Galvanized Steel Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Galvanized Steel Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

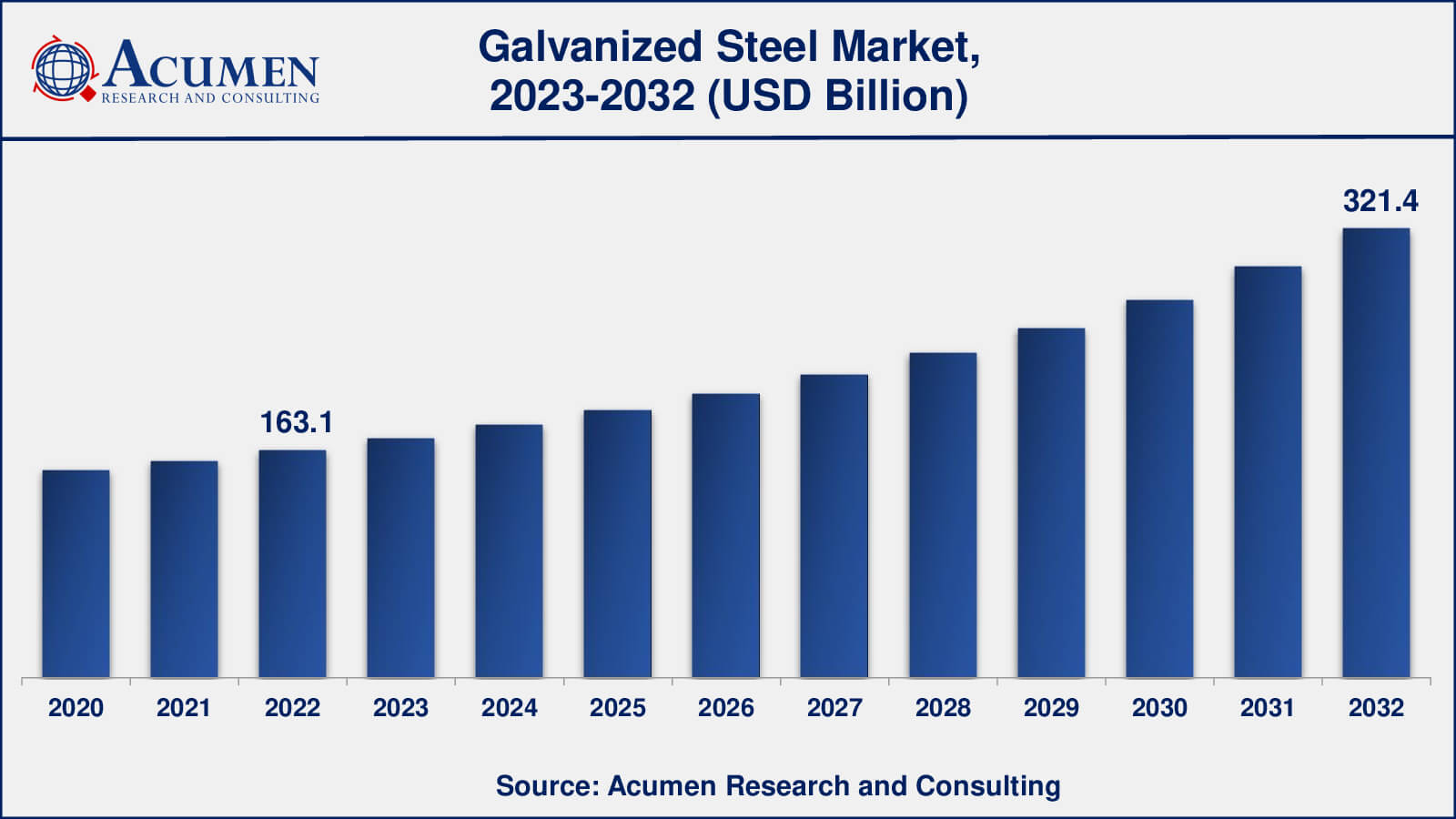

The Global Galvanized Steel Market Size accounted for USD 163.1 Billion in 2022 and is estimated to achieve a market size of USD 321.4 Billion by 2032 growing at a CAGR of 7.2% from 2023 to 2032.

