Graphite Electrode Rod Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Graphite Electrode Rod Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

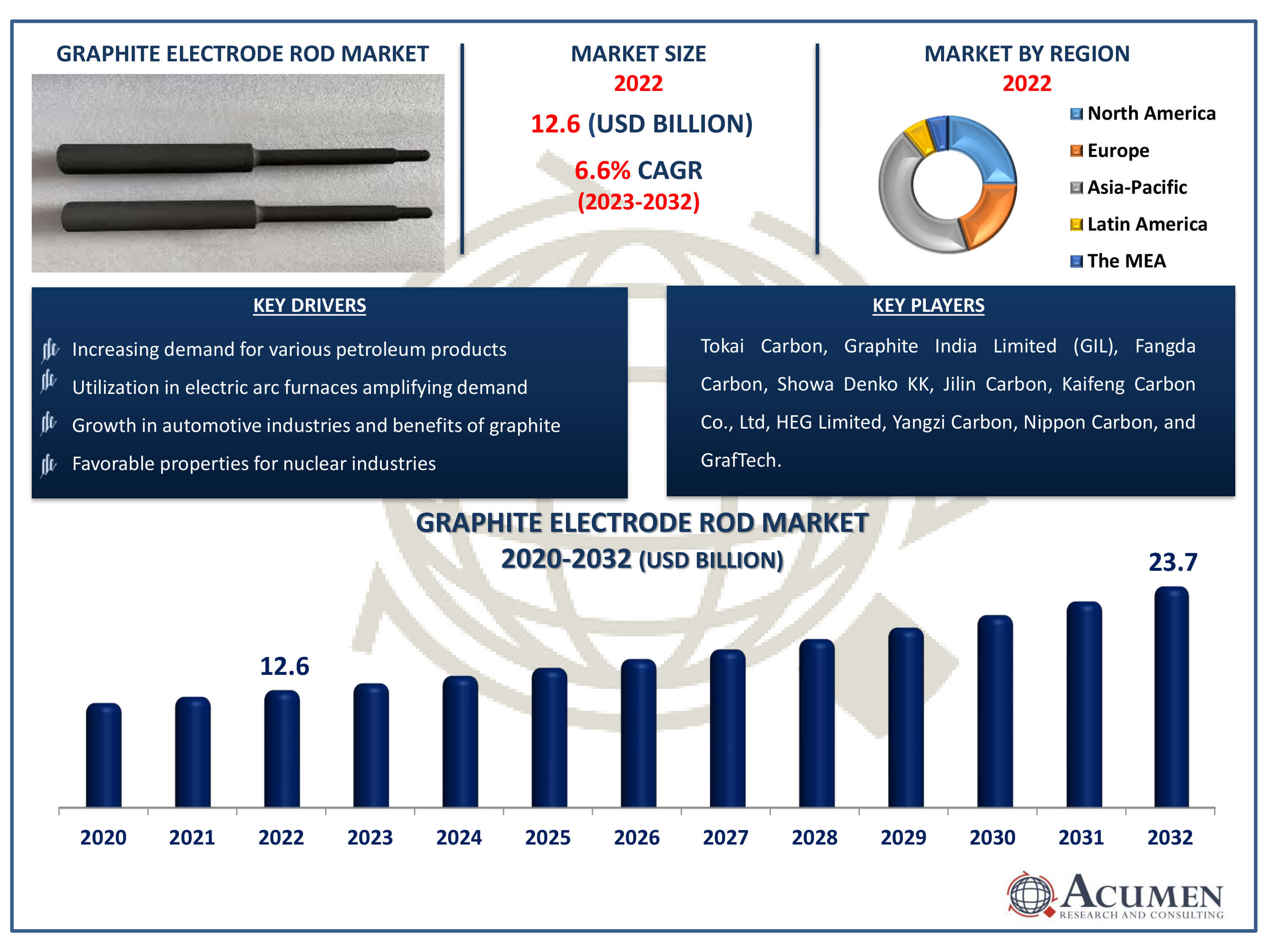

The Graphite Electrode Rod Market Size accounted for USD 12.6 Billion in 2022 and is estimated to achieve a market size of USD 23.7 Billion by 2032 growing at a CAGR of 6.6% from 2023 to 2032.

