Halal Food and Beverages Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Halal Food and Beverages Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

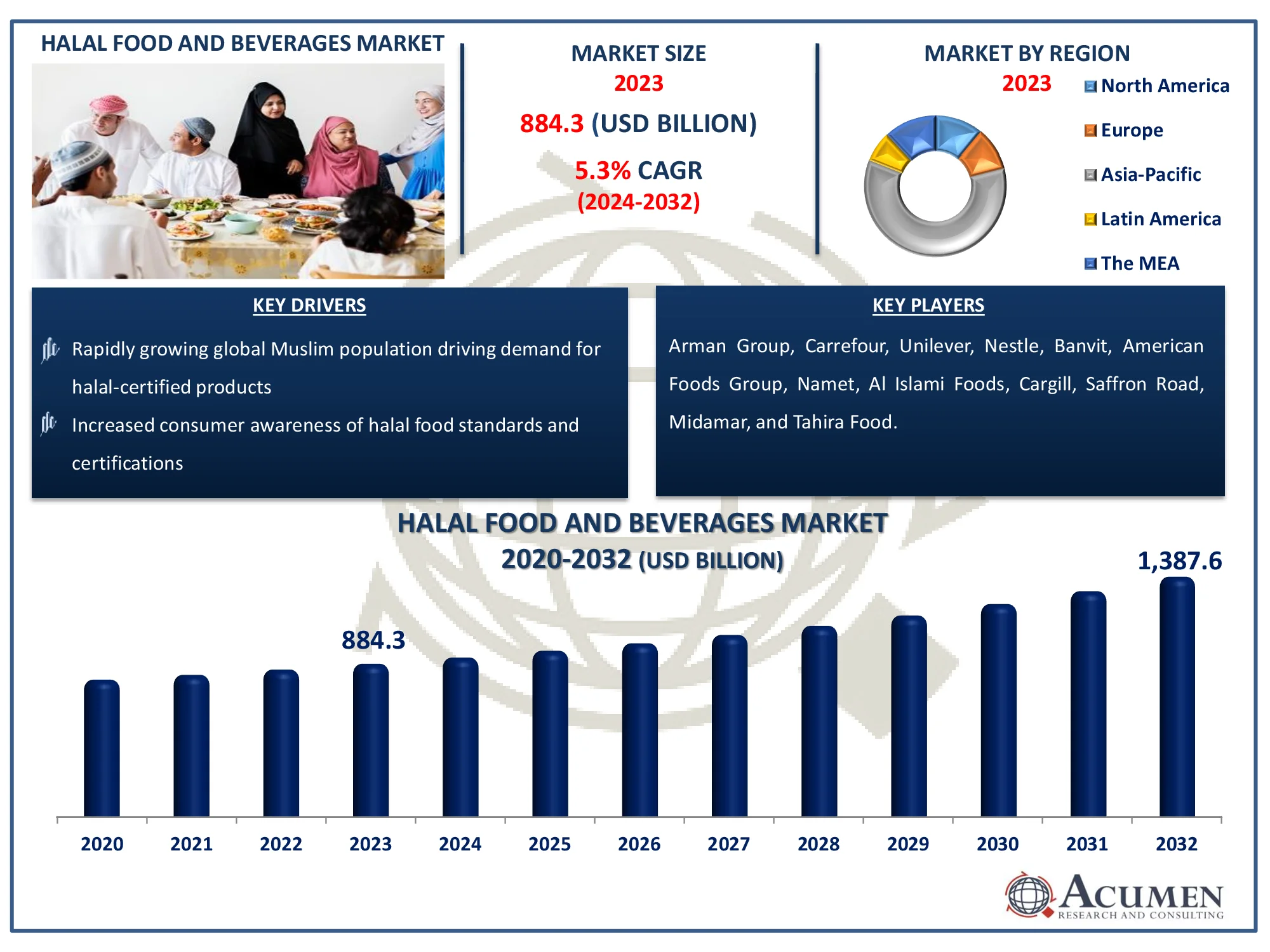

The Global Halal Food and Beverages Market Size accounted for USD 884.3 Billion in 2023 and is estimated to achieve a market size of USD 1,387.6 Billion by 2032 growing at a CAGR of 5.3% from 2024 to 2032.

