Frozen Dessert Market | Acumen Research and Consulting

Frozen Dessert Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

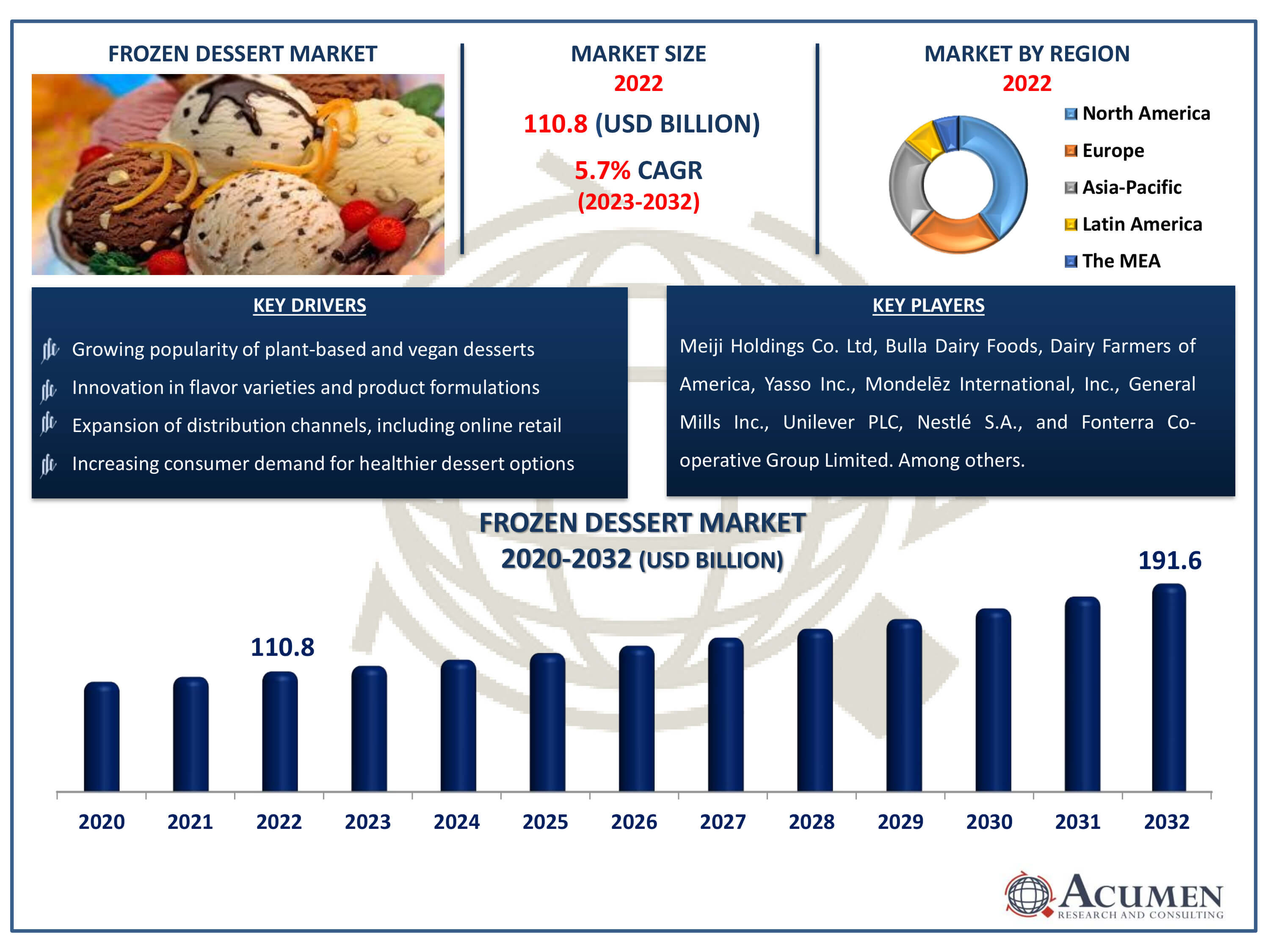

The Frozen Dessert Market Size accounted for USD 110.8 Billion in 2022 and is estimated to achieve a market size of USD 191.6 Billion by 2032 growing at a CAGR of 5.7% from 2023 to 2032.

