Healthcare Bpo Market | Acumen Research and Consulting

Healthcare BPO Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format : ![]()

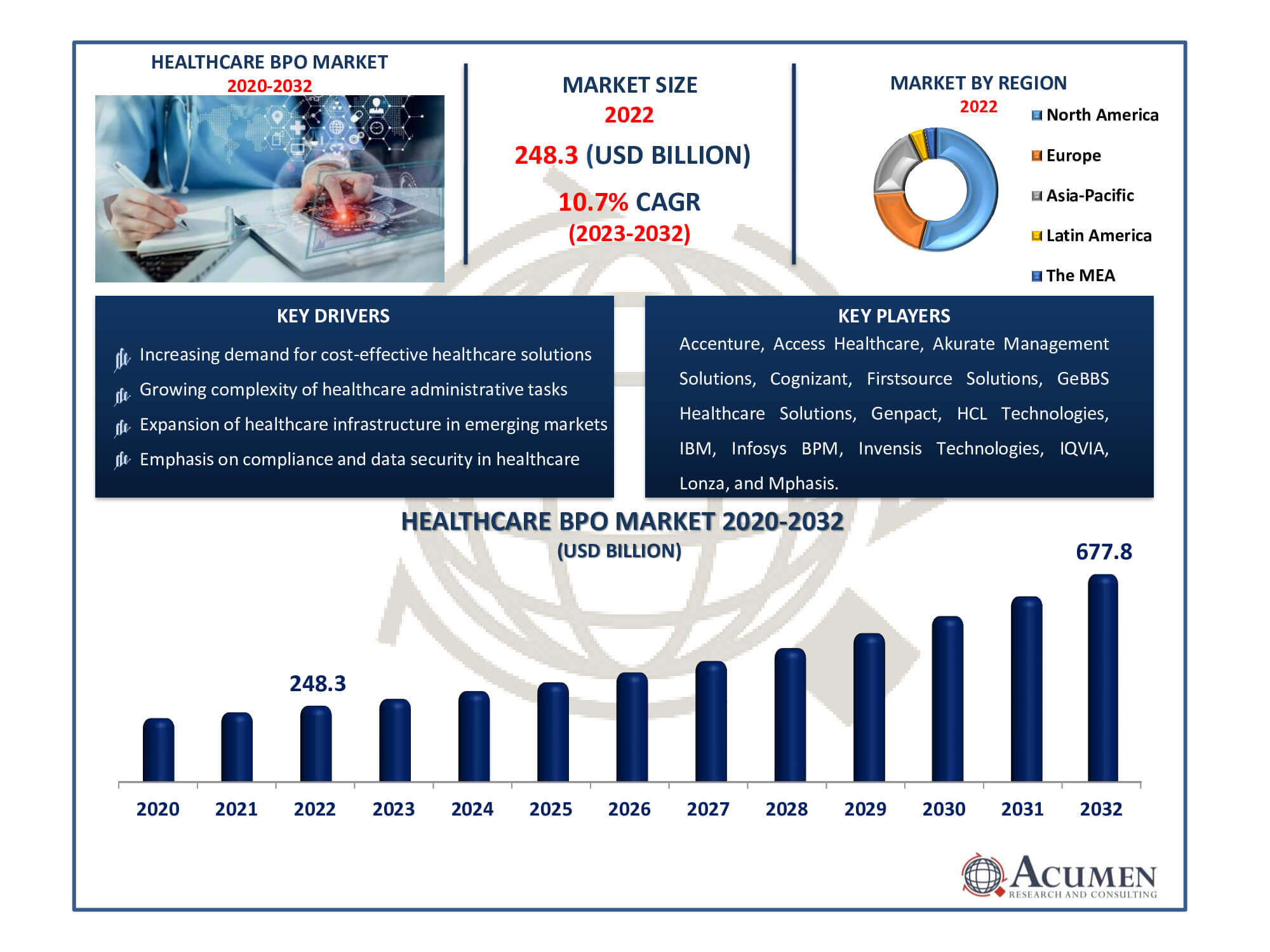

The Healthcare BPO Market Size accounted for USD 248.3 Billion in 2022 and is estimated to achieve a market size of USD 677.8 Billion by 2032 growing at a CAGR of 10.7% from 2023 to 2032.

