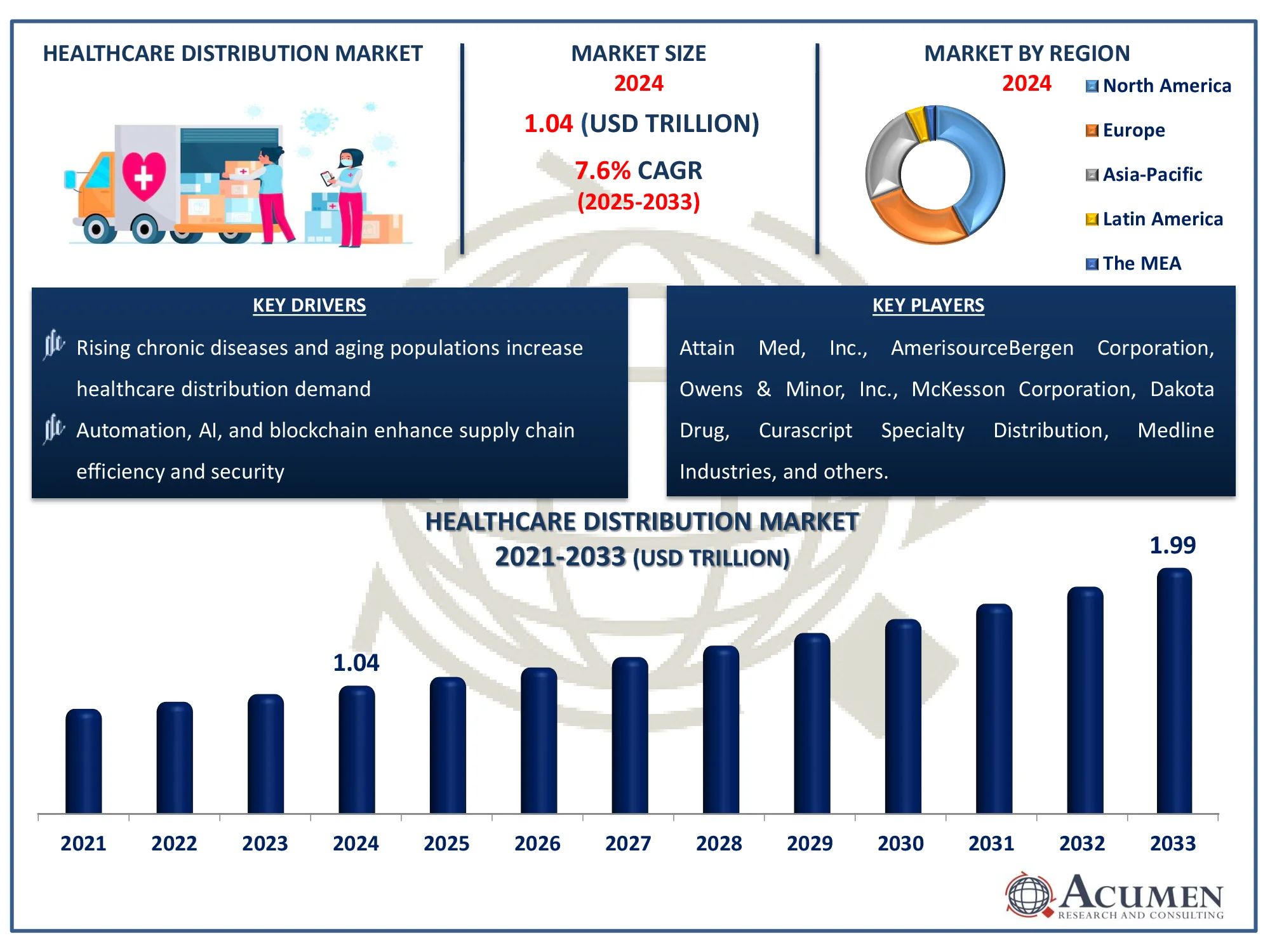

The Global Healthcare Distribution Market Size accounted for USD 1.04 Trillion in 2024 and is estimated to achieve a market size of USD 1.99 Trillion by 2033 growing at a CAGR of 7.6% from 2025 to 2033.

