Gabapentin Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Gabapentin Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

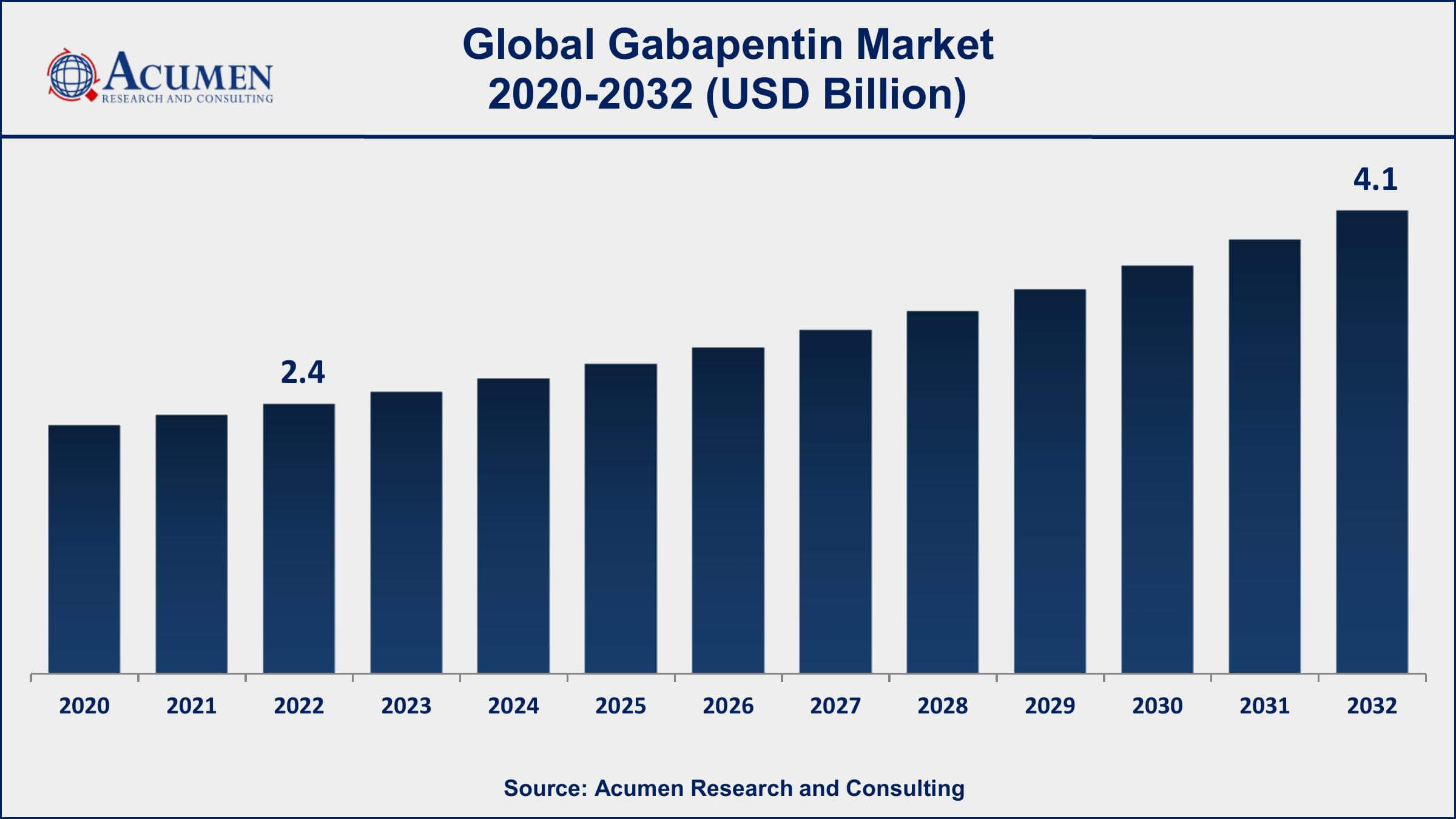

The Gabapentin Market Size accounted for USD 2.4 Billion in 2022 and is projected to achieve a market size of USD 4.1 Billion by 2032 growing at a CAGR of 5.7% from 2023 to 2032.

Gabapentin Market Highlights

- Global Gabapentin Market revenue is expected to increase by USD 4.1 Billion by 2032, with a 5.7% CAGR from 2023 to 2032

- North America region led with more than 36% of Gabapentin Market share in 2022

- Asia-Pacific Gabapentin Market growth will record a CAGR of around 6.3% from 2023 to 2032

- By dosage, the capsule segment is the largest segment in the market, accounting for over 39% of the market share in 2022

- By application, the epilepsy segment has recorded more than 34% of the revenue share in 2022

- Increasing prevalence of neuropathic pain disorders, drives the Gabapentin Market value

Gabapentin is a medication that belongs to the class of anticonvulsants, primarily used to treat seizures and neuropathic pain. It works by stabilizing electrical activity in the brain and affecting the way the nerves send messages to the brain. Gabapentin is also prescribed for various off-label uses, including the treatment of anxiety disorders, insomnia, and certain types of chronic pain conditions. It is thought to be effective in managing these conditions due to its ability to modulate the activity of certain neurotransmitters in the brain.

