Flow Computer Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Flow Computer Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

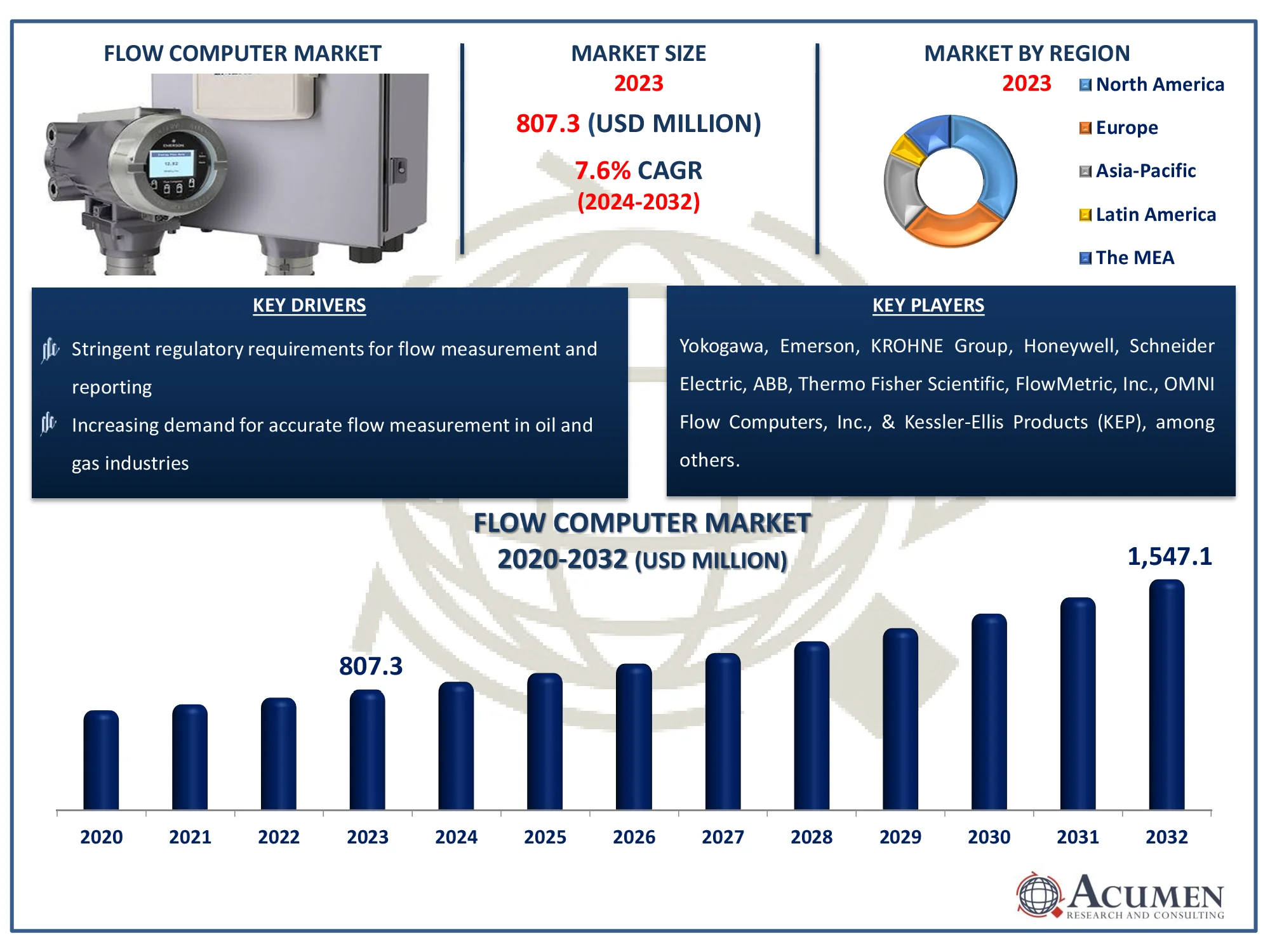

The Global Flow Computer Market Size accounted for USD 807.3 Million in 2023 and is estimated to achieve a market size of USD 1,547.1 Million by 2032 growing at a CAGR of 7.6% from 2024 to 2032.

