Frozen Food Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Frozen Food Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

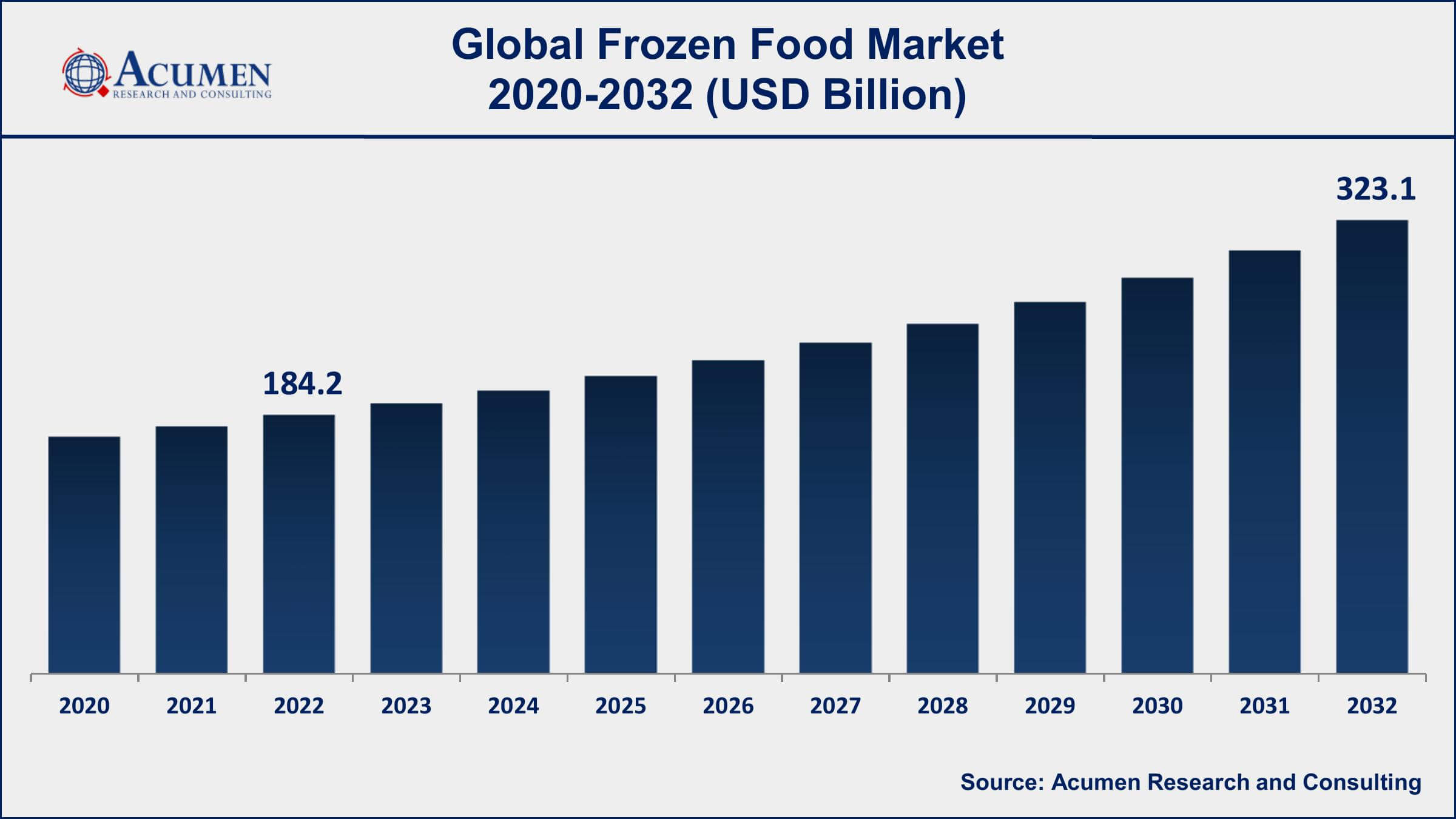

The Global Frozen Food Market Size accounted for USD 184.2 Billion in 2022 and is projected to achieve a market size of USD 323.1 Billion by 2032 growing at a CAGR of 5.9% from 2023 to 2032.