Graphite Electrode Rod Market Highlights

- Global graphite electrode rod market revenue is poised to garner USD 23.7 billion by 2032 with a CAGR of 6.6% from 2023 to 2032

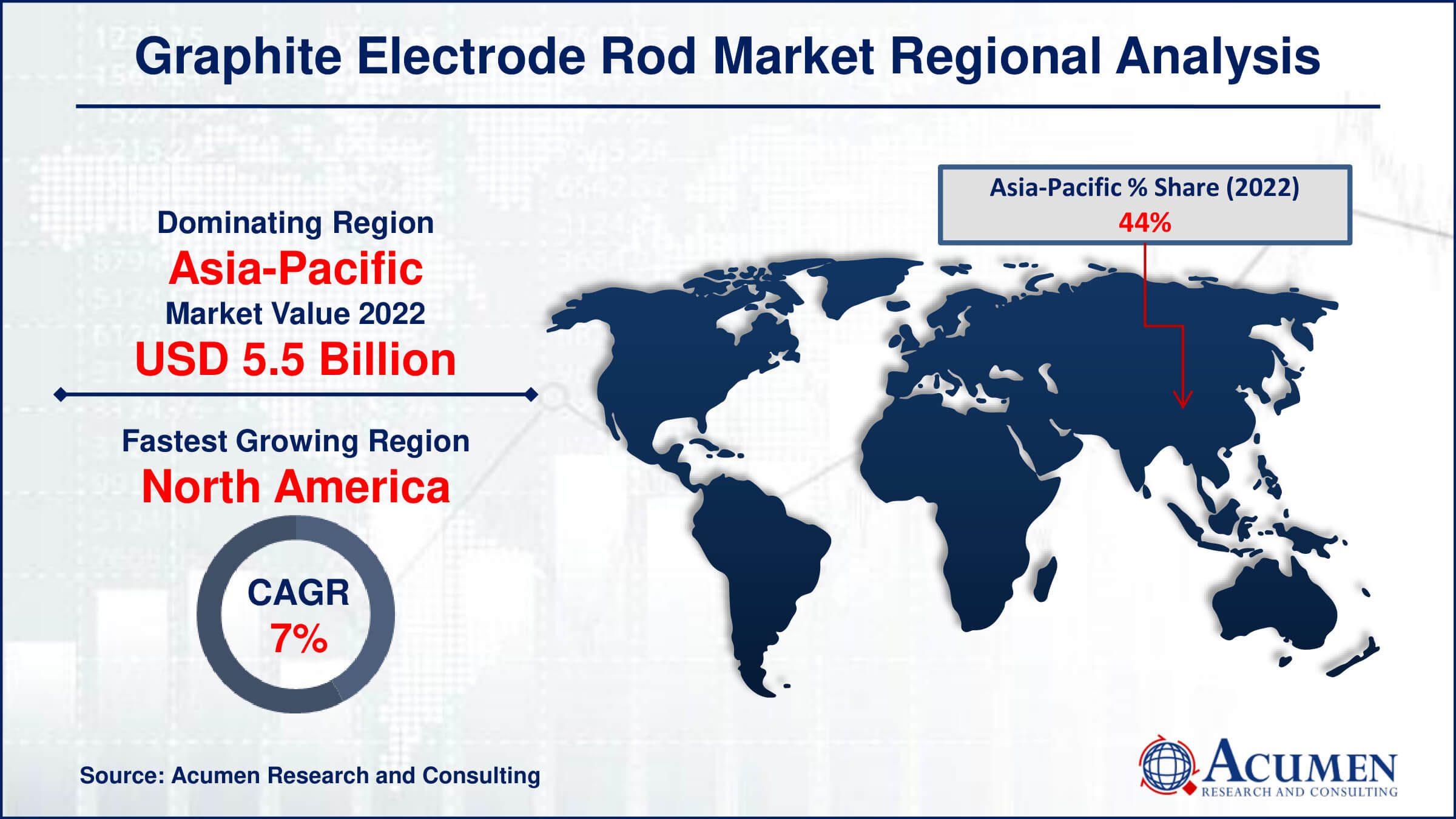

- Asia-Pacific graphite electrode rod market value occupied around USD 5.5 billion in 2022

- North America graphite electrode rod market growth will record a CAGR of more than 7% from 2023 to 2032

- Among application, the electric arc furnace steel manufacturing sub-segment generated noteworthy revenue in 2022

- Based on end-use industry, the steel industry sub-segment generated significant market share in 2022

