Fuel Cell Vehicle Market | Acumen Research and Consulting

Fuel Cell Vehicle Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

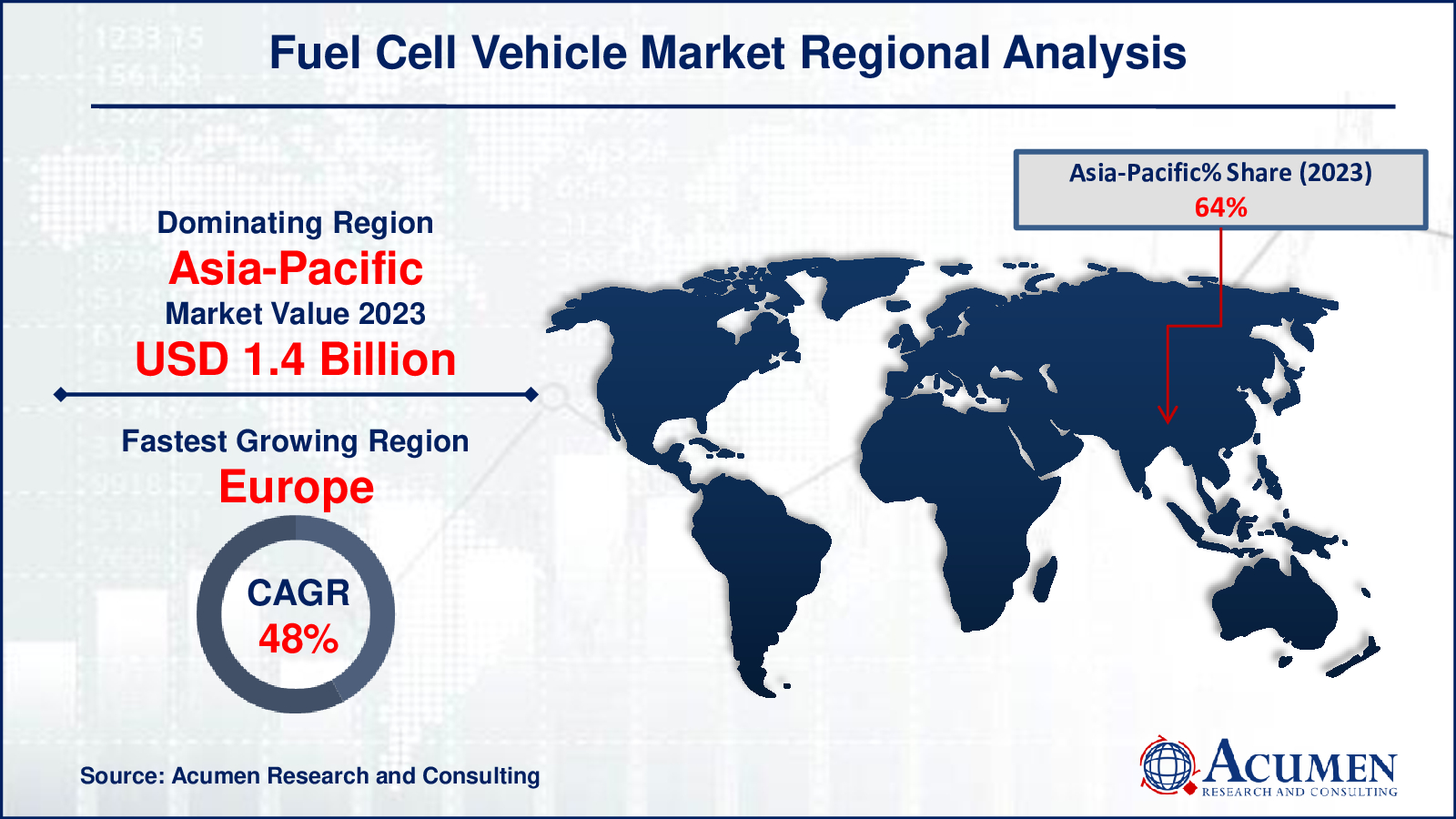

The Fuel Cell Vehicle Market Size accounted for USD 2.2 Billion in 2023 and is estimated to achieve a market size of USD 65.2 Billion by 2032 growing at a CAGR of 46.7% from 2024 to 2032.

