Gum Rosin Market | Acumen Research and Consulting

Gum Rosin Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

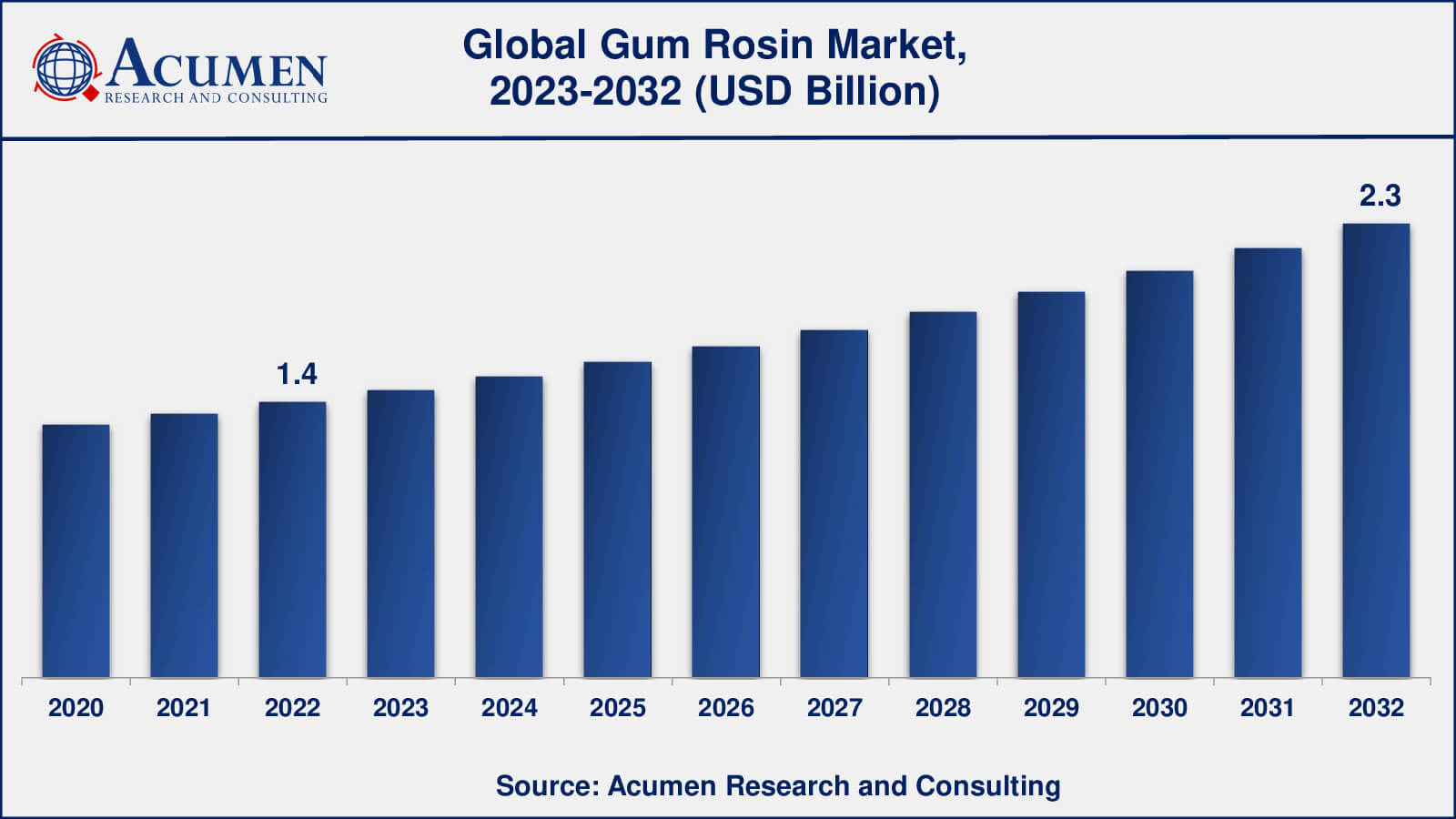

The global Gum Rosin Market size was valued at USD 1.4 Billion in 2022 and is projected to attain USD 2.3 Billion by 2032 mounting at a CAGR of 5.2% from 2023 to 2032.