Healthcare Distribution Market Highlights

- The global healthcare distribution market is projected to reach USD 1.99 Trillion by 2033, growing at a CAGR of 7.6% from 2025 to 2033

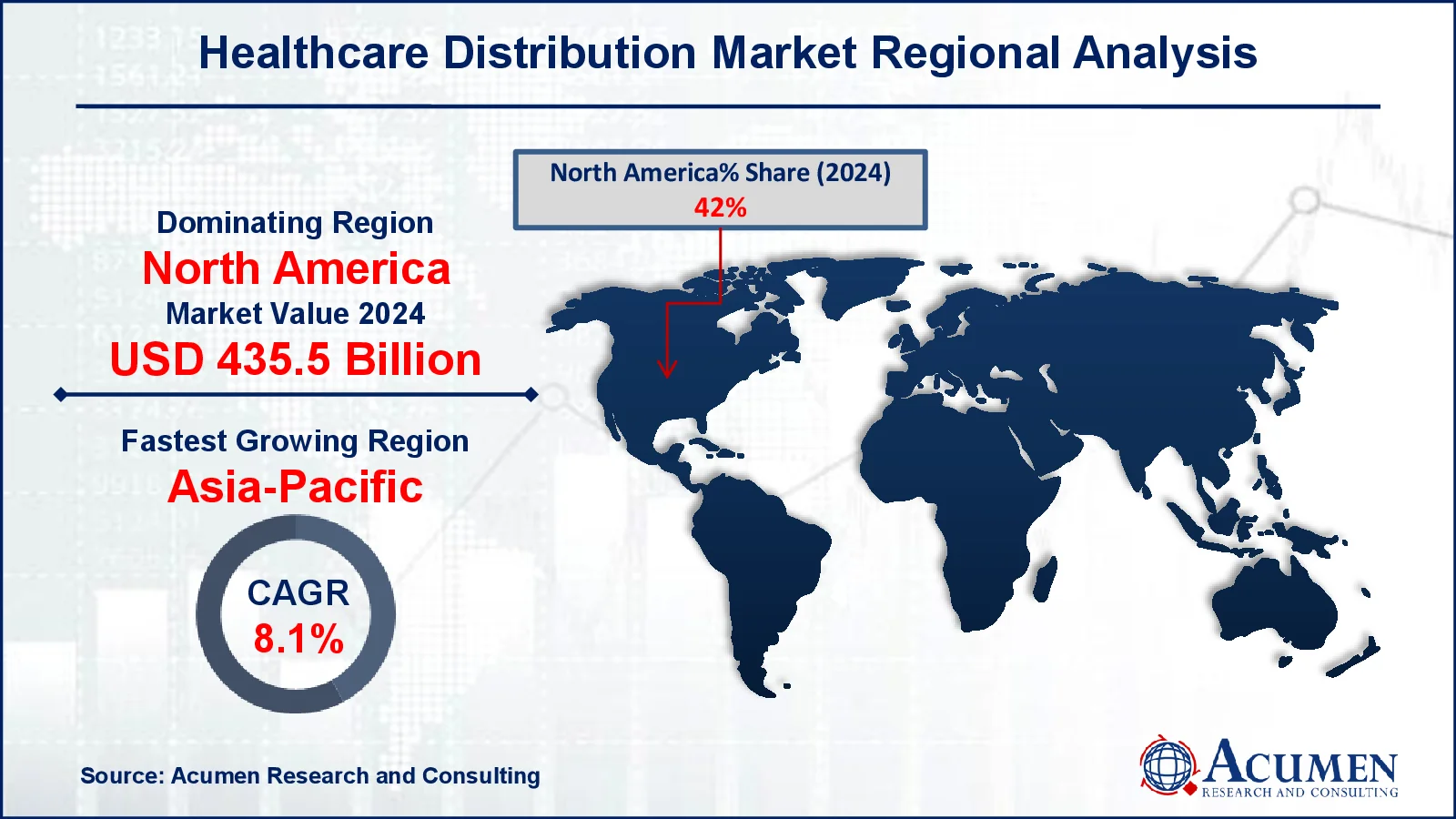

- In 2024, the North America healthcare distribution market was valued at approximately USD 435.5 billion

- The Asia-Pacific healthcare distribution market is expected to expand at a CAGR of over 8.1% from 2025 to 2033

- Based on type, pharmaceutical product distribution services gathered utmost market revenue of USD 539.2 billion in 2024

