Footwear Market | Acumen Research and Consulting

Footwear Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

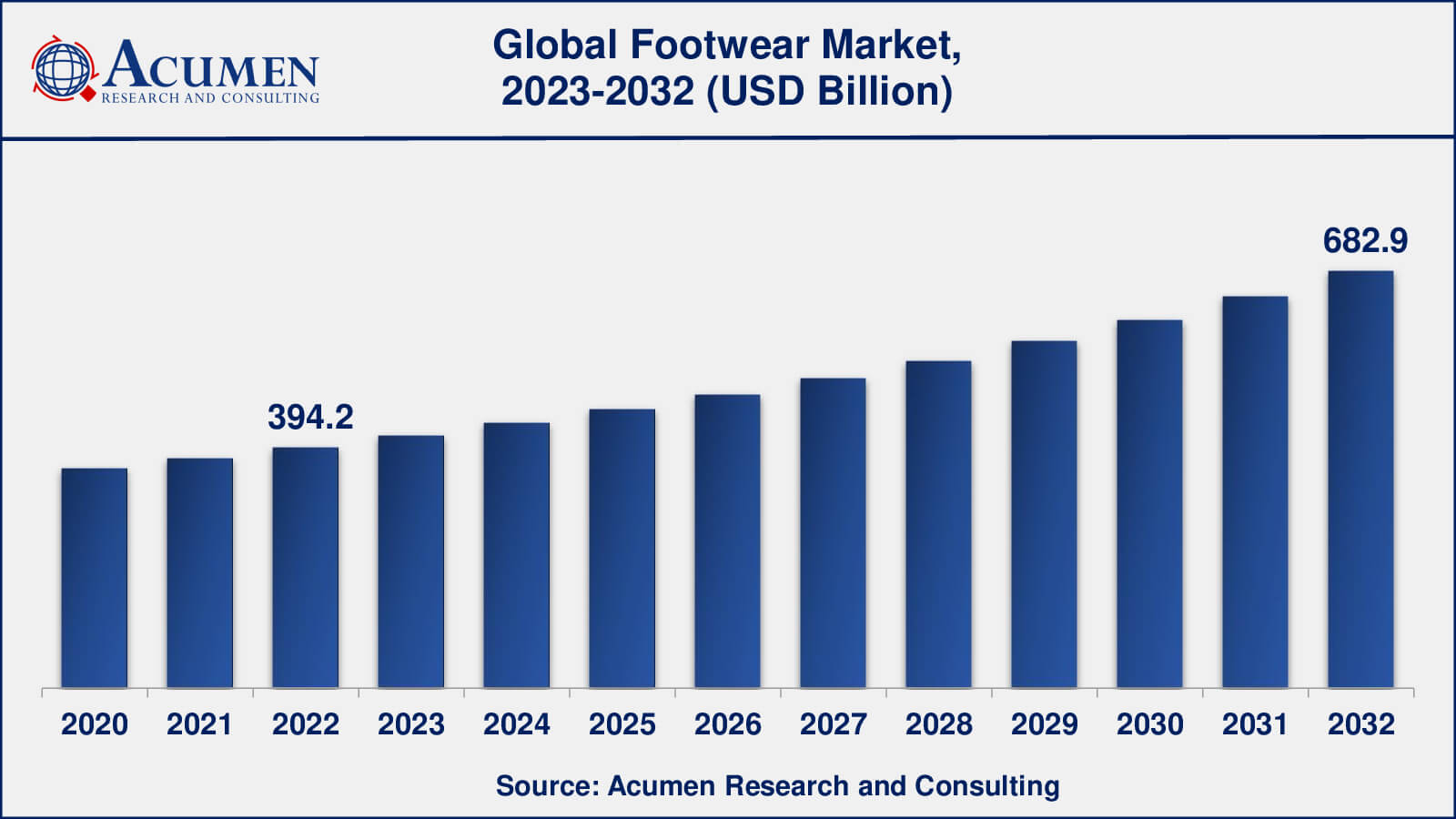

The Global Footwear Market Size accounted for USD 394.2 Billion in 2022 and is estimated to achieve a market size of USD 682.9 Billion by 2032 growing at a CAGR of 5.7% from 2023 to 2032.

