Flue Gas Desulfurization Market | Acumen Research and Consulting

Flue Gas Desulfurization Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

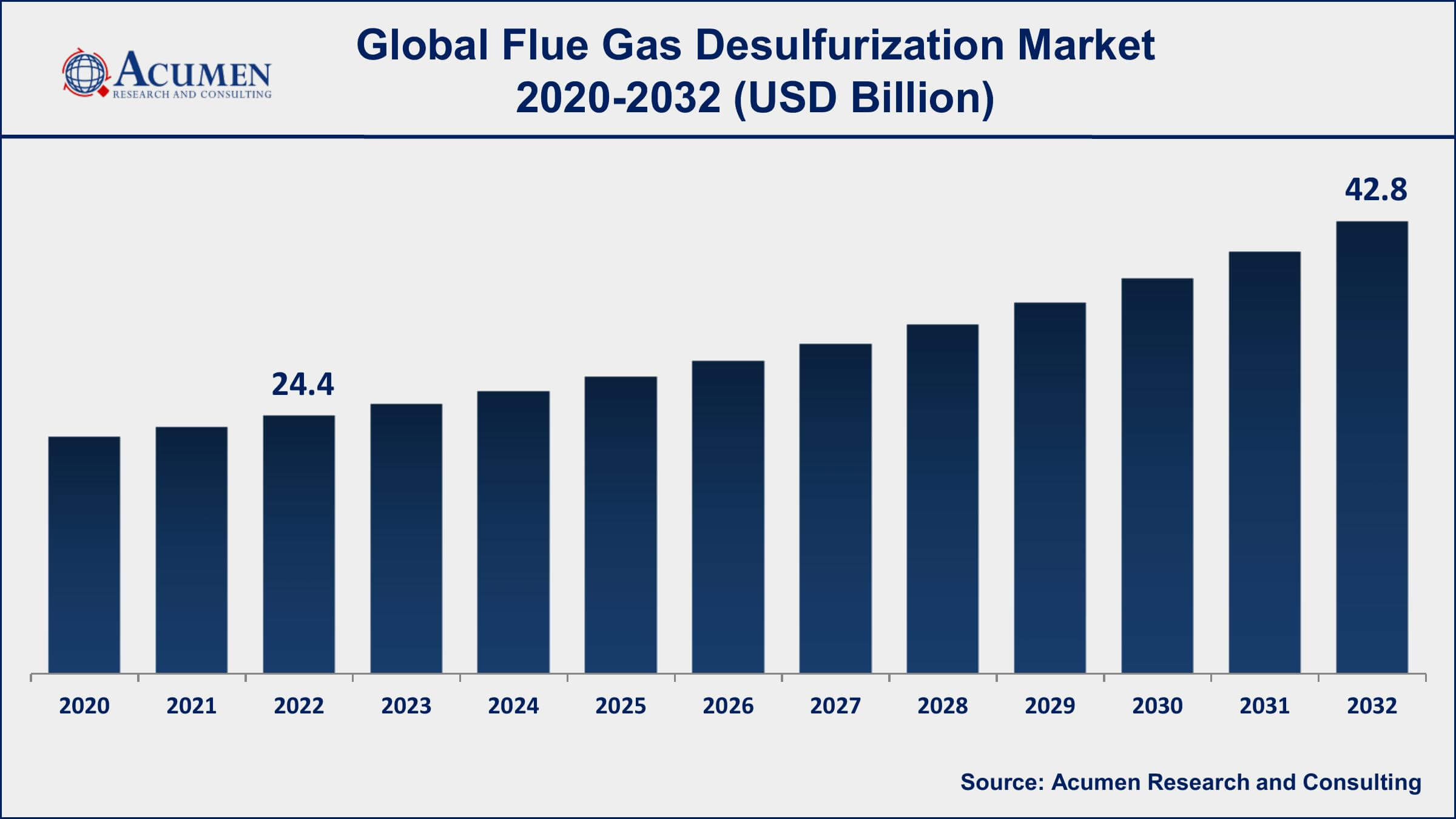

The Global Flue Gas Desulfurization (FGD) Market Size accounted for USD 24.4 Billion in 2022 and is projected to achieve a market size of USD 42.8 Billion by 2032 growing at a CAGR of 5.9% from 2023 to 2032.

