Geomembrane Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Geomembrane Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

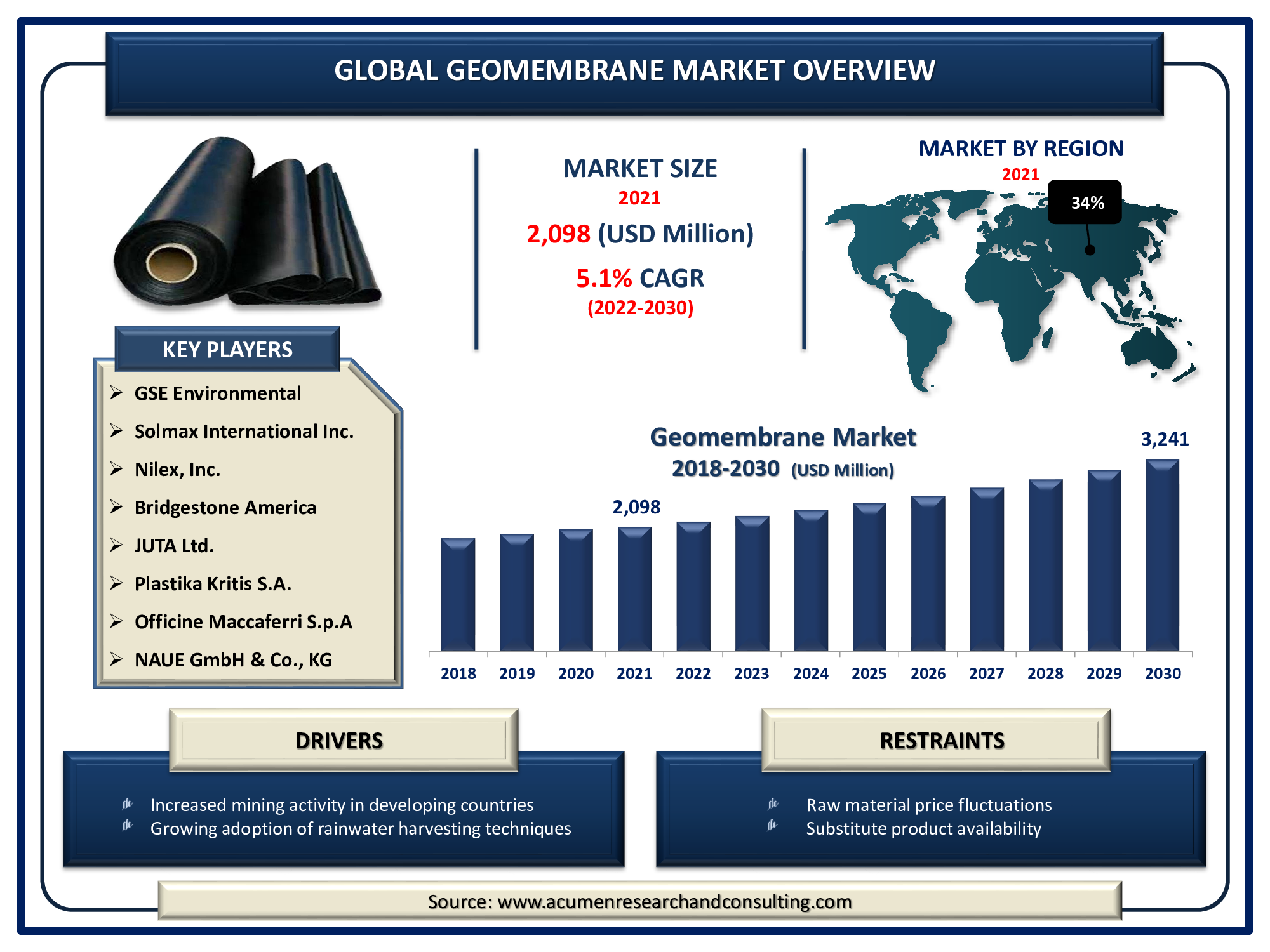

The Global Geomembrane Market size accounted for USD 2,098 Million in 2021 and is expected to reach USD 3,241 Million by 2030 at a considerable CAGR of 5.1% during the forecast period from 2022 to 2030.

