Fluorochemicals Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Fluorochemicals Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

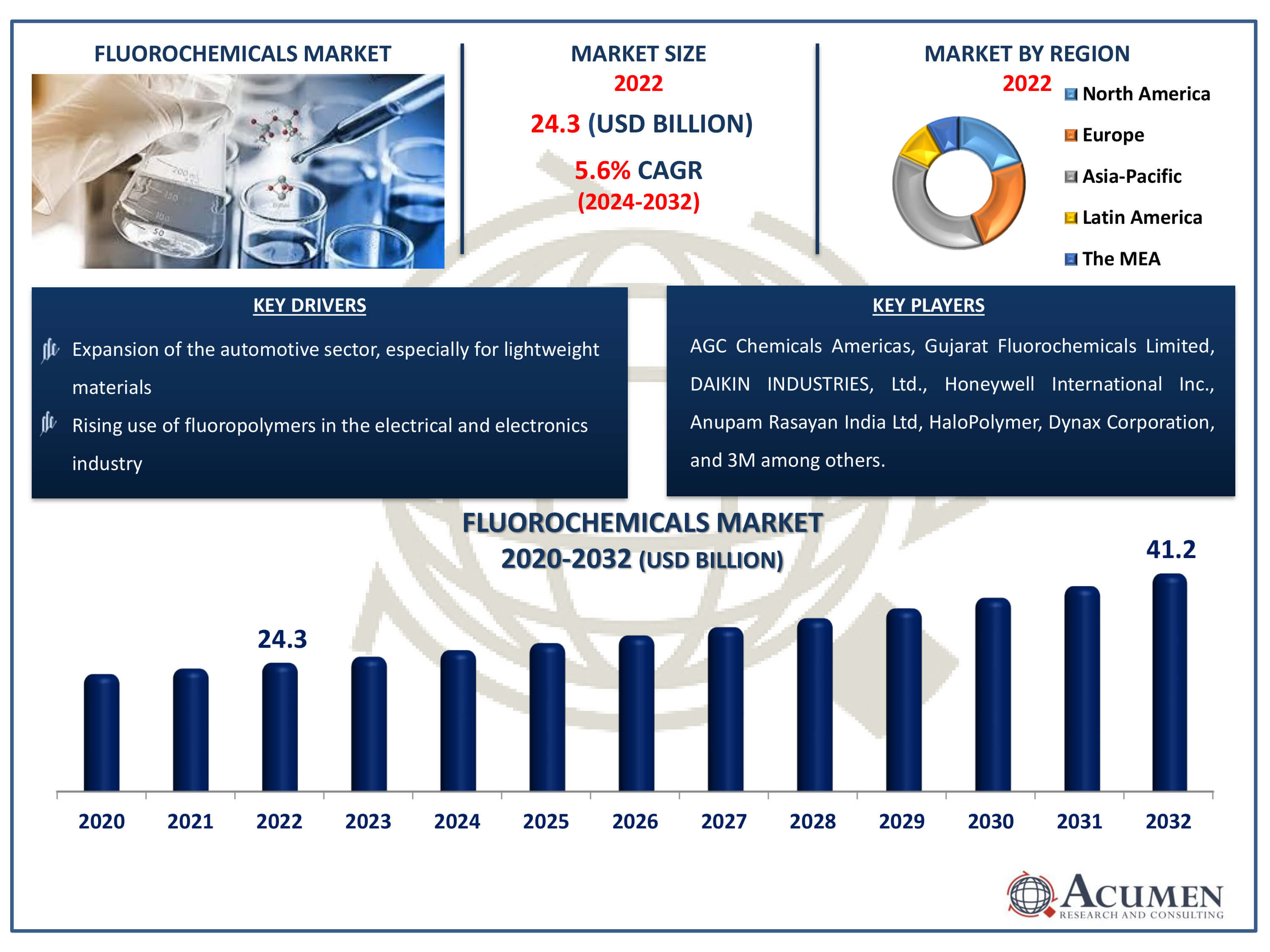

The Fluorochemicals Market Size accounted for USD 24.3 Billion in 2022 and is estimated to achieve a market size of USD 41.2 Billion by 2032 growing at a CAGR of 5.6% from 2024 to 2032.

