Fluoroscopy Equipment Market | Acumen Research and Consulting

Fluoroscopy Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

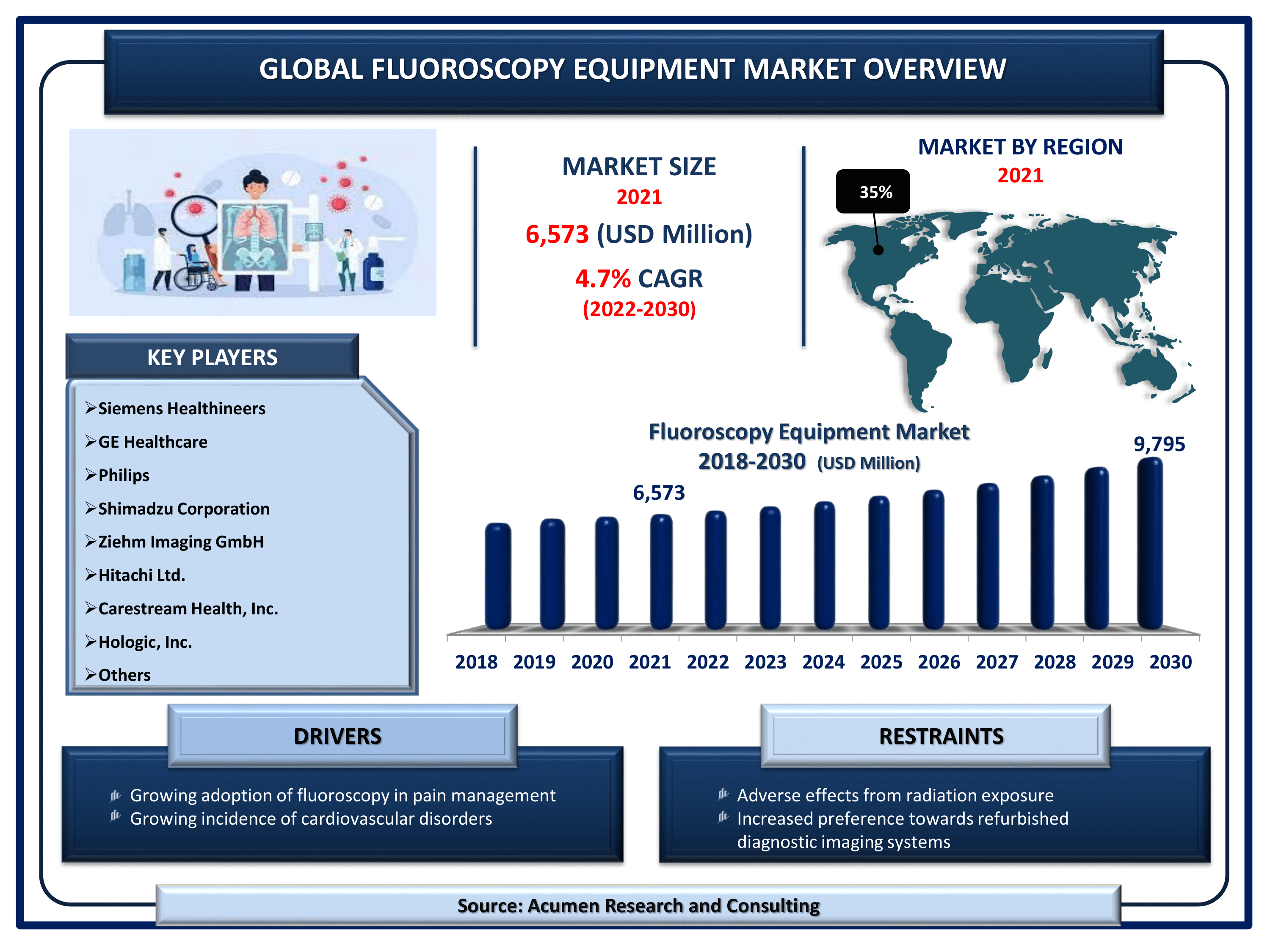

The Global Fluoroscopy Equipment Market Size accounted for USD 6,573 Million in 2021 and is estimated to garner a market size of USD 9,795 Million by 2030 rising at a CAGR of 4.7% from 2022 to 2030. Growing preference for these imagine systems in various medical procedures drive the global fluoroscopy equipment market growth. In addition to that, surging prevalence of gastrointestinal diseases is another factor that is boosting the fluoroscopy equipment market value. Growing adoption of data integrated imaging systems is a prominent fluoroscopy equipment market trends that is flourishing the industry growth.