Fuel Cell Vehicle Market Highlights

- Global fuel cell vehicle market revenue is poised to garner USD 65.2 billion by 2032 with a CAGR of 46.7% from 2024 to 2032

- Asia-Pacific fuel cell vehicle market value occupied around USD 1.4 billion in 2023

- Europe fuel cell vehicle market growth will record a CAGR of more than 48% from 2024 to 2032

- Based on types, the passenger cars sub-segment expected to generated 84% market share in 2023

- Based on end-user, the commercial and industrial sub-segment shows notable growth in 2023

- Rising collaborations between automotive manufacturers and tech companies to advance fuel cell technology and production is the fuel cell vehicle market trend that fuels the industry demand

A fuel cell vehicle (FCV) is an eco-friendly automobile powered by hydrogen fuel cells, generating electricity through a chemical reaction between hydrogen and oxygen, emitting only water vapor as exhaust. FCVs offer zero-emission driving, addressing environmental concerns and reducing dependence on fossil fuels. They are efficient, with longer ranges compared to battery electric vehicles (BEVs) and shorter refueling times, making them suitable for long-distance travel and commercial fleets. Applications span personal transportation to public transit and logistics, promoting sustainability in urban environments and contributing to a greener future through advanced hydrogen infrastructure development.

Global Fuel Cell Vehicle Market Dynamics

Market Drivers

- Increasing environmental regulations favoring zero-emission vehicles

- Growing investments in hydrogen infrastructure development

- Technological advancements leading to improved fuel cell efficiency and cost reduction

Market Restraints

- High initial costs of fuel cell vehicles compared to traditional combustion engine vehicles

- Limited hydrogen refueling infrastructure, particularly outside urban areas

- Challenges in large-scale production and supply chain for hydrogen fuel cells

Market Opportunities

- Rising consumer awareness and acceptance of clean energy solutions

- Government incentives and subsidies promoting adoption of fuel cell vehicles

- Expansion of hydrogen production from renewable sources, enhancing sustainability

Fuel Cell Vehicle Market Report Coverage

| Market | Fuel Cell Vehicle Market |

| Fuel Cell Vehicle Market Size 2022 | USD 2.2 Billion |

| Fuel Cell Vehicle Market Forecast 2032 | USD 65.2 Billion |

| Fuel Cell Vehicle Market CAGR During 2023 - 2032 | 46.7% |

| Fuel Cell Vehicle Market Analysis Period | 2020 - 2032 |

| Fuel Cell Vehicle Market Base Year |

2022 |

| Fuel Cell Vehicle Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Bayerische Motoren Werke (BMW) AG, Mercedes-Benz Group, Nikola Corporation, Audi AG, Honda Motor Company, Hyundai Motor Group, Ballard Power Systems Inc., Volvo AB, General Motors, and Toyota Motor Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Fuel Cell Vehicle Market Insights

The FCV market is experiencing a surge in demand driven by increasing environmental regulations favoring zero-emission transportation. For instance, to achieve its target of 1.5 million zero-emission vehicles by 2025, California has allocated funds to establish 100 hydrogen refueling stations, boosting the market for hydrogen fuel cell vehicles. These regulations, aimed at reducing greenhouse gas emissions and air pollutants, prioritize technologies like fuel cells that produce electricity through chemical reactions, emitting only water vapor and heat. This shift is pushing automakers and governments worldwide to invest heavily in hydrogen infrastructure and fuel cell technology development. As a result, the market for fuel cell vehicles is poised for growth as they offer a promising solution to meet stringent emission standards while providing long-range driving capabilities comparable to traditional vehicles.

The high initial costs of fuel cell vehicles compared to traditional combustion engine vehicles pose a significant restraint for the fuel cell vehicle (FCV) Market. These costs primarily stem from the expensive materials and technologies required for fuel cell production, including platinum catalysts and advanced hydrogen storage systems. Additionally, the infrastructure for hydrogen refueling stations is sparse and costly to develop, further increasing the overall cost of ownership for consumers. Despite their environmental benefits and efficiency, these high upfront costs deter widespread adoption of fuel cell vehicles, limiting their market penetration and competitiveness against conventional vehicles in the automotive market.