Footwear Market Key Highlights

- Global footwear market revenue is poised to garner USD 682.9 billion by 2032 with a CAGR of 5.7% from 2023 to 2032

- Asia-Pacific footwear market value occupied more than USD 157.7 billion in 2022

- North America footwear market growth will record a CAGR of around 6% from 2023 to 2032

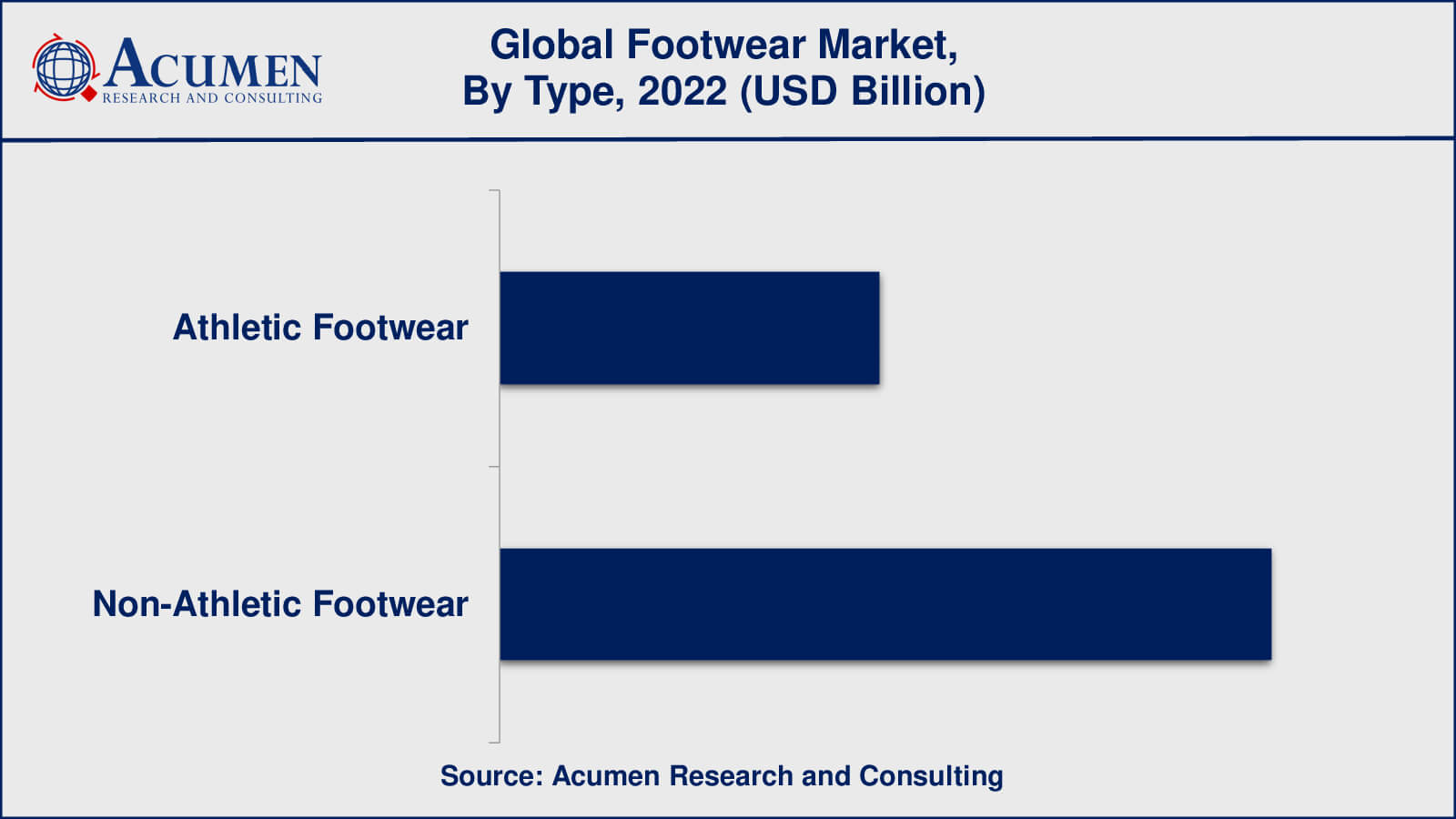

- Among type, the non-athletic footwear sub-segment generated around US$ 264 billion revenue in 2022