In recent years, the market for gabapentin has experienced significant growth due to its diverse applications in the field of neurology and pain management. The rise in the prevalence of neuropathic pain conditions, such as diabetic neuropathy and post-herpetic neuralgia, has contributed to the increasing demand for gabapentin. Additionally, the off-label use of gabapentin for mood disorders and anxiety has further expanded its market reach. Pharmaceutical companies continue to invest in research and development to explore new formulations and expand the drug's applications, further fueling its market growth.

Global Gabapentin Market Trends

Market Drivers

- Increasing prevalence of neuropathic pain disorders

- Off-label use for mood disorders and anxiety

- Continuous research and development efforts

- Growing awareness and acceptance among healthcare professionals

Market Restraints

- Concerns regarding abuse and dependence potential

- Stringent regulatory policies and guidelines

Market Opportunities

- Expansion of gabapentin applications in neurological disorders

- Development of novel formulations for improved efficacy and safety

Gabapentin Market Report Coverage

| Market | Gabapentin Market |

| Gabapentin Market Size 2022 | USD 2.4 Billion |

| Gabapentin Market Forecast 2032 | USD 4.1 Billion |

| Gabapentin Market CAGR During 2023 - 2032 | 5.7% |

| Gabapentin Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Dosage, By Type, By Application, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Pfizer Inc., Mylan N.V., Aurobindo Pharma Ltd., Teva Pharmaceutical Industries Ltd., Lupin Limited, Sun Pharmaceutical Industries Ltd., Novartis AG, Cadila Healthcare Ltd. (Zydus Cadila), Torrent Pharmaceuticals Ltd., Dr. Reddy's Laboratories Ltd., Sandoz International GmbH, and Apotex Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Gabapentin is a medication primarily used to treat seizures and neuropathic pain. It belongs to the class of anticonvulsant drugs and works by stabilizing electrical activity in the brain and altering the way nerves send messages to the brain. This modulation of neural signals helps in controlling seizures and reducing neuropathic pain, which is a type of pain that occurs due to damage or malfunction in the nervous system.

In addition to its approved uses, gabapentin has found diverse applications in the field of medicine. One significant application is in managing chronic neuropathic pain conditions such as diabetic neuropathy and post-herpetic neuralgia. These conditions often cause debilitating pain and can significantly impact a person's quality of life. Gabapentin helps alleviate this pain by interfering with the abnormal electrical activity in the nerves. Moreover, gabapentin is also prescribed off-label for various conditions such as anxiety disorders, bipolar disorder, and insomnia. While these uses are not FDA-approved, healthcare providers sometimes prescribe gabapentin based on their clinical judgment and knowledge of the patient's specific needs.

The market for gabapentin, a medication widely used to treat neuropathic pain and seizures, has experienced significant growth in recent years. One of the primary drivers of this growth is the increasing prevalence of neuropathic pain conditions such as diabetic neuropathy, post-herpetic neuralgia, and fibromyalgia. As the global population ages and the incidence of conditions like diabetes rises, the demand for effective pain management solutions has grown, contributing to the expanding market for gabapentin. Furthermore, gabapentin's versatility in addressing various off-label uses, including anxiety disorders and mood disorders, has significantly broadened its market reach. Physicians often prescribe gabapentin for these conditions due to its relatively low risk of addiction compared to other medications. This off-label usage has opened up new avenues for growth, as patients and healthcare providers seek alternatives to traditional treatments.

Gabapentin Market Segmentation

The globalGabapentin Market segmentation is based on dosage, type, application, distribution channel, and geography.

Gabapentin Market By Dosage

- Tablet

- Oral Solution

- Capsule

According to the gabapentin industry analysis, the capsule segment accounted for the largest market share in 2022. Capsules offer a convenient and precise way of dosing, ensuring patients receive the correct amount of medication. This ease of administration has made capsules a preferred choice for both physicians and patients, particularly in cases where accurate dosage is crucial, such as in the management of neuropathic pain and seizures. Moreover, capsules often have a longer shelf life and are more stable than other forms of medication, ensuring their efficacy over time and enhancing patient trust in the product. Additionally, the capsule format allows for extended-release formulations, providing a sustained and continuous release of gabapentin over a specified period. Extended-release capsules offer the advantage of reduced dosing frequency, leading to improved patient compliance and adherence to the prescribed treatment regimen.

