Gas Feed System Market | Acumen Research and Consulting

Gas Feed System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

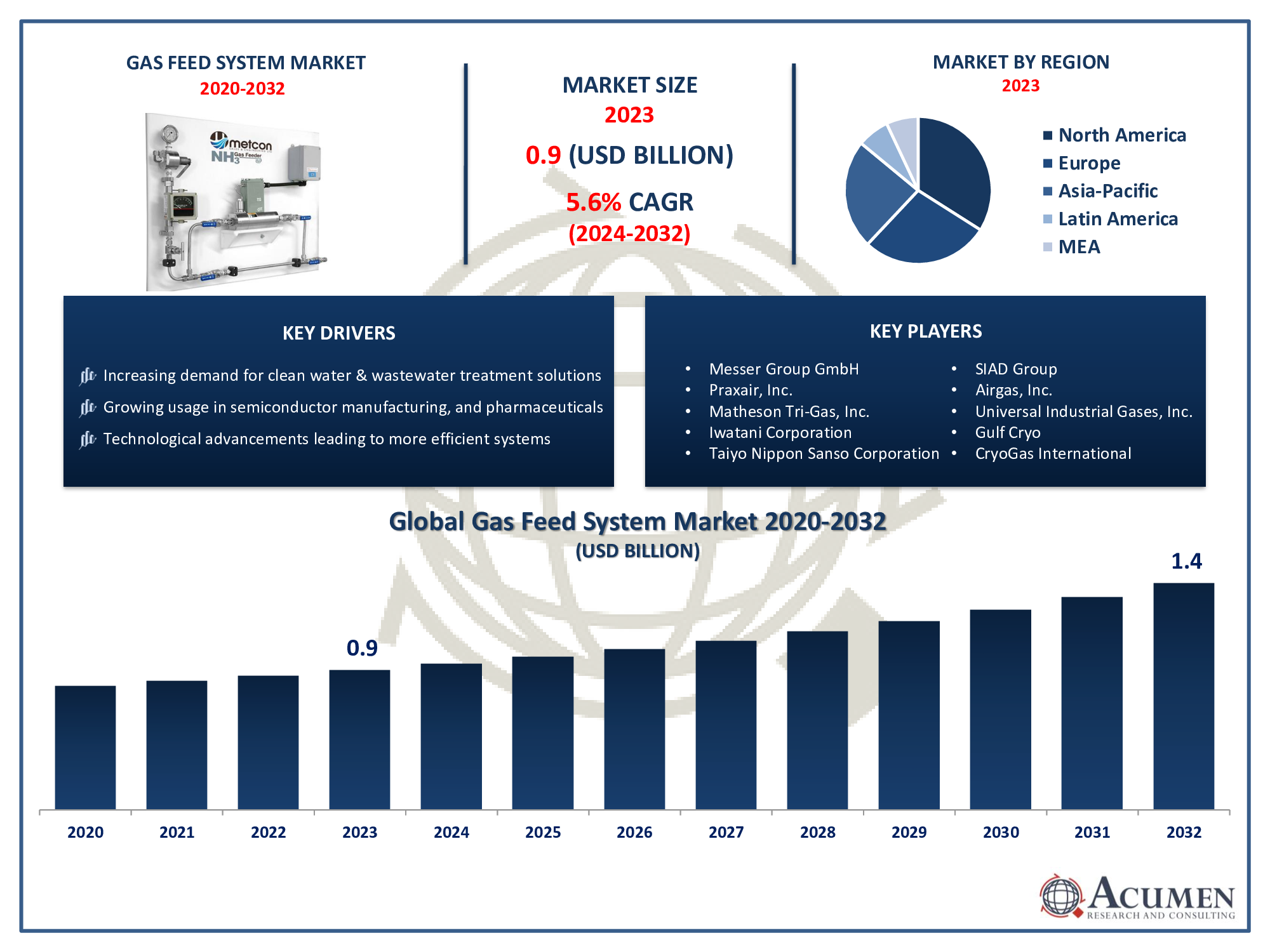

The Global Gas Feed System Market Size accounted for USD 0.9 Billion in 2023 and is projected to achieve a market size of USD 1.4 Billion by 2032 growing at a CAGR of 5.6% from 2024 to 2032.

