Hard Coatings Market | Acumen Research and Consulting

Hard Coatings Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

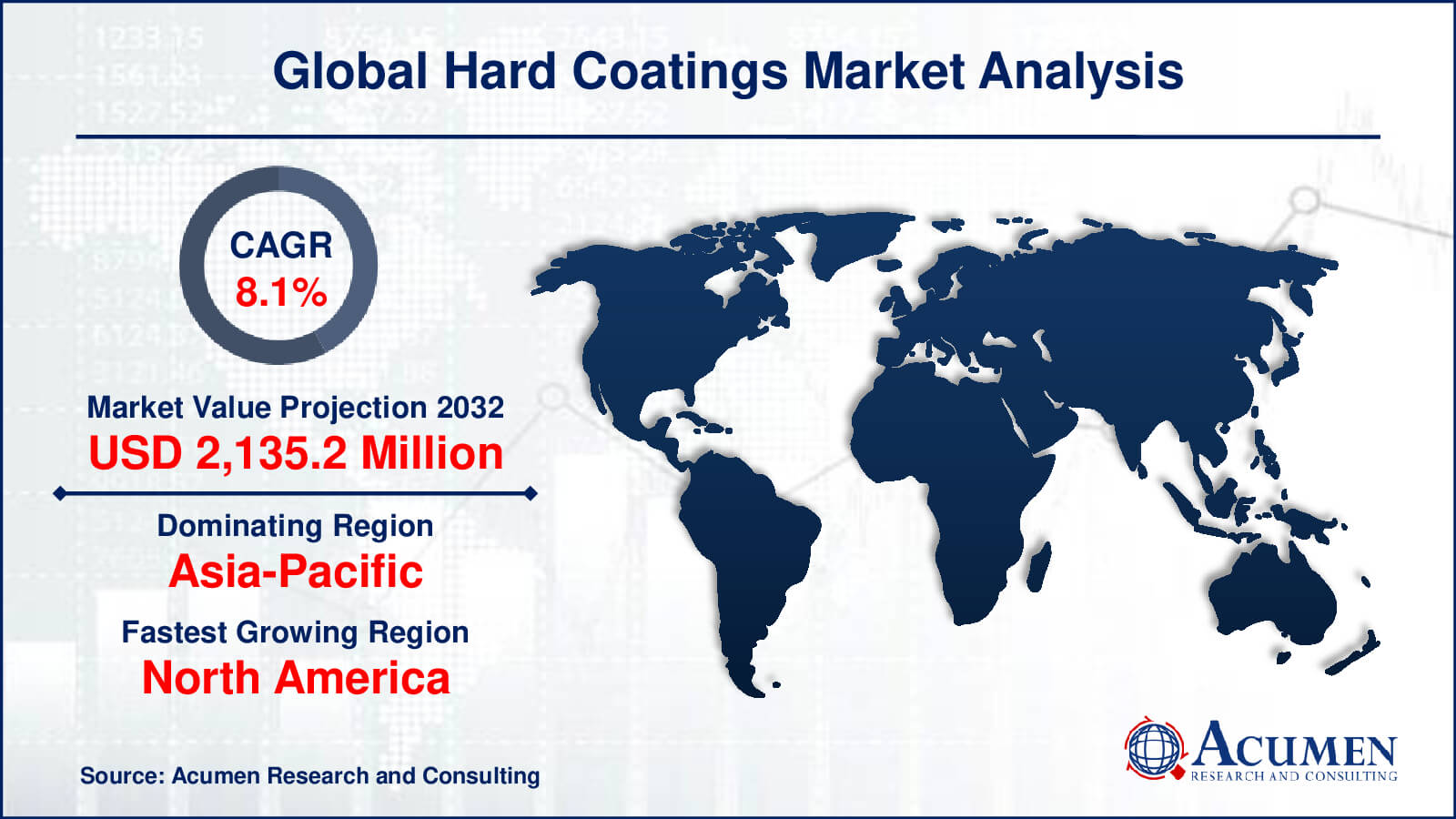

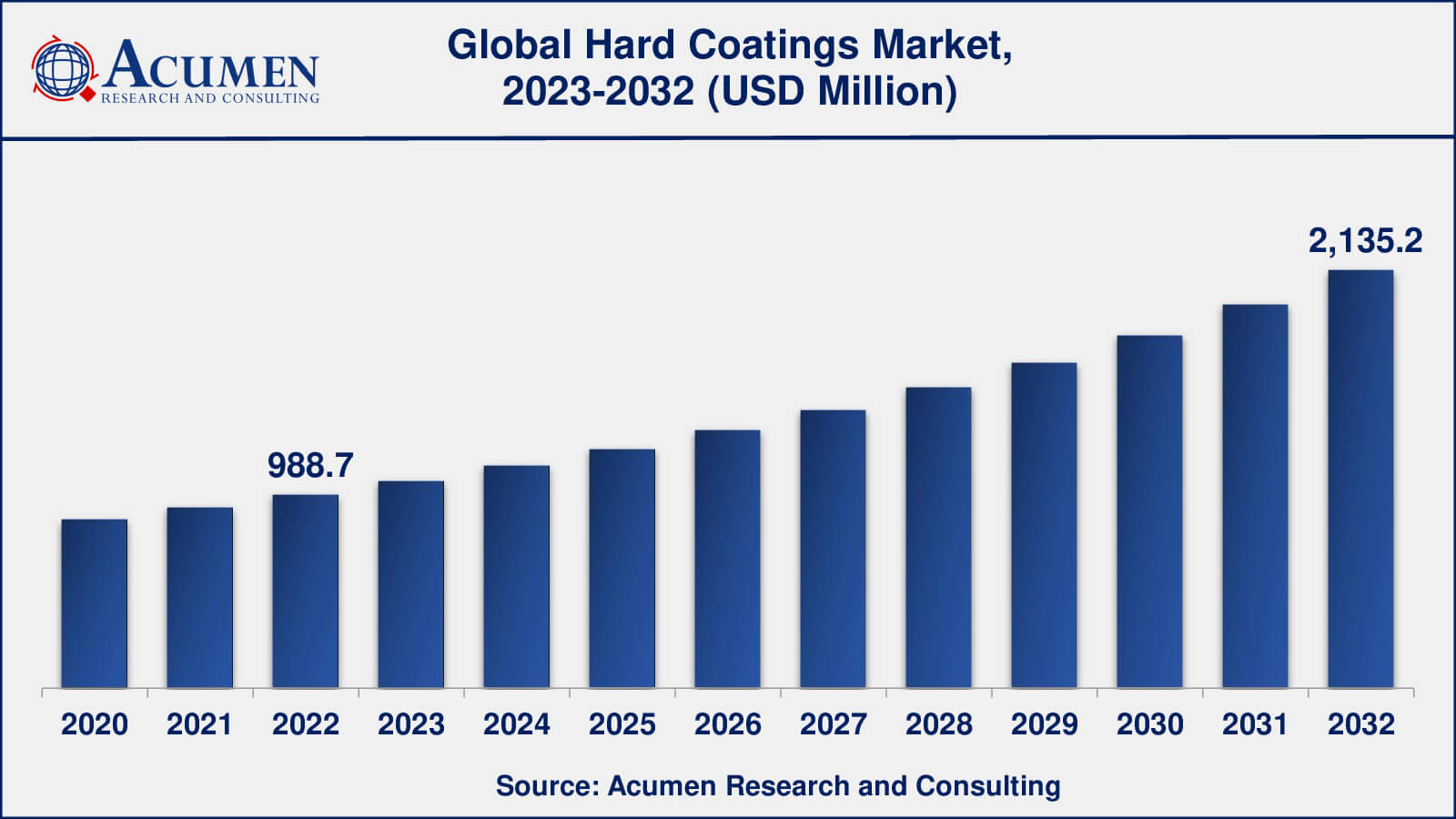

The Global Hard Coatings Market Size collected USD 988.7 Million in 2022 and is set to achieve a market size of USD 2,135.2 Million in 2032 growing at a CAGR of 8.1% from 2023 to 2032.

