Gelatin Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Gelatin Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

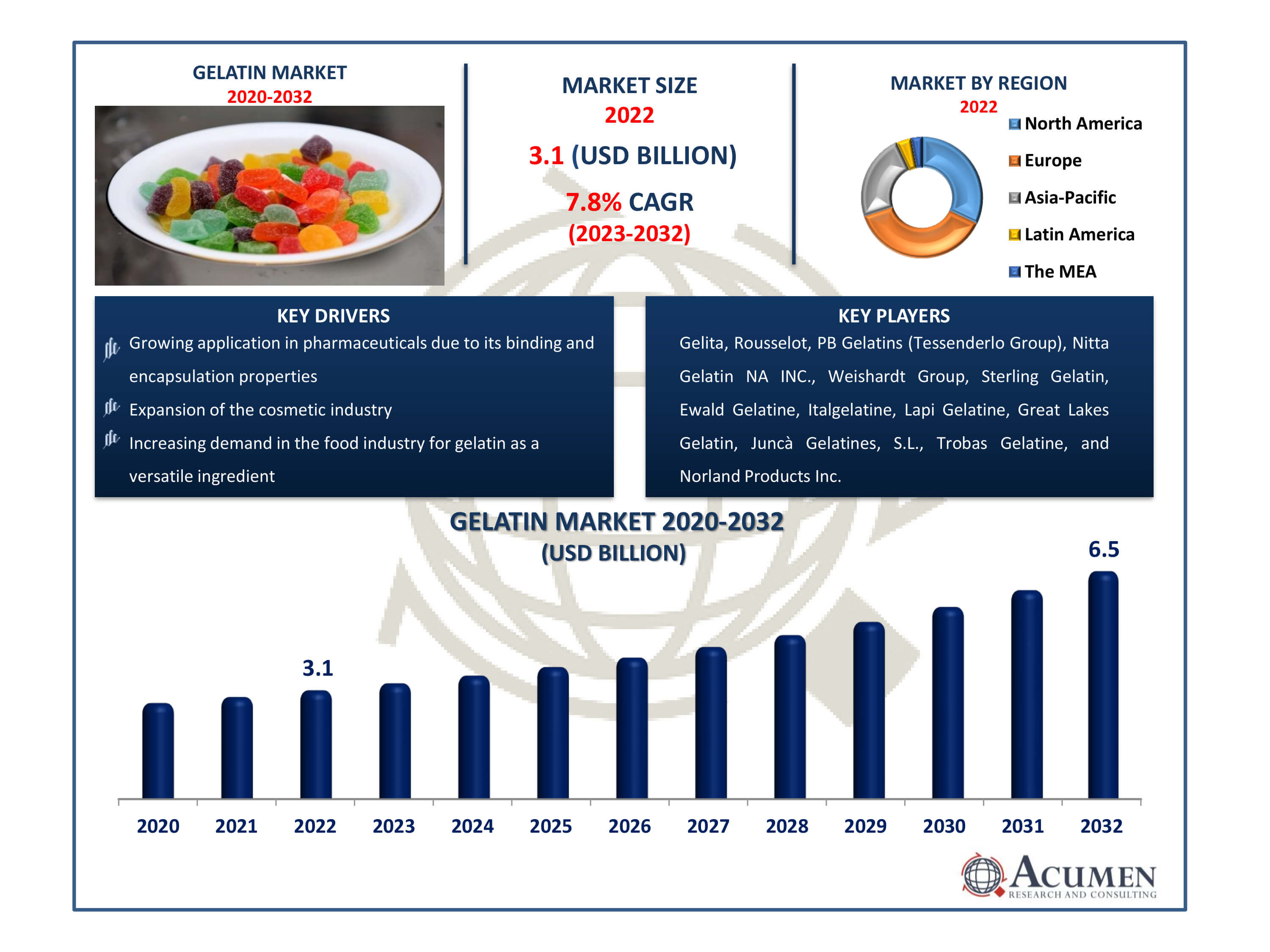

The Gelatin Market Size accounted for USD 3.1 Billion in 2022 and is estimated to achieve a market size of USD 6.5 Billion by 2032 growing at a CAGR of 7.8% from 2023 to 2032.

