Gravure Printing Inks Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Gravure Printing Inks Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

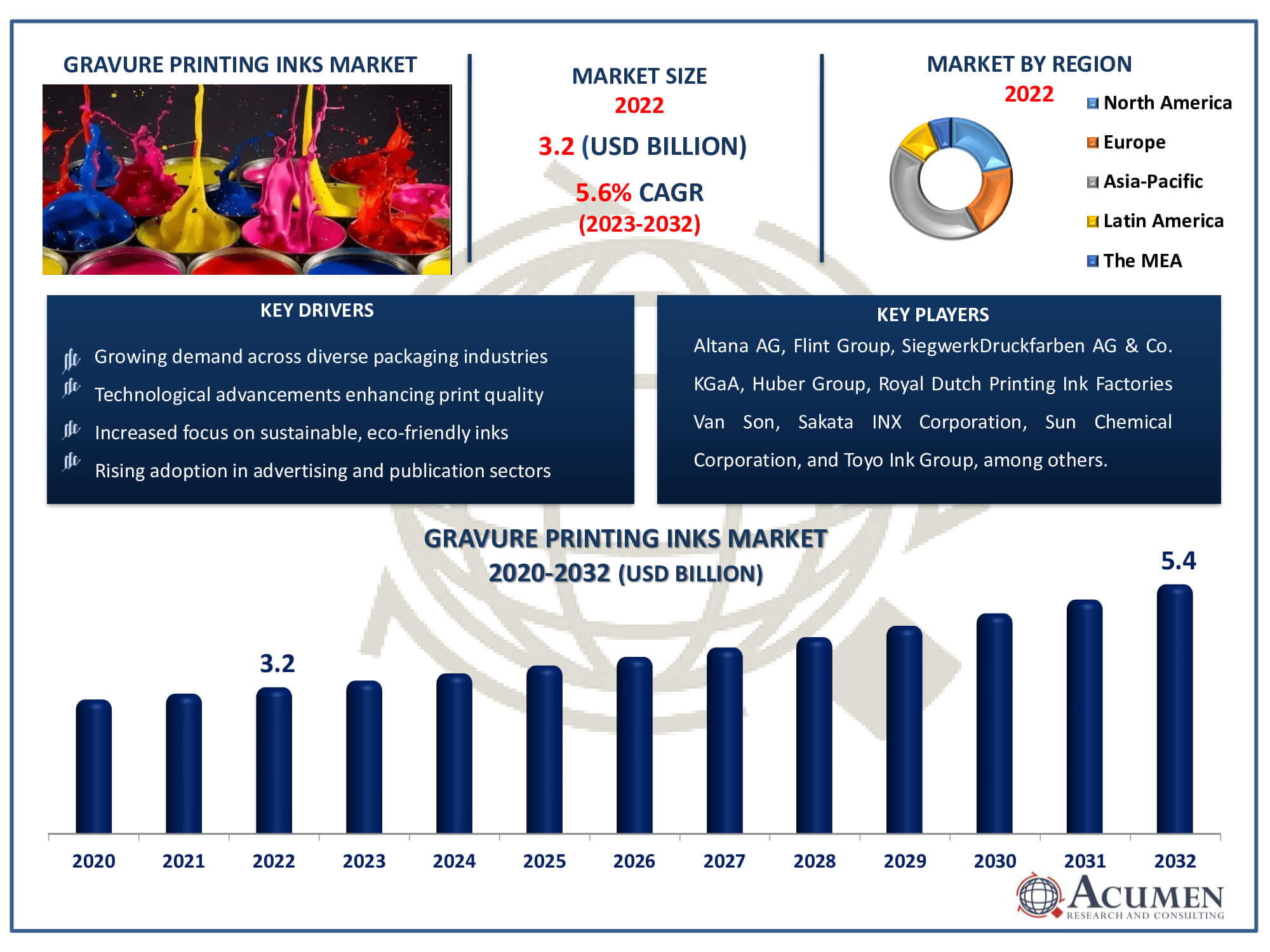

The Gravure Printing Inks Market Size accounted for USD 3.2 Billion in 2022 and is estimated to achieve a market size of USD 5.4 Billion by 2032 growing at a CAGR of 5.6% from 2023 to 2032.

