Golf Cart Market | Acumen Research and Consulting

Golf Cart Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

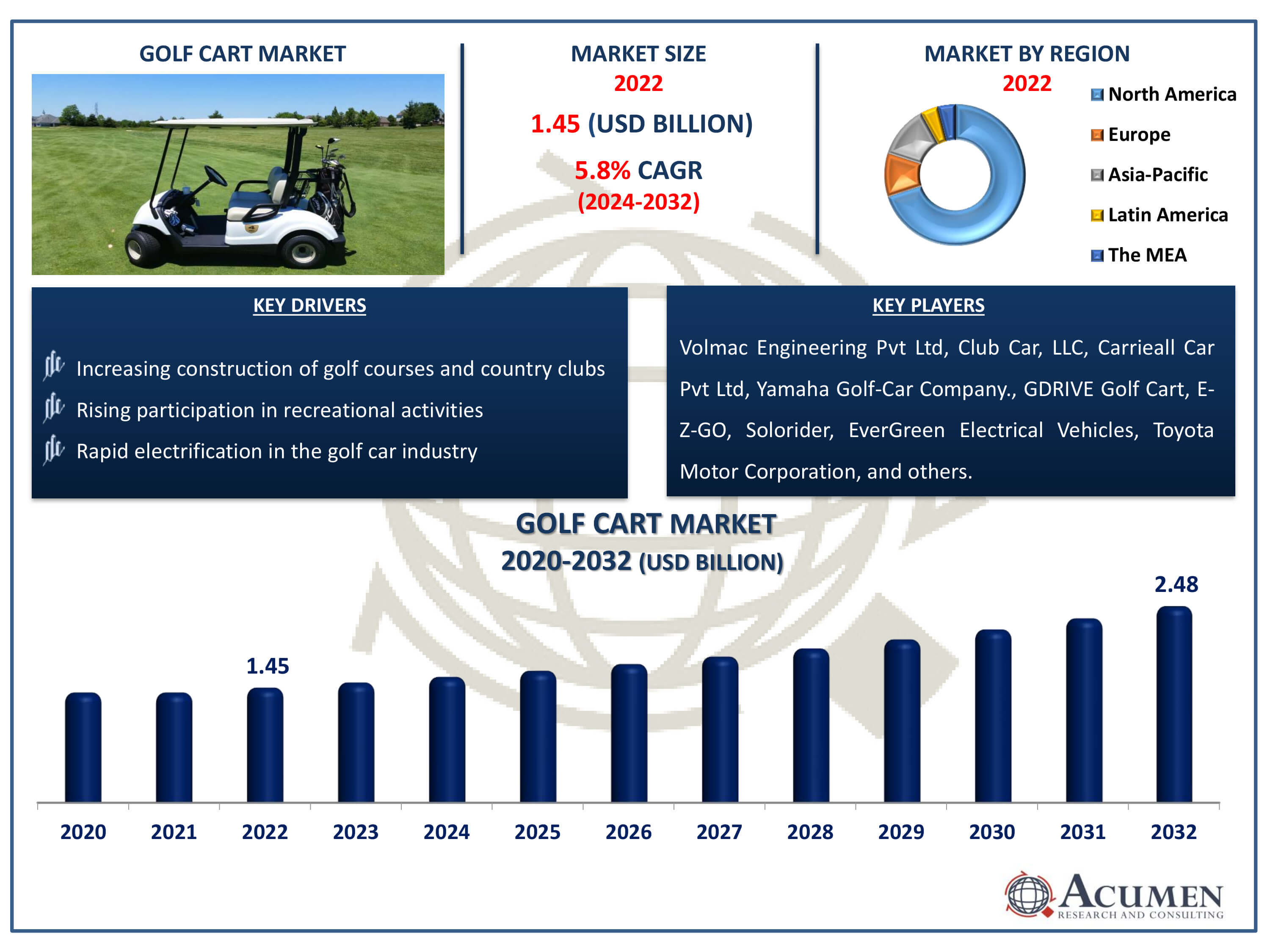

The Golf Cart Market Size accounted for USD 1.45 Billion in 2022 and is estimated to achieve a market size of USD 2.48 Billion by 2032 growing at a CAGR of 5.8% from 2024 to 2032.

