Halal Products Market | Acumen Research and Consulting

Halal Products Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

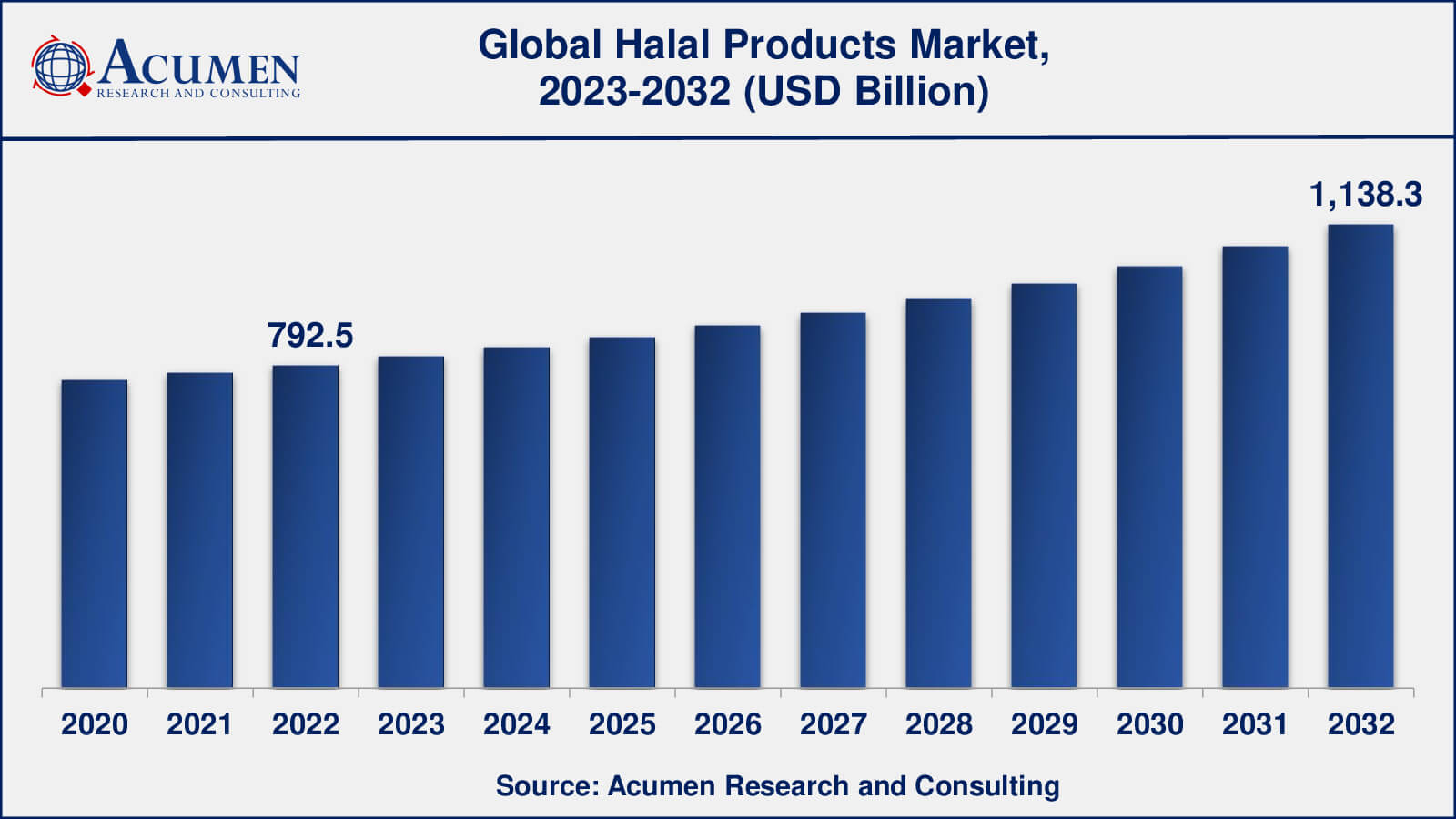

The Global Halal Products Market Size collected USD 792.5 Billion in 2022 and is set to achieve a market size of USD 1,138.3 Billion in 2032 growing at a CAGR of 3.8% from 2023 to 2032.