Fluoroscopy Equipment Market Report Key Highlights

- Global fluoroscopy equipment market revenue is estimated to reach USD 9,795 Million by 2030 with a CAGR of 4.7% from 2022 to 2030

- North America fluoroscopy equipment market generated over 35% regional shares in 2021

- According to the CDC, 30.3 million Americans were diagnosed with heart disease as of 2018

- Asia-Pacific fluoroscopy equipment market will rise with a substantial CAGR from 2022 to 2030

- Based on application segment, cardiovascular evaluated more than 30% of the total market share in 2021

- Growing incidences of cardiovascular disorders in the world fuels the fluoroscopy devices market growth in coming years

Fluoroscopy equipment is a type of medical imaging system that has a visual effect on a monitor similar to an X-ray. During a fluoroscopy procedure, an x-ray beam is passed through a body. The image is transmitted to a monitor so that movement of a body part or an instrument or contrast agent (x-ray die) passing through the body can be traced. Fluoroscopy equipment guides physicians during certain treatment procedures that ultimately drive the fluoroscopy equipment market globally. Modern fluoroscopic equipment is packed with a fluorescent screen and is attached to an electronic device that amplifies and transforms the glowing light into a video signal that is best suited for presentation as an electronic display. The benefit associated with the modern system is that the fluoroscopist doesn’t need to stand close to the fluorescent screen in order to observe live images resulting in a reduction of radiation dose for the fluoroscopist. Also, patients receive less radiation dose owing to amplification due to the overall potential of an imaging system. This factor further raises the demand for the adoption of the modern system resulting in the growth of the fluoroscopy equipment market globally.

Global Fluoroscopy Equipment Market Dynamics

Market Drivers

- Growing adoption of fluoroscopy in pain management

- Growing incidence of cardiovascular disorders

- Advantages of FPDs over image intensifiers

- Robust demand for resting ECG procedures

Market Restraints

- Adverse effects from radiation exposure

- Increased preference towards refurbished diagnostic imaging systems

Market Opportunities

- Growing demand for data-integrated imaging systems

- Increasing need for non-radiation imaging modalities

Fluoroscopy Equipment Market Report Coverage

| Market | Fluoroscopy Equipment Market |

| Fluoroscopy Equipment Market Size 2021 | USD 6,573 Million |

| Fluoroscopy Equipment Market Forecast 2030 | USD 9,795 Million |

| Fluoroscopy Equipment Market CAGR During 2022 - 2030 | 4.7% |

| Fluoroscopy Equipment Market Analysis Period | 2018 - 2030 |

| Fluoroscopy Equipment Market Base Year | 2021 |

| Fluoroscopy Equipment Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Siemens Healthineers, GE Healthcare, Philips, Shimadzu Corporation, Ziehm Imaging GmbH, Toshiba Medical Systems Corporation, Hitachi Ltd., Carestream Health, Inc., Hologic, Inc., Lepu Medical Technology Co., Ltd., Agfa-Gevaert Group, ADANI Systems Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Fluoroscopy Equipment Market Insights

Hybrid or imaging solutions for critically ill patients

Companies developing hybrid or imaging system design in a particular fashion with a smaller footprint for routine cardiovascular procedures, solving complex cases, and multidisciplinary. The C-arms with procedural intelligence support the unique needs of surgeons through workflow automation and optimized image acquisition. The modality design consists of antimicrobial surfaces and uninterrupted laminar flow that helps ensure maximum infection control within the patients tested on the same machine.

Pre-operative 3D data for better analysis by the physicians

Integration of software acts as a lock and key model in the medical devices segment and assists in surgical interventions. The algorithms installed in the software will automatically visualize the target along with relevant anatomical traces that best support precise intra-operative surgery. In cases of Endovascular repair (EVAR) procedures, processing pre-operative datasets take just a minute while manual preparation typically requires fifteen minutes.

Standardized image quality by ALARA dose

Selection of image quality Communication and Networking Riser (CNR) level for the anatomy, devices, and materials that need to be visualized. Incorporating self-adjusting algorithms best supported by OPTIQ software will select the right imaging parameters keeping the radiation exposure to a minimum for the patient and physician's team. By incorporating ALARA it is predicted that 50% less dose is required as compared to other devices that require high visibility with high dose administration.