The expansion of hydrogen production from renewable sources presents a significant opportunity for the fuel cell vehicle market. Hydrogen, when produced using renewable energy sources such as wind or solar power, offers a sustainable alternative to fossil fuels. This renewable hydrogen can be used in fuel cells to generate electricity, powering vehicles with zero emissions apart from water vapor. This shift supports global efforts to reduce greenhouse gas emissions and dependency on non-renewable resources. As infrastructure for hydrogen refueling develops, it encourages the growth of fuel cell vehicles, promoting a cleaner transportation ecosystem for the future.

Fuel Cell Vehicle Market Segmentation

The worldwide market for fuel cell vehicle is split based on type, end-user, and geography.

Fuel Cell Vehicle (FCV) Market By Type

- Passenger Cars

- LCVs

- HCVs

According to the FCV industry analysis, passenger cars dominate market primarily due to consumer demand for environmentally friendly alternatives to traditional combustion engines. Fuel cell technology offers zero-emission driving, which appeals to eco-conscious consumers. Moreover, advancements in fuel cell technology have improved vehicle range and performance, making them more viable for everyday use. Government incentives and regulations promoting clean transportation further drive the adoption of fuel cell passenger cars, positioning them as a significant segment in the evolving automotive industry towards sustainability.

Fuel Cell Vehicle (FCV) Market By End-User

- Residential

- Commercial and Industrial

- Transportation

- Data Center

- Military and Defense

According to the fuel cell vehicle market forecast, the commercial and industrial sectors are expected to dominate market due to several key factors. First, these sectors often have higher demand for vehicles that can operate efficiently over long distances, making fuel cell technology appealing due to its longer range compared to battery electric vehicles. Second, businesses in these sectors often prioritize sustainability and emission reductions, aligning well with the zero-emission nature of fuel cell vehicles. Third, infrastructure development, such as hydrogen refueling stations, tends to be more feasible and economically viable in commercial and industrial settings where centralized refueling points can serve multiple vehicles efficiently. Lastly, government incentives and policies aimed at reducing carbon footprints and promoting clean energy adoption further bolster the attractiveness of fuel cell vehicles in these sectors.