- Among end-users, retail pharmacies held a dominant 51% market share in 2024

- AI-driven analytics and blockchain are enhancing supply chain transparency and efficiency is a popular market trend that fuels the industry demand

Healthcare distribution includes the complete process of acquiring and maintaining medical, laboratory, and pharmacy supplies, as well as customer relationship management (CRM), enterprise resource planning (ERP) assistance, and information management. This industry includes a variety of businesses such as medicine wholesale, distribution, and related services. Prime vendors, customer-centric methods, and true distribution relationships are among the primary factors driving industry evolution. Prime vendors help end users by simplifying orders, maintaining product availability during backorders, and reducing supply chain expenses. A strong emphasis on customer needs propels business success for both distributors and clients. Furthermore, healthcare professionals desire credible distribution partners who function as trusted advisors, respecting and cooperating in their efforts to assist communities, patients, and teams.

Global Healthcare Distribution Market Dynamics

Market Drivers

- Rising chronic diseases and aging populations increase healthcare distribution demand

- Automation, AI, and blockchain enhance supply chain efficiency and security

- Specialty and biologic drug expansion drive distribution growth

Market Restraints

- Strict regulations and compliance requirements create operational challenges

- Global crises and geopolitical issues disrupt supply chains

- Intense competition and pricing controls lower profit margins

Market Opportunities

- E-commerce platforms are transforming pharmaceutical distribution

- Emerging markets provide new growth opportunities for distributors

- Personalized medicine increases demand for specialized distribution

Healthcare Distribution Market Report Coverage

|

Market |

Healthcare Distribution Market |

|

Healthcare Distribution Market Size 2024 |

USD 1.04 Trillion |

|

Healthcare Distribution Market Forecast 2033 |

USD 1.99 Trillion |

|

Healthcare Distribution Market CAGR During 2025 - 2033 |

7.6% |

|

Healthcare Distribution Market Analysis Period |

2021 - 2033 |

|

Healthcare Distribution Market Base Year |

2024 |

|

Healthcare Distribution Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Type, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled Aviation |

Attain Med, Inc., Owens & Minor, Inc., AmerisourceBergen Corporation, McKesson Corporation, Dakota Drug, Curascript Specialty Distribution, Medline Industries, Morris and Dickson Co., LLC, Cardinal Health, Inc., and FFF Enterprises, Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Healthcare Distribution Market Insights

The rising frequency and significant economic burden of chronic diseases are primary market growth drivers. Chronic illnesses such as heart disease, diabetes, and cancer pose a substantial global health and economic issue, with expenses expected to reach $47 trillion by 2030, according to the National Institute of Health (NIH). This trend is driving the growth of the healthcare distribution market, as increased demand for medications, medical supplies, and specialty therapies demands effective distribution networks.

Rising R&D spending and the ongoing release of new medications help to drive market expansion. For example, in May 2022, Nippon Express Co., Ltd. debuted a pharmaceutical-specific logistics service capable of handling goods that require ultra-low temperatures (-20°C to -85°C), enabling a rigorously controlled pharmaceutical distribution platform. Furthermore, technical developments and the expansion of track-and-trace technologies are increasing efficiency throughout the business.

The market is also benefiting from the growing popularity of generic pharmaceuticals and the rapid expansion of the medical device industry. According to our analysis, the Global Medical Devices Market was valued at USD 526.5 Billion in 2023 and is expected to reach USD 924.2 Billion by 2032, rising at a 6.5% CAGR between 2024 and 2032. This expansion is supporting the healthcare distribution market, as increased demand for innovative medical equipment and consumables need effective supply chain networks.

Despite these growth drivers, leading industry participants continue to face significant pricing challenges. However, growing opportunities such as the burgeoning biosimilars market in developing economies, as well as the rising distribution of specialty medications and biopharmaceuticals, are likely to provide substantial growth potential in the coming years.

Healthcare Distribution Market Segmentation

Healthcare Distribution Market Segmentation

The worldwide market for healthcare distribution is split based on type, end-user, and geography.