Hard Coatings Market Statistics

- Global hard coatings market revenue is estimated to reach USD 2,135.2 million by 2032 with a CAGR of 8.1% from 2023 to 2032

- Asia-Pacific hard coatings market value occupied around USD 445 million in 2022

- North America hard coatings market growth will register a CAGR of around 8% from 2023 to 2032

- Among deposition technique, the physical vapor deposition (PVD) sub-segment generated over US$ 543 million revenue in 2022

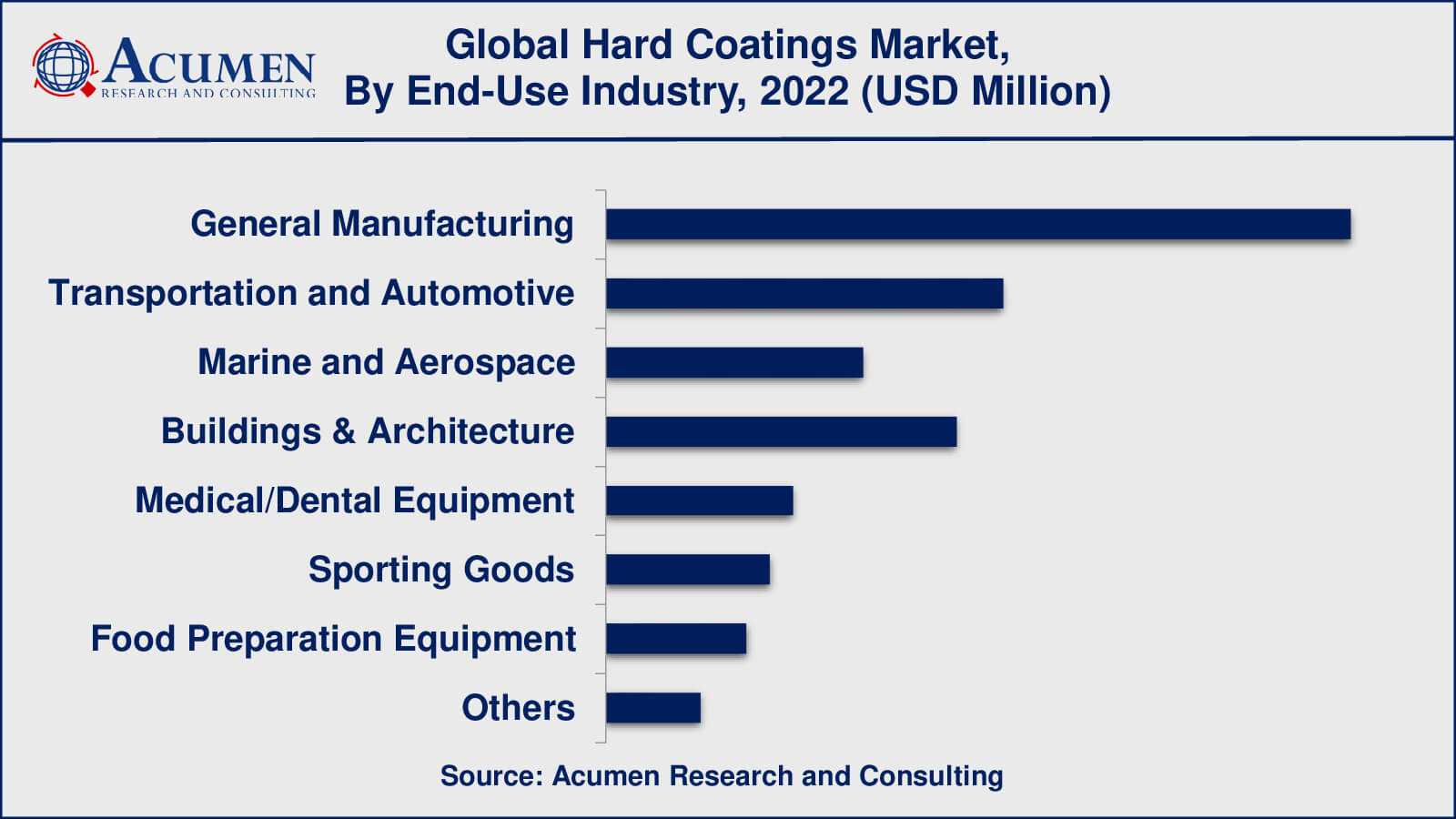

- Based on end-use industry, the general manufacturing sub-segment generated around 32% share in 2022

- Advancements in coating technologies is a popular hard coatings market trend that fuels the industry demand

Hard coating materials can be easily deposited by several deposition techniques including CVD and PVD. PVD is considered to be the most widely used technique across different industries. The cutting tools industry was the first to opt for PVD technology and is expected to continue the significant application of PVD technology to replace traditional deposition techniques.