The increasing shale gas manufacturing capacities, as well as an upsurge in mining activities in emerging nations, are expected to drive the geomembrane market size over the forecast period. Furthermore, the growing use of rainwater harvesting methodologies for agricultural purposes in advanced economies is driving the geomembrane market growth.

Geomembrane is a thin, flexible polymeric sheet that is used in building projects and agricultural production to create an impervious containment or barrier in leakage control projects. Geomembrane is a geosynthetic commodity that has excellent properties, a low acquisition cost, and a high barrier to the flow of water and other liquids. It is used in many industries, including irrigation, petroleum and gas, the environment, fish farming, and agriculture. Furthermore, it creates an impermeable barrier that prevents harmful contaminants or toxic materials from leaking into the surrounding environment. It is also commonly used as a quarantine barrier in irrigation and irrigated agrarian storage capacity.

Geomembrane Market Dynamics

Geomembrane Market Drivers

- Increased mining activity in developing countries

- Increasing spending on infrastructure advancement

- Growing adoption of rainwater harvesting techniques

- The risein aquaculture and fish farming

Geomembrane Market Restraints

- Raw material price fluctuations

- Substitute product availability

Geomembrane Market Opportunity

- Growing environmental consciousness

- Increasing government investment in waste management projects

Report Coverage

| Market | Geomembrane Market |

| Market Size 2021 | USD 2,098 Million |

| Market Forecast 2030 | USD 3,241 Million |

| CAGR During 2022 - 2030 | 5.1% |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Raw Material, By Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | GSE Environmental, Solmax International Inc., Nilex, Inc., Bridgestone America, JUTA Ltd., PlastikaKritis S.A., Officine Maccaferri S.p.A, NAUE GmbH & Co., KG Geofabrics Australasia Pty Ltd., Carlisle SynTec Systems, Carthage Mils Erosion Control Company, Inc., and Anhui Huifeng New Synthetic Materials Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Geomembranes can be highly customized materials depending on their potential applications in a variety of industries. They are widely used in water management, construction, mining, and waste management. Geomembranes' increasing use in construction projects, mining sites, leach pads, and refineries is expected to drive growth in the coming years. The construction industry is one of the most common geomembrane application areas, and it is anticipated to expand further as a result of favorable government regulations around the globe. Growing demand for geomembranes in specialized applications such as erosion protection, foundation hydration barriers, radon, and natural gas barriers, tunnel water resistance, agricultural waste ponds, tank interior linings, floating containment booms, and temporary covers for contaminated agricultural production is expected to drive market growth in the coming years.

However, high raw material price volatility is expected to moderately hinder the geomembrane industry over the forecast period. Besides that, the increasing use of geosynthetic clay liners in dumping sites and lining structures may pose a substitution risk to the geomembranes market value. Furthermore, price increases for bituminous membranes used in the waste disposal and water-resistance are expected to reduce the use of geomembranes over the forecast period.

Geomembrane Market Segmentation

The global geomembrane market segmentation is based on raw material, technology, application, and region.