Fuel Cell Vehicle Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

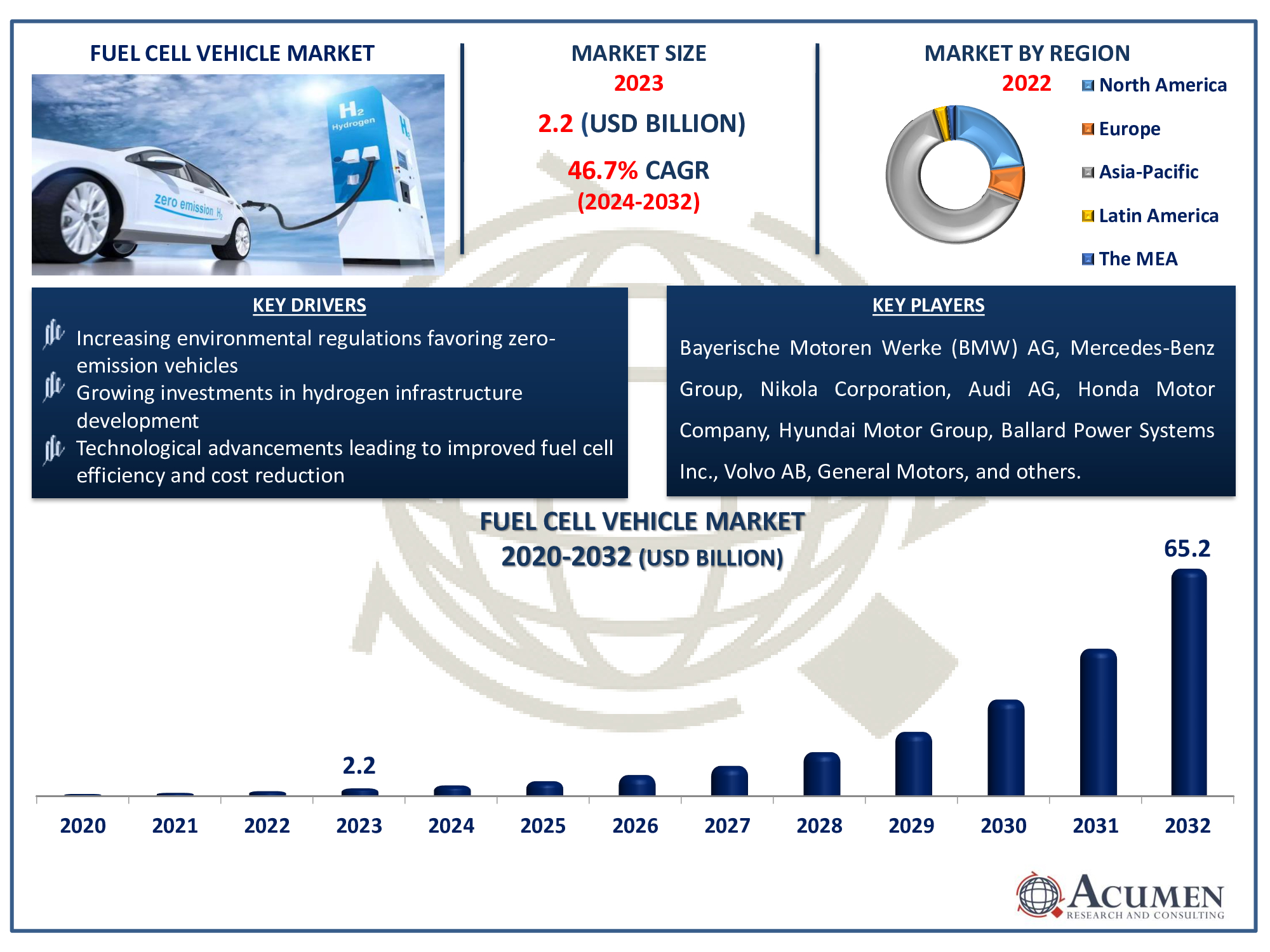

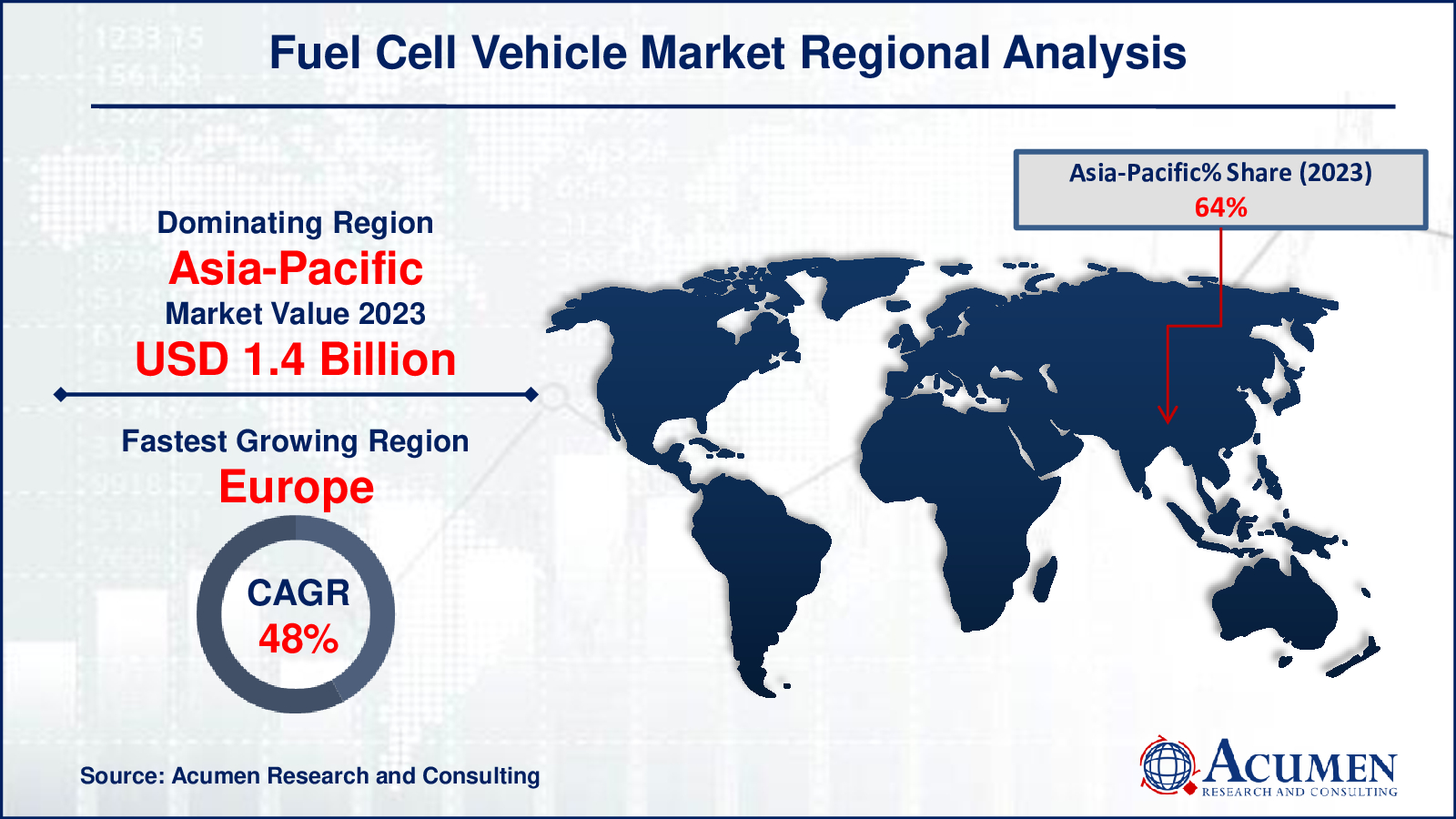

Fuel Cell Vehicle Market Regional Analysis

For several reasons, the Asia-Pacific region currently dominates the fuel cell vehicle (FCV) market due to several factors. Firstly, countries like Japan and South Korea have been early adopters, investing heavily in FCV infrastructure and research. For instance, in August 2022, Toyota revealed a joint venture with Isuzu and Hino Motors to develop hydrogen fuel-cell trucks aimed at the mass market. These trucks are designed to tackle the transportation industry's challenges and support the transition to a carbon-neutral society. Secondly, supportive government policies and incentives, including subsidies and tax breaks, have encouraged consumer adoption. Thirdly, robust technological advancements in hydrogen fuel cells and infrastructure development have bolstered market growth. Lastly, increasing environmental regulations and a push towards sustainable transportation solutions further drive the region's leadership in FCVs.

Europe has emerged as the fastest-growing region in FCV market, driven by stringent emissions regulations and strong governmental support for green technologies. The region's commitment to reducing carbon emissions has spurred substantial investments in hydrogen infrastructure, benefiting the adoption of fuel cell vehicles. For instance, in May 2022, Daimler's European division announced its plans to incorporate electric and hydrogen-powered vehicles into its lineup by 2030. Additionally, increasing consumer awareness and incentives for zero-emission vehicles have further propelled market growth. As automakers expand their portfolios to include more fuel cell models, Europe is poised to maintain its rapid growth trajectory in the global fuel cell vehicle market.

