Hand Held Surgical Instruments Market | Acumen Research and Consulting

Hand-Held Surgical Instruments Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

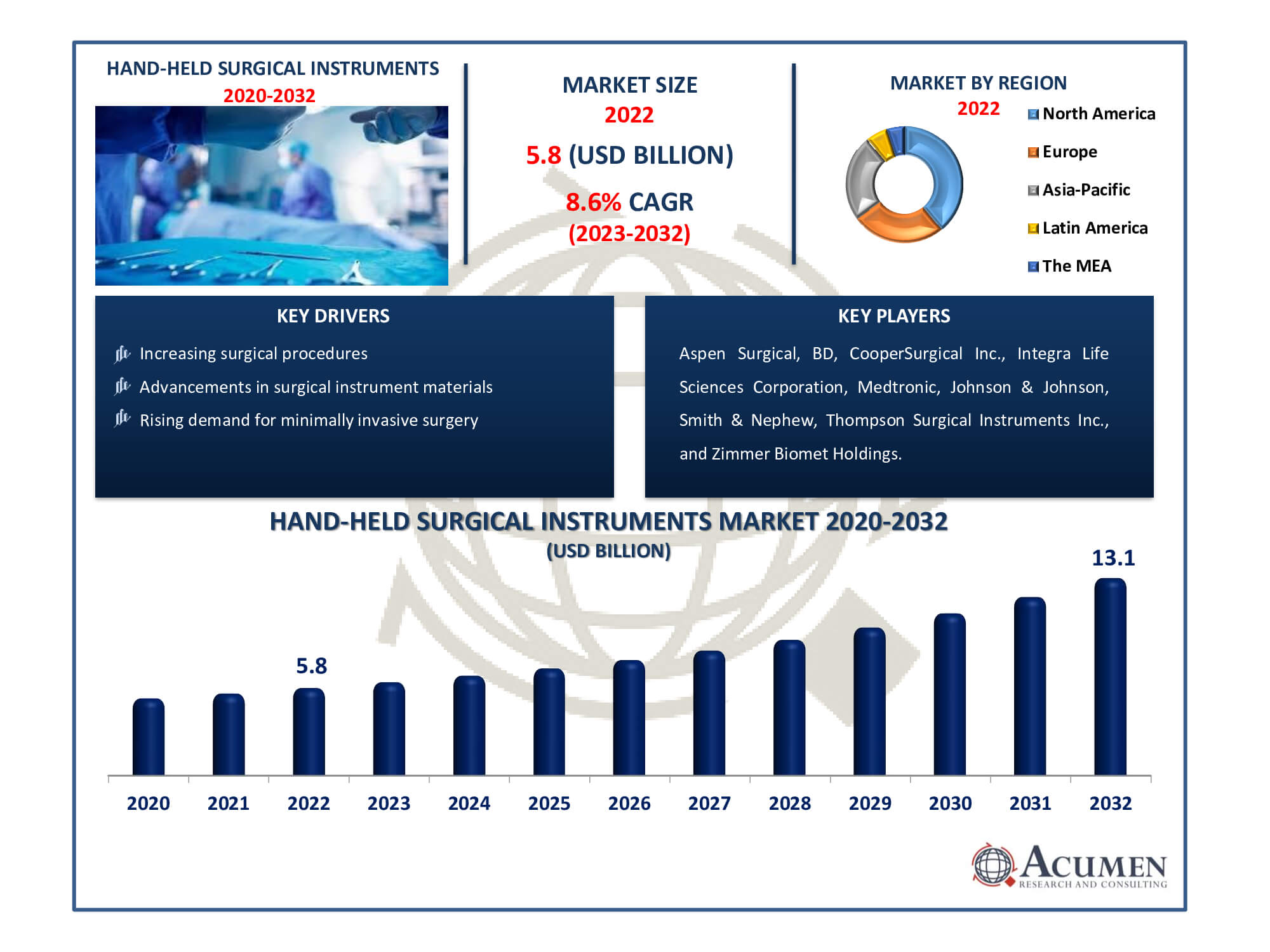

The Hand-Held Surgical Instruments Market Size accounted for USD 5.8 Billion in 2022 and is estimated to achieve a market size of USD 13.1 Billion by 2032 growing at a CAGR of 8.6% from 2023 to 2032.