Gelatin Market Highlights

- Global gelatin market revenue is poised to garner USD 6.5 billion by 2032 with a CAGR of 7.8% from 2023 to 2032

- Europe gelatin market value occupied around USD 1.2 billion in 2022

- Asia-Pacific gelatin market growth will record a CAGR of more than 8% from 2023 to 2032

- Among function, the stabilizer sub-segment generated over US$ 1.3 billion revenue in 2022

- Based on application, the healthcare sub-segment generated around 57% share in 2022

- Increased focus on clean label and natural ingredients, favoring gelatin's natural origin is a popular gelatin market trend that fuels the industry demand

Gelatin is a distinctive protein derived from the partial hydrolysis of collagen found in animal bones and skin. Commonly sourced from porcine skin, bovine hide, and bovine bone, gelatin possesses unique properties that make it valuable as a binder, gelling agent, thickener, or emulsifier. According to the British National Formulary (BNF), gelatin is defined as the product obtained from alkaline, acid, or enzymatic hydrolysis of collagen the primary protein component in bones, skin, and connective tissue of various animals, including poultry and fish. This flavorless, translucent, and colorless protein, extracted from collagen in the body parts of different creatures, forms a dense semi-solid gel primarily composed of glycine and proline, two essential amino acids. Its composition generally includes water, mineral salts, and protein. Available in various forms powder, granules, or sheets gelatin finds versatile use in different formulations.

Global Gelatin Market Dynamics

Market Drivers

- Increasing demand in the food industry for gelatin as a versatile ingredient

- Growing application in pharmaceuticals due to its binding and encapsulation properties

- Rise in health-conscious consumers seeking collagen-based supplements

- Expansion of the cosmetic industry utilizing gelatin in skincare products for its skin-enhancing properties

Market Restraints

- Religious and dietary restrictions limiting the use of animal-derived gelatin

- Fluctuating prices of raw materials impacting production costs

- Concerns over sustainability and ethical sourcing of animal-based gelatin

Market Opportunities

- Innovations in producing plant-based or alternative sources of gelatin

- Emerging markets in developing countries for gelatin-based pharmaceuticals and food products

- Utilizing gelatin in the 3D printing industry for biomedical applications

Gelatin Market Report Coverage

| Market | Gelatin Market |

| Gelatin Market Size 2022 | USD 3.1 Billion |

| Gelatin Market Forecast 2032 | USD 6.5 Billion |

| Gelatin Market CAGR During 2023 - 2032 | 7.8% |

| Gelatin Market Analysis Period | 2020 - 2032 |

| Gelatin Market Base Year |

2022 |

| Gelatin Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Source, By Function, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Gelita, Rousselot, PB Gelatins (Tessenderlo Group), Nitta Gelatin NA INC., Weishardt Group, Sterling Gelatin, Ewald Gelatine, Italgelatine, Lapi Gelatine, Great Lakes Gelatin, Juncà Gelatines, S.L., Trobas Gelatine, Norland Products Inc., El Nasr Gelatin, Nippi Gelatin Division, India Gelatine & Chemicals, and Geltech. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Gelatin Market Insights

Health-conscious consumers are increasingly mindful of the benefits and uses of gelatin, leading to a willingness to invest more in gelatin-based products. This heightened awareness stands as a primary driver for market growth. Gelatin's expanding applications in controlling consistency, purification, and stabilization across various industries contribute significantly to the global market growth.

Factors such as rising income levels, improved living standards in developed economies, and robust growth in end-use industries are notably bolstering market expansion. However, concerns related to the ethical and health aspects surrounding the use of animal body parts for gelatin production restrain market growth. Another significant factor affecting gelatin demand is the increasing desire for functional foods derived from natural sources. Despite the market's growth, several challenges persist, including low acceptance among strict vegetarians and religious groups such as Hindus, Muslims, and Jews. Moreover, there's growing concern among experts about the potential transmission of pathogenic vectors like prions through animal tissue-derived gelatins. However, increasing awareness among the populace, coupled with the rising elderly population, is expected to further drive the gelatin market.

Gelatin Market Segmentation

The worldwide market for gelatin is split based on type, source, function, application, and geography.

Gelatin Types

- Type A

- Type B

The production processes and qualities of type A and type B gelatin differ significantly. Type A gelatin, derived from acid-cured collagen, exhibits a lower isoelectric point, rendering it positively charged in acidic conditions. Gelatin industry analysis indicates that Type A dominates due to its versatility it boasts superior gelling properties, heightened stability in acidic environments, and widespread utilization across industries such as food, pharmaceuticals, and cosmetics. Its expanded applications across various pH ranges and enhanced functional attributes contribute significantly to its market dominance.

