Functional Fluids Market | Acumen Research and Consulting

Functional Fluids Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

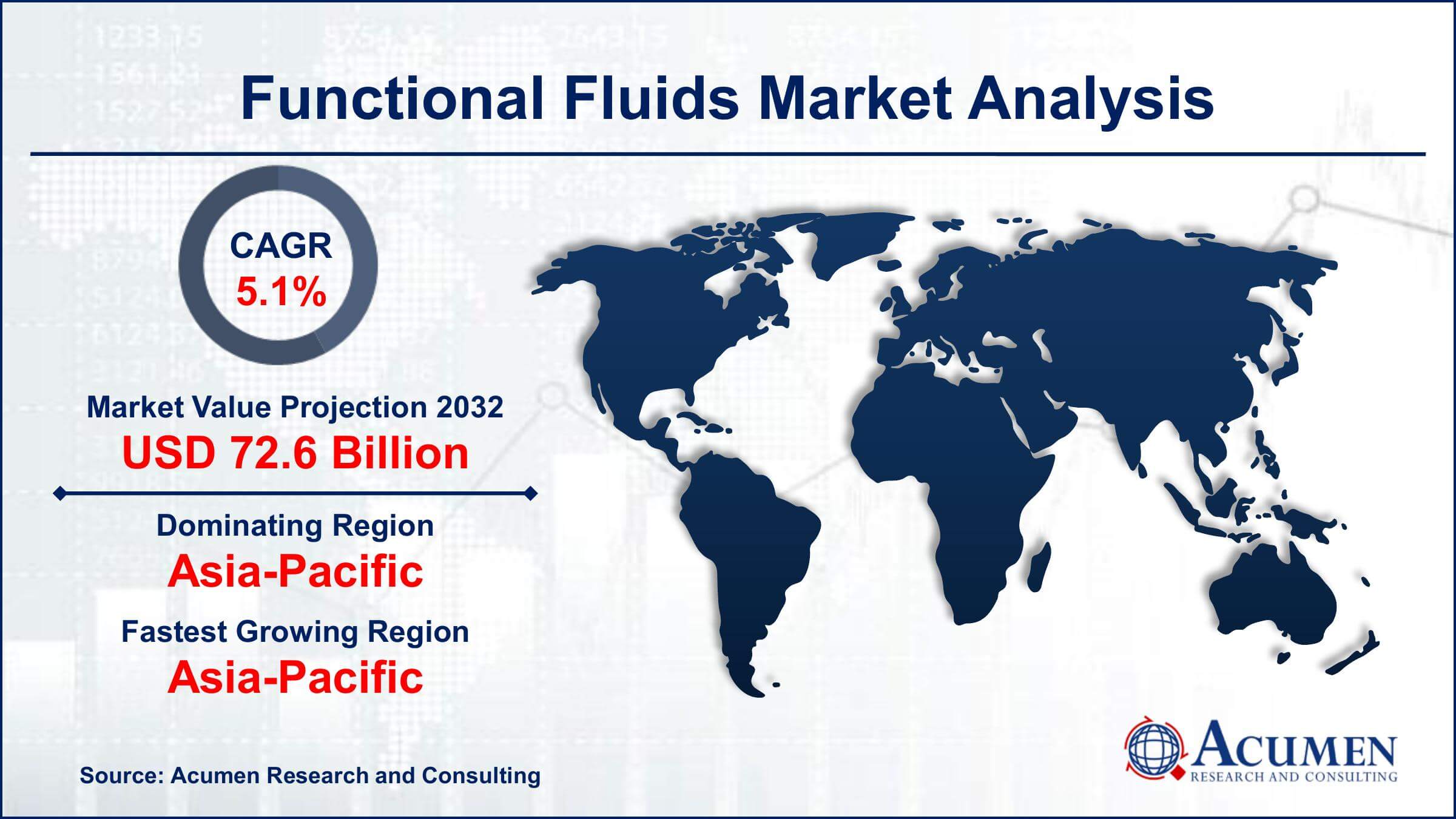

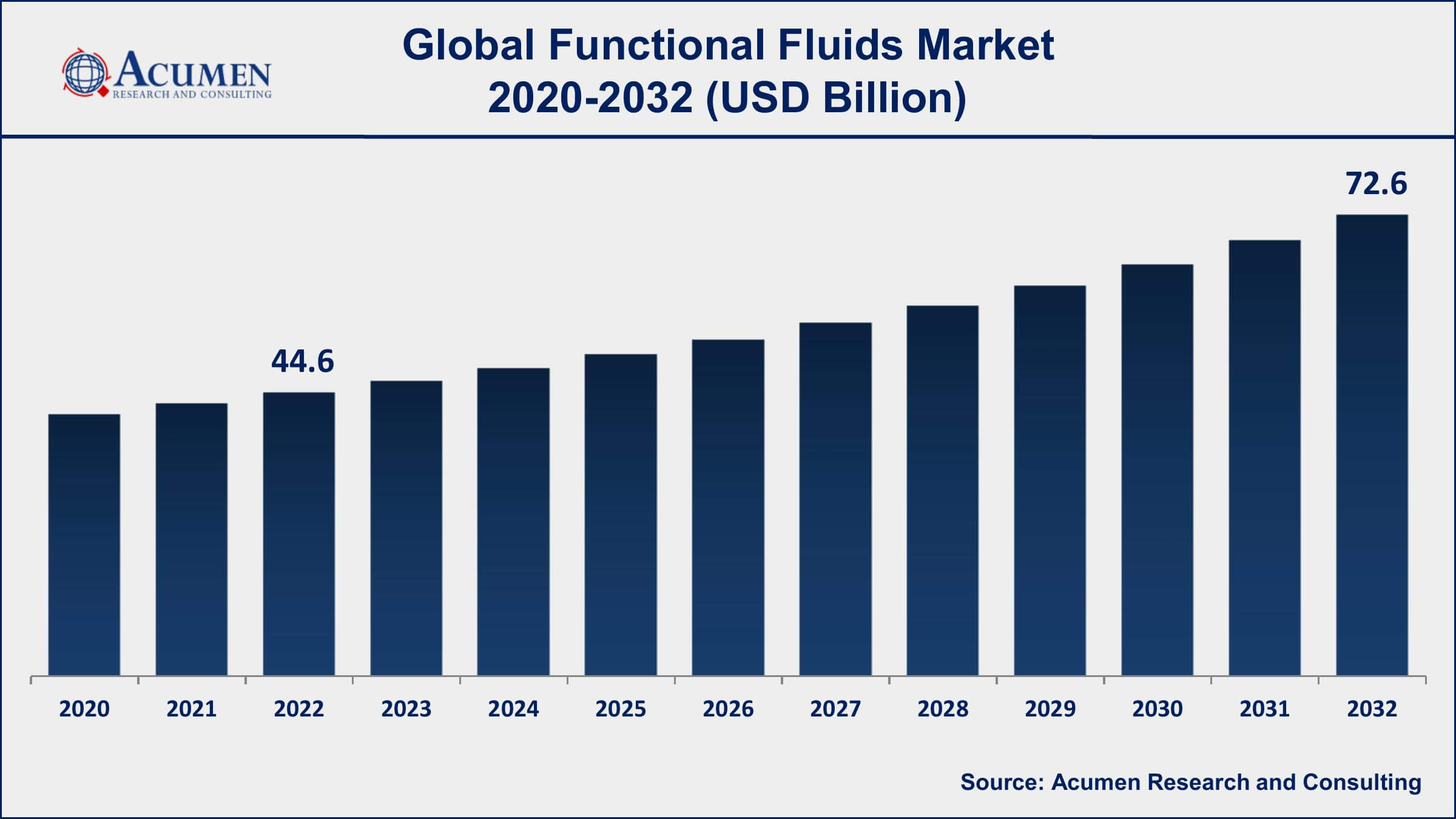

The Global Functional Fluids Market Size accounted for USD 44.6 Billion in 2022 and is projected to achieve a market size of USD 72.6 Billion by 2032 growing at a CAGR of 5.1% from 2023 to 2032.