- Growing demand for high-purity graphite electrodes is a popular graphite electrode rod market trend that fuels the industry demand

Graphite's varied qualities have made it important in a wide range of industries. Graphite is a crucial material known for its low friction and self-lubricating properties, strong heat conductivity and resistance, and great electrical conductivity. Its unique attribute of poor wettability to liquid metals adds to its worth. Graphite is mostly used in the petroleum industry, where graphite electrode rods are common. Furthermore, its importance extends to the automotive industry, where it is critical in the production of electric motors, which contribute to the increasing market for electric vehicles. Beyond these industries, graphite's value extends to a wide range of applications, acting as a foundational element in many technical breakthroughs and industrial processes, cementing its place as an essential component in current engineering and manufacturing landscapes.

Global Graphite Electrode Rod Market Dynamics

Market Drivers

- Increasing demand for various petroleum products

- Utilization in electric arc furnaces amplifying demand

- Growth in automotive industries and benefits of graphite

- Favorable properties for nuclear industries

Market Restraints

- Availability of substitutes due to continuous R&D

- Price fluctuations in raw materials

- Environmental concerns regarding graphite mining

Market Opportunities

- Rising use in renewable energy storage systems

- Technological advancements in graphite manufacturing

- Expansion in emerging markets

Graphite Electrode Rod Market Report Coverage

| Market | Graphite Electrode Rod Market |

| Graphite Electrode Rod Market Size 2022 | USD 12.6 Billion |

| Graphite Electrode Rod Market Forecast 2032 |

USD 23.7 Billion |

| Graphite Electrode Rod Market CAGR During 2023 - 2032 | 6.6% |

| Graphite Electrode Rod Market Analysis Period | 2020 - 2032 |

| Graphite Electrode Rod Market Base Year |

2022 |

| Graphite Electrode Rod Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Tokai Carbon, Graphite India Limited (GIL), Fangda Carbon, Showa Denko KK, Jilin Carbon, Kaifeng Carbon Co., Ltd, HEG Limited, Yangzi Carbon, Nippon Carbon, and GrafTech. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Graphite Electrode Rod Market Insights

The global graphite electrode rod market is primarily driven by the increasing demand for various petroleum products. These rods are also utilized in electric arc furnaces, further amplifying the demand and fostering market growth. Over the past few decades, the rise in automotive industries, coupled with the numerous benefits of graphite, the affordability of the rods, and ongoing technological advancements, has propelled market expansion. Additionally, high-purity graphite electrode rods are favored in nuclear industries due to their low neutron absorption, high thermal conductivity, and ability to withstand high temperatures, further contributing to market growth.

However, continuous research and development, along with ongoing improvements in raw materials, have led to the availability of substitutes, potentially slowing market growth.

One intriguing possibility in the graphite electrode rod market is its rising use in renewable energy, particularly energy storage. With the world's growing emphasis on renewable energy sources, there is a greater demand for effective energy storage systems. Graphite electrode rods are rising to the challenge by becoming critical components in energy storage systems such as lithium-ion batteries. Graphite's unique features, such as high electrical conductivity, thermal stability, and chemical resistance, make it ideal for boosting battery performance and durability. As the number of electric cars and renewable energy installations increases, so will the need for high-quality graphite electrode rods for energy storage. Furthermore, current developments in graphite manufacture, such as higher-purity grades and improved electrode design, provide prospects to improve the efficiency and affordability of energy storage devices. This trend not only expands the market for graphite electrode rods, but it also contributes to the overall shift towards sustainable energy solutions.

Graphite Electrode Rod Market Segmentation

The worldwide market for graphite electrode rod is split based on type, application, end-use industry, and geography.

Graphite Electrode Rod Types

- Regular Power Graphite Electrodes

- Ultra High Power (UHP) Graphite Electrodes

- High Power (HP) Graphite Electrodes

According to graphite electrode rod industry analysis, the largest and most prominent sector is ultra high power (UHP) graphite electrodes. These electrodes are distinguished by their high conductivity, thermal resistance, and capacity to survive severe temperatures and conditions, making them indispensable in demanding industrial applications. Industries that rely significantly on UHP graphite electrodes for efficient and high-performance operations include steel manufacture, which uses electric arc furnaces. Furthermore, the growing demand for UHP graphite electrodes can be attributable to their broad application in a variety of industries experiencing fast industrialization and technological innovation. As businesses seek for increased efficiency, productivity, and sustainability, UHP graphite electrodes' adaptability and outstanding performance establish them as essential components in modern industrial processes. This dominance highlights the vital role that UHP graphite electrodes play in fostering innovation and advancement across a wide range of industrial settings.

