Glass Insulation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Glass Insulation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

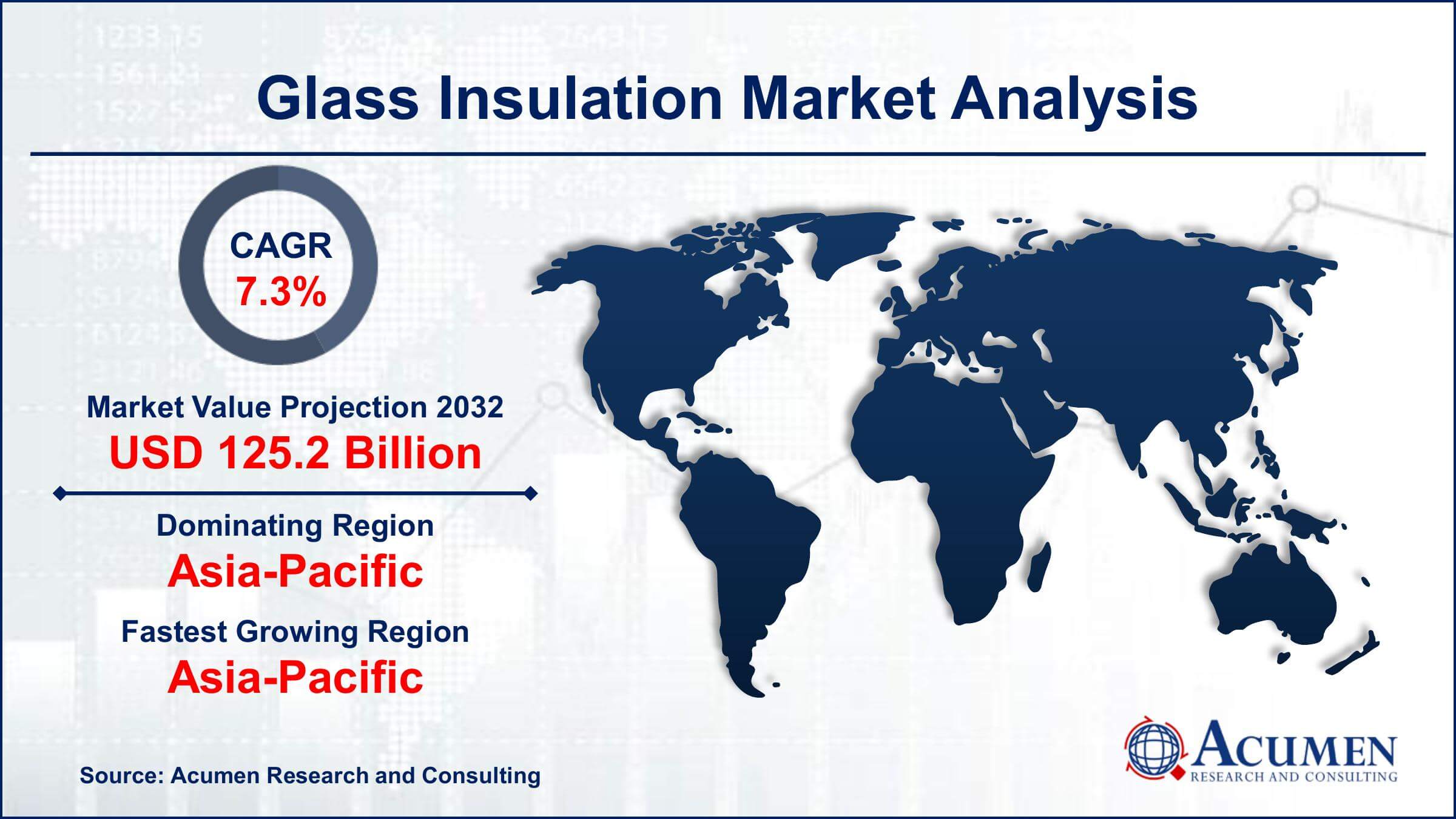

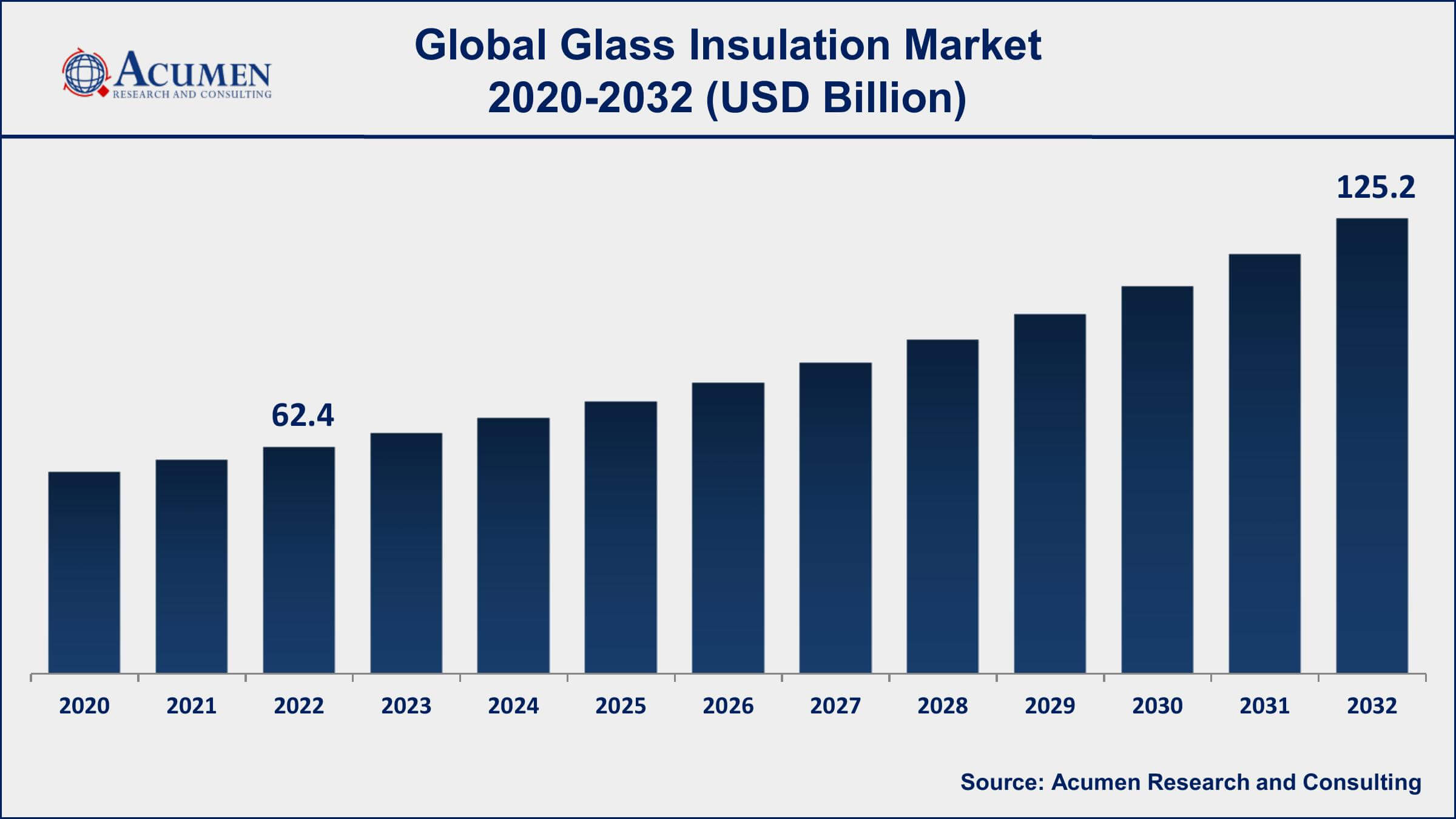

The Global Glass Insulation Market Size accounted for USD 62.4 Billion in 2022 and is projected to achieve a market size of USD 125.2 Billion by 2032 growing at a CAGR of 7.3% from 2023 to 2032.