Fluorochemicals Market Highlights

- Global fluorochemicals market revenue is poised to garner USD 41.2 billion by 2032 with a CAGR of 5.6% from 2024 to 2032

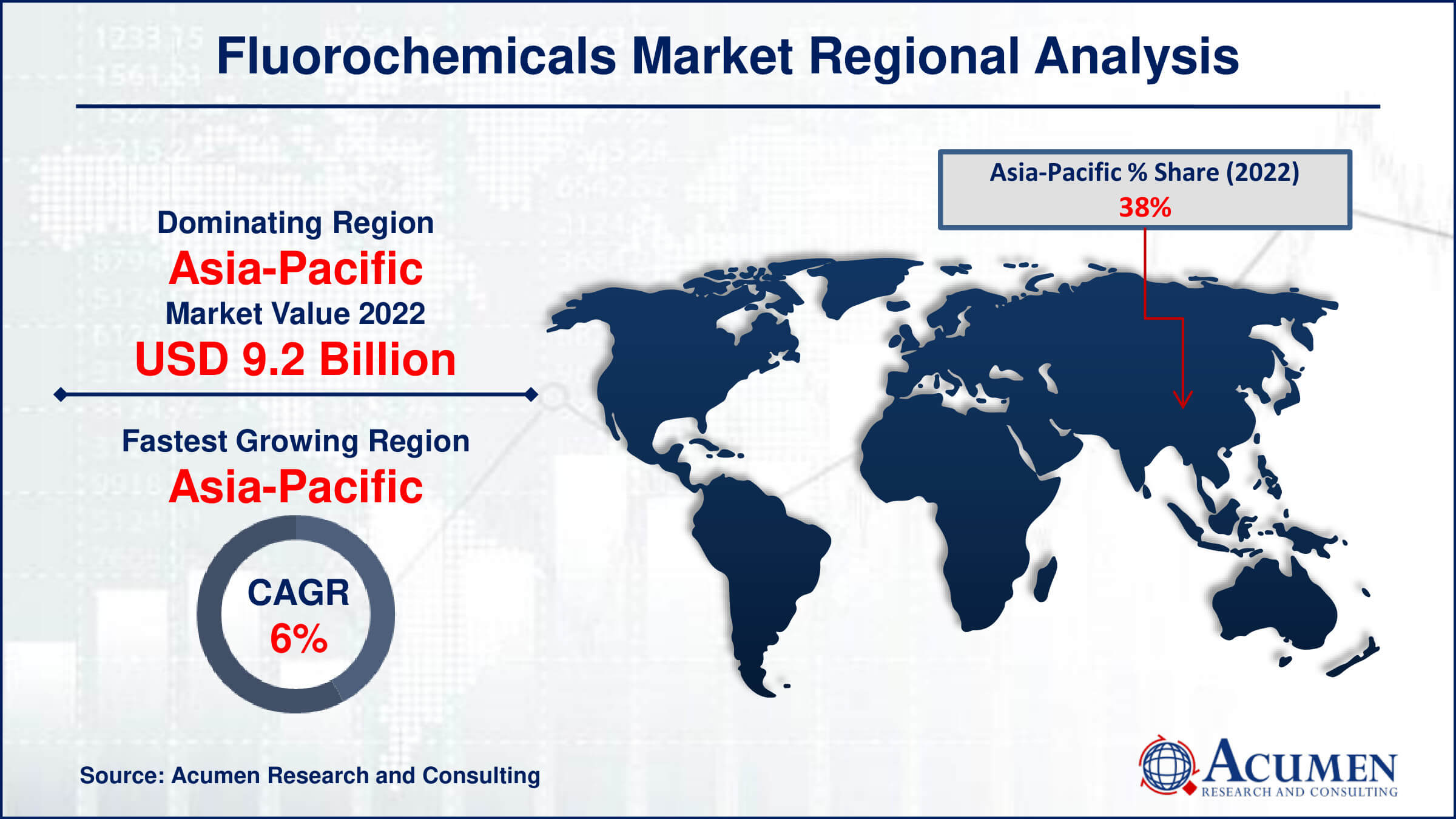

- Asia-Pacific fluorochemicals market value occupied around USD 9.2 billion in 2022

- Asia-Pacific fluorochemicals market growth will record a CAGR of more than 6% from 2024 to 2032

- Among type, the fluorocarbons sub-segment generated more than USD 8.7 billion revenue in 2022

- Based on application, the refrigerant sub-segment generated around 31% market share in 2022

- Technological advancements in production processes to improve efficiency and reduce costs is a popular fluorochemicals market trend that fuels the industry demand

Fluorochemicals are a class of chemical compounds that include fluorine as an organic ingredient. They are generally made up of hydrocarbons having at least one atom of hydrogen replaced with fluorine. These unusual compounds have a number of useful qualities, including strong thermal stability, chemical resistance, and low reactivity, making them vital in a variety of sectors. Fluorochemicals, because of their inertness and biocompatibility, play an important role in the development of pharmaceuticals and medical devices in the pharmaceutical and medical industries. They are utilized in the agrochemical sector to create crop protection solutions that are more effective and long-lasting. The heating, ventilation, air conditioning, and refrigeration (HVACR) business benefits from the usage of fluorochemicals in refrigerants, which helps to create energy-efficient systems. Fluorochemicals are used in automotive lubricants, coolants, and other specialized materials, which improve vehicle performance and durability.