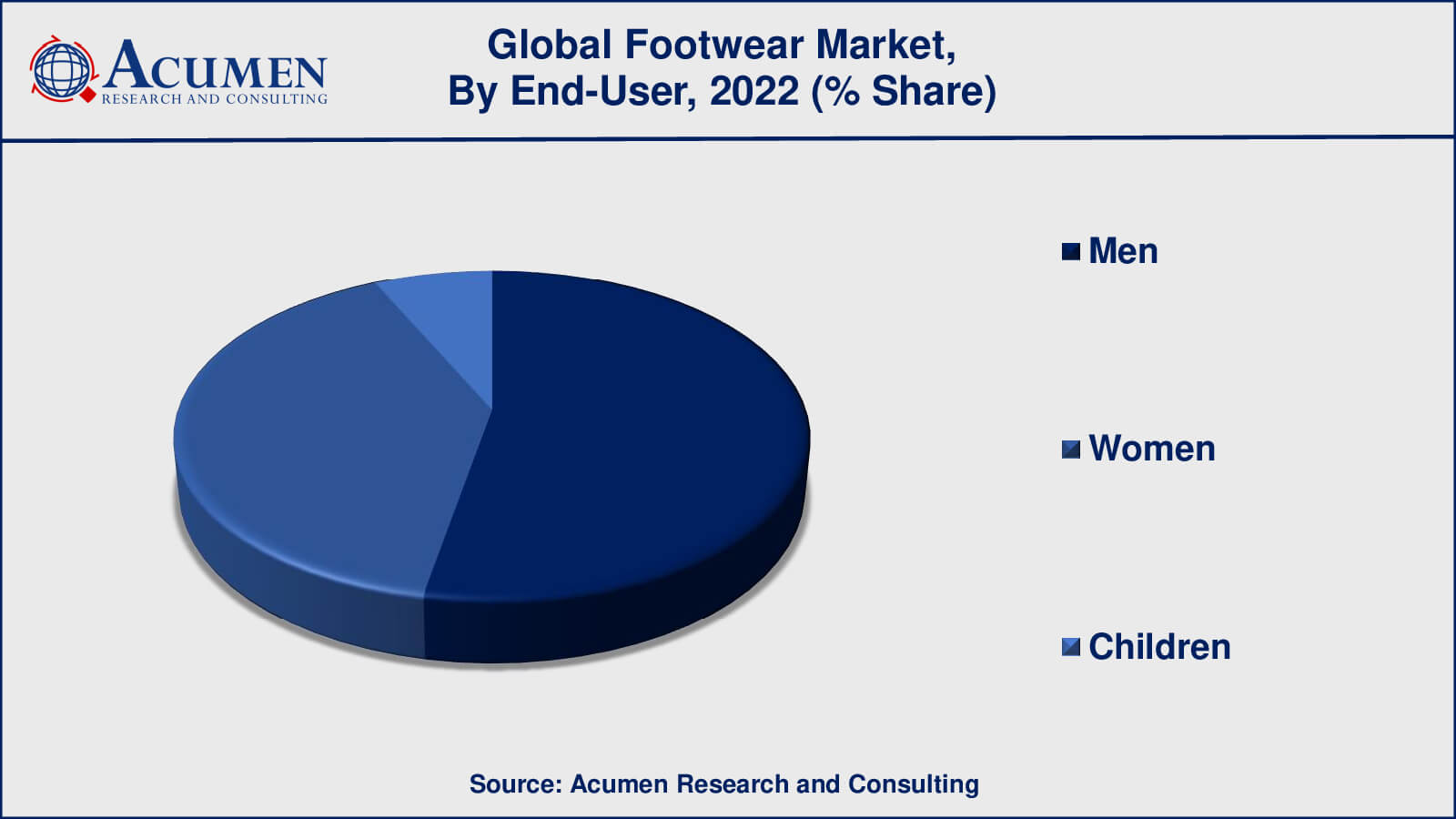

- Based on end-user, the men sub-segment generated around 53% share in 2022

- Demand for athleisure and casual footwear is popular footwear market trends that fuels the industry demand

Footwear is a garment worn on feet and serves the purpose of safeguarding against environmental difficulties such as ground textures and temperature. Footwear mainly serves the purpose to ease locomotion and avoid foil injuries. Secondly, footwear can also be used for custom and beautification as well as to show the status/rank of the person within a social structure. Socks and other hosiery are usually worn additionally between the feet and other footwear for further luxury and relief.

Global Footwear Market Dynamics

Market Drivers

- Increasing population and urbanization

- Growing e-commerce industry

- Increasing health awareness

- Changing lifestyles

Market Restraints

- Intense competition

- Fluctuating raw material prices

- Increasing regulatory requirements

Market Opportunities

- Sustainable and eco-friendly footwear

- Rise of sustainable and ethical fashion

Footwear Market Report Coverage

| Market | Footwear Market |

| Footwear Market Size 2022 | USD 394.2 Billion |

| Footwear Market Forecast 2032 | USD 682.9 Billion |

| Footwear Market CAGR During 2023 - 2032 | 5.7% |

| Footwear Market Analysis Period | 2020 - 2032 |

| Footwear Market Base Year | 2022 |

| Footwear Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Material, By Mode of Sale, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Nike Inc., Adidas AG, Bata Limited, Puma SE, New Balance Inc., Deichmann SE, Skechers USA, Inc., New Balance Inc., Asics Corp., and Under Armour, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Footwear Market Insights

