Food Coating Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Food Coating Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

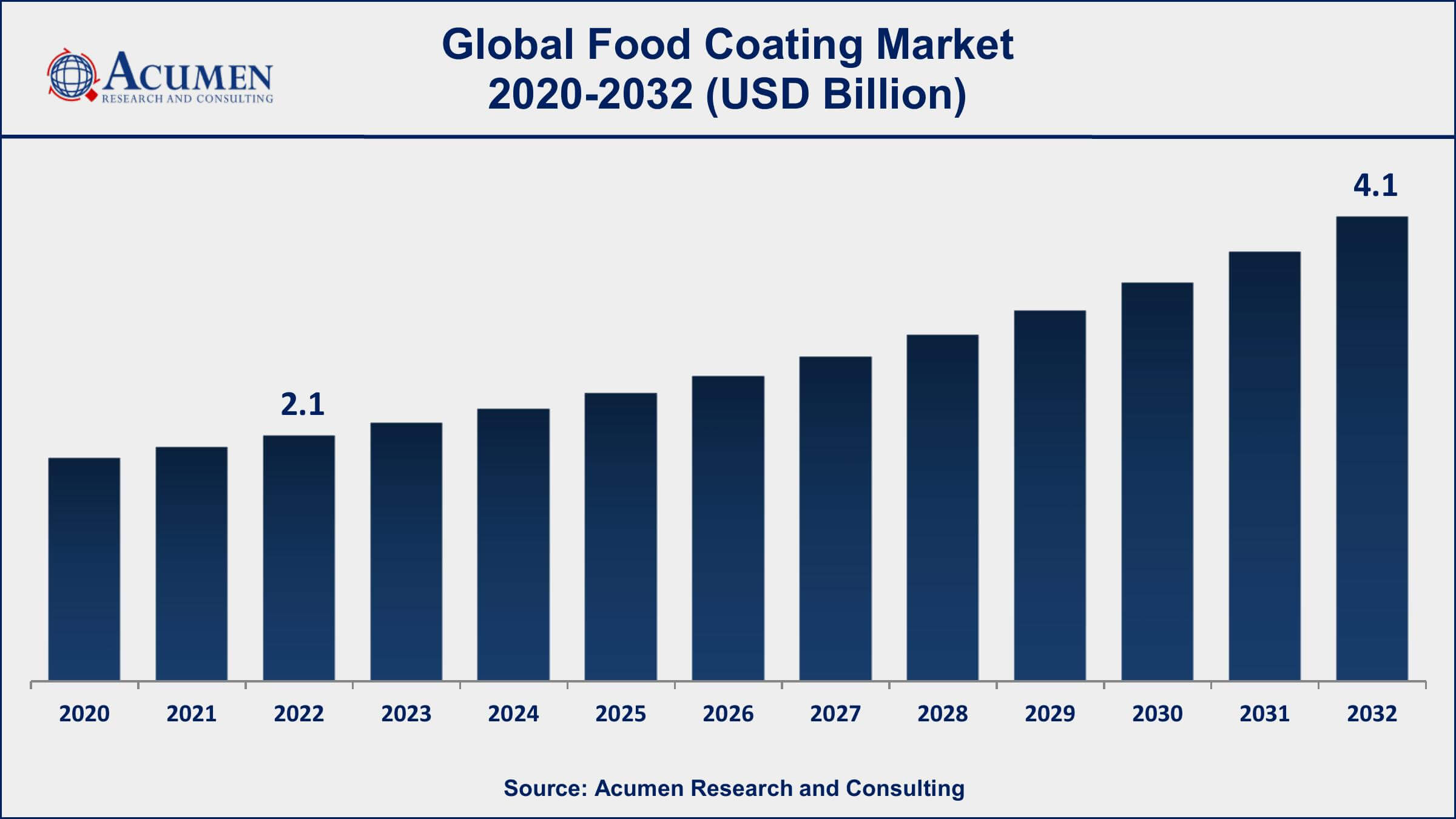

The Global Food Coating Market Size accounted for USD 2.1 Billion in 2022 and is projected to achieve a market size of USD 4.1 Billion by 2032 growing at a CAGR of 6.7% from 2023 to 2032.

