Freight Forwarding Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Freight Forwarding Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

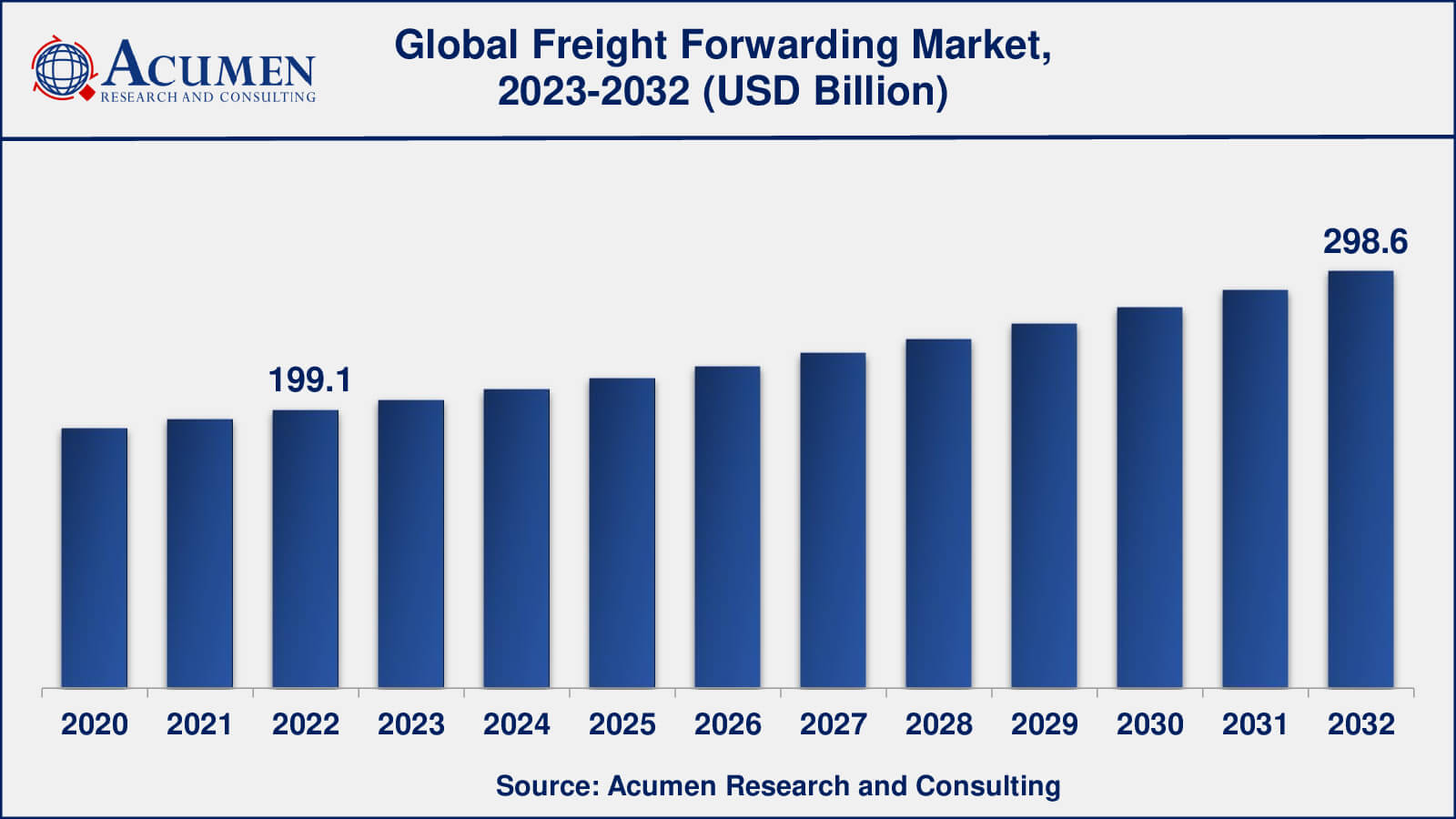

The Global Freight Forwarding Market Size accounted for USD 199.1 Billion in 2022 and is estimated to achieve a market size of USD 298.6 Billion by 2032 growing at a CAGR of 4.2% from 2023 to 2032.