Hand-Held Surgical Instruments Market Highlights

- The global hand-held surgical instruments market is set to achieve revenue of USD 13.1 billion by 2032

- The hand-held surgical instruments market is experiencing a CAGR of 8.6% from 2023 to 2032

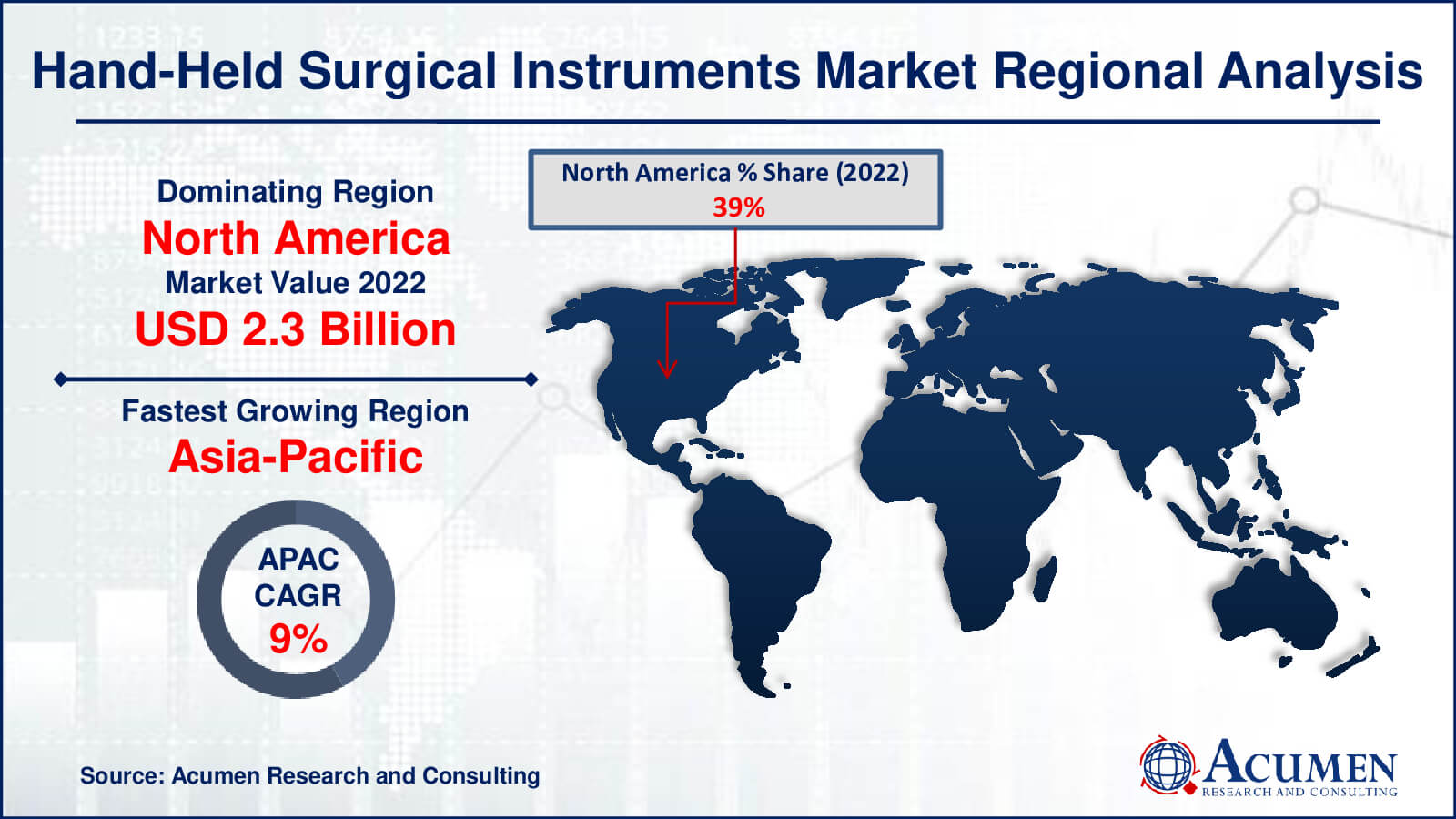

- In 2022, North America dominated the hand-held surgical instruments market with USD 2.3 billion in revenue