Halal Products Market Statistics

- Global halal products market revenue is estimated to reach USD 1,138.3 billion by 2032 with a CAGR of 3.8% from 2023 to 2032

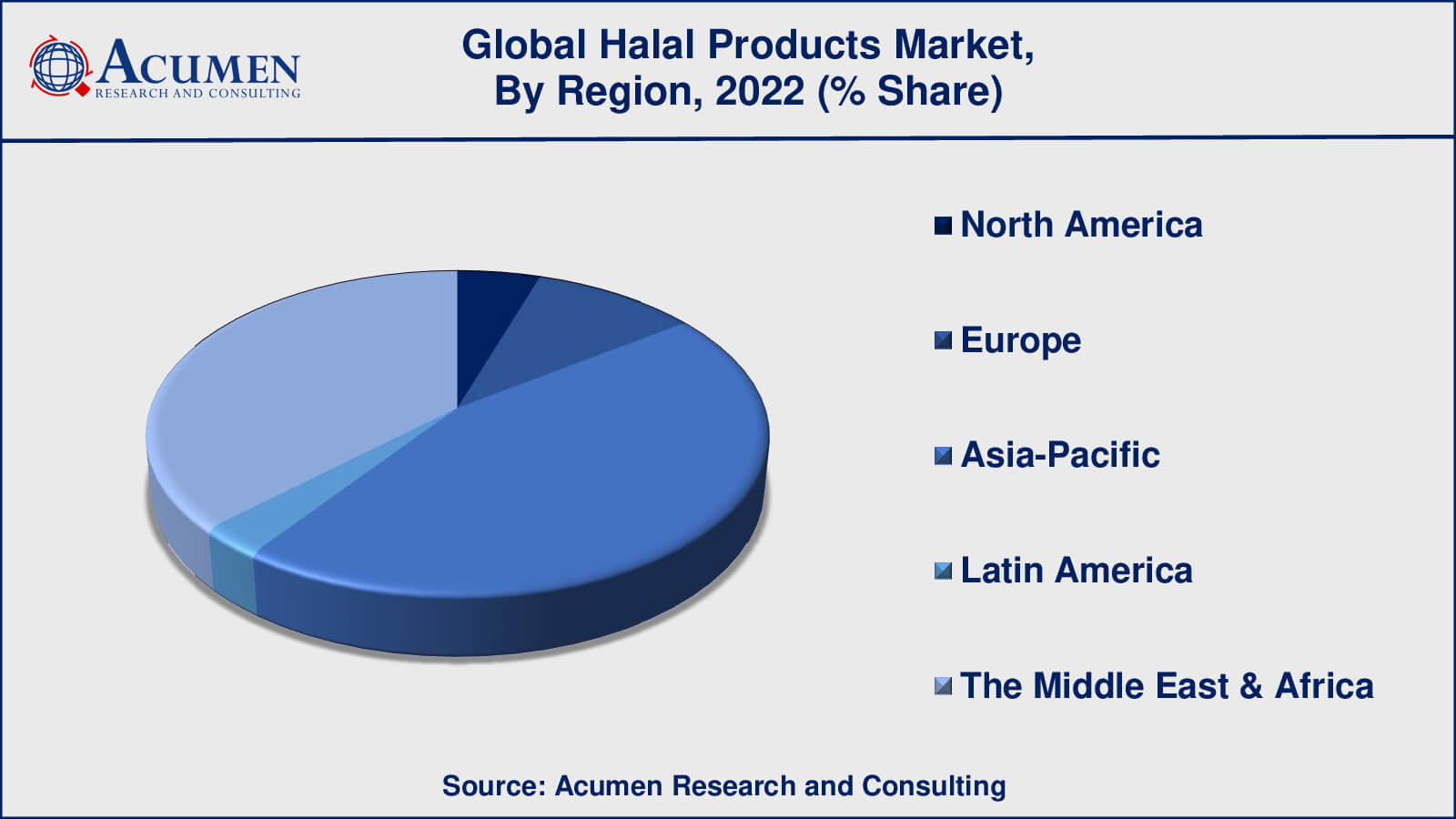

- Asia-Pacific halal products market value occupied more than USD 475.5 billion in 2022