Frozen Dessert Market Highlights

- Global frozen dessert market revenue is poised to garner USD 191.6 billion by 2032 with a CAGR of 5.7% from 2023 to 2032

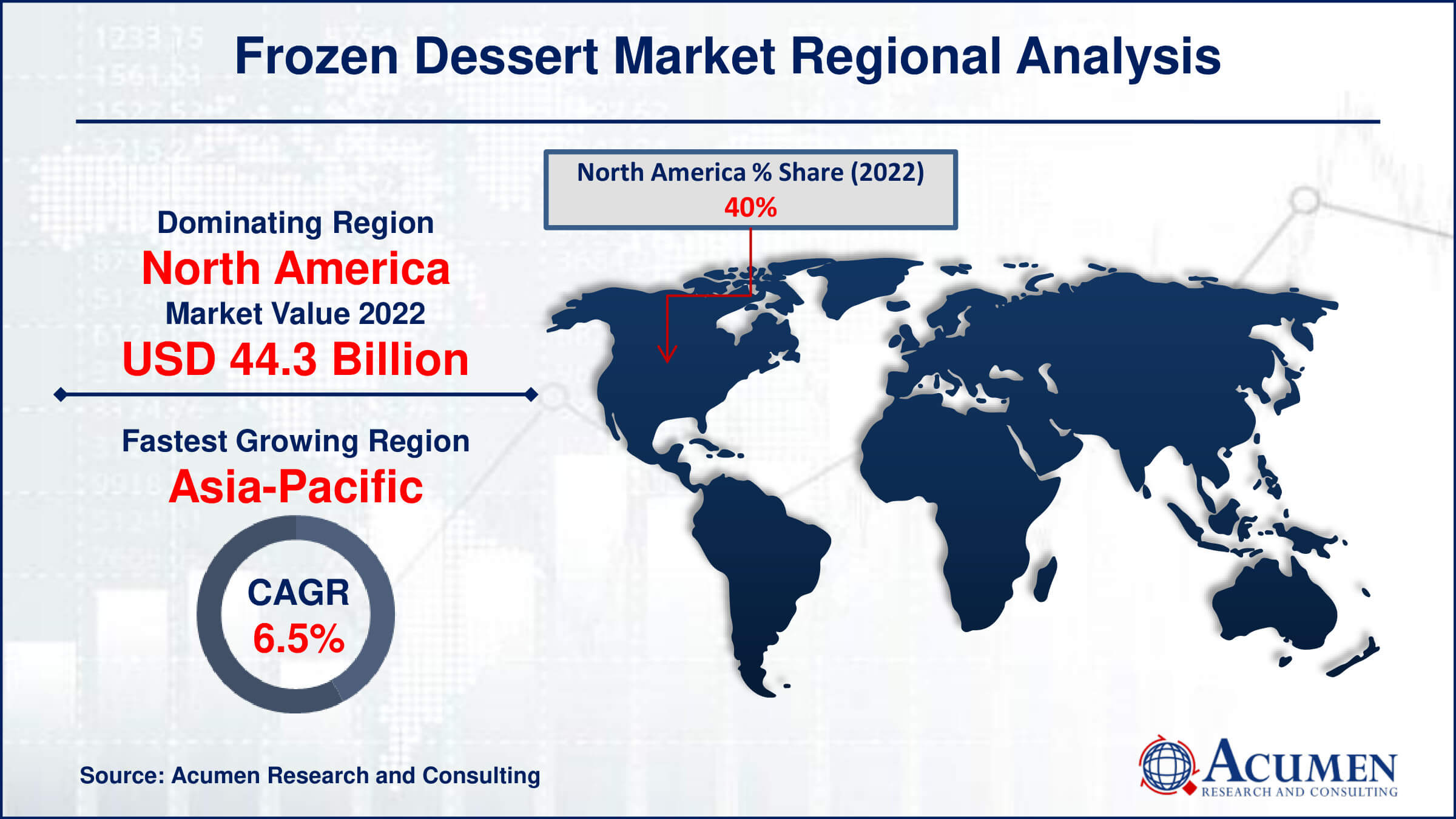

- North America frozen dessert market value occupied around USD 44.3 billion in 2022

- Asia-Pacific frozen dessert market growth will record a CAGR of more than 6.5% from 2023 to 2032

- Among product, the ice cream sub-segment generated more than USD 54.3 billion revenue in 2022

- Based on distribution channel, the supermarket/hypermarket sub-segment generated around 30% market share in 2022

- Strategic partnerships with cafes and restaurants for co-branded offerings is a popular frozen dessert market trend that fuels the industry demand

Frozen desserts, such as ice cream and frozen yoghurt, are commonly relished as sweet snacks. These scrumptious delights, made primarily from milk and cream, provide a creamy and pleasant taste experience. However, the spread of frozen desserts is controlled by several factors. First, supplier concentration has an impact on the market's supply and diversity of frozen dessert alternatives. Second, the use of food processing technology is critical to ensure the efficiency and quality of manufacturing operations. Finally, the size and preference given to retail chains influences customer accessibility and product exposure. Collectively, these elements determine the distribution channels for frozen desserts, impacting customer preferences and market dynamics.