- The Asia-Pacific market is likely to witness CAGR of over 9% from 2023 to 2032

- Among product, the forceps sub-segment generated revenue exceeding USD 1.2 Billion in 2022

- In terms of end-use, the hospitals sub-segment accounted for approximately 69% of the market share in 2022

- Increasing demand for patient-specific or procedure-specific surgical instruments is a notable hand-held surgical instruments market trend

Hand-held surgical instruments are precise equipment that surgeons and medical professionals utilize throughout various surgical operations. These devices are precisely created to meet the delicate and specialized demands of orthopedic procedures, including bone and joint surgery, fracture treatment, and soft tissue manipulation. Because of the frequency of orthopedic disorders such as fractures, joint replacements, and sports-related injuries, there has been a steady and solid need for this specialized equipment. The worldwide ageing population, as well as increased interest in sports and physical activities, has increased the significance of orthopedic surgical tools, making them a cornerstone of the larger hand-held surgical equipment market.

Global Hand-Held Surgical Instruments Market Dynamics

Market Drivers

- Increasing surgical procedures

- Advancements in surgical instrument materials

- Rising demand for minimally invasive surgery

Market Restraints

- Stringent regulatory approvals

- High costs associated with advanced instruments

- Potential risk of infections

Market Opportunities

- Expanding healthcare infrastructure in developing regions

- Rising geriatric population

- Adoption of surgical robots for enhanced precision

Hand-Held Surgical Instruments Market Report Coverage

| Market | Automotive Simulation Market |

| Automotive Simulation Market Size 2022 | USD 5.8 Billion |

| Automotive Simulation Market Forecast 2032 | USD 13.1 Billion |

| Automotive Simulation Market CAGR During 2023 - 2032 | 8.6% |

| Automotive Simulation Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Aspen Surgical, B. Braun Melsungen AG, Becton, Dickinson and Company, CooperSurgical Inc., Integra Life Sciences Corporation, Johnson & Johnson, Medtronic, Smith & Nephew, Thompson Surgical Instruments Inc., and Zimmer Biomet Holdings. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Hand-Held Surgical Instruments Market Insights

The market is expected to be driven by an increase in the number of surgeries performed and a rise in the prevalence of chronic diseases. Additionally, the growing number of accidents, including road accidents, worldwide is contributing to the demand for these surgical instruments.

The increasing prevalence of chronic illnesses, such as neurological, infectious, cardiovascular, and urological diseases, is anticipated to drive the market. According to the World Federation of Neurology, 12 out of every 100 patients die due to neurological illnesses. Cardiovascular diseases are also leading to a higher number of heart surgeries. For example, coronary artery bypass grafting (CABG) is a common surgical procedure to unblock the coronary arteries. The increasing burden of these diseases has led to the development of treatments and therapies, thereby increasing the demand for handheld surgical instruments.

Hand-Held Surgical Instruments Market Segmentation

The worldwide market for hand-held surgical instruments is segmented into product, application, end-use, and geography.

Hand-Held Surgical Instrument Products

- Forceps

- Retractors

- Dilators

- Graspers

- Scalpels

- Cannulas

- Dermatome

- Trocars

- Others

According to hand-held surgical instruments industry analysis, forceps products have dominated due to their diverse and crucial function in numerous surgical operations. Forceps are precise devices that enable surgeons to grab and move tissues, organs, and other structures during surgery with precision and control. Their extensive application in activities such as tissue manipulation, dissection, and vascular occlusion makes them an essential component of surgical practice in a variety of surgical specialties. Forceps are in great demand since they are used in practically all surgical operations, from general surgery to specialized specialties such as neurosurgery, cardiovascular surgery, and orthopedics. Their important significance in guaranteeing surgical accuracy and patient safety helps to explain their market domination in hand-held surgical tools.