Healthcare Distribution Market By Type

- Pharmaceutical Product Distribution Services

- OTC Drugs

- Generic Drugs

- Brand-Name

- Biopharmaceutical Product Distribution Services

- Monoclonal Antibodies

- Vaccines

- Recombinant Proteins

- Blood and Blood Products

- Other Products

- Medical Device Distribution Services

According to healthcare distribution industry analysis, in 2024, the pharmaceutical product distribution services category had the biggest market share, thanks to global pharmaceutical companies' development of production facilities into new markets. This category is further divided into three categories: over-the-counter drugs, generic drugs, and brand-name drugs. Rising investments in pharmaceutical R&D, greater manufacture of pharmaceutical formulations, and outsourcing of pharmaceutical manufacturing to Asian countries have all contributed to its expansion.

Healthcare Distribution Market By End-user

- Retail Pharmacies

- Hospital Pharmacies

- Others

According to healthcare distribution market forecast, retail pharmacies dominated the market among end users throughout 2024 to 2032, accounting for the biggest proportion. This increase was mostly due to programs aimed at providing accessible healthcare in the United States and other developed nations, which resulted in a higher volume of prescriptions. Retail pharmacies process a large number of prescriptions each day, making them an important contributor to market growth.

Healthcare Distribution Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Healthcare Distribution Market Regional Analysis

Healthcare Distribution Market Regional Analysis

In terms of regional segments, in 2024, North America led the regional healthcare distribution market, owing to its large healthcare sector presence and rapid adoption of sophisticated technology. According to data from the Centers for Medicare & Medicaid Services, annual National Health Expenditure (NHE) growth (5.6%) from 2023 to 2032 is expected to outperform average GDP growth (4.3%), raising health spending's percentage of GDP from 17.3% in 2022 to 19.7% in 2032. In 2023, NHE spending increased by 7.5%, outpacing GDP growth of 6.1%. Rising costs for medications, medical devices, and healthcare services are driving need for efficient distribution networks in the region. North America is likely to maintain its dominance during the projection period, supported by ongoing innovation and development in the healthcare industry.

Meanwhile, the Asia-Pacific area is expected to experience the fastest growth over the forecast period. This expansion is being pushed by increased regulatory requirements in various economies to ensure compliance with good manufacturing and distribution processes. Furthermore, the region's pharmaceutical business is expanding rapidly, with tough rules being put in place to improve medicine quality and reliability in emerging markets such as China and India. According to the India Brand Equity Foundation (IBEF), India boasts the most USFDA-compliant pharmaceutical plants outside of the United States, as well as over 2,000 WHO-GMP-approved facilities that serve demand from 150+ countries, for a total of 10,500+ manufacturing facilities. This boosts India's position as a global pharmaceutical hub, increasing exports and creating demand for efficient healthcare delivery networks throughout Asia.

Healthcare Distribution Market Players

Some of the top healthcare distribution companies offered in our report include Attain Med, Inc., Owens & Minor, Inc., AmerisourceBergen Corporation, McKesson Corporation, Dakota Drug, Curascript Specialty Distribution, Medline Industries, Morris and Dickson Co., LLC, Cardinal Health, Inc., and FFF Enterprises, Inc.

Frequently Asked Questions

What was the market size of the global Healthcare Distribution in 2024?

The market size of healthcare distribution was USD 1.04 Trillion in 2024.

What is the CAGR of the global Healthcare Distribution market from 2025 to 2033?

The CAGR of healthcare distribution is 7.6% during the analysis period of 2025 to 2033.

Which are the key players in the Healthcare Distribution market?

The key players operating in the global market are including Attain Med, Inc., Owens & Minor, Inc., AmerisourceBergen Corporation, McKesson Corporation, Dakota Drug, Curascript Specialty Distribution, Medline Industries, Morris and Dickson Co., LLC, Cardinal Health, Inc., and FFF Enterprises, Inc.

Which region dominated the global Healthcare Distribution market share?

North America held the dominating position in healthcare distribution industry during the analysis period of 2025 to 2033.

Which region registered fastest CAGR from 2025 to 2033?

Asia-Pacific region exhibited fastest growing CAGR for market of healthcare distribution during the analysis period of 2025 to 2033.

What are the current trends and dynamics in the global Healthcare Distribution industry?

The current trends and dynamics in the healthcare distribution industry include rising chronic diseases and aging populations increase healthcare distribution demand, automation, AI, and blockchain enhance supply chain efficiency and security, and specialty and biologic drug expansion drive distribution growth.

Which end-user held the maximum share in 2024?

The retail pharmacies held the maximum share of the healthcare distribution industry.