Freight Forwarding Market Highlights

- Global freight forwarding market revenue is poised to garner USD 298.6 billion by 2032 with a CAGR of 4.2% from 2023 to 2032

- Asia-Pacific freight forwarding market value occupied around USD 119 billion in 2022

- Asia-Pacific freight forwarding market growth will record a CAGR of over 5% from 2023 to 2032

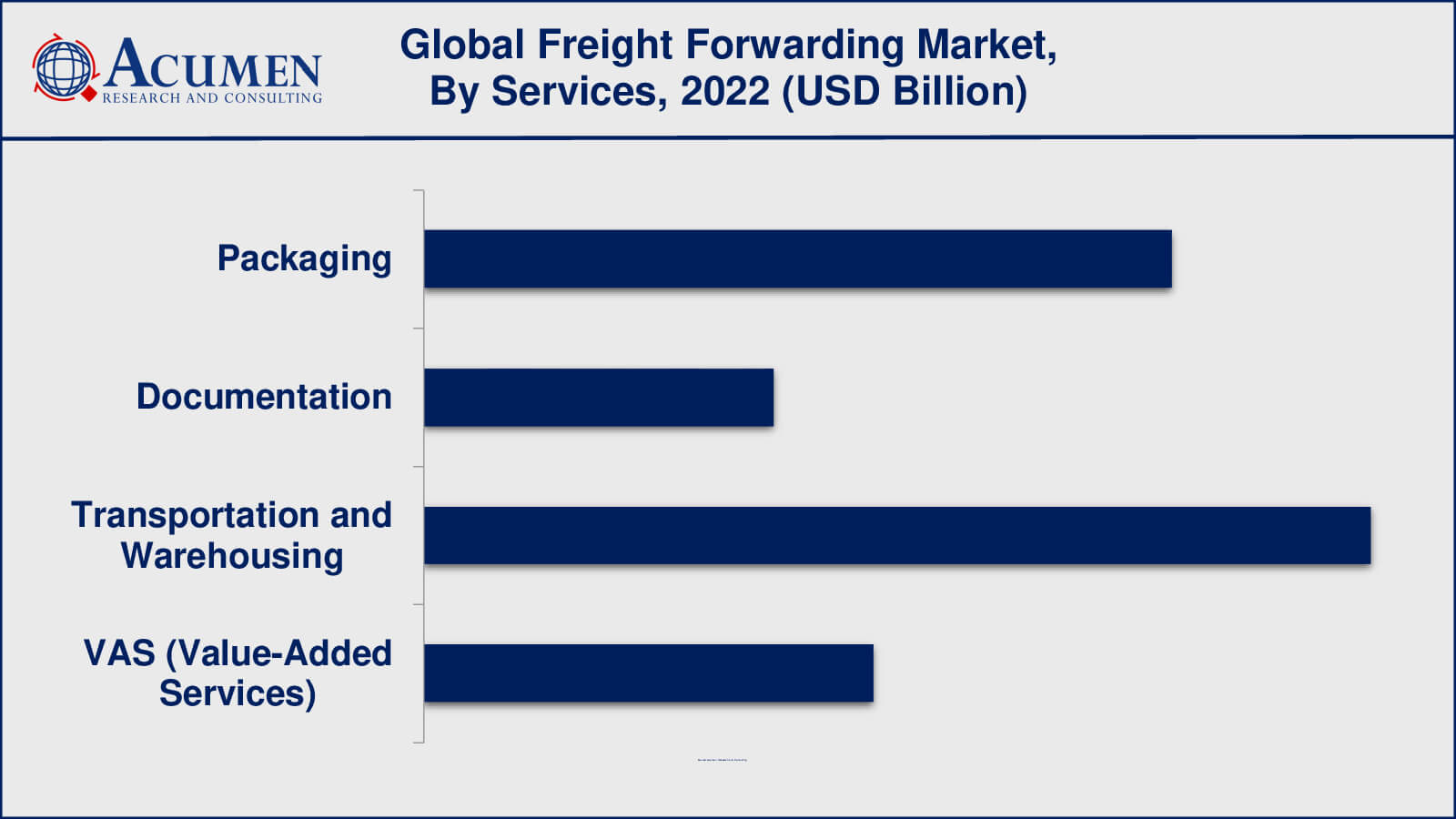

- Among services, the transportation and warehousing sub-segment generated over US$ 75 billion revenue in 2022