Healthcare BPO Market Highlights

- Global healthcare BPO market revenue is poised to garner USD 677.8 billion by 2032 with a CAGR of 10.7% from 2023 to 2032

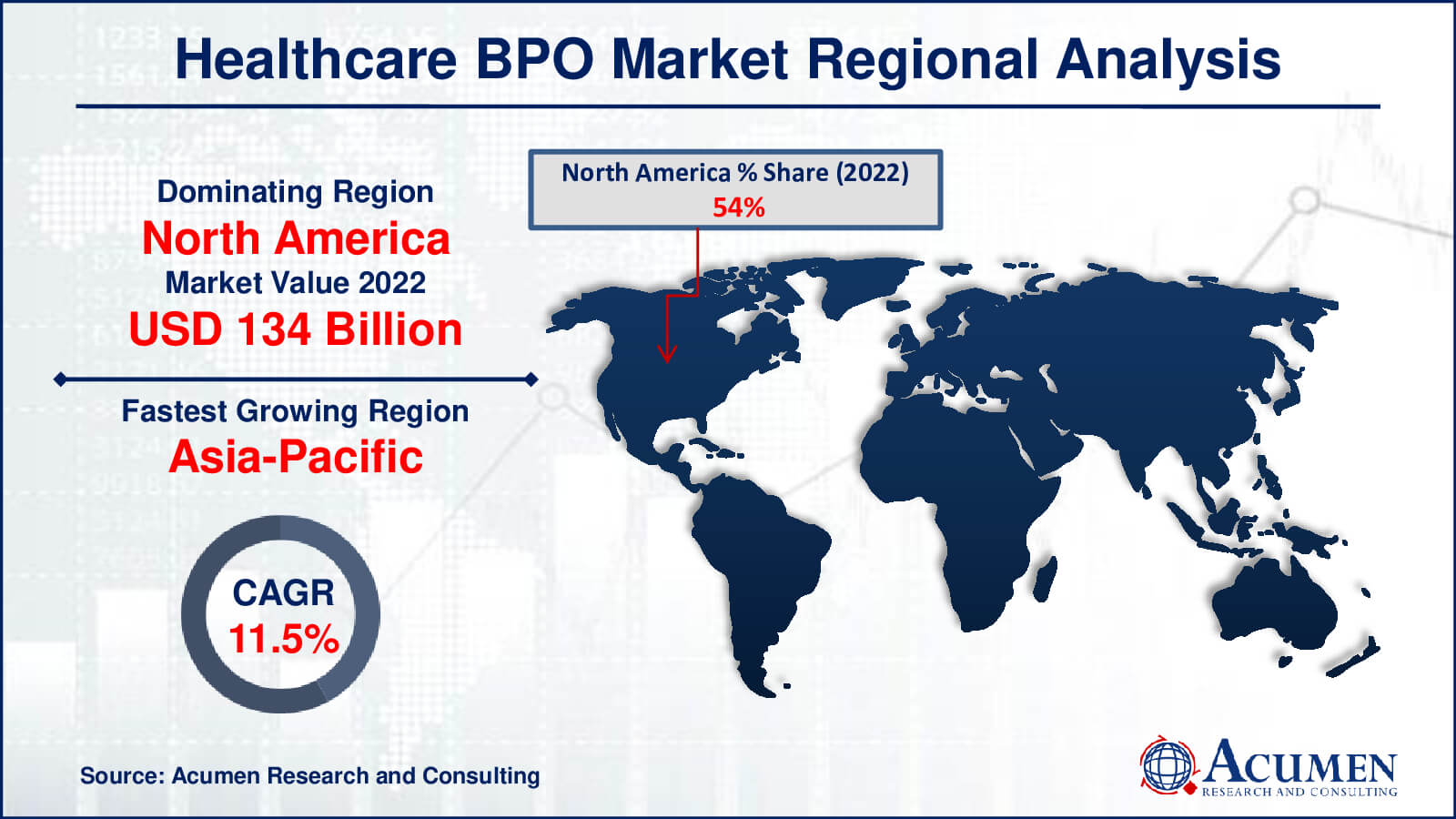

- North America healthcare BPO market value occupied around USD 134 billion in 2022

- Asia-Pacific healthcare BPO market growth will record a CAGR of more than 11.5% from 2023 to 2032

- Among services type, the provider services sub-segment generated over US$ 106.7 billion revenue in 2022