Golf Cart Market Highlights

- The global golf cart market revenue is expected to reach USD 2.48 billion by 2032, with a 5.8% CAGR from 2024 to 2032

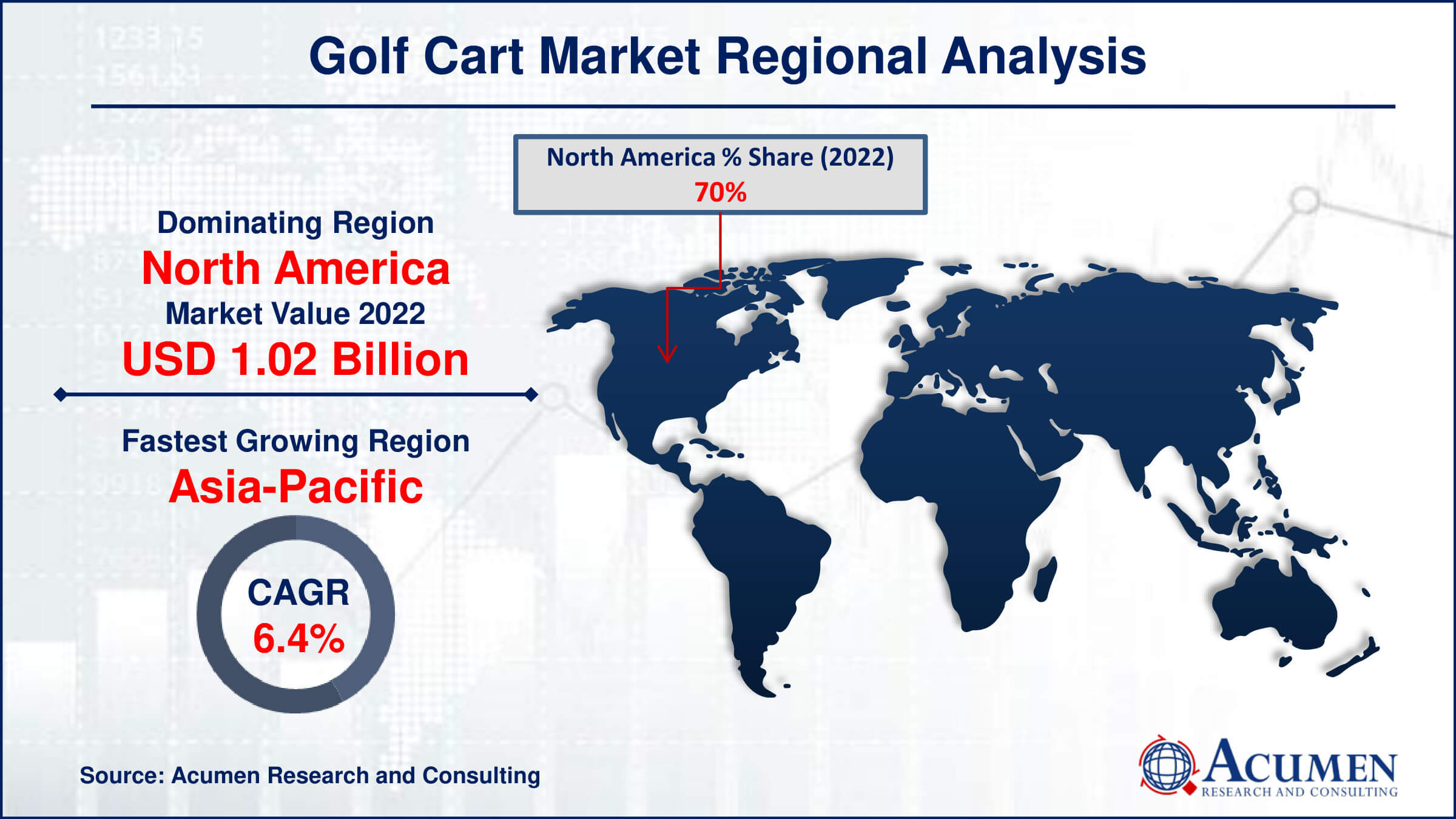

- The North American golf cart market was valued at USD 1.02 billion in 2022

- The Asia-Pacific golf cart market is expected to rise at a CAGR of about 6.4% between 2024 and 2032

- In 2022, the electric golf cart sub-segment accounted for 60% of the market due to its eco-friendliness

- The golf course sub-segment accounted for 54% due to the growing number of golf cources worldwide

- Electric golf carts are becoming increasingly popular due to their eco-friendliness and cheaper running costs compared to gas-powered carts, driving industry demand

A golf cart is a small vehicle typically designed to transport golfers and their equipment around a golf course. These carts are electric or gas-powered and usually have seating for two to four people. Beyond golf courses, they're also used in various recreational and industrial settings like resorts, campuses, and warehouses for transportation of people over short distances. Their compact size, low speed, and relatively low environmental impact make them ideal for these purposes, offering convenience and efficiency in management within restricted spaces.