Key factors supporting the demand for aforementioned techniques include less time intensity and greater durability. Moreover, major applications of these techniques are automotive, precision aerospace parts, industrial gas turbines, and medical instruments. The use of hard coatings in the field of medical instruments and biomedicals to enhance the overall wear resistance as well as to boost the biocompatibility of dental implants and prosthetics are some other key factors anticipated to augment the growth of the global hard coatings market. Ceramic, metal, polymer, and intermetallic are some of the most prevalent products in the global thermal spray coating industry. They are employed on several surfaces to achieve feasible and longer life spans under difficult operating situations. These coatings are widely used in the manufacture of high-strength steels to be applied in LPG cylinders to avoid corrosion cracking. In addition, increasing scope in wear-resistant coating, engineering coating, biomedical, automotive & aerospace, electronics, food processing, energy, and semiconductors are some other key aspects anticipated to fuel the demand for hard coatings over the forecast period.

Global Hard Coatings Market Dynamics

Market Drivers

- Increasing demand from various end-use industries

- Growing demand for durable and long-lasting coatings

- Rising consumer awareness about the benefits of hard coatings

Market Restraints

- High material costs associated with hard coatings

- Stringent regulations and environmental concerns

- Limited availability of skilled labor and specialized equipment

Market Opportunities

- Increasing adoption of hard coatings in the medical sector

- Growing investments in research and development

Hard Coatings Market Report Coverage

| Market | Hard Coatings Market |

| Hard Coatings Market Size 2022 | USD 988.7 Million |

| Hard Coatings Market Forecast 2032 | USD 2,135.2 Million |

| Hard Coatings Market CAGR During 2023 - 2032 | 8.1% |

| Hard Coatings Market Analysis Period | 2020 - 2032 |

| Hard Coatings Market Base Year | 2022 |

| Hard Coatings Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Material Type, By Deposition Technique, By Application, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ASB Industries, Inc., CemeCon, Dhake Industries, Inc., DIARC-Technology Oy, Duralar Technologies, Exxene Corporation, HardCoatings, OC Oerlikon Corporation AG, IHI Ionbond AG, Sulzer Ltd., Zeiss Group, Momentive Performance Materials, Inc., SDC Technologies, Inc., Kobelco, MBI Coatings, Ultra Optics, Platit AG, The Eifeler Group, and Gencoa Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Hard Coatings Market Growth Factors

Increasing awareness among consumers regarding the benefits of hard coatings is a key factor fueling the demand for hard coatings across the globe. However, deposition techniques for the application of hard coatings need greater investments and are generally capital-intensive in nature. These factors are considered to be some of the key restraints in the global corrosion coatings market. The rapid adoption of hard coatings in general manufacturing and other related end-use industries wherein the demand for high material performances are high, and large scale hard coating techniques has brought a huge number of benefits.

Hard Coatings Market Segmentation

The worldwide market for hard coatings is categorized based on material type, deposition technique, application, end-use industry, and geography.

Hard Coatings Industry Material Type Outlook

- Carbides

- Oxides

- Nitrides

- Multi-Component Coatings

- Carbon-Based

- Borides

Carbides have historically been the most extensively used and dominant material type in the hard coatings market, according to hard coatings industry analysis. This is due to carbides' high hardness and wear resistance, which make them suitable for a wide range of applications in industries such as automotive, aerospace, cutting tools, and machining.

Other materials, such as nitrides and oxides, have gained popularity in recent years due to their distinct properties and performance advantages. Because of their superior performance and properties, multi-component coatings, which can combine various material types, are also gaining popularity. Carbon-based coatings are also widely used in certain industries, such as the semiconductor and electronics industries, because they offer excellent adhesion and wear resistance. Borides are a fairly new and emerging material type in the hard coatings market, with significant potential for future growth.

Hard Coatings Industry Deposition Technique Outlook

- PVD

- CVD

The physical vapor deposition (PVD) process has historically had the largest share in the hard coatings market due to its capacity to create high-quality coatings with outstanding adhesion and wear resistance capabilities. In the commonly used deposition method known as PVD, a solid material is first vaporized in a vacuum chamber, and then the vapor is condensed onto a substrate to create a thin film coating. PVD coatings have great adhesion to a variety of substrates, including metals, ceramics, and polymers, and may be applied at low temperatures.