Gravure Printing Inks Market Highlights

- Global gravure printing inks market revenue is poised to garner USD 5.4 billion by 2032 with a CAGR of 5.6% from 2023 to 2032

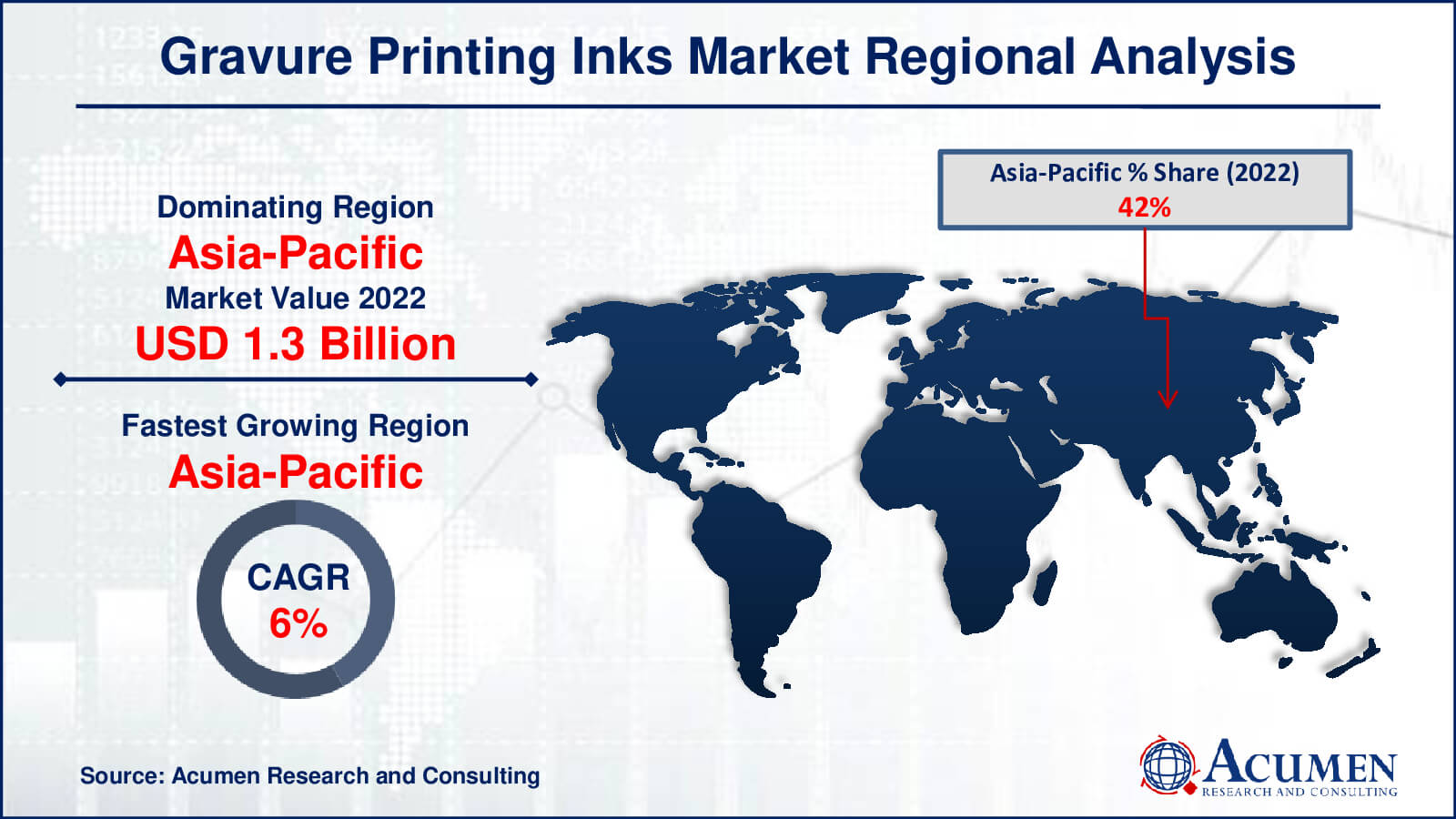

- Asia-Pacific gravure printing inks market value occupied around USD 1.3 billion in 2022

- Asia-Pacific gravure printing inks market growth will record a CAGR of more than 6% from 2023 to 2032

- Among resin, the nitrocellulose sub-segment generated around US$ 1 billion revenue in 2022

- Based on technology, the solvent-based sub-segment generated around 50% share in 2022

- Integration of digital technologies for hybrid printing solutions is a popular gravure printing inks market trend that fuels the industry demand

Gravure printing ink comprises solid resins, pigments, volatile solvents, additives, and fillers. It contains no vegetable oil, and its drying strategies generally involve volatile substances. Gravure printing involves etching and utilizes a rotary printing press. Solvents are used to dissolve or disperse all the solid components of the ink, wet the surface of the substrate, control the ink's drying rate, and modify its consistency to meet printing plate requirements. There are two main types: solvent-based and water-based. While solvent-based ink is fast-drying and requires less time to set, water-based ink is eco-friendly and takes longer to dry. Oil- and solvent-based printing inks have dominated the market for the past few years, while water-based printing ink is expected to grow as the fastest-growing segment. Printing is widely used on various surfaces, ranging from aluminum cans and plastic containers to paper. The primary raw materials for ink production are dyes, binders, solvents, and additives. The demand for gravure printing inks is rapidly increasing due to the expanding range of end-use applications and industries.