The global footwear market is witnessing lucrative growth, owing to the growing demand for elegant, fashionable yet comfortable footwear among all ages. Furthermore, growing health awareness is impelling individuals to accomplish outdoor and indoor physical activities; thus this trend has created high demand for athletic footwear, which in turn, will boost the demand for footwear. Moreover, with the increasing prevalence of diabetes worldwide, it is expected that the market for athletic footwear will increase. Over the decade, the market for footwear has experienced lucrative growth and is expected to continue at the same pace in near future.

Footwear Market Segmentation

The worldwide market for footwear is split based on type, material, mode of sale, end-user, and geography.

Footwear Types

- Athletic Footwear

- Non-Athletic Footwear

Products in this category include casual shoes, dress shoes, boots, and sandals. Non-athletic footwear is frequently worn for casual purposes, and the market is influenced by factors such as changing fashion trends, comfort, and style. Clarks, Skechers, and Dr. Martens are market leaders in non-athletic footwear.

Athletic footwear, on the other hand, plays an important role in the overall footwear market. The rise of athleisure, rising health consciousness among consumers, and the growing popularity of sports and fitness activities have all contributed to the growth of the athletic footwear segment. Nike, Adidas, and Under Armour have long been market leaders in athletic footwear, with a strong emphasis on innovation and technology to create high-performance footwear.

Footwear Materials

- Leather

- Non-Leather

Leather remained the dominant material in the footwear market in terms of revenue and sales. Leather has been a traditional and popular material for footwear due to its durability, quality, and style. However, there has been a growing trend towards non-leather and sustainable materials in the footwear industry, driven by concerns around animal welfare and the environment.