Minimal invasive treatment

Time-consuming manual workforce, unwanted variations in procedural outcomes, and staff training requirements are key barriers in surgeries. Through introducing hybrid image guiding procedures coupled with C-arms overcome all the obstacles. A unique mix of imaging and workflow software ensures simplicity in surgical workflow and standardized treatment across the patient’s severe extremities. The latest C-arm technology in fluoroscopy equipment is a combination of intelligent optimization of image quality and dose assist by automated C-arm positioning. ARTIS-pheno is the only robotic C-arm system available in the global market. Multidisciplinary capabilities enhance minimal invasive treatment across the specialties.

Fluoroscopy Equipment Market Segmentation

The worldwide fluoroscopy equipment market is split based on product, application, end-user, and geography.

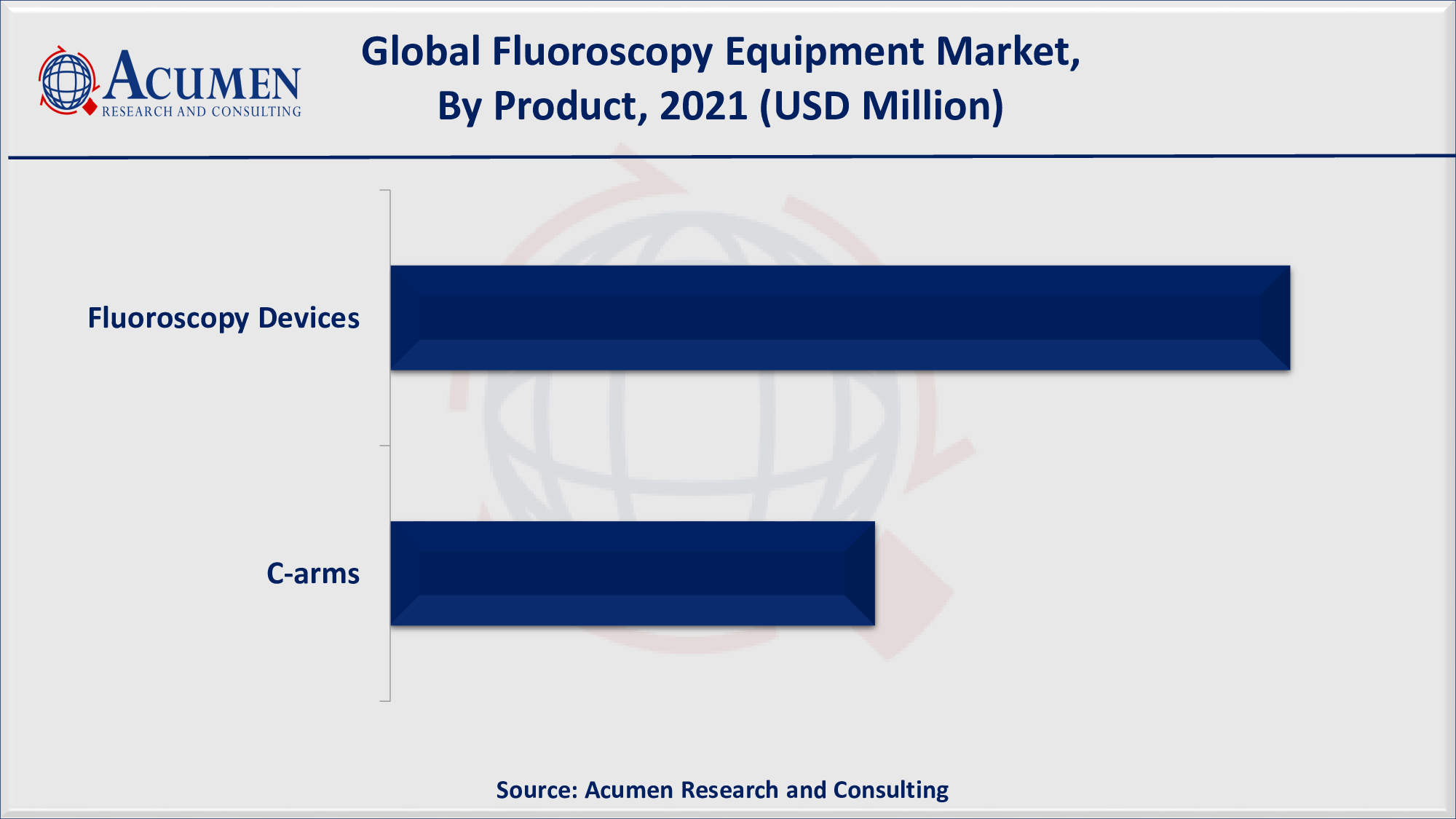

Fluoroscopy Equipment Market By Product

- Fluoroscopy Devices

- C-arms

- Mini C-arms

- Full-size C-arms

According to our fluoroscopy equipment industry analysis, fluoroscopy devices generated significant market revenue in 2021. However, c-arms products will contribute to the fullest in the forthcoming years. This can be achieved due to standardized imaging workflows and minimally invasive treatment coupled with hybrid technology. These are the prominent factors that contribute fullest stupendous growth of the global fluoroscopy market globally. C-arms are divided into fixed C-arms and mobile C-arms. The mobile C-arms will grow at the highest rate in the coming years as it possesses high-quality features in handling complex surgeries. The rising prevalence of cardiovascular diseases and orthopedic surgeries are the major factors that will boost the adoption of mobile C-arms. C-arms are utilized in a wide range of complicated surgeries including cardiovascular diseases, neuro surgeries, gastroenterology, traumatology, and urology disorders.