Gas Feed System Market Highlights

- Global gas feed system market revenue is expected to increase by USD 1.4 Billion by 2032, with a 5.6% CAGR from 2024 to 2032

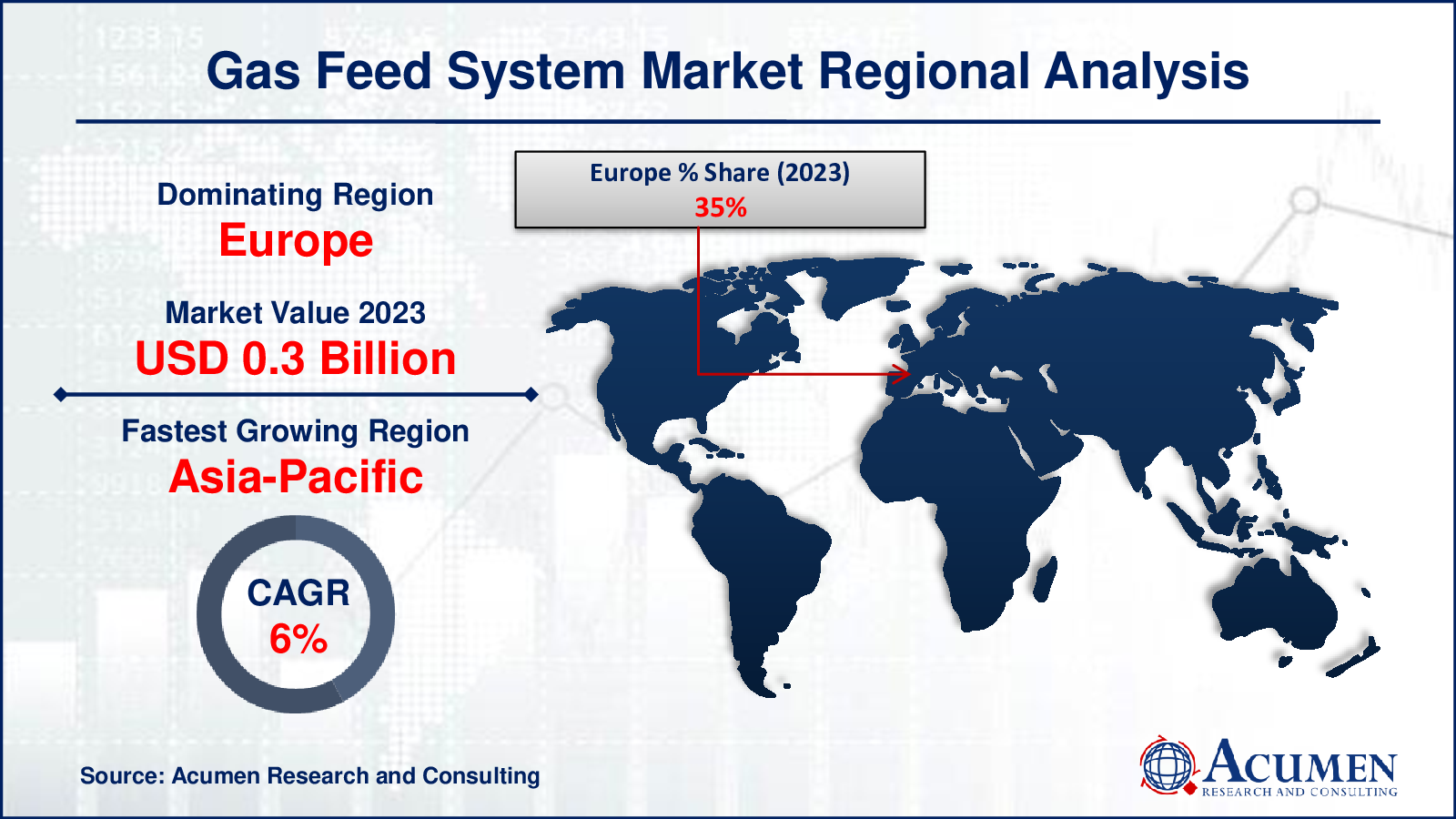

- Europe region led with more than 35% of gas feed system market share in 2023

- Asia-Pacific gas feed system market growth will record a CAGR of around 6.4% from 2024 to 2032

- By type of gas, the chlorine gas feed systems segment held the dominant share of around 46% in 2023

- By application, the industrial segment has recorded more than 31% of the revenue share in 2023

- Increasing demand for clean water and wastewater treatment solutions, drives the gas feed system market value

A gas feed system is a crucial component in various industries, especially those where precise gas delivery is essential for processes such as manufacturing, water treatment, and healthcare. These systems are designed to safely and accurately deliver gases from storage tanks to the point of use. They typically include components like pressure regulators, flow meters, valves, and piping to ensure the controlled release of gases in the required quantities.