Report Key Highlights

- Global glass insulation market revenue is expected to increase by USD 125.2 Billion by 2032, with a 7.3% CAGR from 2023 to 2032

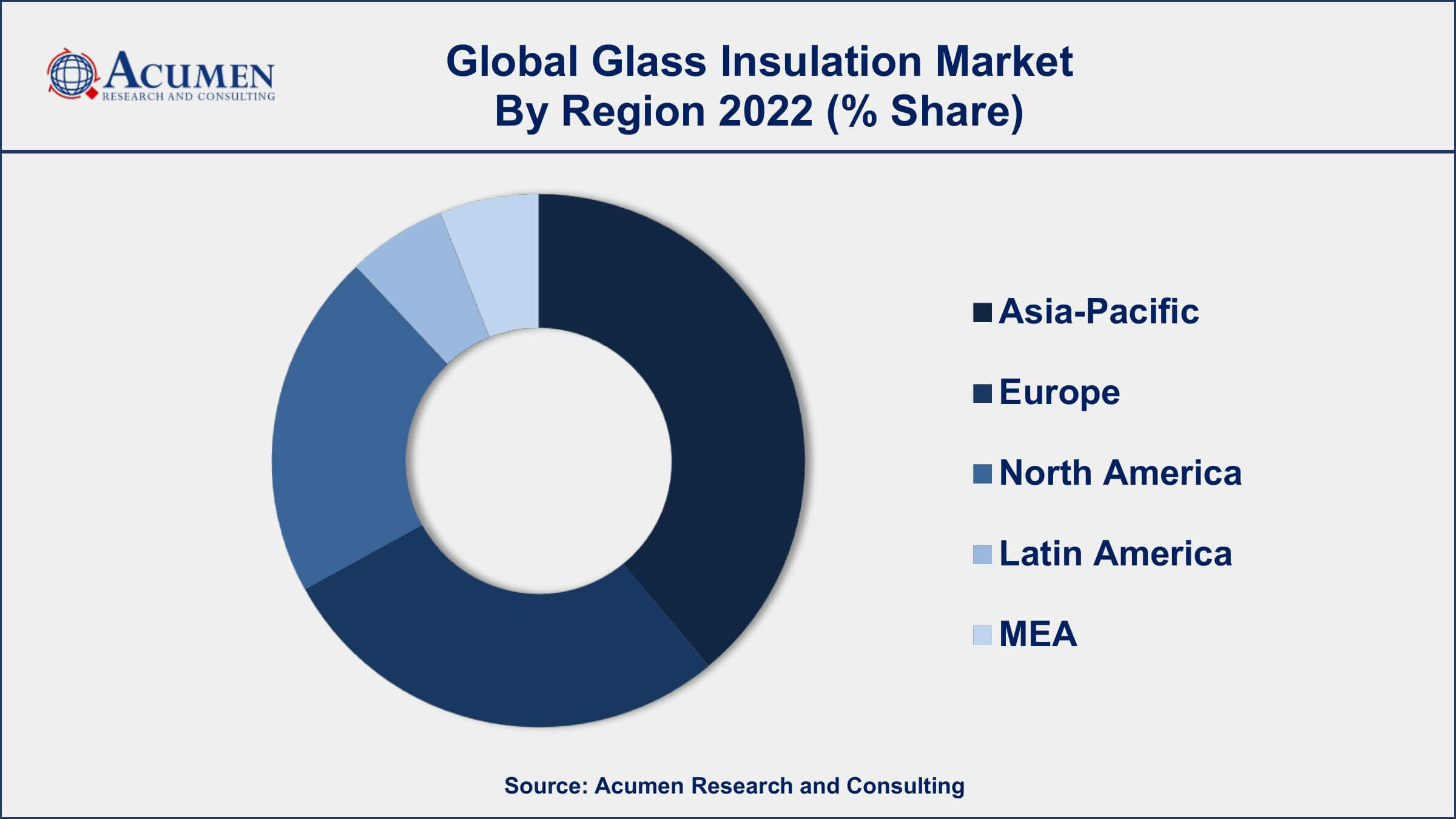

- Asia-Pacific region led with more than 36% of glass insulation market share in 2022