- Based on end-user, the healthcare providers sub-segment generated around 55% share in 2022

- Expansion of BPO services to support pharmaceutical research and development is a popular healthcare BPO market trend that fuels the industry demand

Healthcare BPO (Business Process Outsourcing) refers to the outsourcing done by the healthcare provider or organization for some or all of its business processes remotely. The remote work is usually done in countries like India or the Philippines due to the lower cost of labor. The service providers deliver intelligent health operations that improve patient outcomes by keeping costs under control and increase consumer and provider engagement. Healthcare providers and organizations are managing their administrative and non-core operations in a completely new way thanks to the growth of the BPO (business process outsourcing) market in the sector. Healthcare BPO services are now essential in a time when patient care quality, cost effectiveness, and efficiency are of the utmost importance. These services cover a broad range of duties, including customer assistance, claims processing, medical transcription, and medical billing and coding.

Global Healthcare BPO Market Dynamics

Market Drivers

- Increasing demand for cost-effective healthcare solutions

- Growing complexity of healthcare administrative tasks

- Expansion of healthcare infrastructure in emerging markets

- Emphasis on compliance and data security in healthcare

Market Restraints

- Regulatory and compliance challenges

- Concerns about data privacy and security

- Resistance to outsourcing critical healthcare functions

Market Opportunities

- Advancements in healthcare technology and digital solutions

- Growth of telemedicine and remote healthcare services

- Increasing demand for specialized niche BPO services

Healthcare BPO Market Report Coverage

| Market | Healthcare BPO Market |

| Healthcare BPO Market Size 2022 | USD 248.3 Billion |

| Healthcare BPO Market Forecast 2032 | USD 677.8 Billion |

| Healthcare BPO Market CAGR During 2023 - 2032 | 10.7% |

| Healthcare BPO Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Services Type, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Accenture, Access Healthcare, Akurate Management Solutions, Cognizant, Firstsource Solutions, GeBBS Healthcare Solutions, Genpact, HCL Technologies, IBM Corporation, Infosys BPM, Invensis Technologies, IQVIA, Lonza, Mphasis, NTT Data Corporation, and Omega Healthcare. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Healthcare BPO Market Insights

Regulatory changes in the US, coupled with the implementation of the Patient Protection and Affordable Care Act (PPACA), are supporting the demand for payer services in the market. There is a continuous push to reduce rising healthcare costs, ensuring that a broader population can access healthcare solutions, which is further fueling market growth. The increasing demand for niche services, revenue loss due to billing errors, growing consolidation in the healthcare industry, and the need for structured processes and documentation are some of the other factors that are bolstering market expansion. Additionally, the patent cliff, along with rising R&D costs and stringent regulations in the pharmaceutical service market, is contributing to the market's growth.

The intricate and constantly changing world of healthcare compliance and regulations is a major barrier to the growth of the BPO market in healthcare. Numerous strict laws are applied to the healthcare sector with the goals of safeguarding patient information, guaranteeing high-quality care, and upholding moral principles. The Health Insurance Portability and Accountability Act (HIPAA) in the United States and numerous foreign data protection laws are just a few of the complicated standards that BPO service providers working in this industry must manage.

The ongoing integration of cutting-edge technologies like blockchain, robotic process automation (RPA), and artificial intelligence (AI) presents an intriguing potential in the healthcare BPO market. These technologies have the ability to increase accuracy, expedite procedures, and raise service standards all around. Tasks like invoicing, medical coding, and claims processing can benefit from the application of AI and RPA, which lowers error rates and boosts productivity. Blockchain provides a more transparent and impenetrable approach to data management by guaranteeing the security and integrity of medical records. These developments give BPO companies a competitive edge in addition to enhancing service quality.

Healthcare BPO Market Segmentation

The worldwide market for healthcare BPO is split based on services type, end user, and geography.

Healthcare BPO Services Type

- Provider Services

- Service

- Medical Document Management Services

- Pharmacy Information Management Services

- Laboratory Information Management Services

- Revenue Cycle Management Services

- Others

- Service

- Payer Services

- Service

- Claims Management

- Customer Relationship Management Services

- Billing and Accounts Management Services

- Fraud Detection Services

- Others

- Service

- Operational Services

- Service

- Supply Chain Management Services

- Business Process Management Services

- Others

- Service

- IT Infrastructure Management Services

The provider services category has the biggest market share in the healthcare BPO business because to its critical role in assisting healthcare providers such as hospitals and clinics. Market analysis underscores that the revenue cycle of healthcare organizations depends on these services, which encompass vital tasks like medical billing, coding, and transcribing. Providers can increase efficiency, cut expenses, and boost accuracy by outsourcing these responsibilities. provider services are the most popular category in the Healthcare BPO market due to the increasing demand for effective revenue management and the necessity of concentrating on essential patient care. This trend is projected to continue in the foreseeable future, making Provider Services a consistently dominant segment in the market.