Halal Food and Beverages Market Highlights

- Global halal food and beverages market revenue is poised to garner USD 1,387.6 billion by 2032 with a CAGR of 5.3% from 2024 to 2032

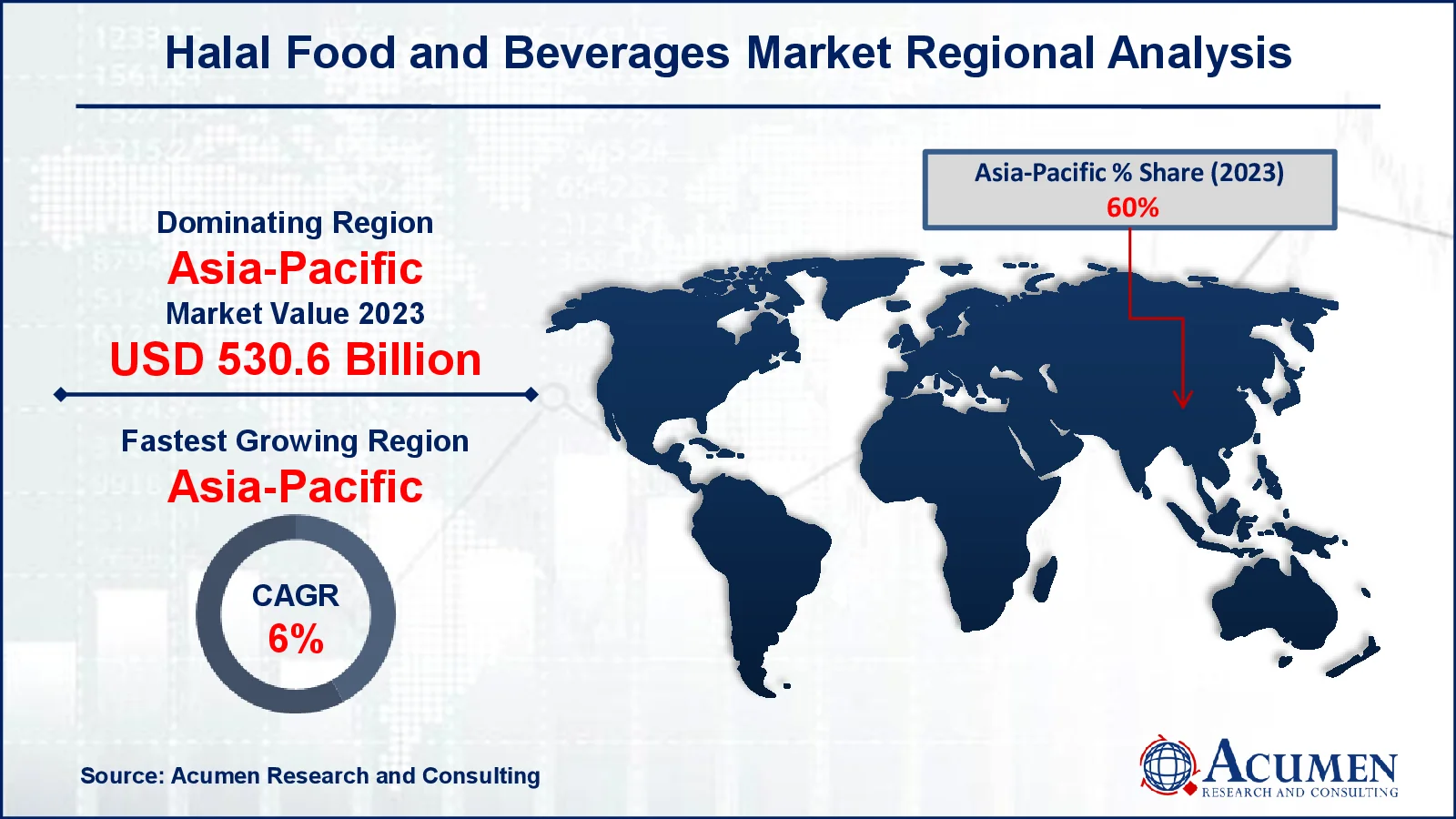

- Asia-Pacific halal food and beverages market value occupied around USD 530.6 billion in 2023