Gelatin Sources

- Bovine

- Porcine

- Poultry

- Marine

- Others

The bovine segment's ascendancy in the gelatin market is predominantly attributed to its widespread availability and diverse applications. Sourced from cattle, bovine gelatin stands as a dependable and abundant source within the industry. Its prominence is driven by the abundance of cattle-related byproducts and the cost-effectiveness associated with bovine sources. Moreover, its remarkable gelling capabilities cater to a spectrum of industries like food, pharmaceuticals, and cosmetics, further consolidating its market domination. The segment's consistent supply, cost efficiency, and advantageous functional properties position it favorably for sustained dominance, with market forecast indicating continued growth owing to these factors.

Gelatin Functions

- Stabilizer

- Thickener

- Gelling Agent

- Others

The stabilizer category has the greatest market share in the gelatin industry due to its broad usage and vital significance across multiple applications. Gelatin-based stabilizers find extensive use in food, pharmaceuticals, and cosmetics for their capacity to enhance texture, prolong shelf life, and ensure consistent product quality. Market analysis highlights the dominance of this segment owing to the widespread demand for stabilizers in various industries, particularly in food production. Gelatin stabilizers are instrumental in crafting desirable textures and stabilizing emulsions, showcasing adaptability and indispensability across diverse sectors, thereby reinforcing the stabilizer segment's stronghold within the gelatin market.

Gelatin Applications

- Healthcare

- Cosmetics

- Food & Beverages

- Functional Foods

- Meat Processing

- Functional Beverages

- Dietary Supplements

- Confectionery

- Desserts

- Others

As per the gelatin market forecast, the food & beverage category maintains the largest share due to its expansive and versatile applications across various consumables. Gelatin serves as a pivotal ingredient in an extensive array of food products, spanning confectionery, dairy, confections, and meat items. Its unique functionalities as a gelling agent, stabilizer, and thickener significantly contribute to achieving desired textures, consistency, and prolonged shelf life in food manufacturing. The perpetual and widespread demand for gelatin in food applications, coupled with its adaptable nature, positions the food & beverage segment as the enduring leader in the gelatin industry, with promising market forecast indicating sustained growth based on these factors.