- Asia-Pacific halal products market growth will register a CAGR of around 4% from 2023 to 2032

- Among product, the meat sub-segment generated over US$ 396 billion revenue in 2022

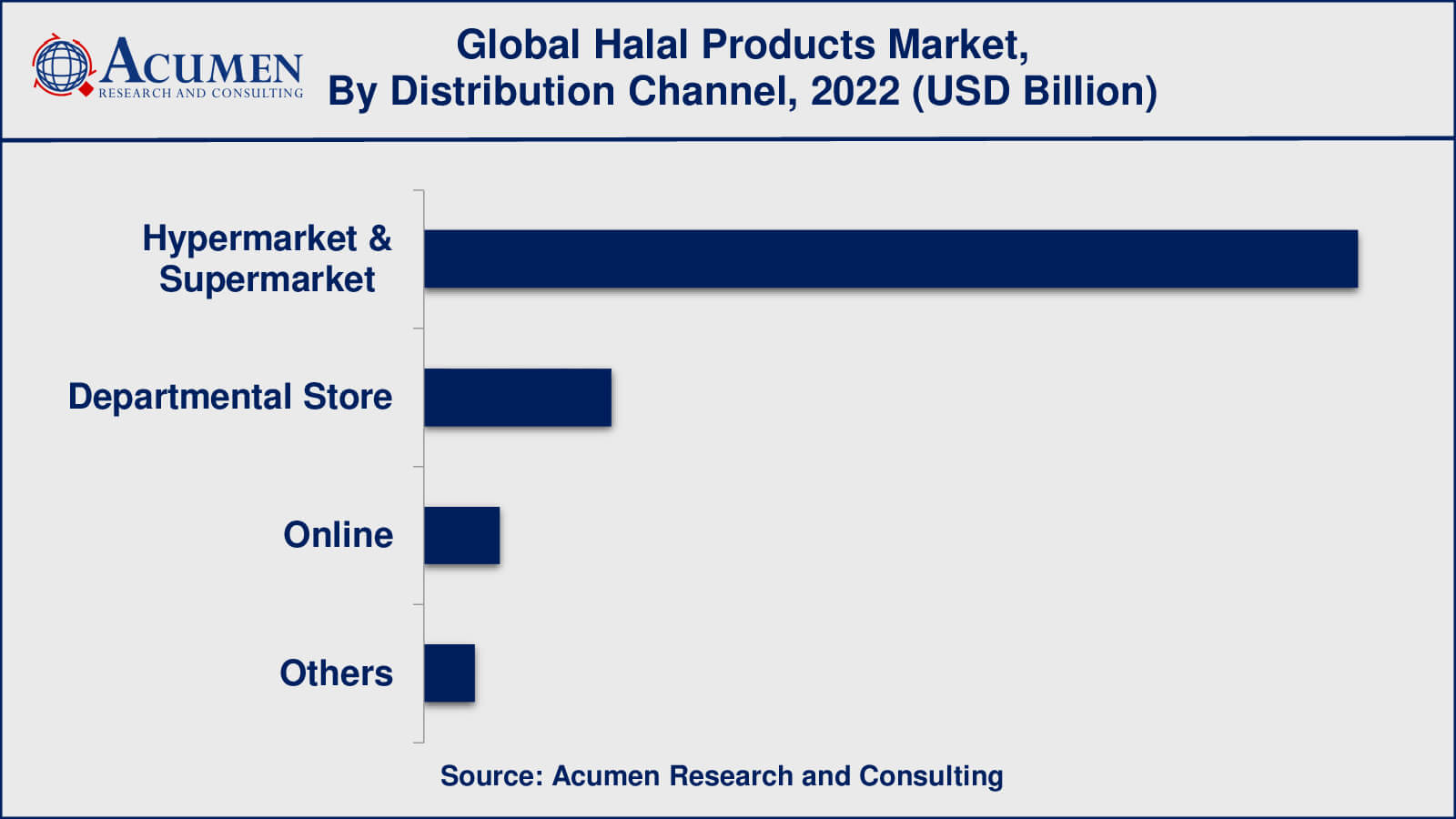

- Based on distribution channel, the hypermarket and supermarket sub-segment generated around 75% share in 2022