Non-leather materials such as synthetic leather, recycled plastics, and natural fibers have been gaining popularity in recent years. This trend has been fueled by the rise of sustainable and eco-friendly fashion, as well as advancements in technology that have allowed for the creation of high-quality non-leather materials that can mimic the look and feel of real leather.

Footwear Mode of Sale

- Online Sale

- Retail Sale

As per the footwear market forecast, online footwear sales were rapidly increasing and are expected to continue to rise in the future. The COVID-19 pandemic has hastened the transition to online shopping, and footwear is no exception. Because of the convenience, wider product selection, and competitive pricing that online retailers can provide, consumers are increasingly turning to them to purchase footwear.

Retail sales of footwear, on the other hand, remain an important and sizable segment of the market. Customers can try on and feel products in physical retail stores before making a purchase, and many consumers still prefer the in-store shopping experience. Additionally, some footwear brands and retailers have implemented omnichannel strategies that integrate online and offline sales channels to provide customers with a seamless shopping experience.

Footwear End-User

- Men

- Women

- Children

Men's footwear is a significant end-user segment in the footwear market. While the men's footwear segment has historically been larger in terms of revenue and sales, it has been steadily growing in recent years and is an important part of the market. Factors driving the men's footwear market include rising demand for casual and athletic footwear, the rise of sneaker culture, and the expansion of e-commerce and online retail channels. Furthermore, consumer awareness and concerns about environmental issues have fueled a growing trend towards sustainable and eco-friendly men's footwear.

In addition, women's footwear is expected to grow at a rapid pace in the coming years. When compared to men's and children's footwear, women's footwear has traditionally been a more fashion-driven category, with a wider range of styles, designs, and materials.

Footwear Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Footwear Market Regional Analysis

In terms of geography, the global footwear market can be divided into North America, Latin America, Europe, Asia-Pacific, and Middle East & Africa (MEA). Asia-Pacific dominates the global footwear market and generated the highest revenue in 2022. In Asia-Pacific, China is the largest manufacturer as well as the largest consumer and exporter in the region. Globally, China and India are the largest producers of footwear. Asian countries mostly export their products to the United Kingdom and the United States. China dominates footwear production worldwide. Owing to changing lifestyles among individuals, the non-athletic footwear segment is witnessing increased demand. In China, domestic footwear manufacturer dominates the market. North America is the second largest footwear market owing to the local populace actively contributing to sports and athletic activities. Since North America is a forerunner in many innovations; the region is witnessing rapid development in the design and quality of footwear. Furthermore, the e-commerce business has been demonstrating robust growth in the region, particularly in Canada and the US. This has assisted sellers of footwear to gain a wider reach and healthier visibility in the region.

Footwear Market Players

Some of the top Footwear companies offered in the professional report include Nike Inc., Adidas AG, Bata Limited, Puma SE, New Balance Inc., Deichmann SE, Skechers USA, Inc., New Balance Inc., Asics Corp., and Under Armour, Inc.

Frequently Asked Questions

What was the market size of the global footwear in 2022?

The market size of footwear was USD 394.2 billion in 2022.

What is the CAGR of the global footwear market from 2023 to 2032?

The CAGR of Footwear is 5.7% during the analysis period of 2023 to 2032.

Which are the key players in the footwear market?

The key players operating in the global market are including Nike Inc., Adidas AG, Bata Limited, Puma SE, New Balance Inc., Deichmann SE, Skechers USA, Inc., New Balance Inc., Asics Corp., and Under Armour, Inc.

Which region dominated the global footwear market share?

Asia-Pacific held the dominating position in footwear industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of footwear during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global footwear industry?

The current trends and dynamics in the footwear industry include increasing population and urbanization, growing e-commerce industry, and rising health awareness.

Which type held the maximum share in 2022?

The non-athletic type held the maximum share of the footwear industry.