- According to the U.S. Department of Energy, adding insulation to an existing home can save up to 30% on heating and cooling costs

- According to a study by the National Institute of Standards and Technology (NIST), the use of insulation in buildings can reduce energy consumption by up to 40%

- Glass wool insulation is the most common type of insulation used in both residential and non-residential buildings

- Growing trend of energy-efficient retrofitting of buildings, drives the glass insulation market size

Glass insulation is a type of thermal insulation material that is used to reduce heat transfer between surfaces of different temperatures. It is made from glass fibers or glass wool, which are produced by melting glass and then spinning it into fibers or wool. Glass insulation is commonly used in the construction industry to insulate walls, ceilings, and roofs, as well as in industrial applications to insulate pipes, tanks, and equipment. It is also used in the automotive and aerospace industries to improve energy efficiency and reduce noise levels.

The global glass insulation market value has been experiencing steady growth in recent years due to increasing demand from the construction and industrial sectors. Factors such as rising energy costs, stringent building codes, and environmental regulations have led to an increased focus on energy-efficient building materials, which have benefited the glass insulation market growth. Additionally, the growing popularity of green buildings and sustainable construction practices has further boosted the demand for glass insulation products. Technological advancements in glass insulation manufacturing processes have also led to the development of high-performance insulation products with improved thermal efficiency, fire resistance, and acoustic insulation properties.

Global Glass Insulation Market Trends

Market Drivers

- Increasing demand for energy-efficient buildings and sustainable construction practices

- Stringent building codes and environmental regulations

- Rising energy costs and focus on reducing greenhouse gas emissions

- Technological advancements in glass insulation manufacturing processes

Market Restraints

- High initial costs of glass insulation products compared to traditional insulation materials

- Volatility in raw material prices

Market Opportunities

- Development of new high-performance glass insulation products

- Growing trend of energy-efficient retrofitting of buildings

Glass Insulation Market Report Coverage

| Market | Glass Insulation Market |

| Glass Insulation Market Size 2022 | USD 62.4 Billion |

| Glass Insulation Market Forecast 2032 | USD 125.2 Billion |

| Glass Insulation Market CAGR During 2023 - 2032 | 7.3% |

| Glass Insulation Market Analysis Period | 2020 - 2032 |

| Glass Insulation Market Base Year | 2022 |

| Glass Insulation Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Owens Corning, Saint-Gobain S.A., Knauf Insulation, Johns Manville, Guardian Industries, Nippon Sheet Glass Co. Ltd., Pittsburgh Corning Corporation, PPG Industries, Inc., AGC Inc., Central Glass Co. Ltd., Euroglas GmbH, and Schott AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The glass of windows is insulated so that the heat or fire is reflected from the room. Thermally insulated glasses are also known as low e-glass and low-emissivity. Insulated glass also allows the light and heat from the sun to go through the glasses. Insulated glass offers benefits such as improved thermal insulation, solar heat gain, energy efficiency, and less condensation. Glass insulation also controls the temperature and humidity of rooms or buildings. Windows of the train, hotels, houses, cell phones, and cars employ glass insulation.

The rapidly growing construction industry is the major driving factor for the glass insulation market. The construction industry is enormously growing in the emerging economies of India, China, Brazil, Argentina, UAE, Saudi Arabia, Malaysia, Turkey, and parts of Africa, thereby driving the market for glass insulation. Moreover, the stringent government regulation regarding energy-efficient buildings also drives the market for glass insulation. The market for glass insulation is also driven by the marine industry as they require insulated glass to reduce sound pollution. However, the market for glass insulation may face growth hindrances owing to the shortage of raw materials. The manufacturers of insulated glass have huge growth opportunities from the emerging economies of Asia-Pacific which includes India, China, Malaysia, Indonesia, Australia & Korea, and parts of the Middle East and Latin America.