Gum Rosin Market Highlights

- Global gum rosin market revenue is poised to garner USD 2.3 billion by 2032 with a CAGR of 5.2% from 2023 to 2032

- North America gum rosin market value occupied around USD 592 million in 2022

- Asia-Pacific gum rosin market growth will record a CAGR of more than 6% from 2023 to 2032

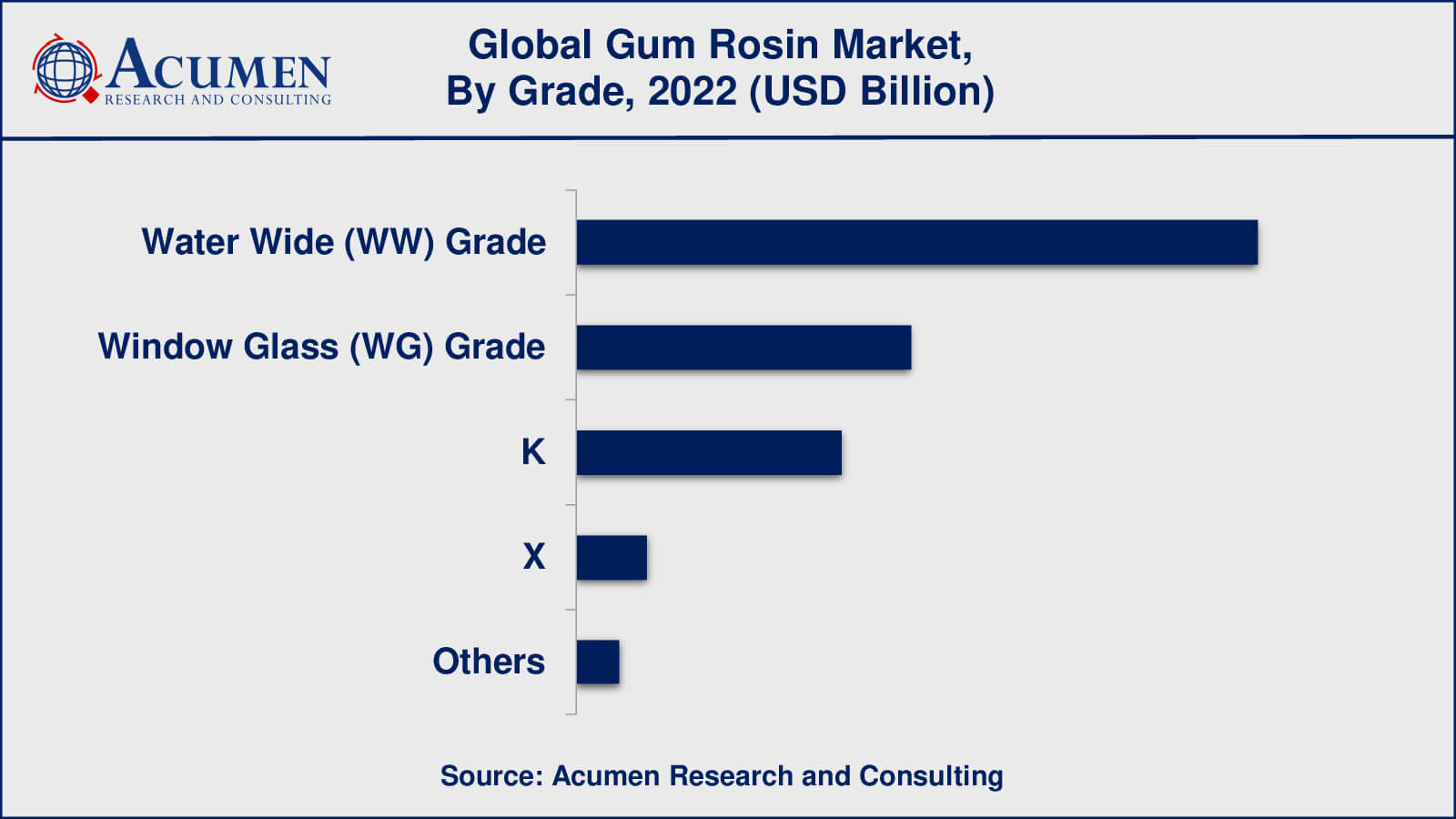

- Among grade, the water wide (WW) grade sub-segment occupied over US$ 690 million revenue in 2022

- Based on application, the adhesives & sealants sub-segment gathered around 49% share in 2022

- Expanding use of gum rosin in the pharmaceutical and food sectors is a popular gum rosin market trend that drives the industry demand

Gum rosin is a natural resin obtained from pine trees, namely the sap of Pinus taeda and Pinus elliottii. It is acquired via tapping, which involves making tiny incisions in the tree bark to release the sticky resin. The resin is then collected and processed into gum rosin, which are solid, clear, and brittle chunks or flakes. Gum rosin has been employed for ages in a variety of industries due to its unique qualities. It is a versatile substance with uses in adhesives, varnishes, inks, rubber manufacture, and even the creation of some forms of paper. Because of its tackiness and sticky characteristics, it is used in items such as glue sticks, tapes, and some types of coatings.