Hand-Held Surgical Instrument Applications

- Orthopedic Surgery

- Cardiology

- Ophthalmology

- Wound Care

- Audiology

- Thoracic Surgery

- Urology & Gynecology Surgery

- Plastic Surgery

- Neurosurgery

- Others

In the hand-held surgical instrument market, orthopedic surgery applications have risen to dominance due to their pivotal role in a wide spectrum of orthopedic procedures. These instruments are meticulously designed for the intricate and specialized needs of orthopedic surgeries, encompassing tasks related to bone and joint surgery, fracture management, and soft tissue manipulation. The prevalence of orthopedic conditions, such as fractures, joint replacements, and sports-related injuries, has led to a consistent and robust demand for these specialized instruments. The global aging population and the growing interest in sports and physical activities have further fueled the prominence of orthopedic surgical instruments, making them a cornerstone of the broader hand-held surgical instrument market. Their critical role in enhancing patients' mobility, relieving pain, and improving their overall quality of life firmly establishes orthopedic surgery as the dominant application within this market.

Hand-Held Surgical Instrument End-Uses

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Others

In the market for hand-held surgical instruments, hospitals have emerged as the dominant end-use sector, and this can be attributed to several key factors. Hospitals are the primary hub for a wide range of surgical procedures, from routine surgeries to complex, specialized interventions. The demand for hand-held surgical instruments is consistently high in hospital settings due to the diverse medical services they offer, including orthopedic, cardiovascular, neurosurgery, obstetrics and gynecology, and many others. Moreover, hospitals are equipped with a range of operating rooms and specialized units, where these instruments find extensive use in ensuring surgical precision and patient care. Additionally, the large patient inflow at hospitals necessitates a comprehensive inventory of surgical instruments, further boosting their dominance in this sector.

Hand-Held Surgical Instruments Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Hand-Held Surgical Instruments Market Regional Analysis

In 2022, North America led the market, driven by the increasing prevalence of chronic diseases such as cardiovascular diseases, neurological disorders, cancer, diabetes, and autoimmune diseases. According to the World Bank, in 2015, there were 4,511 surgeries per 100,000 people in the U.S., a factor that has contributed to the regional market's growth. The World Health Organization (WHO) reports that the burden of non-communicable diseases is highest in the European region and is expected to continue growing at a high rate in the future. According to the European Road Safety Observatory Annual Accident Report for 2017, over 1,079,720 road injuries were reported in 2015. With the increasing number of surgeries, the demand for surgical instruments is rising in the region.

In Asia-Pacific, the growing geriatric population is one of the central factors driving the market. One of the central factors driving the market in the Asia-Pacific region is the growing geriatric population. According to the National Census report of 2015, nearly 26.7% of Japan's total population is aged 65 years or older, leading to a high prevalence of chronic diseases in the country. The hand-held surgical instruments market can be categorized by application into neurosurgery, cardiovascular surgery, orthopedic surgery, plastic and reconstructive surgery, obstetrics and gynecology, and others. The 'others' category, which includes general surgery, urologic surgery, thoracic surgery, wound closure, and microvascular surgery, held the largest share of revenue in 2017. The increase in the number of general surgical procedures is a key factor driving the growth of this segment.

Hand-Held Surgical Instruments Market Players

Some of the top hand-held surgical instruments companies offered in our report include Aspen Surgical, B. Braun Melsungen AG, Becton, Dickinson and Company, CooperSurgical Inc., Integra Life Sciences Corporation, Johnson & Johnson, Medtronic, Smith & Nephew, Thompson Surgical Instruments Inc., and Zimmer Biomet Holdings.

Frequently Asked Questions

How big is the hand-held surgical instruments market?

The hand-held surgical instruments market collected USD 5.8 billion in 2022.

What is the CAGR of the hand-held surgical instruments market from 2023 to 2032?

The CAGR of hand-held surgical instruments is 8.6% during the analysis period of 2023 to 2032.

Which are the key players in the hand-held surgical instruments market?

The key players operating in the global market are Aspen Surgical, B. Braun Melsungen AG, Becton, Dickinson and Company, CooperSurgical Inc., Integra Life Sciences Corporation, Johnson & Johnson, Medtronic, Smith & Nephew, Thompson Surgical Instruments Inc., and Zimmer Biomet Holdings.

Which region dominated the global hand-held surgical instruments market share?

North America held the dominating position in hand-held surgical instruments industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of hand-held surgical instruments during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global hand-held surgical instruments Industry?

The current trends and dynamics in the hand-held surgical instruments industry include increasing surgical procedures, advancements in surgical instrument materials, and rising demand for minimally invasive surgery.

Which product held the maximum share in 2022?

The forceps product held the maximum share of the hand-held surgical instruments Industry.