In recent years, the market for gas feed systems has experienced significant growth, driven by several factors. One key driver is the increasing demand for clean water and wastewater treatment solutions globally, where gas feed systems are utilized for disinfection and pH control processes. Additionally, industries such as semiconductor manufacturing, pharmaceuticals, and food and beverage production require precise gas delivery systems to maintain product quality and safety standards. Moreover, advancements in technology have led to the development of more efficient and reliable gas feed systems, further fueling market growth.

Global Gas Feed System Market Trends

Market Drivers

- Increasing demand for clean water and wastewater treatment solutions

- Growing usage in semiconductor manufacturing, pharmaceuticals, and food production

- Technological advancements leading to more efficient systems

- Ongoing industrialization and urbanization globally

- Stringent environmental regulations driving the need for precise gas control

Market Restraints

- High initial investment costs

- Regulatory complexities in different regions

Market Opportunities

- Integration of automation and digitalization in industrial processes

- Development of customized solutions for specific industry needs

Gas Feed System Market Report Coverage

| Market | Gas Feed System Market |

| Gas Feed System Market Size 2022 |

USD 0.9 Billion |

| Gas Feed System Market Forecast 2032 | USD 1.4 Billion |

| Gas Feed System Market CAGR During 2023 - 2032 | 5.6% |

| Gas Feed System Market Analysis Period | 2020 - 2032 |

| Gas Feed System Market Base Year |

2022 |

| Gas Feed System Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type of Gas, By Application, By Technology, By End-User Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Messer Group GmbH, Praxair, Inc. (Now part of Linde plc), Matheson Tri-Gas, Inc., Iwatani Corporation, Taiyo Nippon Sanso Corporation, SIAD Group, Airgas, Inc. (A subsidiary of Air Liquide S.A.), Universal Industrial Gases, Inc., Gulf Cryo, nexAir, CryoGas International, and Gas Innovations. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Gas Feed System Market Dynamics

A gas feed system is a critical component used in various industries to safely and accurately deliver gases from storage tanks to the point of use. These systems are designed to ensure the controlled release of gases in the required quantities, often incorporating components like pressure regulators, flow meters, valves, and piping. Gas feed systems play a vital role in processes where precise gas delivery is essential, such as water treatment, chemical manufacturing, healthcare, food and beverage production, and semiconductor manufacturing. In water treatment, gas feed systems are commonly employed for disinfection and pH control processes. For example, chlorine gas is frequently used for disinfection purposes, while carbon dioxide is utilized to adjust pH levels in water treatment plants. In the healthcare sector, gas feed systems are used in medical gas delivery systems to supply gases like oxygen, nitrous oxide, and anesthesia gases to patients in hospitals and clinics.

The gas feed system market has been experiencing robust growth in recent years, driven by several key factors. One significant driver is the increasing demand for clean water and wastewater treatment solutions worldwide. Gas feed systems play a vital role in disinfection and pH control processes in water treatment plants, ensuring the safety and purity of drinking water and compliance with stringent environmental regulations. Moreover, as urbanization and industrialization continue to accelerate, the need for efficient water treatment solutions is further amplified, fueling the demand for gas feed systems. Additionally, the adoption of gas feed systems is expanding across various industries, including semiconductor manufacturing, pharmaceuticals, and food production. These sectors rely on precise gas delivery for a wide range of applications, such as inert gas blanketing, gas chromatography, and modified atmosphere packaging.

Gas Feed System Market Segmentation

The global gas feed system market segmentation is based on type of gas, application, technology, end-user industry, and geography.

Gas Feed System Market By Type of Gas

- Chlorine Gas Feed Systems

- Natural Gas Feed Systems

- Carbon Dioxide Gas Feed Systems

According to the gas feed system industry analysis, the chlorine gas feed systems segment accounted for the largest market share in 2023. Chlorine gas is widely utilized in water treatment plants for disinfection purposes due to its effectiveness in killing harmful microorganisms. As the demand for clean water continues to rise globally, driven by population growth, urbanization, and increasing industrial activities, the need for efficient chlorine gas feed systems has intensified. These systems play a critical role in ensuring the safety and reliability of water treatment processes by accurately controlling the dosage of chlorine gas delivered to the water. Moreover, stringent regulatory standards governing water quality and safety have further propelled the adoption of chlorine gas feed systems. Regulatory bodies worldwide impose strict guidelines to ensure that water treatment facilities maintain high standards of disinfection and comply with health and environmental regulations.

Gas Feed System Market By Application

- Industrial

- Commercial

- Agricultural

- Environmental

- Residential

In terms of applications, the industrial segment is expected to witness significant growth in the coming years. Industries across various sectors, including manufacturing, chemicals, pharmaceuticals, and food and beverage, rely on gas feed systems for a wide range of applications such as inert gas blanketing, chemical processing, sterilization, and packaging. As these industries continue to expand and evolve, the demand for efficient and reliable gas feed systems has surged. These systems play a crucial role in ensuring precise control and delivery of gases to support various industrial processes, enhancing productivity, efficiency, and product quality. Moreover, advancements in industrial automation and digitalization have further accelerated the growth of the industrial segment in the gas feed system market.