Another well-liked deposition method in the hard coatings market is chemical vapor deposition (CVD), which employs the chemical reaction of gaseous precursors on a heated substrate to produce a solid coating. Higher temperatures can be used to deposit CVD coatings, which provide good control over the composition and structure of the coating. Cutting tools and turbine parts are two examples of applications where CVD coatings are frequently employed because they require great temperature tolerance.

Hard Coatings Industry Application Outlook

- Optics

- Decorative Coatings

- Cutting Tools

- Cams

- Bearings

- Gears

- Hydraulic/Pneumatic Components

- Cylinders

- Others (Firearms, Implants and Injection Molding Dies)

The market for hard coatings has historically been dominated by cutting tools because of the high demand for wear-resistant coatings in the machining and tooling sectors. Hard coatings can increase tool life, increase cutting speeds, and reduce tool wear, resulting in increased productivity and cost savings.

Hard coatings are used to provide scratch resistance, anti-reflective properties, and other functional properties in the manufacture of lenses, mirrors, and other optical components. Hard coatings are used to provide durability and scratch resistance in the production of decorative items such as watches, jeweler, and fashion accessories. Hard coatings are used in the manufacture of bearings to provide wear resistance and friction reduction. Hard coatings are used in the manufacture of gears to increase wear resistance and performance.

Hard Coatings Industry End-Use Industry Outlook

- General Manufacturing

- Transportation and Automotive

- Marine and Aerospace

- Railroad

- Buildings & Architecture

- Medical/Dental Equipment

- Sporting Goods

- Food Preparation Equipment

- Others (Textile, Nuclear Plants and Defense/Military)

According to the hard coating market forecast, transportation and automotive will account for the lion's share from 2023 to 2032. Because of the high demand for wear-resistant coatings in engine and transmission components, cutting tools, and other applications, the transportation and automotive industries have historically dominated the hard coatings market. Hard coatings can increase component life, decrease maintenance costs, and improve performance, resulting in increased productivity and cost savings in the transportation and automotive industries.

Hard coatings are used to provide wear durability and enhance component life in a variety of manufacturing applications such as metal forming, plastic injection molding, and machining. In the marine and aerospace industries, hard coatings are used to provide wear resistance as well as corrosion protection in harsh environments. Hard coatings are used in buildings and architecture to provide scratch resistance and improve surface durability. Hard coatings are used to provide wear resistance and biocompatibility in medical and dental equipment applications.