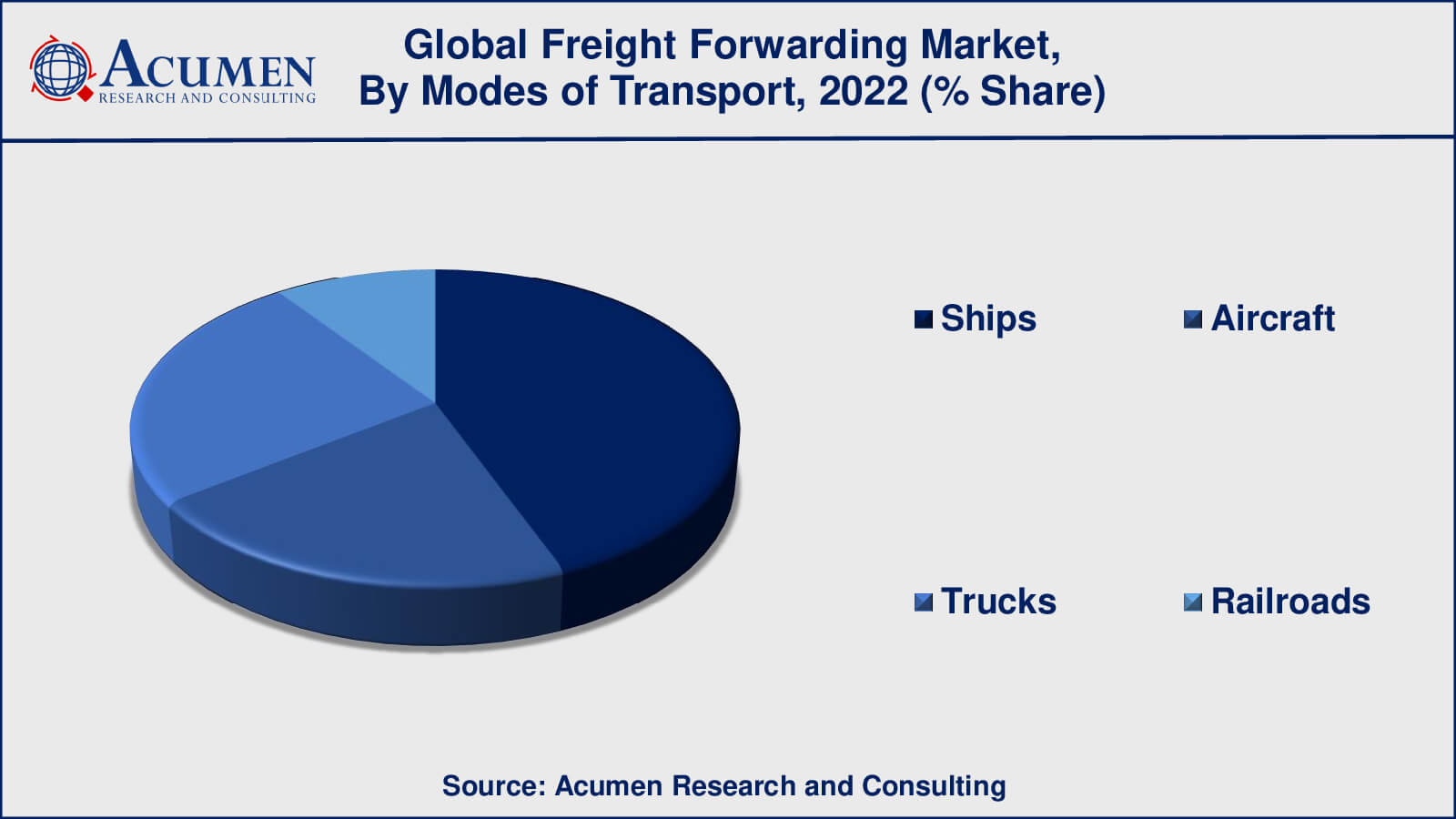

- Based modes of transport, the ships sub-segment generated around 44% share in 2022

- The need for end-to-end logistics solutions is a popular freight forwarding market trend that fuels the industry demand

Freight forwarding is done by freight forwarders who are the intermediate representatives and organize the economical, safe, and efficient transportation and storage of goods for several industries, especially from manufacturers to the end-user or the final place of distribution. Freight forwarders have continuing contracts with airline carriers, shippers as well as rail and road operators for the transportation of cargo.

Global Freight Forwarding Market Dynamics

Market Drivers

- Globalization and international trade growth

- E-commerce and the demand for fast and efficient logistics services

- Technological advancements and adoption of new technologies

- Infrastructure development and expansion of transportation networks

Market Restraints

- Fluctuating fuel prices and operational costs

- Trade disputes and geopolitical instability

- Shifts in consumer demand and supply chain disruptions

Market Opportunities

- Rising demand for specialized logistics services and value-added services (VAS)

- Increasing focus on sustainability and environmentally-friendly logistics solutions

- Growing demand for perishable goods and temperature-controlled logistics services

Freight Forwarding Market Report Coverage

| Market | Freight Forwarding Market |

| Freight Forwarding Market Size 2022 | USD 199.1 Billion |

| Freight Forwarding Market Forecast 2032 | USD 298.6 Billion |

| Freight Forwarding Market CAGR During 2023 - 2032 | 4.2% |

| Freight Forwarding Market Analysis Period | 2020 - 2032 |

| Freight Forwarding Market Base Year | 2022 |

| Freight Forwarding Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Services, By Modes of Transportation, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Agility Global Integrated Logistics, BDP International, C.H. Robinson, CEVA Logistics, DAMCO, DSV, Expeditors International, Geodis, Hellmann Worldwide Logistics and Kerry Logistics. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Freight Forwarding Market Insights