Graphite Electrode Rod Applications

- Electric Arc Furnace Steel Manufacturing

- Refinement of Steel

- Silicon metal production

- Other Applications

The electric arc furnace steel manufacturing sector is the largest of the segments listed for the market and it is expected to increase over the Graphite Electrode Rod industry forecast period. This is mostly because the steel industry, which mostly uses graphite electrodes for the melting and refining processes, has adopted electric arc furnaces (EAFs) on a large scale. The need for graphite electrodes to support EAF steel production is rising as the steel industry expands internationally, especially in Asia Pacific. Furthermore, because graphite electrodes are so versatile, they may be employed in a range of sizes and configurations to meet diverse production needs and furnace capacities. The market for graphite electrode rods is dominated by the Electric Arc Furnace Steel Manufacturing sector because to the strong expansion of industries including construction, automotive, and infrastructure, which in turn fuel the need for steel.

Graphite Electrode Rod End-Use Industries

- Steel industry

- Aluminum industry

- Foundry industry

- Chemical industry

- Others

The main sector is shown to be the steel industry. The main reason for this domination is the widespread use of graphite electrodes in electric arc furnaces (EAFs) used to produce steel. Global demand for graphite electrodes is consistently driven by the steel industry's significant dependence on EAFs, particularly for the manufacture of specialty steels and alloys. Additionally, the continual expansion of the steel sector is supported by the growing urbanization, industrialization, and infrastructure development in many different countries, which in turn increases demand for graphite electrode rods. Furthermore, the steel industry's prominence as the largest end-user segment in the graphite electrode rod market is sustained by investments in modernized EAF facilities, which are fueled by advancements in steel manufacturing technologies and an increasing emphasis on energy efficiency and environmental sustainability.

Graphite Electrode Rod Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Graphite Electrode Rod Market Regional Analysis

In terms of graphite electrode rod market analysis, the global graphite electrode rod market is dominated by Asia-Pacific due to significant demand from sectors such as petroleum, automotive, and nuclear. High R&D spending and continuous technological development has fueled market growth. North America holds the second leading position. Major factors contributing to market growth include increasing demand for electric motors in automotive industries, government support for R&D, and high investment in technological advancement. North America is the fastest-growing region during the graphite electrode rod market forecast period, largely driven by the availability of a large workforce at low cost, cheap raw materials, and ongoing economic development. In Asia-Pacific China dominates the market due to its large production capacity for raw materials and being a prominent consumer of the products. On the other hand, LAMEA anticipates significant market opportunities due to the continuous growth of automotive and petroleum industries and the limited number of market players in this region.

Graphite Electrode Rod Market Players

Some of the top graphite electrode rod companies offered in our report includes Tokai Carbon, Graphite India Limited (GIL), Fangda Carbon, Showa Denko KK, Jilin Carbon, Kaifeng Carbon Co., Ltd, HEG Limited, Yangzi Carbon, Nippon Carbon, and GrafTech.

Frequently Asked Questions

How big is the graphite electrode rod market?

The graphite electrode rod market size was valued at USD 12.6 billion in 2022.

What is the CAGR of the global graphite electrode rod market from 2023 to 2032?

The CAGR of graphite electrode rod is 6.6% during the analysis period of 2023 to 2032.

Which are the key players in the graphite electrode rod market?

The key players operating in the global market are including Tokai Carbon, Graphite India Limited (GIL), Fangda Carbon, Showa Denko KK, Jilin Carbon, Kaifeng Carbon Co., Ltd, HEG Limited, Yangzi Carbon, Nippon Carbon, and GrafTech.

Which region dominated the global graphite electrode rod market share?

Asia-Pacific held the dominating position in graphite electrode rod industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of graphite electrode rod during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global graphite electrode rod industry?

The current trends and dynamics in the graphite electrode rod industry include increasing demand for various petroleum products, utilization in electric arc furnaces amplifying demand, growth in automotive industries and benefits of graphite, and favorable properties for nuclear industries.

Which application held the maximum share in 2022?

The electric arc furnace steel manufacturing application held the maximum share of the graphite electrode rod industry.