Global Golf Cart Market Dynamics

Market Drivers

- Increasing construction of golf courses and country clubs

- Rising participation in recreational activities

- Rapid electrification in the golf cart industry

Market Restraints

- High initial maintenance and purchasing cost

- Low power and speed

Market Opportunities

- Technological advancements in golf carts

- Rapidly developing hotel and resort industry

- Growing disposable income and availability of golf-facilities

Golf Cart Market Report Coverage

| Market | Golf Cart Market |

| Golf Cart Market Size 2022 | USD 1.45 Billion |

| Golf Cart Market Forecast 2032 |

USD 2.48 Billion |

| Golf Cart Market CAGR During 2024 - 2032 | 5.8% |

| Golf Cart Market Analysis Period | 2020 - 2032 |

| Golf Cart Market Base Year |

2022 |

| Golf Cart Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Product Type, By Operation, By Ownership, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Volmac Engineering Pvt Ltd, Club Car, LLC, Carrieall Car Pvt Ltd, Yamaha Golf-Car Company., GDRIVE Golf Cart, E-Z-GO, Solorider, EverGreen Electrical Vehicles, Toyota Motor Corporation, Columbia ParCar Corp, Cruise Car, Inc., Hitachi Chemical Co., Ltd., Garia Luxury Golf Car., Xiamen Dalle Electric Car Co., Ltd. Company, and Maini Material Movement Pvt. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Golf Cart Market Insights

The increasing construction of golf courses and country clubs drives the demand for the golf carts market. As industrialization and globalization increase, there is a surge in the demand for golf cart construction. For instance, according to the National Golf Foundation, $4 billion was invested in games on May 12, 2022, across more than 16,000 golf courses worldwide. Additionally, rising participation in recreational activities and rapid electrification in the golf car industry further drive the demand for the golf cart industry. Manufacturers are focused on developing electric models of golf carts with the latest battery technology and enhanced travel range. For instance, E-Z-GO introduced its first golf car, the EZ-GO Liberty, with the addition of four forward-facing seats in the compact cart

However, the high initial maintenance and purchasing costs impede the growth of the golf cart sector. Golf carts, used for transportation or utility vehicles, come with initial costs and various features like air conditioning, radios, GPS, and refrigerators. They also require maintenance such as batteries, service brakes, and rear axles. As a result, these maintenance and initial costs may hamper market growth in the forecast year

Technological advancements in golf carts create an opportunity for the golf cart market. Key manufacturers in the golf cart industry are focused on new inventions and technology. For instance, Texton launched the street-legal Liberty, an updated model of the Freedom RXV with a speed of 25 mph, in June 2023. Furthermore, there is adoption of new technology, such as solo rider technology designed for single users. Innovations like solar-powered golf carts and extreme golf carts further boost market demand. The latest technology developed in the golf cart market is the golf board, which contains back and front gear boxes and has 75% less impact on turns than traditional golf carts.

Golf Cart Market Segmentation

The worldwide market for golf cart is split based on product type, operation, ownership, application, and geography.

Golf Cart Product Types

- Electric Golf Cart

- Gasoline Golf Cart

- Solar Golf Cart

According to the golf cart industry analysis, electric golf carts dominated the market in 2023. Electric golf carts offer various factors such as cost-effectiveness, reduced noise, and eco-friendliness. Requiring rechargeable batteries, electric golf carts are sustainable and environmentally friendly compared to gasoline golf carts. Their lower operational and maintenance costs make them the preferred choice in the market. Additionally, technological advancements in electric golf carts further enhance their speed, power, and overall efficiency, which becomes an influencing factor for the dominance of electric golf carts in the market. For instance, Tomberlin, under the Nordic Group of Companies, Ltd. brand, unveiled the E-MERGE GT golf cart in May 2020. Featuring a 7-inch LCD Dash Display, Backlit Headliner with Rearview Camera, and LSV Compliance, it's equipped with a 5 kW, 17 hp (peak) AC drive motor and a 450-amp Sevcon AC controller.