Glass Insulation Market Segmentation

The global glass insulation market segmentation is based on type, application, and geography.

Glass Insulation Market By Type

- Insulating Glass Units

- Glass Wool

- Cellular Glass

In terms of types, the insulating glass units segment has seen significant growth in the glass insulation market in recent years. Insulating glass units (IGUs) are a type of glass insulation product that consists of two or more panes of glass separated by an air or gas-filled space, typically filled with argon or krypton gas. IGUs are commonly used in windows, doors, and skylights in residential and commercial buildings to improve energy efficiency and reduce noise levels. The IGUs segment of the insulation market has been experiencing steady growth in recent years, driven by increasing demand for energy-efficient building materials and rising construction activities in emerging economies. The growth of the segment is also attributed to the increasing popularity of green buildings and sustainable construction practices, which require the use of energy-efficient building materials such as IGUs.

Glass Insulation Market By Application

- Residential Construction

- Non-Residential Construction

- HVAC

- Industrial

- Others

According to the glass insulation market forecast, the non-residential construction segment is expected to witness significant growth in the coming years. Non-residential construction includes commercial, industrial, institutional, and infrastructure projects, such as office buildings, hospitals, schools, airports, and bridges. Glass insulation products are widely used in these applications to improve energy efficiency, reduce heating and cooling costs, and provide acoustic insulation. The non-residential construction segment is expected to continue driving growth in the global market due to ongoing investments in infrastructure and commercial projects in emerging economies, as well as increasing focus on energy-efficient retrofitting of existing buildings in developed economies. Technological advancements in glass insulation manufacturing processes and the development of new high-performance insulation products are also expected to further boost the demand for glass insulation products in the non-residential construction segment.

Glass Insulation Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Glass Insulation Market Regional Analysis

The Asia-Pacific region dominates the global glass insulation market, accounting for a significant share of the total market revenue. The region's dominance can be attributed to several factors, including the growing demand for energy-efficient building materials, rapid urbanization, and increasing construction activities in emerging economies such as China, India, and Southeast Asian countries. One of the key drivers of the Asia-Pacific regional market growth is the increasing demand for energy-efficient buildings and sustainable construction practices. Governments in the region are implementing stringent building codes and environmental regulations to promote energy efficiency, which has led to increased adoption of glass insulation products. Additionally, the region is experiencing rapid urbanization, which has created a demand for high-quality and sustainable building materials.

Glass Insulation Market Player

Some of the top glass insulation market companies offered in the professional report include Owens Corning, Saint-Gobain S.A., Knauf Insulation, Johns Manville, Guardian Industries, Nippon Sheet Glass Co. Ltd., Pittsburgh Corning Corporation, PPG Industries, Inc., AGC Inc., Central Glass Co. Ltd., Euroglas GmbH, and Schott AG.

Frequently Asked Questions

What was the market size of the global glass insulation in 2022?

The market size of glass insulation was USD 62.4 Billion in 2022.

What is the CAGR of the global glass insulation market from 2023 to 2032?

The CAGR of Glass Insulation is 7.3% during the analysis period of 2023 to 2032.

Which are the key players in the glass insulation market?

The key players operating in the global market are including Owens Corning, Saint-Gobain S.A., Knauf Insulation, Johns Manville, Guardian Industries, Nippon Sheet Glass Co. Ltd., Pittsburgh Corning Corporation, PPG Industries, Inc., AGC Inc., Central Glass Co. Ltd., Euroglas GmbH, and Schott AG.

Which region dominated the global glass insulation market share?

Asia-Pacific held the dominating position in glass insulation industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of glass insulation during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global glass insulation industry?

The current trends and dynamics in the glass insulation industry include increasing demand for energy-efficient buildings and sustainable construction practices.

Which Application held the maximum share in 2022?

The non-residential construction application held the maximum share of the glass insulation industry.