Flue Gas Desulfurization Market Key Highlights

- Global flue gas desulfurization market revenue is expected to increase by USD 42.8 Billion by 2032, with a 5.9% CAGR from 2023 to 2032

- Asia-Pacific region led with more than 40% of flue gas desulfurization market share in 2022

- In the United States, the use of FGD has helped to reduce SO2 emissions by over 90% since the implementation of the Clean Air Act in 1970

- According to the U.S. Energy Information Administration (EIA), about 62% of coal-fired power plants in the United States have installed FGD systems as of 2020

- China is the world's largest user of FGD technology, with over 90% of its coal-fired power plants equipped with FGD systems as of 2021

- Rising adoption of FGD technology in power plants and other industries, drives the flue gas desulfurization market size

Flue gas desulfurization (FGD) is a technology used to remove sulfur dioxide (SO2) from the exhaust flue gases generated by coal-fired power plants, industrial boilers, and other facilities that burn coal or oil. The FGD process involves spraying a mixture of water and limestone or lime into the flue gas stream, which reacts with the sulfur dioxide to produce calcium sulfate or calcium sulfite, which can be disposed of as solid waste or converted into useful products. The FGD technology is effective in reducing the emissions of sulfur dioxide, which is a major contributor to acid rain, respiratory illnesses, and other environmental and health problems.

The global FGD market has been witnessing significant growth in recent years due to the increasing demand for clean energy and stringent environmental regulations across the world. The market is primarily driven by the growth of the power generation sector, especially in developing countries, where governments are focusing on increasing electricity production while reducing the emission of harmful pollutants. Moreover, the increasing use of FGD technology in industries such as cement, steel, and chemical, among others, is also driving the FGD market growth.

Global Flue Gas Desulfurization Market Trends

Market Drivers

- Stringent environmental regulations to reduce harmful emissions from industries

- Increasing demand for electricity across the world

- Growing awareness about the benefits of clean energy

- Rising adoption of FGD technology in power plants and other industries

Market Restraints

- High installation and maintenance costs associated with FGD systems

- Technical challenges and operational issues with FGD systems

Market Opportunities

- Growing demand for natural gas-based power generation

- Increasing investment in renewable energy sources such as wind and solar

Flue Gas Desulfurization Market Report Coverage

| Market | Flue Gas Desulfurization Market |

| Flue Gas Desulfurization Market Size 2022 | USD 24.4 Billion |

| Flue Gas Desulfurization Market Forecast 2032 | USD 42.8 Billion |

| Flue Gas Desulfurization Market CAGR During 2023 - 2032 | 5.9% |

| Flue Gas Desulfurization Market Analysis Period | 2020 - 2032 |

| Flue Gas Desulfurization Market Base Year | 2022 |

| Flue Gas Desulfurization Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By End-Users, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | General Electric Company, Babcock & Wilcox Enterprises, Inc., Mitsubishi Hitachi Power Systems, Ltd., Siemens AG, Doosan Heavy Industries & Construction Co., Ltd., Thermax Limited, Hamon Corporation, Ducon Technologies Inc., FLSmidth & Co. A/S, Clyde Bergemann Power Group, Marsulex Environmental Technologies Corporation, and Andritz AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Flue gas desulfurization is the technology applied to eradicate sulfur dioxide from flue smokes of the power plant. Currently, flue gas desulfurization is the only commercially available technology for the reduction of sulfur dioxide from power plants. Lime plays an important role in several air pollution controller applications. To remove hydrogen chloride and sulfur dioxide from flue fumes, lime is used. Lime is also used for the elimination of mercury as it is more reactive compared to limestone. The efficiency of sulfur dioxide using lime scrubbers at electric plants is approximately in the range of 95 to 99 percent. In addition, the efficiency of HCL elimination at the corporation waste plant is in the range of 95 to 99 percent.

The market for flue gas desulfurization is predicted to grow owing to the increase in demand for electricity and power. The generation of electricity & power leads to the emission of harmful chemicals into the environment and hence flue gas desulfurization technology comes into the picture. Moreover, the increase in sulfur dioxide content in the environment, leading to the degradation of the atmosphere has raised concerns among various government establishments, which also paves the growth ways for the flue gas desulfurization technology. Also, the requirement to substitute damaged flue gas desulfurization equipment for smooth operations of industrial parts is an added advantage for the flue gas desulfurization market growth. The high upkeep cost of flue gas desulfurization technology is the major restraining factor for the flue gas desulfurization market value. Also, the presence of different methods to eliminate the emission of sulfur dioxide restricts the market growth for flue gas desulfurization. However, the decreasing cost associated with the flue gas desulfurization technology is likely to provide a huge growth opportunity for the manufacturers of flue gas desulfurization.