Frozen Food Market Key Highlights

- Global frozen food market revenue is expected to increase by USD 323.1 Billion by 2032, with a 5.9% CAGR from 2023 to 2032

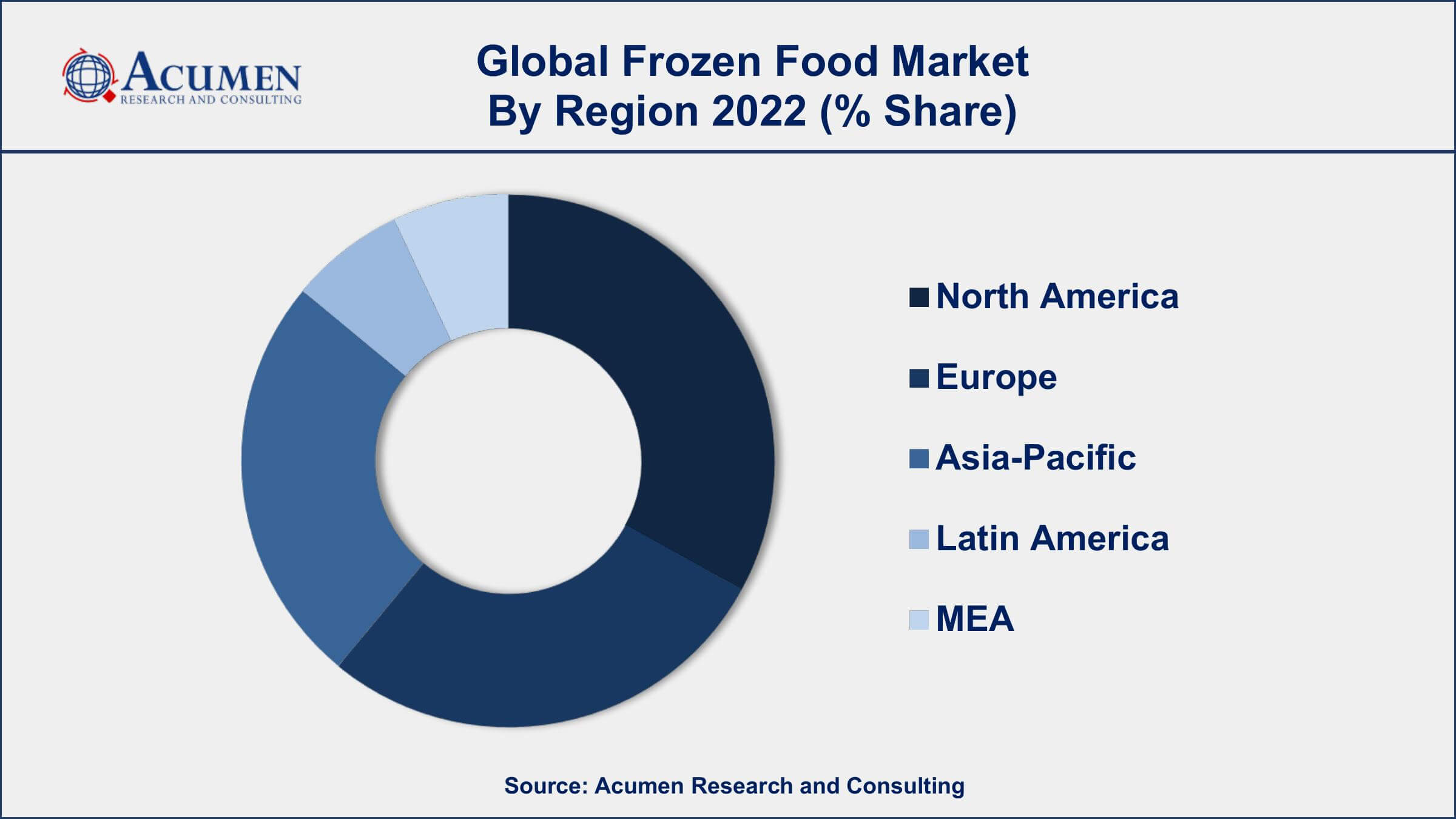

- North America region led with more than 33% of frozen food market share in 2022