Disintermediation, especially from cloud-based services is improbable, although the technology is anticipated to become increasingly popular for freight forwarders operating across the globe which is anticipated to drive the global market. Moreover, a cooperative supply chain network, further driven by technology and computer software is projected to bring impetus to the enhancement of the overall freight forwarding industry over the forecast period. Also, acquisitions and mergers in the global freight forwarding industry have disturbed the sea and air freight positions. Furthermore, owing to the lesser demands in the global market, various companies are focusing on enhancing their profitability rather than the growth of their product portfolio. This is further established via investments in technology and software, rationalization as well a focus on high capital agreement opportunities.

Freight Forwarding Market Segmentation

The worldwide market for freight forwarding is split based on services, modes of transport, application, and geography.

Freight Forwarding Services

- Packaging

- Documentation

- Transportation and Warehousing

- VAS (Value-Added Services)

According to our freight forwarding industry analysis, transportation and warehousing services typically account for the largest share of the freight forwarding market. This includes goods movement by air, sea, road, and rail, as well as warehouse and distribution centre management. Packaging services are also an important part of the freight forwarding market because they help to protect goods during transportation. However, packaging services typically have a smaller market share than transportation and warehousing. Customs clearance, insurance, and supply chain management are all becoming increasingly important in the freight forwarding market. While VAS represents a smaller share of the market compared to transportation and warehousing, it is expected to continue growing in importance as companies seek more comprehensive logistics solutions.