Healthcare BPO End User

- Healthcare Providers

- Healthcare Payers

- Others

The healthcare providers category has the largest share in the healthcare BPO market due to its critical role in patient care. Market forecasts suggest that healthcare providers, which include clinics, hospitals, and other medical institutions, depend on business process outsourcing (BPO) to reduce the complexity of their non-core operations, such as processing claims, medical billing, and coding. By outsourcing these services, healthcare providers can increase operational efficiency and keep their primary focus on patient care. The ongoing and projected demand for BPO services is driven by the intricate administrative and financial procedures found in the healthcare sector, making the healthcare providers segment not only the largest but also a promising and sustained growth driver in the market.

Healthcare BPO Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Healthcare BPO Market Regional Analysis

North America continues to lead the global healthcare BPO market, driven by its early adoption of outsourcing practices, a multitude of healthcare providers, and well-established healthcare infrastructure. The intricacies of the U.S. healthcare system necessitate BPO services like coding, claims processing, and medical billing for effective revenue management. North America's healthcare sector constantly faces the challenge of cost reduction without compromising patient care. As a result, healthcare organizations increasingly rely on BPO to enhance cost-effectiveness and streamline non-core operations. The region's stringent regulatory framework, including the Health Insurance Portability and Accountability Act (HIPAA), reinforces the need for BPO service providers with expertise in healthcare data management. Market forecasts indicate that North America will maintain its dominance in the healthcare BPO market, with sustained growth expected in the foreseeable future.

Asia-Pacific experiences the fastest growth in the healthcare BPO market, attributed to several significant factors. The region's burgeoning healthcare industry benefits from a growing middle class, an expanding population, and improved healthcare access. The demand for specialized BPO services to manage intricate administrative and financial tasks is rising in parallel with the healthcare industry's growth. Asia-Pacific, known for its skilled workforce and cost-effective labor markets, attracts outsourcing to countries like the Philippines and India, renowned for their expertise in business process outsourcing (BPO) services. The region is witnessing increased adoption of digital healthcare solutions and innovative technologies, driving the demand for BPO services to support these technological advancements. Market analysis and forecasts confirm North America's dominance and project sustained growth in the Asia-Pacific healthcare BPO market.

Healthcare BPO Market Players

Some of the top healthcare BPO companies offered in our report include Accenture, Access Healthcare, Akurate Management Solutions, Cognizant, Firstsource Solutions, GeBBS Healthcare Solutions, Genpact, HCL Technologies, IBM Corporation, Infosys BPM, Invensis Technologies, IQVIA, Lonza, Mphasis, NTT Data Corporation, and Omega Healthcare.

Frequently Asked Questions

How big is the healthcare BPO market?

The market size of healthcare BPO was USD 248.3 billion in 2022.

What is the CAGR of the global healthcare BPO market from 2023 to 2032?

The CAGR of healthcare BPO is 10.7% during the analysis period of 2023 to 2032.

Which are the key players in the healthcare BPO market?

The key players operating in the global market are including Accenture, Access Healthcare, Akurate Management Solutions, Cognizant, Firstsource Solutions, GeBBS Healthcare Solutions, Genpact, HCL Technologies, IBM Corporation, Infosys BPM, Invensis Technologies, IQVIA, Lonza, Mphasis, NTT Data Corporation, and Omega Healthcare.

Which region dominated the global healthcare BPO market share?

North America held the dominating position in healthcare BPO industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of healthcare BPO during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global healthcare BPO industry?

The current trends and dynamics in the healthcare BPO industry include increasing demand for cost-effective healthcare solutions, growing complexity of healthcare administrative tasks, expansion of healthcare infrastructure in emerging markets, and emphasis on compliance and data security in healthcare.

Which services type held the maximum share in 2022?

The provider services type held the maximum share of the healthcare BPO industry.