- Growing demand for halal-certified products is a popular halal products market trend that fuels the industry demand

Halal is an Arabic word meaning permissible. Halal food adheres to the food habits and rules of Islamic laws and is defined in the Kuran. The Islamic way of koshering animals is by killing them by putting a cut to the carotid artery, jugular vein, and windpipe. Moreover, according to the Halal law, animals should be healthy and alive at the time of their slaughter and all the blood after cutting the jugular vein should be drained through the carcass. During the process of an animal’s slaughter, a Muslim should recite shahada or tasmiya, generally, a dedication considered a ritual. Various people debate about the aspects of halal including the allowance of stunning. According to the Halal Food Authority, a non-profit organization that maintains and monitors the rules and regulations on the production of halal meat, stunning should not be used to slaughter an animal. Stunning is only allowed if the animal manages to survive after the first cut and is killed by the halal process thereafter. Various food providers offer halal foods and related products such as spring rolls, halal foie gras, ravioli, chicken nuggets, pizza, lasagna, and baby food among others. Stunned food products may contain by-products or other such animal body parts which do not permit Muslims to use on their bodies or eat. Till the last few years, halal food was processed exclusively for Muslims but now halal food is consumed across the globe by all ethnic backgrounds and religions since halal food is popular for its hygiene, safety, and ethical quality. This is a key factor analyzed to drive the global halal product market over the forecast period.

Global Halal Products Market Dynamics

Market Drivers

- Growing muslim population

- Increasing awareness of halal

- Rising demand for halal food

- Strong industry partnerships

Market Restraints

- Lack of standardization

- Limited access to halal products

- High production costs

Market Opportunities

- Growing halal cosmetics industry

- Increase in halal tourism

Halal Products Market Report Coverage

| Market | Halal Products Market |

| Halal Products Market Size 2022 | USD 792.5 Billion |

| Halal Products Market Forecast 2032 | USD 1,138.3 Billion |

| Halal Products Market CAGR During 2023 - 2032 | 3.8% |

| Halal Products Market Analysis Period | 2020 - 2032 |

| Halal Products Market Base Year | 2022 |

| Halal Products Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Nestlé S.A, Cargill, Incorporated, Unilever, Saffron Road, Nema Company, Al Hamara, Prima Agri, Reinert Group, Pure Ingredients, Cleone Foods, Al-Falah Halal Foods, Eggelbusch, Crown Chicken, Shaheen Foods, Euro Foods Group, Tesco, Sickendiek Fleischwarenfabrik Gmbh & Co. Kg, Sainsbury's and Marks & Spencer. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Halal Products Market Growth Factors

One of the key factors boosting the global halal food market is rising awareness about halal food among consumers of all religions across the globe. Moreover, increasing awareness about halal food products globally through social media and other backgrounds, as well as rising demand for cleaner and more hygienic food derivatives across the Islamic population of the world are some other major factors accelerating the growth of the global halal food & beverage market over the forecast period. Furthermore, the halal food market is expanding over the coming years and its demand for new varieties is in turn anticipated to increase over the coming years. Moreover, rising awareness regarding halal food products and new and better ways of slaughtering animals is anticipated to pose a positive impact on the global halal food products market.

Halal Products Market Segmentation

The worldwide market for halal products is categorized based on product, application, distribution channel, and geography.

Halal Products Industry Product Outlook

- Meat

- Poultry

- Bakery and Confectionery

- Dairy Products

- Canned And Frozen Food

- Others

According to the halal products industry analysis, meat products dominate the halal food market. This is due to the fact that halal meat is a fundamental requirement for Muslim consumers and an essential component of their diet. Muslims are required to consume only halal meat that has been prepared in accordance with Islamic dietary laws, such as the animal being slaughtered by a Muslim who recites Allah's name and the animal being free of certain defects and diseases.