Flow Computer Market Highlights

- Global flow computer market revenue is poised to garner USD 1,547.1 Million by 2032 with a CAGR of 7.6% from 2024 to 2032

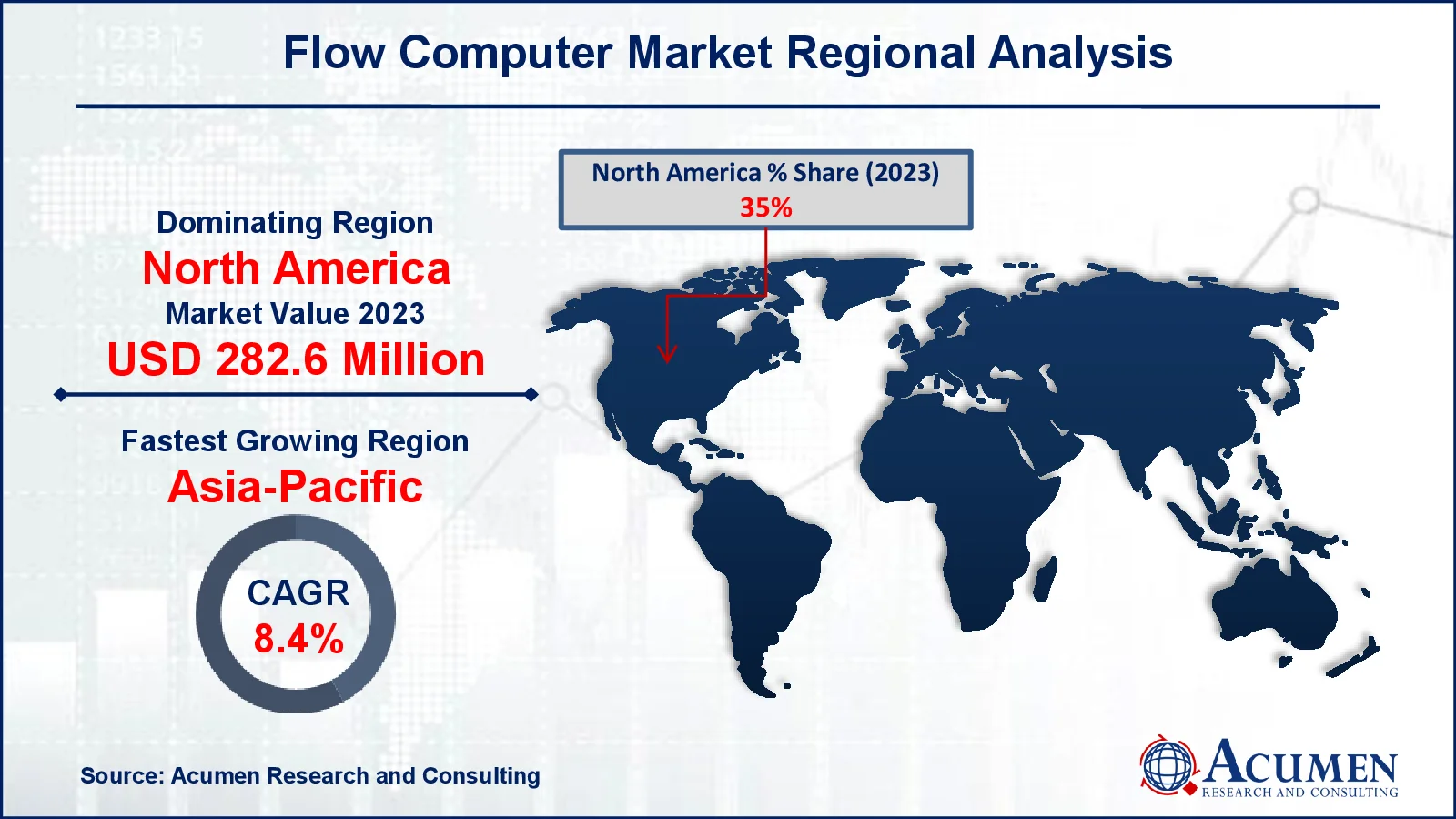

- North America flow computer market value occupied around USD 282.6 million in 2023

- Asia-Pacific flow computer market growth will record a CAGR of more than 8.4% from 2024 to 2032

- Among product, the hardware sub-segment generated noteworthy revenue in 2023

- Based on application, the oil & gas sub-segment generated significant market flow computer share in 2023

- Development of wireless and IoT-enabled flow computers is a popular flow computer market trend that fuels the industry demand

A flow computer is a specialized device used in the measurement and management of fluid and gas flow in industrial processes. It is designed to accurately calculate and record flow rates, volumes, and other critical parameters by processing input signals from flow meters and sensors. The flow computer integrates various measurements such as pressure, temperature, and density to provide precise flow calculations. Typically used in oil and gas, chemical, and water treatment industries, flow computers ensure compliance with regulatory standards and optimize operational efficiency. They support multiple communication protocols for integration with supervisory control and data acquisition (SCADA) systems, enabling real-time monitoring and control. Advanced flow computers offer features like data logging, alarm management, and diagnostic capabilities. Their accuracy and reliability are essential for maintaining process integrity, reducing losses, and ensuring safety in complex industrial environments.