Golf Cart Operations

- Manual

- Powered

Based on various operations, manual golf carts are typically pushed or pulled by the golfer and are designed for use on smaller courses or for golfers who prefer walking but need assistance carrying their clubs. Powered golf carts, on the other hand, are equipped with electric motors or gas engines, offering convenience and ease of use, particularly on larger courses or for golfers who prefer not to walk long distances.

Golf Cart Ownerships

- Rented

- Fully Owned

According to the golf cart market forecast, rented ownership is expected to dominate over power ownership throughout 2024 to 2032. With the expansion of car rental services worldwide, there is a growing demand for rental golf carts. This rise in demand is particularly noticeable during occasional events like weddings and trade shows. In such situations, people require golf carts for short durations, such as a few days or weeks. For these reasons, end-users prefer rented ownership compared to fully owning one.

Golf Cart Applications

- Golf Course

- Personal Service

- Commercial Services

By application, the golf course segment registered the maximum share in 2022 and is projected to maintain its dominance over the estimated period from 2024 to 2032. Golf courses often equip their carts with GPS tracking and invest in fleets of carts. They serve various traditional purposes and have an inherent link with golf carts. Golf carts are essential for transporting equipment and players to enhance the overall experience. Additionally, the growing number of golf courses worldwide, rising golf tourism, and the increasing popularity of golf as a sport make them a preferred choice in the market.

Golf Cart Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Golf Cart Market Regional Analysis

In terms of regional analysis, North America dominates the golf cart market, commanding a significant share of the industry. This dominance is attributed to several factors, including the region's strong golfing culture, extensive infrastructure for golf courses, and robust leisure industry. Moreover, the presence of key market players and continuous technological advancements further bolster North America's position. For instance, DSG Global, Inc., a rising force in the Electric Vehicle and Golf Cart sectors, unveiled its groundbreaking Shelby Golf Cart series at the PGA Show, the premier event for the golf industry, held in Orlando, Florida, from January 24 to 28, 2022. The demand for golf carts in this region is fueled not only by golf enthusiasts but also by various commercial and recreational applications such as transportation, resorts, and industrial facilities. Overall, North America continues to drive growth and innovation within the golf cart industry.

Asia-Pacific is the fastest-growing region in the golf cart market. This is due to economic developments and infrastructure advancements driving the demand for golf carts across the region. With an established market and rapid growth trajectory, the golf cart industry presents opportunities in the forecast year. Robust key players focus on new inventions and developments in the Asia-Pacific region. For instance, Yamaha Motor Co., Ltd. joined with the National Golf Course Owner's Association in January 2021, presenting incentives on purchases or leases of its golf & utility vehicles through the National Golf Course Owner Association Smart Buy Marketing Purchasing Program. This strategic move is predicted to help Yamaha continue building important business relationships and place its innovative vehicles successfully.

Golf Cart Market Players

Some of the top golf cart companies offered in our report includes Volmac Engineering Pvt Ltd, Club Car, LLC, Carrieall Car Pvt Ltd, Yamaha Golf-Car Company., GDRIVE Golf Cart, E-Z-GO, Solorider, EverGreen Electrical Vehicles, Toyota Motor Corporation, Columbia ParCar Corp, Cruise Car, Inc., Hitachi Chemical Co., Ltd., Garia Luxury Golf Car., Xiamen Dalle Electric Car Co., Ltd. Company, and Maini Material Movement Pvt. Ltd.

Frequently Asked Questions

How big is the golf cart market?

The golf cart market size was valued at USD 1.45 billion in 2022.

What is the CAGR of the global golf cart market from 2024 to 2032?

The CAGR of golf cart is 5.8% during the analysis period of 2024 to 2032.

Which are the key players in the golf cart market?

The key players operating in the global market are including Volmac Engineering Pvt Ltd, Club Car, LLC, Carrieall Car Pvt Ltd, Yamaha Golf-Car Company., GDRIVE Golf Cart, E-Z-GO, Solorider, EverGreen Electrical Vehicles, Toyota Motor Corporation, Columbia ParCar Corp, Cruise Car, Inc., Hitachi Chemical Co., Ltd., Garia Luxury Golf Car., Xiamen Dalle Electric Car Co., Ltd. Company, and Maini Material Movement Pvt. Ltd.

Which region dominated the global golf cart market share?

North America held the dominating position in golf cart industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of golf cart during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global golf cart industry?

The current trends and dynamics in the golf cart industry include increasing construction of golf courses and country clubs, rising participation in recreational activities, and rapid electrification in the golf car industry.

Which product type held the maximum share in 2022?

The electric golf cart product type held maximum share of the golf cart industry.