Food Coating Market Highlights

- Global food coating market revenue is expected to increase by USD 4.1 Billion by 2032, with a 6.7% CAGR from 2023 to 2032

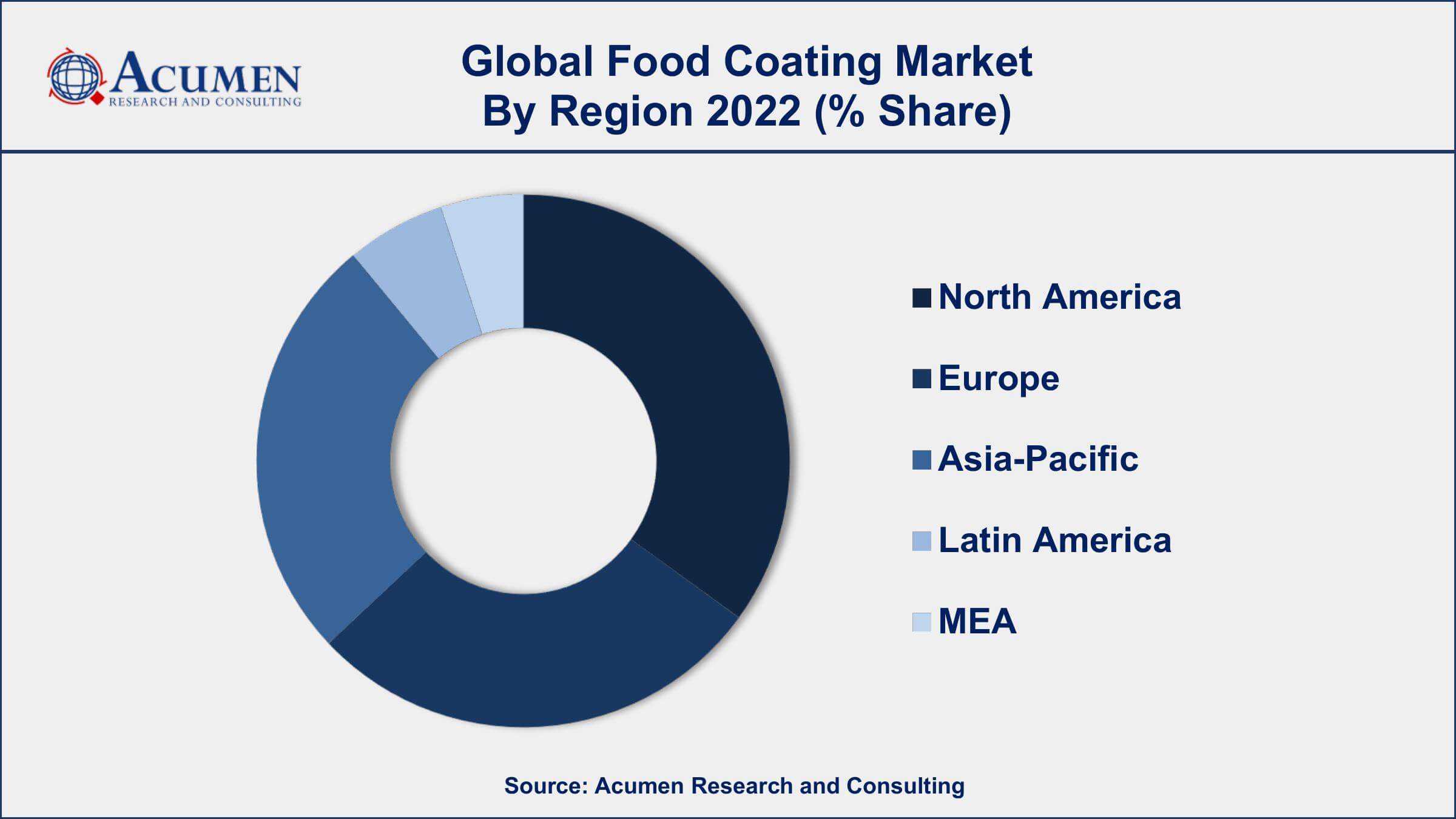

- North America region led with more than 38% of food coating market share in 2022

- Asia-Pacific food coating market growth will record a CAGR of around 8% from 2023 to 2032

- By ingredient forms, the liquid coating segment held the largest market share in 2022, accounting for over 62% of the total revenue

- By application, the meat, poultry, and seafood segment are predicted to grow at the fastest CAGR between 2023 and 2032

- Increasing demand for processed and convenience foods, drives the food coating market value

Food coating refers to the process of applying a layer of ingredients to the surface of food products to improve their texture, taste, appearance, and shelf-life. The coating can be either dry or wet and can be applied to various types of food products, including meat, poultry, seafood, vegetables, fruits, and bakery products. Food coating ingredients can include flours, starches, sugars, proteins, hydrocolloids, and fats.

