Food Preparation Appliance Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Food Preparation Appliance Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

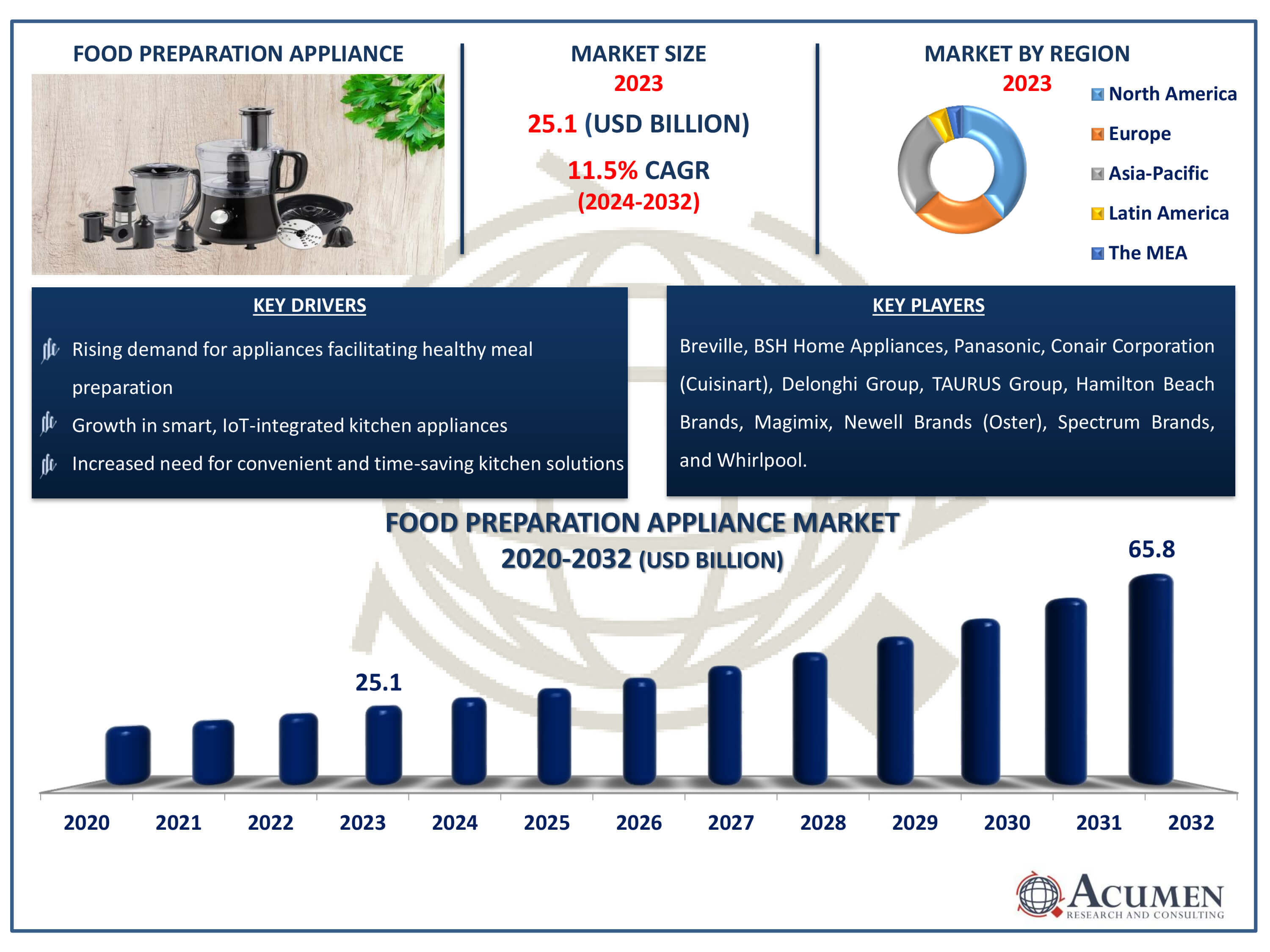

The Food Preparation Appliance Market Size accounted for USD 25.1 Billion in 2023 and is estimated to achieve a market size of USD 65.8 Billion by 2032 growing at a CAGR of 11.5% from 2024 to 2032.