One of the most common applications for gum rosin is the manufacture of rosin-based products, notably rosin esters. These esters are produced by chemically altering gum rosin in order to improve its performance in various applications. Esterification with glycerol or pentaerythritol, for example, can produce rosin esters, which are used in printing inks and paints. Gum rosin is also used extensively in the music business. Rosin is used by musicians to increase friction and improve bow grip on violin, cello, and other string instrument strings. While playing, this allows for crisper and more resonant tones.

Global Gum Rosin Market Dynamics

Market Drivers

- Increasing demand for adhesives and sealants in various industries

- The growing popularity of rosin-based products in the paints and coatings industry

- Rising demand for printing inks in the packaging and publishing sectors

- Expanding applications of gum rosin in the rubber and tire manufacturing industry

- Growing adoption of rosin in the electronics and soldering industries

Market Restraints

- Environmental concerns and sustainability issues related to gum rosin extraction

- Competition from synthetic resins and alternative raw materials

- Fluctuations in the availability of pine trees and natural resin sources

- Price volatility due to changing supply-demand dynamics

- Stringent regulations and restrictions on the use of certain rosin derivatives

Market Opportunities

- Development of eco-friendly and sustainable rosin extraction methods

- Increasing investments in research and development for innovative rosin applications

- Growing demand for bio-based adhesives and materials in various industries

- Emerging markets in developing regions with untapped growth potential

Gum Rosin Market Report Coverage

| Market | Gum Rosin Market |

| Gum Rosin Market Size 2022 | USD 1.4 Billion |

| Gum Rosin Market Forecast 2032 | USD 2.3 Billion |

| Gum Rosin Market CAGR During 2023 - 2032 | 5.2% |

| Gum Rosin Market Analysis Period | 2020 - 2032 |

| Gum Rosin Market Base Year | 2022 |

| Gum Rosin Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Grade, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | DRT (Dérivés Résiniques et Terpéniques), Forestar Chemical Co., Ltd., Guangdong KOMO Co., Ltd., Indonesia Pinus, Ingevity Corporation, IRE, ISEGAUR, Kraton Corporation, Pinova Holdings, Inc., Resinall Corporation, Shanghai Lomon Corporation, and Wuzhou Sun Shine Forestry & Chemicals Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Gum Rosin Market Insights

The gum rosin market is impacted by a variety of dynamic variables that shape its demand, supply, and overall growth trajectory. The rising demand for adhesives and sealants in various sectors is one of the major forces fueling the market. Because of its tackiness and bonding capabilities, gum rosin is an important element in adhesive formulations, making it a favored choice for creating glue sticks, tapes, and other sticky products used in the construction, packaging, and automotive industries. Another motivator is the increasing popularity of rosin-based products in the paint and coatings sector. Rosin esters, which are generated from gum rosin, have great solubility and compatibility with a wide range of resins, allowing them to be used in high-performance coatings. They are widely utilized in paints, varnishes, and printing inks, helping to drive the gum rosin market forward.

The growing need for printing inks in the packaging and publishing industries is driving the gum rosin market. Rosin-based inks are popular because to their excellent adhesion, color stability, and printability, making them ideal for flexographic, gravure, and offset printing processes. Furthermore, gum rosin is widely used in the rubber and tire production industries. Its sticky and reinforcing qualities make it a key component in rubber compositions, improving tire and other rubber product durability and performance.

Despite these factors, the gum rosin industry confronts several challenges. The extraction of gum rosin has substantial environmental and sustainability hurdles. Unsustainable harvesting and deforestation can have a severe influence on pine tree populations, causing environmental deterioration and future supply shortages. Furthermore, the industry is being challenged by synthetic resins and other raw materials. Manufacturers and end-users may choose synthetic substitutes with comparable or superior performance characteristics, thus reducing demand for gum rosin in a variety of applications.