Global Gravure Printing Inks Market Dynamics

Market Drivers

- Growing demand across diverse packaging industries

- Technological advancements enhancing print quality

- Increased focus on sustainable, eco-friendly inks

- Rising adoption in advertising and publication sectors

Market Restraints

- Environmental concerns related to solvent-based inks

- Fluctuating prices of raw materials

- Regulatory challenges regarding ink compositions

Market Opportunities

- Expansion in emerging markets with rising printing needs

- Development of innovative specialty inks

- Shifting consumer preferences towards eco-conscious products

Gravure Printing Inks Market Report Coverage

| Market | Gravure Printing Inks Market |

| Gravure Printing Inks Market Size 2022 | USD 3.2 Billion |

| Gravure Printing Inks Market Forecast 2032 | USD 5.4 Billion |

| Gravure Printing Inks Market CAGR During 2023 - 2032 | 5.6% |

| Gravure Printing Inks Market Analysis Period | 2020 - 2032 |

| Gravure Printing Inks Market Base Year |

2022 |

| Gravure Printing Inks Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Resin, By Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Altana AG, Flint Group, SiegwerkDruckfarben AG & Co. KGaA, Huber Group, Royal Dutch Printing Ink Factories Van Son, Sakata INX Corporation, Sun Chemical Corporation, Toyo Ink Group, T&K TOKA Corporation, Wikoff Color Corporation, and Zeller+Gmelin GmbH & Co. KG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Gravure Printing Inks Market Insights

The global increase in end-user applications, particularly in sectors such as packaging and overlays, is expected to remain a key driving factor for the gravure printing ink market over the next seven years. Within the packaging industry, labels and tags are anticipated to drive gravure ink demand. Gravure printing ink is expected to be the predominant and preferred type due to its ability to deliver high and consistent graphic quality printing and higher ink coverage. It finds application in various products such as wrapping papers, magazines, food packaging, furniture covers, postcards, wallpaper, paneling, and greeting cards. The rising demand for processed food leading to increased food packaging needs is projected to fuel market growth. Its applications extend to various specialized needs such as UV light and moisture resistance based on different printing requirements.

UV-cured inks are utilized in non-food product packaging, such as for tobacco items. The increasing demand for water-based and UV-cured printing inks, owing to their compliance with environmental standards, is anticipated to drive growth in the gravure printing ink market over the forecast period. Additionally, protection against environmental exposure leads to a reduction in excessive packaging requirements for manufacturers. This is expected to have a positive impact on market growth during the gravure printing inks industry forecast period. Gravure printing faces tough competition from flexo printing due to its lower cost and consequently higher efficiency. However, the market is projected to experience significant growth as new chamber and press technologies have reduced lead times and costs, making it more attractive to manufacturers.

The increasing demand for gravure printing inks drives market growth. Additionally, the rising need for bio-based printing inks is expected to further stimulate market expansion. Moreover, the demand for printing inks in metal cans, labels, and flexible materials is fueling market growth. However, the growing awareness of e-books' presence and stringent environmental regulations regarding ink production are anticipated to restrict market growth. The fluctuating prices of raw materials, along with various environmental regulations concerning dissolvable printing inks, are expected to hinder the development of the gravure printing ink market, posing challenges to industry participants over the gravure printing inks market forecast period.

The gravure printing inks market has gained momentum globally, owing to the exceptional image reproduction and low per-unit costs offered by gravure printing. These inks find extensive use in the rapidly expanding packaging sector across many countries. The production of water-based and UV-cured printing inks is poised to create potential opportunities for industry participants in the foreseeable future. Innovative advancements, such as the quick-change press developed by Cerrutti and Schiavi, enabling swift changeovers within shorter timeframes while ensuring high efficiency at reduced costs, are expected to present lucrative opportunities for industry players.

Gravure Printing Inks Market Segmentation

The worldwide market for gravure printing inks is split based on resin, technology, application, and geography.