Freight Forwarding Modes of Transport

- Ships

- Aircraft

- Trucks

- Railroads

According to freight forwarding market forecast, maritime transportation, which includes ships and other vessels, is the dominant mode of transport in the global freight forwarding market. This is because ships are the most cost-effective way to transport large volumes of goods over long distances, especially for bulk commodities such as oil, minerals, and grain. Road transportation, which includes trucks and other vehicles, is the freight forwarding market's second-largest mode of transport. Trucks are especially important for short-haul and last-mile deliveries because they provide flexibility and can reach destinations that other modes of transportation cannot.

Air transportation, including cargo planes and other aircraft, is an important mode of transport in the freight forwarding market, especially for time-sensitive and high-value goods. However, due to its higher cost in comparison to other modes of transportation, air freight accounts for a smaller portion of the overall market. Rail transportation, which includes trains and other railway vehicles, is a smaller mode of transportation in the freight forwarding market than the other modes mentioned above. However, rail remains an important option for certain types of goods and long-distance transportation.

Freight Forwarding Applications

- Industrial and Manufacturing

- Retail

- Healthcare

- Media and Entertainment

- Military

- Oil and Gas

- Food and Beverages

- Others

The largest application segment in the freight forwarding market is the industrial and manufacturing sector. This is because this industry necessitates the movement of large volumes of goods, such as raw materials, components, and finished products, across multiple locations. In the freight forwarding market, the retail sector is also a significant application segment. This includes transporting goods from manufacturers to distribution centres, as well as transporting goods from distribution centres to retail stores or directly to consumers via e-commerce channels.

In the freight forwarding market, the healthcare sector is an important and growing application segment. This includes pharmaceuticals, medical devices, and other healthcare products requiring specialised handling and temperature control. Because it necessitates the transportation of equipment, machinery, and supplies to remote locations all over the world, the oil and gas industry is a major application segment in the freight forwarding market.

Freight Forwarding Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Freight Forwarding Market Regional Analysis

The Asia-Pacific region is the largest and fastest-growing market for freight forwarding, driven by the rapid growth of economies such as China, India, and Southeast Asia. Some of the world's busiest ports, such as Shanghai, Singapore, and Hong Kong, are located in the region and serve as major transportation hubs for goods moving between Asia, Europe, and North America.

Europe is another significant freight forwarding market, with many established players providing a wide range of services across the continent. The region has a robust transportation infrastructure, which includes a vast network of roads, railways, and waterways.

The United States, the world's largest economy and a major hub for global trade, dominates the North American freight forwarding market. The region has advanced logistics infrastructure, such as numerous large airports, seaports, and rail terminals.

Freight Forwarding Market Players

Some of the top Freight Forwarding companies offered in the professional report include Agility Global Integrated Logistics, BDP International, C.H. Robinson, CEVA Logistics, DAMCO, DSV, Expeditors International, Geodis, Hellmann Worldwide Logistics and Kerry Logistics.

Frequently Asked Questions

What was the market size of the global freight forwarding in 2022?

The market size of freight forwarding was USD 199.1 billion in 2022.

What is the CAGR of the global freight forwarding market from 2023 to 2032?

The CAGR of freight forwarding is 4.2% during the analysis period of 2023 to 2032.

Which are the key players in the freight forwarding market?

The key players operating in the global market are including Agility Global Integrated Logistics, BDP International, C.H. Robinson, CEVA Logistics, DAMCO, DSV, Expeditors International, Geodis, Hellmann Worldwide Logistics and Kerry Logistics.

Which region dominated the global freight forwarding market share?

Asia-Pacific held the dominating position in freight forwarding industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of freight forwarding during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global freight forwarding industry?

The current trends and dynamics in the freight forwarding industry include globalization and international trade growth, e-commerce and the demand for fast and efficient logistics services, and technological advancements and adoption of new technologies.

Which services held the maximum share in 2022?

The transportation and warehousing services held the maximum share of the freight forwarding industry.