Fuel Cell Vehicle Market Players

Some of the top fuel cell vehicle companies offered in our report include Bayerische Motoren Werke (BMW) AG, Mercedes-Benz Group, Nikola Corporation, Audi AG, Honda Motor Company, Hyundai Motor Group, Ballard Power Systems Inc., Volvo AB, General Motors, and Toyota Motor Corporation.

Frequently Asked Questions

How big is the fuel cell vehicle market?

The fuel cell vehicle market size was valued at USD 2.2 Billion in 2023.

What is the CAGR of the global fuel cell vehicle market from 2024 to 2032?

The CAGR of fuel cell vehicle is 46.7% during the analysis period of 2024 to 2032.

Which are the key players in the fuel cell vehicle market?

The key players operating in the global market are including Bayerische Motoren Werke (BMW) AG, Mercedes-Benz Group, Nikola Corporation, Audi AG, Honda Motor Company, Hyundai Motor Group, Ballard Power Systems Inc., Volvo AB, General Motors, and Toyota Motor Corporation

Which region dominated the global fuel cell vehicle market share?

Asia-Pacific held the dominating position in fuel cell vehicle industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of fuel cell vehicle during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global fuel cell vehicle industry?

The current trends and dynamics in the fuel cell vehicle industry include increasing environmental regulations favoring zero-emission vehicles, growing investments in hydrogen infrastructure development, and technological advancements leading to improved fuel cell efficiency and cost reduction

Which type held the maximum share in 2023?

The passenger cars hold the maximum share of the fuel cell vehicle industry.