Gravure Printing Ink Resins

- Acrylic

- Nitrocellulose

- Polyamide

- Polyurethane

- Others (including Polyester, Maleic, Ketonic, and Polyvinyl)

In terms of gravure printing inks market analysis, the nitrocellulose segment is projected to dominate the global industry by 2022. Nitrocellulose serves as a fundamental substance used in ink formulations in both mono- and bi-component structures. This material finds extensive use due to its advantages, including easy drying, film-forming ability, cost-effectiveness, heat resistance, solubility in alcohol, ether blends, ketones, and esters, as well as compatibility with hydrocarbons. It exhibits low odor, excellent dimensional stability, but limited resistance to acids and alkalis.

Gravure Printing Ink Technologies

- Solvent-based

- Water-based

- Others (including UV-curable)

Solvent-based gravure printing inks rank among the most widely used gravure inks globally. This popularity primarily stems from their ability to dry quickly and their ease of adaptation to various substrates. Conversely, water-based gravure printing inks are gaining traction due to their compliance with several environmental regulations.

Many countries worldwide have implemented environmental regulations concerning the emission of Volatile Organic Compounds (VOCs) from solvent-based printing inks. Consequently, several nations are increasingly adopting water-based inks across various printing applications to align with these environmental standards. Fueled by their sustainability, gravure inks are replacing solvent-based inks in diverse applications.

Gravure Printing Ink Applications

- Furniture

- Packaging

- Publication

- Others (including Wrapping Paper, Wallpaper, Textile, and Label)

According to gravure printing inks industry analysis, the primary factor propelling the global industry is the expansion of the packaging industry. The growth of transportation and packaging sectors worldwide, particularly in developing regions, alongside the rise in industrialization, is driving the global market. Gravure printing inks find application in printing materials like polyester, oriented polypropylene (OPP), nylon, and polyethylene (PE), further augmenting their demand. Moreover, gravure stands as a preferred printing process in the packaging industry due to its capability to print on thin films such as polyester, nylon, and polyethylene. This is expected to drive the demand for gravure printing inks globally in the gravure printing inks market forecast period.

Gravure Printing Inks Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Gravure Printing Inks Market Regional Analysis

The Asia-Pacific gravure printing ink market is anticipated to witness significant growth over the forecast period due to the expanding overlay and food packaging industries in the region. Increasing demand for processed and canned foods in emerging countries such as China and India is expected to positively impact the market in this region. Moreover, the rise in disposable income, leading to a growing interest in interior design with customized wallpapers, is projected to drive demand and consequently foster market growth.

The European market is anticipated to remain a key regional market owing to its emphasis on environmentally friendly products and the growing demand for commercial printing. In North America, significant growth in the gravure printing ink market is expected during the forecast period due to technological advancements in gravure printing. Additionally, the demand for flexographic printing inks has notably increased in several countries in North America and Europe due to lower ink consumption, reduced labor requirements, and faster changeovers in flexographic printing.

Gravure Printing Inks Market Players

Some of the top gravure printing inks companies offered in our report includes Altana AG, Flint Group, SiegwerkDruckfarben AG & Co. KGaA, Huber Group, Royal Dutch Printing Ink Factories Van Son, Sakata INX Corporation, Sun Chemical Corporation, Toyo Ink Group, T&K TOKA Corporation, Wikoff Color Corporation, and Zeller+Gmelin GmbH & Co. KG.

Frequently Asked Questions

How big is the gravure printing inks market?

The gravure printing inks market size was USD 3.2 Billion in 2022.

What is the CAGR of the global gravure printing inks market from 2023 to 2032?

The CAGR of gravure printing inks is 5.6% during the analysis period of 2023 to 2032.

Which are the key players in the gravure printing inks market?

The key players operating in the global market are including Altana AG, Flint Group, SiegwerkDruckfarben AG & Co. KGaA, Huber Group, Royal Dutch Printing Ink Factories Van Son, Sakata INX Corporation, Sun Chemical Corporation, Toyo Ink Group, T&K TOKA Corporation, Wikoff Color Corporation, and Zeller+Gmelin GmbH & Co. KG.

Which region dominated the global gravure printing inks market share?

Asia-Pacific held the dominating position in gravure printing inks industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of gravure printing inks during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global gravure printing inks industry?

The current trends and dynamics in the gravure printing inks industry include growing demand across diverse packaging industries, technological advancements enhancing print quality, increased focus on sustainable, eco-friendly inks, and rising adoption in advertising and publication sectors.

Which resin held the maximum share in 2022?

The nitrocellulose resin held the maximum share of the gravure printing inks industry.