Glycol Ether Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Glycol Ether Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

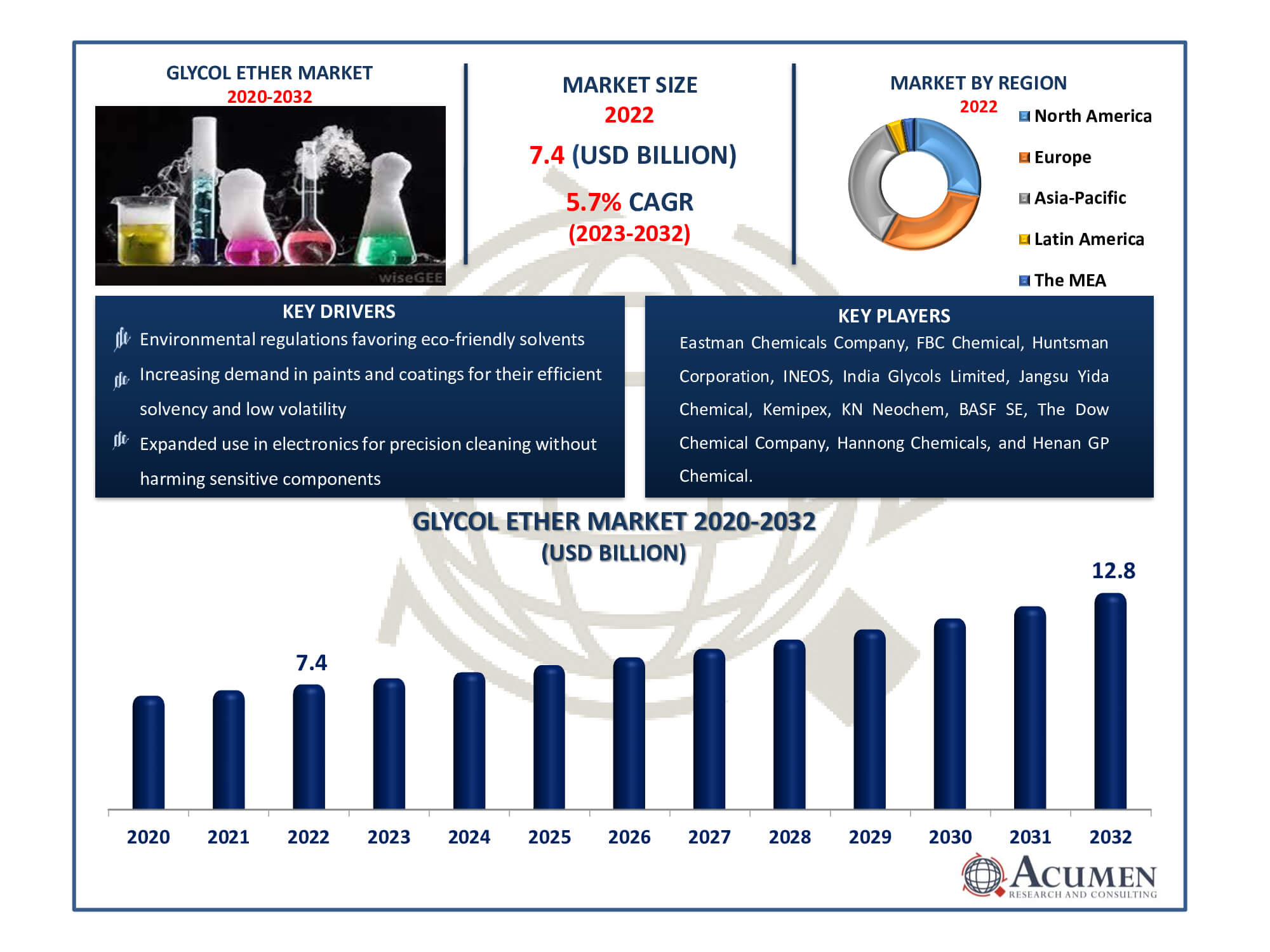

The Glycol Ether Market Size accounted for USD 7.4 Billion in 2022 and is estimated to achieve a market size of USD 12.8 Billion by 2032 growing at a CAGR of 5.7% from 2023 to 2032.