Report Key Highlights

- Global functional fluids market revenue is expected to increase by USD 72.6 Billion by 2032, with a 5.1% CAGR from 2023 to 2032

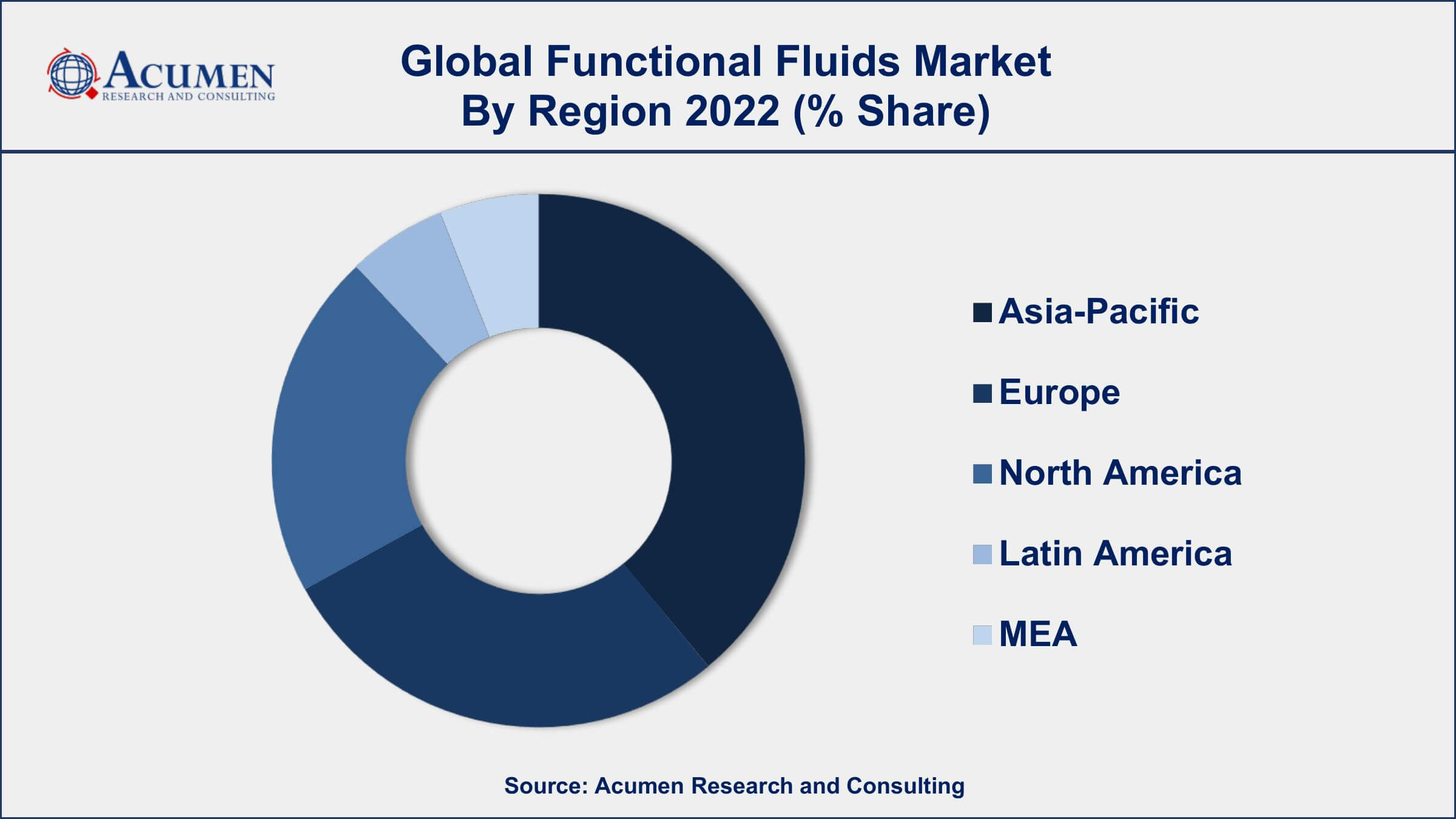

- Asia-Pacific region led with more than 38% of functional fluids market share in 2022