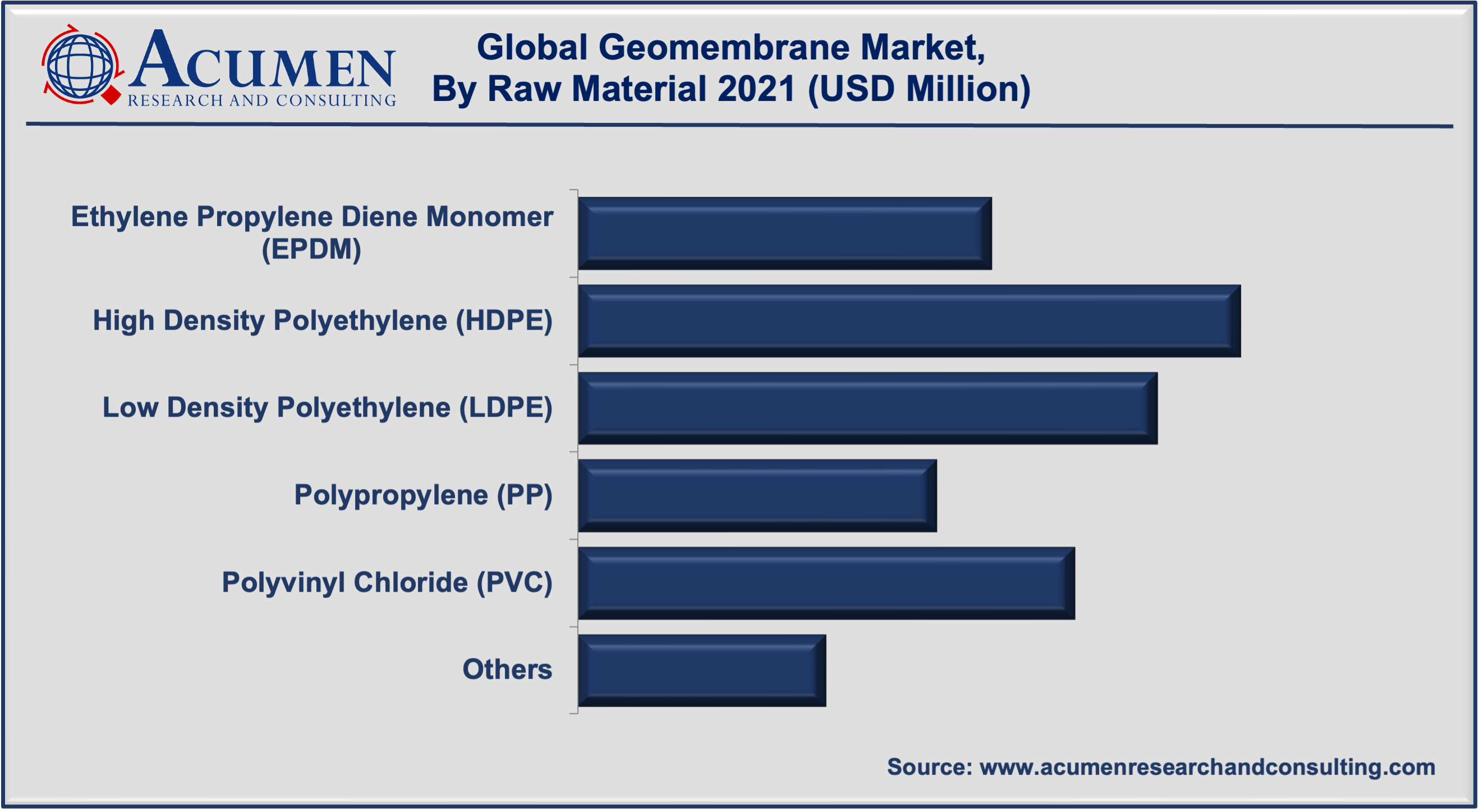

Geomembrane Market by Raw Material

- Ethylene Propylene Diene Monomer (EPDM)

- High Density Polyethylene (HDPE)

- Low Density Polyethylene (LDPE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Others

Based on raw material, the high-density polyethylene (HDPE) segment is expected to account for a significant market share in the coming years. HDPE is expected to lead the raw material segment for the manufacturing of geomembranes due to key properties such as ease of implementation and thermal conductivity. Chemical inertness, ultraviolet protection, excellent durability, good stability, inherent flexibility, and weather aging resistance are just a few of the benefits of these membranes. It is primarily used in the production of geomembranes due to its application in industries such as mining, agriculture, and construction, all of which have high growth potential.