Global Frozen Dessert Market Dynamics

Market Drivers

- Increasing consumer demand for healthier dessert options

- Growing popularity of plant-based and vegan desserts

- Innovation in flavor varieties and product formulations

- Expansion of distribution channels, including online retail

Market Restraints

- Fluctuating prices of raw materials like dairy and fruits

- Regulatory challenges and labeling requirements

- Seasonal demand fluctuations impacting sales

Market Opportunities

- Rising demand for premium and artisanal frozen desserts

- Expansion into emerging markets with growing disposable incomes

- Introduction of novel ingredients and functional benefits

Frozen Dessert Market Report Coverage

| Market | Frozen Dessert Market |

| Frozen Dessert Market Size 2022 | USD 110.8 Billion |

| Frozen Dessert Market Forecast 2032 |

USD 191.6 Billion |

| Frozen Dessert Market CAGR During 2023 - 2032 | 5.7% |

| Frozen Dessert Market Analysis Period | 2020 - 2032 |

| Frozen Dessert Market Base Year |

2022 |

| Frozen Dessert Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Category, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Meiji Holdings Co. Ltd, Bulla Dairy Foods, Dairy Farmers of America, Yasso Inc., Mondel?z International, Inc., General Mills Inc., Unilever PLC, Nestlé S.A., Fonterra Co-operative Group Limited, Dunkin' Brands Group Inc., and Inner Mongolia Yili Industrial Group Co. Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Frozen Dessert Market Insights

The significant growth of the frozen dessert market worldwide can be attributed to the evolving tastes of consumers and increasing public awareness. Moreover, the addition of various products catering to a wide range of consumer preferences in the dessert segment, coupled with rising disposable incomes, further propels market expansion. Frozen desserts typically comprise milk, vegetable fats, and a variety of flavors and dried fruits. The dessert industry's development is driving the trend of consuming frozen desserts post-dinner as efficient digestive aids. Additionally, climate change contributes to the demand for frozen desserts, such as ice cream and frozen yogurt. Ice cream sales alone are estimated to surge by up to 50% on warm days and decline by 20% during inclement weather. Consumers often indulge in ice cream to cool down in hot weather, thereby boosting market growth.

However, the market's development faces challenges due to increasing health concerns among individuals. Many customers seek healthier alternatives, such as low-calorie, vegan, and dairy-free options, influencing market dynamics. According to the World Health Organization (WHO), the global diabetic population, currently exceeding 400 million, is projected to surpass 600 million in the next two decades. This surge in diabetic patients underscores the need for the industry to develop sugar-free products to cater to health-conscious consumers. Despite these challenges, the growing popularity of frozen desserts has prompted several companies to diversify their product portfolios in this sector. For instance, Coca-Cola, a leading carbonated beverage giant, has expanded its business by introducing frozen desserts in India. The company has also pledged to invest 11,000 crore in the development, distribution, and marketing of a range of fruit-based products and desserts, reflecting its commitment to the agricultural ecosystem and food processing facilities.

Frozen Dessert Market Segmentation

The worldwide market for frozen dessert is split based on product, category distribution channel, and geography.

Frozen Dessert Products

- Frozen Yogurt

- Ice Cream

- Confectionary & Candies

- Others

According to frozen dessert industry analysis, by product, the market is segmented into ice cream, confectionery & candies, and frozen yogurt. Ice cream stands out as one of the most prominent products in this industry, accounting for over 49% of the market share in 2022. As its popularity transcends generations, the demand for ice cream experiences substantial growth.

Various factors, including flavors, shapes, fat content, texture, and taste, drive the development of ice cream. Sugar-free ice creams have gained significant popularity due to their perceived health benefits. While ice cream consumers prioritize taste and nutritional value, factors such as cost, brand, and ambiance also influence purchasing decisions. According to a study, 36% of Brazilians reportedly opt for cheaper ice cream brands, favoring private labels.