Global Fluorochemicals Market Dynamics

Market Drivers

- Growing demand for refrigerants in air conditioning and refrigeration industries

- Expansion of the automotive sector, especially for lightweight materials

- Rising use of fluoropolymers in the electrical and electronics industry

- Increasing industrialization and urbanization in emerging markets

Market Restraints

- Environmental concerns and regulatory restrictions on certain fluorocarbons

- Availability of alternatives such as natural refrigerants

- High manufacturing costs of certain fluorochemicals

Market Opportunities

- Development of environmentally friendly fluorochemical alternatives, such as hydrofluoroolefins (HFOs)

- Growing demand for advanced materials in renewable energy applications

- Expansion in untapped markets, particularly in Asia-Pacific and Latin America

Fluorochemicals Market Report Coverage

| Market | Fluorochemicals Market |

| Fluorochemicals Market Size 2022 | USD 24.3 Billion |

| Fluorochemicals Market Forecast 2032 |

USD 41.2 Billion |

| Fluorochemicals Market CAGR During 2024 - 2032 | 5.6% |

| Fluorochemicals Market Analysis Period | 2020 - 2032 |

| Fluorochemicals Market Base Year |

2022 |

| Fluorochemicals Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Type, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AGC Chemicals Americas, Gujarat Fluorochemicals Limited, DAIKIN INDUSTRIES, Ltd., Honeywell International Inc., Anupam Rasayan India Ltd (Tanfac Industries Ltd.), HaloPolymer, Dynax Corporation, 3M, Dongyue Group, Derivados del Flúor, S.A.U. (MINERSA GROUP), DIC CORPORATION, and Arkema. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Fluorochemicals Market Insights

Factors such as the drop in prices in the automotive and commercial refrigeration industries are expected to drive considerable growth in the fluorochemicals market. In developing countries such as China, Brazil, and India, the commercial refrigeration market witnessed remarkable growth due to the rise in disposable income. However, the market growth for fluorochemicals can be hindered by the increase in stringent environmental regulations regarding fluorocarbons. For instance, a major factor hampering market growth is environmental concerns associated with hydrofluorocarbons. Despite these challenges, the increase in aluminum production is projected to deliver lucrative growth opportunities in Asia-Pacific during the fluorochemicals industry forecast period. The rise in demand for aluminum, primarily due to its growing use in the automotive and construction sectors, is projected to lead to an increase in hydrofluoride production.

The electrical and electronics segment is expected to experience rapid growth in terms of CAGR. Compounds extracted from mined fluorite are used to produce fluorochemicals, which are commonly employed in the manufacture of fluoropolymers, fluorocarbons, and fluorosurfactants for various applications, including refrigerants, aluminum, and blowing agents. The ongoing demand for smartphones is likely to continue driving consumer electronics production, with a typical replacement cycle of around two years. The mobile phone market also influences new technologies and subsequent developments in consumer electronics. The increasing prevalence of IoT, connected appliances, and professional electronics can be attributed to the mobility provided by smartphones. Significant advancements and the availability of cutting-edge technologies such as fingerprint scanners and high-resolution displays offer numerous growth opportunities for the consumer electronics industry as a whole.

Fluorochemicals Market Segmentation

The worldwide market for fluorochemicals is split based on type, application end-use, and geography.

Fluorochemicals Types

- Fluorocarbons

- Fluoroelastomers

- Fluoropolymers

- Inorganics

- Others

According to fluorochemicals industry analysis, the fluorocarbons segment leads the market, accounting for the majority of the share due to its flexible uses and widespread use across multiple sectors. Fluorocarbons, which comprise hydrofluorocarbons (HFCs) and hydrochlorofluorocarbons (HCFCs), are well-known for their high chemical stability, lack of reactivity, and distinctive qualities such as low boiling temperatures and nonflammability. These properties make fluorocarbons indispensable in applications such as refrigeration, air conditioning, aerosol propellants, and solvents.

Despite worries about their environmental effect, notably ozone depletion and global warming potential, fluorocarbons remain in high demand due to their exceptional performance features. Furthermore, the industry is shifting towards more ecologically friendly alternatives, such as hydrofluoroolefins (HFOs), which retain the benefits of classic fluorocarbons while reducing environmental effect. This development of the fluorocarbons industry assures long-term expansion and adaptability in response to regulatory changes and environmental considerations.