Glycol Ether Market Highlights

- Global glycol ether market revenue is poised to garner USD 12.8 billion by 2032 with a CAGR of 5.7% from 2023 to 2032

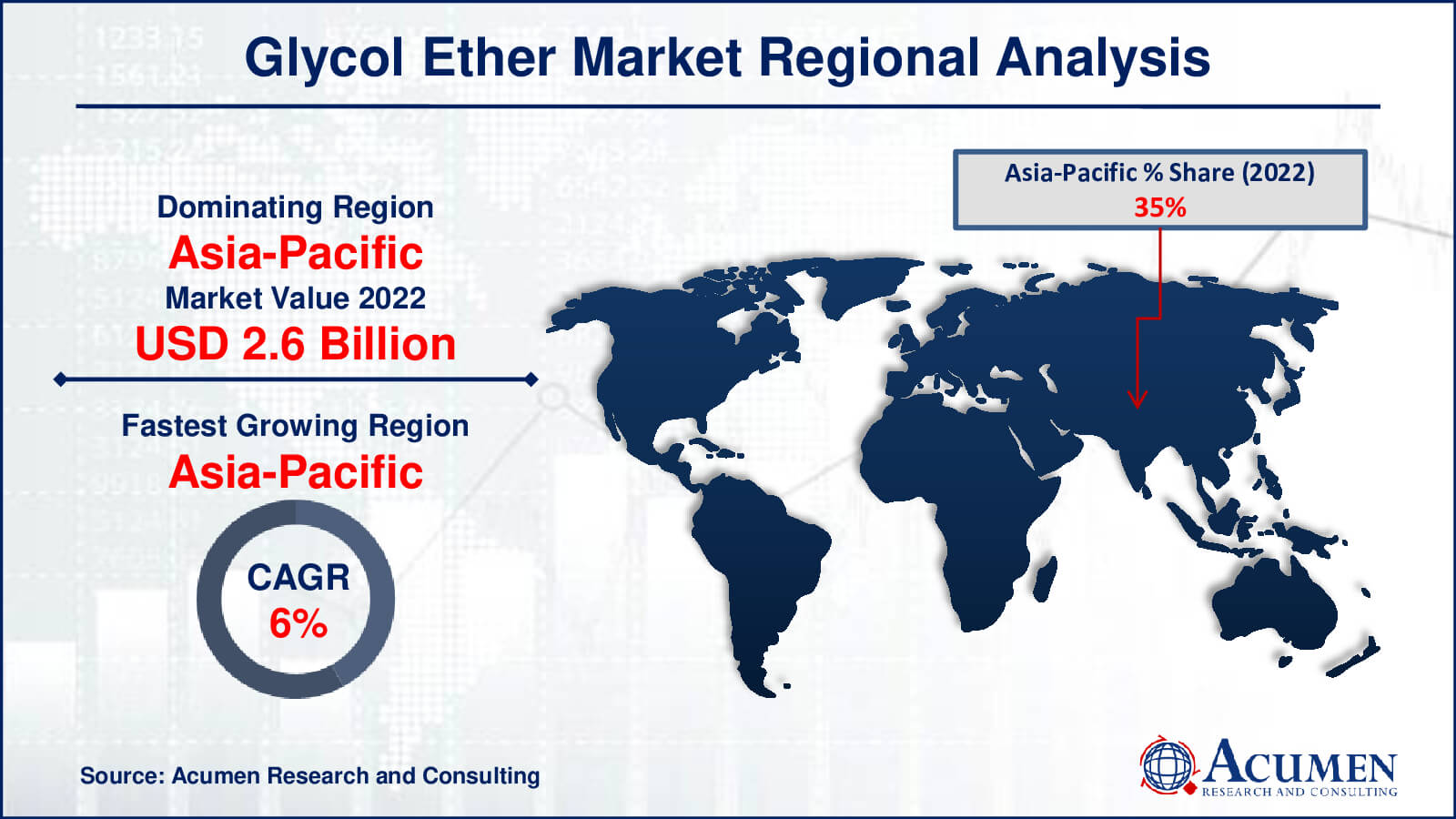

- Asia-Pacific glycol ether market value occupied around USD 2.6 billion in 2022

- Asia-Pacific glycol ether market growth will record a CAGR of more than 6% from 2023 to 2032

- Among product, the p-series sub-segment generated over US$ 6 billion revenue in 2022

- Based on application, the solvent sub-segment generated around 42% share in 2022

- Focus on R&D for novel uses like agrochemicals is a popular glycol ether market trend that fuels the industry demand

Glycol ethers are a class of solvents formed from ethylene oxide or propylene oxide, which are both obtained from ethylene or propylene. These solvents are flexible and find use in a variety of sectors, including paints, coatings, cleansers, inks, and cosmetics. Glycol ethers are classified according to whether they are generated from ethylene glycol or propylene glycol, and they appear in a variety of forms with varying characteristics. They are prized for their capacity to dissolve a wide variety of compounds, which makes them useful as solvents in various formulations. Some glycol ethers, for example, are employed as cleaning agents due to their ability to dissolve oils, greases, and other dirt. Others are used in paints and coatings because they evaporate slowly, allowing for better coating application and leveling. Because of their propensity to mix with both water and oil, several glycol ethers can be found in cosmetics and personal care products.