Flue Gas Desulfurization Market Segmentation

The global flue gas desulfurization market segmentation is based on type, end-users, and geography.

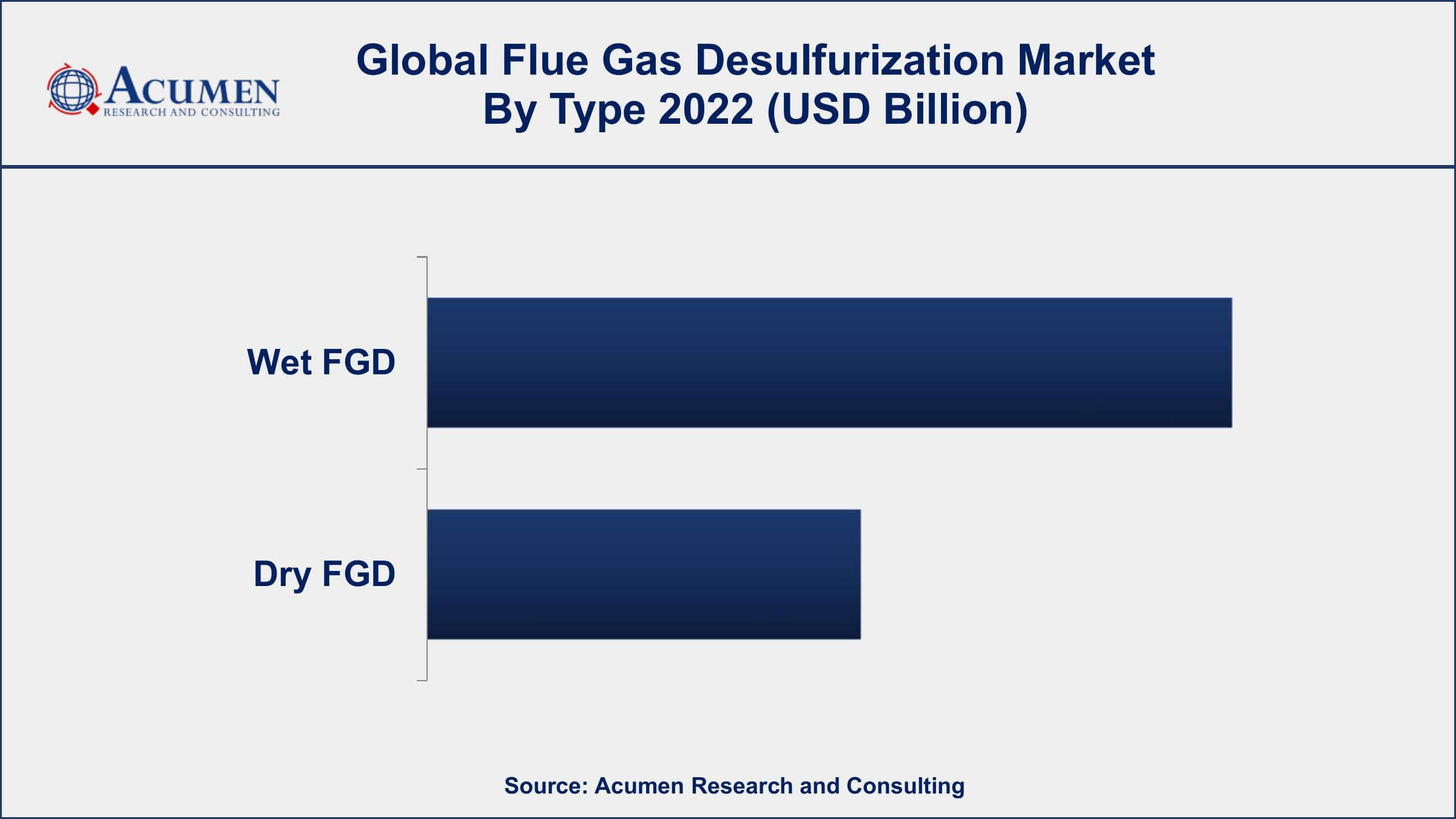

Flue Gas Desulfurization Market By Type

- Wet FGD

- Dry FGD

In terms of types, the wet FGD segment has seen significant growth in the flue gas desulfurization market in recent years. Wet Flue Gas Desulfurization (FGD) is one of the most commonly used FGD technologies in the market. This technology involves the use of a wet scrubber to remove SO2 from the flue gases generated by power plants and other industries. Wet FGD systems are highly efficient in reducing SO2 emissions and are capable of removing up to 95% of the pollutants from the flue gases. The growth of the wet FGD segment in the market is primarily driven by the increasing demand for clean energy and the need to comply with stringent environmental regulations. Wet FGD systems are widely adopted by power plants and other industries to reduce emissions and comply with the regulations imposed by governments and environmental agencies.

Flue Gas Desulfurization Market By End-users

- Iron & Steel Industry

- Power Generation

- Chemical Industry

- Cement Manufacturing Industry

- Others

According to the flue gas desulfurization market forecast, the power generation segment is expected to witness significant growth in the coming years. Power plants are the largest emitters of sulfur dioxide (SO2) and other harmful pollutants, and the adoption of FGD technology in power generation is critical to reducing emissions and complying with environmental regulations. The growth of the power generation segment in the FGD market is primarily driven by the increasing demand for electricity across the world, particularly in developing countries. Rapid urbanization, industrialization, and population growth are driving the demand for electricity, which in turn is leading to the construction of new power plants and the expansion of existing ones. This is creating significant opportunities for FGD technology providers to supply their products and services to power plants.

Flue Gas Desulfurization Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Flue Gas Desulfurization Market Regional Analysis

The Asia-Pacific region dominates the Flue Gas Desulfurization (FGD) market due to several factors. The region has witnessed significant industrial growth in recent years, leading to a rise in the demand for energy and the adoption of FGD systems to reduce emissions. Countries such as China, India, and Japan are the major contributors to the growth of the FGD market in the region. China, in particular, has a large number of coal-fired power plants, which are the major emitters of sulfur dioxide and other pollutants. The country has implemented stringent regulations to reduce emissions from power plants, which has led to a significant increase in the installation of FGD systems.