Global Flow Computer Market Dynamics

Market Drivers

- Increasing demand for accurate flow measurement in oil and gas industries

- Rising adoption of automation in industrial processes

- Stringent regulatory requirements for flow measurement and reporting

- Technological advancements in flow computing and data integration

Market Restraints

- High initial cost of flow computer systems

- Complexity in integration with existing industrial infrastructure

- Limited availability of skilled personnel for operation and maintenance

Market Opportunities

- Growth in the water and wastewater treatment industry

- Expanding applications in the renewable energy sector

- Rising investments in smart city projects

Flow Computer Market Report Coverage

|

Market |

Flow Computer Market |

|

Flow Computer Market Size 2023 |

USD 807.3 Million |

|

Flow Computer Market Forecast 2032 |

USD 1,547.1 Million |

|

Flow Computer Market CAGR During 2024 - 2032 |

7.6% |

|

Flow Computer Market Analysis Period |

2020 - 2032 |

|

Flow Computer Market Base Year |

2023 |

|

Flow Computer Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Component, By Product, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Yokogawa, Emerson, ABB, KROHNE Group, Honeywell, Schneider Electric, Thermo Fisher Scientific, FlowMetric, Inc., OMNI Flow Computers, Inc., Kessler-Ellis Products (KEP), Dynamic Flow Computers, and FMC Technologies. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Flow Computer Market Insights

The growth of the global flow computer market is primarily driven by the increasing adoption of process automation across various industries, such as oil and gas, chemical, and water and wastewater treatment. These sectors rely heavily on accurate and efficient flow measurement systems to optimize their operations, ensure compliance with regulations, and enhance overall productivity. Flow computers play a crucial role in achieving these objectives by providing precise flow data and integrating seamlessly with other automated systems. The introduction of advanced applications, including single stream, scanner model, and multi-stream flow computers, further propels market growth. These innovations offer enhanced functionality, flexibility, and accuracy, meeting the diverse needs of different industrial applications. For instance, single stream flow computers are ideal for simple measurement tasks, while multi-stream flow computers can handle more complex applications involving multiple flow measurements simultaneously.

Additionally, various industry verticals such as automotive, and food and beverage are increasingly deploying flow computers to automate and streamline their business processes. This trend underscores the growing recognition of the benefits that flow computers bring to industrial operations, including improved efficiency, reduced operational costs, and enhanced data accuracy. The global market is expected to witness significant growth in the flow computer industry forecast period, driven by several key factors. One of the primary drivers is the increased collaboration between research institutions and businesses, which fosters innovation and the development of advanced flow computing solutions. Licensing agreements and partnerships among companies also contribute to market growth by facilitating the exchange of technology and expertise.

Furthermore, increased investment in research and development (R&D) for flow computers is expected to yield new and improved products, catering to the evolving demands of various industries. This R&D investment is crucial for staying competitive in the market and addressing emerging challenges and opportunities. The growing acceptance of advanced technology and changing consumer preferences also play a vital role in driving the flow computer market globally. As industries continue to seek ways to improve efficiency and accuracy in their operations, the demand for sophisticated flow computing solutions is likely to rise, fueling market expansion.

Flow Computer Market Segmentation

Flow Computer Market Segmentation

The worldwide market for flow computer market is split based on component, product, application, and geography.

Flow Computer Market By Component

- Hardware

- Software

- Services

According to flow computer industry analysis, the hardware segment is the largest in the market, primarily due to its critical role in the accurate and reliable measurement of fluid and gas flow. Hardware components, including sensors, transmitters, and flow meters, form the backbone of flow computing systems. These components are essential for capturing real-time data on flow rates, pressure, and temperature, which are then processed by the flow computer to provide precise measurements. The robust demand for durable and high-performance hardware, particularly in industries like oil and gas, chemicals, and water and wastewater treatment, drives this segment's dominance. Additionally, advancements in hardware technology, such as the development of multi-stream and wireless flow meters, further enhance their adoption, ensuring sustained growth in the hardware segment of the flow computer market.