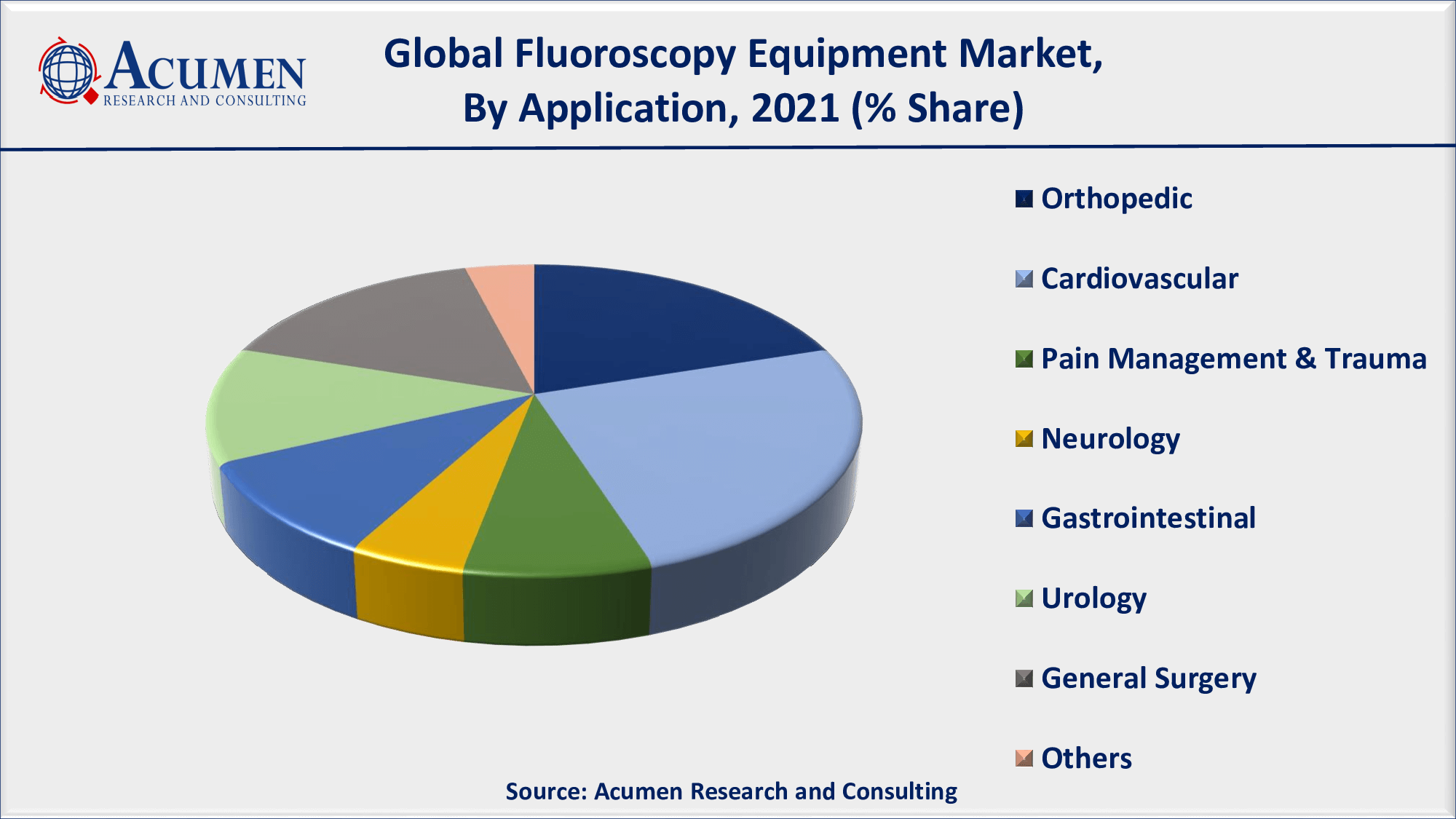

Fluoroscopy Equipment Market By Application

- Orthopedic

- Cardiovascular

- Pain Management & Trauma

- Neurology

- Gastrointestinal

- Urology

- General Surgery

- Others

By application segment, cardiology dominates the global fluoroscopy equipment market worldwide. Based on the diagnostic application, cardiology is the largest diagnostic application segment of the fluoroscopy equipment market. The largest share is accounted for owing to the high burden of cardiovascular disorders (CVDs) worldwide and the benefits associated with the integration of fluoroscopy systems during the diagnosis and treatment of complicated cardiac disorders.

Fluoroscopy Equipment Market By End-User

- Hospitals

- Diagnostic Centers

- Specialty Clinics

The hospitals sub-segment earned the highest revenue in 2021 and will continue to do so in the future years, according to our fluoroscopy equipment market forecast. FPDs provide no image distortion, increased sensitivity, and improved patient coverage. Many hospitals are now using FPD fluoroscopes due to its benefits. The growing inclination for advanced technology, as well as the requirement to transition to newer, more efficient goods, will be significant drivers of growth in this market segment.

Fluoroscopy Equipment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

North America dominated the fluoroscopy equipment Market with utmost shares

North America dominates the overall regional market of fluoroscopy equipment. In the past, North America recorded the largest market share for the fluoroscopy equipment market globally. Rising incidences of unintentional sports injuries, a surge in CVD, and an increasing number of surgeries performed related to hip and knee replacement drive the growth of the regional market of North America and will continue to dominate till the forecast period. According to the Johns Hopkins University, The Johns Hopkins Hospital, and Johns Hopkins Health System, in the US about 30 million children and teens participate in some form of organized sports and more than 3.5 million injuries are reported annually. Almost one-third of all the injuries recorded that are observed in childhood are sports-related injuries.