Food Preparation Appliance Market Highlights

- Global food preparation appliance market revenue is poised to garner USD 65.8 billion by 2032 with a CAGR of 11.5% from 2024 to 2032

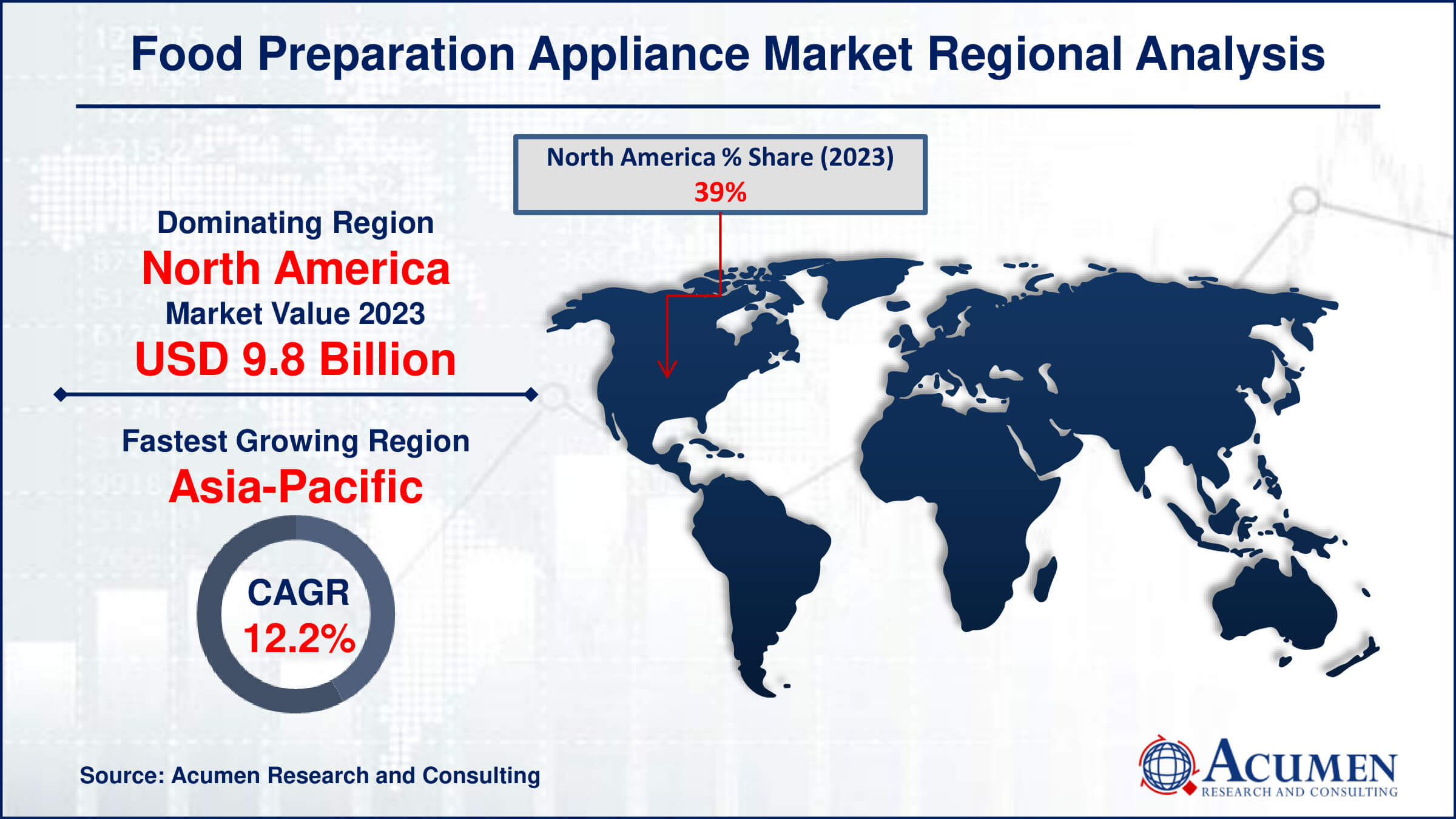

- North America food preparation appliance market value occupied around USD 9.8 billion in 2023

- Asia-Pacific food preparation appliance market growth will record a CAGR of 12.2% from 2024 to 2032

- Among type, the blenders sub-segment gathered significant revenue in 2023

- Based on end-user, the residential sub-segment occupied utmost market share in 2023

- Increased demand for appliances that promote healthy eating and meal prep is a popular food preparation appliance market trend that fuels the industry demand

Food preparation appliances are kitchen devices that help with the various phases of food preparation, making it more efficient, convenient, and fun. These appliances include a variety of instruments such blenders, food processors, mixers, juicers, choppers, and grinders. Each appliance is designed to perform a specific purpose, such as blending smoothies and purees, processing meal ingredients, mixing dough and batters, or extracting juice from fruits and vegetables. These instruments are crucial in both residential and commercial kitchens, meeting the demands of both home cooks and professionals.