Geomembrane Market by Technology

- Extrusion

- Calendering

- Others

In terms of technology, the extrusion segment is expected to have the largest market share in 2021. It is widely used in building construction, rainwater harvesting, environmental protection, and groundwater protection. An increase in these activities globally is expected to boost the segment over the forecasted timeframe. Extruded geomembranes are made from linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE). Furthermore, extruded geomembranes are made by temperature-welding thermoplastic materials such as HDPE. The widespread use of such materials, which have significant growth potential, is expected to benefit extrusion technology.

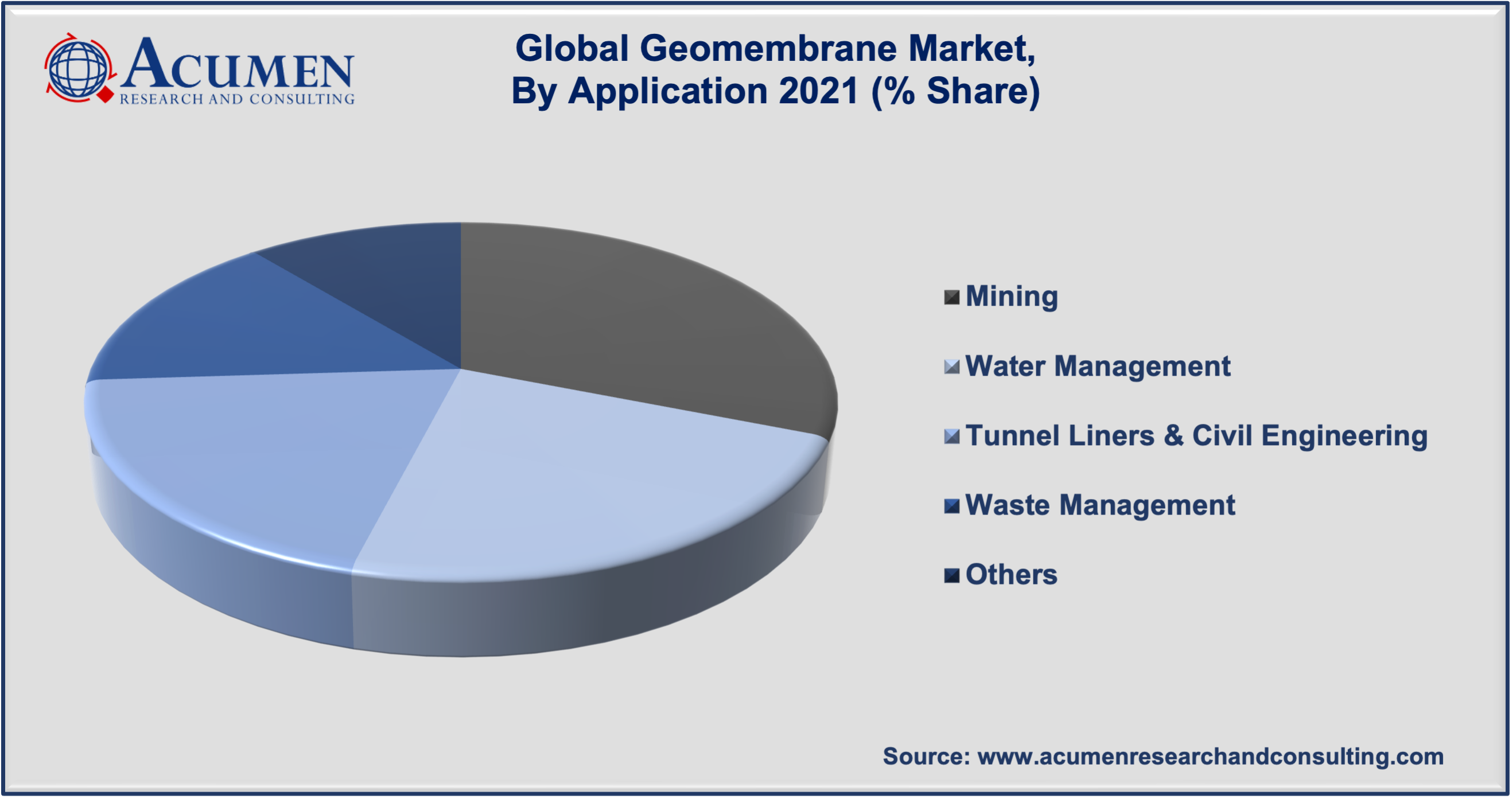

Geomembrane Market by Application

- Mining

- Water Management

- Tunnel Liners & Civil Engineering

- Waste Management

- Others

According to the geomembrane market forecast, the mining segment will hold a significant share in 2021 and will grow at a significant rate during the forecast period. Due to their exceptional functionalities, such as excellent corrosion resistance, UV resistance, a wide temperature range, weather resistance, low permeability, and high cracking and puncture resistance, geomembranes are rapidly being adopted in mining. In the mining industry, it is also used to prevent leachate leakage where metal dissolution occurs. The use of geomembrane results in drainage solutions, oil and gas mining, and soil contamination protection. However, as the demand for efficient water usage and groundwater remediation grows, so does the demand for geomembrane in canal lining applications.

Furthermore, the waste management application segment held a sizable market geomembrane market share in 2021. Government entities promote the use of geomembranes by enforcing stringent waste management regulations in the industrial and municipal sectors. Over the forecast period, the burgeoning shale gas sector in North America and Europe is expected to drive substantial growth in the use of geomembranes in irrigation systems.

Geomembrane Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Asia-Pacific is the fastest-growing region in the global market, owing to the presence of emerging economies such as India, China, Japan, and others in the region, with industrial activities expected to increase in the coming years. This factor will increase geomembrane implementation during the forecast period. The rapid growth of this