Global Glycol Ether Market Dynamics

Market Drivers

- Increasing demand in paints and coatings for their efficient solvency and low volatility

- Growing adoption in pharmaceuticals due to compatibility with diverse active ingredients

- Environmental regulations favoring eco-friendly solvents

- Expanded use in electronics for precision cleaning without harming sensitive components

Market Restraints

- Health risks necessitating strict handling and potential regulatory limitations

- Fluctuating raw material prices impacting production costs and market stability

- Competition from alternatives and ongoing research into substitutes affecting adoption

Market Opportunities

- Diversifying applications in cosmetics due to compatibility with various formulations

- Innovations in production for cost-effective and sustainable manufacturing

- Untapped markets in Asia-Pacific and Latin America driving expansion

Glycol Ether Market Report Coverage

| Market | Glycol Ether Market |

| Glycol Ether Market Size 2022 | USD 7.4 Billion |

| Glycol Ether Market Forecast 2032 | USD 12.8 Billion |

| Glycol Ether Market CAGR During 2023 - 2032 | 5.7% |

| Glycol Ether Market Analysis Period | 2020 - 2032 |

| Glycol Ether Market Base Year |

2022 |

| Glycol Ether Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By End-use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Eastman Chemicals Company, FBC Chemical, Huntsman Corporation, INEOS, India Glycols Limited, Jangsu Yida Chemical, Kemipex, KN Neochem, BASF SE, The Dow Chemical Company, Hannong Chemicals, and Henan GP Chemical. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Glycol Ether Market Insights

Increased application usage is anticipated to drive the market size of glycol ethers, notably in personal care, cleaners, paints & coatings, pharmaceuticals, and printers. The growing demand for water-based coatings includes glycol ether as a coalescing agent, likely fueling industry growth in personal care and printing inks. Glycol ether finds widespread use in formulating skin and hair products, including shampoos, personal cleanliness products, and bath products within the personal care and cosmetics sectors. The global cosmetics market is poised for significant expansion, propelled by rising disposable incomes and lifestyle changes, particularly increasing demand for skincare products due to varying climatic conditions. A surge in consumer awareness regarding health hygiene in the personal care sector is expected to further propel the glycol ether market size.

The broader utilization of printed products like books, newspapers, magazines, and technical materials is expected to drive increased demand in the printing industry, supported by ongoing economic growth. The global demand for printing ink is predicted to rise due to the increased need for corrugated cardboard and flexible packaging applications. Glycol ether is extensively employed in printing inks due to its rapid drying and compatibility with high-speed roll-to-roll printing processes. The automotive market's demand for glycol ether is anticipated to grow, fueled by rising consumer awareness and changing societal attitudes toward environmental sustainability. In 2018, China represented a significant portion of global sales. The paints and coatings market for vehicle color is expected to experience growth driven by increasing demand for non-toxic coatings and evolving consumer perceptions regarding technological advancements. These coatings are widely used for protection against external elements such as UV rays and rain, further promoting market expansion and environmental protection.

Due to stringent FDA and EU regulations, Glycol ether is restricted in consumer goods. The complex interaction of organic matter with its toxicity, effervescence, and compatibility with inorganic substances makes conducting systematic research challenging, hindering market growth. Low product levels and direct human exposure can result in health issues such as conjunctivitis, upper respiratory problems, headaches, temporary vision clouding, and nausea.

Glycol Ether Market Segmentation

The worldwide market for glycol ether is split based on product, application, end-use industry, and geography.

Glycol Ether Products

- P-Series

- Butyl Ether

- Methyl Ether Acetate

- Methyl Ether

- Others

- E-Series

- E-series Glycol Ether

- Ethylene Glycol Butyl Ether Acetate

- Ethylene Glycol Propyl Ether

- Others

According to glycol ether industry analysis, the P-Series sector has the biggest market share in the glycol ether industry. P-Series glycol ethers generated from propylene dominate due to their reduced toxicity levels, and are used in a variety of industries for a variety of purposes. Propylene glycol butyl ether and methyl ether acetate are two solvents that are widely used in coatings, metal treatment, and electronics. Their appeal arises from practical applications in personal care products, efficient paint fluxing, and enhanced printing solvents. The P-Series glycol ethers maintain a significant position in the industry, driving market growth and providing as preferred solutions across a wide range of industries due to their outstanding features and broad industrial applicability.