Gas Feed System Market By Technology

- Mass Flow Controllers

- Positive Displacement Flow Meters

- Variable Area Flow Meters

- Diffusion Systems

According to the gas feed system market forecast, the mass flow controllers segment is expected to witness significant growth in the coming years. Mass flow controllers are widely utilized in industries such as semiconductor manufacturing, pharmaceuticals, biotechnology, and research laboratories, where accurate and stable gas flow control is essential for maintaining process integrity and product quality. As these industries continue to expand and demand higher levels of precision and reliability, the need for advanced mass flow controllers has intensified, driving market growth. One key driver of growth in the MFCs segment is the increasing demand for process optimization and efficiency in industrial operations. Mass flow controllers offer precise control over gas flow rates, enabling manufacturers to achieve consistent and repeatable results, reduce waste, and improve overall productivity.

Gas Feed System Market By End-User Industry

- Energy & Power

- Healthcare

- Water and Wastewater Treatment

- Chemicals

- Food & Beverage

Based on the end-user industry, the water and wastewater treatment segment is expected to continue its growth trajectory in the coming years. Gas feed systems play a pivotal role in water treatment processes by facilitating the precise dosing of chemicals such as chlorine, ozone, and sulfur dioxide, which are essential for disinfection, pH adjustment, and odor control. With growing population, urbanization, and industrial activities leading to heightened pollution levels and water contamination, there's a rising demand for effective water treatment solutions, thereby propelling the growth of gas feed systems in this segment. Stringent regulatory standards and guidelines pertaining to water quality and safety are also driving the adoption of gas feed systems in the water and wastewater treatment sector.

Gas Feed System Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Gas Feed System Market Regional Analysis

Europe has emerged as a dominating region in the gas feed system market due to several key factors that contribute to its strong position in the industry. One significant factor is the region's stringent environmental regulations and standards, which drive the adoption of gas feed systems across various sectors such as water and wastewater treatment, pharmaceuticals, and chemical manufacturing. European countries have robust regulations governing air and water quality, necessitating the use of precise gas feed systems to ensure compliance and mitigate environmental impact. This regulatory framework creates a favorable environment for the growth of the gas feed system market in Europe. Moreover, Europe boasts a well-established industrial base with advanced manufacturing capabilities and a strong emphasis on innovation and technological advancement. The region is home to several prominent gas feed system manufacturers and suppliers, offering a wide range of products and solutions tailored to diverse industrial applications. Additionally, Europe's focus on sustainability and energy efficiency further drives the demand for efficient gas feed systems that optimize resource utilization and minimize environmental footprint. As a result, the region continues to witness significant investments in research and development aimed at enhancing the performance, reliability, and sustainability of gas feed systems, consolidating its position as a leader in the global market.

Gas Feed System Market Player

Some of the top gas feed system market companies offered in the professional report include Messer Group GmbH, Praxair, Inc. (Now part of Linde plc), Matheson Tri-Gas, Inc., Iwatani Corporation, Taiyo Nippon Sanso Corporation, SIAD Group, Airgas, Inc. (A subsidiary of Air Liquide S.A.), Universal Industrial Gases, Inc., Gulf Cryo, nexAir, CryoGas International, and Gas Innovations.

Frequently Asked Questions

What was the market size of the global gas feed system in 2023?

The market size of gas feed system was USD 0.9 Billion in 2023.

What is the CAGR of the global gas feed system market from 2024 to 2032?

The CAGR of gas feed system is 5.6% during the analysis period of 2024 to 2032.

Which are the key players in the gas feed system market?

The key players operating in the global market are including Messer Group GmbH, Praxair, Inc. (Now part of Linde plc), Matheson Tri-Gas, Inc., Iwatani Corporation, Taiyo Nippon Sanso Corporation, SIAD Group, Airgas, Inc. (A subsidiary of Air Liquide S.A.), Universal Industrial Gases, Inc., Gulf Cryo, nexAir, CryoGas International, and Gas Innovations.

Which region dominated the global gas feed system market share?

Europe held the dominating position in gas feed system industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of gas feed system during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global gas feed system industry?

The current trends and dynamics in the gas feed system industry include increasing demand for clean water and wastewater treatment solutions, and growing usage in semiconductor manufacturing, pharmaceuticals, and food production.

Which application held the maximum share in 2023?

The industrial application held the maximum share of the gas feed system industry.