region's economy is largely due to its rapidly growing population, as well as steadily increasing urbanization and industrialization. These factors are fueling the region's demand for waste and water management projects in agriculture and construction. Furthermore, strict environmental regulations imposed by governments throughout the region are expected to propel the geomembranes market trend in a variety of applications such as energy, oil and gas, civil, agriculture, athletic, liquid containment, concrete preservation, spill or secondary containment, and industrial applications.

Geomembrane Market Players

Some of the prominent global geomembrane market companies are GSE Environmental, Solmax International Inc., Nilex, Inc., Bridgestone America, JUTA Ltd., PlastikaKritis S.A., Officine Maccaferri S.p.A, NAUE GmbH & Co., KG Geofabrics Australasia Pty Ltd., Carlisle SynTec Systems, Carthage Mils Erosion Control Company, Inc., and Anhui Huifeng New Synthetic Materials Co., Ltd.

Frequently Asked Questions

How much was the market size of global geomembrane market in 2021?

The global geomembrane market size accounted for USD 2,098 Million in 2021.

What will be the projected CAGR for global geomembrane market during forecast period of 2022 to 2030?

The projected CAGR of geomembrane during the analysis period of 2022 to 2030 is 5.1%.

Which are the prominent competitors operating in the market?

The prominent players of the global geomembrane market involve GSE Environmental, Solmax International Inc., Nilex, Inc., Bridgestone America, JUTA Ltd., PlastikaKritis S.A., Officine Maccaferri S.p.A, NAUE GmbH & Co., KG Geofabrics Australasia Pty Ltd., Carlisle SynTec Systems, Carthage Mils Erosion Control Company, Inc., and Anhui Huifeng New Synthetic Materials Co., Ltd.

Which region held the dominating position in the global geomembrane market?

Asia-Pacificheld the dominating share for geomembrane during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for geomembrane during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global geomembrane market?

Increased mining activity in developing countries, increasing spending on infrastructure advancement, and growing adoption of rainwater harvesting techniques are the prominent factors that fuel the growth of global geomembrane market.

By segment Raw Material, which sub-segment held the maximum share?

Based on raw material, high density polyethylene (HDPE)segment held the maximum share for geomembrane market in 2021.