As a result, demand for halal meat is significant and growing globally, particularly in Muslim-majority countries such as Indonesia, Pakistan, Bangladesh, and Turkey. Other halal food product categories, such as poultry, nutraceuticals & dietary supplements, bakery and confectionery, canned and frozen food, and others, are growing in demand as Muslim and non-Muslim consumers become more aware of halal products.

Halal Products Industry Application Outlook

- Food & Beverages

- Nutraceuticals & Dietary Supplements

- Infant Formula

- Animal Feed Industry

- Others

The halal products market is dominated by the food and beverage application. This is due to the fact that halal food is a fundamental requirement for Muslim consumers and an important part of their daily diet. Muslims are required to consume only halal food, which is prepared in accordance with Islamic dietary laws, such as not containing pork or alcohol, being prepared and processed in accordance with halal methods, and being free of certain defects or diseases.

As a result, the demand for halal food is significant and growing globally, particularly in Muslim-majority countries such as Indonesia, Pakistan, Bangladesh, and Turkey. Meat, canned and frozen food, poultry, dairy products, bakery and confectionery, and other subcategories are all included in the halal food & beverages market application.

Halal Products Industry Distribution Channel Outlook

- Hypermarket & Supermarket

- Departmental Store

- Online

- Others

Hypermarkets and supermarkets are expected to dominate the halal products market distribution channels, according to the halal products market forecast. This is due to the fact that hypermarkets and supermarkets offer a wide variety of halal food products under one roof, making it easy for Muslim consumers to purchase their daily halal food requirements. Furthermore, in order to attract customers, hypermarkets and supermarkets offer a variety of promotional activities and discounts on halal food products, which contributes to this distribution channel's dominance.

However, with the rising penetration of the internet and the ease of shopping online, the online distribution channel is rapidly growing in popularity. Online shopping allows consumers to buy halal food products from the comfort of their own homes and offers a wider variety of halal food products from different regions that may not be available in local supermarkets.

Halal Products Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Halal Products Market Regional Analysis

The Asia-Pacific region dominates the halal products market, with the highest market share. This is because countries with a large Muslim population, such as Indonesia, Malaysia, Pakistan, and India, are major consumers of halal products. The rising demand for halal products in China and Japan is also fueling the region's halal product market growth.

Another important market for halal products is the Middle East and Africa region. The region has a sizable Muslim population, and demand for halal products is rising as people become more aware of halal certification and the availability of a diverse range of halal products.

The market for halal goods is expanding quickly in Europe as a result of the rise in Muslim immigrants and the desire for halal goods among non-Muslim consumers. The three biggest markets in Europe for halal goods are the UK, Germany, and France.

Halal Products Market Players

Some of the halal products companies include Nestlé S.A, Cargill, Incorporated, Unilever, Saffron Road, Nema Company, Al Hamara, Prima Agri, Reinert Group, Pure Ingredients, Cleone Foods, Al-Falah Halal Foods, Eggelbusch, Crown Chicken, Shaheen Foods, Euro Foods Group, Tesco, SickendiekFleischwarenfabrik, Sainsbury's and Marks & Spencer.

Frequently Asked Questions

What was the market size of the global halal products in 2022?

The market size of halal products was USD 792.5 billion in 2022.

What is the CAGR of the global halal products market from 2023 to 2032?

The CAGR of halal products is 3.8% during the analysis period of 2023 to 2032.

Which are the key players in the halal products market?

The key players operating in the global market are including Nestlé S.A, Cargill, Incorporated, Unilever, Saffron Road, Nema Company, Al Hamara, Prima Agri, Reinert Group, Pure Ingredients, Cleone Foods, Al-Falah Halal Foods, Eggelbusch, Crown Chicken, Shaheen Foods, Euro Foods Group, Tesco, SickendiekFleischwarenfabrik, Sainsbury's and Marks & Spencer.

Which region dominated the global halal products market share?

Asia-Pacific held the dominating position in halal products industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of halal products during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global halal products industry?

The current trends and dynamics in the halal products industry include growing muslim population, increasing awareness of halal, and rising demand for halal food

Which product held the maximum share in 2022?

The meat product held the maximum share of the halal products industry.