Galvanized Steel Market Highlights

- Global galvanized steel market revenue is poised to garner USD 321.4 billion by 2032 with a CAGR of 7.2% from 2023 to 2032

- Asia-Pacific galvanized steel market value occupied around USD 65 billion in 2022

- Asia-Pacific galvanized steel market growth will record a CAGR of more than 8% from 2023 to 2032

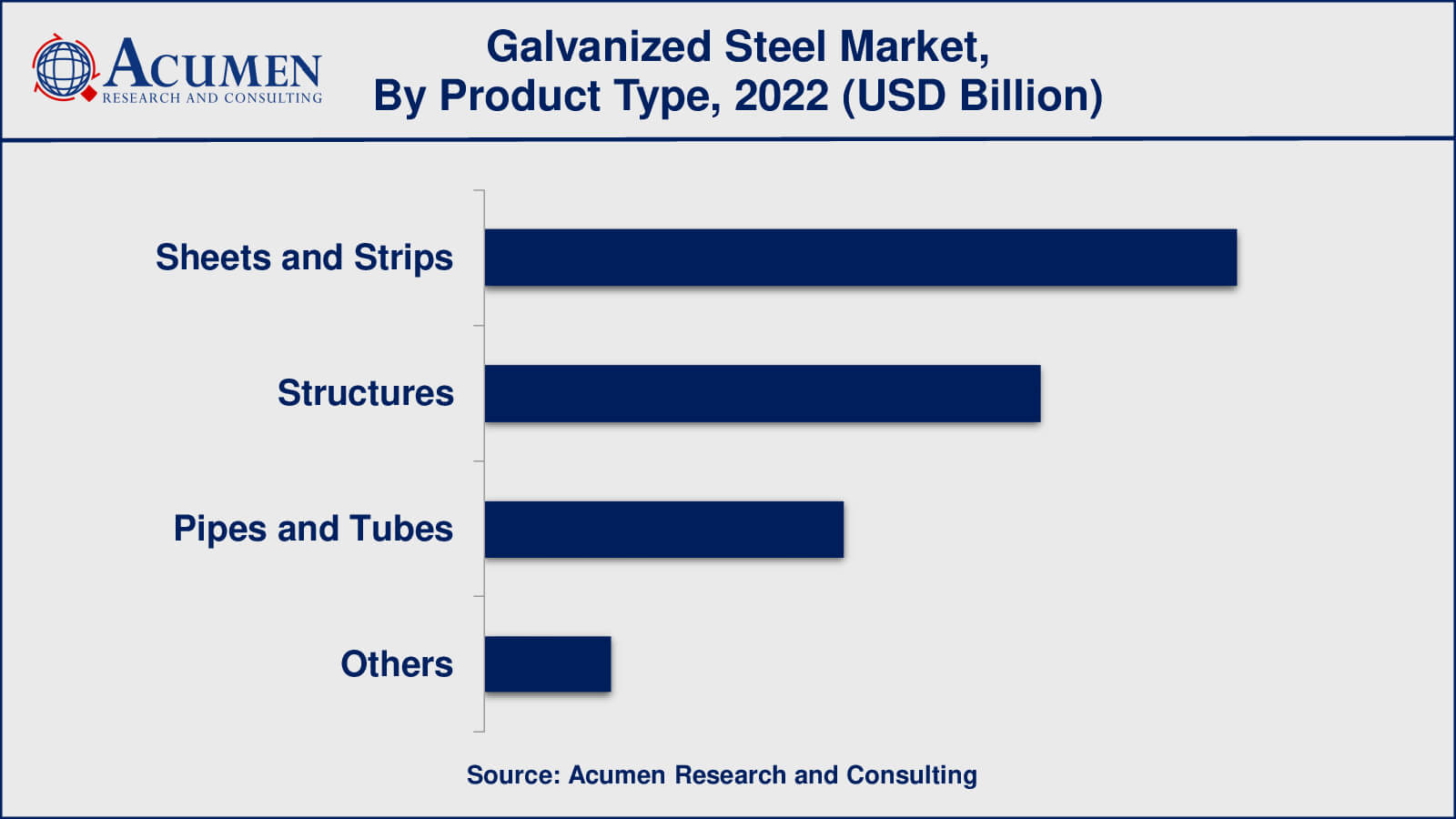

- Among product type, the sheets & strips sub-segment occupied over 40% share in 2022