Frozen yogurt, with its associated health benefits, is poised for rapid growth in the frozen dessert industry forecast period. This frozen dessert, made from yogurt or other dairy and non-dairy ingredients, competes with ice cream and is often considered a healthier alternative. With consumers increasingly shifting from ice cream to frozen yogurt, it emerges as the fastest-growing product in the market.

Frozen Dessert Categories

- Conventional

- Sugar-free

The conventional category dominates the frozen dessert market due to its extensive appeal and conventional consumer preferences. Ice cream, gelato, sorbet, and frozen custard are all examples of conventional frozen desserts. These items often appeal to a wide range of consumers, including people of all ages and tastes. Furthermore, typical frozen desserts frequently have sumptuous flavours and creamy textures that appeal to classic dessert fans. Despite rising desire for healthier alternatives, the familiarity and comfort associated with traditional frozen desserts continue to generate large sales. As a result, the conventional category remains dominant in the market, catering to a wide range of consumer interests and preferences.

Frozen Dessert Distribution Channels

- Supermarket/Hypermarket

- Cafe & Bakery Shops

- Convenience Stores

- Online

- Others

In 2022, the supermarket/hypermarket segment held the largest market share. During the frozen dessert market forecast period, this segment is expected to experience the fastest growth, driven by increased consumer demand for desserts as part of daily meals, alongside the purchase of frozen desserts and everyday food items.

The growing trend of shopping at specialty stores has created opportunities for cafes and bakeries to introduce various frozen dessert products. Recent developments have prompted these establishments to adapt their menus to include nutrient-rich desserts, further enhancing their offerings. Additionally, several internet distribution partners are now offering innovative alternatives to deliver frozen desserts directly from their source points to customers' doorsteps. Consequently, online purchases of frozen desserts have surged, contributing to the segment's growth in the market.

Frozen Dessert Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Frozen Dessert Market Regional Analysis

North America emerged as the largest national market in 2022 due to the increasing demand for ice cream in the region. In that year, the U.S. accounted for over 90% of the market share in North America. Changing lifestyles and growing health awareness have propelled the industry's development.

Frozen yogurt, boasting over 400 brands, is a popular product among customers, offering a wide variety of flavors. To further promote yogurt consumption and related products, the United States Department of Agriculture (USDA) has initiated several programs throughout the region. Low-fat yogurt serves as a significant source of calcium and is increasingly promoted by health and nutrition organizations.

In terms of frozen dessert market analysis, in the forecast period, Asia-Pacific is expected to emerge as the fastest-growing regional market. Factors such as the region's increasing population, lifestyle changes, higher disposable incomes, and shifting climatic conditions are driving economic growth.

Frozen Dessert Market Players

Some of the top frozen dessert companies offered in our report includes Meiji Holdings Co. Ltd, Bulla Dairy Foods, Dairy Farmers of America, Yasso Inc., Mondel?z International, Inc., General Mills Inc., Unilever PLC, Nestlé S.A., Fonterra Co-operative Group Limited, Dunkin' Brands Group Inc., and Inner Mongolia Yili Industrial Group Co. Ltd.

Frequently Asked Questions

How big is the frozen dessert market?

The frozen dessert market size was valued at USD 110.8 billion in 2022.

What is the CAGR of the global frozen dessert market from 2023 to 2032?

The CAGR of frozen dessert is 5.7% during the analysis period of 2023 to 2032.

Which are the key players in the frozen dessert market?

The key players operating in the global market are including Meiji Holdings Co. Ltd, Bulla Dairy Foods, Dairy Farmers of America, Yasso Inc., Mondel?z International, Inc., General Mills Inc., Unilever PLC, Nestlé S.A., Fonterra Co-operative Group Limited, Dunkin' Brands Group Inc., and Inner Mongolia Yili Industrial Group Co. Ltd.

Which region dominated the global frozen dessert market share?

North America held the dominating position in frozen dessert industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of frozen dessert during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global frozen dessert industry?

The current trends and dynamics in the frozen dessert industry include increasing consumer demand for healthier dessert options, growing popularity of plant-based and vegan desserts, innovation in flavor varieties and product formulations, and expansion of distribution channels, including online retail.

Which product held the maximum share in 2022?

The ice cream product held the maximum share of the frozen dessert industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date