- The automotive industry is the largest end-use industry for functional fluids, accounting for over 33% of the total market share

- According to the US Department of Energy, hydraulic fluids account for up to 1% of total energy consumption in the manufacturing sector when utilized in hydraulic equipment

- Engine oil is the most widely utilized functional fluid in the automotive industry, with around 6 billion gallons consumed annually in the United States alone

- Increasing focus on improving the efficiency of industrial processes and equipment, drives the functional fluids market size

Functional fluids refer to a diverse range of liquids or fluids that are specially designed to perform specific functions in various industrial applications. These fluids are used in a wide range of industries, including automotive, aerospace, industrial machinery, and construction, among others. Functional fluids are used to reduce friction, transfer heat, and protect against corrosion and wear, among other functions. They play a critical role in the efficient functioning of various industrial equipment and machinery.

The functional fluids market has been witnessing steady growth in recent years. The increasing demand for functional fluids from various industries, including automotive and construction, is one of the major drivers of market growth. Additionally, the growing demand for high-performance lubricants and fluids that can withstand high temperatures and pressures is also driving the growth of the market. Furthermore, the increasing demand for bio-based functional fluids that are environmentally friendly is also expected to drive market growth in the coming years.

Global Functional Fluids Market Trends

Market Drivers

- Growing demand from various industries such as automotive, aerospace, and construction

- Increasing focus on improving the efficiency of industrial processes and equipment

- Advancements in lubrication technology and increased R&D efforts

- Increasing demand for high-performance lubricants and fluids that can withstand high temperatures and pressures

Market Restraints

- Fluctuating prices of raw materials

- Stringent environmental regulations and norms

Market Opportunities

- Increasing demand for specialized functional fluids

- Development of bio-based and eco-friendly functional fluids

Functional Fluids Market Report Coverage

| Market | Functional Fluids Market |

| Functional Fluids Market Size 2022 | USD 44.6 Billion |

| Functional Fluids Market Forecast 2032 | USD 72.6 Billion |

| Functional Fluids Market CAGR During 2023 - 2032 | 5.1% |

| Functional Fluids Market Analysis Period | 2020 - 2032 |

| Functional Fluids Market Base Year | 2022 |

| Functional Fluids Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ExxonMobil Corporation, Royal Dutch Shell plc, BASF SE, Chevron Corporation, Total SE, The Dow Chemical Company, BP plc, Idemitsu Kosan Co. Ltd., FUCHS PETROLUB SE, INEOS Group AG, Ashland Global Holdings Inc., and Clariant AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Functional fluids comprise a wide range of other liquids and oils which are deployed as transmission fluids, lubricants, heat transfer fluids, hydraulic fluids, and metalworking fluids during several industrial processes and procedures such as grinding, machining, stamping, forging, milling among others. Moreover, various functional fluids are used in different end-user industries such as transportation, automotive, solar power, and chemical. The most recent development in the global functional fluids industry is the increasing prominence of metal removal fluids since they have less or no mineral oil and thus deliver benefits such as lubrication and excellent visibility during various metal working operations and processes. With the increasing demand for new technology-based functional fluids made up of synthetic material, the primary fabricated and metal segments, the rising popularity of such products is anticipated to immensely benefit the overall global functional fluids market growth over the forecast period.

The increasing requirements for high-performance products as well as an increasing number of stringent environmental norms and regulations are some of the key factors fueling the demand for functional fluids, which in turn, is projected to accelerate the growth of the global functional fluids market value over the forecast period. In addition, the increasing growth of the market is also expected to be fueled by the increasing availability of good quality base stocks as a consequence of the increasing number of investments in newer base stock capacities across the globe. Owing to the rapidly expanding supply of functional fluids, original equipment manufacturers are taking important steps towards global specifications and are increasingly adopting to advocate the employment of high-performance synthetic products such as functional fluids. Furthermore, functional fluids have emerged as one of the most ideal choices due to their capability to decrease overall maintenance time and turnaround costs by increasing the drain intervals.