Asia-Pacific is anticipated to witness fast growth in the fluoroscopy equipment market in the coming years. As India witnessing strong economic growth, the growing prevalence of chronic and lifestyle disorders, and improvements in healthcare infrastructure have uplifted the demand for fluoroscopy equipment at end-use hospitals. Rising demand will offer lucrative market opportunities resulting in the overall growth of the APAC market. In addition, high government involvement, revised healthcare reforms & policies further contribute to the stupendous growth of the regional market.

Fluoroscopy Equipment Market Players

The fluoroscopy equipment companies profiled in the report include GE Healthcare, Philips, Shimadzu Corporation, Ziehm Imaging GmbH, Toshiba Medical Systems Corporation, Hitachi Ltd., Carestream Health, Inc., Hologic, Inc., Lepu Medical Technology Co., Ltd., Agfa-Gevaert Group, ADANI Systems Inc. and among others.

Frequently Asked Questions

What is the size of global fluoroscopy equipment market in 2021?

The market size of fluoroscopy equipment market in 2021 was accounted to be USD 6,573 Million.

What is the CAGR of global fluoroscopy equipment market during forecast period of 2022 to 2030?

The projected CAGR of fluoroscopy equipment market during the analysis period of 2022 to 2030 is 4.7%.

Which are the key players operating in the market?

The prominent players of the global fluoroscopy equipment market are GE Healthcare, Philips, Shimadzu Corporation, Ziehm Imaging GmbH, Toshiba Medical Systems Corporation, Hitachi Ltd., Carestream Health, Inc., Hologic, Inc., Lepu Medical Technology Co., Ltd., Agfa-Gevaert Group, ADANI Systems Inc.

Which region held the dominating position in the global fluoroscopy equipment market?

North America held the dominating fluoroscopy equipment during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for fluoroscopy equipment during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global fluoroscopy equipment market?

Growing adoption of fluoroscopy in pain management, growing incidence of cardiovascular disorders, and advantages of FPDs over image intensifiers drives the growth of global fluoroscopy equipment market.

Which product held the maximum share in 2021?

Based on product, fluoroscopy devices segment is expected to hold the maximum share fluoroscopy equipment market.