- According to a survey by the American Frozen Food Institute, 88% of consumers buy frozen food at least occasionally, and 70% of consumers believe that frozen food is just as nutritious as fresh food

- According to a report, frozen pizza is the most popular frozen food in the United States, with sales reaching over $5.2 billion in 2020

- The most popular types of frozen food products include ready meals, vegetables, fruits, meat, fish and seafood, and bakery products

- According to a study by the Frozen Food Foundation, 74% of consumers believe that frozen foods are just as healthy as fresh foods

- Increasing demand for convenient and ready-to-eat food products, drives the frozen food market size

Frozen food refers to food products that have been frozen and stored at low temperatures to maintain their quality and freshness. This process involves freezing the food to very low temperatures which helps to preserve the flavor, texture, and nutritional value of the food. Frozen food can include a wide range of products including fruits, vegetables, meat, seafood, ready meals, and desserts.

The global frozen food market has experienced significant growth in recent years, due to several factors such as the increasing demand for convenient and ready-to-eat food products, the growing popularity of online food delivery services, and the changing lifestyles of consumers. In addition, the advancements in freezing technology have allowed manufacturers to produce high-quality frozen food products that can be easily stored, transported, and cooked. The increasing adoption of frozen food products by the food service industry has also contributed to the frozen food market growth.

Global Frozen Food Market Trends

Market Drivers

- Increasing demand for convenient and ready-to-eat food products

- Advancements in freezing technology

- Growing popularity of online food delivery services

- Busy lifestyles of consumers

- Increasing demand from the foodservice industry

Market Restraints

- Health concerns associated with frozen food products

- Limited variety and taste of frozen food products

Market Opportunities

- Growing popularity of plant-based frozen food products

- Technological advancements in the packaging and processing of frozen food products

Frozen Food Market Report Coverage

| Market | Frozen Food Market |

| Frozen Food Market Size 2022 | USD 184.2 Billion |

| Frozen Food Market Forecast 2032 | USD 323.1 Billion |

| Frozen Food Market CAGR During 2023 - 2032 | 5.9% |

| Frozen Food Market Analysis Period | 2020 - 2032 |

| Frozen Food Market Base Year | 2022 |

| Frozen Food Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Type, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Nestle SA, Unilever NV, General Mills Inc., Conagra Brands Inc., McCain Foods Limited, Kellogg Company, Nomad Foods Limited, Dr. Oetker GmbH, Tyson Foods Inc., Birds Eye Ltd., Ajinomoto Co. Inc., and Schwan's Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Frozen food is a product that is preserved by freezing it from the time of preparation till it is consumed. The process helps in slowing down the decomposition by converting residual moisture to the form of ice thereby, restraining the growth of several bacterial species. Various factors are responsible for the increasing growth of the frozen food industry such as the rising number of employed women, busy lifestyles of people, changing purchasing pattern of people, and availability of frozen food in a variety of categories. The convenience of usage offered by frozen food is another factor propelling the market growth. Owing to these factors, the use of frozen food is increasing at a higher pace, particularly in urban areas.

The continuous increase in the number of retail chains that include supermarkets and hypermarkets is influencing market growth positively. However, some factors responsible for hampering the growth of the frozen food market value in developing countries include inadequate availability of refrigeration facilities in some retail stores, high cost of maintenance & logistics, and the lack of proper distribution facilities in rural as well as semi-urban areas. On the other hand, a continuous rise in the growth of the market is anticipated in the developed market. The advancement in freeing technologies resulting in increasing shelf-life of frozen products is another factor leading to market growth.

Frozen Food Market Segmentation

The global frozen food market segmentation is based on product type, type, distribution channel, and geography.