Another constraint impacting market dynamics is price volatility. Weather conditions, tree health, and geopolitical variables can all affect the availability of gum rosin, causing supply and price changes. Furthermore, severe laws and limitations on the usage of some rosin derivatives may hinder expansion. Some rosin derivatives may be hazardous to one's health and the environment, forcing regulatory agencies to set restrictions or seek alternatives.

Gum Rosin Market Segmentation

The worldwide market for gum rosin is split based on grade, application, and geography.

Gum Rosin Grades

- Water Wide (WW) Grade

- Window Glass (WG) Grade

- K

- X

- Others

According to a gum rosin industry research, the water wide (WW) grade has traditionally been more dominating and widely used in the market. Water white (WW) grade and window glass (WG) grade are two commonly used grades of gum rosin in adhesives, coatings, and inks. WW grade is noted for its pale colour and is frequently used in applications requiring colour purity. WG grade, on the other hand, is slightly deeper in colour but still suited for a wide range of applications. Grades designated by letters such as K, X, and Others are often specialised categories used by distinct suppliers or purchasers, and their qualities and uses may differ.

Gum Rosin Applications

- Adhesives & Sealants

- Printing Inks

- Paper Sizing

- Coating & Paints

- Soaps & Reagents

- Others

According to gum rosin market forecast, adhesives & sealants are predicted to lead the industry. Because of its tackiness and adhesive characteristics, gum rosin is an important element in the formulation of adhesives and sealants, and it is widely utilised in a variety of sectors, including construction, packaging, automotive, and woodworking. While the dominance of certain applications might shift over time as a result of shifting market needs and industry trends, adhesives and sealants have historically been among the leading users of gum rosin. Other uses such as printing inks, paper sizing, coatings and paints, soaps and reagents, and others add to the total demand for gum rosin, but adhesives and sealants have continuously been a major driving factor in the industry.

Gum Rosin Market Regional Segmentation

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Gum Rosin Market Regional Analysis

Asia-Pacific was a major user and producer of gum rosin. China was a market leader, with considerable gum rosin production and export. Other regional nations, such as Indonesia and Vietnam, also contributed to the market's expansion. The region's fast industrialization, construction, and automotive industries increased demand for adhesives, coatings, and rubber goods, which increased demand for gum rosin.

Another important market for gum rosin was North America, with the United States being a major user and importer. The use of gum rosin in different applications such as adhesives, inks, and coatings, as well as the presence of a well-established chemical industry, drove demand in North America. Europe accounts for a sizable portion of the gum rosin industry, with notable manufacturers including Finland, Portugal, and Greece. Gum rosin demand was boosted by the region's substantial presence in the coatings, paints, and adhesives sectors.

Gum Rosin Market Players

Some of the top gum rosin companies offered in our report include DRT (Dérivés Résiniques et Terpéniques), Forestar Chemical Co., Ltd., Guangdong KOMO Co., Ltd., Indonesia Pinus, Ingevity Corporation, IRE, ISEGAUR, Kraton Corporation, Pinova Holdings, Inc., Resinall Corporation, Shanghai Lomon Corporation, and Wuzhou Sun Shine Forestry & Chemicals Co., Ltd.

Frequently Asked Questions

What was the size of the global gum rosin market in 2022?

The size of gum rosin market was USD 1.4 billion in 2022.

What is the gum rosin market CAGR from 2023 to 2032?

The gum rosin market CAGR during the analysis period of 2023 to 2032 is 5.2%.

Which are the key players in the gum rosin market?

The key players operating in the global gum rosin market are including DRT (Dérivés Résiniques et Terpéniques), Forestar Chemical Co., Ltd., Guangdong KOMO Co., Ltd., Indonesia Pinus, Ingevity Corporation, IRE, ISEGAUR, Kraton Corporation, Pinova Holdings, Inc., Resinall Corporation, Shanghai Lomon Corporation, and Wuzhou Sun Shine Forestry & Chemicals Co., Ltd.

Which region dominated the global gum rosin market share?

Asia-Pacific region held the dominating position in gum rosin industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of gum rosin during the analysis period of 2023 to 2032.

What are the current trends in the global gum rosin industry?

The current trends and dynamics in the gum rosin industry include increasing demand for adhesives and sealants in various industries, growing popularity of rosin-based products in the paints and coatings industry, and rising demand for printing inks in the packaging and publishing sectors.

Which application held the maximum share in 2022?

The water wide (WW) grade application held the maximum share of the gum rosin industry.