The food coating market has been growing steadily in recent years due to increasing demand for processed foods, convenience foods, and ready-to-eat meals. Food coating is widely used in the food industry to enhance the sensory appeal of food products, extend their shelf-life, and provide a barrier against moisture, oxygen, and other contaminants. The market growth is driven by factors such as increasing consumer preference for processed and convenience foods, technological advancements in food coating equipment, and the development of new food coating ingredients that cater to changing consumer preferences and dietary requirements.

Global Food Coating Market Trends

Market Drivers

- Increasing demand for processed and convenience foods

- Rising consumer awareness regarding food safety and quality

- Technological advancements in food coating equipment

- Growing trend of clean label and natural food ingredients

Market Restraints

- High cost of food coating ingredients and equipment

- Limited availability of raw materials in certain regions

Market Opportunities

- Increasing adoption of plant-based and vegan diets

- Growing demand for gluten-free and allergen-free food products

Food Coating Market Report Coverage

| Market | Food Coating Market |

| Food Coating Market Size 2022 | USD 2.1 Billion |

| Food Coating Market Forecast 2032 | USD 4.1 Billion |

| Food Coating Market CAGR During 2023 - 2032 | 6.7% |

| Food Coating Market Analysis Period | 2020 - 2032 |

| Food Coating Market Base Year | 2022 |

| Food Coating Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Ingredient Type, By Ingredient Form, By Equipment Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Cargill, Incorporated, Archer Daniels Midland Company (ADM), Kerry Group plc, Ingredion Incorporated, DuPont de Nemours, Inc., Ashland Global Holdings Inc., Tate & Lyle PLC, PPG Industries, Inc., The Dow Chemical Company, SensoryEffects, Bowman Ingredients, and Dohler Group. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Food coating is the process of applying a layer of ingredients to the surface of food products. The coating can be dry or wet and is used to improve the texture, taste, appearance, and shelf-life of food products. The coating ingredients can include flours, starches, sugars, proteins, hydrocolloids, and fats. Food coating can be applied to various types of food products, including meat, poultry, seafood, vegetables, fruits, and bakery products. The application of food coating in the food industry is diverse and can serve various purposes. One of the primary applications of food coating is to provide a barrier against moisture, oxygen, and other contaminants, which helps to extend the shelf-life of food products. Food coating can also improve the sensory appeal of food products, making them more visually appealing, crunchy, or crispy. For example, coating chicken with bread crumbs or batter before frying enhances its texture and flavor. In addition, food coating can also provide a protective layer to prevent the loss of moisture or flavor during cooking, thus improving the quality and taste of the final product.

The food coating market has been experiencing significant growth in recent years due to the increasing demand for processed and convenience foods. The market is driven by various factors such as the need to improve the sensory appeal of food products, increase their shelf-life, and provide a barrier against moisture, oxygen, and other contaminants. The food coating caters to various industries such as bakery, confectionery, meat, poultry, seafood, and snacks. The market growth is driven by various factors such as increasing consumer preference for processed and convenience foods, the development of new food coating ingredients, and technological advancements in food coating equipment.

Food Coating Market Segmentation

The global food coating market segmentation is based on ingredient type, ingredient form, equipment type, application, and geography.

Food Coating Market By Ingredient Type

- Cocoa and Chocolate

- Breaders

- Fats and Oils

- Sugars and Syrups

- Flours

- Salts, Spices, and Seasonings

- Batter

- Others

According to the food coating industry analysis, the sugars and syrups segment accounted for the largest market share in 2022. This growth is driven by various factors such as the increasing demand for processed and convenience foods, the development of new sugar and syrup-based coatings, and the growing trend towards clean label and natural food ingredients. The segment includes various types of sugars and syrups such as glucose syrup, maltodextrin, high-fructose corn syrup, and honey. Sugars and syrups are widely used as coating agents in the food industry, primarily due to their functional properties, such as moisture retention, texture improvement, and caramelization.