- Asia-Pacific halal food and beverages market growth will record a CAGR of more than 6% from 2024 to 2032

- Among product, the meat & alternatives sub-segment generated around USD 459.8 billion revenue in 2023

- Based on application, the hypermarkets/supermarket sub-segment generated 72% halal food and beverages market share in 2023

- Rising interest in halal food tourism and culinary experiences globally is a popular halal food and beverages market trend that fuels the industry demand

Halal is the term used to describe what is allowed or lawful under traditional Islamic law. It is usually used to describe approved foods and beverages. Halal foie gras, spring rolls, chicken nuggets, ravioli, lasagna, pizza, and baby food are among the many halal certified foods available. Pork is a common example of non-halal food product. Halal food is rapidly spreading in the United States. Total sales were driven by an expanding Muslim population as well as younger non-Muslim customers who consumed these dishes for non-religious reasons.

Global Halal Food and Beverages Market Dynamics

Market Drivers

- Rapidly growing global Muslim population driving demand for halal-certified products

- Increased consumer awareness of halal food standards and certifications

- Expansion of halal food production and distribution networks worldwide

- Rising demand for halal products among non-Muslim consumers due to perceived quality and hygiene

Market Restraints

- High costs associated with halal certification and compliance processes

- Limited availability of halal-certified products in some regions

- Challenges in maintaining consistent halal standards across global supply chains

Market Opportunities

- Growth of online retail channels for halal food and beverages

- Increasing adoption of halal certification in non-Muslim-majority countries

- Expanding innovation in halal plant-based and alternative protein products

Halal Food and Beverages Market Report Coverage

|

Market |

Halal Food and Beverages Market |

|

Halal Food and Beverages Market Size 2023 |

USD 884.3 Billion |

|

Halal Food and Beverages Market Forecast 2032 |

USD 1,387.6 Billion |

|

Halal Food and Beverages Market CAGR During 2024 - 2032 |

5.3% |

|

Halal Food and Beverages Market Analysis Period |

2020 - 2032 |

|

Halal Food and Beverages Market Base Year |

2023 |

|

Halal Food and Beverages Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Distribution Channel, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Arman Group, Midamar, Carrefour, Unilever, Nestle, Banvit, American Foods Group, Namet, Al Islami Foods, Cargill, Saffron Road, and Tahira Food. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Halal Food and Beverages Market Insights

The global halal food and beverages market is driving at a high speed during the forecast period 2024–2032, owing to the growing Muslim population and their considerably increasing spending on food & non-beverages. For instance, according to the Pew Research Center the global Muslim population is predicted to increase rapidly, from approximately 1.6 billion in 2010 to over 2.8 billion by 2050. This increase is expected to be twice as rapid as the overall global population. As a result, the proportion of Muslims in the global population is expected to increase from 23% in 2010 to 30% by 2050. In the recent years there has been an incredible demand for the halal food items owing to the varied tastes and interests of Muslim population across the globe.

Additionally, increasing standard of living, improved lifestyles, and growing disposable incomes across the globe are some of the major factors propelling the growth of the market. The market is expected to witness the considerable growth in coming years owing to the increasing demand for food supplements as a result of rising number of populations with malnutrition.

Halal Food and Beverages Market Segmentation

The worldwide market for halal food and beverages is split based on product, distribution channel, and geography.