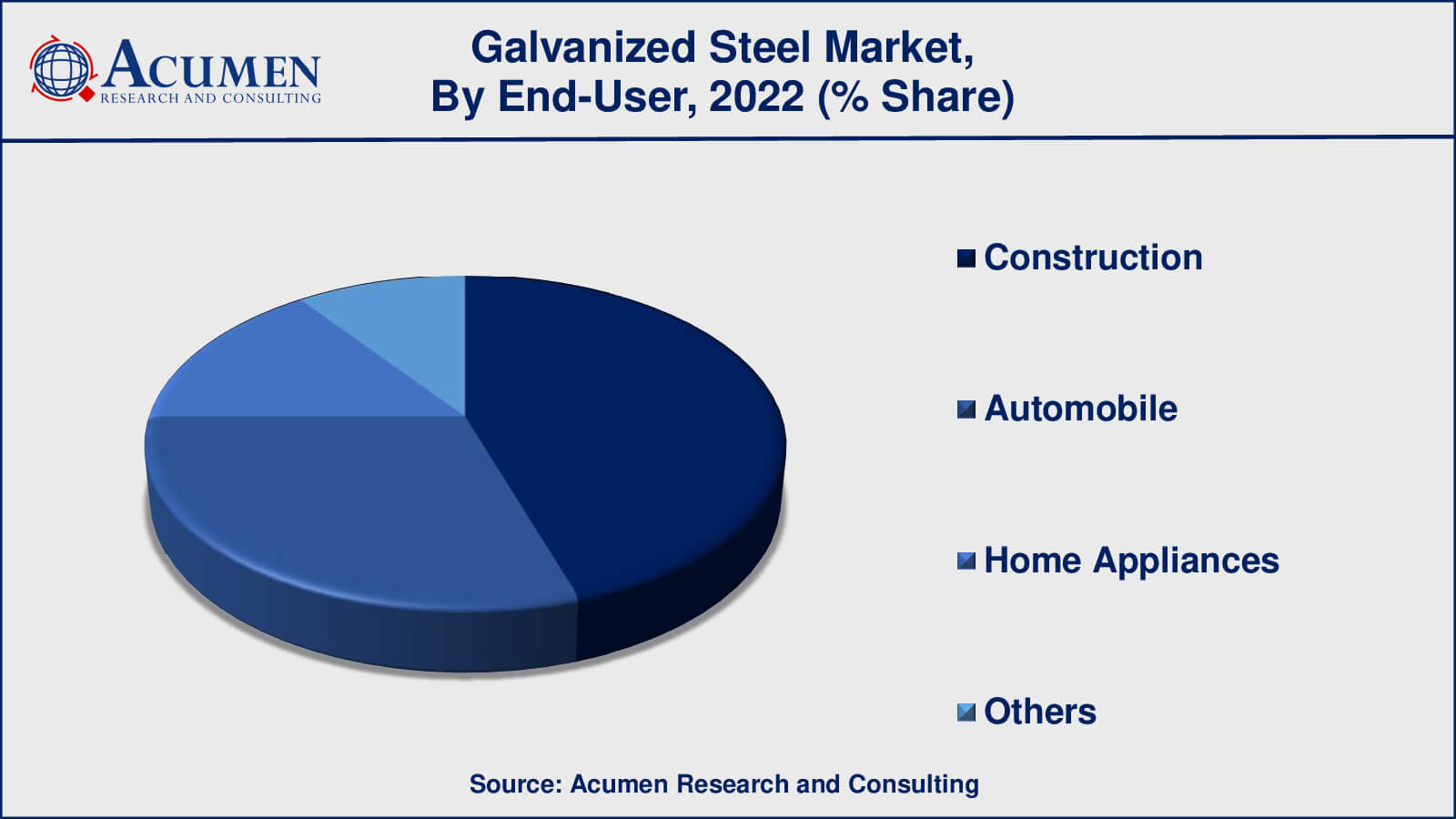

- Based on end-user, the construction sub-segment generated around 45% share in 2022

- Growing need for effective corrosion resistance is a popular market trend that fuels the industry demand