Frozen Food Market By Product Type

- Ready Meals

- Frozen Fruit & Vegetables

- Frozen Seafood

- Frozen Soups

- Frozen Meat & Poultry

- Bakery Products

- Others

According to the frozen food industry analysis, the ready meals segment accounted for the largest market share in 2022. Ready meals are pre-cooked and frozen food products that are convenient and easy to prepare. They typically include a variety of cuisines and dishes, such as pasta, pizza, ethnic food, and desserts. The ready meals segment is driven by several factors, including the busy lifestyles of consumers, increasing demand for convenience food products, and advancements in freezing technology. Ready meals offer a quick and easy solution for consumers who are short on time or do not have the skills or desire to cook from scratch. Frozen ready meals also have a longer shelf life and can be stored for an extended period without losing their nutritional value.

Frozen Food Market By Type

- Raw material

- Ready-to-drink

- Ready-to-eat

- Ready-to-cook

In terms of types, the ready-to-cook segment is expected to witness significant growth in the coming years. Ready-to-cook products are pre-cut, marinated, and seasoned food items that are frozen and sold as a complete meal kit or individual components that can be easily prepared by consumers at home. The growth of the ready-to-cook segment can be attributed to several factors, including the increasing demand for convenient food products, changing lifestyles of consumers, and the need for easy-to-prepare home-cooked meals. The ready-to-cook products offer a quick and easy solution for consumers who are looking for healthy and nutritious meal options that can be prepared in a short amount of time.

Frozen Food Market By Distribution Channel

- Online

- Offline

According to the frozen food market forecast, the online segment is expected to witness significant growth in the coming years. The increasing popularity of e-commerce platforms and online grocery shopping has made it easier for consumers to buy frozen food products online, which has led to the growth of the online segment. The online segment's growth in the market can be attributed to several factors, including the convenience of online shopping, the availability of a wide range of products, and the increasing adoption of smartphones and other digital devices. Online platforms offer consumers the ability to browse and purchase frozen food products from the comfort of their homes and have them delivered directly to their doorsteps, which has become especially important during the COVID-19 pandemic.

Frozen Food Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Frozen Food Market Regional Analysis

North America is dominating the frozen food market due to several factors, including the increasing demand for convenience food products, changing lifestyles of consumers, and the availability of a wide range of frozen food options. Additionally, the well-established distribution channels and the increasing number of supermarkets and hypermarkets have made it easier for consumers to access frozen food products in the region. The North American market's dominance in the frozen food industry can also be attributed to the increasing demand for healthy and nutritious frozen food products, including organic and plant-based options. The region's health-conscious consumers are increasingly looking for healthier and sustainable food options, which has led to the growth of the organic and plant-based frozen food segments.

Frozen Food Market Player

Some of the top frozen food market companies offered in the professional report include Nestle SA, Unilever NV, General Mills Inc., Conagra Brands Inc., McCain Foods Limited, Kellogg Company, Nomad Foods Limited, Dr. Oetker GmbH, Tyson Foods Inc., Birds Eye Ltd., Ajinomoto Co. Inc., and Schwan's Company.

Frequently Asked Questions

What was the market size of the global frozen food in 2022?

The market size of frozen food was USD 184.2 Billion in 2022.

What is the CAGR of the global frozen food market from 2023 to 2032?

The CAGR of frozen food is 5.9% during the analysis period of 2023 to 2032.

Which are the key players in the frozen food market?

The key players operating in the global market are including Nestle SA, Unilever NV, General Mills Inc., Conagra Brands Inc., McCain Foods Limited, Kellogg Company, Nomad Foods Limited, Dr. Oetker GmbH, Tyson Foods Inc., Birds Eye Ltd., Ajinomoto Co. Inc., and Schwan's Company.

Which region dominated the global frozen food market share?

North America held the dominating position in frozen food industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of frozen food during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global frozen food industry?

The current trends and dynamics in the frozen food industry include increasing demand for convenient and ready-to-eat food products, and advancements in freezing technology.

Which product type held the maximum share in 2022?

The ready meals product type held the maximum share of the frozen food industry.