Gelatin Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

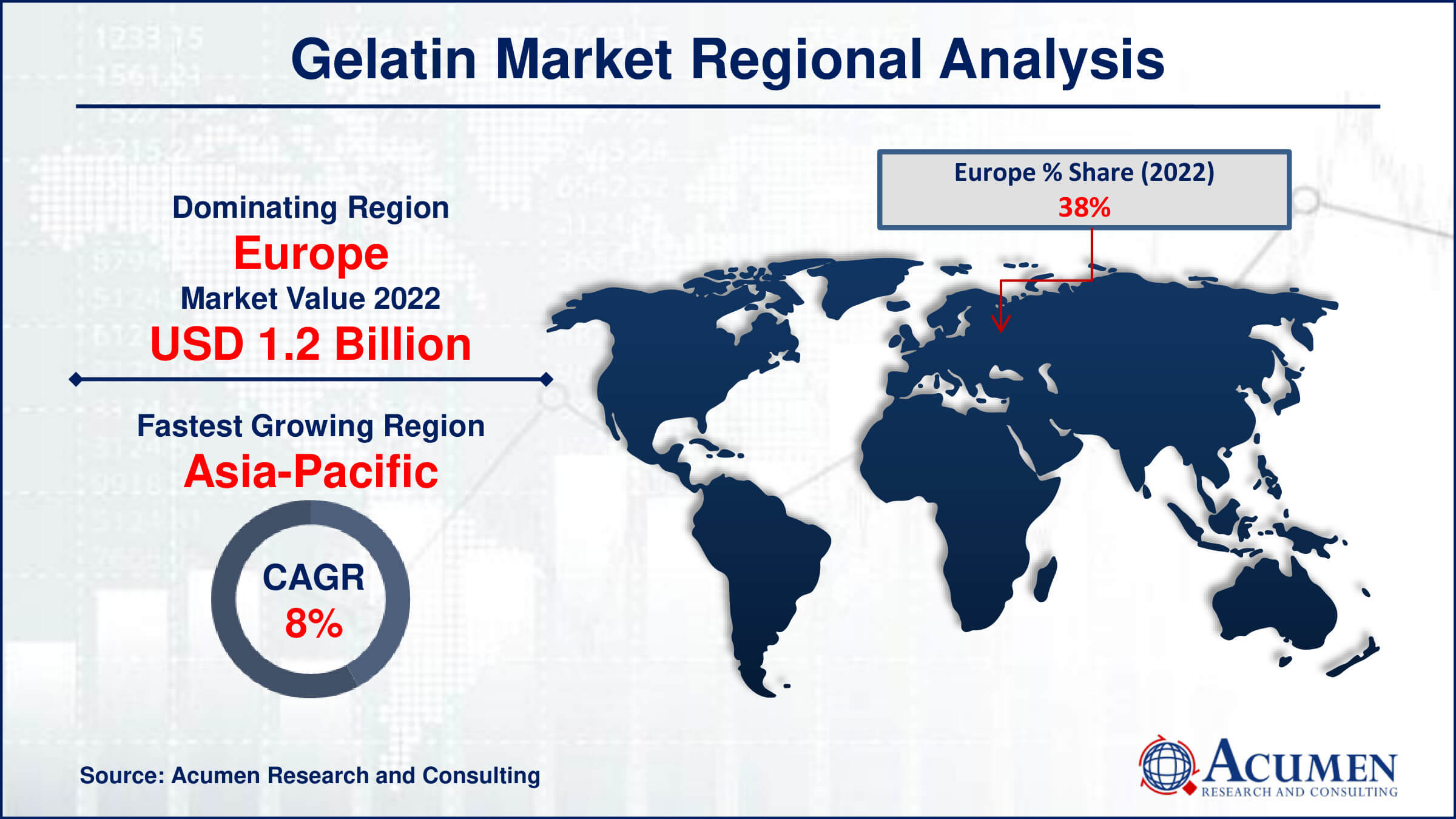

Gelatin Market Regional Analysis

Europe has the highest share of the gelatin market due to its established food and pharmaceutical sectors, which employ gelatin extensively in a variety of goods. The region's strict quality standards, as well as its emphasis on natural ingredients in food and cosmetics, drive up demand for gelatin. Furthermore, Europe's substantial position in the pharmaceutical sector, where gelatin is critical for drug encapsulation and delivery systems, considerably contributes to its market supremacy.

North America is the second-largest region in the gelatin market. Gelatin is in high demand in pharmaceuticals, confectionary, and dietary supplements due to the development of a modern healthcare infrastructure and a strong food and beverage industry. Furthermore, the region's emphasis on clean-label products and functional foods drives gelatin consumption.

The Asia-Pacific region has emerged as the fastest-growing gelatin market, owing to growing populations, rising disposable incomes, and increased health concern. The developing food and beverage sector, together with a booming cosmetics business, drives demand for gelatin as a stabilizer, thickener, and gelling agent in this region. Furthermore, gelatin is widely used in capsule formulations by pharmaceutical businesses in Asia-Pacific. The region's shifting consumer tastes towards natural and sustainable components contribute to gelatin's quick rise in a variety of applications, bolstering its significance in the Asia-Pacific market.

Gelatin Market Players

Some of the top gelatin companies offered in our report includes Gelita, Rousselot, PB Gelatins (Tessenderlo Group), Nitta Gelatin NA INC., Weishardt Group, Sterling Gelatin, Ewald Gelatine, Italgelatine, Lapi Gelatine, Great Lakes Gelatin, Juncà Gelatines, S.L., Trobas Gelatine, Norland Products Inc., El Nasr Gelatin, Nippi Gelatin Division, India Gelatine & Chemicals, and Geltech.

Frequently Asked Questions

How big is the gelatin market size?

The market size of gelatin market was USD 3.1 billion in 2022.

What is the CAGR of the global gelatin market from 2023 to 2032?

The CAGR of gelatin is 7.8% during the analysis period of 2023 to 2032.

Which are the key players in the gelatin market?

The key players operating in the global market are including Gelita, Rousselot, PB Gelatins (Tessenderlo Group), Nitta Gelatin NA INC., Weishardt Group, Sterling Gelatin, Ewald Gelatine, Italgelatine, Lapi Gelatine, Great Lakes Gelatin, Junc� Gelatines, S.L., Trobas Gelatine, Norland Products Inc., El Nasr Gelatin, Nippi Gelatin Division, India Gelatine & Chemicals, and Geltech.

Which region dominated the global gelatin market share?

Europe held the dominating position in gelatin industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of gelatin during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global gelatin industry?

The current trends and dynamics in the gelatin industry include increasing demand in the food industry for gelatin as a versatile ingredient, growing application in pharmaceuticals due to its binding and encapsulation properties, rise in health-conscious consumers seeking collagen-based supplements, and expansion of the cosmetic industry utilizing gelatin in skincare products for its skin-enhancing properties.

Which source held the maximum share in 2022?

The bovine source held the maximum share of the gelatin industry.