Food Coating Market By Ingredient Form

- Dry

- Liquid

In terms of ingredient forms, the liquid segment is expected to witness significant growth in the coming years. This growth is driven by various factors such as the increasing demand for processed and convenience foods, the development of new liquid coating ingredients, and the growing trend towards clean label and natural food ingredients. The segment includes various liquid coating agents such as oils, fats, egg wash, and dairy-based coatings. These liquid coatings are widely used in the food industry due to their functional properties, such as flavor enhancement, texture improvement, and moisture retention. Furthermore, the rising popularity of plant-based and vegan diets is creating new opportunities for the liquid segment.

Food Coating Market By Equipment Type

- Coaters and Applicators

- Breader Applicators

- Seasoning Applicators

- Batter Applicators

- Flour Applicators

- Other Coaters and Applicators

- Enrobers

According to the food coating market forecast, the coaters and applicators segment is expected to witness significant growth in the coming years. This growth is driven by various factors such as the increasing demand for processed and convenience foods, the development of new coating equipment, and the growing trend towards automation in the food industry. The segment includes various equipment such as tumbling and spray coating systems, enrobing machines, and batter and breading applicators. These equipment are widely used in the food industry for coating various food products such as snacks, confectionery, meat, poultry, and seafood. Furthermore, the expansion of the food industry in emerging economies such as China, India, and Brazil is expected to create new opportunities for the coaters and applicators segment.

Food Coating Market By Application

- Meat and Seafood Products

- Bakery Cereals

- Bakery Products

- Confectionery Products

- Snacks

Based on the application, the meat and seafood products segment is expected to continue its growth trajectory in the coming years. This growth is driven by various factors such as the increasing demand for meat and seafood products, the development of new coating ingredients, and the growing trend towards convenience and processed foods. Meat and seafood products are widely coated with various ingredients such as flours, batters, bread crumbs, and spices to enhance their texture, flavor, and appearance. The segment includes various types of meat and seafood products such as chicken, fish, shrimp, and pork. Moreover, the meat and seafood products segment is witnessing a growing trend towards healthier coating options.

Food Coating Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Food Coating Market Regional Analysis

North America is currently dominating the food coating market, accounting for a significant share of the global market. There are several factors contributing to this dominance, including the increasing demand for convenience foods, the presence of established food processing companies, and the growing trend towards healthy and natural food ingredients. One of the major drivers of the food coating market in North America is the demand for convenience foods. Consumers in North America are increasingly looking for food products that are easy and quick to prepare, and coated foods such as frozen chicken nuggets, French fries, and onion rings fit this requirement perfectly. Additionally, the growing trend towards snacking and the popularity of fast food restaurants are driving the demand for coated snacks and fast food items. Another factor contributing to the dominance of North America in the food coating market is the presence of established food processing companies.

Food Coating Market Player

Some of the top food coating market companies offered in the professional report include Cargill, Incorporated, Archer Daniels Midland Company (ADM), Kerry Group plc, Ingredion Incorporated, DuPont de Nemours, Inc., Ashland Global Holdings Inc., Tate & Lyle PLC, PPG Industries, Inc., The Dow Chemical Company, Sensory Effects, Bowman Ingredients, and Dohler Group.

Frequently Asked Questions

What was the market size of the global food coating in 2022?

The market size of food coating was USD 2.1 Billion in 2022.

What is the CAGR of the global food coating market from 2023 to 2032?

The CAGR of food coating is 6.7% during the analysis period of 2023 to 2032.

Which are the key players in the food coating market?

The key players operating in the global market are including Cargill, Incorporated, Archer Daniels Midland Company (ADM), Kerry Group plc, Ingredion Incorporated, DuPont de Nemours, Inc., Ashland Global Holdings Inc., Tate & Lyle PLC, PPG Industries, Inc., The Dow Chemical Company, Sensory Effects, Bowman Ingredients, and Dohler Group.

Which region dominated the global food coating market share?

North America held the dominating position in food coating industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of food coating during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global food coating industry?

The current trends and dynamics in the food coating industry include increasing demand for processed and convenience foods, and rising consumer awareness regarding food safety and quality.

Which ingredient form held the maximum share in 2022?

The liquid ingredient form held the maximum share of the food coating industry.