Functional Fluids Market Segmentation

The global functional fluids market segmentation is based on type, application, and geography.

Functional Fluids Market By Type

- Process Oil

- Bio-based Hydraulic Fluid

- Metalworking Fluid

- Hydraulic and Transmission Fluid

- Coating Fluid

- Heat Transfer Fluid

- Others

In terms of types, the process oil segment has seen significant growth in the functional fluids market in recent years. Process oils are used as raw materials or processing aids in the manufacturing of various products such as tires, rubber goods, and plastics, among others. They are also used in the production of adhesives, coatings, and printing inks. The process oil segment in the market is expected to witness significant growth in the coming years. The growth of this segment is being driven by various factors, including the increasing demand for process oils in the automotive and tire industries, which are major consumers of process oils. The growth of the construction and manufacturing industries is also expected to drive the demand for process oils. Additionally, the development of new and innovative formulations of process oils is expected to further drive the growth of this segment.

Functional Fluids Market By Application

- Automotive

- Industrial Machinery

- Construction

- Metals and Mining

- Transportation

- Others

According to the functional fluids market forecast, the automotive segment is expected to witness significant growth in the coming years. Automotive fluids, including engine oils, transmission fluids, and brake fluids, are essential to the proper functioning of vehicles, and the growth of the automotive industry is expected to drive the demand for these fluids. The automotive segment in the market is expected to witness significant growth in the coming years. The growth of this segment is being driven by various factors, including the increased production of vehicles worldwide, particularly in emerging economies. The growing demand for high-performance lubricants and fluids that can withstand high temperatures and pressures is also driving the demand for functional fluids in the automotive industry. Moreover, the increasing demand for eco-friendly and bio-based automotive fluids is expected to create new growth opportunities in this segment. Automakers are increasingly focusing on developing sustainable and eco-friendly products, and this is expected to drive the demand for eco-friendly functional fluids in the automotive industry.

Functional Fluids Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Functional Fluids Market Regional Analysis

Geographically, Asia-Pacific is currently dominating the functional fluids market, and this trend is expected to continue in the coming years. The growth of the market in the region is being driven by various factors, including the increasing demand from various industries such as automotive, construction, and manufacturing. The region is home to some of the fastest-growing economies in the world, including China and India, which are major consumers of functional fluids. Moreover, the increasing investments in infrastructure and construction projects in the region are driving the demand for functional fluids, particularly in the construction industry. The growing demand for high-performance lubricants and fluids that can withstand high temperatures and pressures is also driving the growth of the functional fluids market in the region, particularly in the automotive industry.

Functional Fluids Market Player

Some of the top functional fluids market companies offered in the professional report include ExxonMobil Corporation, Royal Dutch Shell plc, BASF SE, Chevron Corporation, Total SE, The Dow Chemical Company, BP plc, Idemitsu Kosan Co. Ltd., FUCHS PETROLUB SE, INEOS Group AG, Ashland Global Holdings Inc., and Clariant AG.

Frequently Asked Questions

What was the market size of the global functional fluids in 2022?

The market size of functional fluids was USD 44.6 Billion in 2022.

What is the CAGR of the global functional fluids market from 2023 to 2032?

The CAGR of functional fluids is 5.1% during the analysis period of 2023 to 2032.

Which are the key players in the functional fluids market?

The key players operating in the global market are including ExxonMobil Corporation, Royal Dutch Shell plc, BASF SE, Chevron Corporation, Total SE, The Dow Chemical Company, BP plc, Idemitsu Kosan Co. Ltd., FUCHS PETROLUB SE, INEOS Group AG, Ashland Global Holdings Inc., and Clariant AG.

Which region dominated the global functional fluids market share?

Asia-Pacific held the dominating position in functional fluids industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of functional fluids during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global functional fluids industry?

The current trends and dynamics in the functional fluids industry include increasing demand for electric vehicles, and growth in renewable energy storage solutions.

Which type held the maximum share in 2022?

The process oil type held the maximum share of the functional fluids industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date