India is also a major contributor to the growth of the FGD market in the region. The country has a large number of coal-fired power plants, and the government has implemented regulations to reduce emissions from these plants. The adoption of FGD systems is gaining momentum in the country, and many power plants are retrofitting their existing units with FGD technology.

Flue Gas Desulfurization Market Player

Some of the top flue gas desulfurization market companies offered in the professional report include General Electric Company, Babcock & Wilcox Enterprises, Inc., Mitsubishi Hitachi Power Systems, Ltd., Siemens AG, Doosan Heavy Industries & Construction Co., Ltd., Thermax Limited, Hamon Corporation, Ducon Technologies Inc., FLSmidth & Co. A/S, Clyde Bergemann Power Group, Marsulex Environmental Technologies Corporation, and Andritz AG.

Frequently Asked Questions

What was the market size of the global flue gas desulfurization in 2022?

The market size of flue gas desulfurization was USD 24.4 Billion in 2022.

What is the CAGR of the global flue gas desulfurization market from 2023 to 2032?

The CAGR of flue gas desulfurization is 5.9% during the analysis period of 2023 to 2032.

Which are the key players in the flue gas desulfurization market?

The key players operating in the global market are including General Electric Company, Babcock & Wilcox Enterprises, Inc., Mitsubishi Hitachi Power Systems, Ltd., Siemens AG, Doosan Heavy Industries & Construction Co., Ltd., Thermax Limited, Hamon Corporation, Ducon Technologies Inc., FLSmidth & Co. A/S, Clyde Bergemann Power Group, Marsulex Environmental Technologies Corporation, and Andritz AG.

Which region dominated the global flue gas desulfurization market share?

Asia-Pacific held the dominating position in flue gas desulfurization industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of flue gas desulfurization during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global flue gas desulfurization industry?

The current trends and dynamics in the flue gas desulfurization industry include stringent environmental regulations to reduce harmful emissions from industries, and increasing demand for electricity across the world.

Which type held the maximum share in 2022?

The wet FGD type held the maximum share of the flue gas desulfurization industry.