Hard Coatings Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

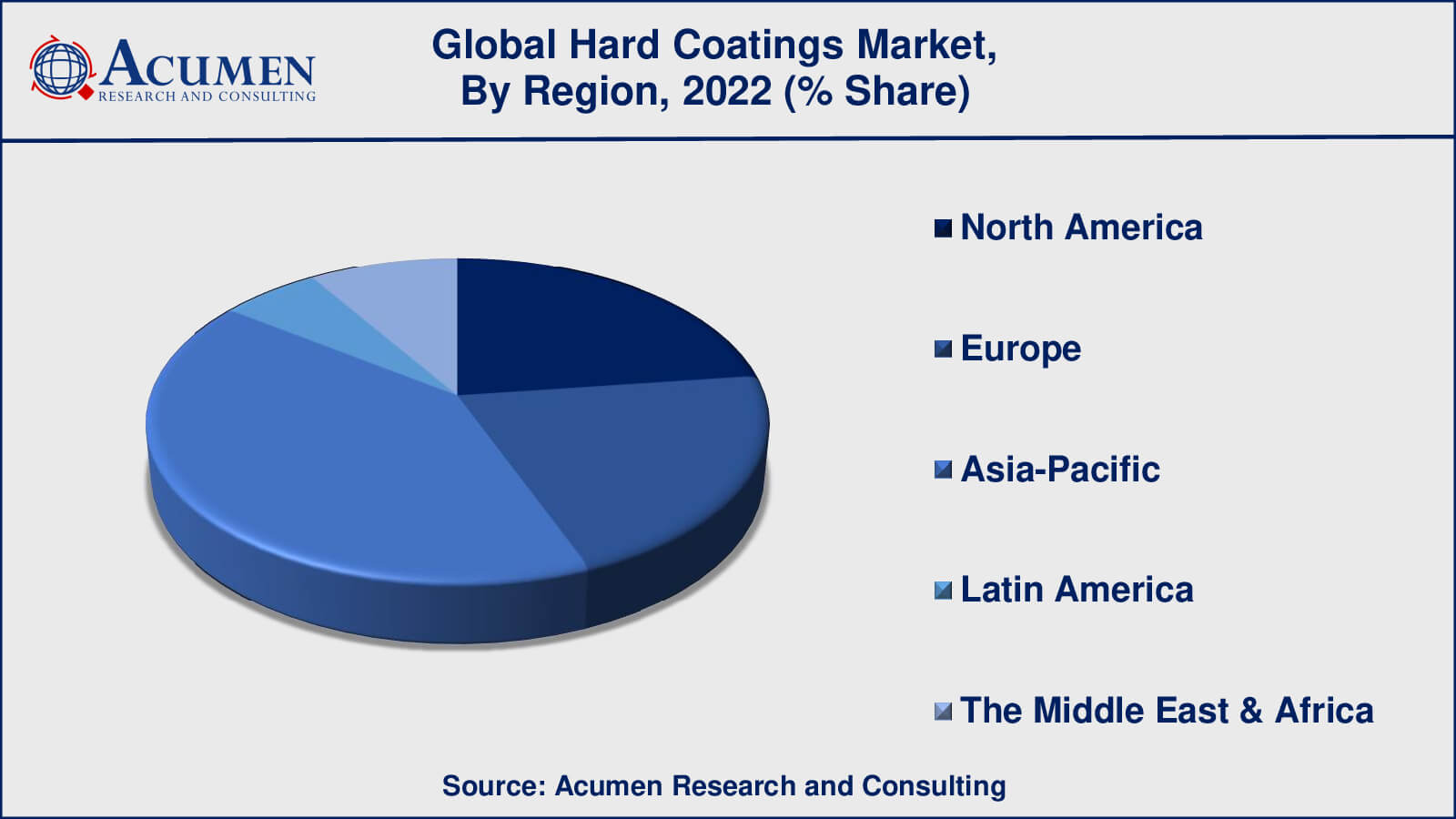

Hard Coatings Market Regional Analysis

The Asia-Pacific region is the largest market for hard coatings, owing to rapid growth in manufacturing in countries such as China, India, Japan, and South Korea. Several major manufacturers of cutting tools, automotive components, and other applications requiring hard coatings are located in the region.

Demand for hard coatings in North America is driven by industries such as automotive, aerospace, and general manufacturing. Several major manufacturers of medical equipment, aerospace components, and other applications that require hard coatings are located in the region.

Hard Coatings Market Players

Some of the hard coatings companies include ASB Industries, Inc., CemeCon, Dhake Industries, Inc., DIARC-Technology Oy, Duralar Technologies, Exxene Corporation, HardCoatings, OC Oerlikon Corporation AG, IHI Ionbond AG, Sulzer Ltd., Zeiss Group, Momentive Performance Materials, Inc., SDC Technologies, Inc., Kobelco, MBI Coatings, Ultra Optics, Platit AG, The Eifeler Group, and Gencoa Inc.

Frequently Asked Questions

What was the market size of the global hard coatings in 2022?

The market size of hard coatings was USD 988.7 million in 2022.

What is the CAGR of the global hard coatings market from 2023 to 2032?

The CAGR of hard coatings is 8.1% during the analysis period of 2023 to 2032.

Which are the key players in the hard coatings market?

The key players operating in the global market are including ASB Industries, Inc., CemeCon, Dhake Industries, Inc., DIARC-Technology Oy, Duralar Technologies, Exxene Corporation, HardCoatings, OC Oerlikon Corporation AG, IHI Ionbond AG, Sulzer Ltd., Zeiss Group, Momentive Performance Materials, Inc., SDC Technologies, Inc., Kobelco, MBI Coatings, Ultra Optics, Platit AG, The Eifeler Group, and Gencoa Inc.

Which region dominated the global hard coatings market share?

Asia-Pacific held the dominating position in hard coatings industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of hard coatings during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global hard coatings industry?

The current trends and dynamics in the hard coatings industry include increasing demand from various end-use industries, growing demand for durable and long-lasting coatings, and rising consumer awareness about the benefits of hard coatings

Which material type held the maximum share in 2022?

The carbides material type held the maximum share of the hard coatings industry.