These appliances come in a variety of forms, ranging from manual devices to sophisticated electric and smart ones. Electric food preparation machines frequently include various settings and attachments to increase their versatility and functionality, allowing users to accomplish activities like chopping, slicing, shredding, and mixing with ease. Smart appliances equipped with IoT technology provide sophisticated capabilities such as app control, voice help, and automation, resulting in better convenience and precision during food preparation. Overall, food preparation appliances play an important role in modern kitchens since they simplify and speed up the cooking process, provide consistency, and allow for the development of a wide range of foods.

Global Food Preparation Appliance Market Dynamics

Market Drivers

- Rising demand for appliances facilitating healthy meal preparation

- Growth in smart, IoT-integrated kitchen appliances

- Increased need for convenient and time-saving kitchen solutions

- Higher spending on premium kitchen appliances

Market Restraints

- Expensive smart and premium appliances limit adoption

- Environmental impact of energy-intensive appliances

- Preference for manual tools in some regions

Market Opportunities

- Growing demand in Asia-Pacific, Latin America, and Africa

- Customizable and innovative appliances attract diverse consumers

- Demand for energy-efficient and eco-friendly kitchen appliance

Food Preparation Appliance Market Report Coverage

| Market | Food Preparation Appliance Market |

| Food Preparation Appliance Market Size 2022 | USD 25.1 Billion |

| Food Preparation Appliance Market Forecast 2032 | USD 65.8 Billion |

| Food Preparation Appliance Market CAGR During 2023 - 2032 | 11.5% |

| Food Preparation Appliance Market Analysis Period | 2020 - 2032 |

| Food Preparation Appliance Market Base Year |

2022 |

| Food Preparation Appliance Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By End-User, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Breville, BSH Home Appliances, Conair Corporation (Cuisinart), Delonghi Group, Hamilton Beach Brands, Magimix, Newell Brands (Oster), Panasonic, Spectrum Brands (Black+Decker), TAURUS Group, and Whirlpool (KitchenAid). |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Food Preparation Appliance Market Insights

Several main reasons drive the food preparation appliance industry, including changing consumer lifestyles and technical improvements. One of the key causes is the growing emphasis on health and wellness, which has resulted in an increase in demand for appliances that help prepare nutritious meals at home. Blenders, juicers, and food processors are especially popular because they make it easy for people to integrate fruits, vegetables, and other healthful components into their meals. Furthermore, urbanization and increasingly hectic lifestyles have increased the demand for practical, time-saving kitchen solutions. Multi-cookers, electric choppers, and food processors allow users to prepare meals quickly and efficiently, making them ideal for busy lifestyles.

Despite these development factors, the industry confronts various constraints that may limit its progress. The high cost of technologically advanced and luxury appliances can be a significant deterrent for many buyers, particularly in price-sensitive regions. This restricts the adoption of such appliances to higher-income homes, thus delaying the kitchen appliance market growth. Furthermore, concerns about energy usage and the environment are becoming more prevalent. Many electric food preparation equipment require a lot of energy, which raises concerns about their environmental impact. Finally, in some areas, traditional techniques of food preparation remain popular, and cultural or economic constraints can limit the adoption of contemporary appliances.

On the other hand, the kitchen appliance market provides several prospects for expansion and innovation. Rising disposable incomes, urbanization, and changing consumer lifestyles present significant opportunities in emerging markets such as Asia-Pacific, Latin America, and Africa. Companies can tap into these markets to broaden their customer base. Moreover, there is great possibility for product innovation and customisation. Manufacturers can create appliances with advanced functionality, distinctive looks, and tailored options to meet the specific needs and tastes of their customers. Additionally, emphasizing sustainability and eco-friendly products can provide a competitive advantage. Developing energy-efficient appliances and those produced from recyclable materials can address the growing customer demand for environmentally conscious products, helping companies to stand out in the marketplace.

Food Preparation Appliance Market Segmentation

The worldwide market for food preparation appliance is split based on product type, end-user, distribution channel, and geography.