Galvanized steel is a form of steel that has been coated with a coating of zinc via the galvanization process. This coating protects the steel against corrosion and rust, increasing its resilience and lifetime. During galvanization, the steel is submerged in molten zinc or electrochemically treated, resulting in a strongly bound zinc coating on its surface. When exposed to environmental variables such as moisture and oxygen, this layer functions as a sacrificial anode, corroding preferentially over the underlying steel. As a result, galvanized steel is widely employed in outdoor applications, building projects, and industrial settings where corrosion resistance is essential. It is regarded for its combination of strength, low cost, and rust resistance, making it a valuable material in a variety of sectors.

Earlier, corrosion and repair of corrosion damages was a huge problem that resulted in high costs and also led to the waste of natural resources and many other indirect costs. Thus, the specification of galvanization was introduced and evolved as a new emerging market. Galvanization which was once considered only as a means of corrosion protection is now specified for an array of reasons such as longevity, sustainability, lower initial costs, availability, durability, and even aesthetics. One of the most common methods for galvanizing is hot dip. Galvanized steel has a wide range of applications in automobile, construction, home appliances, furniture, and other industries.

Global Galvanized Steel Market Dynamics

Market Drivers

- Rising applications of steel pipes in the oil and gas industry

- Rapid infrastructural development

- Economic growth in China and India

- Rising demand for galvanized steel in industrial applications

Market Restraints

- The volatility in raw material prices

- Increasing environmental concerns

- Substitutes and alternatives

Market Opportunities

- Rising awareness of sustainability

- Advancement in technology

- Innovation in coating techniques

- Participation in large-scale global infrastructure projects

Galvanized Steel Market Report Coverage

| Market | Galvanized Steel Market |

| Galvanized Steel Market Size 2022 | USD 163.1 Billion |

| Galvanized Steel Market Forecast 2032 | USD 321.4 Billion |

| Galvanized Steel Market CAGR During 2023 - 2032 | 7.2% |

| Galvanized Steel Market Analysis Period | 2020 - 2032 |

| Galvanized Steel Market Base Year | 2022 |

| Galvanized Steel Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Coating Method, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Ansteel, ArcelorMittal, Baosteel, CSC (China Steel Corporation), JFE Steel, JSW Steel, Ma Steel (Magang Group), Nippon Steel Sumitomo Metal, Nucor, POSCO, Severstal, Shandong Iron & Steel Group, ThyssenKrupp, United States Steel (USS), and Wuhan Iron and Steel (WISCO). |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Galvanized Steel Market Insights

Some of the major factors driving the growth of galvanized steel market include the upsurge in population, consumer awareness, changing consumer lifestyle & preferences, urbanization, and development in the economy that drives the demand for related products. In addition, the increasing application of galvanized steel in the manufacturing of home appliances and agricultural buildings also supports the growth of this market. Commercial and residential constructions are on the rise owing to strengthening economic conditions and elevating spending capacity. Over the last few decades, the galvanized steel market has considerably grown both in terms of product development and usage. The availability of diversified products empowers the allied industry stakeholders with better and more economical solutions. Yet, the industry faces several challenges in terms of new product development, product approval, and standardization. The galvanized steel market has high potential due to increasing investments in infrastructure and construction sectors. The prime expenditure of investment was consumed on residential construction. In oil and gas industries increasing applications of steel pipes for various applications in these industries such as transportation, refining, as well as exploration steel pipes are used majorly. Increasing demand for steel pipes will drive the growth of the galvanized steel market in the near future.

Galvanized Steel Market Segmentation

The worldwide market for galvanized steel is split based on product type, coating method, application, and geography.

Galvanized Steel Product Type

- Sheets and Strips

- Structures

- Pipes and Tubes

- Others

According to galvanised steel industry analysis, sheets and strips have traditionally been a prominent product category that dominates the galvanised steel market. They are a popular product in the galvanised steel industry. They are flat, thin strips of steel that have been galvanised. Galvanization is the process of coating steel with a layer of zinc to improve corrosion resistance and durability. When exposed to moisture, oxygen, and environmental components, this procedure helps to preserve the steel from rust and other types of damage.