Flow Computer Market By Product

- Wired Flow Computers

- Wireless Flow Computers

The wired flow computers segment dominates the flow computer market due to its established reliability and widespread use across numerous sectors. These computers are highly recognized for their reliable and continuous data transfer, which is essential for precision and consistency. Wired flow computers are critical in industries such as oil and gas, chemical processing, and water and wastewater treatment because they provide accurate flow measurements and smooth interaction with control systems. Their strength and endurance make them ideal for severe industrial applications, further increasing their appeal. The ubiquitous infrastructure that supports wired connections adds to their sustained dominance. Despite the growing interest in wireless technology, wired flow computers continue to be industry leaders due to their proven performance and durability.

Flow Computer Market By Application

- Oil & Gas

- Water & Wastewater

- Energy & Power Generation

- Food & Beverage

- Chemical

- Pulp & Paper and Metal & Mining

- Others

The oil & gas segment is the leading area for flow computers, primarily due to the industry's complex and demanding operational requirements. In oil and gas operations, accurate flow measurement is vital for processes such as exploration, extraction, refining, and distribution. Flow computers provide precise data necessary for ensuring regulatory compliance, optimizing production, and managing financial transactions. The sector’s need for high accuracy in measuring the flow of crude oil, natural gas, and other products makes flow computers indispensable. Furthermore, the global expansion of oil and gas infrastructure, coupled with the continuous demand for energy, drives significant investment in advanced flow measurement technologies. The robust design and reliability of flow computers make them particularly suited to the harsh environments and critical conditions typical in the oil and gas industry, further reinforcing their dominance in this segment.

Flow Computer Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Flow Computer Market Regional Analysis

Flow Computer Market Regional Analysis

In terms of flow computer market analysis, in 2023, North America dominated the industry in terms of revenue, a trend expected to continue due to the region's proactive stance towards adopting advanced technologies. North America benefits from a robust ecosystem of technology conglomerates specializing in flow computer manufacturing. The United States, in particular, serves as a key manufacturing hub and supplier of electronic devices, home to major industry players like Yokogawa Corporation of America, Emerson Electric Co., Honeywell International Inc., and Schlumberger Limited.

Meanwhile, the Asia-Pacific region is poised to exhibit a high compound annual growth rate (CAGR) during the flow computer market forecast period. This growth is driven by the increasing adoption of advanced and innovative products and the proliferation of manufacturing facilities across various industries. Countries in Asia-Pacific are rapidly industrializing, leading to heightened demand for accurate flow measurement solutions in sectors such as oil and gas, chemicals, and water treatment. Additionally, government initiatives supporting industrial automation and digital transformation further fuel market growth in the region. The expanding market presence of global players and the emergence of local manufacturers also contribute to the dynamic growth trajectory of the flow computer market in Asia-Pacific.

Flow Computer Market Players

Some of the top flow computer companies offered in our report includes Yokogawa, Emerson, ABB, KROHNE Group, Honeywell, Schneider Electric, Thermo Fisher Scientific, FlowMetric, Inc., OMNI Flow Computers, Inc., Kessler-Ellis Products (KEP), Dynamic Flow Computers, and FMC Technologies.

Frequently Asked Questions

How big is the flow computer market?

The flow computer market size was valued at USD 807.3 million in 2023.

What is the CAGR of the global flow computer market from 2024 to 2032?

The CAGR of flow computer is 7.6% during the analysis period of 2024 to 2032.

Which are the key players in the flow computer market?

The key players operating in the global market are including Yokogawa, Emerson, ABB, KROHNE Group, Honeywell, Schneider Electric, Thermo Fisher Scientific, FlowMetric, Inc., OMNI Flow Computers, Inc., Kessler-Ellis Products (KEP), Dynamic Flow Computers, and FMC Technologies.

Which region dominated the global flow computer market share?

North America held the dominating position in flow computer industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of flow computer during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global flow computer industry?

The current trends and dynamics in the flow computer industry include increasing demand for accurate flow measurement in oil and gas industries, rising adoption of automation in industrial processes, stringent regulatory requirements for flow measurement and reporting, and technological advancements in flow computing and data integration

Which product held the maximum share in 2023?

The wired flow computers product held the maximum share of the flow computer industry.