Fluorochemicals Applications

- Surfactants

- Propellants

- Aluminum Production

- Refrigerant

- Automobile

- Agrochemicals

- Others

The refrigerant is the largest segment in the fluorochemicals industry because of its vital role in refrigeration and air conditioning systems. Fluorinated refrigerants, such as hydrofluorocarbons (HFCs) and hydrochlorofluorocarbons (HCFCs), are commonly utilised in home and commercial cooling systems due to their outstanding thermodynamic qualities, which include low boiling points and great energy efficiency. Fluorochemical refrigerants continue to be in high demand due to population expansion, urbanisation, and rising temperatures caused by climate change. Furthermore, strict laws aimed at eliminating ozone-depleting compounds such as chlorofluorocarbons (CFCs) have hastened the use of fluorinated refrigerants. Moreover, continuous technical improvements in refrigeration systems, such as the development of more energy-efficient and ecologically friendly alternatives like hydrofluoroolefins (HFOs), contribute to the refrigerant segment's continued expansion in the fluorochemicals market.

Fluorochemicals End-Uses

- Electrical & Electronics

- Petrochemicals

- Chemicals

- Aerospace

- Others

The electrical and electronics sector dominates the fluorochemicals market due to the widespread use of fluorinated materials in electrical and electronic equipment. Fluoropolymers, including polytetrafluoroethylene (PTFE) and fluorinated ethylene propylene (FEP), are appreciated for their superior electrical insulation, chemical resistance, and high-temperature stability. Fluoropolymers are essential in the electronics sector for the production of cables, connectors, and circuit boards, since they provide electrical interference protection while also maintaining excellent performance and dependability. These materials are also employed in semiconductor production procedures due to their purity and inertness, which are required when developing modern electronic components. Furthermore, the demand for high-speed data transmission and 5G infrastructure is increasing the use of fluorinated materials in fibre optic cables and other telecommunications equipment. As the globe grows more reliant on electronic gadgets and digital connection, the electrical and electronics industry's need for fluorochemicals is likely to rise, cementing its market dominance.

Fluorochemicals Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Fluorochemicals Market Regional Analysis

In terms of fluorochemicals market analysis, the Asia-Pacific region controls a sizable portion of the worldwide industry and is the fastest-growing area due to a variety of variables. One of the fundamental causes is raising industrialization and urbanization in significant nations such as China, India, and South Korea. These nations have experienced significant expansion in industries that rely heavily on fluorochemicals, such as automotive, construction, and electronics. In China, the world's largest producer, the widespread use of fluorochemicals in refrigerants, air conditioning systems, and other industrial applications drives market expansion. The country's expanding manufacturing sector, notably in consumer electronics and electric cars, demands a large amount of fluorochemicals.

Similar tendencies can be seen in India, where the automobile and construction industries are thriving as urbanization and disposable incomes rise. The demand for efficient air conditioning and refrigeration solutions to accommodate the country's shifting temperature patterns and urban lifestyles propels the industry even further. South Korea, noted for its high technology and electronics sector, makes a substantial contribution to the region's economy. The country's strong emphasis on research and technical improvement increases the need for specialized fluorochemicals in a variety of high-tech applications. Furthermore, the region's favorable regulatory framework, as well as government measures fostering foreign investment and sustainable practices, helps to drive market growth in fluorochemicals. The demand for environmentally friendly refrigerants and other fluorinated products presents opportunities for growth and development in the fluorochemicals market forecast period.

Fluorochemicals Market Players

Some of the top fluorochemicals companies offered in our report includes AGC Chemicals Americas, Gujarat Fluorochemicals Limited, DAIKIN INDUSTRIES, Ltd., Honeywell International Inc., Anupam Rasayan India Ltd (Tanfac Industries Ltd.), HaloPolymer, Dynax Corporation, 3M, Dongyue Group, Derivados del Flúor, S.A.U. (MINERSA GROUP), DIC CORPORATION, and Arkema.

Frequently Asked Questions

How big is the fluorochemicals market?

The fluorochemicals market size was valued at USD 24.3 billion in 2022.

What is the CAGR of the global fluorochemicals market from 2024 to 2032?

What is the CAGR of the global fluorochemicals market from 2024 to 2032?

Which are the key players in the fluorochemicals market?

The key players operating in the global market are including AGC Chemicals Americas, Gujarat fluorochemicals Limited, DAIKIN INDUSTRIES, Ltd., Honeywell International Inc., Anupam Rasayan India Ltd (Tanfac Industries Ltd.), HaloPolymer, Dynax Corporation, 3M, Dongyue Group, Derivados del Fl�or, S.A.U. (MINERSA GROUP), DIC CORPORATION, and Arkema.

Which region dominated the global fluorochemicals market share?

Asia-Pacific held the dominating position in fluorochemicals industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of fluorochemicals during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global fluorochemicals industry?

The current trends and dynamics in the fluorochemicals industry include growing demand for refrigerants in air conditioning and refrigeration industries, expansion of the automotive sector, especially for lightweight materials, rising use of fluoropolymers in the electrical and electronics industry, and increasing industrialization and urbanization in emerging markets.

Which application held the maximum share in 2022?

The refrigerant application held the maximum share of the fluorochemicals industry.