Structures have also seen tremendous growth in the galvanised steel sector. This is due to the widespread usage of galvanised steel in structural applications requiring durability, strength, and corrosion resistance, such as building frames, bridges, and other infrastructure projects.

Galvanized Steel Coating Method

- Electrical Galvanized Steel

- Hot-Dip Galvanized Steel

Historically, hot-dip galvanised steel dominated the galvanised steel industry. Hot-dip galvanization is a popular and efficient method of coating steel with a zinc layer to offer corrosion resistance. It includes immersing the steel in a bath of molten zinc, resulting in a metallurgically bonded zinc coating that provides good rust and environmental element protection.

Electro-galvanized steel, also known as electrical galvanised steel, is a form of galvanised steel that has been electroplated with a thin coating of zinc. Unlike hot-dip galvanization, which requires immersing steel in molten zinc, electro-galvanization deposits a zinc coating onto the steel surface using an electric current. When opposed to hot-dip galvanization, this method produces a thinner and more regulated zinc coating.

Galvanized Steel End-User

- Construction

- Automobile

- Home Appliances

- Others

According to galvanized steel market forecast, the construction sector is expected to generate a considerable market share from 2023 to 2032. With an increasing emphasis on safety and heightened security at national borders, there is often a shortage of manpower for effective security monitoring. This situation creates a demand for home appliance robots, and this segment is anticipated to make a significant contribution to the market's growth in the coming years.

In recent years, the home appliances segment has emerged as a significant end-user segment in the galvanized steel market. The increasing demand for enhanced security measures in various sectors, including commercial areas, residential neighborhoods, and other monitored spaces, has necessitated the use of home appliance robots. This substantial demand for home appliance robots serves as a key driver for the market's growth. Two noteworthy applications of mobile robots include home appliances and gas leak detection systems.

Galvanized Steel Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Galvanized Steel Market Regional Analysis

In terms of regional segments, Asia-Pacific has consistently held the largest revenue share in the galvanized steel market in recent years. This growth can be attributed to the increase in steel manufacturing and exports, with China leading the steel market in this region. Major contributors to the market's growth are China, India, and Japan, largely due to their economic expansion. Government investments in infrastructure and construction projects in developing countries are key factors driving the growth of the galvanized steel market, which is expected to boost demand in the upcoming years.

North America closely follows with the second-largest revenue share in the galvanized steel market. The rising demand for galvanized steel in industrial applications and the increasing use of steel pipes in the oil and gas industry are factors contributing to the market's growth in this region in the near future. Furthermore, Europe has also witnessed a significant growth rate during the forecast period from 2023 to 2032.

Galvanized Steel Market Players

Some of the top galvanized steel companies offered in our report includes Ansteel, ArcelorMittal, Baosteel, CSC (China Steel Corporation), JFE Steel, JSW Steel, Ma Steel (Magang Group), Nippon Steel Sumitomo Metal, Nucor, POSCO, Severstal, Shandong Iron & Steel Group, ThyssenKrupp, United States Steel (USS), and Wuhan Iron and Steel (WISCO).

Frequently Asked Questions

What was the market size of the global galvanized steel in 2022?

The market size of galvanized steel was USD 163.1 billion in 2022.

What is the CAGR of the global galvanized steel market from 2023 to 2032?

The CAGR of galvanized steel is 7.2% during the analysis period of 2023 to 2032.

Which are the key players in the galvanized steel market?

The key players operating in the global market are including Ansteel, ArcelorMittal, Baosteel, CSC (China Steel Corporation), JFE Steel, JSW Steel, Ma Steel (Magang Group), Nippon Steel Sumitomo Metal, Nucor, POSCO, Severstal, Shandong Iron & Steel Group, ThyssenKrupp, United States Steel (USS), and Wuhan Iron and Steel (WISCO).

Which region dominated the global galvanized steel market share?

Asia-Pacific held the dominating position in galvanized steel industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of galvanized steel during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global galvanized steel industry?

The current trends and dynamics in the galvanized steel industry include the rising applications of steel pipes in the oil and gas industry, the rapid infrastructural development, the economic growth in China and India, and rising demand for galvanized steel in industrial applications.

Which product type held the maximum share in 2022?

The sheets & strips product type held the maximum share of the galvanized steel industry.