Halal Food and Beverages Products

- Milk & Milk Products

- Meat & Alternatives

- Grain Products

- Fruits & Vegetables

- Others

According to halal food and beverages industry analysis, the market is divided into five major product categories: milk and milk products, meat and alternatives, grain products, fruits and vegetables, and others. The meat & alternatives section has the highest share, accounting for over 52% of the market. This dominance is linked to the rising global Muslim community, which places a high value on halal-certified beef products that follow rigorous religious rules. Increased consumer awareness of halal certification, as well as the global expansion of halal meat production and distribution networks, are driving the segment's growth. Furthermore, alternatives such as plant-based halal proteins are gaining popularity, increasing the segment's market share and appeal to a wide range of consumer groups.

Halal Food and Beverages Distribution Channels

- Hypermarkets/Supermarket

- Online

- Departmental Store

- Others

The halal food and beverage market is distributed via important channels such as hypermarkets/supermarkets, online platforms, department stores, and others. Among them, hypermarkets/supermarkets dominate, accounting for around 72% of the market. This significance stems from the convenience that these establishments provide, including a vast range of products and simple access to halal-certified goods. Their vast reach in urban and semi-urban areas assures a steady supply of halal food and beverages for a huge client base. Furthermore, supermarkets frequently include specialized halal aisles, which increase visibility and confidence among Muslim and non-Muslim customers. Promotional events, discounts, and on-site verification of halal certification labels all contribute to this distribution channel's supremacy.

Halal Food and Beverages Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Halal Food and Beverages Market Regional Analysis

Geographically, the global halal food and beverages market is segmented into four major regions such as North America, Europe, Asia Pacific (APAC), and Latin America, and Middle East & Africa (Latin America and MEA).

North America is expected to take notable the global halal food and beverages market share especially in U.S. during the forecast period 2024–2032. The U.S. is estimated to be the major consumer of meat products, and has an opened opportunity for the use of halal foods and beverages in this region. Moreover, increasing consumption of halal food and beverages products due to the changing consumer preference may uplift the growth of the market in this region.

Europe is expected to hold the around 10% share for the market growth during the forecast period. The Muslim population is increasing at a high rate owing to the immigration and high birth rates. The increasing awareness of health benefits and growing consumption of meat is driving the market in this region.

Asia-Pacific is expected to be the largest and fastest growing region in this industry during the halal food and beverages market forecasted period owing to the increasing demand for the meat and meat products and as well as high disposable income.

The Latin America and MEA is expected to be one of the growing regions as the demand for the halal food products is high across the Islamic countries such as Saudi Arabia, the United Arab Emirates, Kuwait, Bahrain, Oman, and Qatar due to religious norms which is predicted to result in significant revenue generation across the Middle East and African region.

Halal Food and Beverages Market Players

Some of the top halal food and beverages companies offered in our report include Arman Group, Midamar, Carrefour, Unilever, Nestle, Banvit, American Foods Group, Namet, Al Islami Foods, Cargill, Saffron Road, and Tahira Food.

Frequently Asked Questions

How big is the halal food and beverages market?

The halal food and beverages market size was valued at USD 884.3 billion in 2023.

What is the CAGR of the global halal food and beverages market from 2024 to 2032?

The CAGR of halal food and beverages is 5.3% during the analysis period of 2024 to 2032.

Which are the key players in the halal food and beverages market?

The key players operating in the global market are including Arman Group, Midamar, Carrefour, Unilever, Nestle, Banvit, American Foods Group, Namet, Al Islami Foods, Cargill, Saffron Road, and Tahira Food.

Which region dominated the global halal food and beverages market share?

Asia-Pacific held the dominating position in halal food and beverages industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of halal food and beverages during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global halal food and beverages industry?

The current trends and dynamics in the halal food and beverages industry include rapidly growing global Muslim population driving demand for halal-certified products, and increased consumer awareness of halal food standards and certifications.

Which distribution channel held the maximum share in 2023?

The hypermarkets/supermarket distribution channel held the maximum share of the halal food and beverages industry.