Glycol Ether Applications

- Solvent

- Anti-Icing Agent

- Hydraulic and Brake Fluid

- Chemical Intermediate

The solvent application dominates the glycol ether market due to its widespread use in a range of sectorsand it will grow continue during the glycol ether industry forecast period. Because of their great solubility, low volatility, and compatibility with a wide range of materials, glycol ethers are effective solvents in paints, coatings, inks, and cleaning agents. Their importance is heightened by their position as effective transporters for active compounds in medications and cosmetics. The versatility of glycol ethers as high-performance solvents in a wide range of applications, from industrial processes to personal care products, solidifies their market dominance, driving their leadership in the solvent segment and demonstrating their indispensable role across multiple industries.

Glycol Ether End-use Industries

- Paints & Coatings

- Electronics

- Printing

- Cosmetics & Personal Care

- Pharmaceuticals

- Others

The versatility of glycol ethers in this industry accounts for the paints & coatings segment's dominance in the glycol ether market. Their exceptional solvency, low volatility, and compatibility enable them to play a major role in improving paint fluxing, levelling, and wet edge performance. This section benefits from the efficacy of glycol ethers in guaranteeing smoother finishes, decreased brush marking, and extended wet edge, which optimises the painting process. Their multifaceted utility in improving coating characteristics cements the Paints & Coatings segment's leadership, demonstrating glycol ethers' indispensability in this industry.

Glycol Ether Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Glycol Ether Market Regional Analysis

In terms of glycol ether market analysis, Asia-Pacific is the largest area due to fast industrialization and strong manufacturing activity. Its thriving paint, coatings, electronics, and pharmaceutical industries fuel significant demand for glycol ethers. The region's economic expansion, combined with expanded infrastructure development and expanding automotive and construction industries, consolidates its leadership in glycol ether consumption, positioning it as a key market hub.

Asia-Pacific is the fastest-growing region in the industry also it is expected to grow over the glycol ether market forecast period, owing to booming industrialization, technical developments, and expanding applications across several industries. Because of changing consumer preferences and rising disposable budgets, the region is seeing increased demand for glycol ethers in paints, electronics, cosmetics, and pharmaceuticals. Asia-Pacific is positioned for significant expansion, cementing its position as the market's fastest-growing region, thanks to continuing industrial advancements and expanding use across varied industries.

Europe maintains its position as the second-largest region in the glycol ether market, owing to its established industrial base and widespread applicability across numerous sectors. The region's thriving automotive and construction industries contribute significantly to glycol ether use. Furthermore, severe rules supporting eco-friendly solvents increase demand for these compounds in paints, coatings, and pharmaceuticals. Europe's well-established industrial landscape and emphasis on sustainability position it as a significant consumer of glycol ethers, reinforcing its position as a leading participant in this market.

Glycol Ether Market Players

Some of the top glycol ether companies offered in our report includes Eastman Chemicals Company, FBC Chemical, Huntsman Corporation, INEOS, India Glycols Limited, Jangsu Yida Chemical, Kemipex, KN Neochem, BASF SE, The Dow Chemical Company, Hannong Chemicals, and Henan GP Chemical.

Frequently Asked Questions

How big is the glycol ether market?

The market size of glycol ether was USD 7.4 billion in 2022.

What is the CAGR of the global glycol ether market from 2023 to 2032?

The CAGR of glycol ether is 5.7% during the analysis period of 2023 to 2032.

Which are the key players in the glycol ether market?

The key players operating in the global market are including Eastman Chemicals Company, FBC Chemical, Huntsman Corporation, INEOS, India Glycols Limited, Jangsu Yida Chemical, Kemipex, KN Neochem, BASF SE, The Dow Chemical Company, Hannong Chemicals, and Henan GP Chemical.

Which region dominated the global glycol ether market share?

Asia-Pacific held the dominating position in glycol ether industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of glycol ether during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global glycol ether industry?

The current trends and dynamics in the glycol ether industry include increasing demand in paints and coatings for their efficient solvency and low volatility, growing adoption in pharmaceuticals due to compatibility with diverse active ingredients, environmental regulations favoring eco-friendly solvents, and expanded use in electronics for precision cleaning without harming sensitive components.

Which product held the maximum share in 2022?

The p-series product held the maximum share of the glycol ether industry.