Gabapentin Market By Type

- Branded

- Generic

In terms of types, the generic segment is expected to witness significant growth in the coming years. Generic gabapentin offers a cost-effective alternative to the brand-name drug, making it more accessible to patients and healthcare systems globally. This affordability factor has significantly contributed to the widespread adoption of generic gabapentin, especially in regions with a focus on cost-efficient healthcare solutions and where there is a high prevalence of neuropathic pain and seizures. Moreover, the generic segment has witnessed a surge in demand because of regulatory initiatives promoting the use of generic medications. Government healthcare agencies and insurance companies often incentivize the prescription and dispensing of generic drugs to reduce overall healthcare expenditure. This policy-driven approach has boosted the market share of generic gabapentin, leading to its substantial growth.

Gabapentin Market By Application

- Epilepsy

- Restless Legs Syndrome

- Neuropathic Pain

- Others

According to the gabapentin market forecast, the epilepsy segment is expected to witness significant growth in the coming years. Gabapentin, as an anticonvulsant, works by stabilizing electrical activity in the brain, making it a valuable treatment option for individuals with epilepsy. The drug has gained prominence as an adjunctive therapy, often prescribed alongside other antiepileptic drugs, to enhance seizure control. The continuous advancements in the understanding of epilepsy mechanisms, coupled with extensive clinical studies validating gabapentin's efficacy, have bolstered its reputation among neurologists and healthcare professionals specializing in epilepsy treatment. Additionally, the growing prevalence of epilepsy, both in developed and developing countries, has propelled the demand for gabapentin within the epilepsy segment.

Gabapentin Market By Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

Based on the distribution channel, the hospital pharmacy segment is expected to continue its growth trajectory in the coming years. Hospitals often encounter patients with diverse neurological conditions, including neuropathic pain, seizures, and mood disorders, where gabapentin proves to be an effective treatment option. The drug's ability to manage these conditions, coupled with its relatively favorable side effect profile, has made it a staple in hospital formularies. Furthermore, the ease of administration and availability of various formulations, including injectables and oral capsules, allows healthcare providers to tailor treatments to individual patient needs, making gabapentin a versatile choice within hospital settings. Moreover, the hospital pharmacy segment has experienced growth due to an increasing focus on evidence-based medicine and cost-efficiency.

Gabapentin Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Gabapentin Market Regional Analysis

North America dominates the gabapentin market for several reasons, primarily attributed to the region's advanced healthcare infrastructure, high prevalence of neuropathic pain and seizures, and robust pharmaceutical industry. The United States, in particular, boasts a significant portion of the global gabapentin market share. One of the key factors contributing to North America's dominance is the region's well-established healthcare system, characterized by extensive insurance coverage and easy access to healthcare services. This ensures that patients suffering from neurological conditions such as neuropathic pain and seizures have access to prescribed medications, including gabapentin, leading to consistent demand. Additionally, there is a high prevalence of chronic pain conditions, neuropathic pain, and epilepsy in North America. Factors such as the aging population, sedentary lifestyles, and an increase in chronic diseases like diabetes contribute to the rising incidence of these conditions. Gabapentin, with its efficacy in managing these disorders, is in high demand, further fueling the market growth. Moreover, the region is home to several prominent pharmaceutical companies involved in the production and distribution of gabapentin.

Gabapentin Market Player

Some of the top Gabapentin Market companies offered in the professional report include Pfizer Inc., Mylan N.V., Aurobindo Pharma Ltd., Teva Pharmaceutical Industries Ltd., Lupin Limited, Sun Pharmaceutical Industries Ltd., Novartis AG, Cadila Healthcare Ltd. (Zydus Cadila), Torrent Pharmaceuticals Ltd., Dr. Reddy's Laboratories Ltd., Sandoz International GmbH, and Apotex Inc.

Frequently Asked Questions

How big is gabapentinin market?

The market size of gabapentin was USD 2.4 Billion in 2022.

What is the CAGR of the global gabapentin market from 2023 to 2032?

The CAGR of gabapentin is 5.7% during the analysis period of 2023 to 2032.

Which are the key players in the gabapentin market?

The key players operating in the global market are including Pfizer Inc., Mylan N.V., Aurobindo Pharma Ltd., Teva Pharmaceutical Industries Ltd., Lupin Limited, Sun Pharmaceutical Industries Ltd., Novartis AG, Cadila Healthcare Ltd. (Zydus Cadila), Torrent Pharmaceuticals Ltd., Dr. Reddy's Laboratories Ltd., Sandoz International GmbH, and Apotex Inc.

Which region dominated the global gabapentin market share?

North America held the dominating position in gabapentin industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of gabapentin during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global gabapentin industry?

The current trends and dynamics in the Gabapentin industry include increasing prevalence of neuropathic pain disorders, off-label use for mood disorders and anxiety, and continuous research and development efforts.

Which type held the maximum share in 2022?

The generic type held the maximum share of the gabapentin industry.