Food Preparation Appliances Market By Product Type

- Blenders

- Food Processors

- Juicers

- Mixers

- Coffee Machines

- Toasters and Grills

- Microwave Ovens

- Cooktops and Ranges

- Slow Cookers and Pressure Cookers

- Others

According to the food preparation appliance industry analysis, the blenders and food processors are frequently listed as the market's major product kinds. These appliances have grown significantly as a result of their versatility and compatibility with health and wellness trends that stress the preparation of smoothies, purees, and nutritious meals. Blenders, in particular, have become indispensable in many families because to their ease in preparing quick and nutritious drinks and meals. Food processors are also highly prized for their capacity to perform a wide range of food preparation activities efficiently.

However, coffee machines have performed well in the market, owing to the growing coffee culture and desire for high-quality, convenient home-brewing solutions. The popularity of specialty coffee drinks, as well as the convenience of pod and espresso machines, help to explain their substantial market dominance.

Food Preparation Appliances Market By End-User

- Residential

- Commercial

The residential segment dominates the food preparation appliance market, owing to strong consumer demand for simple and efficient cooking options in the home. This demand is being driven by a growing interest in healthy food, increased disposable incomes, and the availability of a diverse selection of equipment designed for household usage. Furthermore, technical improvements such as smart and IoT-enabled appliances increase the attraction of these products to tech-savvy consumers. While the commercial segment is substantial, the sheer volume of residential customers and their different needs ensures that the residential market continues to be the key growth driver.

Food Preparation Appliances Market By Distribution Channel

- Online Retail

- Offline Retail

As per our food preparation appliance market forecast, online retail has emerged as the primary distribution route. This trend is fueled by the convenience it provides for consumers, who can browse a wide choice of products, compare prices, and make purchases from the comfort of their own homes. Online shops also allow customers to read reviews and recommendations, which improves their buying experience and trust in their purchases. Furthermore, advances in digital technology and logistics have spurred e-commerce growth, allowing consumers to get their purchases more swiftly and effectively. While physical retail continues to play an important role, particularly in terms of hands-on experiences and rapid availability, internet retail's accessibility and convenience have propelled it to the forefront of kitchen appliance purchases.

Food Preparation Appliance Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Food Preparation Appliance Market Regional Analysis

The food preparation appliance market showcases varying regional dynamics shaped by consumer preferences, economic factors, and cultural influences. In North America and Europe, a high adoption rate of advanced appliances is driven by affluent lifestyles, convenience emphasis, and health-conscious behaviors. Products like blenders, food processors, and high-end coffee machines are popular due to their convenience and performance features. Technological advancements and a mature retail infrastructure also contribute to market growth in these regions.

In contrast, the Asia-Pacific region, comprising China, Japan, and India, represents a rapidly growing market fueled by urbanization, rising disposable incomes, and changing dietary habits. A growing demand exists for both traditional and modern appliances catering to diverse culinary preferences. The kitchen appliance market sees opportunities for growth driven by the expanding middle-class population, increasing consumer awareness about health and wellness, and the adoption of smart home technologies. The presence of large domestic manufacturers alongside international brands enhances product availability and competitive dynamics in this dynamic market segment.

Food Preparation Appliance Market Players

Some of the top food preparation appliance companies offered in our report includes Breville, BSH Home Appliances, Conair Corporation (Cuisinart), Delonghi Group, Hamilton Beach Brands, Magimix, Newell Brands (Oster), Panasonic, Spectrum Brands (Black+Decker), TAURUS Group, and Whirlpool (KitchenAid).

Frequently Asked Questions

How big is the food preparation appliance market?

The food preparation appliance market size was valued at USD 25.1 billion in 2023.

What is the CAGR of the global food preparation appliance market from 2024 to 2032?

The CAGR of food preparation appliance industry is 11.5% during the analysis period of 2024 to 2032.

Which are the key players in the food preparation appliance market?

The key players operating in the global market are including Breville, BSH Home Appliances, Conair Corporation (Cuisinart), Delonghi Group, Hamilton Beach Brands, Magimix, Newell Brands (Oster), Panasonic, Spectrum Brands (Black+Decker), TAURUS Group, and Whirlpool (KitchenAid).

Which region dominated the global food preparation appliance market share?

North America held the dominating position in food preparation appliance industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of food preparation appliance during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global food preparation appliance industry?

The current trends and dynamics in the food preparation appliance industries include rising demand for appliances facilitating healthy meal preparation, growth in smart, IoT-integrated kitchen appliances, and increased need for convenient and time-saving kitchen solutions.

Which end-user held the maximum share in 2023?

The residential held the maximum share of the food preparation appliance industry.